You need to report insurance premiums in 2020 to the Federal Tax Service, and not to extra-budgetary funds. Tax authorities have developed a new calculation form that replaces the previous 4-FSS and RSV-1 calculations; it must be applied starting with reporting for the 1st quarter of 2020. The form and instructions for filling out the calculation were approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. In addition, new BCCs are now used to pay insurance premiums.

Read more about the new form, as well as the procedure for filling it out with an example, in this article.

The procedure for submitting the calculation of insurance premiums in 2020

Organizations and individual entrepreneurs with employees must submit a new single calculation to the Federal Tax Service on a quarterly basis. The last day for submitting calculations is the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). The first report on the new form must be submitted no later than May 2, 2020, due to the postponement of dates due to the May holidays.

With an average number of more than 25 people, a single calculation must be submitted only in electronic form; others can submit it on paper. Please note that now the date for submitting the calculation of premiums from 2020 is the same for all policyholders, regardless of the method of submitting the calculation.

Important: the calculation is considered not submitted if the total pension contributions for each employee do not coincide with the total amount of Pension Fund contributions. After receiving notification of this from the Federal Tax Service, the policyholder has 5 days to eliminate the error, otherwise a fine cannot be avoided.

Taxes and Law

Based on Article 62 of the Labor Code of the Russian Federation, the employer cannot refuse to provide the employee with information about the transferred insurance premiums. At the same time, if the employer for some reason cannot provide this information, it is possible to obtain information from the Pension Fund of the Russian Federation or use the corresponding government service on the government services website.

According to Article 62 of the Labor Code of the Russian Federation, upon a written application from an employee, the employer is obliged, no later than three working days from the date of filing this application, to provide the employee with copies of documents related to work (copies of an order for employment, orders for transfers to another job, an order for dismissal from work; extracts from the work book; certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance, period of work with a given employer, etc.).

Thus, the employer does not have the right to refuse to provide the employee with information about accrued and actually paid insurance premiums.

Informing insured persons about the status of their individual personal accounts in the compulsory pension insurance system in accordance with federal laws of April 1, 1996 No. 27-FZ and July 24, 2002 No. 111-FZ

The insured person has the right:

— receive free of charge once a year at the territorial office of the fund (TOF) at the place of residence or work the information contained in his personal account;

— obtain from the policyholder free copies of individual information and information about the work (insurance) experience for the period before registration in the OPS system, submitted by the policyholder in relation to this insured person to the Pacific Fleet;

— contact the Pacific Fleet with an application to clarify the address of residence contained in the personal account in order to obtain the information contained in the personal account;

- apply to the Pacific Fleet (PFR) or to the court with an application to correct the individual information contained in his ILS, in case of disagreement with the specified information;

- contact the Pacific Fleet with an application to send it information about the state of the ILS in electronic form.

To obtain information about insurance premiums actually paid, you can obtain information from the Pension Fund. Location of the Pension Fund: Moscow, st. Shabolovka, 4.

PFR postal address for sending documents and requests: st. Shabolovka, 4, GSP-1, Moscow, 119991, PFR (Order of the Ministry of Health and Social Development of Russia dated December 19, 2011 N 1572n “On approval of the Administrative Regulations for the provision by the Pension Fund of the Russian Federation of public services for informing insured persons about the status of their individual personal accounts in the mandatory pension insurance in accordance with the Federal Laws “On individual (personalized) accounting in the compulsory pension insurance system” and “On investing funds to finance the funded part of the labor pension in the Russian Federation”)

In addition, it is possible to use the corresponding government service.

Information on the procedure for providing public services is provided to the insured person using telephone communications, electronic information, by posting on the official website of the Pension Fund and its territorial bodies on the Internet www.pfrf.ru, as well as on information stands on the premises of the Pension Fund and its territorial bodies.

To receive government services, you must submit a request for an extract from your individual personal account on the website https://www.gosuslugi.ru/.

When receiving an application from an insured person to send him information in electronic form (about refusal to send him information in electronic form), the territorial body of the Fund: checks the correctness of the application; checks the compliance of the information specified in the application with the citizen’s identity document and the insurance certificate of compulsory pension insurance; checks whether the Fund has an agreement with the credit institution specified in the application; registers the application, issues (sends by mail) a receipt-notification of registration of the insured person’s application for sending him information in electronic form (about refusing to send him information in electronic form).

When consulting on written requests from insured persons, a response to the request is sent by mail to the applicant within a period not exceeding thirty calendar days from the date of registration of the written request. In exceptional cases, as well as in the case of sending a request to a higher authority to obtain clarifications necessary for consideration of a written application, the period for consideration of a written application may be extended by the head or his deputy in charge of organizing personalized accounting, but not more than thirty days, with simultaneous notification about this by the applicant and indicating the reasons for the extension.

How to fill out the Calculation of insurance premiums in 2020

The calculation consists of a title page and three sections. In turn, sections 1 and 2 include applications: in section 1 there are 10 of them, in section 2 there is only one application. All policyholders are required to submit the following parts of the Calculation:

- Title page,

- Section 1, containing summary data on insurance premiums payable to the budget,

- Subsection 1.1 of Appendix No. 1 of Section 1 – calculation of pension contributions,

- Subsection 1.2 of Appendix No. 1 of Section 1 – calculation of compulsory medical insurance contributions,

- Appendix No. 2 of Section 1 – calculation of social insurance contributions in case of temporary disability and in connection with maternity,

- Section 3 – personalized information about insured persons.

The remaining subsections and annexes are presented if there is data to fill them out.

The calculation is completed in rubles and kopecks. In unfilled cells, dashes are added. All words in the Calculation lines are written in capital letters. The detailed line-by-line procedure for filling out the Calculation was approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551.

Let's look at how to calculate insurance premiums in 2020 using the following example.

In the 1st quarter of 2020, Alpha LLC accrued insurance premiums from payments to 1 employee, who is also the manager. The organization works on the simplified tax system and applies the basic tariff of insurance premiums.

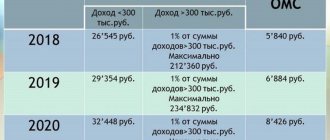

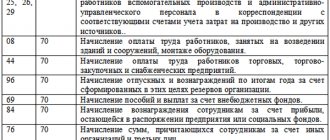

Contributory payments to Mikhailov I.P. amounted to 30,000 rubles monthly. In January-March, insurance premiums were charged for each month:

Pension Fund (22%) - 6600.00 rubles each, compulsory medical insurance (5.1%) - 1530.00 rubles each, social insurance (2.9%) - 870.00 rubles each.

The total amount of payments to Alpha LLC for the 1st quarter: 90,000 rubles.

The total amount of contributions of Alpha LLC for the 1st quarter: Pension Fund (22%) - 19,800.00 rubles, compulsory medical insurance (5.1%) - 4590.00 rubles, social insurance (2.9%) - 2610.00 rubles.

It will be more convenient to fill out the sections for calculating insurance premiums in 2020, the example of which we are considering, in the following sequence:

- First, fill in the personalized information in section 3 . This section is completed for all insured persons and includes information for the last 3 months. In our case, the information is filled in for one employee, but if there are more insured persons, then the amount of information in the Calculation must correspond to their number.

- The next step is to fill out subsection 1.1 of appendix 1 of section 1 on pension contributions: we summarize and transfer here the accounting data from section 3. Remember that all indicators of personalized information in total must coincide with the indicators of subsection 1.1. Our example is simplified and there is only one employee, so we simply transfer his indicators from section 3.

- Next, fill out subsection 1.2 of Appendix 1 of Section 1 on contributions to compulsory medical insurance. Indicators of insurance premiums for health insurance are reflected only in this section of the Calculation.

- Social insurance premiums are calculated in Appendix 2 of Section 1 . If there were social insurance expenses (sick leave, benefits) during the billing period, then this should be reflected in Appendix 3 to Section 1, which means line 070 of Appendix 2 of Section 1 should be filled in. In our example, there were no such expenses, so Appendix 3 is not fill it out.

- Having filled out the sections for each type of contribution, we fill out the summary section 1 . The amount of insurance premiums payable to the budget is indicated here. Please note that the BCC indicated on lines 020, 040, 060, 080 and 100 have not yet been approved for 2020, so in our example the codes for 2020 are indicated, in which the first 3 digits are replaced by 182, which means payment to the Federal Tax Service.

- In conclusion, we number all completed Calculation sheets and indicate their number in a special line on the Title Page. Under each section we will put the signature of the head and the date.

Which calculation is considered not presented?

The calculation is considered not submitted if (clause 7 of Article 431 of the Tax Code of the Russian Federation):

- section 3 contains false personal data of an individual;

- there are errors in the numerical indicators of section 3 (in the amount of payments, base, contributions);

- the sum of the numerical indicators of sections 3 for all individuals will not coincide with the data for the organization as a whole, reflected in subsections 1.1 and 1.3 of Appendix No. 1 to section 1 of the calculation;

- the amount of contributions to mandatory pension insurance (based on a base not exceeding the maximum value) in sections 3 for all employees is not equal to the amount of contributions to mandatory pension insurance for the organization as a whole in subsection 1.1 of Appendix No. 1 to section 1 of the calculation.

Changes 2017 for Pension Fund reporting

Since 2020, in order to strengthen control over the receipt of funds from insurance premium payers intended for extra-budgetary funds, these payments have been equated to tax transfers and have become regulated not by individual laws relating to them, but by rules general for tax legislation.

As a result of this transfer, insurance premiums began to:

- checked according to the same scheme as tax payments;

- be subject to the same system of sanctions for late filing of reports and payment of fees;

- according to the same scheme as taxes, collected in case of non-payment, offset and returned.

With the introduction of new reporting, the Pension Fund stopped:

- receive quarterly individual information about the length of service of insured individuals;

- accept reports on contributions intended for the Compulsory Medical Insurance Fund.

However, the Pension Fund retained the following functions:

- on recording personal data on the calculation and payment of contributions, which tax authorities are required to transfer to the Pension Fund of the Russian Federation (Article 11.1 of the Law “On Individual (Personalized) Accounting..." dated 04/01/1996 No. 27-FZ);

- checking the correctness of the information received through the Federal Tax Service;

- agreeing on issues of offset and return of overpaid contributions;

- acceptance of a number of other reports created by policyholders.

Thus, from 2020, the Pension Fund receives the same amount of information as before, but it comes to the fund from two sources: from the Federal Tax Service (from the summary report submitted there by the policyholder) and from the policyholder himself.

The procedure for filling out the SZV-ISH form

SZV-ISH form is filled out in ink, with a ballpoint pen, in block letters, or using computer technology without erasing or corrections. Any colors except red and green can be used.

The form consists of a header and eight sections:

- Heading

- Section 1 “Information about the policyholder”

- Section 2 “Information about the insured person”

- Section 3 “Reporting period”

- Section 4 “Information on the amount of payments and other remuneration accrued in favor of the insured person”

- Section 5 “Information on accrued insurance premiums for the reporting period”

- Section 6 “Information about paid insurance premiums”

- Section 7 “Information on the amount of payments and other remuneration in favor of an individual employed in the relevant types of work for which insurance premiums are calculated at an additional rate for certain categories of insurance premium payers”

- Section 8 “Periods of work of the insured person”

Heading

Registration number in the Pension Fund of Russia - indicates the registration number assigned by the Pension Fund when registering as an insurer.

Page — the page number is indicated in the format 001, 002, etc. Page numbering is continuous within each form for the insured person, starting from the title page.

TIN - individual taxpayer number assigned by the tax office; 12 digits for individual entrepreneurs, 10 digits for legal entities (put a dash in the last two cells).

KPP - reason code for registration at the location of the organization, also assigned by the tax office; 9 digits for legal entities, not filled in for individual entrepreneurs. For a separate subdivision, the checkpoint of this subdivision is indicated.

Section 1. Information about the policyholder

Registration number in the Pension Fund of Russia, INN, KPP - similar to the title.

Name (short) - in accordance with the constituent documents (name in Latin transcription is allowed).

Section 2. Information about the insured person

Last name and (or) first name are required, patronymic may be absent, but must be indicated if it is. The data must correspond to the data specified in the insurance certificate of compulsory (state) pension insurance. The full name is indicated in Russian transcription in the nominative case.

SNILS is the insurance number of the employee’s individual personal account.

The contract number and the date of conclusion of the contract are filled in only for periods up to and including 2001.

Type of contract - one of the meanings is indicated: “labor” or “civil law”.

Additional tariff code - filled in in accordance with the Classifier, filled out only for persons on whose earnings insurance premiums are calculated at the additional tariff (AVIA - for flight crew members of civil aviation aircraft).

Section 3. Reporting period

Reporting period (code) - filled in in accordance with the Classifier.

Calendar year - indicates for which year the form is being submitted.

Instructions for filling out the SZV-ISH correction form, sections 1-3

Section 4. Information on the amount of payments and other remuneration accrued in favor of the insured person

Section 4 contains information on wages and other income accrued in favor of the insured person. Only the lines of those months that are included in the reporting period are filled in.

The category code of the insured person - column 2 is filled in in accordance with the Classifier.

Features of filling out for reporting periods:

- 1997—2001 gg. - category code - column 2. The amount of total accruals taken into account when assigning a pension - in column 3. The amount minus accruals for sick leave (disability certificates) and scholarships is indicated in column 4 or 5 “including for which insurance premiums are accrued for compulsory pension insurance: included in the base for calculating insurance contributions, not exceeding the maximum.”

- 2002—2009 gg. - only data on the category code of the insured person is filled in - column 2, line “Total”.

- since 2010 - category code - column 2. In column 3 - the amount of payments and other remunerations accrued by payers of insurance premiums in favor of an individual within the framework of labor relations, including employment contracts, and civil contracts, the subject of which is the implementation works, provision of services, as well as under author's order agreements, agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, while for the reporting periods of 2010 the amounts are indicated for the last 6 months of the reporting period, and for reporting periods since 2011 - for the last three months of the reporting period. Columns 4 and 5 indicate the amount included in the calculation base for insurance premiums, not exceeding the maximum. Columns 6 and 7 indicate the amount included in the accrual base for insurance premiums included in the base that exceeds the limit.

Instructions for filling out the corrective form SZV-ISH, section 4

Total - always filled out, except in cases where the category codes of the insured person changed during the reporting period.

If the category codes of the insured person changed during the reporting period, then several SZV-ISH forms are submitted for this insured person, separately for each code.

Section 5. Information on accrued insurance premiums for the reporting period

Features of filling out for reporting periods:

- 1997—2000 gg. — in column 1 “Paid by the policyholder” the amount of accrued insurance premiums paid by the employer at the established rate is indicated. Column 2 “Paid from the earnings of the insured person” indicates the amount of accrued insurance premiums paid at the rate established for working citizens, including employees under the GPA, the subject of which is the performance of work and the provision of services, as well as copyright agreements.

- 2001 d. - in column 3 “By tariff” the amount of accrued insurance premiums is indicated; Column 4 “At the additional rate” indicates the amount of accrued insurance premiums at the additional rate.

- 2002—2013 gg. — in column 5 “For insurance pension” the amount of accrued insurance contributions for the insurance pension is indicated; Column 6 “For funded pension” indicates the amount of accrued insurance contributions for funded pension. At the same time, for the reporting periods of 2010, the amounts for the last 6 months of the reporting period are indicated, and for reporting periods from 2011 - for the last three months of the reporting period.

- 2014—2016 gg. — Column 7 indicates the amount of accrued insurance premiums for the amount of payments and other remunerations included in the base, which does not exceed the maximum.

For payers of insurance premiums who make payments and other remuneration in favor of crew members of ships registered in the Russian International Register of Ships, the amount of accrued insurance premiums is not indicated in relation to ship crew members.

Section 6. Information about paid insurance premiums

Section 6 is completed only for the reporting periods 2010-2013 .

Data on the amounts of insurance premiums paid in the last three months of the reporting period (except for 2010) are indicated in rubles and kopecks.

For reporting periods of 2010, data on the amounts of insurance premiums paid in the last 6 months of the reporting period are indicated in rubles and kopecks.

The amounts of advance payments are taken into account. The amount of overpaid (collected) insurance premiums is not taken into account.

Instructions for filling out the SZV-ISH correction form, sections 5, 6

Section 7. Information on the amount of payments and other remuneration in favor of an individual employed in the relevant types of work for which insurance premiums are calculated at an additional rate for certain categories of insurance premium payers

The section is completed in case of payment of insurance premiums at an additional rate, accrued on the amounts of payments and other remunerations of insured persons engaged in the types of work specified in paragraphs 1 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400-FZ for the reporting periods of 2013 —2016 :

- underground work, work with hazardous working conditions, in hot shops, with difficult working conditions, as working locomotive crews, in field geological exploration, prospecting, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work, logging work and timber rafting, work on loading and unloading operations in ports, as crew members on ships of the sea, river fleet and fishing industry fleet, drivers of buses, trolleybuses, trams, flight crews, dispatchers and ITS of civil aviation, in underground and open-pit mining, rescuers and etc.

The column “Code of special assessment of working conditions” is filled in using the code of special assessment of conditions in accordance with the Classifier.

Section 8. Periods of work of the insured person

The period of work of the insured person within the framework of a civil contract is filled in with the following codes reflected in column 11:

- “AGREEMENT” - if payment under the agreement was made during the reporting period;

- “NEOPLDOG” or “NEOPLAVT” - if there is no payment for work under the contract.

Territorial conditions (code), Special working conditions (code), Calculation of length of service, Conditions for early assignment of a labor pension - To be filled out in accordance with the Parameter Classifier.

Instructions for filling out the SZV-ISH correction form, sections 7, 8

The SZV-ISH form is signed by the executor (at the request of the manager), certified by the signature of the manager or authorized representative and the seal of the organization (if any). The policyholder (employer), who is not a legal entity, certifies incoming documents with a personal signature.