Are cars included in the fixed assets register?

Motor transport can be considered a fixed asset (FPE) both in tax accounting and accounting if the criteria prescribed by law are met.

Criteria for inclusion in the register of fixed assets of a company in tax accounting in accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation:

- exploited in the process of producing and selling products, providing services, carrying out work, and managing an enterprise;

- the cost of the object starts from one hundred thousand rubles .

https://youtu.be/3-vfVZ5gY9k

When is it necessary to apply a depreciation reduction factor?

It is established at the legislative level that when purchasing expensive equipment or objects, a reducing depreciation factor is applied.

Thus, a coefficient with a value of 0.5 is subject to application:

- in relation to passenger cars, the original cost of which exceeds 600 thousand rubles;

- for minibuses with an initial cost above 800 thousand rubles.

It should be borne in mind that such a requirement is established for tax accounting. But for accounting purposes such a requirement is not mandatory.

In addition, as a result of the application of a reduction factor, the maximum value of the value of the vehicle changes periodically, and a time comes when the value of the vehicle becomes less than the values established by law. What to do in such a situation?

From the point of view of the Ministry of Finance of the Russian Federation, the established method for calculating depreciation of property should not change throughout the entire depreciation period. From a practical point of view, the application or non-application of the coefficient does not affect the depreciation of property.

Thus, as a result of a change in the value limit of a vehicle, a legal entity that is the owner of a vehicle may decide to stop applying the reduction factor. However, such a decision is fraught with litigation.

Is it necessary to calculate SPI when determining depreciation of vehicles?

If motor transport is defined on the balance sheet of an enterprise as fixed assets, then a depreciation group .

With its help you can calculate the SPI of vehicles.

In accounting, SPI can be calculated without being assigned to such a group. It is calculated based on the estimated time and operating conditions.

The enterprise must charge depreciation throughout the service life of the vehicle until it reaches the maximum degree of wear and tear and write-off.

How to extend the life of a car?

Every more or less experienced driver knows perfectly well that a car must be serviced in a timely and efficient manner. If you follow the manufacturer's recommendations, the service life of the car in years or kilometers can be significantly increased.

Here is a list of recommendations that must be followed:

- Strictly undergo technical inspections on time and carry out repairs in accordance with the rules.

- Buy only original spare parts. Non-original analogues, which are cheaper in price, can ultimately lead to more serious damage.

- Do not carry loads whose weight exceeds the maximum load capacity of the vehicle.

- Adhere to speed limits and recommendations regarding gear shifting.

- Do not increase the load on the motor unless absolutely necessary. That is, there is no need to suddenly start or accelerate to high speed and then suddenly brake at traffic lights. It is important to slow down when driving on bad roads. This way you can significantly reduce the load on your car’s suspension and extend its life.

These are all simple, familiar actions that few people follow. However, if you follow the manufacturer’s recommendations, take care of the car and do not overload it, then after decades the iron horse will look like new. Even after sale, such a vehicle will be successfully used for years and will not cause any problems to the new owner. Therefore, you should not skimp on technical inspection and original spare parts, because all this will help you get rid of problems in the future.

How is it calculated in accounting?

The accounting legislation does not have a clear time frame for limiting private investment.

An enterprise can establish the SPI according to the Classifier used for tax accounting, or set its other value, guided by certain factors.

Read this article on how to get a deduction for training at a driving school.

According to clause 20 of PBU 6/01, the factors influencing the SPI of motor transport are:

- expected duration of further operation of the vehicle;

- documentary restriction of SPI of transport (end of a rental or leasing agreement for vehicles);

- operating conditions of transport : weather conditions, frequency of shifts, territorial features of the area of application, etc.

When are increasing car depreciation rates applied?

The legislation determines that when depreciating vehicles, not only a reducing factor can be applied, but also an increasing one. The need to apply an increasing coefficient is determined at the discretion of the business entity and depends on certain circumstances. One of the grounds for such a decision is to secure such a possibility in the relevant decision of the legal entity - an internal regulatory act.

The legislation stipulates that the use of a multiplying factor:

- in value 2 it is possible for road transport that operates in an aggressive environment and at increased intensity;

- in value 3, if this applies to vehicles received under leasing conditions. In this case, the consent of both the lessor and the lessee is required.

Method for calculating SPI in tax documentation using the Classifier

In the Decree of the Government of the Russian Federation dated January 1, 2002 “On the Classification of fixed assets included in depreciation groups,” you can see the SPI Classifier according to the depreciation groups of transport.

All vehicles belong to separate depreciation groups; the group number is affected by the vehicle type, size, power, and area of operation.

For all cars, the SPI can vary from two to nine years .

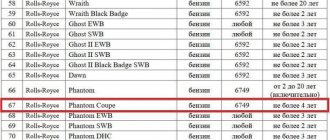

The SPI TS classifier can be presented as the following table :

| No. | Depreciation group | SPI, years | Kind of transport |

| 1 | 2 | from two to three | Utility lifts with platforms |

| 2 | 3 | from three to five |

|

| 3 | 4 | from five to seven |

|

| 4 | 5 | from seven to nine |

|

Is a driver's license an identification document? Read here.

The most reliable cars with long service lives

The American company JD Power and Associates, based on a survey of 80,000 new car owners, compiled a car reliability rating. The company's analysts for each manufacturer determined the number of problems that 100 car owners had during the first 90 days of operation. The first places went to the concerns whose cars had the fewest problems.

For the second year in a row, the Korean concern Kia takes first place. There are an average of 72 faults per 100 new cars sold.

Second place goes to the Korean company Genesis (a subsidiary of Hyundai) with a result of 77 faults per 100 cars.

Third place – Porsche. For every 100 Porsche cars sold, there are 78 breakdowns.

The remaining places in the ranking are given to the following brands:

- Ford.

- Chrysler.

- BMW.

- Chevrolet.

- Hyundai.

- Lincoln.

- Nissan.

Considering the fact that these models have fewer breakdowns, we can conclude that their service life is longer compared to competitor cars. However, if not used properly, even they will not last long.

Cars

The SPI of passenger cars can be determined depending on the dimensions and engine size of the car:

- from seven to nine years – large cars with an engine capacity of 3.5 liters or more;

- from five to seven years – small cars for people with disabilities;

- from three to five years - other passenger cars.

As an example, we will find out the SPI of a Toyota Auris 2008 . The engine capacity of this car is 1.6 liters.

This means that his SPI can range from three to five years.

Methods for calculating depreciation in accounting

Depreciation is a representation of the depreciation of a vehicle in monetary terms. Depreciation rates can be used to determine the remaining useful life of a vehicle.

For vehicles that were not purchased new, depreciation is applied in the form of:

- linear method, the essence of which is that for the entire period of remaining operation, the cost of the vehicle at which it was placed on the balance sheet is written off in equal parts;

- the reducing balance method, the essence of which is that the rate of annual contributions is calculated by applying two indicators: the period of use and the increased coefficient. In this case, coefficient 2 or 3 is applied depending on the method of operation of the vehicle. Depreciation is calculated on the residual value of the car at the beginning of each year. Keep in mind that this method only applies to cars that are transferred under the terms of a leasing agreement;

- a method of writing off the cost of a vehicle based on the total number of years during which the vehicle was in use. In this case, multiply the depreciation rate by the original or current cost of the vehicle.

In addition, for material objects a proportional method is used, when the volume of products released or produced for the current year must be divided by the expected service life. This method can be applied to the initial cost of a material object.

In practice, the first and fourth methods of depreciation are most often used. A legal entity can change the depreciation method used at the beginning of each year.

However, the law establishes the following requirement: if a non-linear depreciation method was initially used, then you can switch to another only after five years.

When applying depreciation deductions, follow the standards prescribed in Article 259 of the Tax Code of the Russian Federation.

Watch the video. Car wear and tear and calculation methods:

https://youtu.be/rBPTGfQnx_0

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7-495-899-01-60

Moscow, Moscow region

+7-812-389-26-12

St. Petersburg, Leningrad region

8-800-511-83-47

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

Buses

The SPI of buses depends on its dimensions and area of use (city or intercity):

- from seven to nine years – other types of buses, the length of which is from 16.5 to 24 meters;

- from five to seven years - large buses up to 24 meters long, which travel within the city and between cities;

- from three to five years – small buses up to 7.5 meters long.

For example, let's take a bus 18 meters long that transports passengers between cities.

Based on the length and place of operation, it can be determined that its depreciation group is 4, that is, its service life is from five to seven years .

Read in this article how long honey is valid. certificate for obtaining a driver's license.

Useful service life - individual parameter

The concept of a vehicle's useful life does not depend on the vehicle itself. To a greater extent, it is determined by operating conditions. If you fill the engine with cheap oil and do not change it every 10 thousand kilometers, then any car will not drive for a long time, and durability classes do not play any role here. However, cars with timely maintenance and low annual mileage can last much longer without causing any problems to the owner.

Many car owners know from personal experience that a second-class car in terms of useful life can last more than 20 years. And then you can even sell it quite expensively. The new owner will also drive for 5-10 years, but only subject to timely maintenance.

Trucks

SPI for trucks is calculated based on the load capacity and area of application of the vehicle:

- from seven to nine years – trucks, the cargo weight of which is from 3.5 to 12 tons, trailers, semi-trailers;

- from five to seven years – dump trucks, vans, special equipment;

- from three to five years – small cars with a carrying capacity of up to 3.5 tons.

For example, KamAZ can be included in the group of dump trucks.

Accordingly, its depreciation group is 4, that is, its SPI is in the range from five to seven years .

https://youtu.be/jifxgHwSGo0

How to determine the useful life of a used car

A special procedure is provided for determining the period and procedure for calculating depreciation in relation to a vehicle that was purchased second-hand.

Under such conditions, reduce the remaining service life of the car, determined using the Classifier, by the indicator of the time period during which it was subjected to operation by the previous owner.

The operating time is calculated based on the vehicle’s technical passport data, and not from the words of the previous owner.

Requirements for depreciation groups

- the possibility of increasing the economic efficiency of property use;

- access to detailed, conveniently grouped information about the company’s work;

- the emergence of the opportunity to make the most profitable management decisions;

- simplification of tax and accounting;

- reducing the likelihood of accounting errors.

Each enterprise uses in its work various fixed assets that are its property and are used in the production of goods, provision of services, and performance of work. To accept them for accounting, the initial cost is determined. Accounting during use is carried out at residual value.

OKOF: code 310.29.10.5

310.29.20.23 - Other trailers and semi-trailers

Classifier: OKOF OK 013-2014 Code: 310.29.20.23 Name: Other trailers and semi-trailers Subsidiary elements: 4 Depreciation groups: 1 Direct adapter keys: 31

310.29.10.5 — Special purpose motor vehicles

Classifier: OKOF OK 013-2014 Code: 310.29.10.5 Name: Special-purpose motor vehicles Subsidiary elements: 4 Depreciation groups: 2 Direct transition keys: 27