A current account is an entry used in a banking or other financial institution to carry out all monetary transactions. The phrase “current account” is familiar to many who are engaged in entrepreneurial activities or are just planning to open their own business. Few people fully understand what operations are permissible to carry out with a current account and how to open it correctly. In this article we will try to fill in all the gaps and fully understand the essence of the concept.

What it is

Many young entrepreneurs who are encountering non-cash payments for the first time do not always have sufficient information regarding opening a current account and have little understanding of its functions.

Such an account allows you not only to store and accumulate funds, but also helps in the payment process, as well as making mandatory payments.

Business activity is impossible without the constant circulation of funds, so it is important to properly set up the system in order to avoid any errors in the process of making mandatory payments. There may be an immediate parallel to a relatively simple bank account, but there are fundamental differences. Both an individual and a legal entity have a number in the bank, but for companies it appears in all office papers.

So, a current account is an account intended for a legal organization, created for the purpose of storing funds, as well as paying payments.

People first started talking about a bank account for commercial enterprises more than 150 years ago. It owes its appearance to English bankers, who needed to separate personal cash savings from those that were in “circulation” and constantly used in the process of doing business. Gradually, the idea of a separate bank account for businesses was introduced in all developed countries.

For a businessman, a current account becomes an effective tool that, if used correctly, can bring benefits, save time and optimize business activities. Such an account is to some extent comprehensive, since it allows not only to collect funds received from sales, but also to make utility payments, tax deductions, and payments for goods and services.

The main goal is to carry out all existing transactions using cashless payments. This saves time and affects the quality of the entrepreneur’s work.

What does a checking account look like? It is always represented by a 20-digit code, and each bank client has its own unique code.

What do the numbers on a checking account mean?

There are 20 digits in total. All of them are explained in Appendix No. 1 to Bank of Russia Regulation No. 579-P dated February 27, 2017. Every few digits in the designation are divided into groups:

| Account key code. Each bank account in the plan of bank accounts has the first five digits as a key. In this way, you can distinguish internal accounts from external ones, accounts of individuals from settlement accounts, etc. In this case, the first three digits - 407 means that the account belongs to a legal entity (if it were 408, it would mean that it is an individual entrepreneur, 406 - a state organization, 405 - federal, etc.), and the second two - 02 - then that the organization is commercial. 01 - financial (yes, they distinguish themselves!, 03 - non-profit, etc.). |

| Currency code. 810 - Russian ruble, 840 - American dollar, 978 - euro. At the same time, the ruble has another code - 643, but it is used for international payments. |

| Key. It is calculated using a special algorithm depending on the bank’s BIC and other digits of the number. If you make a mistake in even one digit of the number, the key will not match and it will be clear that you have made a mistake somewhere. Although it’s better to make only one mistake. There are many examples when two mistakes at once make the key correct, and the money goes somewhere far away and for a long time. |

| The number of the bank branch that opened the account. This is not at all the number that is hidden behind the BIC (bank identification number). Serves for internal banking purposes. To make it clear whose account it is and who is responsible for it. |

| Account serial number. Many people think that this is a client code, but it is not. Just a number and that's it. You can, for example, open one account and then another. And then the same client will be assigned different numbers. Therefore, there is not much sense in it, everything inside the bank is numbered as 1...2...3 and so on. |

What is it for?

Now let's take a closer look at why every businessman is required to have his own personal checking account:

- The account allows you to keep track of funds and their target distribution;

- Represents the possibility of using non-cash payments;

- Conduct foreign exchange transactions, cooperating with foreign partners;

- Use effective banking services that help optimize business operations;

- Pay wages, benefits, sick leave to employees of the enterprise;

- Make mandatory contributions to government agencies, in particular, the Pension Fund;

- Convert cash to a non-cash account;

- Track all transactions performed on the account.

A current account gives its owner many advantages, so opening this account is one of the first mandatory manipulations that a businessman must perform after opening an individual entrepreneur.

It is important to note that the current account is not created for the purpose of storing money, it is intended for instant debiting of funds as needed. This is facilitated by all kinds of channels for transferring funds to their destination.

Along with the official name, the term “demand account” has taken root, that is, one that is used at a specific moment for certain needs.

Is it possible to open several current accounts at once?

No problem. You can open as many as the banks allow. True, in the process of discovery, from practice, they will allow things to get worse and worse. The reason is the exchange of information between banks. A client with many accounts in different credit institutions (unless, of course, it is a large corporation with a network of branches) is the first candidate for suspicion of conducting illegal and dubious transactions.

But opening a couple of accounts in different banks will not pose any problems even for individual entrepreneurs. You never know. The main thing is to be able to pay commissions for them.

Documentation

Have you already seen that without a current account it is impossible to carry out basic transactions? Then it's time to figure out what documents will be needed to open an account for an individual entrepreneur?

- Passport of a citizen of the Russian Federation, and you may also need an additional identification document;

- Application completed in accordance with all requirements;

- A certificate from the tax office indicating permission for entrepreneurial activity;

- Entrepreneur's bank card;

- Certificate of opening of an individual entrepreneur;

- An extract from the tax office on the status of payments for the last three months;

- Sometimes it is necessary to indicate the main partners of the organization with whom contracts have been concluded.

When it comes to opening for a legal entity, the list of documents is supplemented with the following items:

- A document certifying the authority of the head of the organization;

- Document from the statistical data department;

- Notarized samples of signature and seal of the organization;

- All necessary certificates to confirm the organization’s activities;

- In the event that the package of documents is not submitted by the manager himself, then a power of attorney is issued;

- Agreement on rent or purchase of premises;

- Data from accounting about the current financial condition of the company.

It is important to check all documents provided for authenticity, as well as carefully fill out the application to avoid mistakes.

What the law says: how many current accounts an organization can have

Now we are close to answering the question of how many current accounts a company can have. Why, in general, in practice do firms and individual entrepreneurs need to open several accounts at once? Here are some typical situations:

- the types of activities that the company conducts have little overlap with each other;

- various retail outlets;

- the company has separate divisions and branches;

- conducting payments in currencies of different countries, etc.;

- payment of taxes according to different systems, special regimes;

- the profitability of the tariffs of a particular bank.

In the 90s of the 20th century, the number of current accounts that a legal entity can open in banks was limited by Decree of the President of the Russian Federation dated May 23, 1994 No. 1006 “On the implementation of comprehensive measures for the timely and full payment of taxes and other obligatory payments to the budget.” According to it, the number of current accounts for an organization is only 1. But since 1995, this restriction was eliminated and was no longer introduced.

Thus, speaking about how many current accounts a legal entity can have on the territory of the Russian Federation, we can safely say - AS MUCH AS ANYONE. How many current accounts can an organization have by law? Also - NO LIMITATIONS.

Moreover, until relatively recently, companies were really worried about how many current accounts an organization could open. After all, each of them (opening and closing) had to be reported to the tax office within 7 days on the basis of clause. 1 item 2 art. 23 Tax Code of the Russian Federation. But now this requirement is not relevant: Law dated April 2, 2014 No. 52-FZ abolished this norm. Now this is done by the banks themselves, where accounts are opened.

Another interesting question: how many current accounts can an organization have in one bank. In fact, the law does not contain any prohibitions or restrictions in this regard. However, it cannot be ruled out that the bank’s internal rules will “insure” it against very “frequent” clients.

Operations

Now let's figure out what manipulations can be carried out using a current account.

- Possibility to withdraw funds. Each bank, based on the existing tariff, puts forward special conditions for cash withdrawal;

- Replenishment of balance. It can be done directly at the bank or remotely by linking a bank card to a current account;

- Carrying out translations for both legal entities and individuals. In the second case, a transfer fee is charged. When transferring funds to legal entities, the account holder must send a request to the bank, which will serve as a notification of the intention to transfer money. The request can be sent through the official website of the bank, as well as using a paper form;

- Transfer of funds to the Pension Fund and the tax office;

- Transfers of funds between partner organizations.

Are the funds in the current account insured by the state?

Everyone knows that the funds of individuals are insured by the Deposit Insurance Agency. Within 1.4 million rubles. From the point of view of the bank and the law, a current account is the same accounting entry as any other. Therefore, if it is used by an individual entrepreneur (the same individual, but engaged in commercial activities and receiving payments), then the funds on it are insured in the same amounts.

But if you represent an LLC, joint stock company or any other organization, the funds in your accounts will be frozen. And you can only get anything during bankruptcy proceedings during bank bankruptcy. Looking ahead, you can immediately say that you are unlikely to get anything. So consider that the money “when the lights go out” in the bank is also erased.

How to open a current account

Opening is a fairly simple procedure that can be accomplished in a short period of time. The opening algorithm is as follows:

- The first thing you need to do is decide on the choice of bank. To do this, it is better to analyze the tariff schedule and other conditions related to the replenishment and withdrawal of funds from the account;

- When you have decided on your choice of bank, it’s time to collect a package of documents for cash settlement services;

- A statement of the established form is attached to the folder with documents. Be sure to fill out all the fields and check the information several times. You can also fill out the application online;

- The last point will be the signing of a cooperation agreement with the bank.

Advantages and disadvantages of using multiple checking accounts simultaneously

When deciding on the need to create more than one current bank account, it is worth assessing all the advantages and disadvantages of this approach to the circulation of funds.

The positive aspects of using multiple bank accounts include:

- Efficiency of funds management. In practice, there are often situations when an urgent payment cannot be sent due to technical problems at the bank. In this case, having a reserve account in another organization will allow you to transfer funds on time.

- Minimizing the risk of losing all funds as a result of the bank’s loss of solvency.

- Reducing the likelihood of information leakage. It becomes more difficult for raiders and unscrupulous businessmen operating in the same industry to obtain information about the turnover of an enterprise.

The disadvantages of working with multiple accounts simultaneously are:

- Increased cost of service. For opening and maintaining several accounts, each bank will have to pay separately, while the likelihood of providing preferential conditions and other additional privileges (for example, assigning a personal manager to the client) as a representative of a business transferring impressive amounts through the bank is reduced.

- The emergence of difficulties in managing finances and subsequent analysis of items of their expenditure.

***

So, the current legislation does not establish any restrictions for legal entities related to the number of current bank accounts that can be simultaneously used by them in the course of business activities. Every businessman can open any number of accounts convenient for him in one or several banks. It is worth remembering that in order to carry out financial transactions whose size exceeds 100,000 rubles, you must have at least one current account. If the company’s turnover is small and the amounts transferred to partners do not reach the specified value, an account may not be opened.

Which bank should I open a current account in?

If you have firmly decided to open a current account, but have not yet decided on a partner bank, we suggest you consider the TOP of the best banks that provide the best conditions to their clients.

Each organization included in our rating is distinguished by stability, reliability and flexible conditions for connecting services.

Tinkoff

It is no coincidence that Tinkoff Bank is in first place in our rating. The thing is that over the past year it has become a leader and the number of clients served by the bank is growing rapidly. Tinkoff offers flexible terms for cooperation and is constantly creating new relevant banking offers.

Opening here is absolutely free. The cost for use varies from 490 to 4,990 rubles per month. To be able to carry out transactions on the account without commission, it is enough to pay an amount of 990 rubles, which will be enough for 30 days of use.

Alfa Bank

Alfa Bank has become an indispensable assistant for entrepreneurs, since most experienced businessmen have been choosing the organization as a partner for doing business for several years now.

You can use the bank’s services absolutely free, and the monthly service fee ranges from zero to 9,900 rubles, the calculation is made on an individual basis. The commission for payments does not exceed 50 rubles.

Raiffeisenbank

The bank attracts customers by allowing them to apply remotely without visiting a bank branch. New details will be sent to your email in just a few minutes.

Opening an account is free; there are several tariffs available for users, differing in tariffs and volumes of transactions performed. The commission for each transaction is 25 rubles. The starter package implies a monthly service fee of only 990 rubles, and owners of the “maximum” tariff plan pay 7,500 rubles per month.

Sberbank

Sberbank offers the most favorable conditions to all entrepreneurs who decide to contact the bank for the first time to open a current account. On what terms does Sberbank cooperate?

- Registration is absolutely free;

- The monthly cost of service starts from 0 rubles;

- The commission for all transactions starts from 16 rubles and depends on the type of transaction and the volume of transferred funds.

VTB 24

VTB is one of the oldest banks in Russia, and accordingly, has unshakable authority among younger banking organizations. He was one of the first to offer legal entities the registration of current accounts, and also provides affordable service rates and the efficiency of all manipulations with funds.

What can VTB-24 offer for individual entrepreneurs and LLCs?

- Can be opened absolutely free for your organization;

- The cost of service will depend on the package you choose; it implies a fee of 1,200 rubles monthly, and the “Premium” package, recommended for large enterprises, is serviced by bank employees for 3,200 rubles;

- No commission is deducted for the first five payments.

Why are checking account fees so high?

This is already outdated information. If you are just planning to register a company or LLC, even an individual entrepreneur, then it is safe to say that you do not yet know that immediately after registration you will be bombarded with calls with offers from various banks to open a current account with them. And many will be attracted by zero service fees. But they are still going to make money from you. And banks do this, as a rule, in three ways, in various combinations:

- They charge you service fee For a month, for a quarter or for a year. In state and some private banks it can amount to amounts up to 1000 rubles per month. However, many work for 0;

- They are going to sell you additional services . Payments by cards (acquiring), card projects, salary projects, will issue you foreign currency earnings, maybe even give you a loan;

- They will definitely make money for you when withdrawing cash . There are banks with established minimum withdrawal amounts for free, but taking advantage of the fact that the Central Bank is fighting cash withdrawals, they simultaneously earn huge amounts of money whenever they try to withdraw any large amount from their account.

Adviсe

- Be extremely careful when choosing a bank, analyze all available offers;

- For a beginner, a starter package of services is enough for the first time. If your company gradually begins to expand, and the number of transactions with money increases, as well as the volume of transfers, then you should think about switching to a different tariff;

- If you have decided to close, you must write an application at a bank branch or fill out an electronic form;

- When registering an LLC, it is not necessary to run headlong to the bank; the law does not provide for mandatory account registration deadlines;

- If necessary, you may not be limited to opening one account, there may be several of them, for example, one of them is foreign currency, and the second is ruble;

- If funds are credited to your account by mistake or the required amount is missing, be sure to contact the bank branch to determine the reason; sometimes system failures may occur.

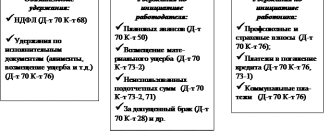

Obligations of the parties

When completing the agreement, both parties must follow certain bank account rules :

- Banks:

- A comprehensive RKO is carried out.

- Transfer money according to instructions.

- Issue checks (checks and cash).

- Provide telegraph forwarding services.

- Save funds on account.

- The money is returned upon request.

- Confidentiality is guaranteed.

- Maintain banking secrecy.

- Follows the rules for performing transactions on current accounts .

- Clients:

- Calculations are made taking into account existing laws.

- Submit to the bank the reporting required for cash settlement services.

- Notify the institution of changes in company data (form of government, address, details, etc.).

The credit institution and the client must comply with the terms of the agreement, including the financial part. It states:

- Interest rate.

- Payment for opening an account.

- The amount of bonuses for permanent account holders and others.

Conclusion

A current account allows commercial organizations to store and use earned funds for payments and transfers. Such an account is comprehensive and allows you to solve a number of important tasks, from transferring funds for the purchase of raw materials to paying wages to employees of the enterprise. To open an account, you need to decide on a bank, analyze which organization has the needs and what operations it will deal with.

“Do you agree that a current account greatly facilitates the process of doing business? Did you find anything useful in the article? Don’t forget to leave comments and rate, your opinion is important to us!”

Rate this article:

[Total: 3 Average: 5/5] (Article Rating: 5 out of 5)

Author of the article Angela Karpacheva Freelancer

Restrictions on payments for LLCs without a current account

Settlements of organizations with citizens and other organizations by virtue of Art. 861 of the Civil Code of the Russian Federation can be carried out both in cash and in the form of non-cash payments. However, the Directive of the Central Bank of Russia “On the implementation...” of October 7, 2013 No. 3073-U imposes a significant restriction on the procedure for making payments in cash.

It is contained in clause 6 of the Directive and is that organizations or individual entrepreneurs for each transaction cannot pay an amount of more than 100,000 rubles.

It is the presence of a limitation on the maximum amount of transactions that, as a rule, contributes to the decision-making on opening current accounts by organizations.

In addition, it is necessary to take into account that, by virtue of clause 4 of the Instructions, without a current account it is impossible to:

- rent real estate;

- issue or return a loan and interest on it;

- engage in activities related to organizing and conducting gambling.

- carry out transactions with securities.

Without using a current account, an organization significantly limits its capabilities, since it cannot enter into transactions of any kind in an amount exceeding 100,000 rubles, and also does not have the right to fulfill obligations under certain types of civil transactions or carry out certain types of activities.

Paying homeowners' association taxes without opening a current account

To implement this requirement, the Moscow Government issued Resolution No. 299-PP dated April 24, 2007 “On measures to bring the management system of apartment buildings in the city of Moscow in accordance with the Housing Code of the Russian Federation,” according to which organizations performing the functions of managing apartment buildings, regardless of their organizational and legal form (SUE, HOA, housing cooperative, LLC, JSC, etc.) from the budget of the city of Moscow, subsidies are provided for the maintenance and ongoing repairs of an apartment building - for the total area of residential premises (excluding the area of summer premises: glazed and open loggias, terraces, balconies) occupied by certain categories of citizens (owners of the only housing; owners of privatized apartments; citizens occupying premises under social tenancy agreements).

Concept

Before saying how many current accounts an LLC can have, you need to understand what current Russian legislation means by them.

Oddly enough, the concept of “current account” is absent in the law. Indirect information can only be obtained from paragraph 2.3 of the Central Bank instruction dated May 30, 2014 No. 153-I “On opening and closing bank accounts, deposit accounts, and deposit accounts.” According to it, banks open current accounts:

- legal entities that are not credit institutions;

- individual entrepreneurs;

- individuals – private practitioners.

Current accounts are opened for transactions related to:

- with entrepreneurial activity;

- or private practice.

Current accounts are also opened for representative offices of credit institutions, as well as non-profit organizations, for conducting operations to achieve the goals for which the latter were created.

Responsibility for the lack of a current account of the homeowners association

According to Federal Law dated June 3, 2009 N 103-FZ “On activities for accepting payments from individuals carried out by payment agents,” the management company (HOA) is a service provider, which means they must use special accounts. 18. When making settlements with a paying agent when accepting payments, the supplier is obliged to use a special bank account.

The Supplier does not have the right to receive funds accepted by the payment agent as payments to bank accounts that are not special bank accounts. If there is no special account, a fine is imposed under clause 2 of Article 15.1 of the Administrative Code.

Article 15.1. Violation of the procedure for handling cash and the procedure for conducting cash transactions, as well as violation of the requirements for the use of special bank accounts2. It is necessary to conclude an Agreement with non-members of the HOA on the maintenance and repair of common property in an apartment building and the provision of utilities. In accordance with Part 1 of Art. 137, art. 162 A HOA can manage an apartment building in two forms.

Which governing body of the partnership - the general meeting of HOA members or the HOA board - has the right to decide on the choice of the form of management of the apartment building? The answer to this question should be contained in the charter of the partnership. If the HOA charter does not include this issue within the competence of the board, then this issue is resolved by the HOA members at their general meeting.

Two forms of management of an apartment building in which an HOA has been created: Management of an apartment building independently by the HOA I. The liability of homeowners' associations and other management companies arises in the cases named in Chapter 7 of the Code of Administrative Offenses of the Russian Federation “Offenses in the field of property protection.” Specific compositions are named in Art. 7.22-7.23.3 of this document. Criminal liability applies to specific citizens, not legal entities. The chairman or any of the members of the HOA board may be involved in it.

For example, when they commit crimes such as embezzlement (Article 160 of the Criminal Code) or fraud (Article 159 of the Criminal Code). Among the offenses there are also those that fall under the signs of abuse of power (Art.

201 CC). Concludes contracts with resource supply companies and acts as a provider of utility services. Concludes contracts for the provision of other services in the interests of premises owners.

Management of an apartment building by an HOA under an agreement with the management organization II. The HOA enters into an agreement for the management of an apartment building with the Management Organization, entrusting such an organization with the performance of work and services for the management, maintenance and repair of an apartment building, the functions of an executor in the provision of utilities, the conclusion of other agreements in the interests of the owners of premises in the building, as well as the calculation and collection of payments for services provided by the management organization under the contract Sample contract for the provision of services.

When choosing a management organization, you can use the information from the Apartment Building Management Portal.

Do I need a special account for settlements with owners for housing and utility services?

Articles on the topic

“Don’t use a special account for settlements with owners? This is a violation and there will be a fine." Many have heard such complaints addressed to them and actually paid a fine. Judicial practice is also not in favor of organizations managing apartment buildings.

There is, however, a homeowners' association that defended its case in the Supreme Court of the Russian Federation. We have found the position of the highest courts and the Federal Tax Service on the issue of using special accounts for payments for housing and communal services and will tell you about them in this article.

How to keep records with multiple checking accounts

If an organization or individual entrepreneur has opened several accounts, then it is necessary to carefully consider the income and expenses for each account. The company's internal reporting must be structured in such a way that it is clear from which account funds were received or spent. This is important not only in terms of documentary procedures, but also when submitting reports to the tax authority.

The best tool today is online accounting. You can enter as many accounts as you like into the system and all transactions will be processed automatically. In addition, tax and accounting reporting will be generated automatically.

If representatives of the Federal Tax Service decide to visit your organization for the purpose of conducting an inspection, then they should not have any questions about maintaining records for different accounts. If you think that the tax authority will check transactions on only one account, then you are mistaken. Any items of expenses and income must be documented.

If you don't have any papers, you may be fined. Therefore, it is better to take care of proper accounting of transactions on all accounts in a timely manner. If accounts are opened in different banks, this complicates the task. It is important not to get confused in your own calculations and clearly distinguish which operations will be carried out on one account and which on another. For this you need to use special accounting services.

Do not open more than three

Companies opening large numbers of bank accounts should consider the following:

- Increased maintenance costs. Most tariff plans require a subscription fee even if there are no or minimal transactions. Those. the more bills, the more fixed costs. And they don't always pay for themselves through preferential tariffs.

- Complicating accounting and payment processing. If a company has several, and even more so several dozen accounts, then to carry out settlements it is necessary not only to allocate a special employee, but to create a separate division - the treasury. This also makes it difficult to analyze cash expenditures.

- Opportunity to be blacklisted. In accordance with the law of 08/07/2001 No. 115-FZ “On combating legalization...” and the documents of the Central Bank of the Russian Federation adopted on its basis, banks conduct financial monitoring of their clients. One of the main criteria is the transfer of tax payments. If a company has many accounts, it is possible that some of them will not be subject to taxes at all. Therefore, the relevant banks can, on formal grounds, include the organization in the “black list”. This may lead to blocking of the account, as well as problems in interaction with other credit institutions. It is clear that all these circumstances can be explained, and today there is a mechanism for “rehabilitation” of bank clients, but in any case, such situations significantly complicate doing business.

- The need to simultaneously fulfill the requirements of many banks. Banks provide favorable service rates only if a number of conditions are met. This could be account turnover or a transfer of a salary project to a given bank. It is often very difficult or even impossible to reconcile the requirements of several banks. This makes it more difficult to benefit from feed-in tariffs.

How to pay taxes without a bank account?

This is the most controversial issue in the topic under consideration. The formal side of the issue is that clause 4 of Art. 58 of the Tax Code of the Russian Federation allows paying taxes both in cash and non-cash. However, within the meaning of the norm, each enterprise must make payments only through a bank from its own (in accordance with Article 5 of the Federal Law “On Banks...” dated December 2, 1990 No. 395-1) current account.

In practice, there are often cases when an authorized individual pays tax for an organization in cash. At the same time, tax representatives are loyal to such actions, but warn that if the payment falls into the unknown, it will take a long time to search and identify it. The tax authorities themselves often accept such actions on the part of taxpayers and recognize taxes paid in cash (letter of the Federal Tax Service dated September 18, 2015 No. SA-4-8 / [email protected] ).

Thus, the issue of opening an account is decided by the LLC, depending on the type and scale of activity. Its absence is not an offense if the company actually does not conduct large financial transactions and pays taxes through representatives - individuals. However, it is important to consider that it will not be possible to develop a serious business without a bank account, especially given the widespread use of bank terminals to pay for goods and services using bank cards.

Open an account: right or obligation?

Before the organizers of a new business think about how many current accounts a legal entity can have, the question logically arises: is this even a right or an obligation?

So: oddly enough, this is right. But it can easily be transformed into an obligation when you need to comply with the cash payment limit.

Thus, the Central Bank of Russia, in its instruction dated October 7, 2013 No. 3073-U, determined that the main condition for cash payments is the amount of payments under one agreement: no more than 100,000 rubles (clause 6). Otherwise, open a bank account.

| LLC Law | Law on JSC |

| The Company has the RIGHT to open bank accounts in the prescribed manner on the territory of the Russian Federation and abroad (clause 4 of article 2) | The Company has the RIGHT to open bank accounts in the prescribed manner on the territory of the Russian Federation and abroad (Clause 6, Article 2) |

How many accounts can a legal entity have?

In some cases, an organization may need to use several current accounts at the same time. For example, this may happen when working in different areas that do not intersect with each other, when the enterprise has separate divisions or branches, or when making payments in different currencies.

Don't know your rights?

In the mid-90s of the last century, Presidential Decree “On the Implementation of...” dated May 23, 1994 No. 1006 was in force in Russia, establishing a limit on the maximum possible number of current accounts used by one organization, which is why an entrepreneur could open only one account at a time. In March 1995, Decree No. 1006 was terminated, and since then the legislator has not introduced such serious restrictions that significantly complicate business activities.

Current legislation does not prohibit an entrepreneur from opening several accounts at the same time. Moreover, he can open an unlimited number of them in different Russian banks, without transmitting information about them to regulatory authorities. The Federal Law “On Amendments...” dated 04/02/2014 No. 52 canceled the validity of sub-clause. 1 item 2 art. 23 of the Tax Code of the Russian Federation, according to which taxpayers were required to notify the tax service of the fact of opening or closing bank accounts within 7 days. Currently, the responsibility for transmitting such notifications to the regulatory authority lies with the banking organization in which the account was opened.

The difference between a current account and current and personal accounts

A current account, unlike current personal accounts of individuals, is not intended to receive passive income in the form of interest, and, as a rule, is not used for the purpose of accumulating savings. Since funds accumulated in a current account are available for withdrawal on demand, such accounts are often called “on demand”.

The procedure for opening an account was approved by Bank of Russia Instruction No. 153-I dated May 30, 2014. To open an account, you must contact the selected bank and provide the required documents according to the bank’s list. One bank can open several current accounts for one client, differing in the currency of the account and the intended purpose of the funds accumulated on them.

Account number

The structure of a current account consists of 20 characters. They allow you to identify the type of account and the currency for which the company (IP) uses it.

Please note that account numbers opened in different banking institutions may be the same. In this regard, when transferring money it is also necessary to indicate:

- BIC;

- correspondent account number;

- a number of other bank details.

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.