Waybill for a special vehicle. Form 3 spec.

A waybill for a special vehicle in form 3-special is the primary document required for keeping records of the operation of all special vehicles in the organization’s parking lot, and also serves as the basis for calculating wages to the drivers of these vehicles.

Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78 established a unified 3-special form of this waybill. The document is drawn up for one shift or to display information about two customers at the same time. Details required to be filled in the document:

- date of issue of the document, stamp of the organization that owns the vehicle (displayed until the document is completed as a whole);

- data about the vehicle (fill in the “Vehicle performance results” section);

- information about the organization that owns the vehicle.

If some columns of the waybill are filled out incorrectly or when appropriate amendments are made, you should fill out the “Special Notes” column with the correct data.

The document is issued by the dispatcher or other authorized person and given to the driver of the vehicle upon submission of the waybill for the previous shift.

Below is a sample of filling out for this waybill:

The basis for issuing an invoice to the customer organization are correctly filled out tear-off coupons of the waybill for a special 3-special vehicle.

The need for waybills

Individual entrepreneurs and organizations need waybills for the following purposes:

- accounting for fuel (gasoline) and fuel consumption;

- accounting for total vehicle costs;

- depreciation charges for vehicles;

- organization (control) of vehicle traffic;

- calculating salaries for drivers.

Regardless of whether the vehicle is leased or owned by the company, it is necessary to issue a waybill relating to the primary documentation.

What is a special vehicle

First of all, let’s define the essence of the term “special vehicle”. This can be done by drawing an analogy with the definition of a special vehicle, which is given in Art. 6 of the Technical Regulations of the CU, approved by the decision of the CU Commission dated 09.12.2011 No. 877.

In this international agreement, which is also valid in the Russian Federation, special transport means a vehicle used to perform special functions that require the use of special equipment. The Customs Union Commission also lists examples of relevant vehicles:

- truck cranes;

- fire trucks;

- tow trucks;

- cars with lifts, etc.

- truck crane waybill

- bulldozer waybill

- drilling rig waybill

- waybill for compressor unit

- tanker waybill

- concrete mixer waybill

- forklift waybill

- fuel tanker waybill

- etc.

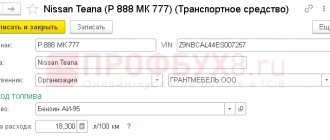

The proposed program allows you to keep records and issue waybills for special vehicles in the 3-special form in any configuration of

1C: Enterprise 7.7

(Accounting, Simplified, Entrepreneur, Trade, Production, etc.).

The 3-special form is presented in accordance with the law; details that are not in the unified 3-special form have been added to it.

Working with waybills is the same as with regular document journals: you can enter a new document, copy, delete, print. And at the same time, the waybill log is an external file and does not require implementation in the configuration

.

The open program is a table with five tabs:

1) “Waybills”

Trip log, where you can enter new trip sheets, copy, edit and delete saved documents using the corresponding buttons for the driver and vehicle.

2) "Drivers"

The internal directory “Drivers” has additional details that are not included in the standard directory “Employees” (driver’s license number and license category).

3) "Cars"

The internal directory “Cars” makes it possible to set 4 types of fuel consumption rates for a special vehicle:

- Mileage norm.

- Norm from the transported cargo.

- Norm from the operation of special equipment.

- The norm for warming up the engine in the winter season.

When specifying indicators in the form of a waybill (mileage, operation of special equipment, etc.), incl. allowances to the norm, under appropriate operating conditions, fuel consumption is automatically calculated according to the norm.

In the journal, the “Reports” button generates reports based on the waybill database:

— Travel log; — Journal of speedometer readings; — Fuel consumption report; — Report on refueling by the driver;

The download file is a self-extracting archive (to unpack you need to double-click and click the “Install” button in the window that opens). Contains the text file ReadMe.txt with a description of the operation of the program for accounting and issuing waybills for a truck.

Forms of waybills for special equipment

The State Statistics Committee of the Russian Federation, in Resolution No. 78 dated November 28, 1997, introduced a number of unified forms of waybills into the business circulation of transport enterprises. Among these is the 3-special form (waybill for a special vehicle).

Since 2013, it is not necessary to use forms approved by Goskomstat. However, there is usually no point in using alternatives to them: firstly, the enterprise will need to spend time developing them, and secondly, it is necessary to ensure that the structure of the waybill complies with the requirements contained in the order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152.

Find out about the latest requirements of the Ministry of Transport for details in waybills in the materials:

- “The list of mandatory details of the waybill has been expanded”;

- “From December 15, 2017, the waybill will be issued using a new form”;

- “Waybills: from March 1, 2020, the order of issuance changes.”

Form 3-special fully satisfies the criteria of the specified order of the Ministry of Transport, therefore, in practice, Russian transport companies continue to use it.

This form can be used as:

- a primary document through which a company accountant can write off fuel and lubricant expenses;

- document for calculating the driver's salary;

- a document used as a source of information for drawing up an invoice for payment of transport services to the customer of a special vehicle.

In addition, a waybill is a document that must be presented by the driver to a traffic police officer upon request during a document check.

Read about what the punishment will be for not having a waybill.

What form can I use?

Since 2013, legislation does not provide for the obligation to use unified forms of documents. Therefore, the waybill can be developed by the organization independently, but with the presence in the form of all the mandatory details approved by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152. The developed form must be fixed in the accounting policy of the organization.

Mandatory details of the waybill for special equipment in 2019:

Many organizations use a waybill for special equipment in the 3-special form, the form of which was approved by Decree of the State Statistics Committee of the Russian Federation dated November 27, 1997 No. 78. It is familiar to both organizations and inspectors, so its use is completely justified.

A sample waybill for special equipment in form 3-special can be downloaded below.

Purpose of waybill

The functions of the waybill are as follows:

- confirms the driver’s right to operate the vehicle;

- confirms the serviceability of the vehicle;

- used to write off fuel and lubricant costs;

- based on the document, the driver’s wages are calculated;

- the sheet confirms the fact that work has been performed for the customer, who, based on the data presented, pays for the work of the special vehicle.

Thus, this is a multifunctional document, the presence of which can be checked during an on-site inspection by the Federal Tax Service or other departments. For the absence of waybills, administrative liability may be imposed.

Purpose of the sheet for the accounting department

Based on the waybill, employees of the accounting department:

- Take into account the costs of fuel and lubricants;

- Calculate the driver's salary;

- Present the customer company with a check for the work performed.

When issuing a document, as well as when transferring it to the accounting department, the responsible employee must make a note in a special accounting journal.

Similar articles

- Bus waybill: form and sample

- Waybill for a truck of an individual entrepreneur

- New waybills for cars

- Truck waybill: form and sample

- Passenger car waybill form: sample filling

The legislative framework

Filling out waybills must comply with the following regulations:

- Federal Law No. 402 of December 6, 2011, since the waybill is a primary accounting document.

- Order of the Ministry of Transport dated September 18, 2008 No. 152 and Order of the Ministry of Transport dated December 21, 2020 No. 467, amending the document dated 2008.

The 2020 Order contains several important amendments that came into effect on March 1, 2020. For example, the number of mandatory details has increased, the seal of a health worker has become optional - just a signature is enough, the period for which a waybill is issued has changed: now you can do this only for 1 work shift or day, etc.

New waybill form in 2020:

What changed

Officials did not approve the new travel form, which is mandatory for everyone. The Ministry of Transport only made amendments to the procedure for filling out the document. Order of the Ministry of Transport of Russia dated December 21, 2018 No. 467.

The Ministry of Transport has made four changes to waybills from March 1, 2019. Firstly, he reduced the period for which a waybill can be issued. Secondly, I added new props. Thirdly, he noted the stamps when certifying signatures. Fourthly, he clarified when to record odometer data. How to issue a waybill from March 1, 2020, see the sample at the end of the article.

Duration of the waybill. It is no longer possible to issue one waybill for several trips on different working days or shifts. Now the document should be drawn up before each trip or shift, or before the start of the first trip if the driver makes several trips during the shift.

Previously, the company could issue a waybill for any period not exceeding a month for several flights.

New props. The waybill will need to indicate not only the date and time of the pre-trip inspection of the technical condition of the vehicle, but also the pre-shift inspection.

The completed document is signed by the dispatcher and the head of the institution or persons authorized by the head. If the company uses a seal (as defined by the charter), then the voucher is sealed. The document is always drawn up in a single copy and handed over to the driver. At the end of the trip, the driver must hand it over to the person in charge against signature.

Markings on waybills. Notes on medical examination and odometer readings are now certified only with a signature. The stamp is no longer needed. The employee must sign personally, indicate his last name and initials. For who can conduct a medical examination of a driver, see the recommendation “When it is necessary to conduct a mandatory medical examination of an employee.”

Odometer data. Odometer readings must be entered into the waybill from March 1 only when the car leaves the parking lot. An exception is provided only for those cases when several waybills were issued for one car for different drivers. Then the odometer readings are entered twice: into the travel document of the driver who is the first to leave, and into the document of the driver who is the last to arrive at the parking lot.

Which form to use

Waybill form No. 3 special. developed by the State Statistics Committee and approved by its Resolution No. 78 of November 28, 1997. Use of the form was mandatory until the end of 2012. Since the beginning of 2013, entrepreneurs have received the right to use their own forms. The main thing is that the required number of details is met and the use of the form is recorded in the company’s accounting policies.

Despite this right, some companies are still faithful to the unified forms, especially those for whom such forms are suitable. They are convenient and familiar to use, familiar to inspection authorities.

Which forms to choose is decided by the company management based on its own convenience.

Legislative framework of the Russian Federation

valid Editorial from 28.11.1997

detailed information

| Name of document | DECREE of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78 “ON APPROVAL OF UNIFIED FORMS OF PRIMARY ACCOUNTING DOCUMENTATION FOR ACCOUNTING THE WORK OF CONSTRUCTION MACHINERY AND MECHANISMS, WORK IN ROAD TRANSPORT” |

| Document type | resolution |

| Receiving authority | State Statistics Committee of the Russian Federation |

| Document Number | 78 |

| Acceptance date | 01.01.1970 |

| Revision date | 28.11.1997 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

DECREE of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78 “ON APPROVAL OF UNIFIED FORMS OF PRIMARY ACCOUNTING DOCUMENTATION FOR ACCOUNTING THE WORK OF CONSTRUCTION MACHINERY AND MECHANISMS, WORK IN ROAD TRANSPORT”

Form N 3 SPECIAL TRAVEL SHEET FOR A SPECIAL VEHICLE

Standard interindustry form N 3 special

APPROVED

by Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78

| place for organization stamp | First customer's coupon for waybill N _______ | |||||||||||||||||

| from "____" _________ 19__ | ||||||||||||||||||

| WAY SHEET FOR A SPECIAL VEHICLE | N | Organization | ||||||||||||||||

| series | Code | l | ||||||||||||||||

| from "____" _________ 19__ | OKUD form | 0345002 | car model | |||||||||||||||

| Organization | according to OKPO | And | ||||||||||||||||

| State license plate | ||||||||||||||||||

| name, address, telephone number | Operating mode | n | ||||||||||||||||

| Column | Customer | |||||||||||||||||

| And | ||||||||||||||||||

| car model | Brigade | |||||||||||||||||

| I | ||||||||||||||||||

| State license plate | surname, i., o. responsible person | |||||||||||||||||

| Driver | time, h, min. | speedometer readings, km | ||||||||||||||||

| O | arrival | departures | upon arrival | upon departure | ||||||||||||||

| Full Name | 19 | 20 | 21 | 22 | ||||||||||||||

| Certificate N | Class | T | ||||||||||||||||

| R | Customer | |||||||||||||||||

| License card | standard, limited | |||||||||||||||||

| cross out what is unnecessary | e | signature | full name | |||||||||||||||

| Registration N | Series | N | M.P. | |||||||||||||||

| h | cutting line | |||||||||||||||||

| Second customer's coupon for waybill N _____ | ||||||||||||||||||

| Trailer | State license plate | Garage number | A | from "____" _________ 19__ | ||||||||||||||

| Organization | ||||||||||||||||||

| brand | ||||||||||||||||||

| car model | ||||||||||||||||||

| Driver and car work | Fuel movement, l | Operating time, h, min. (cycle) | ||||||||||||||||

| operation | scheduled time, h, min. | zero mileage, km | speedometer reading, km | actual time, days of the month, h min | fuel | issued | remainder at | passed | rate change coefficient | special equipment | engine | State license plate | ||||||

| brand | code | away | return | |||||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |||||

| Leaving the garage | Customer | |||||||||||||||||

| Return to the garage | Signature | Refueler | Mechanics | Refueler | Dispatcher | |||||||||||||

| Series and numbers of issued coupons | ||||||||||||||||||

| Driver's task | Special marks | surname, i., o. responsible person | ||||||||||||||||

| at whose disposal (name and address of the customer) | Time | Type of work | ||||||||||||||||

| arrival | departures | time, h, min. | speedometer readings, km | |||||||||||||||

| 15 | 16 | 17 | 18 | arrival | departures | upon arrival | upon departure | |||||||||||

| 1 | 23 | 24 | 25 | 26 | ||||||||||||||

| 2 | ||||||||||||||||||

| Customer | ||||||||||||||||||

| I checked my driver's license and issued the assignment. | The car is technically in good working order and is allowed to leave | signature | full name | |||||||||||||||

| issue fuel | liters | Mechanic | M.P. | |||||||||||||||

| in words | signature | full name | ||||||||||||||||

| Dispatcher | The car received: | |||||||||||||||||

| Driver | ||||||||||||||||||

| signature | full name | |||||||||||||||||

| The driver is allowed to drive a car due to health reasons | signature | full name | ||||||||||||||||

| When returning the car | OK | |||||||||||||||||

| signature | full name | faulty | ||||||||||||||||

| Place for stamp | Passed by the driver | |||||||||||||||||

| signature | full name | |||||||||||||||||

| Received by mechanic | ||||||||||||||||||

| signature | full name | |||||||||||||||||

Reverse side of form N 3 special

| Information about the work performed (to be filled in by the organization) | Marking the completion of the task | |||||||||||||

| Type of work | route of movement or object of work | type of work | time, h, min | speedometer readings at | customer | |||||||||

| Name | code | Name | code | arrival | arrival | code | ||||||||

| 27 | 28 | l | departures | departure | job title | signature | ||||||||

| 1. | ||||||||||||||

| 2. | And | place for stamp | ||||||||||||

| full name | ||||||||||||||

| Paid time, h, min | Tariff, rub, kopecks | Total payable, rub, kopecks | n | 37 | 38 | 39 | 40 | 41 | 42 | 43 | ||||

| 29 | 30 | 31 | ||||||||||||

| 1. | And | |||||||||||||

| 2. | ||||||||||||||

| Total | I | |||||||||||||

| Taxi driver | ||||||||||||||

| Position, surname, name, patronymic of the employee responsible for the safe movement of cargo | Riggers (slingers) | |||||||||||||

| from the car owner | at the customer's | surname, i., o. | ID number | |||||||||||

| signature | full name | O | 44 | 45 | 46 | 47 | ||||||||

| cutting line | T | |||||||||||||

| Information about the work performed (to be filled in by the organization) | The result of the car | Wage | ||||||||||||

| Type of work | R | fuel consumption, l | time on duty, h, min | mileage, km | code | amount, rub. cop. | ||||||||

| Name | code | according to the norm | actually | Total | incl. simply and for technical reasons | |||||||||

| 32 | 33 | e | 48 | 49 | 50 | 51 | 52 | 58 | 59 | |||||

| 1. | ||||||||||||||

| 2. | h | Line downtime | ||||||||||||

| Name | code | date and time, h, min | signature of the responsible person | |||||||||||

| Paid time, h, min | Tariff, rub, kopecks | Total payable, rub, kopecks | A | Start | ending | |||||||||

| 34 | 35 | 36 | 53 | 54 | 55 | 56 | 57 | |||||||

| 1. | ||||||||||||||

| 2. | ||||||||||||||

| Total | ||||||||||||||

| Taxation | ||||||||||||||

| Taxi driver | ||||||||||||||

| signature | full name | |||||||||||||

Filling out the waybill for a special vehicle

The waybill is issued before leaving for the mission. Make up the paper in one copy. Form No. 3 special used only for one or two customers. If there are more of them during a working day or shift, then a new sheet is drawn up.

Filling out the waybill falls on the shoulders of the dispatcher or other designated employee. You can draw up a waybill on paper, or you can do it on a computer using a special program. The driver usually fills out his part of the form by hand. He enters information about the trip and work completed, and also signs the acceptance and delivery of the car.

Front side

So, the dispatcher begins to enter information from the header of the document. What to include:

- number and series of the waybill (if the series is indicated);

- full name of the organization, address, telephone number, OGRN or ORGNIP;

- OKPO code;

- operating mode;

- column, brigade (name or number);

- information about the car: make, license plate and garage (if available). The information must correspond to that specified in the documentation;

- Full name of the driver, his license number and class or category;

- information about the license card, if the driver works under a license (number, series);

- trailer brand, state and garage number, if a trailer is used.

Next is a table with data on the work of the driver and the vehicle. When leaving the garage, note the scheduled time, mileage numbers, speedometer readings, actual time: day, month, hours, minutes. The dispatcher must indicate the same data at the end of the shift or working day, but only in the “Return to the garage” column.

On the right is a table with information about the movement of fuel. It is necessary to indicate: the brand and code of the fuel, how much was issued, how much was there upon departure, how much was left upon return and how much was returned, the rate change factor. The operating time of the engine and special equipment of the machine is also indicated here. The fuel operator, mechanic, and dispatcher must sign for each of the indicators.

This is followed by a column indicating the series and numbers of issued customer coupons. The coupons themselves are located on a special tear-off part of the document.

The following table contains the task for the driver. It is also filled out by the dispatcher. The following information must be provided:

- at whose disposal the transport with the driver is sent (company name and address);

- time of arrival and departure to the site;

- type of work to be performed;

- notes.

The following are written down:

- dispatcher (he also notes the amount of fuel dispensed);

- a paramedic after a pre-trip examination - that the driver can start working due to health reasons;

- mechanic - that the transport is technically sound when leaving and when returning;

- the driver - that he accepted the car in good condition, and then handed it over.

Important! Each signature is placed at its own time after a thorough inspection. Admission to work is not possible without checking the driver’s health and the technical condition of the car.

Reverse side

The table with data on the completion of the task is filled out by the driver. Things to note:

- route of movement or object of work;

- name of the work and its code;

- time of arrival at and departure from the site;

- Speedometer readings during arrival and during departure.

The last column must be signed by the customer of the work and stamped if the company continues to use it.

The following is a table where you need to indicate those responsible for the safe movement of cargo on the part of the contractor and the customer, the full names of the slingers and the numbers of their certificates.

The next part of the form is filled out in the accounting department. The data is needed to calculate the driver's wages. The following information must be entered:

- fuel consumption according to the norm and actually;

- how long the driver spent in the outfit;

- how long the downtime took, if any;

- mileage.

If there were downtimes, then information about them is entered into the appropriate table. Indicate the name, code, start and end time of the downtime. The responsible person puts his signature.

The last plate indicates the amount of wages for the shift and is signed by the accountant.

Coupons for customers

The waybill contains tear-off coupons for customers. They are needed to issue an invoice to this organization. What should be indicated in such a coupon:

- waybill number;

- date of compilation of the sheet;

- name of the company providing the car;

- vehicle registration number;

- Full name of the customer's representative;

- arrival and departure times;

- speedometer data at the time of arrival and departure;

- signature of the customer's representative;

- name and code of work performed;

- information about the amount of payment;

- signature of the taxi driver - accountant.

The coupon is filled out by the organization that owns the vehicle.

Sample of filling out a waybill for a passenger car

[ads-pc-2] [ads-mob-2]

Let's take a closer look at how to fill out a waybill.

Filling out the front side

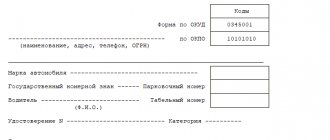

The company stamp is affixed at the top, the number (if necessary, series) and the date of the document are affixed below.

In the next column you must indicate the name of the company, its address and telephone number. The company's registration code with the statistical authorities (OKPO) is also reflected here.

After this, the dispatcher fills in the make of the car, its license plate number, and inventory garage identifier.

Full name is written in the corresponding line. driver, personnel number, driver's license details, if any - class.

The next section of the waybill is filled out if the enterprise is specialized, for example, a taxi. For such companies, license cards are required; their details must be entered here.

The dispatcher determines the task for the driver and indicates the exact delivery address of the vehicle. After this, the specialist endorses the document and hands it to the driver.

There is a special section in the document for the mechanic, where he notes the serviceability of the car and the speedometer readings, the balance in the tank, and endorses it with his full name. The driver also signs below for receipt of the car with a transcript of his personal data.

During refueling, the employee reflects the amount of fuel filled and its brand. A station employee can sign next to the displacement as confirmation.

The dispatcher indicates the actual date and time of return to the garage, if necessary, making a note of downtime, delays, etc.

When returning, the driver hands the car over to a mechanic, who checks its condition, notes the remaining balance in the tank at the end of the working day and the odometer. Confirming receipt of the car, the technician puts his signature, and the driver handing it over puts his own.

Next, the document is filled out by the dispatcher, who, based on the speedometer readings, calculates the normal fuel consumption, comparing it with the actual one and identifying excess consumption or savings.

Filling the reverse side

[ads-pc-4] [ads-mob-4]

On the reverse side of the document, the driver personally fills out information about the process of fulfilling his official assignment, indicating the departure and destination places with a decoding of the time period and kilometers traveled.

When working with third parties, they can sign for the driver to complete the task against his notes. At the bottom of the document, the dispatcher calculates the total number of hours worked per day and the mileage using the speedometer. Depending on the applied remuneration system, it determines the employee’s salary and transmits the waybill after recording it in the registration journal to the accounting department. The accountant confirms the correctness of the calculations with his signature.

A sample of the waybill can be viewed below.

Registration and storage of waybills

After opening, the waybill is registered in the waybill movement log. After the sheet is closed, a corresponding note is made in the journal. The sheets must be stored in the organization for 5 years, in accordance with the above-mentioned Order of the Ministry of Transport No. 152 of 2008. The journal itself, after filling, is also sent for storage for a similar period.

Waybill for a special vehicle (form No. 3 special)

The waybill for a special vehicle is the primary document. The data contained in the document allows you to record the operation of a special vehicle. Based on this document, the driver’s wages are calculated.

The typical inter-industry form of a waybill for special vehicle No. 3 consists of several sections - this is the waybill itself and two tear-off coupons. There are only two tear-off coupons, therefore, according to one waybill, the contractor can complete the tasks of no more than two customers. The waybill is issued to the contractor against receipt only if he has handed over the previous waybill issued to him; you should also note that the validity of this sheet is limited. The waybill can be valid for one day or shift.

To fill out the waybill for a special vehicle, the enterprise appoints a special authorized person or a vehicle dispatcher, who fills them out in one copy. The data that he enters into the waybill usually relates to the task and does not relate to the “Vehicle performance results” section. The vehicle operation results section is filled out by persons directly responsible for and monitoring the operation of the vehicle indicated in the waybill.

In order for the waybill to be valid, the following details must be filled in:

- date of issue of the waybill for a special vehicle, form No. 3

- details of the organization that owns the vehicle

- seal, stamp of the organization to which the vehicle belongs

The waybill form contains a “special notes” section. This section is filled in with data in any form. May contain information about accompanying persons, explanations of the task, information about changes in the task that the dispatcher indicated in the task to the driver section.

The basis for issuing an invoice to the customer is a tear-off coupon. These coupons contain information about the customer, the vehicle, arrival and departure times, and speedometer readings. Filled out by the organization that issued the waybill.

Attention! The Ministry of Transport, by orders No. 17 of 01/18/2020 and No. 476 of 11/07/2017, introduced new mandatory details into the waybill forms in addition to the approved order No. 152 of 09/18/2008.

Types of waybills

Waybill forms differ depending on the types of transport used for transportation. Document forms differ in the order of completion and content.

We invite you to familiarize yourself with the unified document forms in the form of a table, with the help of which you can decide on the most suitable document form for your company:

| Form name | Approval date | Purpose | Peculiarities | ||

| Waybills for passenger cars in 2020 | |||||

| OKUD 0345001 Form 3 "Passenger car waybill" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | Justification of costs for fuel and lubricants | Draws up for a period of 1 day | ||

| Form PL-1 “Waybill for a passenger car of an individual entrepreneur” | Order of the Ministry of Transport of the Russian Federation dated June 30, 2000 No. 68 (as amended on September 22, 2003) | Designed for individual entrepreneurs | Can be used voluntarily | ||

| OKUD 6002208 Form 16 “Passenger car waybill” | Order of the Minister of Defense of the Russian Federation dated March 28, 2008 No. 139 | Justification of costs for fuel and fuels and lubricants in primary accounting | Used by military structures | ||

| OKUD 6002209 Form 16a "Passenger car waybill" | Order of the Minister of Defense of the Russian Federation dated March 28, 2008 No. 139 | Used to account for vehicle operation | Used by military structures | ||

| OKUD 0345003 Form 4 "Taxi waybill" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | Used as a primary document by organizations that have a taxi fleet to calculate earnings for taxi drivers | Issued by the dispatcher daily against the driver's signature | ||

| Waybills for trucks and special vehicles 2020 | |||||

| OKUD 0345002 Form 3 special "Waybill for a special vehicle" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | For the operation of a special vehicle (for example, truck cranes, cleaning machines, etc.), and the correct calculation of wages for the vehicle driver | Compiled for 1 day (shift) to complete a task for 1-2 customers | ||

| Form 4-M "Truck waybill" | Instruction of the USSR Ministry of Finance No. 156 dated November 30, 1983 | For transportation of various goods in intercity format (over a long period of time) | The waybill contains a tear-off coupon for the customer of the cargo | ||

| OKUD 0345004 Form 4-C "Truck waybill" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | Allows you to keep comprehensive records of the transportation of goods (goods) by this type of transport and is intended for piecework transportation | Compiled for 1 day and has a tear-off part (coupon) | ||

| OKUD 0345005 Form 4-C "Truck waybill" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | Used when paying for truck work at a time rate | It is necessary to attach waybills if material assets are transported | ||

| Form PG-1 “Waybill for a truck of an individual entrepreneur” | Order of the Ministry of Transport of the Russian Federation dated June 30, 2000 No. 68 (as amended on September 22, 2003) | Intended for individual entrepreneurs as a basis for calculating wages to the driver and transportation of cargo, as well as for settlements with customers for transported goods and for writing off costs for fuel and fuels and lubricants | Draws up for a period of 1 day | ||

| Form 412-APK "Tractor waybill" | Order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 No. 750 | Used to record work performed by tractor drivers during transport work | It is not allowed to release the tractor from the garage for transport work without a waybill | ||

| Waybills for buses | |||||

| OKUD 0345006 Form 6 "Bus waybill" | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | The primary document for recording bus operation both on city routes and in the suburbs. The document is the basis for calculating the bus driver's salary. | The document contains general information about the bus, fuel consumption and the task that the driver received. | ||

| Form PA-1 “Bus waybill for an individual entrepreneur” | Order of the Ministry of Transport of the Russian Federation dated June 30, 2000 No. 68 (as amended on September 22, 2003) | The primary document for recording the operation of an individual entrepreneur bus. The document is the basis for calculating the bus driver's salary. | PA-1 is no longer mandatory for use; individual entrepreneurs are allowed to develop their own forms of the document | ||

| OKUD 0345007 Form 6 special “Non-public bus waybill” | Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 | Used for non-public buses (for example, for transporting employees to work or for other irregular transportation) | The waybill contains a tear-off coupon for the customer | ||

In addition to waybills, the document flow of organizations and individual entrepreneurs using vehicles or providing cargo transportation services must contain the following accounting documents:

1. Journal of registration of individual entrepreneurs’ waybills (the form of the document is approved by Order of the Ministry of Transport of the Russian Federation dated June 30, 2000 No. 68 (as amended on September 22, 2003)). 2. Invoices (in form T-1, which is approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78). 3. Journal of the movement of waybills (according to Form 8, which is approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78).

The head of the organization must issue an order appointing someone responsible for issuing waybills and maintaining the Waybill Registration Journal. The journal is filled out in chronological order.

When you have decided which form of waybill should be used for the needs of the enterprise, do not forget to approve this document in the accounting policy. This must also be done if you switch to using another form of waybill.

Let us note that an organization or individual entrepreneur has the right to use its own developed document forms, but it is important that it contains all the mandatory details established by Russian legislation.