What kind of posting generates negative exchange rate differences depends on the reasons for their formation. Read our article about the procedure for making entries for exchange rate differences and their calculation in accounting and tax accounting.

Rules for making entries for negative and positive exchange rate differences in accounting in 2020

An example of calculating exchange rate differences in accounting

How to calculate exchange rate differences in tax accounting?

Accounting for exchange rate differences in the VAT return

Results

An example of calculating exchange rate differences in accounting

According to paragraph 3 of PBU, exchange rate differences in accounting are considered as the difference between the value of assets (debts) accounted for in foreign currency on the date of their payment (or the reporting date of the current period) and the value of assets (debts) on the date of their display in accounting in the current period (or the reporting date of the previous period).

The reporting date is the end of the year (clauses 4, 12, 13 PBU 4/99).

IMPORTANT! pp. 4, 6 tbsp. 15 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ defines the reporting date as the last calendar day of the period for which reporting is prepared.

Before the decision of the Supreme Court of the Russian Federation dated January 29, 2018 No. AKPI17-1010, organizations were required to prepare interim monthly and quarterly reports (clause 48 of PBU 4/99, clause 29 of the Regulations on accounting and financial reporting, approved by order of the Ministry of Finance of Russia dated July 29. 1998 No. 34n (as amended on March 29, 2017). However, the Supreme Court of the Russian Federation came to the conclusion that the preparation of interim accounting (financial) statements is not the responsibility of every economic entity, and declared clause 48 of PBU 4/99 and clause 29 invalid Regulations on accounting and financial reporting in the Russian Federation, indicating that interim reporting is presented only in certain cases.

Cases when economic entities are required to submit interim reports are listed in paragraph 4 of Art. 13 of the law of December 6, 2011 No. 402-FZ. These include cases provided for:

- Legislation of the Russian Federation.

For example, it is legally established that insurance organizations, mutual insurance companies, and insurance brokers are required to submit interim reports (clause 2 of article 4.1, clause 8 of article 32.8 of the law “On the organization of insurance business in the Russian Federation” dated November 27, 1992 No. 4015- I), issuers of securities (Clause 7, Article 30 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ).

- Regulatory legal acts of state accounting regulatory bodies.

- Treaties.

- Constituent documents.

- Decisions of the owner of an economic entity.

Thus, if your organization does not fall under any of the above cases, then it has no obligation to prepare interim reports, and therefore, it is not required to generate exchange rate differences in accounting at the end of each quarter or month.

Assets (debts) are revalued at the Central Bank exchange rate or at the rate fixed by laws or agreement of the parties to the transaction (clause 5 of the PBU).

Example

Export Import LLC took the following actions in 2020 (currency rate is conditional).

| date | Actions | Dt | CT | Amount, dollars | Central Bank exchange rate, rub./dollar | Amount, rub. |

| 26.05 | An advance payment has been sent to the supplier for frozen berries | 60 | 52 | 41 200 | 55,9208 | 2 303 936,96 |

| 03.06 | Frozen berries were received from the supplier and capitalized | 41 | 60 | 123 620 | 56,6616 | 6 973 986,03 = 41 200 × 55,9208 + (123 620 – 41 200) × 56,6616 |

| 18.06 | Frozen berries are resold to the buyer | 62 | 90 | 194 670 | 57,4942 | 11 192 395,91 |

| 29.06 | Payment received from buyer for frozen berries | 52 | 62 | 194 670 | 57,5598 | 11 205 166,26 |

| 29.06 | Requirements to the buyer were revalued on the date of their payment - positive CD was written off | 62 | 91 | — | 57,5598 | 12 770,35 = 194 670 × (57,5598 – 57,4942) |

| 30.06 | The debt to the supplier was revalued at the end of the month - a negative CR was credited* * Posting is done if there is an obligation to prepare interim reports. | 91 | 60 | — | 57,2649 | 49 723,99 = (123 620 – 41 200) × (57,2649 – 56,6616) |

| 04.07 | The balance of the debt to the supplier has been paid | 60 | 52 | 82 420 | 57,5375 | 5 533 761,22 |

| 04.07 | The debt to the supplier was revalued on the date of payment - a negative CR was credited* * This calculation is made on the condition that the organization as of the reporting date of June 30 was obliged to draw up interim reports and reflect exchange rate differences | 91 | 60 | — | 57,5375 | 22 467, 69* = (123 620 – 41 200) × (57,5375 – 57,2649) |

| 04.07 | The debt to the supplier was revalued on the date of payment - a negative CR was credited* * This calculation is made on the condition that the organization as of the reporting date of June 30 was not required to prepare interim reports and reflect exchange rate differences | 91 | 60 | — | 57,5375 | 72 191,68 = (123 620 – 41 200) × (57,5375 – 56,6616) |

IMPORTANT! Advances received (paid) in foreign currency are recorded in the accounting system in rubles at the exchange rate on the date of their receipt (payment) and are not subject to subsequent revaluation (clauses 9, 10 of the accounting regulations).

Positive and negative exchange rate differences - postings and examples

Exchange rate difference is a concept used in settlements of foreign exchange transactions. An organization's foreign currency assets, except advances, are subject to regular revaluation, which results in positive and negative differences. Let's look at how exchange rate differences are reflected in accounting and how to reflect positive and negative exchange rate differences in transactions.

Types of exchange rate differences

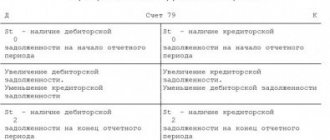

Exchange rate difference is the difference in the valuation of a foreign currency asset in ruble terms on the date of payment and the reporting date.

Exchange rate differences (CR) can be positive or negative. Positive means an additional valuation of assets and a write-down of liabilities, negative - a write-down of assets and an additional valuation of liabilities.

Exchange differences arise:

- On the date of the operation;

- At the end of the reporting period.

Example and postings for positive exchange rate differences

Stella LLC in March 2020 sold Bounty LLC in the amount of 11,800 USD, including VAT 1,800 USD. Payment was made in rubles at the Central Bank exchange rate on the day of payment. The terms of the agreement provide for a 50 percent advance payment. Currency rate on the date of advance payment was 62.00 rubles, on the date of shipment - 62.40 rubles, on the date of payment for goods - 63.00 rubles.

Postings from Stella LLC at the time of advance payment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62.2 | Receipt of advance payment reflected (62*5,900) | 365 800 | Payment order in. |

| 76 (advances) | 68 | Reflected VAT on advance payment (365,800*18/118) | 55 800 | SF issued |

Postings at the time of shipment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90.1 | The shipment of goods is reflected (62.4*11800) | 736 320 | Invoice |

| 90 (VAT) | 68 | VAT on shipment(55800+62.4*900) | 111 960 | SF issued |

| 62.2 | 62.1 | Advance offset | 365 800 | Accounting information |

| 68 | 76 (advances) | Acceptance of VAT deduction from advance payment | 55 800 | Book of purchases |

Postings at the time of final payment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62.1 | Final payment reflected (63*5900) | 371 700 | Payment order in. |

| 62 | 91.1 | A positive exchange rate difference is reflected in the transaction ((62.4-63)*5900) | 3 540 | Accounting information |

Reflection of negative exchange rate differences in transactions

Let's assume that in the previous example the currency exchange rate was:

- on the date of advance payment - 62.00 rubles. per USD;

- at the time of shipment - 61.50 rubles;

- at the time of final payment - 61.00 rubles/cu.

Then the postings at the time of shipment will look like this:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62.1 | 90.1 | Reflection of shipment(61.5*5900) | 362 850 | Invoice |

| 90 (VAT) | 68 | VAT on sales (55800+61.5*900) | 111 150 | SF issued |

| 62.2 | 62.1 | Prepayment credited | 365 800 | Accounting information |

| 68 | 76 (advances) | Accepted for deduction of VAT on advance payment | 55 800 | Book of purchases |

As you can see, VAT on prepayment is not recalculated.

And postings at the time of transfer of the balance of payment:

Get 267 video lessons on 1C for free:

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62.1 | Final payment (61*5900) | 359 900 | Payment order in. |

| 91.2 | 62.1 | Negative exchange rate difference accrued ((61.5-61)*5,900) | 2 950 | Accounting information |

Exchange rate difference when selling currency

Account 52 “Currency accounts” is intended for accounting for foreign currency funds.

conducts an operation to sell currency in the amount of 100,000 US dollars. The Central Bank dollar exchange rate on the day of currency transfer is 61.20 rubles/dollar. The bank dollar exchange rate on the day of sale is 61.00 rubles, the Central Bank rate is 60.00 rubles/dollar. USA.

The company accountant makes the following entries:

| Dt | CT | Operation description | Amount, rub. | Document |

| 57 | 52 | DS for the purchase of currency were transferred (61.2*100,000) | 6 120 000 | Payment order ref. |

| 51 | 91.1 | Revenue from the sale of currency was credited (61*100,000) | 6 100 000 | Bank statement |

| 91.2 | 57 | The value of currency for sale has been written off (60*100,000) | 6 000 000 | Buh. reference |

| 91.2 | 57 | The exchange rate difference was written off ((61.2-60)*100,000) | 120 000 | Buh. reference |

| 91.2 | 76 | Accrual of commission when selling currency (6,100,000*0.1%) | 6 100 | Buh. reference |

| 76 | 51 | Payment of commission | 6 100 | Payment order ref. |

| 91.9 | 99 | Reflection of profit from sale (6,100,000-6,000,000) | 100 000 | Buh. reference |

Exchange rate difference when purchasing currency

The organization needs to buy $1,000. USA. Funds in the amount of 65,000 rubles were transferred to the transit account. for purchase at a rate of no more than 65.00 rubles/dollar. The next day, the bank bought foreign currency at the rate of 63.00 rubles/dollar, the Central Bank rate on the same day was 63.50 rubles/dollar.

| Dt | CT | Operation description | Amount, rub. | Document |

| 57 | 51 | DS for currency purchases are listed | 65 000 | Plat. order |

| 52 | 57 | The purchased currency is credited to the account at the Central Bank rate (63.5*1,000) | 63 500 | Bank statement |

| 57 | 91.1 | The exchange rate difference is reflected ((63.5-63)*1,000) | 500 | Buh. reference |

| 51 | 57 | Refund of unused amount(65,000 – 63,500) | 1 500 | Bank statement |

| 91.2 | 76 | Commission for purchasing currency (63,500*0.5%) | 317,5 | Buh. reference |

| 76 | 51 | Commission transferred to the bank | 317,5 | Plat. order |

Exchange differences in import transactions

Import settlements are transactions between a resident and a non-resident (supplier of goods):

- The moment of transfer of ownership of goods is regulated by a foreign trade contract.

- Recalculation of the cost (except for advances and deposits) expressed in the currency of payment is carried out on the date of the transaction and at the end of the reporting period.

- After accepting the goods for accounting, only the debt to the supplier itself needs to be recalculated.

- In foreign trade transactions, amounts for payment and accounting of customs duties and customs duties arise.

Example

Mercury LLC purchases goods from a foreign counterparty, the contract value of which is 10,000 US dollars. Ownership of the goods passes to Mercury at the time of filing the customs declaration. The customs value corresponds to that specified in the contract.

Source: https://BuhSpravka46.ru/buhgalterskie-provodki/polozhitelnyie-i-otritsatelnyie-kursovyie-raznitsyi-provodki-i-primeryi.html

How to calculate exchange rate differences in tax accounting

According to paragraph 11 of Art. 250 of the Tax Code of the Russian Federation, a positive exchange rate difference is established as the difference formed when property or claims presented in foreign currency are revalued upward, and debts are revalued downward.

Negative differences are formed when property or claims presented in foreign currency are revalued downward, and debt is revalued upward (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation).

Property, claims (debts) presented in foreign currency are revalued on the date of the event that occurred earlier than the others, such as: receipt of property in ownership, repayment of the claim (debt) or the end of the month (clause 8 of Article 271, clause 10 of Article 272 Tax Code of the Russian Federation).

When revaluing claims (debts), the Central Bank rate or the rate fixed by law or agreement of the participants in the transaction is used (clause 8 of Article 271, clause 10 of Article 272 of the Tax Code of the Russian Federation).

Advances received (paid) in foreign currency are taken into account in rubles at the Central Bank exchange rate on the date of their receipt (payment) and are not subject to subsequent revaluation (clause 8 of Article 271, clause 10 of Article 272 of the Tax Code of the Russian Federation).

Before the decision of the Supreme Court dated January 29, 2018 No. AKPI17-1010, accounting and tax accounting standards for the assessment and recognition of exchange rates coincided. After the Supreme Court of the Russian Federation made a decision to invalidate clause 29 of the Regulations on Accounting and Financial Reporting, the Ministry of Finance of the Russian Federation declared it invalid (see Order of the Ministry of Finance of Russia dated April 11, 2018 No. 74n, which entered into force on May 7, 2018). As a result, the assessment and recognition of exchange rate differences in tax and accounting of organizations that do not prepare interim reporting will now be carried out according to different rules, which for most taxpayers will lead to the formation of temporary differences.

See also “PBU 18/02 - who should apply and who should not?”

Reflection in reporting

In accounting, exchange rate differences are included in other income (expenses). In synthetic accounting, according to clause 21 of PBU 3/2006, they must be reflected SEPARATELY. Note that from the wording of this paragraph it follows that income (expense) on currency purchase and sale transactions is not included in the amount of exchange rate differences. According to paragraph 22 of PBU 3/2006, the financial statements disclose: