Heirs of the eighth line are recognized as persons who did not belong to any of the seven lines, that is, they were not even distant relatives, but were disabled and were dependent on the testator . Based on Art. 1148 of the Civil Code (Civil Code) of the Russian Federation, disabled dependents inherit by law simultaneously and on an equal basis with the heirs of the queue, which at a particular moment is called for inheritance. In the absence of other heirs, dependents are called upon to inherit as heirs of the eighth order.

Being dependent on the testator

Dependency is defined as acceptance from the breadwinner of full maintenance or assistance, which was the main and permanent source of livelihood for this person. Dependents can be family members or other persons . Establishing the fact that a person is a dependent may become necessary in any of the following three cases:

- in case of compensation for damage associated with the death of the breadwinner;

- in case of granting a pension upon the death of the breadwinner;

- to receive an inheritance.

According to the Civil Code of the Russian Federation, minor or disabled children of the testator, his disabled parents and spouse or other disabled dependents can receive, regardless of the contents of the will, half the share or more that is due to each of them in the event of inheritance by law, that is, the so-called obligatory share .

Disabled as :

- women who have reached the age of 55 years;

- men over 60 years of age;

- all groups of disabled people (regardless of whether the listed persons were assigned a disability or old-age pension);

- for young people who have not yet reached the age of 16, if they are still studying - up to 18 years, and with full-time education - up to 23 years.

Disabled dependents are divided into two groups :

- those included in the circle of heirs according to the order established by law, regardless of their joint or separate residence with the testator;

- not included by law in the circle of heirs, but who lived together with the testator .

In the absence of other heirs, the disabled dependents of the testator, who are not legally included in the circle of heirs and did not live with him, can claim the inheritance on a general basis as heirs of the eighth stage.

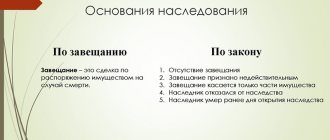

Distribution according to law. Differences from a will

In order to outline what exactly inheritance by law is, let’s compare it with the more popular procedure - the distribution of inheritance in accordance with a will. When distributing the property of the deceased according to a will, all values that were specified by the testator are distributed strictly among those indicated by the deceased himself. There are only two exceptions - if the heir was declared unworthy by the court or if the law requires the transfer of part of the valuables as a mandatory share to the disabled heir. In this case, the obligatory share will be equal to half of what the disabled person would have received through standard inheritance in the order of priority.

In inheritance by law, the order of distribution is completely different. Since the will of the deceased is not officially documented, inheritance takes place in a manner pre-established by the state, that is, in accordance with inheritance lines. There are eight of them in total, and only the first and eighth differ significantly. Property is distributed among representatives of these queues in order and in equal shares, but at the same time they can refuse the property assigned to them in favor of others. Let's take a closer look at these inheritance queues.

Minimum period of being dependent on the testator

If by the day of the death of the testator, in addition to relatives who belong to the line called for inheritance, there are relatives of even more distant lines of inheritance, and who were dependent on the testator for at least a year , then they (even if they did not live together with the testator) will equally with the main heirs. The same rule should apply to dependents who were not relatives of the testator, but upon entering into the inheritance, at the same time as the main heirs, they had to live with the testator. If there are no heirs of other orders , then they inherit independently, in accordance with the law, as heirs of the eighth order.

Is the order of succession taken into account when there is a will?

According to the law, after the death of the testator, cousins take ownership rights if there are no heirs by law from the 1st stage. In the case of a will, inheritance does not allow primary legal successors to take part in the division of property values. Refusal – release from the right of inheritance. This is a separate document drawn up in the presence of a notary, which excludes the heir from the list of such heirs according to legal norms. A refusal is issued if a will was previously signed.

The declaration of will is often formalized by people who are dependent on the deceased, when the latter transfers valuables to his ward. But he will not be able to use it, because he is incapacitated. Even if there are no relatives of the trustee, the dependent has no right to claim the inheritance. The rules of succession require the allocation of a mandatory part of the property even in the presence of a written expression of will.

The obligatory share is transferred to the children of the deceased. The law is a confirmation of the state's care for minor children. Until reaching adulthood, a guardian will manage the property. Documents on the topic of guardianship registration are easy to download on the Internet. But a will can also be challenged. An unscrupulous heir is a person who received property by putting pressure on the testator

In the case where a man and a woman lived together, but were not married, the inheritance by law is not transferred to the common-law spouse. This rule applies to children born out of wedlock, unless the offspring are registered accordingly. Paternity is relevant if both parents are listed on the birth certificate. Otherwise, the child or his parent is not included in the queue for inheritance by law. The legal successor is such under the will.

Documentary confirmation of the fact of dependency

The fact of dependency must be documented. However, if there is no documentary evidence of dependency, then it is established in court. The fact of dependency in court must be proven on the basis of any available documents confirming dependency (certificate of residence, pension book and other documents), as well as with the help of testimony of witnesses (at least three people, usually: neighbors, relatives, medical workers, etc. .d.).

After the death of the testator, a dependent may have an independent source of livelihood, but will still be considered to be dependent on the testator. When determining disability, several factors will be taken into account simultaneously, including disability due to disability or age. If the child is a dependent, then you can limit yourself to having a resolution from the guardianship and guardianship authority on the dependency.

Dependents called upon to inherit must submit the following documents :

- a certificate from the testator’s place of work confirming that the latter has dependents, or a certificate from the housing maintenance organization with such information;

- a certificate from the state social security authorities confirming the assignment of a pension in case of loss of a breadwinner;

- documents that can confirm the income of the dependent, as well as the person who provided him;

- documents confirming the fact that the dependent received alimony (when such payments took place);

- relevant certificate of disability or disability certificate.

Example 22-year-old citizen M., a full-time student, filed a lawsuit to recognize his share in the inheritance as a dependent who received assistance from citizen S., a friend of his late father, who died and was the testator. This assistance was received in his name to pay for education and was the main source of livelihood for the citizen. M. The court satisfied M.'s claim with the determination of the share of the inheritance.

Property is considered

escheat if:

- there are no heirs (both by will and by law);

- none of the heirs received the right to inherit;

- heirs are legally excluded from inheritance;

- none of the heirs accepted the inheritance;

- all the heirs renounced the inheritance, and none of them indicated that the refusal was in favor of another heir.

Escheated property passes by law, by way of inheritance, into the ownership of the Russian Federation , and if this property is in the form of residential premises, into the ownership of a municipal entity.

Example Citizen Yu., at the age of 60, as a dependent of the testator, filed a claim regarding her share in the inheritance left by her breadwinner, Gr. T. The court, by its decision, confirmed that, according to the current legislation, Ms. Yu., as a disabled dependent, has the right to half the share or more, which is due to each heir in the event of inheritance by law - that is, to the obligatory share.

Inheritance queues

There are 8 inheritance queues:

- The first priority includes the spouse, parents and children, grandchildren;

- the second - siblings, grandparents, nephews and nieces;

- to the third - uncles and aunts, cousins;

- to the fourth - great-grandparents;

- to the fifth - children of nephews and nieces, siblings of grandparents;

- to the sixth - grandchildren of nephews and nieces, children of cousins, great uncles and aunts, children of siblings of grandparents;

- to the seventh - stepsons, stepdaughters, stepfather and stepmother;

- the eighth category includes disabled dependents.

Attention! According to Art. 1141 part 3 of the Civil Code of the Russian Federation, heirs of the eighth stage inherit the property of the testator if there are no successors of the previous stage. That is, they are either absent altogether, or do not have the right to inheritance (excluded from inheritance), or none of them accepted the inheritance (refused it).

Requirements for heirs of the 8th stage

Heirs of the eighth priority have the right to receive an inheritance in the same way as persons of the first priority.

To qualify, dependents must meet the following requirements:

- at the time of accepting the inheritance they must be disabled;

- the deceased provided for them for at least one year before his death.

Note. The dependent is not required to live at the same address with the testator.

Recognition of inheritance in the Russian Federation is carried out in accordance with the law or a will. Successors have the opportunity to assume their legal rights in two ways:

- By submitting an application to a notary. This technique is considered basic and makes it possible to register property in a shorter period.

- Through the court. This method is used if the notary refuses to issue a certificate to the heir for various reasons.

Both methods imply issuing a positive conclusion about inheritance rights only if the heirs have provided all the required documents.

Eighth line of heirs by law

The family consists of the father (N.), his wife (O.), and their two children. For some time, N.’s mother and her partner (F.) lived with them (the marriage was not officially registered between them). Thus, F. in relation to N. is not a relative or even a stepfather. But the relationship developed between them in such a way that even after the death of N.’s mother, he continued to live for several years with N. and his family. In fact, F. was disabled, had no independent income and was completely supported by N.

Lines of heirs according to law

- Due to the fact that the adopted person loses any legal ties with his relatives by origin (including his natural parents), according to paragraph 2 of Art. 1147 of the Civil Code, he, like his offspring, also loses the possibility of inheriting them . Likewise, his parents and other relatives by descent cannot be the legal successors of the adopted person and his descendants.

- An exception to this rule is provided for in paragraph 3 of Art. 1147 of the Civil Code, according to which, in cases where the adopted person retains any family relations with relatives by origin in accordance with a court decision, he has the right to inherit from such relatives, just as they inherit from him. What’s interesting is that if an adopted child maintains a relationship with one of the parents, then he maintains relationships with all of his relatives .

- Based on this, an adopted person can equally inherit property from both the adoptive parent and his relatives, and from his blood relatives with whom he maintains relations. However, after the death of an adopted person, not only his descendants, but also the adoptive parent and his relatives, as well as other blood relatives, can inherit his property.

We recommend reading: Registration at the Place of Stay: What is it?