Features of the division of the hereditary mass

The estate is the totality of all the assets of a deceased person, as well as his liabilities at the time of death. We are talking about movable and immovable property, shares, bank accounts, securities and personal savings. The estate also includes the debts of the testator. For example, if the deceased did not manage to pay off the loan, then this obligation will be assigned to the person who accepted the inheritance.

Regardless of the composition of the hereditary mass, its division occurs in two ways:

- by will;

- in law.

By writing a will, a citizen has the opportunity to independently determine the following points:

- composition of heirs;

- shares of each of the applicants;

- the presence of a testamentary refusal (in this case, the heirs receive property with a condition that they undertake to fulfill);

- disinheritance of one or more legitimate claimants.

Thus, by writing a will, a citizen can influence the order of inheritance. If desired, he can disinherit his legitimate successors. To do this, it is enough simply not to indicate them in the document. Property can be transferred not only to relatives, but also to third parties. Organizations may also be included among the recipients.

When making a will, it is important to remember the mandatory heirs. These are the only persons who cannot be deprived of property. We are talking about the testator's dependents - disabled relatives who are supported by him. These include:

- minor children;

- disabled parents or spouse;

- disabled children who have reached adulthood.

In addition, third parties whom he supported financially are considered dependents of the deceased citizen. However, in this case, the fact of living together with the breadwinner for the last year is required.

The interests of compulsory heirs are protected at the federal level. Their rights are spelled out in Article 1149 of the Civil Code of the Russian Federation. Therefore, if the testator does not indicate a dependent in the will, the latter will be able to obtain the property through the court. The share of the obligatory heir is half of the part of the inheritance that he would have claimed during the distribution of property according to the law.

When transferring property under a will, the recipient is not required to prove family ties with the testator. You just need to present your identity card to the notary.

Testamentary disposition has an important advantage over legal inheritance. By drawing up this document, the testator can transfer the inheritance not only to blood, but also to illegitimate and adopted children. Even if the child was not officially adopted, he will be able to receive the property of the testator under the will. The only drawback for adopted children is the increased amount of state duty.

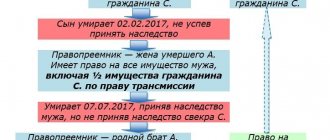

If there is no testamentary disposition, then only the relatives of the deceased citizen will be able to receive the inheritance. Moreover, we are talking about candidates from the closest line.

The law distinguishes 8 lines of inheritance. If there are no first-line successors, the inheritance will be divided among the second-line applicants. They inherit the property in equal shares.

After the death of parents between children

If the father and mother died at the same time, then their children are the heirs of the first order. They will receive property if:

- there is no will or the children of deceased citizens are indicated in it among the recipients;

- there is no basis for recognizing the heirs as unworthy.

In addition to children, the primary successors are also the parents and dependents of the deceased. The distribution of the hereditary mass occurs according to the following rules:

- The mother and father of each deceased citizen claim a share in the property of their child only. If the parents were previously deprived of parental rights, they are excluded from the list of heirs.

- The child has the right to receive the property of each of the deceased parents.

- The dependent receives a share of the property of the citizen who supported him. Thus, he has no right to claim the property of the spouse of the deceased breadwinner.

As mentioned above, a will can radically change the composition of the heirs and the order of division of the inheritance.

After the death of one of the parents

If one of the parents dies, the following persons have the right to his property:

- spouse;

- children;

- parents;

- dependents.

By law, each of the above heirs claims an equal share in the property of the deceased citizen. However, accepting an inheritance is a right, not an obligation. Therefore, the successor can refuse the property.

There are two types of failures:

- Absolute. A person renounces his share of the inheritance. To do this, he needs to write an application and submit it to a notary. It is impossible to cancel such a decision, and the citizen is forever excluded from the list of heirs. Passive refusal is also possible when the heir does not submit documents for the inheritance within six months after the death of the testator. In this case, the heir can change his decision by seeking restoration of the deadlines through the court.

- Address. This is a refusal in favor of one of the applicants. Property can only be transferred to heirs in line or to applicants under a will.

Registration of a waiver on behalf of an incapacitated heir is possible only with the consent of a representative of the guardianship authorities. It will be possible to obtain permission only if accepting the inheritance is inappropriate (for example, the amount of the testator’s debts exceeds the value of the assets).

If one of the spouses dies, the second is not only his heir, but also owns half of the jointly acquired property. Therefore, it is important to highlight the marital share, which is excluded from the inheritance mass. To do this, you should contact a notary.

According to the law, jointly acquired property is divided in half. Thus, the widow of the deceased owns half of the common property. After allocating the marital share, the composition of the inheritance mass is formed.

Section options

Current legislation provides for the following options for the division of inherited property:

- By agreement. The heirs can agree on the distribution of the inheritance. To do this, a written agreement is drawn up and certified by a notary. Subsequently, the notary uses this document when creating certificates of inheritance.

- Through the court. If an agreement cannot be reached, then the only option is to go to court. If there are objects in shared ownership, it will be possible to determine the order of their use.

How to divide the inheritance after the death of the father

- document identifying the recipient of the inheritance;

- father's death certificate;

- a document proving the relationship with the deceased;

- a certificate of the father’s place of registration (from the Federal Migration Service or from the Housing Office);

- documents on inherited property (agreements and certificates of ownership of real estate, bank accounts, registration certificate for a car, etc.);

- property valuation documents;

- receipt of payment of the state fee for issuing a certificate of inheritance.

We recommend reading: Housing and communal services benefits for large families

Cases when children will not be able to receive an inheritance after the death of their parents

Let's consider cases of exclusion of children from heirs:

- The successor is declared unworthy. This is possible if a citizen has committed a crime against the testator or other heirs. Heirs who tried to increase their share of the inheritance by illegal means are also considered unworthy. To remove a person from the list of successors, you must go to court.

- The testator did not indicate a son or daughter in the will. In this case, the deprived heir can challenge the order through the court. If this succeeds, then further distribution of property will take place according to the law. To challenge a will, you will have to prepare a good documentary basis. Otherwise, the claim will be rejected and the applicant will be left with nothing. It should be remembered that the testator does not have the right to disinherit his dependents.

- The child was adopted. From the moment the court decision on adoption enters into force, the child becomes the heir of his adoptive parents. Thus, he will not be able to inherit the property of his blood parents. The exception is adoption by a stepmother or stepfather (intrafamily). In this case, the right to inheritance of the blood parent is retained.

- The amount of the testator's debts exceeded the value of his assets. As discussed above, debts are part of the estate. Accordingly, if the value of debt obligations is equal to or greater than the value of assets, then entering into an inheritance will be inappropriate.

Registration of inheritance after the death of parents

To enter into an inheritance after the death of a parent, a citizen must submit documents to a notary. The inheritance case is opened in the notary office that is located at the place of permanent registration of the testator. If the deceased made a will, then you need to contact the notary who keeps a copy of this order.

The procedure for entering into inheritance will be as follows:

- We collect documents.

- We are writing a statement.

- We submit the papers to the notary.

- We pay the state fee.

- We receive a certificate of inheritance.

What documents will be needed

The main document when inheriting a parent's property is a birth certificate. If you change your last name, you will have to present a corresponding certificate. If the child was officially adopted, then he does not need to present the court decision on adoption to the notary. In this case, a birth certificate is also sufficient, since the law equates adopted children with natural ones.

An error in the documents can complicate the process of obtaining a parental inheritance. There is often confusion between the letters “e” and “e”. In this case, the discrepancy will have to be corrected before submitting the documents to the notary. Otherwise, the applicant will not be able to prove the existence of a family connection with the testator. A passport can be replaced on the basis of a birth certificate.

If an error was made in the certificate itself, then you will have to request documents from the registry office archive. In the absence of strong evidence, relationship will have to be established through court.

The inheritance process is simplified with a will. In this case, the recipient of the property only needs to present an identity card to the notary.

Young children cannot enter into inheritance on their own. Instead, an authorized representative takes part in the process. It could be:

- parent;

- adoptive parent;

- guardian or trustee;

- representative of the guardianship authorities;

- head of an organization for orphans.

If a minor is over 14 years old, he can submit and sign documents independently with parental permission.

Submitting an application to a notary

The procedure for submitting documents to a notary depends on the legal capacity of the applicant. The following options are possible here:

- Capable adults submit an application independently. If necessary, the heir can issue a power of attorney for the representative.

- Minor heirs (under 14 years of age) do not have the right to be present at the conclusion of such transactions. Instead of a successor, all actions are performed by a legal representative.

- Children over 14 years of age can independently participate in the inheritance process with the consent of a parent or guardian.

- A guardian acts on behalf of an incapacitated applicant.

Payment of state duty

The amount of the contribution depends on the degree of relationship between the testator and the successor. Close relatives pay 0.3% of the value of the alienated property. The maximum contribution amount is 100 thousand rubles. If the estate contains bank deposits, they are not subject to duty.

If the property is inherited by an adopted or illegitimate child who was unable to confirm the existence of a relationship with the testator, then the contribution amount will be 0.6% of the value of the share in the inheritance. The maximum amount of duty in this case is one million rubles.

The following persons are exempt from paying state duty:

- incapacitated persons;

- minor heirs;

- disabled people of groups 1 and 2 (receive a 50% discount).

Division of property after the death of parents

You must wait six months after the death of the testator to enter into the inheritance. Only after this the apartment will become the property of the heir. But even then, incidents are possible if other heirs who did not get a piece of the pie challenge this fact in court. Second minus. There is a danger that other applicants will challenge the heir's right to receive an apartment under the will. For example, you can challenge the legal capacity of the testator at the time of signing the will and recognize the will as an invalid transaction if there are grounds. Minus the third. Heirs may appear with an obligatory share in the inheritance and then they will have to share. The fourth minus. Entering into an inheritance is a troublesome matter and again you will have to incur expenses in order to obtain a document confirming the right to property. ALIENATION There are other common ways of transferring real estate to relatives.

We recommend reading: Buy an Apartment Without a Mortgage Using Maternity Capital