Scrap metal in the hazardous waste classifier

Sales of scrap ferrous and non-ferrous metals

Based on the order of the Ministry of Natural Resources, scrap ferrous and non-ferrous metals belong to hazard class V. Wastes of this group are considered practically non-hazardous, their impact on the environment is minimal or absent.

At the same time, ferrous metal dust is defined as waste of IV (higher) hazard degree. The degree of impact of waste of this group on the environment is minimal (the recovery period after pollution is up to 3 years).

How to issue a payment order from a tax agent when paying VAT on scrap metal

According to the rules for filling out payment orders approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, the following fields of the payment order must be filled in:

- “ Payer status” (field 101) - VAT is paid by a company or individual entrepreneur as a tax agent - code “02”

- “Payer’s INN” (field 60)

- “Payer’s checkpoint” (field 102) - An individual entrepreneur puts “0”, the company puts its own checkpoint.

- “Payer” (field

is the short name of the tax agent

is the short name of the tax agent

- “Recipient’s TIN” (field 61) - TIN of the tax office to which the tax agent transfers the value added tax

- “Recipient checkpoint” (field 103) - checkpoint of the tax office where the tax agent sends the value added tax

- “Recipient” (field 16) is the tax office to which the value added tax is transferred. The field is filled in as follows: “UFK for Moscow (IFTS No. 7 for Moscow).” You cannot indicate only the Federal Tax Service number. For example: “IFTS No. 7”.

- “Payment priority” (field 21) - code “5”, in special cases “3”

- “OKTMO” (field 105) - code according to the All-Russian Classifier of Municipal Territories. For companies - the code at the location, and for individual entrepreneurs - at the place of residence.

- “Basis of payment” (field 106) - current payment “TP.

- “Period for which the tax/contribution is paid” (field 107) - when paying VAT as a tax agent, in field 107 you must enter the date of payment of funds to the counterparty.

- “Document number” (field 108) - indicate “0” (since in field 106 “TP”)

- “Document date” (field 109) - indicate “0” (since in field 106 “TP”)

- “Payment type” (field 110) - «0».

- “Purpose of payment” (field 24) - value added tax withheld by the tax agent from the cost of goods (name) from the organization under the agreement dated "" _______20__, No. __

Accounting for scrap ferrous and non-ferrous metals at the enterprise

In accordance with the order of the Ministry of Natural Resources No. 721 dated September 1, 2011, all types of waste, from class I to class IV, including scrap ferrous and non-ferrous metals, are subject to documentary recording.

The procedure for recording production and consumption waste is determined by each enterprise individually. It is recommended to draw up a local regulatory act that approves the following provisions:

- documentation of scrap metal accounting (including reporting forms);

- storage conditions for scrap ferrous and non-ferrous metals;

- procedure for processing scrap metal (transfer to a third party or independent processing);

- the official responsible for accounting for scrap metal (including the preparation of reporting documents).

How will a scrap metal buyer account for VAT from January 1, 2020?

Now we will give clarifications for buyers on record keeping. The tax base for calculating value added tax is determined based on the purchase price of goods, that is, based on the contract value including VAT. From January 1, 2020, instead of the previous VAT rate of 18%, a new rate of 20% is introduced. And instead of the previous settlement rate of 18/118, a settlement rate of 20/120 is introduced. According to paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, the rate of 20/120 is applied to the tax base, which includes VAT. Therefore, if the cost of the goods is 240 rubles, 40 rubles. – this is VAT.

Example.

The tax agent must withhold value added tax from funds transferred against future deliveries to the scrap metal supplier, even if this is an advance.

The moment of determining the tax base for tax agents is made on one of the earliest dates:

- day of shipment

- day of payment/partial payment

Currently, the procedure for calculating VAT for tax agents specified in clause 8 of Art. 161 of the Tax Code of the Russian Federation is not enshrined in the Tax Code of the Russian Federation, therefore we believe that it will be identical to the procedure established for tax agents specified in paragraph 5 of Art. 161 Tax Code of the Russian Federation. Consequently, if the moment of determining the tax base for the tax agent is the day of payment/partial payment for upcoming supplies, then on the day of shipment for payment/partial payment the moment of determining the tax base will arise again. No payment - the moment of determining the tax base for value added tax will occur only on one date and this will be the date of shipment.

If the tax agent uses metal in an activity that is subject to value added tax, then the VAT paid as a tax agent can be claimed as a deduction. If for some reason the transaction price has changed or the amount of scrap metal in the primary documentation has changed, the amount of value added tax must be adjusted.

The general formula for calculating value added tax debt to the budget is determined as follows: seller’s VAT + restored VAT - VAT deductible.

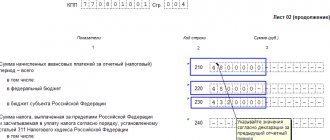

At the end of each tax period, the buyer, who is a tax agent, must submit a declaration to the tax office at the place of his registration. The VAT return form was approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] Deadline - no later than the 25th day of the month following the expired tax period. Thus, the reporting dates are: April 25, July 25, October 25, January 25. Carefully study the features of filling out the declaration by the buyer

Procedure for storing scrap ferrous and non-ferrous metals

Federal Law No. 99 of May 4, 2011 provides for mandatory licensing of activities related to waste disposal and processing. In particular, on the basis of clause 30, part 1, art. 12 FZ-99, the collection, use, disposal and disposal of waste of hazard classes I–IV is subject to licensing.

Due to the fact that scrap ferrous and non-ferrous metals are classified as hazard class V, scrap metal recycling activities are not subject to licensing. Thus, organizations whose activities generate scrap metal as production or consumption waste can store scrap in their own warehouses and process metal waste without the need to obtain a license .

The situation is different with ferrous metal dust, which is produced as waste by metallurgical and metalworking enterprises. This type of waste belongs to hazard class IV, which means that its storage and processing activities must be licensed.

However, here too, legislators have provided minor concessions for business entities. Based on the provisions of Federal Law 99, ferrous metal dust can be stored as production or consumption waste in specially equipped areas and only on the condition that the period of such storage does not exceed 6 months.

"Advance" VAT.

Taking into account clause 15 of Art. 167 of the Tax Code of the Russian Federation, buyers of scrap metal determine the moment of determining the tax base in the manner established by clause 1 of Art. 167, - either on the date of shipment by the seller of the goods, or on the date of receipt by the latter of advance payment for the goods.

In paragraph 2 of Letter No. SD-4-3 / [email protected] the Federal Tax Service explained: when prepaying upcoming deliveries of scrap metal, the tax agent calculates VAT both on the date of transfer of payment (partial payment) and on the date of shipment of scrap metal against this payment (partial payment ). Further, the department, referring to Art. 171 of the Tax Code of the Russian Federation (clauses 3, 5, 8, 12 and 13, in particular), indicates: the amounts of calculated “agency” (“advance”) tax are subject to deductions. And the amounts of tax accepted for deduction (by virtue of paragraphs 3 and 4 of paragraph 3 of Article 170) are subject to restoration.

Amounts of tax accepted for deduction in relation to payment, partial payment on account of future deliveries of goods are subject to restoration in the amount of tax accepted by the taxpayer for deduction on goods purchased by him, in payment for which the amounts of previously transferred payment, partial payment are subject to offset according to the terms of the agreement (if the presence of such conditions).

According to the author, the recommendation of the main tax department of the country does not raise questions among tax agents - VAT payers. We are talking about “simplistic people” - and here they may have a “stammer”. The point is about a tax deduction - does a “simplified” tax payer have the right to apply it?

However, if you carefully study the norms of the Tax Code of the Russian Federation, doubts will be dispelled. Clauses 12 (on the deduction of “advance” VAT) and 13 (on the deduction of VAT when adjusting shipments) Art. 171 can also be applied by those who do not pay VAT (unlike paragraphs 3, 5 and 8, from which it clearly follows that these rules are addressed only to taxpayers).

With this approach, the “simplified” buyer, when making an advance payment for a future supply of scrap metal, will calculate “advance” VAT. When the seller ships the goods, the “advance” VAT calculated for the seller can be deducted by the buyer.

The “simplified” person is not entitled to deduct “advance” and “shipping” VAT for himself!

A buyer who makes an advance payment against a future delivery has the right to deduct VAT from the advance payment (for himself - the buyer) only if he is a VAT payer. In our case, a “simplified person” (a person who is not recognized as a VAT payer due to the application of a special tax regime - clause 2 of Article 346.11 of the Tax Code of the Russian Federation) does not deduct VAT from the advance payment (therefore, it does not restore this tax in the future).

This is important to know: Section 9 of the VAT return: sample filling

For the same reason, the buyer will not be able to deduct VAT calculated on the shipment of scrap metal. This right (as stated in paragraph 3 of paragraph 3 of Article 171 of the Tax Code of the Russian Federation) is available to buyers - tax agents (named in paragraph 8 of Article 161 of the Tax Code of the Russian Federation), who have calculated VAT in accordance with paragraph. 2 clause 3.1 art. 166 of the Tax Code of the Russian Federation, provided that the scrap metal was purchased by them for the purposes specified in paragraph 2 of Art. 171, in particular:

to carry out transactions recognized as objects of taxation (with the exception of goods provided for in paragraph 2 of Article 170, for which the tax is taken into account in their value);

Let's use the condition of example 1.

Sales of scrap ferrous and non-ferrous metals: documentation

In general, the sale of scrap and non-ferrous metals is carried out on the basis of an agreement concluded between the supplier of metal waste and the enterprise that processes scrap.

The contract form is not provided for by law; the document is drawn up in free form, taking into account the requirements of the Civil Code of the Russian Federation.

The text of the agreement must contain the following information:

- parties to the contract (names of organizations, information about representatives in the preamble);

- subject of the contract (sale of scrap ferrous/non-ferrous metals);

- contract amount, payment procedure;

- conditions for the transfer of scrap metal (based on a power of attorney, when drawing up a transfer and acceptance certificate);

- details of the parties (addresses, bank details).

The contract form for the sale of ferrous and non-ferrous metals at home can be downloaded here ⇒ Agreement for the sale of scrap metal.

“Simpler” is a scrap metal seller.

A “simplifier” can also be a scrap metal seller. What should you keep in mind in such circumstances?

As a general rule, sellers do not calculate VAT when selling scrap metal. In the contract and the primary accounting document, the “simplified” seller makes the appropriate entry (“Without tax (VAT)”).

But if the right to use the simplified tax system is lost in accordance with Ch. 26.2 of the Tax Code of the Russian Federation, the former “simplified” person calculates and pays tax on scrap metal sales transactions independently. This follows from paragraph. 8 clause 8 art. 161 Tax Code of the Russian Federation. Calculation and payment of tax are carried out starting from the period in which the payer switched to the simplified tax system until the date of occurrence of circumstances that are the basis for the loss of the right to use the simplified tax system.

An organization that uses the simplified tax system and, accordingly, accompanies documents with the entry “Without tax (VAT),” sold scrap metal on April 15, 2018.

As of June 10, 2018, it exceeded the maximum amount of income (150 million rubles) for applying the simplified tax system and therefore the company lost the right to use the special regime from the beginning of the second quarter of 2020 (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

For scrap shipped in the second quarter of 2020 for the period from 04/01/2018 to 06/10/2018 (in this case, the sale took place on 04/15/2018), the organization will calculate VAT independently, without transferring the “procedure” to the buyer.

Buyers - tax agents who are on the simplified tax system, when purchasing scrap metal from VAT payers, calculate “agency” VAT. They will be able to apply a deduction for the tax calculated on the prepayment for the seller. According to the “advance” and “shipping” VAT for themselves, they do not have such a right.

We recommend that the interested reader read Letter No. SA-4-3/ [email protected] , in which the Federal Tax Service provided examples of filling out VAT documents when making transactions with scrap metal. New groups of transaction type codes (KVO) are also given here. The first group of KVO is for use in the purchase book and sales book of the seller, as well as in the intermediary’s accounting journal (33 and 34), the second is for use in the sales book and the buyer’s purchase book (41, 42, 43, 44).

Taxation of scrap metal sales operations in 2020

Until 2020, organizations selling scrap ferrous and non-ferrous metals were exempt from paying VAT on this operation on the basis of Art. 149 of the Tax Code of the Russian Federation.

On January 1, 2020, a new version of the Tax Code of the Russian Federation came into force, in which this clause was abolished. This means that operations for the sale of scrap metal are subject to VAT taxation in the general manner.

The inclusion of transactions for the sale of scrap in the list of taxable transactions provides that the seller of metal waste, when shipping scrap, is obliged not only to issue an act of acceptance of the transfer, but also an invoice.

As for income tax, the position of legislators remains the same. Enterprises on OSNO have the right to include in the calculation of the tax base the entire amount of expenses associated with the storage of scrap metal, as well as its transfer for disposal or processing. “Simplers” and “simplers” can also reduce the cost of processing and storing waste.

We fill out a VAT return for transactions with scrap metal and aluminum

Then multiply the figure by the estimated rate of 20/120 and enter VAT in column 17 of the sales book. Calculate VAT even if you apply a special regime or are exempt from VAT under Article 145 of the Tax Code.

If the buyer works in the general mode and the goods are accepted for accounting, he simultaneously registers the invoice in the purchase book in order to accept the tax for deduction (clause 9 of Article 172 of the Tax Code). But companies in a special regime will not be able to make such a deduction. After all, they are not recognized as VAT payers.

When registering invoices, you must indicate new transaction type codes. Recommended transaction codes by the Federal Tax Service for registering invoices for the sale of scrap{amp}gt;{amp}gt;{amp}gt;

Postings for accounting for the sale of scrap metal in 2020

In order to understand the accounting procedure for scrap metal sales operations, let's look at a few examples.

Example No. 1. Accounting for sales of scrap from the seller

An agreement was concluded between MetalGrand LLC and Pogruzchik LLC, according to which MetalGrand sells scrap ferrous metals worth 1,200 rubles to Pogruzchik. without VAT. Based on the terms of the contract, the supplier independently calculates VAT and pays the tax to the budget.

Operations for the sale of scrap metal are reflected in the accounting records of MetalGrand with the following entries:

| Dt | CT | Sum | Description | A document base |

| 62 | 90.1 | 1,200 rub. | Sales of scrap metal to the buyer are taken into account | Agreement, acceptance certificate, invoice |

| 90.2 | 41 | 920 rub. | The cost of sold scrap metal was written off | Costing |

| 51 | 62 | 1,200 rub. | Payment for the shipped scrap metal has been received to the MetalGrand account | Bank statement |

conclusions

The VAT return for the first quarter must be completed taking into account the new requirements of the Federal Tax Service. If you have already reported for VAT, it is safer to submit an “adjustment”.

Sellers are VAT payers

They do not determine the tax base, so in Section 3 the sale of scrap metal is not shown. As part of the declaration, they must submit the title page, section 1 and section 9.

Buyers – tax agents – VAT payers

The accrual of tax and the deductions due to it must be reflected in section 3. The title page, sections 1, 3, 8 and 9 are submitted as part of the declaration.

Buyers – tax agents – VAT evaders

Indicate the amount of tax payable to the budget on line 060 of section 2. The new transaction code on line 070 of section 2 is 1011715. The declaration includes the title page, section 1 with dashes, as well as sections 2 and 9. Invoices for advance payment, VAT for which buyers accept deductions, are reflected in section 9 with a minus.

If you find an error, please select a piece of text and press Ctrl+Enter.

Sales of scrap metal are not subject to VAT

Commentary on Article 149 of the Tax Code of the Russian Federation. Transactions not subject to taxation (exempt from taxation)

Article 149 of the Tax Code of the Russian Federation contains a list of transactions that are not subject to taxation. This list is quite extensive. But for the most part it affects the sale (as well as the transfer, execution, provision for one’s own needs) of goods, work and services on the territory of the Russian Federation of a social nature. Among them: medical goods and services, services in the field of education for non-profit organizations to carry out training and production (in the areas of basic and additional education) or educational process, passenger transportation services, funeral services, sale of postage stamps and lottery tickets, carried out by decision of the authorized authority, services for the provision for use of residential premises in the housing stock of all forms of ownership, services provided by cultural and art institutions in the field of culture and art, as well as the sale of religious objects and religious literature, a number of banking transactions, provision of services by lawyers, execution by notaries notarial actions, services of sanatorium-resort, health and recreation organizations and others.

Moreover, when selling goods (work, services) provided for in paragraph 3 of Article 149 of the Tax Code of the Russian Federation, the taxpayer has the right to refuse benefits for a period of at least a year.

Federal Law No. 119-FZ of July 22, 2005 introduced a number of changes to Article 149 of the Tax Code of the Russian Federation, which established benefits for VAT payers.

Benefits for entrepreneurs involved in gambling business

Until January 1, 2006, legal entities engaged in the organization of betting and other risk-based games (including using slot machines) gambling business were exempt from VAT. Such a benefit was provided to them by subparagraph 8 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. Since January 1, 2006, a similar benefit has been provided to individual entrepreneurs.

But here we need to pay attention to such a nuance. The definition of gambling business is given in Article 2 of the Federal Law of July 31, 1998 N 142-FZ “On the Tax on Gambling Business”, which became invalid on January 1, 2004, and in Chapter 29 of the Tax Code of the Russian Federation “Tax on Gambling Business”, entered into force on January 1, 2004. In accordance with these documents, the gambling business is a business activity associated with the extraction of income by organizations or individual entrepreneurs in the form of winnings and (or) fees for gambling and (or) betting, which is not the sale of goods (property rights), works or services .

According to paragraph 2 of Article 153 of the Tax Code of the Russian Federation, when determining the tax base, revenue from the sale of goods (work, services) is determined based on all income of the taxpayer associated with payments for the specified goods (work, services) received by him in cash and (or) in kind forms, including payment in securities. Taking into account the fact that the gambling business is an activity that is not the sale of goods (works, services), there is no subject to value added tax when carrying out a gambling business.

Other types of activities not related to the gambling business, carried out by an individual entrepreneur, are subject to VAT in accordance with the generally established procedure. At the same time, he is obliged to keep separate records of income from these types of business activities and make mandatory payments for these types of business activities in accordance with the legislation of the Russian Federation.

Thus, individual entrepreneurs involved in the gambling business had the right not to pay VAT until January 1, 2006.

Benefit for notaries

Until January 1, 2006, tax authorities required notaries to pay VAT. Thus, in the letter of the Federal Tax Service of Russia dated October 19, 2005 N MM-6-03 / [email protected] it is said that in accordance with Article 143 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs are recognized as VAT payers. And according to paragraph 4 of paragraph 2 of Article 11 of the Tax Code of the Russian Federation, individual entrepreneurs are understood to be individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity, as well as private notaries. Therefore, for tax purposes, notaries are classified as individual entrepreneurs, which is confirmed by the Determination of the Constitutional Court of the Russian Federation dated 06.06.2002 N 116-O.

Thus, when notaries carry out operations recognized as subject to VAT taxation, they must calculate and pay tax to the budget in the generally established manner.

However, since January 1, 2006, the situation has changed. Federal Law No. 119-FZ of July 22, 2005 supplemented paragraph 3 of Article 149 of the Tax Code with subparagraph 15.1. This subparagraph states that VAT is not assessed on the performance of notarial acts and the provision of legal and technical services by notaries engaged in private practice in accordance with the legislation of the Russian Federation on notaries.

Sales of scrap metal are not subject to VAT

Federal Law No. 119-FZ of July 22, 2005 supplemented paragraph 3 of Article 149 of the Tax Code with subparagraph 24, which states that VAT is not assessed on the sale of scrap and waste of ferrous and non-ferrous metals.

We note that organizations that trade in scrap metal should be guided by the Federal Law of June 24, 1998 N 89-FZ “On Production and Consumption Waste”, as well as the Rules for the Management of Scrap and Ferrous Metal Waste, approved by the Decree of the Government of the Russian Federation of May 11, 2001 No. 369, and the Rules for the management of scrap and non-ferrous metal waste, approved by Decree of the Government of the Russian Federation of May 11, 2001 No. 370.

According to these Rules, organizations can accept scrap metal only from its owners upon presentation of documents proving their identity. Persons handing over scrap metal that does not belong to them, in addition to identification documents, must have a corresponding power of attorney from the owner of the scrap metal.

When accepting non-ferrous metal scrap, the person handing over this scrap must provide the receiving organization with a corresponding written statement. This application must indicate on what basis the applicant has the right of ownership of the scrap being handed over. Applications must be retained at the scrap metal facility for five years.

Scrap of non-ferrous metals cannot be accepted from individuals under 14 years of age. Such scrap may be accepted from persons aged 14 to 18 years with the written consent of their legal representatives - parents, adoptive parents or trustees. However, you can accept scrap non-ferrous metals from individuals who have reached the age of sixteen and have been declared fully capable in the prescribed manner.

Reception of scrap and waste of ferrous and non-ferrous metals is carried out by net weight, defined as the difference between the gross weight and the weight of the vehicle, containers and contamination. Organizations accepting scrap metal are required to conduct radiation monitoring and carry out incoming inspection of each batch of scrap metal for explosion hazards.

When accepting scrap metal, an acceptance certificate must be drawn up. The forms of this act are established in appendices No. 1 to the Rules for handling scrap ferrous and non-ferrous metals. The acceptance certificate is drawn up in two copies: one is given to the person handing over the scrap, and the second remains with the receiving organization.

Taxation of gifts

From January 1, 2006, paragraph 3 of Article 149 of the Tax Code of the Russian Federation was supplemented with subparagraph 25. According to this subparagraph, VAT is not assessed on the transfer for advertising purposes of goods (work, services), the cost of acquiring (creating) a unit of which does not exceed 100 rubles. Note that this benefit has rather negative consequences for taxpayers.

The fact is that the Ministry of Finance of Russia and the Federal Tax Service of Russia insist on charging VAT when distributing gifts as part of an advertising campaign. An example of this is letters from the Ministry of Finance of Russia dated March 28, 2005 N 03-04-11/66 and dated November 25, 2004 N 03-04-11/209. They indicate that in accordance with Article 39 of the Tax Code of the Russian Federation, sales mean the transfer of ownership, including on a free basis. In accordance with Article 146 of the Tax Code of the Russian Federation, sales of goods are subject to VAT.

The tax base is equal to the market price of goods.

But not all experts agree with this point of view. As an objection, the argument is made that the distribution of goods is an integral part of the organization's advertising expenses. However, it is impossible to document the moment at which ownership of gifts passes from the company to the recipients. Often, such arguments helped taxpayers in arbitration courts to prove that the distribution of goods for advertising purposes should not be subject to VAT (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated January 13, 2003 N KA-A40/8381-02 and Resolution of the Federal Antimonopoly Service of the North-West District dated December 14, 2004 N A05-3624/04-22).

The novelty introduced into Article 149 of the Tax Code of the Russian Federation indirectly confirms that gifts whose unit cost exceeds 100 rubles should be subject to VAT. It will not be easy to prove otherwise in court.

Please note that when advertising goods whose cost does not exceed 100 rubles, the enterprise is obliged to organize separate VAT accounting for purchased goods (works, services). This is the requirement of paragraph 4 of Article 170 of the Tax Code of the Russian Federation. However, if the cost of goods distributed as part of an advertising campaign does not exceed 5 percent of the total production costs, the entire VAT on purchased goods, works and services, as well as property rights can be deducted.

Particular attention should be paid to paragraph 4 of Article 149 of the Tax Code of the Russian Federation, according to which the taxpayer is obliged to keep separate records of transactions subject to and not subject to taxation, as well as paragraph 6 of Article 149 of this Code, which directly indicates that taxpayers must have the necessary licenses to carry out activities for subsequent avoidance of taxation under the conditions specified in this article.

In addition, it must be borne in mind that tax exemption in accordance with the provisions of this article does not apply when carrying out business activities in the interests of another person on the basis of commission agreements, commission agreements or agency agreements, unless otherwise provided by this Code.

‹ Comments to ST 148 of the Tax Code of the Russian FederationupComments to ST 150 of the Tax Code of the Russian Federation ›

Exceptions

Article 2 of Federal Law No. 335-FZ establishes that individuals who are not registered as individual entrepreneurs are exempt from the duties of a tax agent. Thus, you can freely buy scrap metal without paying VAT only for personal purposes. But when deciding to engage in entrepreneurial activity, even without registering an individual entrepreneur, an individual becomes obligated to remit value added tax.

Video about the “crowbar” tax:

VAT issues when buying and selling scrap metal

→ The article from the magazine “MAIN BOOK” is current as of June 8, 2020.

L.A. Elina, leading expert Since 2020, the sale of scrap metal is subject to VAT.

If the buyer is an organization or individual entrepreneur, in most cases it is he who must calculate VAT as a tax agent. During the 5 months that the new rule has been in effect, quite a few questions have arisen.

Our organization procures scrap metal by purchasing it from citizens who are not entrepreneurs. We then sell this scrap to another company.

Do we, as a tax agent, have to pay VAT when buying or selling scrap metal?

— When purchasing scrap metal from individuals who are not entrepreneurs, your organization should not calculate VAT as a tax agent. If you apply a special regime or have received an exemption from fulfilling your duties as a VAT payer under Art. 145 of the Tax Code of the Russian Federation, then when you sell scrap metal to the buyer-organization, you do not need to calculate VAT and pay it to the budget.

And neither you nor your buyer. In this case, you need to put o or make another similar entry in the contract and invoice; .

How is the sale of scrap metal reflected in accounting?

Buyers of scrap metal make payments separately based on the results of each quarter in which they received such goods.

Reduce the tax accrued during the quarter by the amount of deductions and increase by the amount of restored VAT. The tax agent - the buyer must increase the VAT charge on the tax amounts that he recovered when:

- received goods for which he had previously paid an advance payment and accepted tax as a deduction (or upon return of the advance);

- took into account the decrease in the cost or quantity of goods (corrected the amount previously accepted for deduction).

Such rules are established by paragraph 4 of subparagraph 3 of paragraph 3 and paragraph 6 of subparagraph 4 of paragraph 3.

The buyer agent has the right to reduce the tax accrued at the end of the quarter for the following types of deductions. They are listed in paragraph 4.1.

- Accrued VAT. You can use it only if two conditions are met. Firstly, the agent must be a VAT payer. Secondly, the purchased scrap metal must be registered and intended for use in transactions subject to this tax. If both conditions are met, then the deduction can be applied in the quarter in which VAT was calculated. The Tax Code allows deduction of “calculated” and not paid amounts.

Agents who apply special regimes are not VAT payers. Therefore, they are not entitled to this deduction. As do buyers who use the tax exemption under .

Scrap metal exporters who apply a 0 percent rate have a special VAT claim for deduction. Scrap metal is a commodity commodity. Therefore, if you purchased it for sale for export, then you can apply the deduction no earlier than on the last day of the quarter in which the documents confirming the right to the zero rate were collected. This follows from point 3. Explanations - in .

When returning the goods to the seller or prepayment to the buyer. Agents - buyers have the right to such it if they are VAT payers (clause 5 of Article 171 of the Tax Code). Wherein:

- if the buyer returns the goods received, he takes for deduction the tax that he previously accrued instead of the seller when shipping this goods;

- if the seller returns the advance payment, then the buyer accepts for deduction the tax accrued earlier (on the day the seller receives the advance payment).

- From the advance payment transferred by the agent. When an advance form of payment is provided, VAT is calculated from the advance payment transferred to the seller and accepted for deduction (paragraph 2, clause 12, article 171 of the Tax Code). This right can be used by everyone: VAT payers, those who apply special regimes, and those who use the right to tax exemption.

With prepayment for the seller. Agents first charge value added tax on the advance payment, and then accept it as a deduction. The right to deduction arises at the moment when the seller has shipped the goods for which he previously received an advance payment (Clause 8 of Article 171 of the Tax Code).

When the cost or quantity of goods decreases. Agents - buyers have the right to it instead of sellers. First they charge value added tax on the shipment. Then, if the cost or quantity of goods has been reduced, the excess tax charged is taken as a deduction. This follows from paragraph 13 of Article 171 of the Tax Code.

- the amount of the prepayment received (for the advance);

- cost of goods shipped (for shipment).

There are no special rules for processing and registering invoices when selling scrap metal. Until amendments have been made to it, please refer to the appendices to it. There are also new transaction codes for recording invoices in the sales ledger, purchase ledger and invoice ledger.

| The buyer is a tax agent, VAT payer | The buyer-agent applies a special regime or uses a VAT exemption | ||||

| The buyer made an advance payment | |||||

| Calculation from prepayment using the formula: VAT amount on advance | Advance amount | Advance amount | Rate 18% | Settlement rate (18/118) | |

Registers an invoice for prepayment in the sales book. Indicates the amount calculated by the formula. You do not create your own invoice for prepayment.

Acts as a buyer Accepts for deduction the tax calculated from the prepayment.Registers an invoice for prepayment from the seller with the calculated amount in the purchase book. He does not create his own invoice for the advance payment.

The seller shipped and the buyer purchased the goods The agent acts instead of the sellerAccrual from shipment according to the formula:

VAT amount on shipment

| Cost of shipped goods | Cost of shipped goods | Rate 18% | Settlement rate (18/118) |

Registers the shipment invoice in the sales ledger. Indicates the amount calculated by the formula. Does not create your own shipping invoice.

Accepts for deduction the tax calculated from the advance payment.

Registers an invoice for prepayment in the purchase book. Indicates the amount calculated by the formula. Doesn't create his own account.

Acts as a buyer Accepts for deduction the calculated amount of VAT on the shipment. Registers an invoice for it with the calculated amount in the purchase book. Has no right to deduction. Nothing is recorded in the purchase ledger. Restores the tax previously accepted for deduction from the advance payment. Registers an invoice for prepayment with the calculated amount in the sales book. He does not create his own account (subclause 3, clause 3, article 170 of the Tax Code).Record corrected and adjusting invoices in the books in the same manner. In situations where the buyer is not an agent, complete the paperwork in the general manner.

Sellers who pay VAT issue invoices for advance payments and shipments with the note “VAT is calculated by the tax agent.” The exception is the sale of scrap metal for export and to individuals. Agents - buyers do not prepare payment documents for prepayment and shipment of scrap metal themselves. This procedure follows from paragraph 8 of Article 161, paragraph 3.1 of Article 166 and paragraph 5 of Article 168 of the Tax Code.

The seller, a value added tax payer, registers invoices for prepayment and for shipment in his sales book. In column 2, indicate the transaction codes that are given in the attachment to the letter. For example, if you are registering a primary invoice for an advance payment, enter code 33 in column 2, and if for shipment, enter code 34. For transaction codes for other situations, see the table “Codes of types of VAT transactions.”

In column 14 (cost without tax) indicate:

In column 13b and column 17 (tax amount):

- make dashes if you are compiling a sales book on paper;

- indicate the number “0” if you maintain it electronically in the established format or upload information to section 9 of the declaration.

This order follows from the attachment to the letter.

When dealing with scrap metal, the seller, a VAT payer, fills out a purchase book if he registers an adjustment invoice to reduce the cost of shipments. In this case, indicate transaction type code 34 in column 2 of the book. In column 15, indicate the difference in cost. If you are compiling a purchase book on paper, put a dash in column 16 (amount of tax to be deducted).

The buyer - agent registers invoices for advance payment and for shipment in the sales book. Despite the fact that he acts both as a seller and as a buyer, all transactions for the calculation (recovery) of VAT are recorded in one book.

In column 2 of the sales book, indicate the transaction codes according to the appendix to the letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/480. For example:

- 41, when you register an invoice for an advance payment in order to charge tax on it instead of the seller;

- 42, when you register an invoice for a shipment in order to charge tax on it instead of the seller;

- 43, when you register an invoice for an advance payment, so that after the goods have been shipped by the seller, you can restore the deduction from the advance payment as a buyer.

In column 14 (cost without tax) enter:

- the amount of the prepayment, if you register an invoice for it;

- cost of goods upon registration for shipment.

In column 17 of the sales book, the buyer indicates the amount from the advance payment or the amount from shipment, which was determined by the calculation method. This procedure follows from the attachment to the letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/480.

Registers in the sales book an invoice for the advance received from the seller. Indicates the VAT amount calculated using the formula. He does not prepare his own invoice for the advance payment.

Accepts for deduction VAT calculated on the advance payment.Registers in the purchase book an invoice for an advance payment from the seller with the calculated amount of VAT. He does not prepare his own invoice for the advance payment. The seller shipped and the buyer purchased the goods. 3 The tax agent acts instead of the seller.

Calculate VAT on shipments using the formula:

| Cost of shipped goods | × | VAT rate (18%) | × | Settlement rate (18/118) |

Registers the shipment invoice received from the seller in the sales ledger. Indicates the VAT amount calculated using the formula. He does not prepare his own invoice for shipment.

The tax agent acts as a buyer4 Accepts for deduction the calculated amount of VAT on the shipment. Registers in the purchase book an invoice for shipment from the seller with the calculated amount of VAT.Restores VAT previously accepted for deduction from the advance payment. Registers in the sales book an invoice for an advance payment from the seller with the calculated amount of VAT. Does not have the right to deduct. Nothing is recorded in the purchase ledger.

Does not restore VAT accepted for deduction from the advance payment. Nothing is recorded in the sales book.

Record corrected and adjusting invoices in the books in the same manner.

Let us remind you that the form of this report was approved by order of the Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Also see.

“This category does not reflect the sale of scrap metal in the VAT return in 2019 in Section 3, since the tax base is not established. But there are three exceptions:

- para. 8 clause 8 art. 161 of the Tax Code of the Russian Federation (loss of the right to exemption from the duties of the payer or to a special regime);

- para. 7 paragraph 8 art. 161 of the Tax Code of the Russian Federation (inaccurate entry by the payer-seller in the “primary” of the phrase “Without VAT”);

- sale of these goods to ordinary individuals without individual entrepreneur status.

At the same time, transactions with scrap metal must be reflected in the sales book, as well as Sections 1 and 9 of the VAT return. When issuing adjustment invoices - in Section 8. Now about how to fill out a VAT return with scrap metal to tax agents as paying buyers.

Changes for sellers

Changes are also expected in the activities of scrap metal sellers: they need to issue an invoice for the amount excluding tax and put o.

For sellers who work under the terms of special tax regimes or tax exemptions when selling scrap metal and recycled aluminum, from the beginning in the contract and primary accounting documentation, the note “Without tax (VAT)” should be made. In this case, the tax agent does not have an obligation to pay it. The same mark is placed on documents for transactions that are not subject to VAT.

Important! Sellers who misrepresent and misuse o will have to pay it themselves.

In addition, the payment of VAT on scrap metal remains with the seller if:

- scrap metal is sold to an individual;

- scrap metal is exported;

- the right to exemption from tax or to apply a special tax regime has been lost.

Thus, you can avoid the need to pay VAT on scrap metal only by concluding an agreement with companies or individual entrepreneurs who are not included in the list of VAT payers (work under a simplified taxation system or other special regimes). But due to the innovations, experts predict an increase in scrap prices by the amount of the tax rate, so the introduction of amendments will affect all market participants, including entrepreneurs who, in fact, are not VAT payers.

How does a tax agent calculate taxes payable to the budget?

The VAT payable to the budget for the quarter, which is the tax period for the stipulated tax, must be calculated by the buyer of scrap metal - the tax agent using the following formula:

We have already talked about VAT calculation. Let's look at the other two indicators of the formula.

The buyer needs to restore VAT (paragraph 4, subparagraph 3, paragraph 3 and paragraph 6, subparagraph 4, paragraph 3, Article 170 of the Tax Code):

- upon receipt of metal scrap, on account of which an advance was previously transferred and VAT was accepted for deduction;

- return of advance;

- reducing the cost/quantity of scrap by agreement with the seller, i.e. when adjusting the amount of tax previously claimed for deduction.

VAT deductions for the purchaser of scrap are described in clause 4.1 of Art. 173 NK.

is the short name of the tax agent

is the short name of the tax agent