KBK codes in the FSS injuries, NS and PZ, penalties, fines, arrears in 2017

Have the BCCs changed for contributions to the Social Insurance Fund in 2020? No, there were no changes to the social insurance codes, it remains the same as in 2020. Below is the List of income classification codes (KBK FSS), also reserved by the Ministry of Finance of the Russian Federation to reflect payments to the FSS of the Russian Federation for organizations and individual entrepreneurs.

| KBK number | Purpose of transfer |

Insurance against injuries at work and occupational diseases | |

| 393 1 0200 160 | Insurance premiums for employees for “injuries” |

| 393 1 0200 160 | KBC for paying penalties to the FSS from the National Tax Service in 2020 |

| 393 1 0200 160 | Fines - amounts of monetary penalties |

KBC voluntary contributions to the Social Insurance Fund in 2020 for individual entrepreneurs for themselves | |

| 393 11700 180 | voluntary contributions from the entrepreneur |

| 393 1 1600 140 | Fines for violation of the established deadline for submitting reports to the Social Insurance Fund or failure to submit them, late registration) |

Note: If, due to an error in the KBK FSS details, the money does not go to the correct account, the policyholder will be charged a penalty.

to menu

https://youtu.be/-Fn3zhPxbjY

How much insurance premiums should an individual entrepreneur pay for himself in 2020?

Individual entrepreneurs must pay insurance premiums for themselves even in the absence of employees. According to the Tax Code, the main areas are:

- formation of a future pension;

- coverage of funds spent on the provision of medical services.

Since 2020, individual entrepreneurs must make contributions regardless of whether they carry out their activities or are simply registered.

Table of current contribution amounts and deadlines for 2020

| View | Size for 1 year (RUB) | Date of deduction |

| formation of a pension (for profits < 300 thousand rubles) | 32 448 | December 31, 2020 |

| formation of a pension (for profits > 300 thousand rubles) | 32,448 + 1% from above the established value | July 1, 2021 |

| Providing free medical services | 8 426 | December 31, 2020 |

In 2020, a single BCC is used for contributions to the formation of a future pension and an amount that exceeds 300 thousand rubles.

Changes in payment of insurance premiums in 2020

2020 is marked by the establishment of a new amount of insurance premiums for individual entrepreneurs. From January 1, contributions will not depend on the amount of the minimum wage.

The established amount of the contribution is fixed in the Tax Code of the Russian Federation.

Compared to 2020, the amount of insurance payments will increase by 4,600 rubles, but rates will no longer affect the amount of the premium. For clarity, we suggest that you familiarize yourself with the table showing the dynamics of the minimum amount for the year:

| Types of deductions | Amount for 2020 (RUB) | Amount for 2020 (RUB) |

| pension formation | 29 354 | 32 448 |

| provision of free medical services | 6 884 | 8 426 |

With an income of over 300 thousand rubles per year, the entrepreneur must pay additionally at a rate of 1%. However, these excesses do not apply to health insurance.

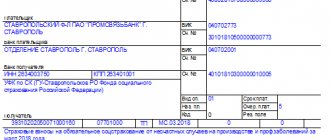

Details of the Social Insurance Fund Moscow 2020, official website, Contributions for compulsory social insurance

Recipient: UFK for Moscow (Governmental institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation)

INN 7710030933 Checkpoint 770701001

BIC of the recipient's Bank: 044525000

Recipient's BANK: Main Directorate of the Bank of Russia for the Central Federal District of Moscow (Abbreviated name - Main Directorate of the Bank of Russia for the Central Federal District)

Recipient's ACCOUNT NUMBER: 40101810045250010041

For policyholders (IPs) who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity:

KBK 393 11700 180 – voluntary contributions from the entrepreneur

Monetary penalties (fines) for violation of the law (for example, failure to submit a report or late submission of a report, failure to provide information about opening an account, etc.)

KBK 393 1 1600 140 – fine

Other proceeds from monetary penalties (fines) and other amounts for damages

KBK 393 1 1600 140 – administrative fine

Official website of the state institution FSS Moscow

Social insurance website: ... link Branches: ... link

to menu

On changes in bank details for payment of financial sanctions from January 1, 2020

Citizens are asked to pay attention to the fact that payments will need to be made using other details

GU - Main Directorate of the Pension Fund of the Russian Federation No. 7 for Moscow and the Moscow Region reports changes in bank details from January 1, 2020:

Information on bank details for payment by policyholders of financial sanctions provided for in Article 17 of Federal Law No. 27-FZ dated 01.04.1996 “On individual (personalized) accounting in the compulsory pension insurance system”

| Name of bank details | For policyholders registered in Moscow | For policyholders registered in the Moscow region |

| TIN | 7703363868 | 7703363868 |

| checkpoint | 772501001 | 772501001 |

| Recipient | UFK for Moscow (for the State Branch of the Pension Fund of Russia for Moscow and the Moscow region) | UFK for the Moscow region (for the State Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region) |

| payee's bank | Main Directorate of the Bank of Russia for the Central Federal District | Main Directorate of the Bank of Russia for the Central Federal District |

| BIC | 044525000 | 044525000 |

| Check | 40101810045250010041 | 40101810845250010102 |

| OKTMO | 45380000 | 46000000 (or other OKTMO.. related to the territory of the Moscow region) |

| KBK | 392 1 1600 140 | 392 1 1600 140 |

https://www.pfrf.ru/branches/moscow/info/~strahovateljam/3890

Information on bank details for payment by officials of organizations of financial sanctions provided for in Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation

| Name of bank details | For officials of organizations registered in Moscow | For officials of organizations registered in the Moscow region |

| TIN | 7703363868 | 7703363868 |

| checkpoint | 772501001 | 772501001 |

| Recipient | UFK for Moscow (for the State Branch of the Pension Fund of Russia for Moscow and the Moscow region) | UFK for the Moscow region (for the State Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region) |

| payee's bank | Main Directorate of the Bank of Russia for the Central Federal District | Main Directorate of the Bank of Russia for the Central Federal District |

| BIC | 044525000 | 044525000 |

| Check | 40101810045250010041 | 40101810845250010102 |

| OKTMO | 45380000 | 46000000 (or other OKTMO.. related to the territory of the Moscow region) |

| KBK | 392 1 1600 140 | 392 1 1600 140 |

https://www.pfrf.ru/branches/moscow/info/~strahovateljam/5313

Information on bank details for payment by policyholders of financial sanctions provided for in Articles 48–51 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

| Name of bank details | For policyholders registered in Moscow | For policyholders registered in the Moscow region |

| TIN | 7703363868 | 7703363868 |

| checkpoint | 772501001 | 772501001 |

| Recipient | UFK for Moscow (for the State Branch of the Pension Fund of Russia for Moscow and the Moscow region) | UFK for the Moscow region (for the State Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region) |

| payee's bank | Main Directorate of the Bank of Russia for the Central Federal District | Main Directorate of the Bank of Russia for the Central Federal District |

| BIC | 044525000 | 044525000 |

| Check | 40101810045250010041 | 40101810845250010102 |

| OKTMO | 45380000 | 46000000 (or other OKTMO.. related to the territory of the Moscow region) |

| KBK | 392 1 0900 140 | 392 1 0900 140 |

https://www.pfrf.ru/branches/moscow/info/~strahovateljam/6013

ERRORS in the PAYMENT ORDER (payment) in the FSS of the Russian Federation and PENALTY, liability

If the payment order for the transfer of insurance premiums contains incorrect payment parameters:

- Federal Treasury account;

- KBK FSS contributions 2020;

- name of the beneficiary bank of the regional branch of the social insurance fund.

then the obligation to pay contributions is considered not fulfilled.

The remaining errors do not prevent the transfer of money to the budget or the payment of contributions, which means they will not lead to. Such shortcomings include: incorrect TIN or checkpoint of the recipient.

to menu

Which OKTMO should I indicate when paying insurance premiums?

We indicate OKTMO (8 or 11 characters) of the municipal district in whose territory the fiscal authorities are located - recipients of insurance payments. This code is the same for all contributions - i.e. when making contributions to the Pension Fund of the Russian Federation, medical insurance and when paying contributions for employees, the individual entrepreneur must put the same numerical value.

We recommend reading: Taxes and contributions of individual entrepreneurs: types, terms and amounts of payments to the tax office.

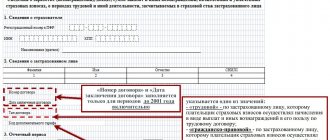

FSS NS and PZ payment, sample filling in 2020, where to pay

Note: Legal entities - firms, employers of individual entrepreneurs, paying for employees.

How to correctly fill out a payment order to the Federal Social Insurance Fund of the Russian Federation in 2020 in case of an accident? This is a very important question, because if the money goes “by”, then the organization or individual entrepreneur will face penalties and fines.

Below is a form, a sample of filling out a payment order and a collection order in social insurance upon request to the Tax Service.

So, we examined the FSS KBK for injuries, NS and PZ, penalties for insurance contributions to the FSS for the correct preparation of instructions for contributions.

to menu

How to compile PFR details for individual entrepreneurs

By recruiting workers for his enterprise, a private entrepreneur not only uses their labor, but also takes responsibility as an employer. Therefore, he is obliged to pay an insurance premium for them. If he refuses, he may be held accountable by law. Various sanctions and seizure of all transactions related to current accounts are possible. Only when the company is officially liquidated does the receipt of payments stop.

Using the details for paying contributions to the Pension Fund for individual entrepreneurs, the entrepreneur pays money for his employees every month, before the 15th day of the month following the date when the wages were paid.

Contributions are accepted under several conditions:

- Even if the enterprise is left without profit, the businessman transfers the payment to the Pension Fund by the end of the current year. It is calculated using a special formula: Minimum wages x 26 x 12. This year the minimum wage was 7,500 rubles, i.e. it increased compared to last year to 23,400 rubles.

- The second part of the payments depends on how much revenue is received from business activities. If, upon calculation, it turns out that the entrepreneur has more than 300,000 rubles in his accounts, he pays 1 percent of the amount that exceeded the permissible limit.

The size of contributions is limited: it cannot be 8 times larger than the first payment. This year, according to calculations, the second payment is 187,200 rubles.

But the Pension Fund does not only withdraw funds. Its employees are obliged to distribute incoming money to the personal accounts of the enterprise’s employees, if, of course, their employer deposits the required amount on time, along with reporting.

Reporting via the Internet. Contour.Extern

Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, RAR, RPN. The service does not require installation or updating - reporting forms are always up to date, and the built-in check will ensure that the report is submitted the first time. Send reports to the Federal Tax Service directly from 1C!

4. Detailed information about the inspection will open. It has the subheading “Payment Details”. This data can be used to create a counterparty of the Federal Tax Service and a bank account (menu Counterparties -> Counterparties -> Create counterparty).

The Federal Tax Service details have been received.

What else do you need to know about the PF and Social Insurance Fund details for paying insurance premiums in 2020

From January 2020, all insurance premiums are transferred to the Federal Tax Service, excluding payments for compulsory social insurance, which are paid by employers against situations of injury at work and other emergencies. Under this point, social contributions will continue to be transferred to the Social Insurance Fund. There are no plans to adjust the details for these payments.

In accordance with the administrative document of the Federal Tax Service No. ММВ-7-11/551 dated October 10, 2020, registration numbers in the Pension Fund and the Social Insurance Fund are no longer required to be indicated in the calculation form for insurance payments. Thus, this does not need to be indicated in the payment documentation either.

Previously, also, if the registration identifier of the insurance company with the Pension Fund was incorrectly filled out in the payment documentation when paying insurance premiums, this was not a point preventing the correct transfer of the payment for its intended purpose. This was taken into account by the legislator in a letter from the Federal Tax Service for Moscow No. 21-11/06201 dated February 2, 2005.

Pension Fund of the Russian Federation (PFR)

A payment order is generated for the payment of taxes and fees to the budget using special details, including KBK, OKTMO, etc.

Important!

The OKTMO code is a special digital designation that represents the code of the municipality in which the organization operates or makes payments.

Organizations in payment orders and declarations indicate the OKTMO code of the area where the activity is carried out or a separate unit is located. In the case of individual entrepreneurs, the need to register at the place of business depends on the tax regime. Read more in the article “Activities of individual entrepreneurs in another region.”

You can find out your or the required OKTMO using a special service on the website of the Federal Tax Service of Russia.

Individual entrepreneur insurance premiums for employees in 2020

For contributions to the Pension Fund for employees, the following tariffs apply:

| Type of contribution | Percentage value | |

| if the profit is less than the established amount | with a profit of more than the established amount from in excess of the amount | |

| pension formation | 22 | 10 |

| in case of incapacity and maternity leave | 2,9 | |

| provision of free honey. services | 5,1 | |

The established values for 2020 for deductions are:

- RUB 1,292,000 – pension provision;

- 912,000 rub. – temporary disability, etc.;

- The limit does not apply to the medical field.

Filling out the document

Menu: My organization -> Personal account -> Calendar.

1. Select the nearest payment date; 2. Click on the “Proceed” button for the required payment. In this case, most of the payment details (KBK, OKTMO*) will be entered automatically. * By default, the OKTMO code specified in the organization details is entered. If the activity is carried out in another location, then changes must be made manually.

tax payment (manually):

1. Menu: Cash -> Payment orders -> 2. Select “Transfer of funds to the budget” ->

4. Type of payment “Electronic”.

6. In the Counterparty field, the controlling authority to which the tax will be paid must be indicated.

9. Select the type of tax.

11. BCC must be indicated for tax deductions. 12. Indicate the OKTMO code.

13. The basis for payment must be indicated. For example, according to the list, the basis for payment “TP” is the current payment. This designation indicates the transfer of taxes and contributions for the past year. Meanwhile, when paying a debt, you should enter the code “ZD” (when this occurs at the initiative of the payer and before receiving a request from the Federal Tax Service).

17. We indicate the amount of tax and the purpose of payment. For example, “Unified tax on imputed income, for the 2nd quarter of 2020.”

Generating a payment order to pay a fine:

1. Menu: Cash -> Payment orders -> Click the green button “Create payment order”. 2. Select “Transfer of funds to the budget” -> “Transfer of tax or contribution from a current account.” 3. The number and date are entered automatically. 4. Type of payment “Electronic”. 5. We fill out the organization’s bank account. 6. In the Counterparty field, the regulatory authority to which the fine will be paid must be indicated. 7. We indicate the bank account of the controlling authority. 8. In the order of payment, indicate number 5. 9. Select the type of tax. 10. Select the status of the compiler. 11. The BCC must be indicated for penalties. 12. Indicate the OKTMO code. By default, the OKTMO specified in the organization details is entered. If the activity is carried out in another location, then changes must be made manually. 13. The basis of the payment must indicate TP or PO. — when making a payment at the request of the tax office, enter the value “TR”; — when an organization pays a fine/penalty on its own, indicate the code “ZD”. 14. We indicate the tax period, and the “Tax period value” field will be filled in automatically based on the “Tax period” field. 15. The act number and date of the act are indicated only if documents were sent to you by the regulatory authority. 16. UIN. This field indicates the Unique Accrual Identifier (UIN) of 20 characters. If the author of the order does not have information about the UIN, the value “0” is indicated. Unique accrual identifiers are generated by tax authorities. Accordingly, the UIN can only be clarified at the territorial tax authority. 17. We indicate the amount of the fine and the purpose of payment. For example, “Transport tax fine.” 18. The status and date of sending to the bank are not filled in.

Posting statements upon tax payment

It is necessary to record the fact of payment of tax or contribution to the budget. To do this, when posting a statement in the Sky service, we indicate the standard operation “Transfer to the budget” and the type of tax/fee that was paid.

The wiring will be as follows:

Dt 68 (69) (Tax/fee) Kt 51 (Current account) - for the amount of tax/fee/fine.

Since 2020, due to the transfer of insurance premiums to the tax office, the details for transferring payments have changed. Particular attention should be paid to information about the recipient of contributions, new BCCs and payment information.

Let's take a closer look at what new details need to be indicated in payment orders for the transfer of insurance premiums.

What details do I need to use to pay insurance premiums for individual entrepreneurs?

All insurance payments - fixed, additional and for employees - are transferred to the tax office at the place of registration of the individual entrepreneur, in different payments. They indicate the recipient - this is the Federal Tax Service, the personal data of the entrepreneur (in the field for the sender), the KBK (20 numeric characters), the tax period.

The payment breakdown includes the individual entrepreneur’s pension number (personal or as an employer), month, quarter or year, depending on the period. Penalties and fines are transferred separately from the tax, to your budget code.

Payments are posted to the individual entrepreneur’s personal account automatically. Any error or discrepancy in data leads to the fact that the payment falls into the unclear section, the contributions will be recorded as arrears, and for individual entrepreneurs this will result in additional penalties.

Tax details (TBC) for payment of each insurance premium:

Obligatory payments

- Pension: contribution - 182 1 02 021 4 00 611 0016 0;

- penalties - 182 1 02 021 4 00 630 1016 0;

- fine - 182 1 02 021 4 00 621 1016 0.

- contribution - 182 1 02 021 0 30 810 1316 0;

Additional fees

| View | Tax | Penalty | Sanctions |

| Pension Fund | 182 1 02 021 400 611 1016 0 | 182 1 02 021 400 630 1016 0 | 182 1 02 021 400 621 1016 0 |

Employee contributions

| View | Tax | Penalty | Sanctions |

| Pension | 182 1 02 020 100 610 1016 0 | 182 1 02 020 100 630 1016 0 | 182 1 02 020 100 621 1016 0 |

| Medical insurance | 182 1 02 021 010 810 1316 0 | 182 1 02 021 010 830 1316 0 | 182 1 02 021 010 820 1316 0 |

| Social insurance | 182 1 02 020 900 710 1016 0 | 182 1 02 020 900 730 1016 0 | 182 1 02 020 900 721 1016 0 |

| Deductions for accidents | 393 1 02 020 500 710 0016 0 | 393 1 02 020 500 730 0016 0 | 393 1 02 020 500 721 0016 0 |

Details for paying insurance premiums to the Pension Fund in 2018.

Since the tax office is currently administering pension contributions, PFR details will not be needed to pay insurance premiums in 2020. Processing payment orders has become easier, since the details for transferring payments are the same as for transferring taxes.

Initially, it was not entirely clear how to fill out the “Payer Status” column of the payment order (field 101). Officials could not come to a common opinion on the formation of this column, but ultimately came to the conclusion that the following codes should be entered:

- 01 - for legal entities;

- 09 - for entrepreneurs.

Changes in the payment order are also related to the recipient of payments, since the funds are transferred to the tax office. In this regard, in the “Recipient” column (field 16), it is necessary to indicate the abbreviated name of the Federal Treasury body. In addition, here you need to indicate the abbreviated name of the tax office in brackets.

In fields 61 and 103, the INN and KPP of the tax office to which the payment is sent are written. Taking these points into account, you also need to fill in the recipient’s bank details, namely:

- payee's bank;

- BIC and correspondent account of the recipient's bank with the Central Bank of the Russian Federation;

- Current account number of the Federal Tax Service.

Important! For periods before 2020 and after this year, different BCCs are indicated.

In addition, it is necessary to fill out new details of insurance contributions in 2020, namely:

- basis of payment;

- taxable period;

- document number and date (if payment is made at the request of the Federal Tax Service).

Until 2020, fields 106-109 had to be filled with zeros.

for examples

of filling out payment orders

with new details:

for pension insurance

for health insurance

for social insurance

Memo on payment of insurance premiums for billing periods starting from January 1, 2020

Date of publication: 09/01/2017 14:49 (archive)

When preparing settlement documents for the payment of insurance premiums for compulsory pension, medical and social insurance for billing periods starting from 01/01/2017, check that the details are filled out correctly:

— in the “Budget classification code” attribute one of the following values is indicated:

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (payment amount for billing periods starting from January 1, 2020) | 18210202010061010160 - tax 18210202010062110160 - penalty 18210202010062210160 - interest 18210202010063010160 - fine |

| Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount for billing periods starting from January 1, 2020) | 18210202090071010160 - tax 18210202090072110160 - penalty 18210202090072210160 - interest 18210202090073010160 - fine |

| Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund (payment amount for billing periods starting from January 1, 2020) | 18210202101081013160 - tax 18210202101082013160 - penalty 18210202101082213160 - interest 18210202101083013160 - fine |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (payment amount for billing periods starting from January 1, 2020) | 18210202140061110160 - tax 18210202140062110160 - penalty 18210202140062210160 - interest 18210202140063010160 - fine |

| Insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (payment amount for billing periods starting from January 1, 2020) | 18210202103081013160 - tax 18210202103082013160 - penalty 18210202103083013160 - fine |

When determining the current budget classification code, we recommend using the Correspondence Table posted on the Federal Tax Service website.

— the recipient’s TIN/KPP details indicate the value of the TIN/KPP of the tax authority administering the payment; — the “OKTMO” detail indicates the value of the OKTMO code at the location of the organization (place of residence of the individual); — in the “Payer status” detail one of the following values is indicated:

“01” - a legal entity making payments to individuals

“09” – individual entrepreneur (IP)

“10” – notary engaged in private practice

“11” - lawyer who established a law office

“12” - head of a peasant (farm) enterprise

“13” - an individual who is not an individual entrepreneur, making payments to individuals.

Please pay attention! If you incorrectly specified the details in the payment document, the payment is taken into account as part of the outstanding receipts and is reflected in your “Settlements with the Budget” card only after measures have been taken to clarify it.

Payments for insurance premiums are clarified taking into account the requirements established by paragraph 9 of Article 45 of the Tax Code of the Russian Federation - payment clarification regarding the amount of insurance contributions for compulsory pension insurance is not carried out if, according to the territorial body of the Pension Fund of the Russian Federation, information about this amount is taken into account on the individual account of the insured person.

Details for paying insurance premiums for injuries in 2018.

As for insurance premiums for injuries, their administrator remains the Social Insurance Fund. In this regard, the FSS details for paying insurance premiums in this category in 2020 have not changed.

When generating a payment order, you must indicate code 08 in the “Payer Status” column, and use previously established codes for the KBK. In the “Recipient” column (field 16) you need to enter the name of the Territorial Social Insurance Fund, and in fields 61 and 103 - its TIN and checkpoint. In fields 13-15 and 17, intended for bank details, the same values are entered as previously used (before 2017). When sending current payments for contributions “for injuries” or to pay off debts on them on personal initiative, you must enter zeros in fields 106-109.

See below for a sample of filling out a payment order for these insurance premiums.

FSS details for paying insurance premiums in 2017

The established FSS details for paying insurance premiums will change in 2017. Insurance payments for social insurance, temporary disability certificates, and in connection with pregnancy and childbirth now come under the control of the tax service.

In all payment documents, instead of the territorial FSS service, it will be necessary to indicate the corresponding federal tax service. Such a change also entails an adjustment to the budget classification code, which must be indicated to insurance companies when transferring payments for obligations.

What are the consequences of errors in the details for transferring contributions in 2020?

If the details for transferring insurance premiums in 2020 are incorrectly specified, the funds will not reach the recipient and will remain stuck in the accounts of unexplained payments. The organization will have overdue debt, on which the tax authorities will charge penalties.

If the error is due to an incorrect indication of the KBK, then it will be enough to submit an application clarifying this payment order details. If the error concerns the indication of an incorrect Treasury account of the Russian Federation or the details of the recipient's bank, you will need to pay the insurance premium again, and then return the incorrect amounts through the bank.

Starting from 2020, it is possible to count overpayments on contributions of only one type, for example, overpaid contributions to compulsory medical insurance against future payments for the same. Offsetting between different types of insurance premiums cannot be made. If the overpayment under the OPS was posted to the employees’ personal cards, it cannot be returned in any way (according to clause 6.1 of Article 78 of the Tax Code of the Russian Federation).

Details for paying insurance premiums for individual entrepreneurs

For individual entrepreneurs registered with the Moscow Federal Tax Service:

Insurance contributions to the Pension Fund are paid according to the following details:

Recipient of the payment: UFK for the city of Moscow (GU - Branch of the Pension Fund of the Russian Federation for the city of Moscow and Moscow Region)

TIN 7703363868

Gearbox 770301001

Account 40101810800000010041

Bank: Branch 1 Moscow, Moscow 705

BIC: 044583001

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (from an income amount of no more than 300,000 rubles)

OKTMO: everyone has their own. You can determine OKTMO on the FIAS website.

KBK: 392 1020214006 1000 160

Insurance contributions to the FFOMS are paid according to the following details:

Recipient of the payment: UFK for the city of Moscow (GU - Branch of the Pension Fund of the Russian Federation for the city of Moscow and Moscow Region)

TIN 7703363868

Gearbox 770301001

Account 40101810800000010041

Bank: Branch 1 Moscow, Moscow 705

BIC: 044583001

Purpose of payment: Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund

OKTMO: everyone has their own. You can determine OKTMO on the FIAS website.

KBK: 392 1020210108 1011 160

Insurance contributions to the Pension Fund (1%) are paid according to the following details:

Recipient of the payment: UFK for the city of Moscow (GU - Branch of the Pension Fund of the Russian Federation for the city of Moscow and Moscow Region)

TIN 7703363868

Gearbox 770301001

Account 40101810800000010041

Bank: Branch 1 Moscow, Moscow 705

BIC: 044583001

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (1% of the amount of income exceeding 300,000 rubles)

OKTMO: everyone has their own. You can determine OKTMO on the FIAS website.

KBK: 392 1020210108 1011 160

Attention! Check the details for paying insurance premiums for individual entrepreneurs on the website of the Pension Fund of the Russian Federation - www.pfrf.ru. There you will also find details for regional branches of the Pension Fund.

New details

In 2020, new account details for paying taxes and contributions have been established. This is stated in the letter of the Federal Treasury of the Russian Federation No. 05-04-09/27053.

Fill out the payment slips with the new details in the Bukhsoft program.

Fill out the payment form with new details

| No. | Name UFK | 20-digit number of the bank account to be closed | 20-digit number of the new bank account to be opened |

| UFK for the Republic of Adygea | 40101810100000010003 | 40101810803490010004 | |

| UFK for the Republic of Kalmykia | 40101810300000010003 | 40101810303490010005 | |

| UFK for the Karachay-Cherkess Republic | 40101810900000010001 | 40101810803490010006 | |

| UFK for the Republic of Mari El | 40101810100000010001 | 40101810922020016001 | |

| UFK for the Republic of Mordovia | 40101810900000010002 | 40101810022020017002 | |

| UFK for the Republic of Tyva | 40101810900000010001 | 40101810050049510001 | |

| UFK for the Udmurt Republic | 40101810200000010001 | 40101810922020019001 | |

| UFK for the Republic of Khakassia | 40101810200000010001 | 40101810150045510001 | |

| UFC in the Altai Territory | 40101810100000010001 | 40101810350041010001 | |

| UFC in the Trans-Baikal Territory | 40101810200000010001 | 40101810750042010001 | |

| UFC in Kamchatka Territory | 40101810100000010001 | 40101810905070010003 | |

| UFK for the Irkutsk region | 40101810900000010001 | 40101810250048010001 | |

| UFK in the Kirov region | 40101810900000010001 | 40101810222020011001 | |

| UFK for the Kurgan region | 40101810000000010002 | 40101810065770110002 | |

| UFC in the Kursk region | 40101810600000010001 | 40101810445250010003 | |

| UFC in the Magadan region | 40101810300000010001 | 40101810505070010001 | |

| UFK for the Murmansk region | 40101810000000010005 | 40101810040300017001 | |

| UFK for the Novgorod region | 40101810900000010001 | 40101810440300018001 | |

| UFC in the Oryol region | 40101810100000010001 | 40101810845250010006 | |

| UFK for the Penza region | 40101810300000010001 | 40101810222020013001 | |

| UFC in the Rostov region | 40101810400000010002 | 40101810303490010007 | |

| UFK for the Samara region | 40101810200000010001 | 40101810822020012001 | |

| UFK for the Smolensk region | 40101810200000010001 | 40101810545250000005 | |

| UFC in the Tyumen region | 40101810300000010005 | 40101810965770510005 | |

| UFK for the Khanty-Mansiysk Autonomous Okrug-Ugra | 40101810900000010001 | 40101810565770510001 | |

| UFK for the Yamalo-Nenets Autonomous Okrug | 40101810500000010001 | 40101810465770510002 |

In the Bukhsoft program, all changes to payments have already been made. We update the details on the day the amendments come into force, so accountants’ payments reach the Federal Tax Service on time. Now the cost of the program for a year with a discount is .

A gift is a digital signature for submitting documents to the Federal Tax Service and other authorities.

Details of the Pension Fund for payment of insurance premiums in 2017

The established details of the Pension Fund for the payment of insurance premiums in 2017 due to the transfer of control functions to the Federal Tax Service from January will also undergo some changes. When filling out payment documentation, you must consider the following:

- the recipient of insurance payments instead of the territorial department of the Pension Fund must now indicate the relevant tax office;

- all details will change, including checkpoint and TIN of the payment recipient;

- The changes will also affect KBK contributions.

Budget classification codes for insurance obligations are changing from 2017 because a new payment administrator will be appointed.

In general, starting from 2020, the procedure for transferring insurance premiums will be significantly simplified. In order to correctly transfer payments for insurance obligations relating to pension and social insurance, the company’s responsible persons must correctly fill out all the details in the payment documents. Attention should also be paid to the correctness of the Federal Treasury account, budget classification codes and the full name of the banking organization that is the recipient of the contribution.

Changes in legislation on insurance premiums from 2020

Officials have made significant changes to the chapter of the Tax Code of the Russian Federation concerning insurance premiums. In 2020, these amendments will impact most taxpayers. For example, for simplified people, contributions at reduced rates were canceled, which is why the payment details also changed.

The table below shows the main changes:

| What changed | How has it changed? | Base |

| Insurance contribution rate for compulsory pension insurance | The effect of the reduced rate for insurance premiums for mandatory insurance is now not limited to the end of 2020; premiums will continue to be calculated at a rate of 22% until the base limit is reached and 10% after. | The wording of sub-clause has been changed. 1 item 2 art. 425 of the Tax Code of the Russian Federation (clause 6 of Article 1 of Law No. 303-FZ dated August 3, 2018), Art. 426 of the Tax Code of the Russian Federation (clause 7 of article 1 of the law dated August 3, 2018 No. 303-FZ). |

| The list of persons entitled to apply preferential rates of insurance premiums has been reduced | Taxpayers listed in sub. 5-6 and 9 p. 1 art. 427 of the Tax Code of the Russian Federation, no longer has the right to apply preferential reduced rates of insurance premiums. These taxpayers include:

The right to apply reduced tariffs for the following taxpayers specified in subparagraph. 7 and 8 clause 1 art. 427 of the Tax Code of the Russian Federation, extended until the end of 2024:

| Subp. 3 p. 2 art. 427 of the Tax Code of the Russian Federation, the wording of which indicates the right to apply reduced tariffs only in the period from 2020 to 2018. Subp. "b" clause 8 of Art. 1 of the Law of August 3, 2018 No. 303-FZ, which added sub. 3 p. 2 art. 427 Tax Code of the Russian Federation. |

In addition, the base limits for calculating insurance contributions for pension insurance and social insurance for temporary disability and maternity have been increased. This increase happens every year. In 2020 the limits are:

How to calculate income of an individual entrepreneur under different taxation regimes

Since 2020, the rules for accounting for the income of entrepreneurs on OSNO have changed to charge an additional 1% contribution to pension insurance. Let us recall that previously, to determine this amount, all income was taken into account, without reducing it by business expenses incurred.

The Constitutional Court of the Russian Federation recognized this calculation procedure as illegitimate, therefore, an individual entrepreneur who works on the general taxation system does not take into account all income received, but minus professional deductions, to calculate an additional 1%.

Unfortunately, for payers of the simplified system with the object “Income minus expenses” and the Unified Agricultural Tax, the same rule continues to apply as before: the additional contribution is calculated from all income received. Perhaps this rule will be changed someday, but for now these taxpayers are at a disadvantage.

The procedure for determining the base for additional insurance premiums for individual entrepreneurs for themselves in different regimes is fixed in paragraph 9 of Article 430 of the Tax Code of the Russian Federation.

| Contribution category | Sum |

| Fixed payment for health insurance, regardless of income | 8,426 rubles |

| Fixed payment for pension insurance if the individual entrepreneur’s income for the year does not exceed 300 thousand rubles | 32,448 rubles |

| Additional payment for pension insurance if the individual entrepreneur received more than 300,000 rubles in income per year | 1% of income exceeding 300,000 rubles |

| Tax system | Basis for calculating contributions | Article of the Tax Code of the Russian Federation |

| BASIC | Income minus deductions | 210 |

| USN Income | All income received | 346.15 |

| USN Income minus expenses | Income without expenses | 346.15 |

| Unified agricultural tax | Income without expenses | 346.5 |

| UTII | Imputed income | 346.29 |

| PSN | Potential income per year | 346.47 and 346.51 |

If an entrepreneur combines different modes, then the income received from different types of activities is summed up.

Prepare a simplified taxation system declaration online

For the convenience of paying insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

KBC for payment of insurance premiums in 2020

Since 2020, a new list of BCCs has been in force, approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n. But for insurance premiums, the budget classification codes remained the same. This applies to both the contributions themselves and fines and penalties for them. Let us recall the meanings of codes for insurance premiums for organizations and entrepreneurs making payments to hired personnel:

| Insurance contributions for compulsory pension insurance (OPI) (at a general or reduced rate) | |

| 182 1 0210 160 | |

| 182 1 0210 160 | |

| 182 1 0210 160 | |

| Insurance contributions for compulsory social insurance for temporary disability and in connection with maternity (VNiM) | |

| 182 1 0210 160 | |

| 182 1 0210 160 | |

| 182 1 0210 160 | |

| Insurance premiums for compulsory health insurance (CHI) | |

| 182 1 0213 160 | |

| 182 1 0213 160 | |

| 182 1 0213 160 | |

| Insurance contributions for compulsory social insurance against accidents and occupational diseases (paid to the Federal Social Insurance Fund of the Russian Federation) | |

| 393 1 0200 160 | |

| 393 1 0200 160 | |

| 393 1 0200 160 | |

To pay fixed insurance premiums “for yourself” for entrepreneurs, the following BCCs apply:

For special cases, the following budget classification codes are provided:

| Insurance contributions for compulsory pension insurance (at an additional rate for workers engaged in hazardous work) | |

| 182 1 0210 160 | |

| 182 1 0220 160 | |

| 182 1 0200 160 (for payments until 217) | |

| 182 1 0200 160 (for payments until 217) | |

| Insurance contributions for compulsory pension insurance (at an additional rate for workers engaged in hard and dangerous work) | |

| Contributions at an additional rate that does not depend on the results of the special assessment | 182 1 0210 160 |

| Contributions at an additional tariff depending on the results of the special assessment | 182 1 0220 160 |

| 182 1 0200 160 (for payments until 217) | |

| 182 1 0200 160 (for payments until 217) | |

| Additional insurance contributions for an employee's funded pension | |

| Contributions from employee funds | 392 1 0200 160 |

| Contributions from the employer's funds | 392 1 0200 160 |

| Additional insurance contributions for funded pension | |

| Contributions paid by the self-insured person | 392 1 0200 160 |

KBK IP fixed payment 2020

Payment of entrepreneur's personal contributions is made separately from employee contributions. For this purpose, special budget classification codes are provided:

| Fixed payment | Contribution | Penya | Fine |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OPS (including 1% over 300 thousand) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

If an entrepreneur decides to pay contributions to VNiM, then in the payment slip for these contributions he must indicate KBK 393 1 1700 180.

To pay off debts of individual entrepreneurs on personal contributions formed before 2017, other codes are used, which differ from those given in table 14-17 by familiarity:

- in the “medical” code 16-17, the familiar places change to “11”;

- in the “pension” code 14-17, the acquaintance places take the value “1100”;

- in the “pension - 1%” code, “1200” is placed on places 14-17.

How to fill out payment forms for contributions from January 1

In 2020, contributions to social, pension and health insurance will continue to be supervised by the tax authorities.

To ensure that contributions are received by the Federal Tax Service on time and do not get stuck, you need to indicate the correct details in your payments:

- Field 101

of the payment order indicates the status of the person who issued the payment document. In 2020, when transferring insurance premiums to the Federal Tax Service, you must indicate code “01” in this field. When paying contributions for yourself or employees, an individual entrepreneur must indicate the status “09”. - In the

“recipient” field you need to indicate the name of the Federal Treasury and in brackets - the name of the tax office to which the payment is transferred. - Field 104

indicates the BCC in accordance with the legislation of the Russian Federation in 2020:

- 1821020201006 1010 160 – insurance contributions to the Pension Fund for employees of legal entities and individual entrepreneurs;

- 1821020209007 1010 160 – insurance contributions to the Social Insurance Fund for employees of legal entities and individual entrepreneurs;

- 1821020210108 1013 160 – insurance contributions to the FFOMS for employees of legal entities and individual entrepreneurs;

- 1821020214006 1110 160 – fixed contributions to the Pension Fund (individual entrepreneur for himself);

- 1821020210308 1013 160 – fixed contributions to the FFOMS (individual entrepreneurs for themselves).

- Field 105

indicates the OKTMO of the tax authority to which the payment will be transferred. - In field 106

you need to indicate the type of payment - “TP”. - In field 107

you must indicate the period for which insurance premiums will be transferred. - In fields 108 and 109

, when paying insurance premiums in the usual manner, you must indicate “0”. But if penalties or fines are paid, the claim number must be indicated in field 108, and the date of the claim in field 109. - Field 110

is not filled in.

Contributions for accidents at work in 2020 must still be paid to the Social Insurance Fund. The rules for filling out payment slips have not changed:

- KBC

for payment of contributions for injuries in 2020: 3931020205007 1000 160. - In the

“recipient” field you must indicate the name of the Federal Treasury, and in brackets - the name of the Social Insurance Fund. - Field 105

indicates the OKTMO of the organization. - In the “code” field

, intended to indicate the UIN, you must enter the value “0”. - In field 101

you must indicate the status “08”.

Filling out payment documents for contributions

When filling out the FFOMS details for Moscow, you must remember that from January 1, 2014, the policyholder indicates OKTMO instead of OKATO. In addition, the name of the Bank of Russia was also changed:

- in short: Ward 1 Moscow

- in full: Branch 1 of the Main Directorate of the Central Bank of the Russian Federation for the Central Federal District of Moscow

Particular attention should be paid to filling out the top part of the order:

- Moscow companies indicate - In GU MRO FSS Branch No....

- companies from the Moscow region - GU MORO FSS Branch No....

To ensure that payment documents are correctly filled out, tax officials recommend using instructions for filling out such documents posted on the websites of government funds:

- PFR - https://www.pfrf.ru/

- FSS – https://www.fss.ru/

- FFOMS – https:// www.ffoms.ru/

FAQ:

How to find out your UIN?

The UIN can be seen in a written request for payment of a tax or fine sent from the tax service.

What are the BCCs for paying fines for failure to submit or late submission of a report?

- fines — 393 1 1600 140

- other monetary penalties - 393 1 1600 140

At what address is the PFR Branch in Moscow and the Moscow Region located?

- Legal address: 125009, Moscow, Tverskoy Boulevard, 18, building 1

- Actual address: 119602, Russia, Moscow, Akademika Anokhin st., 20, bldg. A

Details for paying insurance premiums for compulsory social insurance against industrial accidents and occupational diseases

Recipient: UFK for Moscow (Governmental institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation)

INN 7710030933 Checkpoint 770701001

KBK 393 1 0200 160 – insurance premiums

KBK 393 1 0200 160 — fine

KBK 393 1 020 2050 07 3000 160 — fines

For policyholders who have voluntarily entered into legal relations under

compulsory social insurance in case of temporary disability and in connection with maternity:

KBK 393 11700 180 – voluntary insurance contributions

Monetary penalties (fines) for violation of the law (for example, failure to submit a report or late submission of a report, failure to provide information about opening an account, etc.)

KBK 393 1 1600 140 – fine

Other proceeds from monetary penalties (fines) and other amounts for damages

KBK 393 1 1600 140 – administrative fine

How to find out UIN

1. For current payments, field 22 (“Code” in the payment order) is entered as 0.

2. From the requirement to pay taxes and contributions.

If an enterprise has arrears on taxes or fees, it will be presented with demands for payment of taxes and fees, which will indicate the required UIN.

The procedure for paying insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity from 01/01/2017.

Transferred to the Federal Tax Service

1.

BCC for contributions for reporting periods before 01/01/2017:

| Name | |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods expired before January 1, 2020) |

2.

BCC for contributions for reporting periods starting from 01/01/2017:

INSURANCE CONTRIBUTIONS FOR COMPULSORY SOCIAL INSURANCE IN CASE OF TEMPORARY DISABILITY AND IN CONNECTION WITH MATERNITY (recipient of the Federal Tax Service)

| Name | |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled payments) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods starting from January 1, 2020) |

Details for paying insurance premiums for compulsory social insurance against industrial accidents and occupational diseases

Recipient: UFK for Moscow (Governmental institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation)

INN 7710030933 Checkpoint 770701001

KBK 393 1 0200 160 – insurance premiums

KBK 393 1 0200 160 — fine

KBK 393 1 020 2050 07 3000 160 — fines

For policyholders who have voluntarily entered into legal relations under

compulsory social insurance in case of temporary disability and in connection with maternity:

KBK 393 11700 180 – voluntary insurance contributions

Monetary penalties (fines) for violation of the law (for example, failure to submit a report or late submission of a report, failure to provide information about opening an account, etc.)

KBK 393 1 1600 140 – fine

Other proceeds from monetary penalties (fines) and other amounts for damages

KBK 393 1 1600 140 – administrative fine

How to find out UIN

1. For current payments, field 22 (“Code” in the payment order) is entered as 0.

2. From the requirement to pay taxes and contributions.

If an enterprise has arrears on taxes or fees, it will be presented with demands for payment of taxes and fees, which will indicate the required UIN.

The procedure for paying insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity from 01/01/2017.

Transferred to the Federal Tax Service

1.

BCC for contributions for reporting periods before 01/01/2017:

| Name | |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods expired before January 1, 2020) |

2.

BCC for contributions for reporting periods starting from 01/01/2017:

INSURANCE CONTRIBUTIONS FOR COMPULSORY SOCIAL INSURANCE IN CASE OF TEMPORARY DISABILITY AND IN CONNECTION WITH MATERNITY (recipient of the Federal Tax Service)

| Name | |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled payments) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods starting from January 1, 2020) |

For employees, the payment slip indicates:

- In detail 13 (“Recipient’s bank”) - the name of the bank in which the account is opened with the Federal Tax Service.

- In detail 14 - BIC of this bank.

- In field 17 is the UFC score.

- In detail 16 (“Recipient”) - the name of the Federal Financial Institution that accepts payments to the Federal Tax Service.

- In fields 61, 103 - TIN, checkpoint of this Federal Tax Service.

- In field 104 (“KBK”) - codes:

- 18210202010061010160 (if a regular pension contribution is paid);

- 18210202131061010160 (additional tariff for hazardous working conditions without special assessment);

- 18210202131061020160 (additional tariff for VU with a special assessment);

- 18210202132061010160 (additional tariff for difficult working conditions and others, as reflected in subparagraph 3-18, paragraph 1, article 30 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, without special assessment);

- 18210202132061020160 (additional tariff for technical specifications and others according to subparagraph 3-18, paragraph 1, article 30 of Law 400-FZ with a special assessment).

- In field 107 (“Tax period”) - the value MS.**.2018, where ** is the serial number of the month for which the contribution is paid.

- In field 24 (“Purpose”) - wording (for the specified BCC):

- “Insurance premiums for compulsory health insurance (for such and such a month)”;

- “Additional tariff contributions in accordance with sub-clause. 1 clause 1 art. 30 of Law 400-FZ (independent of the special assessment) or (depending on the special assessment)”;

- “Additional tariff contributions in accordance with sub-clause. 2-18 paragraph 1 art. 30 of Law 400-FZ (independent of the special assessment) or (depending on the special assessment).”

How to fill out individual fields of a payment order

Individual payment fields have their own details. There are quite a few of them, so we have dedicated separate articles to them on our website:

- Field 110 in a payment order in 2020

- How to fill out field 106 in a payment order in 2020

The recipient of insurance contributions for social insurance against accidents and occupational diseases is the Social Insurance Fund at the place of registration.Current payment details for your tax office can be found on a special tax resource at https://service.nalog.ru/addrno.do. Please indicate what type of taxpayer you are - an entrepreneur or a legal entity. Enter your address or inspection code at the place of registration, click the “Next” button and in the window that opens you will find payment details for paying insurance premiums and other tax payments.

To find the details of your territorial Social Insurance office, go to the website of the Federal Social Insurance Fund of the Russian Federation at the place of registration. You can find the official address on the website https://fss.ru/ru/insurance/index.shtml in the “Regional branches” section.

How to fill out receipts for mandatory insurance premiums for individual entrepreneurs “for yourself” in 2020?

Important information! Pay special attention to the fact that they promise to write off taxes and contributions for the second quarter of 2020 for those individual entrepreneurs who belong to the most affected areas of the economy. They also promise to reduce insurance premiums by 12,130 rubles for such individual entrepreneurs (read more at this link). Read about other measures to support individual entrepreneurs in connection with the pandemic at this link. Good afternoon, dear individual entrepreneurs!

Let’s assume that a certain individual entrepreneur without employees decided to pay mandatory contributions “for himself” for the full year 2020. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia.

Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2020, but we will talk about this case at the very end of this article. Of course, individual entrepreneurs on the simplified tax system “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.

In this case, our individual entrepreneur must pay the state for 2020:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

- Total for the full year 2020 = RUB 40,874.

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these payment amounts come from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2020:

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2020.

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash.

Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2020: from January 1 to March 31

- For the second quarter of 2020: from April 1 to June 30

- For the third quarter of 2020: from July 1 to September 30

- For the fourth quarter of 2020: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2020, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to fill out receipts?

Follow the link:

https://service.nalog.ru/payment/payment.html?payer=ip#paymentEdit

We agree to the processing of personal data and click on the “Continue” button.

Select the payment method “Filling out all payment details of the document”

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click on the “Next” button and you will be taken to the next step.

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure.

Moreover, pay attention to two switches:

- The Federal Tax Service and OKTMO are located in the same region

- The Federal Tax Service Inspectorate and OKTMO are located in different regions

In our example, let them be in the same region, so the following setting was chosen:

If you are in doubt about what to choose, it is better to check with your tax office. The fact is that, indeed, sometimes the tax office may be located in a different region than OKTMO. This happens when one tax office registers entrepreneurs from several regions of the Russian Federation. For example, from remote villages and small settlements. It’s even better to use programs and services for maintaining accounting/tax records for individual entrepreneurs. These receipts are automatically generated in them in a few clicks.

And we press the “Next” button...

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2020: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we introduce a different BCC for 2020: 18210202103081013160

Important: enter KBK WITHOUT SPACES and immediately click on the “Next” button!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice , but at this step you will indicate different BCCs and different amounts of payments for pension and health insurance of individual entrepreneurs “for yourself.”

Let me remind you once again about the payment amounts for the full year 2020:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

If you pay quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

And again click on the “Next” button.

- We select the status of the person who issued the payment as “09” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2020

- Enter the payment amount (of course, you may have a different amount)

And again click on the “Next” button.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf.

Click the “Next” button and check everything carefully again...

After making sure that the data is entered correctly, click on the “Pay” button.

If you want to pay in cash using a receipt, then select “Generate receipt” and click on the “Generate payment document” button

That's it, the receipt is ready

- Since we entered KBK 18210202140061110160 , we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs “for ourselves”.

- In order to issue a receipt for payment of the mandatory contribution for medical insurance of an individual entrepreneur “for yourself,” we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Example of a receipt for a quarterly payment for compulsory pension insurance:

An example of a receipt for a quarterly payment for compulsory health insurance (note that the BCC in the receipt is different):

We print these receipts and go to pay at any Sberbank branch (or any other bank that accepts such payments).

Payment receipts and receipts must be kept!

Important: It is better not to delay the deadline for paying mandatory contributions “for yourself” until December 31, as the money may simply “get stuck” in the depths of the bank. It happens. Please pay at least 10 days before the due date.

How to generate a receipt for payment of 1% of an amount exceeding 300,000 rubles per year?

Indeed, those individual entrepreneurs whose annual income in 2020 will be MORE than 300,000 rubles are also required to pay 1% of the amount exceeding 300,000 rubles. In order not to repeat myself, I am sending you to read a more detailed article about individual entrepreneur contributions “for yourself” in 2020:

We are now more interested in another question: where can I get a receipt for paying this 1%?

Let me remind you once again that this payment must be made strictly before July 1, 2021 (based on the results of 2020, of course).

So here it is. Unlike 2020, there is no separate BCC for paying 1%. This means that when it comes time to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2021. Therefore, follow the news and update your accounting programs in a timely manner).

In fact, you will receive exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

That's all, actually.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

For example, these two receipts can be issued in 1C. Entrepreneur" in literally three clicks. Without thoughtfully studying such boring instructions =)

Best regards, Dmitry Robionek.

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

Sample payment slip for contributions in 2020 with new details

From January 1, new rules for payment orders will apply. Read the instructions in the Simplified magazine.

Ready-made samples of payment slips for insurance premiums for payment in 2020:

Payment of contributions for employees' pension insurance

Art. 18.1 of Federal Law No. 243-FZ of July 3, 2016 obliges all employers in Russia to make contributions to the state budget for employee insurance. Since 2020, the administration of most insurance premiums has been transferred to the Federal Tax Service. Only the so-called contributions for injuries remained under the jurisdiction of the Social Insurance Fund. We will look at what details to indicate in the fields of a payment slip for paying insurance premiums in 2020 in this article.

KBC for insurance premiums in 2019

The budget classification code or BCC is a requisite of banking and payment documents. Based on the BCC, the distribution of funds transferred by the taxpayer takes place. If an incorrect BCC is indicated, the payment will be counted, but due to its incorrect distribution, the payer will be considered arrears.

Order of the Ministry of Finance of Russia dated July 1, 2013 N 65n, as amended by the latest edition dated June 22, 2018, contains the KBK reference book for 2020. The income codes for state duties and various tax regimes have undergone changes.

KBK for payments in 2020

If you need to make payments to the Federal Tax Service and the Social Insurance Fund in 2020, for the periods 2017-2019, then you need to use the following BCCs:

| Name of insurance payment | KBK | KBK fines | KBK penalties |

| for compulsory pension insurance (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for employees) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| for maternity and sick leave (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for injuries in the Social Insurance Fund (for employees) | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

| for compulsory pension insurance (for yourself) | 182 1 0200 160 | 82 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for yourself) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| in retirement with an income of 300 thousand rubles (1%) | 182 1 0210 160 |

In addition, it is necessary to pay contributions to the Federal Tax Service for employees working in conditions that give the right to early retirement, in particular:

| Name of insurance payment | Base | KBK (field 104 of payment) |

| for those employed in jobs with hazardous working conditions | clause 1 part 1 art. 30 of the Federal Law of December 28, 2013 No. 400-FZ | 182 1 0210 160 |

| for those employed in jobs with difficult working conditions | (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ | 182 1 0210 160 |

The additional rate for contributions for these categories of employees depends on the results of a special assessment.

Insurance premiums “for injuries” in 2020 must be transferred to the Social Insurance Fund according to KBK 393 1 0200 160.

All KBK relevant in 2020 are published on this page.

Details of insurance premiums 2020: KBK

Due to the transfer of administrative functions to the tax authorities, the pension fund details for paying insurance premiums in 2019 are not relevant. The most important payment details are the budget classification code KBK (field 104).

KBK for transferring insurance premiums to the Federal Tax Service

When paying pension, medical and insurance contributions, the BCC begins with 182, thereby indicating the recipient of the payment - the Federal Tax Service. An incorrect BCC in a payment slip will result in the money simply going to the wrong account.

Valid codes for 2020 are presented in the table:

| Insurance payment | KBK main | KBK penalties | KBK fine | |

| for compulsory pension insurance | for employees | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Individual entrepreneur for himself | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 | |

| for compulsory health insurance | for employees | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| Individual entrepreneur for himself | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 | |

| for compulsory social insurance in connection with temporary disability and maternity | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 | |

| for pension insurance for individual entrepreneurs with an income of more than 300,000 rubles (1%) | 182 1 0210 160 | |||

Important! The details for paying insurance premiums to the Pension Fund in 2019 for individual entrepreneurs receiving income above 300,000 rubles do not contain a separate KBK (Order of the Ministry of Finance of the Russian Federation dated February 28, 2018 No. 35n)

The law provides for mandatory additional contributions for employers whose employees work in difficult or hazardous conditions. All issues related to them are regulated by the Federal Law “On Additional Insurance Contributions” dated April 30, 2008 N 56-FZ.

When transferring additional contributions, the following bookmaker codes are used:

- for workers in harmful, dangerous conditions (according to clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) 182 1 02 02131 06 1010 160, if a special assessment of working conditions (SOUT) was not carried out and 182 1 0220 160, if special technical assessment has been carried out;

for workers in difficult conditions (according to paragraphs 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) 182 1 0210 160 without special assessment and 182 1 0220 160 based on the results of special assessment.

IMPORTANT! From 01/01/2019, working conditions are assessed only based on the results of special labor assessment (Article 27 of the Federal Law of December 28, 2013 No. 426-FZ)

KBC of contributions to the Social Insurance Fund in 2020

Mandatory social insurance against industrial accidents and occupational diseases is still supervised by the Social Insurance Fund, therefore, the details for transferring contributions to the Social Insurance Fund in 2020 have not changed either. In particular, the payment order must contain the following KBK (393 - FSS code of the payment recipient):

- insurance payment 393 1 0200 160;

penalties 393 1 0200 160;

fines 393 1 0200 160.

In connection with the change in the legal address of the PFR Branch in Moscow and the Moscow Region - 115419, Moscow, st. Stasovoy, 14, bldg. 2 - and by tax registration with the Federal Tax Service No. 25 for Moscow from May 27, 2019, the bank details for paying additional insurance contributions for the funded pension have changed.