What is this hereditary mass?

The estate is the totality of property rights and obligations of the deceased person directly related to the property owned by the testator. Those parts of the inheritance that belong to the category of benefits are called assets, and the property obligations of the deceased are called liabilities. They are transferred to the new owner only in aggregate.

In other words, the subject of inheritance can be not only movable or immovable property, but also financial or other forms of obligations, debts. Responsibilities are inextricably linked with the legacy and pass on to the heir.

Legal successors have the right to demand the return of funds lent to the now deceased, compensation for damage caused to him or the due funded part of the pension (if it was not received at least once).

It is impossible to partially accept the inheritance or refuse a component share: the successor will either receive the benefits along with the debt, or will give up everything. Selective inheritance is allowed only when the recipient of the property is both a legal heir and one according to the last will of the will. This situation allows for the choice of the most favorable balance of rights and obligations.

If there is a will, the heirs are assigned the distribution of shares according to the last will of the testator.

In accordance with the concept of inheritance, legal successors have the right to begin to use the property of the deceased before the completion of the registration procedure. For example, living at home, driving a car, and so on.

When other successors quickly accepted the inheritance with a hasty sale, other successors are entitled to sue for an amount of funds equal to their due share. For example, when selling an apartment to another recipient of the inheritance, the portion due by right of inheritance will be paid in accordance with the amount of the proceeds.

If the successor has a residence permit in the testator’s apartment, then he receives the right of priority in the allocation of the due part of the inheritance.

INCLUSION OF PROPERTY IN THE INHERITANCE MASS.

HEREDITARY MASS. GENERAL PROVISIONS >>>

INCLUSION OF PROPERTY IN THE INHERITANCE >>>

WHAT SHOULD BE INCLUDED IN AN INHERITANCE. COMPOSITION OF INHERITANCE >>>

INCLUDING AN APARTMENT IN THE INHERITANCE >>>

TRIAL OF INHERITANCE DISPUTES >>>

STATE FEE TO THE COURT FOR A CLAIMS FOR INCLUSION IN AN INHERITANCE >>>

COST OF CONDUCTING AN INHERITANCE DISPUTE. WHY DO YOU NEED A LAWYER? >>>

* * *

HEREDITARY MASS. GENERAL PROVISIONS.

Inheritance

is an object of inheritance rights.

The inheritance mass

is all the property, as well as property rights and obligations (debts), that the testator had at the time of his death.

The estate passes to the heirs according to the will

, or when inheriting by law (based on current legislation).

What can be included in the inheritance mass

is specified in Art.

1112 of the Civil Code of the Russian Federation. If the heir has the right to a share in the inheritance,

and it is obligatory, then the debts are paid from the value of the inheritance minus the value of his obligatory share.

Civil cases on the inclusion of property in the inheritance estate

, like other

inheritance disputes,

are considered by courts of general jurisdiction according to the general rules of jurisdiction.

You should know that determining the composition of the inheritance and what is included in it can sometimes be problematic. Let's try to explain to you why this happens with an example.

If only an apartment is inherited according to a will

, the situation is more or less clear (although in some cases it provokes

hereditary disputes

).

But if the heirs need to include in the inheritance mass

, for example, a share in a business (LLC) or the value of uncertificated shares of a closed joint stock company or open joint stock company, then determining the composition of the inheritance is much more difficult.

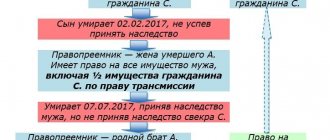

Inheritance of a share in an LLC

means that the heir becomes a participant in this company or receives from this organization the value of the inherited share. If the testator-shareholder had shares of a joint-stock company and he did not manage to receive the dividends due to him due to death, then the unclaimed dividends and shares are transferred to the budget of the Russian Federation.

To correctly determine your inheritance rights

, to resolve issues of inclusion of this or that property in the inheritance mass, we recommend contacting our

inheritance lawyers

, who, in the course of legal advice and preparation for the case

of inclusion in the inheritance mass

, will study the situation in detail, establish what property, property rights and obligations belonged to the testator and which you can apply for.

In the practice of our law firm there are quite a lot of successfully completed cases related to the inclusion of property in the inheritance estate

and determining the composition of the inheritance.

Our probate lawyers

successfully conduct cases in the courts of Moscow and the Moscow region.

get legal advice

on inheritance in our office by making an appointment by phone.

(495) 960-32-76

.

In addition, you can also:

- call us at the telephone number provided or

— send your question to a lawyer online

>>>

- come to our office.

INCLUSION OF PROPERTY IN THE INHERITANCE MASS.

The first step in the inheritance procedure

is to submit an application to a notary to accept the inheritance within six months after the death of the testator (however, the legislation also provides for an increase in this period in a number of cases).

This must be done both if the inheritance is transferred by will

and when inheriting by law.

In the application to the notary, the heirs indicate what property and property rights

they expect to receive a testator.

Upon entering into an inheritance

the entire complex of property and

property rights

(assets) and obligations, debts (liabilities) of the testator passes to the heirs.

It is at this stage that questions may arise about the inclusion of property in the inheritance mass

.

Inclusion of property in the inheritance

is carried out on the basis of the norms of the Civil and Family Codes, legislation on notaries, the Civil Procedure Code of the Russian Federation and other regulations of the Russian Federation.

If the heirs disagree about the composition of the property included in the inheritance, the law determines the judicial procedure for including property in the inheritance mass

.

It should be taken into account that the inclusion of property in the inheritance mass

has its own characteristics depending on what kind of property is inherited.

Therefore, if you have questions about including property in the estate

, only an individual

consultation with a lawyer

.

Rich positive experience in managing inheritance cases and inheritance disputes

lawyers of the YurbIS Legal Bureau provide the opportunity to provide you with assistance in resolving issues of including property in an inheritance,

registering an inheritance

, incl.

after the deadline for accepting the inheritance has been restored

.

Call now! Get legal advice on inheritance

You can visit our office by making an appointment by calling (495)

960-32-76

. In addition, you can also:

- call us at the telephone number provided or

— send your question online

- come to our office.

WHAT SHOULD BE INCLUDED IN AN INHERITANCE. COMPOSITION OF INHERITANCE.

The question of what should be included in the inheritance

, always individual.

To determine what property and property rights can be included in the inheritance

,

inheritance lawyers

study

the will

and the entire complex of property rights of the testator, and also analyze the composition of the heirs.

After the composition of the property has been determined, the inheritance lawyer

proceeds to a detailed study of the situation with each individual type of property, determines whether in this particular case it is possible

to include it in the inheritance

and what actions will need to be taken in order to include such property in the inheritance mass. But there are some peculiarities here too...

in the inheritance

, among other things, includes labor income (salary not received by the testator),

pension accumulations in the State Insurance Company

and Housing Insurance Company, household items and other property.

To establish the exact composition of property (including existing inheritance abroad

), it is necessary to determine its ownership by the testator on the day of death.

For example, the inclusion of certain types of property in the inheritance mass

carried out on the basis of Chapter 65 of the third part of the Civil Code of the Russian Federation.

In particular, it indicates the specifics of including a land plot

or part thereof in the hereditary mass, inheritance of a share in an LLC, inheritance of shares, awards, personal weapons, etc.

So, in some cases, in a dispute about the inclusion of a land plot in the inheritance mass

difficulties arise. For example, it is not always possible to divide a plot between heirs based on its intended purpose. Then the plot passes to the heir, who has the priority right to receive it against his inheritance share. The remaining heirs are paid compensation. If this is not possible, then the plot passes to the heirs on the terms of common shared ownership.

Inheritance of land plots

usually involves the transfer to the heir of not only the land, but also the soil layer, water bodies, and plants located within its boundaries.

Inheritance of the property of a member of the SNT occurs on a general basis, taking into account all the specifics of the system of common joint property. If the heir himself was not a member of the garden partnership / garden cooperative

, then he has the right to receive compensation in the amount of the inherited share.

Determine exactly your rights and establish what can be included in the inheritance estate

, allow

legal advice about inheritance

. Our inheritance lawyer, who is well versed in this area of law, will thoroughly explain your rights to inheritance under a will or by law and help you implement them correctly.

You can get the necessary legal advice from a lawyer at an appointment with our inheritance lawyers

, having previously made an appointment by phone: and (495)

960-32-76

If you have any questions,

- call us at the phone number indicated above or

— send your question to a lawyer online

or

- come to our office

.

INCLUSION OF AN APARTMENT IN THE INHERITANCE MASS.

Inclusion of an apartment in the inheritance estate

– one of the most common cases in inheritance cases. However, here too the situations are very different. Let us give one example when it is necessary to include an apartment in the inheritance estate.

The testator (buyer of the apartment) enters into a deal to purchase housing, fulfills all his obligations under the contract, but dies: he did not have time to register ownership

. A similar situation may arise in the case where the procedure for privatization of an apartment has been started, but due to the death of the testator, privatization has not been completed.

Many questions immediately arise: What to do in this case? Can an heir claim an apartment for which ownership has not been registered

? Is a municipal apartment included in the inheritance estate or not? And other inheritance issues...

For heirs who want to confirm the inheritance of an apartment if it is not owned ( inheritance of a non-privatized apartment

), it is necessary to prove that the testator expressed the will to privatize the apartment and took any action to this end. We can talk about both inheritance by will and inheritance by law.

It should be taken into account that including a non-privatized apartment in the inherited property

quite complicated and the right to

inheritance in non-privatized apartments

requires strong evidence.

At the same time, it is necessary to take into account the fact that the apartment did not become the property of the testator

and is in state or municipal ownership. Therefore, you will have to sue the Department of Housing Policy and Housing Fund of Moscow, and this complicates the inheritance dispute...

inheritance lawyers before taking any action.

Legal bureau YurbIS.

Lawyers by inheritance

Our company will help you collect and prepare all the necessary documents confirming

the inheritance of a non-privatized apartment

, will include the share of the apartment in the inheritance estate and will help you do everything so that

the apartment belonging to the testator passes to you by will

or by law.

Judicial practice on inheritance disputes regarding the inclusion of non-privatized apartments in the inheritance

, is far from clear-cut as we would like.

In the cases of our company's lawyers, we have encountered both positive court decisions and court decisions refusing to include municipal apartments in the inheritance estate

.

Therefore, before deciding to go to court, we recommend that you obtain qualified legal advice on inheritance from our inheritance lawyers

who successfully conduct cases in the courts of Moscow and the Moscow region.

Get legal advice

You can visit our office by making an appointment by phone.

(495) 960-32-76

In addition, you can also:

- call us at the specified phone number or

— ask a lawyer a question online

or

- come to our office in person.

TRIAL OF INHERITANCE DISPUTES.

In accordance with the legislation of the Russian Federation, all disputes about inheritance

are resolved in court according to the rules of jurisdiction established by the Code of Civil Procedure of the Russian Federation.

Inclusion in the inheritance mass: statement of claim.

A claim for the inclusion of property in the inheritance mass (as well as a claim for the allocation of the inheritance mass) is filed in a court of general jurisdiction, where

the trial of inheritance disputes

. It can be submitted by heirs by law or by will.

You will not find a template for a statement of claim for the inclusion of property, since all disputes about inheritance have their own unique specifics and vary greatly depending on the situation, the circumstances of entering into an inheritance, and the possibility of registering an inheritance

, composition of heirs, types of property.

Any claim for inclusion in the estate

is drawn up based on an analysis of this data.

In our company, inheritance lawyers

will help you prepare:

· claim for inclusion of an apartment in the inheritance estate

,

· claim for inclusion of

a share of an apartment

the inheritance estate ,

· a statement of claim for inclusion

of a house

or a share in it in the inheritance estate,

· statement of claim for

of a land plot

in the inheritance mass ,

· statement of claim for

of a share in a business

in the inheritance estate ,

· claim for

of money

and securities in the inheritance

The trial of inheritance disputes is also fully supported by our inheritance lawyers.

.

The interests of the Client in court can be represented by our lawyer in inheritance matters

until the moment when a court decision is made to include the necessary property in the inheritance mass.

Disputes regarding the inclusion of property in the inheritance mass

require a thorough study of available documents, analysis of judicial practice and, of course, certain legal knowledge.

When faced with a similar problem, a person without a legal education most often comes to the conclusion that

he cannot do of a qualified lawyer After all, you should consult a doctor for medical help!? Don't self-medicate!

By contacting YurbIS, you save yourself from dealing with many issues related to litigation and significantly increase the chances of the issue being resolved in your favor!

Call now! Get legal advice

inheritance you can in our office, having previously made an appointment by phone.

and (495) 960-32-76

If after reading our material you still have questions:

- call us at the telephone number provided or

— get a free legal consultation online

or

— come to our office in person.

STATE FEE TO THE COURT FOR A CLAIMS FOR INCLUSION IN AN INHERITANCE.

The state duty on cases of inclusion in the estate is determined by the estimated value of the inherited property. To do this, before preparing a claim, the plaintiff must conduct an assessment of the object of inheritance from a professional appraiser.

As in the case of other property matters, the state fee for the inheritance court

depends on the amount of the claim:

· For a claim of less than RUB 10,000. The state duty to the court on an inheritance case will be 4% (but not less than 200 rubles).

· For an amount of 10,001–50,000 rubles. – 400 rub. + 3% of the amount exceeding 10,000.

· If the amount of the claim is 50,001–100,000 rubles, then 1,600 rubles. + 2% of the amount exceeding 50,000.

· If the amount is 100,001–500,000 rubles, then 2,600 rubles. +1% of the amount exceeding 100,000.

· More than 500,000 rub. – 6600 rub. + 0.5% of the amount over 500,000, but not more than 20,000 rubles.

When considering cases of inclusion in the estate, the state duty may not be paid by some categories of citizens. The list of persons entitled to benefits is given in Art. 333.35 Tax Code of the Russian Federation .

Also, in some cases, the amount of state duty may be reduced.

If the plaintiff has a difficult financial situation, the court may grant a deferment or installment plan to pay the fee. If the plaintiff wants the state fee to go to the probate court

was accepted in installments or with a deferment, then it is necessary to attach a corresponding statement to the claim, which requires setting out the grounds for

deferring the payment of the state duty

.

When you contact our law firm, we are always ready to help you in resolving inheritance issues

: from consultation to court decision.

COST OF CONDUCTING AN INHERITANCE DISPUTE. WHY DO YOU NEED A LAWYER?

Inheritance disputes

are the most complex legal disputes, they require practical experience in working with

inheritance cases

in the courts, communication skills with notaries and registration authorities, and can also last more than one month. Therefore, in order to avoid problems, misunderstandings, and refusals to satisfy claims, it is better to entrust the resolution of these issues to a professional lawyer.

You may ask why you need an inheritance lawyer.

?

We will answer - only to correctly help resolve the inheritance dispute

in court in your favor.

The YurbIS company will become your reliable legal assistant in resolving difficult issues of inheritance, incl. cases regarding the inclusion of property in the inheritance mass

.

Cost of a probate lawyer

determined individually in each specific case.

At the same time, the amount of expenses for registering inheritance rights through the court should include the state fee for inheritance cases in court, as well as legal advice on inheritance

necessary for preparing a claim and studying a specific inheritance case.

cost of conducting a probate case in court includes:

· oral legal advice on inheritance;

· study and legal analysis of provided documents, materials, information;

· development of a legal position on an inheritance dispute

;

· assistance in collecting and processing evidence in the inheritance case

;

· preparation of procedural documents for the court;

· direct representation of your interests in court;

· obtaining a court decision on an inheritance dispute

.

Get the legal advice

You can visit our practicing inheritance lawyers and civil lawyers by making an appointment by phone:

(495) 960-32-76

If after reading our material you still have questions:

- call us at the telephone number provided or

—

You can free

online or

— come to our office in person.

The legal bureau of Sergei Ivanov is always ready to provide you with a full range of legal services for entering into an inheritance and registering inheritance rights, starting from submitting an application to a notary, collecting the necessary documents and ending with obtaining a Certificate of State Registration of Ownership of the inherited property in your name.

Our company is also ready to provide the necessary legal support

in case of disputes and issues related to inheritance, incl. in the following categories of court cases:

— restoration of the period for acceptance of the inheritance >>> — actual acceptance of the inheritance; — disputes about the right to inheritance; — disputes about the division of inheritance; — disputes about the allocation of a mandatory share in the inheritance; — disputes about establishing the fact of acceptance of inheritance; — disputes regarding invalidation of a will; — disputes about the inclusion of property in the inheritance; — inheritance of non-privatized apartments; — registration of property rights by inheritance; ...and other questions!

What property can be included in the inheritance mass?

Inheritance of the property of the deceased is carried out in accordance with the current civil legislation of the Russian Federation.

Debt obligations include promissory notes, issued loans, and the obligation to make payments under the agreement.

Hereditary succession arises upon the death of a citizen, involving the transfer of various items of heritage to a potential new owner and includes:

- real estate (house, apartment, garage, non-residential building, land plot);

- movable property (transport, furniture, equipment, jewelry);

- cash, deposit account, securities and so on.

To add any form of property to the estate, the future owner will need to provide the notary with documentary evidence of the testator's right to own and dispose of this property.

The estate of inheritance may include other personal belongings of the testator.

Recommended reading: Where is a will kept until death?

If for some reason the property was not privatized or the registration procedure was not completed, it is allowed to complete the process in person or resolve the issue through the court. Properly carried out registration allows you to attach the property to the inheritance mass.

If anything unclear arises, it is recommended to seek legal advice.

What makes up the hereditary mass?

The inheritance takes into account the property rights of the deceased, including unregistered ones.

In addition, this includes material assets that he owned during his lifetime:

- Real estate - a plot of land or an estate with a house, a residential building, a dacha, an apartment. Ownership rights to property are confirmed by contracts of sale, exchange, and a certificate of inheritance.

- Any vehicle that is registered to the testator. It could be a car, motorcycle, boat or helicopter. All vehicles registered in the name of the deceased are included in the estate.

- Property acquired by the testator with personal funds - household appliances, furniture, building materials, jewelry.

- Securities registered in the name of the deceased are also inherited.

- Bank deposit , interest and dividends due to the deceased.

- The amount of repayment of a loan issued by the deceased to someone. His successors have the right to demand compensation for the debt in their favor.

- Salary and pension of the deceased. Pension savings. Royalties.

- Rent for space leased by the deceased.

- Funds paid to compensate for damage caused to the life, health, and property of the deceased.

In addition to material benefits, the estate includes the debt obligations of the deceased:

- Outstanding loans;

- Debts on utility bills;

- Debt obligations under receipts and loans.

Material obligations tied to the personality of the deceased are not included in the inheritance. Thus, the successors are not required to pay fines, alimony or compensation for material damage caused by the testator to anyone.

What is not included in the hereditary mass?

Some things and objects of the deceased are not allowed to receive inheritance rights:

- structures, buildings erected by the testator without obtaining the appropriate permission from state authorities;

- legal grounds, obligations related directly to the person of the deceased (appointed alimony payments, loan guarantee, etc.);

- position, authorship, title;

- share of ownership of property acquired jointly during marriage.

The exclusion of erroneously classified possessions is carried out only in court.

The share of the inheritance, which is obligatory for succession by a special category of legal successors, cannot be inherited.

What is not included in the inheritance?

Paragraph 3 of Article 1112 of the Civil Code of the Russian Federation states that such intangible benefits as:

- life and health,

- personal dignity,

- personal integrity,

- honor and good name,

- business reputation,

- privacy,

- inviolability of home,

- personal and family secrets,

- freedom of movement,

- freedom to choose place of stay and residence,

- citizen's name,

- authorship,

- other intangible benefits.

The intangible benefits listed in Article 150 of the Civil Code of the Russian Federation are inalienable and non-transferable in any way.

The rights and obligations that are inextricably linked with the personality of the testator are not included in the inheritance

- right to alimony,

- the right to compensation for harm caused to the life or health of a citizen,

- rights and obligations, the transfer of which by inheritance is not permitted by the Civil Code or other laws.

According to paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in inheritance cases,” the inheritance also does not include “rights and obligations arising from contracts:

- free use (Article 701 of the Civil Code of the Russian Federation),

- instructions (clause 1 of Article 977 of the Civil Code of the Russian Federation),

- commission (part one of Article 1002 of the Civil Code of the Russian Federation),

- agency agreement (Article 1010 of the Civil Code of the Russian Federation).”

Actions with inheritance mass

Inherited property can be added to, reduced, accepted or renounced.

If the testator does not have documents on the right of ownership, or the papers were filled out with errors, then the property cannot be included in the total estate.

If there are disagreements with the composition of the inherited property, potential heirs must, within six months from the moment the notary office opens the inheritance case, send a claim to the district judicial authority.

There are different types of property that are subject to inheritance:

- membership in economic and consumer cooperatives;

- organization or production;

- ownership of a farm participant;

- items of limited circulation;

- territorial allotments;

- unpaid funds that are the main source of livelihood of the testator;

- state awards, orders and so on.

The succession of rights from these categories is carried out according to a special procedure prescribed by Chapter 65 of the current Civil Legislation.

The deceased’s existing production (firm, company) is accepted along with current expenses and debts. It is impossible to make only profit or lead an organization without paying off debt obligations.

Acceptance of an inheritance within a period of six months from the date of death of the testator is formalized by a notary. To do this, future owners must themselves come to the notary firm located closest to the inherited property and submit an application about their desire to acquire inheritance rights. The following documents must be attached:

- the applicant's identity card;

- grounds for ownership of property by the testator;

- confirmation of the status of the successor (marriage certificate, birth certificate, change of surname, will);

- death certificate of the person;

- receipt of payment of state duty.

Entering into inheritance rights is not mandatory. If a potential successor does not want to become the owner of the inheritance, a written refusal must be drawn up. Absolute refusal or in someone else's favor is allowed.

We recommend reading: Register of inheritance cases of the unified notary information system

In relation to the legal aspects of inheritance proceedings, the heir can receive either everything he is entitled to or nothing. For example, if the testator left a private house and apartment to the successor, then you cannot choose one thing: the successor must accept all the benefits of the deceased.

When the now deceased makes a will concerning the distribution of the inheritance in part, then the part that is not indicated within the last will of the testator is subject to inclusion in the estate of the legal heirs.

The procedure for excluding property from the inheritance mass

Civil legislation provides a list of objects that cannot be part of the inheritance mass. Thus, movable and immovable property that is not properly registered, personal non-property rights, as well as personal property rights cannot be included in the total mass.

Exclusion from the estate is possible in two ways:

- by a notary, if the property is of small or insignificant value, by submitting an application;

- in court, in case of controversial situations and disputes between heirs.

In the latter case, a citizen has the right to go to court immediately if a dispute arises or after the expiration of the period for accepting the inheritance, which is 6 months. In other words, when the inheritance case has already been fully formed by the notary and all the heirs have been identified. Such cases are considered according to the general rules of claim proceedings. All heirs are involved in the consideration of this case.

HEALTHY:

Procedure for inclusion and exclusion of property

A claim for inclusion in the estate must be filed no later than 6 months from the date of death of the testator.

If a legally established period is missed for good reasons, a procedure for restoring the inheritance period is allowed. In fact, nothing is restored: the court considers the application, evidence of the weight of the reason, and if the answer is positive, issues a court decision to assign the right of inheritance.

To challenge an inheritance in order to restore the terms or rights of ownership, the law establishes a period of 3 years, after which it will be more problematic to prove the grounds for inheritance.

The court also cancels previously issued certificates to other heirs and recalculates shares. With the finished document, you can go straight to the registration chamber to register a certificate of ownership. Thus, there is no need to contact a notary.

Inclusion in the inheritance mass is carried out on the basis of provided documents and a court decision. It is also possible to carry out the procedure after correcting erroneous filling or completing the documentation process.

Based on the fact of the court's decision, it will be decided to include or not include the testator's things in the estate.

Exclusion of property from the estate occurs if it was not documented in the name of the testator or was registered with errors. Property that is not subject to division cannot be excluded from the inheritance.

Any interested person has the right to apply to the court for an exclusion procedure.

Rights related directly to the personality of the testator, benefits and obligations not permitted by law, and intangible benefits cannot be included in the inheritance.

The successor may be disowned from inheritance by the court or by the testator. This is possible if the heir was found unworthy. An unworthy successor is considered to be a citizen whose guilt in illegal or unlawful acts in relation to the testator has been documented. When considering a case, it is allowed to bring witnesses.

An unlawful act may be evasion of prescribed alimony payments, physical or mental violence, failure to provide assistance, and so on.

The procedure for forming the hereditary mass

As mentioned above, you can only inherit all property, that is, get an apartment, but refusing to pay taxes on it is unacceptable.

There are two options for resolving situations:

- Receipt of all assets and liabilities of the deceased. That is, not only those rights, the receipt of which will be beneficial to the heir;

- Refusal of all inheritance. No one obliges you to accept an inheritance. The heir has the right to refuse to participate in the division of property, both in favor of another heir, and without specifying the relevant persons.

It is important to know that the refusal is irreversible, that is, it will no longer be possible to restore your rights to the inheritance.

The procedure for forming an inheritance mass is strictly defined and consists of including or excluding property from the general list.

Read also: Acquisitive prescription

The procedure for including an inheritance in the estate can proceed as follows:

- If a will serves as justification, then a list of objects is already written in it, indicating all the necessary characteristics;

- In the absence of a will, a list of property is drawn up in the form of an appendix (inventory) in the presence of two witnesses, as well as heirs, indicating a list of inheritance, documents confirming the deceased’s ownership of objects, descriptions of objects of inheritance, and an indication of the approximate cost.

The said document is signed by the heirs, a notary, and also witnesses. If you disagree about the amount of property included in the inheritance, you can appeal the notary’s decision in court. After the court has established the fact that any property belonged to the deceased, it will also be included in the general list of the inheritance estate.

Exclusion of property from the inheritance mass is also possible on the basis of a trial, following which the court will make a decision to remove any object from the list. Any of the heirs can make such a statement to the justice authorities, if there is significant evidence of the illegality of including the property in the total estate.

As an example, we can cite a widow’s statement of disagreement with the inclusion of a jointly owned residential building in the general list of inheritance, since, according to the current legislation, the share should go to her.

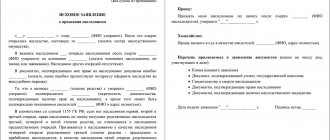

Drawing up and procedure for filing a claim

All documents are transferred to the court at the location of the object of inheritance. If a personal visit is not possible, sending by mail or transfer through a third party is allowed. Before mailing, all documents must be certified by a local notary. The letter is issued with acknowledgment of delivery. Usually, they send a registered letter, but for documents it is recommended to use a valuable item with a description of the attachment, to which you can also attach a notification. When documentation is sent through an intermediary, a notarized power of attorney is required to perform the act on behalf of the applicant.

Recommended reading: Where is a will kept until death?

In an application for inclusion of property in the estate, the following must be indicated:

- personal details of the testator;

- information about the property owned by the deceased;

- information about the plaintiff;

- information about the notary handling the inheritance matter;

- indicate the possessions that were not included in the inherited mass, indicating the reasons;

- other potential successors;

- a package of papers confirming the property rights of the testator;

- request that the properties be included in the main composition.

The appeal necessarily contains the main parts of the semantic content. The introduction contains the details of the participants in the trial and the essence of the requirements. The description reveals the defendant's objections. The motivational part of the document contains the evidence base. The conclusion includes the date of preparation and the signature of the applicant.

An additional package of documents must be attached to the petition, on the basis of which the court can make a verdict:

- as many copies of the claim as there are people involved in the procedure;

- tax payment receipt;

- death certificate;

- confirmation of the testator's ownership;

- an extract on the value of the inherited property.

Documents are required so that there is something on which to make a decision.

The amount of the state duty is not fixed, but depends on the cost of the statement of claim or is calculated using the report forms of an invited appraiser. Based on the cost estimate, the value of the claim is calculated.

Peculiarities of inheritance of jointly acquired property

The spouse of a deceased citizen has the primary right of ownership of the object of inheritance. First, 50% of the jointly acquired property is allocated from the total personal property of the deceased. This part of the property from the estate has a second name: the marital share.

According to current legislation, first the husband or wife acquires an obligatory part of the inheritance, and the remaining amount of property is evenly distributed among other legal successors.

Only citizens who entered into an official marriage with a now deceased citizen have the right to own part of the jointly acquired property. A common-law husband or wife will be able to claim anything only if they prove their dependency.