Every citizen performing labor activity is required to make insurance contributions to an organization called a pension fund. And many people often wonder: why pay money for something you can’t use?

But in reality, insurance premiums are a kind of investment in your future. After all, every citizen is entitled to an old-age pension upon reaching retirement age, and money is required to pay for it. However, changes are constantly taking place in this area, such as percentages, and it is very difficult for an ordinary person to keep track of the whole situation. In this article we will try to talk about changes in insurance premiums, as well as new tariffs for 2019 .

Changes in insurance premiums in 2019

Initially, every working citizen of the country is required to make mandatory payments to the Pension Fund . This is done with the goal that every working person has decent old-age benefits, namely a pension. If you do not contribute these funds, then no one will pay you a pension, since there will be nothing to pay from. To begin with, it is worth noting that there are several types of bets:

- On a universal basis;

- With reduced interest rates;

- Additional bets.

Now let's look at what situation happened earlier and what awaits us in the current 2019 .

In previous years, the interest rate was 22% for the maximum amount, which was 1 million 21 thousand rubles. And if the amount exceeded the limit, then the interest rate was 10%. Previously, the state considered making some changes to them and increasing them, but has not yet adopted these changes, and they do not have legal force. But some small changes will still be made to the system, namely:

- Cancellation of the limit on contributions to the pension fund - making a decision to eliminate the established interest rates;

- Termination of the grace period for firms and organizations - they will now be required to pay on a general basis;

- Establishment of new limit amounts - it is planned that they will increase.

Limits for 2019-2020

Until 2020, employers paid contributions to the Pension Fund, the Compulsory Medical Insurance Fund and the Social Insurance Fund. Now the Federal Tax Service is in charge of their administration, except for deductions for injuries. Chapter 34, dedicated to insurance premiums, appeared in the Tax Code. It prescribed tariffs (Article 425), the procedure for determining the base and its maximum value (Article 421).

The maximum base value is the amount of income upon reaching which reduced contribution rates begin to apply. This limit depends on the average salary established for the year. However, you won’t have to count anything, since these values are approved annually by the Government.

The maximum value of the base for calculating insurance premiums in 2019 was approved by Resolution No. 1426 of November 28, 2020. The dimensions are:

- for pension insurance - 1,150,000 rubles;

- for disability/maternity - 865,000 rubles.

For medical deductions, there is no reduced tariff and no limit for its application. There is also no established limit on the base for calculating insurance premiums for injuries. By the way, in 2020 they are still paid to the Social Insurance Fund - these are the only contributions whose administration has not been transferred to the tax service.

Preliminary figures for the limits for next year are already known - a draft Resolution has been published, which should approve them. This is 1,292,000 rubles for pension insurance and 912,000 rubles for disability/maternity.

Free tax consultation

Below is a table showing the limits for 2015-2020.

Table 1. Income limits by year (in rubles)

| Year | Limit value of the base for insurance premiums | |

| pension | due to illness/maternity | |

| 2020 | 1 292 000 | 912 000 |

| 2019 | 1 150 000 | 865 000 |

| 2018 | 1 021 000 | 815 000 |

| 2017 | 876 000 | 755 000 |

| 2016 | 796 000 | 718 000 |

| 2015 | 711 000 | 670 000 |

Insurance premium rates in 2019

As mentioned earlier in the article, insurance premiums are divided into several types. Each of them is intended for a certain type of people, organizations, as well as social status. Also, each type has its own tariffs, which must be paid by the working citizen - this is if we are talking about mandatory contributions and insurance.

According to the latest data, there are no significant changes in the tariff base of contributions, since most of the tariffs have not undergone major changes or have remained the same.

Now let's take a closer look at all types of payments and their interest rates for the current year:

| Types of contributions | Limits on prescribed amounts | Above the established limit amount |

| Pension insurance (compulsory) | 22% | 10% |

| Maternity or disability insurance (optional) | 2.9% | — |

| Medical insurance (compulsory) | 5.1% | |

As can be clearly seen from the above table, the changes do not represent a critical situation and almost all types of insurance have kept their rates unchanged.

Important ! Employers are required to make contributions in the event of workplace accidents in the prescribed manner. However, this rate depends solely on the company’s decision and is set on an individual basis. These rates may vary.

Blog

Amid mass hysteria over the coronavirus, Putin addressed the people and promised that support would be provided for small businesses. I will not describe my feelings from this help, since they have already been described here

. In this fairly short article, I will talk about reducing insurance premiums to 15% for small businesses in questions and answers.

1.

Where do legs grow from?

a bill there

, which describes measures to support small businesses in the form of reducing insurance premiums to 15 percent. The texts of bills are quite difficult to read, since they are often “tugged up” with pieces of amendments and indicate in which place what to remove and where to add what.

We are only interested in a small part of the bill, which we will talk about.

2.

Who does the reduced insurance premium rate apply to?

The bill directly states that the norms of the Tax Code of the Russian Federation will apply to “ payers of insurance premiums recognized as small or medium-sized businesses

in accordance with the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation

” (hereinafter referred to as 209-FZ).

We open the above law and look at the criteria for recognizing the payer of insurance premiums as a small and medium-sized enterprise (hereinafter referred to as SMP):

Criteria for a small enterprise, which includes the lion's share of the management company

— average headcount of no more than 100 people and income of no more than 800 million rubles. A minimum of 51% of the authorized capital of the management company must belong to individuals or organizations - SMP. The share of organizations not related to the SMP should not exceed 49%, the share of the state, regions or NPOs - 25% (clause “a”, clause 1, part 1.1, article 4 of Law No. 209-FZ).

Medium Enterprise Criteria

(such management organizations are much less common) - the average number of employees is no more than 250 people and the income is no more than 2 billion rubles. The restrictions on the structure of the authorized capital are the same as for small enterprises.

That is, if your management organization meets the above criteria, then from April 1, 2020, it can receive a “gift” from the state in the form of reduced insurance premiums.

note

: on the Federal Tax Service website

a link

to the official Unified Register of Small and Medium-Sized Enterprises, where you can enter the TIN of your company and check your company.

If your management company meets the criteria, but is not in the Federal Tax Service register, then you need to electronically inform the tax authorities about yourself using the link

.

3.

Why did you forget about the HOA?

Because homeowners' associations (TSN, housing cooperatives) cannot be classified as subjects of the SMP

.

This follows from paragraph 1 of Art. 4 of Law N 209-FZ, which states that SSE entities include “ business societies, business partnerships, business partnerships, production cooperatives, consumer cooperatives, peasant (farm) enterprises and individual entrepreneurs"

.

As you can see, HOAs, TSNs and others are not in the law

.

Many will argue that their HOA is in the register on the Federal Tax Service website, but these are, in fact, mistakes made by the tax authorities.

are categorical regarding the classification of HOAs as SMPs

:

Resolution of the First Arbitration Court of Appeal dated February 10, 2017 in case No. A43-19322/2016

According to Article 135 of the Housing Code of the Russian Federation, a homeowners' association is recognized as a type of real estate owner's association, which is an association of owners of premises in an apartment building for the joint management of common property in an apartment building (houses). Article 4 of the Federal Law of July 24, 2007 N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation” also provides that small and medium-sized businesses include those registered in accordance with the legislation of the Russian Federation and meeting the conditions established by part 1.1 of this article , business societies, business partnerships, production cooperatives, consumer cooperatives, peasant (farmer) households and individual entrepreneurs.

Thus, the Partnership, by definition, does not belong to small and medium-sized businesses

, which is subject to the provisions of Article 26.1 of Federal Law N 294-FZ.

Therefore, representatives of the HOA can safely swear at the speakers on TV, since the management company received reduced insurance premiums, but you DON’T!!!

4.

What insurance premium rates apply to SMP from 2021?

The bill states that for NSR subjects starting from 2021

The following insurance premium rates apply:

- for compulsory pension insurance:

within the established limit value of the base for calculating insurance premiums for this type of insurance - 10.0 percent;

over

the established maximum value of the base for calculating insurance premiums for this type of insurance is

10.0 percent;

- for compulsory social insurance in case of temporary disability and in connection with maternity - 0.0 percent

; - for compulsory health insurance - 5.0 percent

.

note

, that from 2021, for NSR subjects, in principle, such a concept as the maximum value of the base for calculating insurance premiums will be “abolished”,

since if the maximum value is exceeded, the insurance premium rate does not change and amounts to a total of 15%.

5.

What insurance premium rates apply to SMP in 2020?

The above-described amendments to the Tax Code of the Russian Federation come into force in 2021, but we are interested in the state’s concessions in 2020.

We open Articles 5 and 6 of the bill and there we see that from April 1, 2020 until the end of the 2020 billing period

For policyholders who are recognized as SMP, the following insurance premium rates apply (I put them in a table, because the devil will break his leg there):

| Within established limit value of the base | Over the limit established limit value of the base | |||

| Payment within the minimum wage | The payment exceeds the minimum wage | Payment within the minimum wage | The payment exceeds the minimum wage | |

| Contribution to compulsory pension insurance | Rate 22% | Rate 10% of the excess amount | Rate 10% | Rate 10% of the minimum wage |

| Compulsory social insurance contribution | Rate 2.9% | Rate 0% of the excess amount | Rate 2.9% | Rate 0% of the excess amount |

| Compulsory medical insurance contribution | Rate 5.1% | Rate 5% of the excess amount | Rate 5.1% | Rate 5% of the excess amount |

| TOTAL | 30% | 15% | 18% | 15% |

As you can see, insurance premium rates are tied primarily to the minimum wage

, which at the time of writing was

12,130 rubles

.

Thus, if an employee’s salary is 20,000 rubles, then the widely advertised benefit will cover the amount of 7,870 rubles, and not the entire amount, as many thought during Putin’s speech

.

6.

How the state does not fulfill its own promises made in the zombie box...

Remember Putin’s serious face when he spoke about the insurance premium rate of 15% and about supporting small businesses. Do you remember?

Now look carefully at what I wrote above, you will see that from 2021 the rate of insurance premiums for management organizations that are SMP will be 15% and will not be tied to the minimum wage

.

And in the now crisis year of 2020, the state did not bother to make a rate of 15%, and the lion’s share of salaries will remain taxed at 30%.

Therefore, look less at the appeals - you will still be deceived

…

Well, you can discuss all this positivity on our forum using the link .

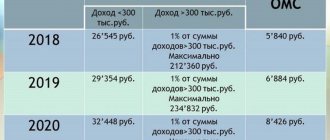

Insurance premium rates for individual entrepreneurs

It should be noted that regardless of whether you are the owner of a large organization or a private entrepreneur, you are required to make insurance payments. In the case of a company, everything is clear, since there is a large staff for which these contributions are paid. But in the case of individual entrepreneurs, everything is a little different. The question is whether you have staff or not.

If there is no staff, then you are still required to pay for yourself alone. But if you also have employees, then you, as their manager, undertake to pay for each of them.

There are also two types of payments - mandatory (fixed) and variable. The first type does not depend on the amount of income, since it is fixed. As for the second type, it directly depends on the size of the entrepreneur’s income. If the amount of income exceeds the mark of 300 thousand rubles, then the percentage of contributions changes depending on the amount of excess.

Reduced rates

Based on the Law, in 2018-2019, contributions will be calculated based on preferential rates for the declared group of employers.

Table 6. Reduced rates for 2020

| Employers | Rates in % | ||

| Pension Fund | FSS | FFOMS | |

| Payers of the simplified tax system. | 20 | 0 | 0 |

| Payers of UTII | |||

| Individual entrepreneurs who switched to PSN | |||

| NPOs - simplifiers | |||

| Charity organizations are simplistic | |||

| Skolkovo resident enterprises | 14 | 0 | 0 |

| Enterprises operating in the field of IT technologies | 8 | 2 | 4 |

| Enterprises in Crimea, near the port of Vladivostok and in progressive economic zones. development | 6 | 1,5 | 0,1 |

| Employers operating on ships included in the Russian International Register of Ships | 20 | 0 | 0 |

The law spells out benefits for a number of legal entities and merchants in the form of reduced tariffs. The list of those who can claim benefits is specified in Art. 427 Tax Code of the Russian Federation. This category includes:

- Legal entities and individual entrepreneurs whose activities are related to the implementation of the results of the intellectual sphere.

- Businessmen working in the field of information technology.

- Businessmen using the simplified tax system for work.

- Pharmaceutical business using UTII.

- Non-commercial activities of entrepreneurs using the simplified tax system.

- IP using a patent.

The tariff reduction is associated with the specialization of the enterprise or individual entrepreneur. Preferential conditions are provided only for those employers who comply with all the specified conditions, otherwise the entrepreneur is deprived of the rights to reduced tariff rates. Basically, benefits are provided to organizations using the simplified tax system, and in the event of a transition to the basic tax system, the preferential conditions cease to apply.

If preferential conditions can only apply to a certain part of production, then the reduced tariff can only be applied to the income of employees whose type of activity falls under preferential conditions. Therefore, the presence of such employees obliges to carry out accounting in a separate form.

Payments to the pension fund are 1% of income over 300 thousand rubles. Compulsory medical insurance payments are made when income exceeds a fixed limit. At the same time, the maximum amount of contributions to the pension fund should not be greater than the fixed rate increased by 8 times.

Persons exempt from insurance contributions include:

- called up for military service;

- caring for a child under 1.5 years of age or an elderly relative;

- those who left the country with their entire family on a diplomatic mission;

- family members of military personnel stationed in distant regions.

Pensioners still have to pay for insurance.

Starting this year, many payers will not pay tariffs on preferential terms. Such payers include companies that are subject to a simplified taxation system, entrepreneurs who pay taxes under the patent system, as well as pharmacies that pay a single tax on imputed income.

Preferential tariffs apply to legal entities and individual entrepreneurs who are subject to a special tax regime, including IT technology specialists, residents of especially important economic zones, participating in the Skolkovo program.

And for the bulk of organizations working under the simplified system, a general 30% tariff is used. In 2020, insurance premiums reduced to 20 percent remained only for non-profit organizations and charitable organizations using the simplified tax system. This benefit will apply to them for a six-year period. Any other simplifier other than those listed above will no longer be able to take advantage of the benefit.

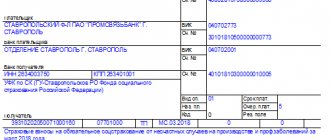

Details and deadlines for payment of insurance premiums

In order to make a payment for a particular insurance payment, you need to know its details. It should also be noted that each type, regardless of the name, has its own unique requisite number. If you provide an incorrect reference number, your payment will not be considered valid. For this reason, it is very important to take this issue seriously.

To get acquainted with the details of each contribution, you can go to the official pages and find out the details of each.

Now regarding payment terms. If you are a private entrepreneur but do not have employees, then you have a deadline of December 31 of the current year. If there are employees, shorter deadlines are set. For companies and organizations that have employees on shorter terms, they are required to make contributions no later than the 15th of each month.

In case of late payment, fines will be issued. And the longer the delay in payments, the greater the fine will be accrued. Also, serious problems with these controls may arise in the future. For this reason, try to make payments on time and without any delays.

KBC for insurance premiums in 2019

The current year is rich in changes and changes in the field of insurance payments. Changes in the place where payments are accepted, as well as in the codes for paying contributions, namely KBK, were also not spared. To begin with, it should be said that now these accruals should be sent not to the fund, as it was before, but to the Federal Tax Service. This applies to compulsory insurance such as pension, medical and social insurance. Also, when filling out a receipt for payment of one of the mandatory insurances, you must also indicate the KBK - a unique code assigned to each payment made.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If you enter the wrong code, then your payment will not be considered paid. Therefore, it is very important to familiarize yourself with the new codes. This can be done on the official website on the Internet.

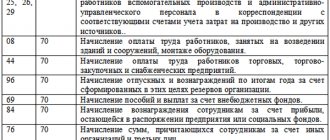

Add. tariffs 2020 (no special assessment carried out): table

The general procedure for using additional tariffs is specified in Article 428 of the Tax Code of the Russian Federation. They are used for certain categories of workers employed in certain jobs, depending on the age of the workers and length of service. But only on the condition that the employer did not carry out SOUT.

| Works | Tariff for compulsory pension insurance |

| Underground, with hazardous working conditions and in hot shops | 9 % |

| With difficult working conditions | 6 % |

| As tractor drivers in agriculture and other sectors of the economy, as well as drivers of construction, road and loading and unloading machines (for women) | |

| With increased intensity and severity in the textile industry (for women) | |

| In expeditions, parties, detachments, at sites and in teams during field geological exploration, search, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work | |

| As working locomotive crews and workers of certain categories, organizing transportation and ensuring traffic safety on railway transport and in the subway, as well as as truck drivers in the technological process in mines, open-pit mines, mines or ore quarries for the removal of coal, shale , ores, rocks | |

| Provided in paragraphs 7-18h. 1 tbsp. 30 Federal Law dated December 28, 2013 No. 400-FZ |