Most individual entrepreneurs in Russia operate on preferential tax systems. The peculiarity of these regimes is that they are exempt from paying several taxes, including VAT. But if an entrepreneur works with large partners, then they prefer those who can provide them with a deduction for value added tax. Can an individual entrepreneur work with VAT in 2020 and will it be beneficial for him?

What is VAT

VAT is one of the taxes that individual entrepreneurs pay under the general taxation system. If an entrepreneur has chosen one of the special regimes (STS, UTII, PSN, Unified Agricultural Tax), then he does not have to pay value added tax, with the exception of certain situations.

VAT is charged on all transactions involving the sale of goods, works, and services in Russia. An exception is a small list of operations given in Article 149 of the Tax Code of the Russian Federation. Based on the name of this tax, you might think that it is not charged on the entire amount of sales, but only on the added value. In fact, everything is much more complicated.

The essence of VAT is easier to illustrate with an example.

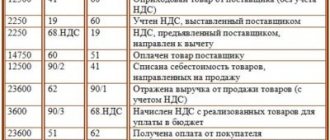

The seller purchased equipment at a wholesale base costing 70,000 rubles excluding VAT per unit. The amount of VAT at a rate of 20% amounted to 14,000 rubles, i.e. The purchase of equipment ultimately cost 84,000 rubles. After this, the equipment is resold for 100,000 rubles plus VAT of 20,000 rubles, for a total of 120,000 rubles. The amount of VAT upon sale already includes the tax that the seller paid when purchasing equipment at the base. And in fact, the seller’s obligation to pay value added tax is only (20,000 – 14,000) = 6,000 rubles. However, if the seller does not document his right to a tax deduction (the conditions are given in Article 171 of the Tax Code of the Russian Federation), then he will have to pay the entire VAT on the sale, i.e. 20,000 rubles.

In this case, the seller will pay tax twice - first when purchasing equipment, and then when transferring VAT on sales. Unfortunately, when offset or refunding this tax, businessmen often have to deal with non-recognition of supporting documents by the Federal Tax Service.

Procedure for filling out an invoice without VAT

In 2020, there were many changes in the regulatory framework for accounting and tax accounting that need to be applied.

Starting from January 1, 2020, individual entrepreneurs on OSN and special regimes are exempt from maintaining registers that duplicate the information reflected in the Book of Purchases and Sales. However, as before, all registration books are provided by those, regardless of the taxation system, who provide intermediary and audit services or are developers, and also enter into commission and agency agreements.

This obligation is specified in Article 174 of the Tax Code of the Russian Federation.

We recommend you study! Follow the link:

Can an individual entrepreneur work simultaneously with VAT and without VAT?

The journals are submitted to the supervising tax authority in the month following the reporting period (usually a quarter) no later than the 20th day. When concluding mediation agreements, “summary” invoices may be presented. All responsibilities are specified in Letter of the Ministry of Finance of the Russian Federation No. 03-07-14/2821 dated January 28, 2015 and Decree of the Government of the Russian Federation No. 1279 dated November 29, 2014.

Detailed filling procedure, which regulates the content of the following information:

- serial number and date of invoices;

- full name and tax identification number of the supplier and buyer;

- name and quantity of goods supplied or services provided;

- cost, in Russian rubles, for one unit and the entire batch;

- the tax rate in effect on the date of the transaction;

- the amount of tax to be transferred to the budget;

- information about the sender and recipient of the cargo;

- if the vacation was made on an advance payment, you must indicate the date and number of the payment document;

- unit of measurement of goods. Not specified when providing services.

Information in accordance with Article 169 of the Tax Code of the Russian Federation must be contained in electronic and paper format. When generating a paper invoice, it is necessary to generate 2 copies, one is received by the seller, the second is given to its customers.

Reporting and payment of VAT

But this is not all the complexity of administering this tax. VAT returns are submitted only electronically via telecommunication channels through a special operator.

The fact is that to control incoming and outgoing VAT, the Federal Tax Service has developed a special ASK system. This system contains information about all transactions involving the payment of value added tax. Partners in one transaction must agree on all amounts in the sales book and purchase book. This allows you to immediately identify unscrupulous taxpayers who did not pay input VAT, but declared a tax refund from the budget.

Declarations are submitted quarterly, no later than the 25th day of the month following the reporting quarter, i.e. April 25, July, October, January respectively.

VAT is paid in a special way, not typical for other taxes. The quarterly tax payable is divided into 3 equal parts and 1/3 is paid each month. For example, tax for the 1st quarter must be paid in equal installments - no later than April 25, May and June. That is, payments to the budget must be made monthly.

VAT payable

It is necessary to pay a fee on the sale of goods if the law does not apply to individual entrepreneurs. VAT will be added to the price of goods. To do this, the cost of the product is multiplied by the tax rate. When carrying out trade operations, a businessman transfers VAT. It includes the cost of the transaction. The buyer is given documents indicating the price including tax. The burden of paying the tax lies with the buyer. The individual entrepreneur is an intermediary between the consumer and the state treasury.

If a business entity is on OSNO and works with added tax, it performs the following actions:

- calculates sales tax;

- issues a VAT invoice;

- prepares a purchase/sales book;

- submits a declaration at the end of the quarter on electronic media;

- transfers money to the budget, dividing payments into three parts.

On video: Changes in invoices dated 10/01/2017

https://youtu.be/k7OBoRfaWaY

Providing an invoice entitles the businessman to a tax deduction, including all taxable transactions. By choosing a special tax regime, a businessman is exempt from paying tax. Except for a few cases when you have to pay it.

Situations when VAT is taken into account for deduction from individual entrepreneurs on the simplified tax system:

- Individual entrepreneurs buy goods and services from companies without a representative office in the Russian Federation.

- As an intermediary, he receives payment in cooperation with a foreign company.

- The issued invoice is indicated by the VAT amount.

- Pays for the rent or purchase of state property to the owner - the government authority.

- Acts as a trustee during transactions.

VAT rates

The tax rates of this tax depend on the category of goods, works or services. The standard VAT rate from 2020 is 20%, but there are situations where it is reduced to 10% or even 0%. There are also so-called settlement rates equal to 10/110 or 20/120.

All situations in which certain rates are paid are indicated in Article 164 of the Tax Code of the Russian Federation. We will present some of them here, but for a complete picture we recommend that you refer to the original source.

| Bid | Category of goods, works, services |

| 0% | Exported goods; international transportation of goods; transportation of oil and oil products, natural gas; electricity supply; space activities; transportation of passengers by rail. |

| 10% | Some essential food items; most products for children; printed publications and books; medicines and medical products; air transportation of passengers and baggage within the Russian Federation. |

| 20% | Other goods, works, services |

Estimated rates are applied in situations specified in paragraph 4 of Article 164 of the Tax Code of the Russian Federation, for example, receiving payment on account of upcoming deliveries of goods.

Which solution should you choose?

Distinctive features of VAT when deducting individual entrepreneurs. Personal income taxes allow you to minimize your risks. Take advantage of the special advantages. mode is necessary in order to interest the client. The decision to charge VAT involves issuing an invoice after the goods have been shipped. You can avoid paying tax twice if you do not write it out twice: on the advance invoice and on the shipping invoice. Those who work under the simplified system must keep documents for 4 years.

On video: Online cash register for individual entrepreneurs, LLCs and UTII. How to work. Step-by-step instruction

https://youtu.be/P3xgCERZfTw

Is it possible not to pay VAT on a common system?

To decide which taxation system will be the most convenient and profitable for a particular case, you need to calculate in advance the tax burden for different options (STS, UTII or PSN). However, not all entrepreneurs choose the tax regime on time; as a result, they have no choice but to work on the general taxation system until the end of the year.

And OSNO is not one tax, but several: personal income tax, value added tax and property tax, which, of course, is both expensive and difficult for small businesses. But an individual entrepreneur has the right not to pay VAT, even if he works on the general taxation system. To do this, you must obtain an exemption from paying this tax.

The grounds for exemption from VAT are provided for in Article 145 of the Tax Code of the Russian Federation. If the entrepreneur does not sell excisable goods, and the total revenue for goods or services does not exceed 2 million rubles in three months, then he must submit an application to his tax office.

In addition to the application itself in the form approved by order of the Federal Tax Service of the Russian Federation dated July 4, 2002 No. BG-3-03/342, you must submit extracts from the sales book and from the book of income and expenses and business transactions. The application deadline is no later than the 20th day of the month from which the exemption is claimed.

After this, VAT can be avoided for 12 months, provided, of course, that the conditions prohibiting the sale of excisable goods and the amount of revenue are met. If necessary, the exemption can be extended each time for the same period.

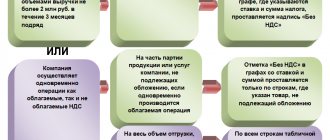

Individual entrepreneurs who have received an exemption from VAT do not pay this tax, do not submit declarations for it and do not keep a purchase book. However, they issue an invoice to customers with the note “Without VAT”.

The essence and role of an invoice

An invoice is drawn up by the seller and transferred to the buyer no later than 5 days after the transaction and is confirmation of the provision of services or the supply of goods.

According to Decree No. 1137 of December 26, 2011, an invoice can be presented on electronic or paper media with equal legal force. Invoices generated digitally must be certified with an electronic digital signature (EDS). It is possible to draw up a corrective document, both separately for the advance payment for delivery and the total paid invoice when releasing goods on prepayment.

Based on its purpose, an invoice must be prepared by all legal entities and individual entrepreneurs who pay VAT to the state budget in the amounts prescribed by law.

Regulatory support for the procedure for generating invoices for an entrepreneur and reflecting the facts of economic activity is provided in the Tax Code of the Russian Federation:

- Articles 168-169, which provide information on the rules of compilation, types, including the legality of creating an electronic version and types of business activities exempt from VAT.

- Paragraphs 11 and 26 of Article 346 determine the obligation to issue documents or its absence under different taxation regimes;

Additionally, the Order of the Federal Tax Service No. ММВ-7-69/3 dated February 27, 2014 defines the procedure for drawing up invoices of all types and formats.

Please note that starting from the 1st quarter of 2020, an invoice must be provided using a new form.

If the individual entrepreneur is on the general taxation system, then invoices must be issued, regardless of the type of activity, within 5 days.

All generated documents are reflected in the Purchase and Sales Books. The purchase book is a register of invoices received from third-party market counterparties for which the tax was paid. The sales book reflects the individual entrepreneur's accounting of all issued documents, on the basis of which the VAT deduction is calculated.

VAT on special regimes

To the question: “Do they pay value added tax on special regimes?” - we have already given a negative answer. But even an individual entrepreneur using the simplified tax system, UTII or PSN is required to pay VAT when importing goods into the territory of the Russian Federation.

In this case, VAT paid at customs is deductible only for OSNO payers. And only an entrepreneur working on the simplified tax system Income minus expenses can take this amount into account as customs payments. As for UTII and PSN, no costs are taken into account.

In what cases do counterparties ask for an invoice?

Unified simplified tax return - sample completion for individual entrepreneurs

It happens that a client asks to provide a personal account without VAT, so as not to violate the established accounting procedures.

Can an individual entrepreneur on the simplified tax system, PNS, UTII issue an invoice with VAT in some other situation? An individual entrepreneur who is not obliged to pay VAT when engaged in intermediary activities must constantly fill out invoices (clause 1 of Article 169 of the Tax Code of the Russian Federation). They define VAT. This does not change the tax regime of the commission agent. He does not pay this tax himself, but forwards the invoice to a third party. But the commission agent must record the issuance and receipt of invoices in an electronic journal, sending it to the Federal Tax Service.

Filling out the document

Results

Let’s summarize the issue “IP with VAT - pros and cons”:

- VAT is a complex and expensive tax. To submit reports on it, you must be well acquainted with accounting or hire an accountant.

- Tax authorities, for the most formal reasons (for example, an incorrectly drawn up invoice), may not provide a deduction, even if the individual entrepreneur actually paid input VAT.

- Buyers who operate under the general tax system choose sellers who can provide them with a deduction for input VAT. If your partners belong to large businesses or the public sector, then it is worth weighing and assessing how much profit you will ultimately receive. You cannot put only the interests of your partners at the forefront.

- If an entrepreneur plans to buy a home, then he must first calculate what personal income tax he will have to pay. You can return up to 260 thousand rubles of paid income tax, which will compensate for losses due to payment of value added tax.

- When planning foreign economic activity, you also need to evaluate what will be more profitable for you - to work on the simplified taxation system Income minus expenses and include import VAT in costs or to remain on the OSNO.

Deciding whether to work as an individual entrepreneur without VAT should be done only after consultation with an experienced accountant. In most cases, it is still easier for an entrepreneur to work without value added tax.

How can an individual entrepreneur issue a VAT invoice?

By choosing a simplified tax regime, an entrepreneur is exempt from paying tax. This is a big plus in the work of an individual entrepreneur.

There are exceptions when an individual entrepreneur needs to correctly draw up a declaration and pay the added tax.

Tax regimes are divided into the following categories:

- main – the businessman pays the added tax;

- special - it includes a simplified tax, a unified system and pension payments. The entrepreneur will pay the tax according to the established rules.

If an individual entrepreneur has issued an invoice without VAT, he issues a document for the purchase of goods or services to the buyer.

You can find out whether an individual entrepreneur issues an invoice without VAT or vice versa, based on some provisions:

- Is the individual entrepreneur a tax agent?

- The business is conducted under a contract, and the client will need to purchase goods on OSNO. You can act as a dealer for a company that works with added tax.

- An entrepreneur is a member of a simple partnership and manages property by proxy.

- Tax on imported goods is paid.

Other cases are selected at the discretion of the individual entrepreneur. He pays the fee and reports on it. Income under the simplified tax system includes the amount paid by the client excluding VAT.

On video: VAT changes from July 1, 2017 .

Obligation to issue invoices

The most important requirement for receiving a deduction is that the supplier issues an invoice correctly. This follows from the provisions of Articles 169, 171, 172, 176 of the Tax Code. At the same time, only sellers - VAT payers have the obligation to issue documents, who must draw them up within five calendar days from the date of receipt of an advance payment or shipment of goods, performance of work, provision of services (clause 1, 3 of Article 168, clause 3 of Art. 169 of the Tax Code of the Russian Federation).

As a general rule, companies using the simplified system are not VAT payers. According to paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation, the only exception is the tax payable when importing goods into the customs territory of the Russian Federation, as well as paid in accordance with Article 174.1 of the Tax Code of the Russian Federation. It follows that these persons should not issue invoices.

note

The Constitutional Court determined that a deduction on an invoice issued by an organization on the simplified tax system according to the rules of Article 169 of the Tax Code of the Russian Federation is possible if the tax is transferred to the budget. In this case, the “special regime officer” has the right to enter into legal relations regarding the payment of tax (definition of the Constitutional Court of the Russian Federation of March 29, 2020 No. 460-O).

This point of view is also shared by the Ministry of Finance in letters dated October 20, 2011 No. 03-07-09/34, dated May 16, 2011 No. 03-07-11/126, etc. As well as the Federal Tax Service of Russia dated July 24, 2008 No. 3- 1-11/239 and Federal Tax Service of Russia for Moscow dated April 5, 2010 No. 16-15/035198. In addition to the absence of the obligation to issue invoices to their customers, simplified companies do not maintain a purchase book, a sales book and do not have to submit a VAT return. And they carry out settlements with customers without allocating VAT amounts in the primary documents.