What is a GPC agreement

The phrase “GPC agreement” stands for a civil agreement.

It is usually used as an alternative to an employment contract when it comes to hiring an individual to perform work or provide services without registering him as a member of the organization. In most cases, a GPC agreement is understood as a contract agreement (if an individual is entrusted with performing work that has a tangible result), or a contract for the provision of services for a fee (if an individual is entrusted with performing actions that do not have a tangible result). It is also possible to combine these types of contracts in one if the task involves both carrying out an activity and obtaining a specific result (clause 3 of Article 421 of the Civil Code of the Russian Federation).

Draw up and print a contract agreement for free using a ready-made template

IMPORTANT. The parties to the GPC agreement are called not “employer” and “employee”, but “customer” and “contractor” - in a work contract, or “customer” and “contractor” - in a service agreement. This must be taken into account when drawing up the contract and related documentation (applications, acts, etc.). Also, in a civil contract there should be no mention of position, working hours, bonuses for holidays and other terms characterizing labor relations. Otherwise, such a contract may be reclassified as an employment contract. And this threatens the organization with a fine of up to 100,000 rubles. (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation) and additional tax charges.

Draw up and print a fee-based service agreement for free using a ready-made template

Contract agreement: general overview

A contract is a type of agreement between a customer and a contractor (the one who performs the service). The contractor undertakes to do his work responsibly and within the agreed time frame, and the employer undertakes to accept and pay in full.

Articles 37 and 38 of the Civil Code of the Russian Federation describe the obligations between the parties. They regulate legal relations of the following types of work:

- research;

- design;

- technological;

- household and construction;

- design and survey.

In some circumstances, subcontractors may be involved on the employee's side. Depending on the type of contract (divisible or not), they will also bear their responsibility. In the first case, everyone bears responsibilities specified separately in paragraphs. With indivisible, performers are responsible for work in equal positions.

It is important to know! The agreement can be drawn up in oral and written forms. It is permissible to conclude in words if the total amount of work does not exceed 10 thousand rubles. If the payment amount is larger, then an agreement is created and certified by a notary.

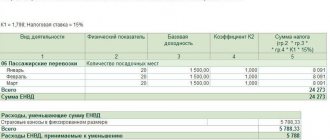

What taxes does the “employer” pay under a GPC agreement?

When paying remuneration to a contractor or performer, it is necessary to accrue and withhold personal income tax (clauses 1-4 of Article 226 of the Tax Code of the Russian Federation). According to the application of an individual who has entered into a GPC agreement, he needs to be provided with standard tax deductions, including for children (clause 3 of Article 218 of the Tax Code of the Russian Federation).

REFERENCE. A freelance employee can receive property and social deductions only through the tax office (clause 8 of article 220, clause 2 of article 219 of the Tax Code of the Russian Federation).

The entire amount of remuneration accrued under a “civil” contract (i.e., the amount taking into account personal income tax) is included by the “employer” on OSNO as part of labor costs (clause 21, part 2, article 255 of the Tax Code of the Russian Federation). The specified amount is also taken into account when calculating the single tax within the framework of the simplified tax system (subclause 6, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

Free accounting and preparation of income tax and personal income tax reports

Subject of the contract and essential terms of the contract

The subject of a contract is the result of the contractor’s activities in the manufacture of a thing, as well as its processing (improving the qualities or changing the consumer properties of an existing thing) or processing (creating a new thing as a result of destroying an existing thing) or performing other work on the instructions of the customer.

Thus, the contract result can be:

- A newly created item (for example, a tailored suit);

- New or updated quality of an existing item (for example, a renovated apartment);

- Another material result (for example, developed documentation).

Note that the contractor’s activities can be aimed at both the creation and destruction of a particular object (for example, dismantling a building).

The subject of the contract is an essential condition of the work contract, therefore, in its absence, the contract is considered not concluded.

We invite you to familiarize yourself with the document on the authorized representative for the sale of an apartment

Differences from taxation under an employment contract

Differences in the taxation procedure for payments under “civil” and employment contracts are related to the date of actual receipt of income.

When transferring payments under an employment contract, the following rule applies: if the employee does not quit, then income in the form of wages is considered to be actually received on the last day of each month (clause 2 of Article 223 of the Tax Code of the Russian Federation). On this day, the employer must calculate wages and calculate income tax, which must be withheld and transferred to the budget. Accordingly, when paying wages for the first half of the month, personal income tax is not calculated or withheld.

The situation is different with remuneration under a civil contract. In this case, the rule established for all other income in cash applies (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Such income is recognized as received on the day of payment or transfer. This means that personal income tax must be calculated and withheld under a “civil” contract for each payment. In this case, the type of payment (advance or final payment), as well as its date (beginning, middle or end of the month) does not matter.

ATTENTION. If the GPC agreement provides for the payment of an advance, then it may be necessary to adjust the personal income tax reporting for the period in which the advance payment was transferred. This can happen if the contractor returns the entire amount received or part of it due to the fact that he does not complete the work in full or on time (letter of the Ministry of Finance dated 08/28/14 No. 03-04-06/43135).

Keep personal income tax records in the web service, generate and submit 6‑personal income tax and 2‑personal income tax via the Internet

Personal income tax

A distinctive feature of a GPC agreement is that the labor and legal relationship of an organization with an individual formalized in this way is not regulated by the Labor Code of the Russian Federation, but by the Civil Code; moreover, an employee working under a GPC is not a full-time employee of the organization. According to Article 420 of the Civil Code of the Russian Federation, a civil process agreement is an agreement between two or more persons on the establishment, modification or termination of civil rights and obligations. The essence of the contract is the performance of certain volumes of work and services for which an individual, after delivering the results of his work, receives income (clause 1 of Article 702 of the Civil Code of the Russian Federation). This is where the questions arise: how to calculate personal income tax and how, and is remuneration under a GPC agreement subject to insurance premiums?