The concept of hereditary mass

All movable and immovable property that was owned by a citizen during his lifetime, after his death turns into the so-called inherited mass. It is she who is inherited by the relatives of the deceased or other persons who have rights to it under the will.

As for whether the savings book contribution is included in the property under the will, it all depends on whether the testator drew up this document and whether he included bank savings in the list of inheritance.

Read about how and by whom the volume of the inheritance mass is determined and by what principle it is distributed between the heirs by law and by will in the separate material “Inherited mass”.

Inheritance by law

The presence of family ties between citizens determines the emergence of a variety of legal and financial relationships between them. These include inheritance rights.

Moreover, the closest relatives of the deceased (children, legal spouse, parents) have legal advantages over more distant family members in terms of receiving an inheritance.

In addition, according to the law, citizens who have the right to an obligatory share in the inheritance can also claim the property of the testator. Including those who were not related to him.

Such persons include, in particular, dependents who were in the care of the deceased.

To find out more information on this issue, go to the material “Inheritance by law”.

Inheritance by will

Each person has the right to independently determine the fate of his property. If he has a clear idea of who should receive material wealth after his death, then during his lifetime he can draw up a will.

In the future, the persons indicated in the document will receive that part of the inheritance mass (or its entirety) that the former owner allocated for them.

A will is a legally stronger procedure for transferring property by inheritance.

Thus, the material assets of the testator, under certain conditions, will first be distributed among the heirs under the will, and only then among the heirs under the law.

You can find out all the nuances of this issue in the publication “Inheritance by will.”

Is it possible to challenge a will?

Any legal document can be challenged if it turns out that the regulations for its preparation were violated, or if it turns out that its provisions violate the law. Therefore, the answer to the question of whether other relatives can challenge the will for a deposit in Sberbank will be in the affirmative. True, for this the applicant will have to provide compelling evidence in favor of the inconsistency of the will. And this is not always possible.

For information about what facts may speak in favor of the annulment of this document, and who has the right to challenge it, read the article “Is it possible to challenge a will?”

How to get a deposit in Sberbank for a deceased parent according to the law

In addition to a testamentary disposition for a deposit in Sberbank, it can be obtained on the basis of the law. Receiving an inheritance by law occurs in the case when the testator left neither a will nor a testamentary disposition.

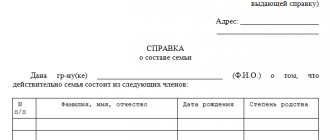

In this case, the Civil Code defines 8 lines of heirs. The first in this order are the spouse and children of the deceased. All heirs turn to a notary, who records their claims to receive the testator's property. To contact a notary office you must present:

- Passport;

- Death certificate of the testator;

- A document confirming your relationship with him.

There are two features of inheritance by law:

- The wife (or husband) of the deceased receives half of the inheritance;

- Minor children and other dependents of the testator have the right to a mandatory share.

A notary will issue a certificate of inheritance, but only after six months from the date of death of the testator. He will also establish the order of succession among the heirs and their shares. In case of disagreement, you can challenge his decisions in court.

You can apply to the bank for a deposit only after receiving a certificate of inheritance.

If the heir did not know about the death of the testator and missed the six-month deadline for opening the inheritance, he needs to go to court to restore his rights.

If there is no deposit agreement, you can contact a notary, who will submit a corresponding request to the bank. Upon such a request, the bank will restore all account details.

In more complex situations, when relatives do not even know the name of the bank, you need to contact a deposit search agency. If the deceased had bank accounts, agency specialists will find them.

When inheriting accounts, one must not forget that the debts of the testator are also inherited.

Testamentary disposition

A testamentary disposition is a document that is executed at the bank by the owner of a savings account in relation to his funds. Using paper, a citizen can indicate to whom the savings should be transferred in the event of his death and in what amount.

The principle and effect of the order are similar to the will, but the document is drawn up only in relation to the finances placed in a specific banking institution.

The account holder has the right to make adjustments to the order at any time.

It is noteworthy that before 2002 it was easier to obtain a bequeathed deposit in Sberbank than it is now. To do this, it was enough to simply contact the bank with a small package of documents. The participation of a notary was not required.

As for whether a will revokes a testamentary disposition in a bank, the answer will be in the affirmative if the instructions specified in these documents differ.

According to Article 1130 of the Civil Code of the Russian Federation, each subsequent will automatically cancels the previous one in whole or in part in those points where a contradiction arises.

You will find more information on all the nuances of the design and operation of this document in a separate article “Testamentary disposition”.

What is a testamentary disposition in Sberbank

In the current 2021, the process of transferring rights has not changed and allows the successor to receive a contribution, as well as the values of the deceased placed in storage.

For your information! As a rule, the re-registration procedure takes from two to three weeks. However, only for cases where a person is aware of the decision, has a lawyer’s response to the request, has gone to a financial institution and registered the money in his name. In some cases, they are asked to provide funds for a funeral from the same funds that were placed on deposit. In accordance with the law, you can receive an amount of no more than 40 thousand rubles.

Those who apply can reduce the time by up to 2 days, using the opportunity of Sberbank. This is achieved through the notary's wide access to lists of finances.

Contacting a notary

After March 1, 2002, the policy regarding the issuance of bequeathed deposits became more stringent. In order to prevent legal disputes and violation of the rights of testators and heirs, it was decided to issue this type of inheritance using the same procedure as any other property - through a notary's office.

It was necessary to first go to a notary, receive a request from him, and then personally apply directly to the bank in order to search for deposits.

In 2011, the procedure for receiving bequeathed contributions was simplified through an electronic notary system. Now notaries, at the request of heirs, can directly check on the spot the Sberbank server data on the bank deposits of a particular testator.

If savings are discovered, the notary, through remote access, will simply include these funds in the total inheritance. As a result, the entire procedure will take no more than one or two days.

The current procedure for entering into an inheritance for deposits in Sberbank is determined by law and includes provisions regulating the timing of accepting an inheritance, a list of required documents and the amount of payments to the state budget for carrying out a legal transaction.

Application deadlines

The standard period for accepting an inheritance is six months. However, sometimes citizens turn to lawyers with a corresponding application much later.

If the reasons for missing the deadlines were compelling and this fact can be confirmed with documents or with the help of testimony, the heirs have a chance to restore their rights through the court and still receive the money.

To learn about the cases in which it is permissible to restore missed deadlines, as well as the concept of limitation of actions, read the article “Time limits for entering into inheritance.”

List of documents

As for what documents are needed to receive a deposit in Sberbank by inheritance, it is usually sufficient:

- Heir's passports.

- Certificate of death of the testator.

- Will or testamentary disposition.

- Documents confirming family ties between the heir and the testator, if there is no will or testamentary disposition.

- Bank documents (passbook, card papers, etc.)

Sometimes additional paperwork may be required. For example, if the heir is a foreign citizen, the notary may ask to provide a legally certified translation of the identity card into Russian.

Is state duty paid?

In order to receive inherited money from an account in Sberbank, citizens must pay a state fee, which is charged for the provision of relevant legal services by a notary office.

The amount that needs to be spent depends on the relationship between the testator and the heir, as well as on the estimated value of the estate.

We have collected all the legal nuances and figures for you in a separate article “State Duty on Inheritance”.

How is money disbursed by testamentary order?

How to receive a deposit in Sberbank by inheritance if a testamentary disposition has been drawn up? Getting started with the explanation, it is worth noting one important date in this case: March 2002. Different rules apply for testamentary dispositions drawn up before and after this period.

For orders drawn up before March 1, 2002, the following instructions apply:

- The heir personally visits the bank where the testator's accounts and deposits are located.

- Provides bank employees with a death certificate, order, passport and all documents that relate to inherited deposits.

- Receives all funds due to him.

Features of inheritance of a deposit registered in Sberbank before June 20, 1991

Sberbank provides citizens with the opportunity to receive deposits of deceased relatives, which they registered before June 20, 1991. There will be no refunds for deposits made after this date.

At the request of the heirs, the bank organizes a search for deposits in all regions of the country. To do this, you need to write and submit a corresponding application to the bank branch. The service is paid.

To receive funds, you must contact a bank branch, providing the package of documents given above. The amount of reindexation depends on the year of birth of the heir.

Heirs born before 1945

Those born before 1945 are eligible to receive three times the deposit amount. That is, the amount of the balance in the savings account will be multiplied by three. The resulting figure will be the amount that the bank will pay to the relatives of the former depositor.

Heirs born in 1946 to 1991

A reduced tariff is provided for this category of citizens. The deposit balance amount will be multiplied by two.

If the heir does not know about the contribution

If the heir does not know that he is entitled to funds according to the will/law, then the contribution will be transferred to another heir(s) in order of priority.

If there are no other claimants to the property, then the inheritance not accepted within 6 months will be considered escheated and the money will go to the state’s balance sheet.

The law allows situations where the heir may not know about the existence of an inheritance or about its discovery. It is also possible that a citizen may be subject to significant circumstances that prevent him from accepting an inheritance (for example, a serious illness). In these cases, a person has the right to file an application with the court demanding restoration of his rights.

Missing deadlines without objective reasons cannot be restored.

For more information on how to regain your right, read the article “How to restore the right to inheritance.”

Features of inheritance by order

Based on Russian laws, a testamentary disposition can be drawn up in several ways:

- in any of the Sberbank offices

- at the notary

To draw up an order at the bank you must:

- Come to a Sberbank branch with your passport and inform the bank employee of your desire

- You need to have a deposit agreement or passbook with you

- The depositor bequeaths his financial property in the presence of bank employees, filling out the order form prescribed by law

- Employees accept and register the depositor's application at the bank

As we wrote above, the same can be done, if desired, at a notary’s office, where they will do the entire procedure described above for you. You will also need to have the above documents with you.

It is necessary to immediately contact a notary for the testator’s relatives to enter into the inheritance, because if no one contacts the bank within 6 months, the testator’s money will be automatically transferred to the state. Otherwise, after this period, you will have to prove in court that you did not have the opportunity to appear before the notary or learned about the death of a relative very late.

Few people know, but the heir, even before full assumption of rights, has the right to withdraw up to 40,000 rubles from the testator’s account for organizing a funeral or for providing medical services to the investor. To do this, the notary must provide a special document on the heir’s right to reimbursement of expenses.

A depositor can bequeath all his funds and assets in the bank:

- individuals

- legal entities

- organizations and institutions

- to the state

How to get money before taking legal rights

You can receive money from the savings book of a deceased relative by will or by inheritance within the framework of the law no earlier than six months after the opening of the inheritance.

However, there is often a need to receive at least part of the amount before this time, because the death of a person is always associated with large expenses for funeral services. Therefore, it is important to know that it is possible to arrange for the receipt of money on a death certificate from the deposit of the deceased to reimburse funeral expenses.

This can, of course, be done earlier than in six months. To receive funds, after opening the inheritance, you must submit a corresponding application to the bank, providing the specified package of documents.