KBK codes according to the simplified tax system “income” 6% in 2019–2020

Incorrect indication of the income code should not lead to major troubles. After all, even if the BCC is incorrect, the money will go to the budget, and this payment details can always be clarified.

A sample application for this can be found here.

However, the fact that a mistake will not entail sanctions should not discourage you. In any case, this is a waste of time and nerves. Therefore, changes in the BCC need to be monitored. Moreover, it is not at all difficult for payers using the simplified tax system to do this with the object “income”: the codes for them have not changed since 2014.

The BCC for the simplified tax system for 2014–2017 for various taxation objects (including the BCC for the simplified tax system of 15% for 2014–2017) can be clarified in reference books. We are now only interested in the BCC under the simplified tax system of 6% for 2019–2020. They are shown in the table.

IMPORTANT! The list of BCCs for 2020 is determined by Order of the Ministry of Finance dated November 29, 2019 No. 207n, and for 2020 it was established by Order of the Ministry of Finance dated June 8, 2018 No. 132n. Find out which BCCs have changed since 2020 here.

Codes according to the simplified tax system “income” 6% for 2019–2020

| Year | Tax | Penalty | Fines |

| 2019 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| 2020 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

As you can see, the KBK according to the simplified tax system “income” of 6% for 2020 for each type of payment is no different from the KBK according to the simplified tax system “income” for 2019 for the same types of payments. The difference in the codes for the main tax, penalties and fines is only in one digit - in the 14th digit, which characterizes the subtype of budget revenues.

Instructions for filling out payment slips for the payment of advance payments under the simplified tax system, as well as tax for the year, including samples of payment slips, were prepared by K+ experts. If you have access to K+, go to the Ready Solution. If you don't have access, get it for free.

Deadline for payment of the simplified tax system for 2020

The deadline for paying the simplified tax depends on who pays it:

- until 31.03 – tax is paid by organizations;

- until 30.04 - individual entrepreneur.

If the deadline for payment falls on a holiday or weekend, it is postponed to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

The deadline for paying the simplified tax for 2020 does not fall on holidays and weekends and is transferred to the budget:

- until March 31, 2020 - by companies;

- until 04/30/2020 - individual entrepreneurs.

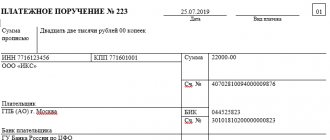

Let's consider the order in which the simplified tax system payment order for 2020 is filled out for the “income” object (6%).

BCC for the simplified tax system “income” and “income minus expenses” in 2019–2020

There are no differences in the BCC applied by organizations and individual entrepreneurs, but their meanings for different objects of taxation are different. The 2019-2020 codes are listed in the table below.

| Payment type | Code for simplified tax system “income” 6% | Code for simplified tax system “income minus expenses” 15% |

| Basic tax | 182 1 0500 110 | 182 1 0500 110 |

| Tax penalties | 182 1 0500 110 | 182 1 0500 110 |

| Tax fines | 182 1 0500 110 | 182 1 0500 110 |

As you can see, the difference is only in the tenth digit of the code (9–11 digits are the income sub-item).

Let us remind you that the indicated rates (6 and 15%) are generally established, but regions can decide to reduce their value.

Instructions for filling out payment slips for the payment of advance payments under the simplified tax system, as well as tax for the year, including samples of payment slips, were prepared by K+ experts. If you have access to K+, go to the Ready Solution. If you don't have access, get it for free.

Read about existing simplified tax rates here.

Payment order for the simplified tax system online

You can also generate a payment invoice for the payment of the simplified tax system on the website of the Federal Tax Service of the Russian Federation in a special service. The whole process will not take much time: you just need to follow the system prompts. When filling out the payment form online, you will need to provide the following information:

- Code of the Federal Tax Service to which the payment is transferred;

- OKTMO at the place of tax payment (you can only enter the address, and the system will automatically determine the code);

- KBK;

- payer status;

- status and basis of payment, its amount and tax period;

- payer details.

After entering the specified information, the program will generate a payment order, which can be printed for payment at a bank branch.

KBK for minimum tax on a simplified taxation system

The minimum tax is paid only by taxpayers who apply the simplified tax system “income minus expenses” in cases where the estimated tax amount from the actual base is less than the minimum established by law - 1% of income.

Thus, at the end of the year, the accountant calculates two amounts, then compares them with each other and chooses the maximum for payment. Currently, the BCC for the minimum and ordinary tax under the simplified tax system “income minus expenses” is one: 182 1 05 01021 01 1000 110. The codes differed until 2020.

Under the simplified tax system with the object “income”, this tax is not calculated.

Read about the form on which the simplified taxation system declaration is generated in this material.

New BCCs for 2020 - contributions to extra-budgetary funds

| Contribution | KBK 2020 |

| PF for employees | |

| Within the established limit of the base for 2016 | 392 1 0200 160 |

| Above the established base limit for 2020 | 392 1 0200 160 |

| Additional tariff according to list 1 | 392 1 0200 160 |

| Additional tariff according to list 2 | 392 1 0200 160 |

| PF IP for yourself | |

| Based on the minimum wage | 392 1 0200 160 |

| With income over 300 thousand rubles | 392 1 0200 160 |

| FFOMS | |

| Contribution | 392 1 0211 160 |

| FSS for employees | |

| For sick leave and maternity leave | 393 1 0200 160 |

| For accidents and occupational diseases | 393 1 0200 160 |

| FSS IP for yourself | |

| Contribution | 392 1 0211 160 |

Penalties according to the simplified tax system

Penalties under the simplified tax system are accrued in case of late payment of taxes and advance payments.

You can calculate the amount of penalties using our service “Fine Calculator” .

BCC under the simplified tax system “income” (penalties) in 2019-2020 - 18210 50101 10121 00110.

Also, an error when specifying the BCC in the payment may result in the accrual of penalties. A payment order with an incorrect code is either subject to return or falls into the “Unclear” category. Penalties are accrued as long as the payment is included in this category. You can correct the situation by submitting an application for clarification of payment. After clarification, the penalty should be reversed.

New BCCs for 2020 - duties

| Duty | KBK 2020 |

| Arbitration court | 182 1 0800 110 |

| Constitutional Court of the Russian Federation | 182 1 0800 110 |

| Constitutional courts of the constituent entities of the Russian Federation | 182 1 0800 110 |

| Courts of general jurisdiction, magistrates' courts | 182 1 0800 110 |

| Supreme Court of the Russian Federation | 182 1 0800 110 |

| Registration of legal entities, individual entrepreneurs, changes to documents, liquidation of legal entities | 182 1 0800 110 |

| For the use of the names “Russia”, “Russian Federation” and phrases with them | 182 1 0800 110 |

| For registration of vehicles and other actions related to vehicles | 188 1 0800 110 |

| For pricing agreements | 182 1 0800 110 |

The BCC is necessary for the state treasury through which incoming funds are distributed according to internal coding. Codes are also needed for entrepreneurs who comply with the requirements for processing government payments (taxes and contributions).

Where can I find the KBK code?

There are several ways to find out the KBK code:

- Get information on the website;

- By sending a request to the State Treasury;

- Obtain information from Order of the Ministry of Finance No. 65Н;

- By making payments on the website (automatic affixing of BCC on many services).

Changing budget classification codes

It would be much easier if the codes were set forever. The Ministry annually introduces new changes to the BCC. Entrepreneurs and accountants are not able to constantly identify KBC innovations during the reporting period. The incorrect code that businessmen specify leads to unexpected expenses and hassles.

Let us note other versions of entrepreneurs who encounter errors:

- The more funds are received through erroneous cash registers, the more unclear they will be;

- Fill the budget additionally by charging fines for late payments of inactive BCCs. Proving timely payment is difficult in practice;

- The uncoordinated actions of the Ministry of Finance and the Ministry of Justice, which appropriate and approve them;

- BCCs are associated with the public sector and various changes in the relevant structures and innovations lead to a change in coding.

There are versions that coding should be carried out through the internal treasury, and not with the help of taxpayers. The KBK code can be assigned by bank employees in accordance with the specified data about the recipient and purpose of the payment account or by treasury employees. A lot of responsibility rests on the shoulders of taxpayers who cannot shirk their responsibilities and comply with coding rules.

Results

The BCCs used for the simplified tax system have remained unchanged since 2014. However, they differ depending on the objects of taxation and the type of payment (tax, penalty, fine). Incorrect indication of the BCC in the payment document may result in money not being credited as intended and will require the taxpayer to take additional actions to clarify the payment.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

KBK for paying taxes according to the simplified tax system for legal entities

| Decoding the code | Budget classification code |

| Tax levied on taxpayers who have chosen income as the object of taxation (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0500 110 (original code) 18210501011011000110 (short code) |

| Tax levied on taxpayers who have chosen income as an object of taxation (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501011012100110 (short code) |

| Tax levied on taxpayers who have chosen income as the object of taxation (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501011012200110 (short code) |

| Tax levied on taxpayers who have chosen income as an object of taxation (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501011013000110 (short code) |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expired before January 1, 2011) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0500 110 (original code) 18210501012011000110 (short code) |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expired before January 1, 2011) (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501012012100110 (short code) |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expiring before January 1, 2011) (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501012012200110 (short code) |

| Tax levied on taxpayers who have chosen income as an object of taxation (for tax periods expired before January 1, 2011) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501012013000110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (including the minimum tax credited to the budgets of the constituent entities of the Russian Federation) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled payments) | 182 1 0500 110 (original code) 18210501021011000110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (including the minimum tax credited to the budgets of the constituent entities of the Russian Federation) (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501021012100110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (including the minimum tax credited to the budgets of the constituent entities of the Russian Federation) (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501021012200110 (short code) |

| A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (including the minimum tax credited to the budgets of the constituent entities of the Russian Federation) (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501021013000110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expired before January 1, 2011) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0500 110 (original code) 18210501022011000110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expired before January 1, 2011) (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501022012100110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expired before January 1, 2011) (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501022012200110 (short code) |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expired before January 1, 2011) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501022013000110 (short code) |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0500 110 (original code) 18210501030011000110 (short code) |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501030012100110 (short code) |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501030012200110 (short code) |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501030013000110 (short code) |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation (for tax periods expired before January 1, 2020) (payment amount (recalculations, arrears and debt) for the corresponding payment, including canceled ones) | 182 1 0500 110 (original code) 18210501050011000110 (short code) |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation (for tax periods expired before January 1, 2020) (penalties on the corresponding payment) | 182 1 0500 110 (original code) 18210501050012100110 (short code) |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation (for tax periods expired before January 1, 2020) (interest on the corresponding payment) | 182 1 0500 110 (original code) 18210501050012200110 (short code) |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation (for tax periods expired before January 1, 2020) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0500 110 (original code) 18210501050013000110 (short code) |

Frequently asked questions FAQ

Let's consider the issues that concern accountants when paying income to the simplified tax system and indicating the KBK.

What code is correct to pay for the simplified tax system 6% and what to do with payments with an incorrect BCC?

BCCs change periodically. It is recommended to check the background information before paying.

BCC for simplified tax system 6% in 2020 - 182 1 0500 110.

It hasn't changed since last year. But if they still listed the wrong code, then this problem is easily solvable. If an error is discovered, a reconciliation report is ordered from the tax office. Based on the results of the reconciliation, the tax authority clarifies the payment and transfers it to the correct code. You can clarify the necessary details without conducting a reconciliation - by writing an application to the tax service in any form. The clarification is made within 10 days. If the tax service considers the payment to be overdue due to an incorrect code and charges a penalty, this can be challenged in court. Based on practice, the courts take the side of the taxpayer in this matter. According to the law, discrepancy between codes is not a basis for recognizing payment deadlines as violated (clause 2, clause 3 [K=14;P=45;T=Article 45 of the Tax Code of the Russian Federation]). After all, if a sum of money was received into the corresponding treasury account, then it entered the budget system of the Russian Federation. This is enough to ensure that the amount paid cannot be considered arrears. This is confirmed, in particular, by [D=5696 3;T=resolution of the Federal Antimonopoly Service of the Volga Region dated April 26, 2011 N A12-17205/2010]. The organization or entrepreneur will not face a fine for incorrectly indicated in the payment order by KBK. The tax office can charge penalties, but they can also be challenged in court.

Which BCC should I indicate when submitting an updated declaration and paying the simplified tax system of 6% for earlier periods?

The updated declaration does not have a special form. It is submitted on the same form as a regular declaration, only with a different adjustment number. Clarifying information for periods that have already passed is submitted on the form that was in force during that tax period (clause 5 [K=14;P=81;T=Article 81 of the Tax Code of the Russian Federation]). If in 2020 an error is discovered in the 2013 data, then clarifying information is submitted on the 2013 form. The same rule applies to indicating the BCC. If a payment is made for any of the past years, then the old BCC of that year is indicated in the “payment purpose” field. At the same time, if the code has changed, it will not be a mistake to deposit funds using the new code. The money is still transferred to the required budget item. Therefore, it is easier to use the code of the current period to correct errors from previous years. For the simplified tax system of 6% this is 182 1 0500 110. The BCC for the simplified tax system of 6% “income” has not changed since 2012.

Is it necessary to adjust advances already made if an individual entrepreneur using the simplified tax system has moved to a region with a different tax rate?

If an individual entrepreneur changes his place of registration to a region where a different tax rate is established according to the simplified tax system, there is no need to recalculate advances already made since the beginning of the year. At the new rate, advance payments are calculated from the period in which the move occurred and the annual tax is paid. This is an explanation from the Ministry of Finance, which was given in Letter No. 03-11-11/13037 dated 03/09/2016. Let us remind you that from 2020, regional authorities can lower the tax rate on the simplified tax system for both the “income minus expenses” object and the “income” object. Previously, regional rates applied only to simplified taxation system payers with the object “income minus expenses.”

Are the new BCCs the same for all regions or different?

The codes are the same for all regions. Changes in BCC values occur at the federal level. New codes are established by orders of the Ministry of Finance. The tax levied on taxpayers who have chosen income as the object of taxation is paid on

KBK 182 1 0500 110.

The specified code is valid for payments in 2012, 2013, 2014, 2015 and 2020.

Is it possible to offset a tax overpayment against a tax payment (advance payment) that has a different BCC?

When offsetting tax overpayments in the form of advances, differences in the code do not matter. It is important that the type of payment be respected: federal taxes are included in the federal budget; regional - to the regional budget; local - to local. If the payments are of the same type, then the tax service cannot refuse to offset the funds due to different BCCs. Such a refusal is unlawful. If an organization pays two taxes going to the same budget (for example, to the federal budget), then the overpayment for one of them can be offset against the other, even though the payment codes are different. The same approach is applied when calculating penalties and fines. To offset the tax overpayment against advance payments, an application is submitted to the Federal Tax Service.

Loan repayment methods

| Repayment procedure | Annuity payments |

| Early repayment | Full / Partial |

| Late mandatory payment | 0.1% of the amount of overdue debt for each day |

| Payment Methods | ATMs and Home Credit branches |

| Internet banking | |

| Mobile app | |

| Card of any bank | |

| Self-service terminals | |

| Salons Euroset, MTS, Beeline |

What you need to know when choosing KBC

In fact, KBK is a designation of tax in digital terms; it is written in the “104” field of the payment slip. For the simplified tax system with different taxation objects (or 15%), the encoding is different. Also, the values change if the “simplifier” decides to include in the budget:

- tax accrued for payment based on the results of the reporting (tax) period, including the minimum tax (1%);

- fines;

- fines.

A payment with an incorrectly specified BCC will obviously be misdirected. Later, you can return the payment, but this is unprofitable - penalties are charged to the payer for late payment. It is better to clarify the payment details by submitting an application to the Federal Tax Service, in which you need to indicate the error and reflect the correct BCC. A copy of the erroneous document executed by the bank must be attached to the form. Tax officials will recalculate penalties if an error was made in the KBK.

Object of taxation and rates

As an object for calculating fees, the payer can choose:

- income;

- income minus expenses.

The choice is made by the subject himself based on the advantages of each tax calculation method, the rules for determining income and expenses, and rates. In accordance with Art. 346.20 of the Tax Code of the Russian Federation, the following rates are established:

- 6 %;

- 15 %.

Regional authorities have the right to reduce them up to setting the rate at 0%. The rate of the simplified tax system “Income minus expenses” 2020 in St. Petersburg is 7%, according to the Law of this federal city No. 185-36 dated 05/05/2009.

The transition to the simplified tax system frees you from paying most of the fees to the state, which is why this system is called simplified. This procedure for calculating financial responsibility is convenient for representatives of small and medium-sized businesses. Thus, in this case, the regional law reduced only the simplified tax system rate “Income minus expenses”; In 2020, St. Petersburg still allows the application of a 0% rate to individual entrepreneurs - simplified tax payers, if they meet the established conditions (staff - up to 15 people, carrying out activities in the field of production and provision of services), first registered from 01.01.2016 . This rule is valid until 2021 and is referred to in practice as tax holidays.

Payment period

In accordance with the Tax Code, taxpayers set the amount of the fee themselves. In this case, payments are made four times a year, that is, advance payments for the first quarter, half a year and nine months are applied, and ultimately the final fee is calculated for the year. The advance must be calculated and paid by the 25th day of the month following the reporting month (that is, by April 25, July and October). The total amount of the fee must be paid according to the correct BCC before March 31 of the year following the reporting year.

Table of payment deadlines

| Reporting period | Deadline for payment |

| 2018 | 01.04.2019 |

| I quarter | 25.04.2019 |

| I half of the year | 25.07.2019 |

| 9 months | 25.10.2019 |

| 2020 | 31.03.2019 |

Installment card "Freedom"

The installment card from Home Credit Bank compares favorably with its competitors in that the installment plan is valid in any store, and not just in a partner store.

Installment terms from Home Credit

- Installment period – up to 10 months (for purchases in partner stores) or up to 51 days (in other stores),

- Card servicing is free,

- SMS package – 2 months free, then 99 rubles per month.

The card also has two pleasant bonuses.

- Skip the next minimum payment (free),

- Extension of installment plan for 10 months (RUB 1,490).