How to pay taxes for individual entrepreneurs and individuals

- Income. The fee is levied on any stable income of a citizen.

- Property. Applies to real estate (apartments, houses).

- Land. Paid for land owned by the taxpayer.

- Water. The costs are paid by the persons using the water bodies and the organisms living in them.

- Transport. Paid by all owners of automobiles and other vehicles.

- Fees for hunting and fishing. Charged on hunting and fishing licenses.

- Pension. This fee is not a tax in the literal sense, it is a contribution to the Pension Fund. Payments came under the jurisdiction of the tax service in 2020.

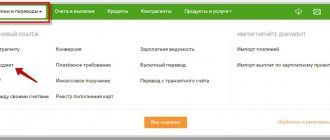

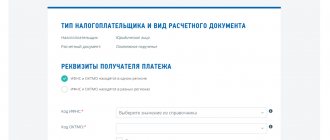

Step-by-step instructions on how to pay taxes for individual entrepreneurs through Sberbank Online are also suitable for individuals. The only difference is in the choice of taxpayer status. For individuals, you must select KBK 13, IP - 09. Searching by taxpayer index is more accurate and convenient than others; many documents do not contain enough information about the recipient organization for the payer to be confident in the correctness of the translation.

Payment of taxes and fees by third parties from November 30, 2020

Federal Law No. 401-FZ dated November 30, 2016 was officially published on the legal information portal on December 30, 2020. From this date, third parties were able to pay taxes and fees for others. This is provided for in paragraph 1 of Article 13 of this law.

From the provisions of the new edition of Article 45 of the Tax Code of the Russian Federation it follows that from December 30, 2020, third parties can pay any taxes and fees for others. From the specified date for an organization, individual entrepreneur or individual, you can transfer:

| Value added tax (VAT) |

| Excise taxes |

| Personal income tax (NDFL) |

| Income tax |

| Mineral extraction tax |

| Water tax |

| State duty |

| Unified Agricultural Tax (USAT) |

| Single tax under “simplified taxation” (USN) |

| "Patent" tax (PSN) |

| Unified tax on imputed tax (UTII) |

| Organizational property tax |

| Gambling tax |

| Transport tax |

| Land tax |

| Property tax for individuals |

| Trade fee |

It is worth noting that the Tax Code does not contain any restrictions regarding the circle of persons who have the right to pay taxes and fees for taxpayers. Thus, various options are possible:

- an organization can pay taxes and fees for another organization, individual entrepreneur or individual;

- an individual entrepreneur can transfer taxes and fees for another individual entrepreneur, organization or individual;

- an individual has the right to pay taxes and fees for another individual, organization or individual entrepreneur.

Thanks to these amendments, for example, the founder or director of a company, starting from November 30, 2020, can easily pay taxes and organization fees from his own funds. This may be necessary if, for example, there is not enough money in the account of a legal entity to pay. Previously, third parties did not have the right to fulfill the obligation to pay taxes and fees for the organization (Letter of the Ministry of Finance of Russia dated February 14, 2013 No. 03-02-08/6).

Writing off debts on personal loans in 2020-2020: procedures

During the bankruptcy procedure, the borrower's property is sold to make settlements with the lender. In addition, for three years an individual does not have the right to occupy management positions, and for five years credit products will not be available to him.

If we look at official information, writing off debts from bailiffs in 2020 occurred very rarely. The end of enforcement proceedings was recorded in only a tenth of all cases considered. This indicates that not all individuals can take advantage of the opportunity to write off bad debts.

On payment of a fine for a manager

Please provide advice on the issue of paying a fine for an administrative offense by an official (General Director) in accordance with the Resolution of the State Labor Inspectorate.

Can we pay this fine through the company's account?

Will GIT accept this payment? When will an administrative violation be canceled?

Answer:

According to paragraph 1 of Article 32.2. of the Code of Administrative Offenses of the Russian Federation must be paid in full by the person brought to administrative responsibility no later than sixty days from the date the resolution imposing the administrative fine comes into force.

In accordance with paragraph 3 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation, the amount of an administrative fine is paid or transferred by a person brought to administrative responsibility to a credit institution , including with the involvement of a bank payment agent or a bank payment subagent operating in accordance with the Federal Law “On National payment system", the organization of the federal postal service or a payment agent operating in accordance with the Federal Law of June 3, 2009 N 103-FZ "On the activities of accepting payments from individuals carried out by payment agents."

According to paragraph 8 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation, a bank or other credit organization, a federal postal service organization, a payment agent engaged in accepting payments from individuals, or a bank payment agent (subagent) to whom the amount of an administrative fine is paid are obliged to immediately after payment of the administrative fine by a person brought to administrative responsibility, send information about the payment of an administrative fine to the State Information System on State and Municipal Payments , provided for by Federal Law of July 27, 2010 N 210-FZ “On the organization of the provision of state and municipal services.”

By virtue of paragraph 5 of Article 32.2. Code of Administrative Offenses of the Russian Federation, in the absence of a document indicating the payment of an administrative fine, and information on payment of an administrative fine in the State Information System on State and Municipal Payments , after the expiration of the period specified in Part 1 or Article 32.2 of the Code of Administrative Offenses of the Russian Federation, a judge, body, official, those who issued the resolution prepare a second copy of the said resolution and send it within ten days to the bailiff for execution in the manner prescribed by federal legislation . If a second copy of the resolution imposing an administrative fine is produced in the form of an electronic document, the said second copy is sent to the bailiff in electronic form via information and telecommunication networks. In addition, an official of the federal executive body, structural unit or territorial body, other government body that examined the case of an administrative offense , or an authorized person of the collegial body that examined the case of an administrative offense, draws up a protocol on the administrative offense provided for by Part 1 of Article 20.25 of the Code of Administrative Offenses RF, in relation to a person who has not paid an administrative fine . A protocol on an administrative offense, provided for in Part 1 of Article 20.25 of the Code of Administrative Offenses of the Russian Federation, in relation to a person who has not paid an administrative fine in an administrative offense case considered by a judge, is drawn up by a bailiff.

From the above rules, in our opinion, it follows that an administrative fine must be paid directly by the official to whom it was issued, independently, on his own behalf .

We do not have at our disposal a regulatory document that would allow or not allow the payment of an administrative fine for an official from the Organization’s account in the event of a violation of labor legislation.

Please note that with regard to the administrative fine payable to Rospotrebnadzor , the website https://24.rospotrebnadzor.ru/directions/practice/96521 contains information on the procedure for filling out a payment order in case of paying a fine for a third party:

“If a legal entity or individual, or individual entrepreneur, pays an administrative fine based on decisions made against other persons, then in the field for the purpose of payment, information about the decision and the person against whom it was issued is indicated. For example: “an administrative fine according to Resolution No. 77 of April 22, 2013 in relation to Ivan Ivanovich Ivanov.”

Similar explanations are available on the traffic police website (https://www.gibdd.ru/r/56/news/1015752/?type=special).

The website of the State Labor Inspectorate for the Leningrad Region (https://git47.rostrud.ru/spravochnaya_informatsiya/30375.html) states the following:

«An administrative fine with reference to the details of the resolution must be paid on behalf of the person to whom the administrative penalty was imposed. Otherwise, the administrative fine is not considered paid. ».

Accordingly, if an administrative fine for violation of labor legislation imposed on a manager is paid by the Organization from its current account (including if information is indicated in the purpose of payment that it was paid for the manager), we do not exclude that the administrative fine paid in this way will not be counted as paid.

We also draw your attention to the fact that from the point of view of the tax authorities, in the case where an administrative fine for an employee is paid by the Organization, the amount of the fine will be qualified by the tax authorities as the income of this employee received in kind on the basis of Article 41 of the Tax Code of the Russian Federation, paragraph 1 of Article 210 of the Tax Code of the Russian Federation , subparagraph 1 of paragraph 2 of Article 211 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated January 20, 2016 No. 03-04-05/1660). Accordingly, in the month when the fine was paid, it will be necessary to include its amount in the taxable income of the general director and withhold personal income tax in the amount of 13% .

At the same time, the explanations of the regulatory authorities do not indicate exactly how the Organization paid the fine for the employee (by paying from its current account or by compensating the employee).

In addition, in accordance with Part 1 of Article 7 of the Law dated July 24, 2009 No. 212-FZ[1] and paragraph 1 of Article 20.1 of the Law dated July 24, 1998 No. 125-FZ[2], the risks of disputes with regulatory authorities regarding the issue of calculation cannot be excluded. insurance premiums from the administrative fine paid for the manager .

Accordingly, in order to avoid the occurrence of these risks, we recommend that the Organization not pay an administrative fine for the manager .

Regarding the duration of the administrative penalty, we inform you that in accordance with Article 4.6. of the Code of Administrative Offenses of the Russian Federation , a person who has been assigned an administrative penalty for committing an administrative offense is considered subject to this punishment from the date the resolution imposing an administrative penalty enters into legal force until the expiration of one year from the date of completion of the execution of this resolution .

An administrative offense is repeated if it is committed during a period when the offender is considered subject to administrative punishment for a similar administrative offense (clause 2, part 1, article 4.3 of the Code of Administrative Offenses of the Russian Federation).

Thus, the head of the Organization will be considered subject to administrative punishment for one year from the date of completion of the execution of the resolution (from the date of payment of the administrative fine).

An individual pays a receipt for a legal entity

In practice, situations often arise when the General Director or any other employee of the company would like to pay for a legal entity. Since November 30, 2020, such an opportunity has appeared, and Article 45, paragraph one of the Tax Code of the Russian Federation states that tax payment can be made by another person. By the way, insurance contributions for compulsory pension insurance, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund (except for the Social Insurance Fund from the National Insurance Fund and the Pension Fund) can also be paid by another person from January 1, 2020.

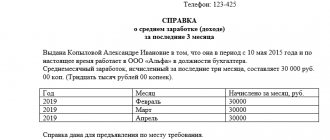

At the top of the form, details of the tax office to which the payment is made are indicated. Everything is standard, without any special features. What should you pay attention to? These are the Payer fields, the Payer INN field and the Payment Name field. If you carefully read the Instructions of the Federal Tax Service, then you need to do this:

Long-awaited changes

Previously, tax legislation obligated taxpayers to pay taxes and fees independently (clause 1 of Article 45 of the Tax Code of the Russian Federation). However, due to the entry into force of Federal Law No. 401-FZ of November 30, 2016, the situation has changed. This law amended Article 45 of the Tax Code of the Russian Federation, thanks to which third parties will be able to pay taxes, fees and insurance premiums for organizations, individual entrepreneurs or individuals. However, the amendments will be introduced in stages, namely:

- from November 30, 2020, some persons have the right to pay taxes and fees for others;

- From January 1, 2020, third parties have the right to transfer insurance premiums for others.

Payment of a fine for an organization from an individual

Let me explain: the fact is that the ability to use different fonts, their sizes and colors in message functions is implemented in order to highlight some special moments and nuances in messages, emphasize some particularly important detail, and attract appropriate attention. In your case, it turns out that in this way you want to show that it is your answer that should be more important and interesting for the Author than the answers of other participants. This kind of behavior is not welcome on our forum. We treat all participants with equal respect and demand the same attitude from forum members. Read the forum rules.

We recommend reading: Which bank is better to get a mortgage in 2020

Let me explain: the fact is that the ability to use different fonts, their sizes and colors in message functions is implemented in order to highlight some special moments and nuances in messages, emphasize some particularly important detail, and attract appropriate attention. In your case, it turns out that in this way you want to show that it is your answer that should be more important and interesting for the Author than the answers of other participants. This kind of behavior is not welcome on our forum. We treat all participants with equal respect and demand the same attitude from forum members. Read the forum rules.

Payment of tax penalties by an individual for an organization

This option is possible, upon agreement with the tax office, of offsetting the payment received from an individual towards the payment of penalties on behalf of the organization. That is, if your institution agrees on this option with a tax inspector, and in addition to this, sends a letter to the head of the tax office about offsetting the payment received from an individual. The justification for such an operation can be Article 313 of the Civil Code of the Russian Federation.

PLEASE TELL ME we have arrears on property taxes due to an error in accounting that we discovered ourselves, we have money for the arrears, but we don’t have money for the penalty. Can a person who made a mistake independently pay a fine through the bank on behalf of the organization? Or is there another option? We are a state budgetary institution. Thank you!

Answers to common questions

Question: The director of the LLC paid penalties for the company in cash through the bank cash desk. At the same time, an error was made in the “Payment Purpose” on the receipt. What can be done in this case? Will I have to pay the tax again?

Answer: You will not need to pay the tax again, but you will need to write an application to the tax office to clarify the payment. A receipt of payment will need to be attached to this application. In this case, clarification of the payment will be possible if the error did not lead to a complete cancellation of the payment. In this case, the application to the tax office is submitted on behalf of the company, and not from the individual who paid the tax.

Payment of fines and penalties to an LLC not through a current account (individual)

The company (USN 6% LLC) had its current account closed as unnecessary (the company does not operate), but a little later penalties and fines came to the company for the previous years. Is it possible for an individual to pay fines for a company? Or there is still the opportunity to pay through an individual entrepreneur. I heard that if an individual pays, it is necessary to write an explanation. I am interested in a step-by-step consultation on what to pay where and how, and what applications and explanations where to submit. You also need payment forms, and an application form or explanation if it is still needed.

We recommend reading: Subsidy for the Construction of a House for a Young Family 2020

“TIN” of the payer is the value of the TIN of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled. If the payer, an individual, does not have a tax identification number (TIN), zero (“0”) is indicated in the payer’s “TIN” details. In this case, in the “Code” field you must specify the Unique accrual identifier (document index);

Reasons for paying tax in cash

All legal entities make their payments through their current accounts. But in practice, situations arise when the company cannot pay from the account. These include the following situations:

- The company's current account was blocked for some reason (for example, the bank's license was revoked).

- The deadlines for paying taxes and fees have already arrived, and the company has not yet managed to open a current account (applies to those taxes, the obligation to pay which does not depend on the fact of receiving income, for example, transport tax or UTII).

- Access to the current account has been lost, and taxes need to be paid urgently. Responsible persons of the company, for example, the chief accountant or other persons with access to the current account, may lose access. One of the options is also possible temporary deactivation of the digital signature, as a result of which it was impossible to use the bank account. In addition, the company may experience technical problems such as internet outages.

Important! This list is not exhaustive. The current account may become unavailable to the organization for other reasons. The above are just some of the most common cases.

Another option for paying tax in cash may be forced collection by bailiffs using a writ of execution. In this case, it does not matter to the regulatory authorities exactly how the tax debt will be paid. The legislation provides for various methods of payment and with any assets of the company: money, property (movable or immovable), through accounts receivable.

Repayment of tax debt in enforcement proceedings is a procedure that is carried out in accordance with legislative norms. Thus, paying taxes by a legal entity in cash is possible, and any individual can do this. But this must be done correctly and subject to certain conditions.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

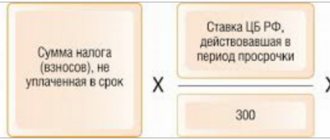

What is the fine for non-payment of personal income tax in 2020

A private individual who pays personal income tax on their own is also punished with a fine if the funds are not transferred on time. Here the punishment may vary. In particular, in the event of a normal late payment, the dishonest payer will be fined in the amount of 20 percent of the income tax not transferred to the state. However, individuals often deliberately hide some part of the income they receive. Accordingly, a smaller amount is transferred to the state as personal income tax. If tax officials discover this, such a payer will have to pay a fine of 40 percent. In case of late payment, the individual will be forced to pay a penalty for each day of delay.

Taxes are one of the most important sources of filling the state budget. Accordingly, the state carefully monitors that all taxpayers make the deductions provided for by law on time and in full. Various punishment options are available for violators, including imprisonment. However, in Russia they can be sent to jail only if the violation of tax laws is clearly intentional or if there are serious arrears.

Payment of an administrative fine through Sberbank online: instructions

There are several ways to do this. For example, if you need to pay a fine to the tax office, you will need to display in the search bar the locality in which the protocol was drawn up or the resolution was issued, and then select the Federal Tax Service from the list of organizations. You can also simply fill out the fields with the details that should appear on the extract from the tax service.

Using remote methods of transferring funds allows you to pay receipts on time and avoid more severe penalties. Thus, we can highlight the following online methods for paying administrative fines (including tax fines and those issued by employees of the Ministry of Internal Affairs) :

Cash payment limit

In order to make transparent control over expensive purchases of ordinary citizens (real estate, cars, jewelry), the Russian Ministry of Finance took the initiative to set a maximum amount for cash payments between individuals. The amount for cash payments under one agreement between individuals is planned to be 300,000 rubles. The changes that are going to be made to Article 861 of the Civil Code of the Russian Federation also provide for punishment in the form of a fine in the amount of the exceeded limit. It was planned that the changes would come into force from the beginning of 2020, however, this project has not yet been considered by the State Duma.

It follows from the text of the Central Bank Directive that the “cache” restriction concerns actions specifically under a single agreement without a limit on time and number of transactions. Let's consider cases when cash payments in excess of the established limit between legal entities and/or individual entrepreneurs are allowed:

We pay the tax service fine

Fines, unlike taxes, are “secret” from taxpayers. Services such as government services or the Personal Account of the Federal Tax Service will notify you about them only when the fine becomes a debt , having increased by two (!) times the original amount. True, as readers rightly suggest, this does not apply to penalties accrued for late payment of taxes. It is visible in the personal account.

Therefore, make sure you find out about the fine imposed on time.

To do this, indicate your current phone number in your personal tax account. The usual operating procedure of the Federal Tax Service is that they notify exclusively by telephone. The payer's email is not used at all. The written document is sent after the consideration of your administrative offense has already been completed. At this stage, it is more difficult to do something with the size of the fine. So it's in our best interest to be informed from the very beginning.

Find mitigating circumstances.

During a telephone conversation with a tax officer, immediately try to clarify why you are being fined and under what article of the Code of Administrative Offenses (CAO). It makes sense, before considering your case, to clarify the possible amount of the fine and submit documents mitigating your guilt. For example, delays in notifying the Federal Tax Service may be explained by your absence from Russia, serious illness or other reasons. In this case, you will no longer face the upper limit of liability or the violation itself will be canceled. Then, study the protocol that you will receive after the review.

If everything is correct, then...

Is it easy to pay the fine?

Oh, don’t rush to answer!..