Additional accrual of insurance premiums for previous periods

Important In other words, if in the period for which additional insurance premiums are calculated, the tax base for income tax was unprofitable and the tax was not paid at all, then paragraph 1 of Article 54 of the Tax Code of the Russian Federation cannot be applied.

In this situation, you need to submit an updated tax return for the previous period with the amount of expenses increased by additional accrued insurance premiums. If last year the tax base for income tax was positive and the amount of tax was paid to the budget, then an updated declaration may not be submitted, but an additional assessment may be taken into account in the current year when the audit report was drawn up (or the organization independently identified an error in the calculation of insurance premiums) . At the same time, in the letter of the Federal Tax Service of Russia dated August 17, 2011 No. AS-4-3/13421, a different approach was voiced. Figure 38 In the second quarter, the organization calculated contributions at this “preferential” tariff and submitted the corresponding reports, while it did not have the right to apply such a tariff. Figure 39 This error was discovered in the third quarter. Corresponding changes are made to the accounting parameters setting - the correct tariff “Organizations using the simplified tax system, except those specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” is indicated, which has been in force since April. The date when changes were recorded is the date when the error was actually detected.

Figure 40 During the next calculation of insurance premiums in July, additional charges for previous periods are made. Figure 41 When generating reports for the 3rd quarter, the recalculation amount will be taken into account in section 4, and also section 2.1 will be additionally formed with the “old” tariff code 07 and filled in indicators “from the beginning of the billing period”.

How to reflect a contribution taxable benefit that has not been credited to the Social Insurance Fund: policyholder reporting

4-FSS

The procedure for correction depends on the year in which the uncredited benefit was paid. If this is 2020 or earlier, then first of all the data in table 2 is corrected: the policyholder excludes social payments not accepted by the fund from the corresponding rows and columns of the table. Accordingly, the indicators for the lines “Expenditures for the purposes of compulsory social insurance” and “Debt owed to the territorial body of the Social Insurance Fund at the end of the reporting (calculation) period” are reduced. And the accountant will record the amount of the benefit not accepted by social insurance in the same line 5 of Table 1.

As a general rule, the policyholder will also need to adjust lines 1–4 of Table 3 and lines 1–3 of Table 6 (in terms of the total amount of payments and rewards in favor of individuals and the distribution of these amounts into taxable and non-taxable insurance premiums). Lines 2 of Table 1 and Table 7 “Accrued for payment of insurance premiums” are adjusted for the amount of additionally accrued insurance premiums - if the arrears were discovered in the same year in which the benefits were initially paid. Accordingly, amendments are made to the lines recording the debt owed by the policyholder at the end of the reporting period.

If 4-FSS is adjusted for the periods of 2020, then there are no tables for calculating contributions and payments for VNiM. The basis for calculating contributions for injuries, the total amount of payments and rewards in favor of individuals, the amount of accrued contributions and the debt owed to the policyholder at the end of the period are subject to correction.

RSV-1

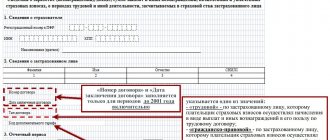

For periods before 2020, personalized information should be clarified using the SZV-KORR form (Resolution of the Pension Fund Board of January 11, 2017 No. 3p). In this form, you provide the employee’s personal data, corrected amounts of payments in his favor and calculated contribution amounts. In case of incomplete reflection of insurance premiums in the reporting for any reporting periods, the amounts of additional accruals are reflected on an accrual basis in the 120th line and in section 4 of the annual form RSV-1 on a separate line for each period.

ERSV

Policyholders submit new calculations for insurance premiums for periods starting from 2020. The general principle for adjusting the calculation in the event of a FSS refusal to reimburse or offset is the same as when correcting Form 4-FSS for 2020: it is necessary to exclude uncredited benefits from Appendix 3, as well as adjust the base for calculating each type of insurance premium and the total amount of payments and rewards in favor of individuals. The lines containing information on the amount of accrued insurance premiums and the amounts on lines 070 and 090 of Appendix 2 are also adjusted.

Read more about the procedure for clarifying personalized information in the ERSV here.

Amounts of additionally accrued insurance premiums – other expenses

And the values in completed line 120 in RSV-1 must be equal to the corresponding values in the “Total” line in section 4. Separately, line 121 indicates contributions to compulsory pension insurance, additionally accrued from payments after exceeding the maximum base value.

How to fill out section 6.6 of RSV-1 Additional accrued amounts of contributions must be reflected not only in section 4 and in line 120 of section 1, but also in sections 6, which are issued separately for each employee. After all, additional charges appeared due to unaccounted payments in favor of specific individuals.

Info This means that unreliable personalized information was also provided on them previously. In this regard, in the calculation of DAM-1, corrective section 6 must be drawn up. In it, in subsection 6.3, the type of adjustment is noted - “corrective” and subsection 6.6 is filled in, which indicates the directly accrued amounts of contributions from payments of this individual (clause 35 of the Procedure for filling out DAM -1).

Since not all operations can be performed with the current date. Some difficulties may arise when making additional charges in 1C 8.2, since there are some peculiarities in performing this operation.

What period to take into account? The tax period for contributions to extra-budgetary funds is recognized as one calendar year. The reporting periods are:

- one block;

- half year;

- 9 months.

In this case, the rate for each period is set depending on the following factors:

- tax payer category;

- the type of fund to which transfers are made;

- the amount of income of the employee from whose salary payments are made.

Situations often arise when, for some reason, contributions are not paid not just for some individual reporting periods, but for years.

In this case, it is necessary to reflect the profits of previous years in the accounting records for the current year. In addition, a permanent negative difference is formed in accounting, as a result of which a permanent tax asset (PTA) is formed.

Changes in accounting and tax accounting at the same time are rare. Sometimes amounts are reduced only in tax accounting. For example, these include payments to unrealistic suppliers, whom inspectors considered to be fly-by-night companies.

Then there will be no changes in accounting. Example 2. In 2014, Xenon2 LLC had an on-site tax audit.

As a result, the inspectors considered that the company worked with unrealistic suppliers in 2013, and withdrew their payment for the products in the amount of 65,000 rubles. On this amount, an additional income tax of 65,000 * 20% = 13,000 rubles was assessed. In addition, a clear overestimation of depreciation in the amount of 14,000 rubles was revealed.

The employee did not return the erroneously paid benefit: UTII

Erroneously paid benefits themselves do not affect the calculation of the tax base. After all, the object of UTII taxation is imputed income, that is, a fixed amount (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

In this case, the organization must pay additional insurance premiums. Then you can reduce the single tax by the amount of these contributions. The total amount of the deduction should not exceed 50 percent of the accrued UTII. This procedure is established by paragraph 2.1 of Article 346.32 of the Tax Code of the Russian Federation.

Other tax consequences of the fund's refusal to reimburse benefit expenses are the same as if the employee had returned the money. That is, if the Federal Social Insurance Fund of Russia refused to reimburse the sick leave benefit, you will have to recalculate the amount of the single tax paid, transfer penalties and submit an updated declaration.

An example of how to reflect costs in taxation when the Federal Social Insurance Fund of Russia refuses to reimburse sick leave benefits. The refusal is related to the payment of benefits to an employee temporarily staying in Russia. The organization applies UTII

Alpha LLC applies UTII. Insurance premiums to extra-budgetary funds are paid at the usual rate. Contributions for insurance against accidents and occupational diseases are calculated at a rate of 0.2 percent.

In May, an Alpha accountant erroneously accrued sick leave benefits to an employee temporarily staying in Russia. In this case, insurance premiums for this employee were paid for a period of less than six months preceding the month in which the insured event occurred. Despite this, hospital child care benefits in the amount of 2000 rubles. was fully paid at the expense of the Russian Social Insurance Fund.

By the amount accrued at the expense of the Russian Social Insurance Fund, the accountant reduced the amount of insurance contributions that he had to pay to this fund. The accountant transferred insurance premiums from payments to citizens to the budget on June 15.

UTII was transferred to the budget on July 25, and the declaration was submitted on July 17.

The FSS of Russia, having discovered an error, on July 30 refused to reimburse the benefit amount. The organization wrote off a payment of 2,000 rubles. at your own expense. Insurance premiums must be charged on this payment.

The amount of contributions that need to be paid to the Pension Fund is: 2000 rubles. × 22% = 440 rub.

Amount of contributions to the Social Insurance Fund of Russia: 2000 rubles. × 2.9% = 58 rub.

Amount 2000 rub. unlawfully reduced the base for calculating contributions to the Social Insurance Fund of Russia.

Debt in contributions to the FFOMS: 2000 rubles. × 5.1% = 102 rub.

Debt on contributions for insurance against accidents and occupational diseases: 2000 rubles. × 0.2% = 4 rubles.

Insurance premiums increase the size of the single tax deduction (440 rubles + 58 rubles + 102 rubles + 4 rubles = 640 rubles). Consequently, there was an overpayment for UTII.

Alpha's accountant prepared the updated Form 4-FSS and the UTII declaration.

Form RSV-1 PFR was submitted after the error was discovered and contained correct information.

Organization of accounting for account 69

An enterprise that makes payments to employees in accordance with concluded employment contracts is obliged to record the accrual of insurance premiums for their subsequent transfer to an extra-budgetary fund. The law provides for compulsory medical, social and pension insurance for employees. The employer must also ensure payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to extra-budgetary funds, account 69 is used. To analyze and control the amounts of contributions, the organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- calculation of the amount of contributions (including fines, penalties);

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to extra-budgetary funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are recorded, but also credits coming from the Social Insurance Fund are made.

Subaccounts 69 accounts

- 69.01 – Social insurance payments

- 69.02.1 — Insurance part of the labor pension

- 69.02.2 — Cumulative part of the labor pension

- 69.02.3 — Contributions to supplement pensions for flight crew members

- 69.02.4 — Contributions to supplement pensions for employees of coal industry organizations

- 69.02.5 - Additional contributions to the insurance part of the pension for employees engaged in work with hazardous working conditions

- 69.02.6 - Additional contributions to the insurance part of the pension for employees employed in jobs with difficult working conditions

- 69.02.7 - Compulsory pension insurance

- 69.03.1 — Federal Compulsory Medical Insurance Fund

- 69.03.2 — Territorial Compulsory Medical Insurance Fund

- 69.04 - Unified Tax in the part transferred to the Federal Budget

- 69.05.1 - Contributions at the expense of the employer

- 69.05.2 - Contributions withheld from employee income

- 69.06.1 — Contributions to the Pension Fund (insurance part)

- 69.06.2 — Contributions to the Pension Fund (funded part)

- 69.06.3 — Contributions to the Compulsory Medical Insurance Fund

- 69.06.4 — Contributions to the Social Insurance Fund

- 69.06.5 - Compulsory pension insurance for entrepreneurs

- 69.11 — Calculations for compulsory social insurance against accidents at work and occupational diseases

- 69.12 — Calculations for voluntary contributions to the Social Insurance Fund for employee insurance in case of temporary disability

- 69.13.1 — Settlements using Social Insurance Fund funds for policyholders paying UTII

- 69.13.2 — Settlements using Social Insurance Fund funds for policyholders using the simplified tax system

Table of typical transactions for account 69

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee according to the employment contract. The amount of accrual of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected in Dt 69. Also, according to Kt 69 the amount of receipts of contributions credited from extra-budgetary funds in favor of the organization can be carried out.

Basic transactions on account 69 are reflected in accounting with the following entries:

| Dt | CT | Description | Document |

| 69 | 51 | Insurance premiums are transferred to an extra-budgetary fund | Payment order |

| 20 | 69 | Insurance premiums accrued to an employee of the main production | Payroll |

| 44 | 69 | Insurance premiums have been accrued to the employee who ensures the process of selling goods | Payroll |

| 99 | 69 | Accrual of fines and penalties for insurance premium payments | Accounting certificate-calculation |

| 51 | 69 | Refund of funds overpaid to extra-budgetary funds | Bank statement |

Example of postings for account 69

On January 31, 2016, Start LLC made a payment to K.R. Sazonov, an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

When paying Sazonov’s salary, the accountant at Start LLC calculated the amount of insurance premiums:

- Pension Fund for the insurance part of the labor pension: 41,300 rubles. x 14.0% = RUB 5,782;

- Pension Fund for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rub.;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rub.;

- Social Insurance Fund for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rub.;

- FFOMS: 41,300 rub. x 1.1% = 454 rubles;

- TFOMS: 41,300 rub. x 2.0% = 826 rub.

The accountant at Start LLC reflected the payment of wages to Sazonov and the accrual of insurance premiums with the following entries:

| Dt | CT | Description | Sum | Document |

| 91.2 | 70 | The salary of K.R. Sazonov has been accrued. | RUB 41,300 | Payroll |

| 91.2 | 70 | Sickness benefits accrued (at the expense of Start LLC) | RUB 2,350 | Payroll |

| 69.01 | 70 | Sickness benefit accrued (at the expense of the state) | RUB 5,150 | Payroll |

| 91.2 | 69.01 | The amount of insurance contributions to the Social Insurance Fund has been calculated | 1198 RUR | Payroll |

| 91.2 | 69.01 | The amount of insurance premiums accrued (accidents and occupational diseases) | 83 rub. | Payroll |

| 91.2 | 69.02.1 | The amount of insurance premiums has been calculated (the insurance part of the pension) | 5782 rub. | Payroll |

| 91.2 | 69.02.2 | The amount of insurance contributions has been accrued (the funded part of the pension) | 2478 rub. | Payroll |

| 91.2 | 69.03.1 | The amount of insurance premiums accrued (FFOMS) | 454 rub. | Payroll |

| 91.2 | 69.03.2 | The amount of insurance premiums accrued (TFIF) | 826 rub. | Payroll |

| 69.01 | 51 | The amount of insurance contributions (accidents and occupational diseases) was transferred to the extra-budgetary fund. | 83 rub. | Payment order |

| 69.02.1 | 51 | The amount of insurance contributions (the insurance part of the pension) was transferred to the extra-budgetary fund | 5782 rub. | Payment order |

| 69.02.2 | 51 | The amount of insurance contributions (the funded part of the pension) was transferred to the extra-budgetary fund. | 2478 rub. | Payment order |

| 69.03.1 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (FFOMS) | 454 rub. | Payment order |

| 69.03.2 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (TFIF) | 826 rub. | Payment order |

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund: calculation of penalties." Posting penalties to the Pension Fund of the Russian Federation (to the Federal Tax Service): when to make the posting The day on which transactions to accrue the amount of penalties should be reflected is selected depending on whether the accountant paid the penalties himself or whether the obligation to pay them was discovered after an audit:

- when the accountant himself corrected the error and paid the penalty, the transactions are posted on the day of their calculation (and the day must be indicated in the calculation certificate);

- if a notice was received to remind you to pay penalties, the accountant makes an entry for the day when the decision to accrue them after the audit came into force.

Legislative acts on the topic It is recommended to study in advance: Document Title Federal Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance” Norms for insurance premiums in cases of injury p.

The employee did not return the erroneously paid benefit: simplified tax system

What matters here is what object of taxation the organization has chosen.

Option 1: “income” object

If a simplified organization pays a single tax on income, then it will not be possible to take into account expenses, including in the form of erroneously paid amounts. Indeed, with such an object of taxation, no expenses are taken into account (clause 1 of Article 346.14, clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Having forgiven the employee the debt, you need to pay additional insurance premiums. By this amount of contributions you can reduce the single tax, as usual, within 50 percent of the accrued tax amount (advance payment). This procedure is established by paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

Other tax consequences of a fund's refusal to reimburse benefit expenses are the same as those that arise when an employee pays back the money. If the Federal Social Insurance Fund of Russia refuses to reimburse the sick leave benefit, the organization will have to recalculate the single tax, pay penalties and submit an updated declaration.

An example of how expenses are reflected in taxation in the event of a partial refusal by the Federal Social Insurance Fund of Russia to reimburse sick leave benefits. The organization applies a simplification with the object of taxation “income”

Alpha LLC applies a simplified taxation system (taxable object “income”). The organization applies the normal rate of contributions.

Employee of the organization A.I. Ivanov presented a sick leave certificate to the organization’s accounting department confirming his incapacity for work from April 1 to April 5. The amount of sick leave was 2,500 rubles.

The accountant mistakenly paid for not three, but two days of sick leave at the expense of the organization. At the expense of Alpha, 1,000 rubles were paid, at the expense of the Federal Social Insurance Fund of Russia - 1,500 rubles.

Ivanov received the benefit on May 5. The amount of sick leave benefits increased the personal income tax base. The employee does not have the right to tax deductions. The tax amount was:

2500 rub. × 13% = 325 rub.

Ivanov was paid:

2500 rub. – 325 rub. = 2175 rub.

Alpha's accountant transferred personal income tax to the budget on May 5.

By the amount accrued at the expense of the Federal Social Insurance Fund of Russia (1,500 rubles), the accountant reduced the amount of insurance contributions that he had to pay to this fund. The accountant transferred insurance premiums from payments to citizens to the budget on May 15.

For 1000 rubles. The accountant reduced the amount of the single tax. The advance payment for the single tax under simplification for the six months was transferred to the budget on July 25.

The FSS of Russia, having discovered an error, on August 26 refused to reimburse 500 rubles. The organization paid this amount at its own expense.

The accountant could reduce the amount of the advance payment for the single tax (in terms of the deduction for sick leave) not by 1000 rubles, but by 1500 rubles. (the amount of deduction does not exceed 50% of the payment). However, in addition to this, the accountant applied a deduction for insurance premiums (they were 500 rubles more, but became 500 rubles less).

The organization had arrears in contributions to the Social Insurance Fund of Russia (the organization unlawfully reduced the base for calculating contributions by 500 rubles). There is no need to add additional contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund from this payment; they are not calculated on the amount of the sick leave benefit.

Alpha's accountant completed an updated Form 4-FSS. The simplified single tax declaration with correct information was submitted after an error was discovered.

Option 2: object “income minus expenses”

If a simplified organization pays a single tax on the difference between income and expenses, then the erroneously paid amounts cannot be taken into account. Firstly, gratuitous payments are not named in the list of expenses that can be taken into account when calculating the single tax under simplification (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Secondly, these amounts do not relate to economically justified expenses (clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation). Therefore, do not recognize the amount of erroneously paid benefits as expenses.

Include the amount of additionally accrued contributions as expenses (subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation). These payments reduce the tax base as they are transferred to extra-budgetary funds (clause 2 of article 346.16 of the Tax Code of the Russian Federation). Do not take into account unpaid insurance premiums when calculating the single tax.

Other tax consequences of a fund's refusal to reimburse benefit expenses are the same as those that arise when an employee pays back the money. If the Federal Social Insurance Fund of Russia refuses to reimburse the sick leave benefit, the organization will have to recalculate the tax base, pay penalties and submit an updated declaration.

An example of how expenses are reflected in taxation in the event of a partial refusal by the Federal Social Insurance Fund of Russia to reimburse sick leave benefits. The refusal was caused by an error in calculating average earnings. The organization applies a simplification (“income minus expenses”)

Alpha LLC applies a simplified taxation system (taxable object “income reduced by the amount of expenses”). Insurance contributions to extra-budgetary funds are calculated at a reduced rate: in the Pension Fund of Russia - 20 percent, in the Federal Social Insurance Fund of Russia - 0, in the Federal Compulsory Medical Insurance Fund - 0. For contributions for insurance against accidents and occupational diseases, a rate of 1 percent is applied.

When calculating A.I. Ivanov's hospital benefit for caring for a sick child, the accountant made a mistake when calculating the average daily earnings. Instead of 400 rub./day. he calculated the benefit based on the average daily earnings of 500 rubles/day.

For five days of sick leave, the employee was credited 2,500 rubles. (at the expense of the FSS of Russia).

Ivanov received the benefit on June 1. The amount of sick leave benefits increased the personal income tax base. The employee does not have the right to tax deductions. The tax amount was:

2500 rub. × 13% = 325 rub.

Ivanov was paid:

2500 rub. – 325 rub. = 2175 rub.

Alpha's accountant transferred personal income tax to the budget on June 1.

The accountant transferred insurance premiums from payments to citizens to the budget on June 15. The organization applied to the fund for reimbursement of the benefits paid.

However, on August 13, the Federal Social Insurance Fund of Russia made a decision to partially refuse to reimburse the amount of the benefit. The administration of the organization decided to write off the payment to Ivanov, which was not reimbursed by the FSS of Russia, at its own expense. The amount of this payment was: 2500 rubles. – 400 rub./day. × 5 days = 500 rub.

The accountant did not reduce the single tax during simplification by the amount of this payment. The organization has arrears in contributions to extra-budgetary funds.

The amount of contributions that need to be paid to the Pension Fund is: 500 rubles. × 20% = 100 rub.

Debt on contributions for insurance against accidents and occupational diseases:

500 × 1% = 5 rub.

Alpha's accountant completed updated forms 4-FSS and RSV-1 Pension Fund.

There was an overpayment for the single tax during simplification. In expenses, an accountant can take into account:

100 rub. + 5 rub. = 105 rub.

Basic entries when paying penalties on insurance premiums

What are penalties and how are they calculated Methods for collecting penalties and the negative consequences of their late payment Reflection of penalties on insurance premiums in accounting Results What are penalties and how are they calculated Since 2020, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty. Please note that arrears in contributions cannot be repaid using overpayments incurred before 2020.

Info A return of the overpayment to the current account is possible only after the arrears have been repaid. For more details, see “Offsetting overpayments on contributions for periods before 2020 is not possible.” Attention The basis for payment of penalties (if they are not paid voluntarily) are the requirements imposed on the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

Algorithm for recording benefits not accepted by the Social Insurance Fund for credit

If the Social Insurance Fund did not accept the taxable benefit and refused to reimburse or offset social payments, then the accountant must proceed as follows:

- Reverse the amount of unaccounted benefits in accounting.

- Write off uncredited amounts as expenses or withhold them from the employee.

- Calculating insurance premiums from uncredited social benefits is the safest way for the policyholder at the moment, recommended by the Federal Tax Service and the Ministry of Finance (letters dated September 22, 2017 No. ED-4-15/19093 and dated September 1, 2017 No. 03-15-07/56382, respectively) .

One can argue with the demands of officials to charge contributions. A selection of law enforcement practices that you will find in ConsultantPlus will help you with this. If you do not have access to the system, you can get it for free.

- Pay additional contributions to the Federal Tax Service or the Social Insurance Fund (for periods before 2020) - if you reduce monthly social contributions to VNiM by the amount of benefits, then after the FSS refuses to offset the benefits, you need to pay additionally to the administrator of contributions to VNiM (until 2020 - FSS, from 2020 - Federal Tax Service) in the amount of social payments not accepted for offset

- Accrue and withhold personal income tax from the employee - this paragraph does not apply to temporary disability benefits, from which personal income tax is already withheld. But with other types of social benefits the situation is more complicated. By analogy with the calculation of insurance premiums: if the Social Insurance Fund refuses to count the payment of benefits, then it ceases to be insurance coverage for compulsory social insurance. This means that it does not apply to payments from the amounts of which income tax is not withheld. Consequently, if an employee refuses to return a benefit that was not credited to the Social Insurance Fund, then such payment becomes his income, from which income tax must be withheld. However, the law does not contain a direct obligation to collect personal income tax on benefits not included in social insurance. But if you do not withhold personal income tax, but charge insurance contributions, this may raise questions among tax authorities, since there will be a difference between the base for calculating insurance contributions and the base for income tax.

- Deal with a possible overpayment of personal income tax - if an employee has returned benefits that were previously subject to income tax, then he will have an overpayment. You must inform the employee about it (clause 1 of Article 231 of the Tax Code of the Russian Federation), and then this overpayment either be offset against future personal income tax payments, or returned to the employee based on an application exclusively to his bank account.

- Transfer contributions and personal income tax* to the budget.

- Calculate penalties for contributions and income tax* and also transfer to the state. At the moment social payments are recognized as non-refundable, the organization has arrears in insurance contributions and personal income tax*. And penalties are calculated for the period from the day following the established date for the transfer of insurance premiums for the month in which the benefit was paid until the day preceding the day of repayment of arrears on contributions or income tax.

A penalty calculator will help you.

- Adjust reporting - you need to make corrections to accounting and tax reporting, including personnel reports: 2-NDFL**, 6-NDFL** (for periods from 2020), 4-FSS, RSV-1 (for periods before 2020), ERSV (for periods starting from 2017).

* If income tax has not been withheld previously and you decide to withhold it anyway.

**Adjusted if you chose to withhold income tax on amounts previously not subject to it.

Let's take a closer look at each stage.

How to reflect arrears on insurance premiums in accounting

- D 26 K 69 - fear. contributions are determined for personnel belonging to general business units;

- D 28 K 69 - fear. contributions are calculated for employees involved in operations to correct defective products;

- D 29 K 69 - fear. contributions are calculated based on personnel employed in service farms;

- D 44 K 69 - fear. contributions are calculated based on personnel involved in the sale of products to consumers;

- D 70 K 69 - the cost of the voucher received from the Social Insurance Fund is deducted from the salary;

- D 51 K 69 - insurance premiums that were overpaid earlier and returned to the budget were credited to the current account;

- D 99 K 69 - reflects the amount of penalties or fines for insurance premiums.

- When carrying out any transactions on insurance premiums, the following entries are generated in the debit of the account.

Peculiarities of reflecting tax penalties in accounting To display penalties in accounting, you can use two accounts - 91 or 99. To display accrued penalties, it is recommended to use account 99, which allows you to avoid a permanent tax liability, since when generating an income tax return, the accrued penalty for insurance contributions are not included in the calculation of the tax base.

It is recommended to consolidate the use of account 99 in the accounting policy of the enterprise. List of possible entries for accrual of penalties for income taxes, VAT, personal income tax and insurance contributions Account Dt Account Kt Posting amount, rub.

Accounting for benefits not accepted for credit by the Social Insurance Fund: the employee did not return the benefit

The benefit cannot be recovered from the employee if the failure to offset social benefits arose due to an accountant’s incorrect interpretation of the law when calculating the amount of the benefit (Part 4, Article 15 of Law 255-FZ). In addition, the manager has the right to decide not to collect benefits regardless of the reason for the failure (Article 240 of the Labor Code of the Russian Federation).

If the employee does not return social benefits, then make the following entries:

| Debit | Credit | Contents of operation |

| 69 | 70 | Reversal of accrual of uncredited social benefits |

| 91-2 | 70 | Payments not credited by the fund are charged to other expenses |

| 91-2 | 69 for subaccounts of settlements with funds or with the Federal Tax Service regarding the calculation of insurance premiums | Insurance premiums accrued on benefits not credited to the Social Insurance Fund |

| 70 | 68 | Personal income tax withheld from social benefits (except for temporary disability benefits) |

| 91-2 | 69 s/account “Penies, fines on social contributions” | Penalties were accrued for late social contributions to the budget |

| 91-2 | 68 s/account “Penies, fines for personal income tax” | Penalties accrued for arrears on personal income tax |

| 69/68 for subaccounts of settlements with funds or with the Federal Tax Service regarding the calculation of insurance premiums/personal income tax, 69 s/account “Penies, fines on social contributions”, 68 s/account “Penies, fines on personal income tax” | 51 | Insurance premiums, personal income tax, penalties for insurance premiums and personal income tax are transferred to the budget |

Withhold personal income tax from the employee if he has not returned the amounts of incorrectly paid benefits, the tax was not withheld earlier and you decide that it is safer to withhold it. If the employee has already quit, inform the Federal Tax Service about the impossibility of withholding income tax.

In tax accounting, benefits not accepted by the Social Insurance Fund for credit are not included in the calculation of income tax, so a permanent difference arises and a permanent tax liability arises.

Read about fixing the differences between accounting and tax accounting here.

Simplificationists also do not take into account benefits that are not included in social insurance in expenses.

How to reflect arrears on insurance premiums in budget accounting

In this case, the calculation basis is the wages and other employee benefits paid to them by the employing company. Each type of contribution has certain calculation features and an interest rate, as well as a limit on the base used for calculation. Until 2020, control over the calculation of insurance premiums was carried out directly by extra-budgetary funds, and starting from January 1, 2017, these powers were transferred to the tax authorities. Now the transfer of contributions, as well as reporting on them, must be sent to the Federal Tax Service at the place of registration of the company. However, this in no way affects the accounting and postings that are compiled in the organization, and, therefore, the correspondence and rules for calculating contributions remain the same.

Charges are generated from the next day after the delay. The penalty is accrued daily until the date of payment of the debt and penalties. If the debtor does not pay the debt in full, a fine is collected by force. That is, through the court. The debt amount is written off from bank accounts. If there are no funds, the property is seized. If a lot of time has passed, no coercive measures apply to the debtor, and the debt is considered uncollectible. In this case, it is written off. IMPORTANT! Refunds from the tax authority for overpayment of taxes can lead to the formation of arrears. Arrears on insurance premiums There are the following types of arrears on insurance premiums:

- According to the FSS. Occurs when there is a debt to the Social Insurance Fund. There is a certain procedure for calculating the amount of arrears: contributions already paid are deducted from the total amount of debt.

Situation

Let’s assume that in 2020, based on a certificate of the amount of earnings of the insured person, the accounting department recalculated the amount of temporary disability benefits for the previous billing period of 2018. That is, the employee received the missing amount of benefits in 2020.

Accordingly, the question arises of reflecting in the calculation of insurance premiums the recalculation (additional accrual) of previously accrued benefits for temporary disability and in connection with maternity for the previous billing period in subsequent reporting periods.

Arrears and its role in tax accounting

Russian Pension Fund. This structure is a financial administrator that distributes funds, which subsequently go to:

- for the payment of pensions upon reaching a certain age;

- to pay for services provided to citizens of the Russian Federation under the compulsory health insurance system.

Payment of insurance premiums is carried out in the following order: Until the 15th day of each month following the reporting month If this date falls on a non-working day, then the last day of reporting is the next working day 22% Rate for pension insurance contribution Rate increases by 10% If the size of the insurance premium base the employer has more than a certain amount 5.1% Rate of contributions to the compulsory medical insurance system There is a certain category of employers who are exempt from paying insurance contributions. They are also not subject to the increased tariff rate of 10%.

Info In order for all mandatory payments to be made on time and in the required amount, it is necessary to pay special attention to the following points:

- what exactly to consider when drawing up a report;

- information regarding inspection reports;

- the process of posting, that is, reflecting information in the financial statements;

- work in the 1C program.

Due to the fact that not all transactions can be carried out on the current date, displaying reporting in accounting programs is important. Difficulties arise when additional charges are made in 1C 8.2, since this operation has its own specifics.

Postings All entries related to the reflection of additional amounts of taxes, contributions, fines and penalties accrued based on the results of audits are made on the date when the audit decision comes into force. For what period is it taken into account? The reporting period for contributions to pension contributions is considered to be 1 year.

On this page:

- What is arrears?

- How is arrears identified?

- Collection procedure

- Statute of limitations for collection

- Summary

Arrears is a term that can be found in legal documents dating back to the 19th century. Then taxes were collected from the peasants, but most did not have the means to pay.

Arrears arose. That difficult period for ordinary people has ended, but the term is still used now. What is arrears? According to the Tax Code, arrears are taxes or mandatory payments that have not been paid.

Simply put, it is debt. Arrears are collected from both individuals and legal entities. The funds paid are sent to the state budget. Tax arrears Tax payments require a set date for payment. If the company does not make payments, then arrears are accrued.

The following categories of employers are required to pay insurance premiums:

- All kinds of organizations with employees who are paid wages or working with contractors who are individuals.

- Individual entrepreneurs who work with hired employees or individual contractors.

- Individuals who do not have the status of an individual entrepreneur, but enter into employment contracts with other individuals and contractors.

- Individual entrepreneurs working under the patent system and conducting private practice - this category includes all kinds of notaries, lawyers, as well as other individuals.

Sometimes it happens that an employer simultaneously falls into several categories that are required to make appropriate contributions to extra-budgetary funds.

Until January 1, 2017, the Pension Fund of Russia was responsible for monitoring contributions to compulsory pension and health insurance. When a debt was incurred by the policyholder, the Pension Fund had the right to collect arrears, penalties and fines from him, in accordance with Law No. 212-FZ dated July 24, 2009. But today, insurance contributions, including “pension” ones, are supervised by the tax service, and it also has the right to collect debts. We will tell you in this article how you now need to repay the arrears in contributions that arose before and after the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation.

Contributions as of January 1: arrears and overpayments

Fines and penalties imposed on the company, unlike arrears, are not an accounting error (clause 2 of PBU 22/2010). They should be recognized as new information and reflected in accounting according to the general rules established in PBU 10/99 “Expenses of the organization” and PBU 7/98 “Events after the reporting date.” Tax arrears must be reflected according to the same rules by which the company corrects errors in accounting (PBU 22/2010).

DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “Calculations for VAT”—VAT is charged on the sale of goods, work or services.

It is possible that tax authorities have identified errors for 2014 and reporting for this period has not yet been signed. Then the postings need to be done in December of last year.

If the manager signed the annual reports, then the accounting procedure depends on the significance of the arrears.

The criteria by which an error is considered significant are usually established by companies in their accounting policies for accounting purposes.

Small enterprises have the right to correct any shortcomings as insignificant (clause 9 of PBU 22/2010).

DEBIT 91 subaccount “Other expenses” CREDIT 68 subaccount “Calculations for property tax”—additional property tax has been accrued.

DEBIT 84 CREDIT 68 subaccount “Calculations for VAT”—added VAT.

DEBIT 99 CREDIT 68 subaccount “Penalties and fines”—penalties and fines have been accrued.

The amounts of arrears, penalties and fines accrued as a result of the audit should be taken into account on the date of entry into force of the decision of the tax authority. Let us remind you that the inspection decision comes into force one month after the company receives it (Clause 9 of Article 101 of the Tax Code of the Russian Federation).

Penalties and fines are not included in tax accounting expenses. Also, the arrears of income tax cannot be written off as expenses. But, for example, transport or land tax can be written off as expenses in the current period based on the decision of the inspectors (see table below).

Which additional charges can be written off in tax accounting and which cannot?

| What additional tax is charged? | Is it possible to include additional accrued amounts in expenses? |

| Income tax or simplified tax | No (clause 4 of article 270 of the Tax Code of the Russian Federation) |

| VAT | |

| Inspectors assessed tax on the sale of goods, works, services | No (clause 19 of article 270 of the Tax Code of the Russian Federation). But the tax that the company erroneously did not present above the price of the goods can be tried to be recovered from the buyer (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 12, 2011 No. F03-6075/2011) |

| Tax authorities have removed VAT deductions | If a company has deducted VAT unlawfully, its amount cannot be included in expenses. An exception is that the inspectors refused to deduct tax that relates to non-taxable transactions. Then this amount of VAT can be attributed to the expenses of the current period. Or include them in the cost of purchased goods (works, services), if the company has not yet taken them into account in expenses (clause 2 of Article 170 of the Tax Code of the Russian Federation) |

| Inspectors have assessed additional tax amounts that need to be restored | Expenses can only include tax on goods, works, and services that the company began using for non-taxable transactions. Or if the company received a subsidy from the federal budget to reimburse costs associated with payment for purchased goods (work, services), including tax (subclause 2, 6, clause 3, article 170 of the Tax Code of the Russian Federation) |

| Property tax, transport or land tax | Yes (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation) |

| Personal income tax | No, tax must be withheld from the individual’s income. If a company does not pay any amounts to an individual, then it is necessary to inform the inspectors that it is impossible to withhold tax (clause 5 of Article 226 of the Tax Code of the Russian Federation) |

| Penalties and fines | No (clause 2 of article 270 of the Tax Code of the Russian Federation) |

Please note: if a company uses the cash method, then additional accrued amounts (say, transport tax) can be taken into account only after they have actually been paid. Similar rules apply to simplified companies that pay tax on the difference between income and expenses.

— VAT, since the company in 2011 underestimated the tax on goods and services sold, and also unlawfully declared deductions in the amount of 255,000 rubles;

- income tax for 2013 in the amount of 270,000 rubles, since the company took into account excess costs for advertising and entertainment expenses;

— penalties and fines in the amount of 152,000 rubles.

DEBIT 91 subaccount “Other expenses” CREDIT 68 subaccount “VAT calculations”—RUB 255,000. — additional VAT has been charged;

DEBIT 99 CREDIT 68 subaccount “Calculations for income tax”—RUB 270,000. — additional income tax has been assessed;

DEBIT 99 CREDIT 68 subaccount “Fees and Fines”—RUB 152,000. - penalties and fines have been assessed.

In tax accounting, the accountant did not include arrears, penalties and fines as expenses.

If you believe that tax authorities have unlawfully accrued some amounts, you can appeal the inspectors’ decision to the Federal Tax Service of Russia. To do this, you need to file an appeal within a month after you received the tax authorities’ decision (clause 2 of Article 139.1 of the Tax Code of the Russian Federation). Then inspectors will not be able to collect additional amounts until officials consider the complaint. After the Federal Tax Service recognizes the additional accruals or part of them as correct, you can reflect these amounts in your accounting.

Let’s say the company did not have time to draw up an appeal and filed a regular one after the tax authorities’ decision came into force. That is, a month after the company received the inspection decision. Then, on its basis, it is necessary to show the arrears, fines, and penalties in accounting. If the Federal Tax Service cancels additional accruals, then make reversal entries. Excess amounts transferred can be returned or offset.

Essence and features

Additional calculation of insurance premiums is required if for the previous reporting period the premium base was mistakenly underestimated by the policyholder. This usually happens due to inexperience and ignorance of the law, although some citizens deliberately avoid paying insurance premiums.

For example, when determining the size of the base, the policyholder forgot to include in the calculations any payment on which contributions are supposed to be calculated and the documents were transferred to the Pension Fund in an incomplete amount. The law provides for fines in such cases.

The following actions are required, in this order:

- Add additional contributions that were not previously taken into account.

- Transfer them to the Pension Fund account.

- Submit the updated RSV-1 form to the local Pension Fund office, where reports are usually submitted (Article 17, Part 1, Federal Law No. 212 of July 24, 2009).

Pension contributions: payment of arrears in 2017

The information from the tax service “On the administration of insurance premiums from January 1, 2020” lists the functions that will be transferred to tax authorities in 2020, these are:

- control over the calculation and timely payment of contributions,

- acceptance of “insurance” reporting, starting with reports for the 1st quarter of 2017,

- offset of overpayments for insurance premiums and excessively collected amounts,

- providing deferment and installment payments,

- collection of arrears, as well as debts on penalties and fines.

This means that now debt for pension and other insurance contributions (except for contributions for “injuries”) is collected according to the rules established by tax legislation (letter of the Ministry of Finance of the Russian Federation dated October 21, 2016 No. 03-02-08/61943). Moreover, the Federal Tax Service equally collects both “insurance” debts of 2020 and previous periods.

Arrears in insurance contributions to the Pension Fund arise if an entrepreneur or organization:

- have not paid the accrued insurance premiums in full,

- violated the deadlines established for payment of contributions.

The tax office may discover arrears during an audit, or after receiving a calculation of insurance premiums for the corresponding reporting period. Transfer of pension and other insurance contributions is carried out no later than the 15th day of the month following the month of their accrual (Article 431 of the Tax Code of the Russian Federation). By comparing the Calculation indicators and the amounts received into the budget, tax authorities determine whether the payer has any arrears or overpayments.

How reports are generated to the Pension Fund of Russia, extra-budgetary funds and the tax authority in 1C 8.3 Accounting

Information on accrued insurance premiums is stored in registers, from which reports are generated to extra-budgetary funds and the tax authority. To do this, on the Salaries and Personnel tab, you need to open Salary reports:

From the section Analysis of contributions to funds:

You can obtain detailed information on taxable amounts by type of accrual and by type of contribution for any period:

For generalized information on accrued contributions and personal income tax in 1C 8.3 Accounting, the Taxes and Contributions register (briefly) is created:

This type of report can be printed on paper monthly:

You can annually print out on paper and verify the accrual amounts for each employee by creating the form recommended by the Pension Fund for the Individual Accounting Card for the amounts of accrued remunerations and payments, as well as accrued insurance premiums for the year:

The card for recording insurance premiums in 1C 8.3 Accounting, in which data on accruals is reflected monthly and cumulatively from the beginning of the year, can have the following form:

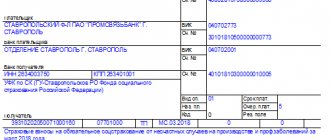

Request of the Federal Tax Service for payment of arrears on insurance premiums of the Pension Fund of Russia

Having discovered arrears, tax authorities send the debtor a demand for payment of insurance premiums.

No longer than three months from the date of detection of arrears in insurance contributions (to the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, the Social Insurance Fund) - this period is given to the tax authorities to send a claim to the payer. But if the contribution is arrears, and the amount of penalties and fines accrued on it does not exceed 500 rubles, the tax authorities have up to 1 year from the date of discovery of the debt to issue a claim (Clause 1, Article 70 of the Tax Code of the Russian Federation).

If the arrears are identified by tax authorities as a result of an audit, then the demand for repayment will be sent to the payer within a shorter period of time - 20 days from the moment the decision on this comes into force (clause 2 of Article 70 of the Tax Code of the Russian Federation).

The demand specifies not only the amount of debt, the amount of penalties accrued at the time of sending the demand, and the period during which the payer must fulfill this demand, but also the penalties that apply to the debtor in case of evasion of such requirements of the Federal Tax Service (Article 69 Tax Code of the Russian Federation).

If the text of the request does not indicate a longer period, then the payer must repay the debt specified in it within 8 days after receiving the document by mail, electronic communication channels, or in the taxpayer’s personal account. At the same time, a claim sent to the debtor by registered mail is automatically considered received 6 days from the date of its dispatch, which means that unscrupulous payers will not be able to avoid liability by simply ignoring the postal notification for receiving a claim for arrears (Clause 6 of Article 69 of the Tax Code of the Russian Federation ).

If the demand for payment of arrears is not fulfilled, the Federal Tax Service may send a decision to the bank to suspend operations on the debtor’s bank accounts, and then all expense transactions, except mandatory ones, will be impossible until the debt is fully repaid on demand (Article 76 of the Tax Code of the Russian Federation).

Recalculation (adjustment) of insurance premiums

Sometimes accountants in the 1C 8.3 Accounting 3.0 database have to recalculate contributions for past periods. To set up automatic recalculation in 1C 8.3, through the Salaries and Personnel tab, select Recalculation of insurance contributions - Create:

To correct errors for previous months that do not affect the previous reporting period, you need to check the box next to the item Self-calculation of contributions to correct errors, setting the month in which the adjustment is reflected and the date (last day of the month).

On the Income Information tab, using the Selection method, select the employee for which additional contributions are calculated, as well as the amount:

Next, go to the Calculated contributions tab and click Calculate. Program 1C 8.3 Accounting will independently determine the amount of additional contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

If the additional accrual affects the previous reporting period for which it will be necessary to submit an adjustment (updated) report, then you must additionally check the box next to the Register for an update report for the last period. After automatic calculation of additional accrual, click Post and close.