The VAT return reflects all information related to the calculation of value added tax. There are sections in the VAT return where you need to fill out the VAT amount for crediting and deducting. There are also sections for tax agents to reflect VAT on exports and imports, as well as transactions that are not subject to taxation.

In order to ensure that tax inspectors do not raid the company for an inspection, it is necessary to fill out the VAT return correctly.

VAT return structure

The VAT return consists of twelve sections. When filling out a VAT return, there is no need to complete all sections. The required sections to be filled out are the title page and the first section, the remaining sections are filled out as necessary, it all depends on what VAT transactions were carried out at the enterprise in the reporting period in which the VAT return is submitted. Let's look at each section separately in table form:

| Section title | Information that is reflected in the section |

| Title page | Information about the enterprise is indicated, namely: INN, KPP, Full name, OKVED code, contact telephone number, and the tax period must also be indicated. |

| Section No. 1 | Reflects the amount of tax that is payable to the budget for the taxpayer |

| Section No. 2 | The amount of tax that is payable to the budget according to the tax agent is reflected. |

| Section No. 3 | Calculation of the amount of tax that must be paid to the budget for those transactions that are subject to taxation |

| Section No. 4 | Calculate the amount of tax that falls under the 0% rate with supporting documents |

| Section No. 5 | Calculation of the amount of tax deduction for sold goods, works, services, at a rate of 0% based on supporting documents |

| Section No. 6 | Calculation of the amount of tax on the sale of goods, works, services at a rate of 0%, but not documented |

| Section No. 7 | Transactions that are not subject to taxation or are exempt from VAT are reflected. |

| Section No. 8 | Displays information from the purchase book that is reflected for the current reporting period |

| Section No. 9 | Reflects data from the sales book that is reflected for the reporting period |

| Section No. 10 | Reflects data from the book of issued invoices for transactions that are associated with persons who provide forwarding services, developers and commission agents and agents working for the benefit of third parties |

| Section No. 11 | Reflects data from the book of received invoices for transactions that are associated with persons who provide forwarding services, developers and commission agents and agents working for the benefit of third parties |

| Section No. 12 | availability of invoices with allocated VAT presented to counterparties. |

What determines the emergence of the right to deduct advances received?

Receipt of payment (in full or partial) on account of a later shipment subject to tax obliges the seller to allocate tax from the amount of this payment (subclause 2, clause 1, article 167 of the Tax Code of the Russian Federation). This procedure is accompanied by the creation of an advance invoice (clause 3 of Article 168 of the Tax Code of the Russian Federation), which gives the buyer the opportunity to apply a deduction during the period of transfer of funds. The seller also acquires the right to use the deduction (clause 8 of Article 171 of the Tax Code of the Russian Federation), but only at a different time. This moment will occur during the period of shipment of what was sold with the condition of prepayment (clause 6 of Article 172 of the Tax Code of the Russian Federation) or during the period of cancellation of the agreement on future shipment, which will result in the return of the advance (clause 5 of Article 171 of the Tax Code of the Russian Federation).

What is the reason for the possibility of such a deduction from the seller? With the fact that there is an obligation to create an invoice at the time of shipment (clause 1 of Article 168 of the Tax Code of the Russian Federation). The use of this deduction eliminates double taxation of income received upon sale.

For details on the specifics of creating an advance invoice and entering it into the purchase/sales books, read the article “Acceptance for deduction of VAT on advances received.”

How to submit a VAT return

The VAT return is submitted electronically; for this, the taxpayer must register in the system for providing tax and accounting information. After which the taxpayer will be provided with an electronic signature, with which he will be able to sign documents and send them to the tax office.

The date of reporting is considered to be the date of dispatch, where the taxpayer receives a response about the fact of its acceptance. After a desk audit, the taxpayer receives an acceptance response in the form of a receipt for acceptance of the reporting or a refusal to accept the reporting in the form of a notice of refusal. If there was a refusal, then it is necessary to adjust the previously sent declaration and send it to the tax office again.

Important!!! If, when sending reports, there are technical failures in the system or operator service, then there is no reason for the accountant to send reports untimely, but this will need to be proven.

Filing reports on paper is permitted only to tax agents who are not VAT payers or are exempt from paying it.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Quarterly submission of declarations

To submit a VAT return in 2020. it is necessary to comply with the deadlines established by the Tax Code. The deadline is the last day of the month following the reporting day; if it falls on a weekend, then on the first working day. Thus, let's look at the time frame for each quarter:

| Deadline | For what period |

| until 04/25/2018 | 1st quarter |

| until July 25, 2018 | 2nd quarter |

| until October 25, 2018 | 3rd quarter |

| until 01/25/2020 | 4th quarter |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Line 070 in the VAT return

The VAT return consists of 12 sections, and almost every section has line 070.

But in each section this line has its own specifics and is filled out according to the appropriate rules. When filling out a VAT return, it is not necessary to fill out all sections; there are sections that do not require completion. But section No. 3 is always filled out and under any circumstances.

Line 070 of Section 3 reflects the amount of VAT calculated on advances paid by customers. Then, at the time of sale of goods (works, services), the advance payment is offset and this VAT is claimed for deduction.

Before entering data on advance VAT in line 070, the buyer must:

| The seller must attribute the advance to future sales, subject to VAT at a rate of 10 or 18% | To do this, you need to do the following: Deduct VAT from the advance received on the day it is received; Determine the amount of VAT using the calculation method; Issue an invoice to the buyer within five days from the date of receipt; The advance payment and the corresponding tax amount are reflected in the sales book and in line 070 of section 3 of the VAT return |

| Sales of goods, works or services are taxed at a rate of 0% or are generally exempt from tax. | In this case, VAT is not charged on the advance payment, and no VAT invoice is issued. And the data on the advance received and VAT invoiced is not reflected in line 070. |

Results

If in the reporting quarter a company or individual entrepreneur carried out transactions subject to VAT, section 9 must be included in the declaration. It contains information from the sales book and details the general indicators of the declaration. The absence of a completed section as part of a non-zero declaration will not allow it to pass logical control when audited by the tax office.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. MMB-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

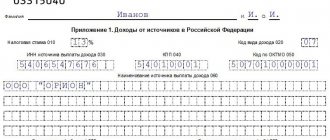

An example of filling out line 070 in the VAT return in section No. 3

Limited Liability Company "OknaPlast" is engaged in wholesale supplies of plastic windows according to customer orders. Contracts are concluded with the buyer only upon provision of an advance payment in the amount of 10% to 30% of the contractual delivery amount.

In the second quarter of 2020, OknaPlast LLC:

- We sold goods in the amount of 29,688,800 rubles. (including VAT = RUB 4,528,800);

- An advance payment was received in the amount of RUB 14,903,400. (VAT = 14,903,400 rubles × 18 / 118 = 2,273,400 rubles);

- Purchases from a supplier of plastic and other components in the amount of RUB 10,055,960, including VAT = RUB 1,533,960.

Therefore, in the second quarter:

- accrued VAT amounted to RUB 6,802,200. (RUB 4,528,800 + RUB 2,273,400);

- VAT deductible: RUB 1,533,960;

- VAT payable: RUB 6,802,200. – 1,533,960 rub. = 5,268,240 rub.

An example of checking the completion of line 170 (with reflection in accounting accounts)

Conditions

In the 4th quarter of 2020, the company received an advance from the buyer - 50% of the contract amount in the amount of RUB 590,000, including VAT 18%. The sale was carried out in accordance with the contract for a single shipment in the 1st quarter of 2020 in the amount of RUB 1,180,000, including VAT 18%.

Exercise

Post the specified conditions among the accounting accounts, show their quarterly reflection in the analysis of account 68.2 and VAT returns.

Calculations

590,000.00 / 118 × 18 = 90,000.00 - VAT amount on prepayment.

1,180,000.00 / 118 × 18 = 180,000.00 - VAT amount on shipment.

180,000.00 – 90,000.00 = 90,000.00 — VAT on sales payable to the budget.

Solution

| Debit | Credit | Amount (rub.) | Reflection in the declaration | |

| 4th quarter 2020 | ||||

| 590 000,00 | gr. 3 page 070 | Advance received | ||

| 76.AB | 90 000,00 | gr. 5 page 070 | VAT charged on advance payment | |

| 1st quarter 2020 | ||||

| 1 180 000,00 | gr. 3 page 010 | Product shipped | ||

| 590 000,00 | Prepayment credited | |||

| 180 000,00 | gr. 5 page 010 | VAT charged on shipment | ||

| 76.AB | 90 000,00 | gr. 3 page 170 | VAT on advance payment is deductible | |

Analysis of account 68.2 for the 4th quarter of 2020

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

| Check | From credit | To debit |

| Balance at the beginning of the period | 0,00 | |

| 76.AB (page 070) | 90 000,00 | |

| Period transactions | 90 000,00 |

Analysis of account 68.2 for the 1st quarter of 2020

| Check | From credit | To debit |

| Balance at the beginning of the period | 0,00 | |

| 76.AB (p. 170) | 90 000,00 | |

| 90.3 (page 010) | 180 000,00 | |

| Period transactions | 180 000,00 | 90 000,00 |

| balance at the end of period | 90 000,00 |

A desk audit of the completion of lines 070 and 170 of VAT returns will establish the compliance of the declared amounts.

***

Line 170 is part of the second part of section 3 of the VAT return “Tax deductions”. It reflects deductions from shipments for which the buyer has previously transferred an advance payment to his supplier. The basis for the deduction is the advance invoice issued by the seller to the buyer upon receipt of advance payment.

It is important to understand that the amount of tax deduction for a specific shipment (line 170) cannot be greater than the amount of VAT previously allocated in the prepayment and indicated in the advance invoice (line 070).

Currently, tax authorities have set up automatic verification of this line, so the supplier needs to learn how to correctly fill out and check the amount of line 170.

What are the penalties for submitting a VAT return on time?

If an enterprise or individual entrepreneur for some reason does not submit a VAT return on time, then he faces penalties, which amount to:

- 1000 rubles – if the tax has been paid or the amount according to the declaration is zero;

- If the tax has not been paid, then 5% of the amount indicated in the declaration for each month of delay, but not more than 30% and not less than 1000 rubles.

Important!!! An error in the VAT return format is not punishable by a fine. In the Resolution of the Arbitration Court of the North Caucasus District dated December 2, 2016 No. F08-9002/2016, the judges noted that clause 1 of Art. 119 of the Tax Code of the Russian Federation provides for a fine for failure to submit a declaration as such. Violation of the declaration format does not fall under this rule.

Where to find a description of the scheme for filling out section 9

The algorithm for filling out section 9 of the VAT return is described in paragraphs. 47–48 of the order of the Federal Tax Service of Russia “On approval of the tax return form...” dated 10.29.2014 No. MMB-7-3 / [email protected] (now applied as amended on 12.28.2018).

For clarity, each paragraph of the order related to section 9 will be deciphered separately:

Appendix No. 1 to Section 9 must be completed in the case when changes were made to the sales book during the reporting period. In this case, line 001 (a sign of the relevance of previously submitted information) is filled in in a manner similar to that described above. The remaining lines of the application are filled in in the following order:

The materials on our website will help you fill out your tax returns:

- “How to fill out an income tax return”;

- “Sample of filling out tax return 3-NDFL”.

Procedure for filling out the declaration

New declaration, approved. Order No. 558, as already noted, includes a title page, traditional sections (1 - 7), as well as new sections (8 - 12).

In the new declaration, as in the previous one, the title page and section 1 are submitted by all taxpayers (tax agents), and sections 2 - 7, an appendix to section 3, as well as new sections 8 - 12 and appendices to sections 8 and 9 are included in declarations only when carrying out relevant operations.

The general requirements for filling out the declaration have not changed.