The main goal of commercial enterprises is to make a profit. Every taxpayer wants to reduce the amount of taxes they pay. In this article we will tell you why optimization of income tax is one of the available methods for achieving this goal.

You can achieve what you want in two ways:

- By reducing the size of the tax base.

- Using tax regulation mechanisms to the maximum.

Tax legislation obliges all commercial enterprises to pay income tax, and therefore it is this type of tax that many companies try to optimize. The peculiarities of income tax make it possible to choose a simple approach to the optimization scheme:

- no minimum tax to pay,

- availability of several options for using expense items.

Optimization of income tax is legal and can be carried out through the following areas:

- changing the company's accounting policy when calculating income tax,

- individual solutions when choosing the type of contracts with clients,

- widespread use of tax breaks and deferments,

- conducting an audit of expenses for servicing fixed assets.

An advantage for any entrepreneur will be awareness of income tax issues - this will help to avoid mistakes when filling out tax returns and not commit an illegal act. Optimization of income tax is an important management decision due to the fact that this type of tax affects the financial results of the company based on the adopted development strategy.

Ways to optimize income tax

It is necessary to understand the difference between tax planning and evading the transfer of income tax to the country's budget. Tax planning is understood as reducing the amount of tax through a variable interpretation of the norms of tax legislation, which does not imply a violation of the law, but is not, in the traditional sense, the behavior of a law-abiding citizen. This is a civilized way of protecting the economic interest of the taxpayer, as opposed to tax evasion or tax circumvention.

As a result, the ability of business owners to engage in tax planning will be beneficial to the state, because it improves the financial and economic performance of the entrepreneur and makes it possible to spend money on the development of the enterprise. This means that the company will pay higher taxes in the future.

When optimizing income tax, the entire set of taxes paid by a businessman is taken into account in order to find the best option for taxing the company's results of activity. Income tax optimization consists of considering:

- object of taxation,

- tax base,

- tax period,

- tax rates,

- calculation rules,

- payment deadlines.

Russia has agreements with many countries to avoid double taxation, and this can be taken advantage of when the income tax rate in another country is lower than in the Russian Federation. Tax legislation requires enterprises to draw up an order approving accounting policies, which must reflect the following points:

- Method for calculating income and expenses.

- Rules for payment of basic income tax and advance payments on it for separate divisions of the enterprise.

- Tax accounting for property subject to depreciation.

- The procedure for forming reserves for doubtful debt obligations.

- Rules for creating a reserve for warranty repairs and maintenance.

- Rules for paying corporate income tax. Read also the article: → “Accounting and tax accounting for income tax (features of calculation) + infographics.”

Companies also have the right, for planning purposes, to develop a contractual policy that includes the choice of:

- counterparties,

- type of contracts,

- individual clauses of the contract.

This can play a significant role. For example, property transferred under a gift agreement is considered to be issued free of charge for tax purposes, which means it is non-operating income.

https://youtu.be/z8Ac7HO_grY

Tax optimization - usually this term refers to activities carried out by a taxpayer in order to reduce tax payments.

The actions of Prestige-Remont LLC to determine optimal volumes are called the corporate tax management system. However, in practice, minimum payments are not always optimal. For example, a company that stands out from the crowd by paying too little risks incurring additional checks, which is fraught with additional costs. Tax management involves optimizing the burden and structure of taxes from all points of view.

Tax optimization is only part of a larger, main task facing the financial management (financial management) of Prestige-Remont LLC. The main task of financial management is financial optimization, i.e. choosing the best way to manage the financial resources of the enterprise Prestige-Remont LLC, as well as attracting external sources of financing.

The company Prestige-Remont LLC can be offered certain tax optimization schemes.

All optimization methods are combined into optimization schemes. None of the methods by itself brings success in tax planning; only a scheme drawn up competently and taking into account all the features allows you to achieve the intended result; on the contrary, a poor-quality tax optimization scheme can cause significant harm to the company. Before implementation, any scheme is checked for compliance with several criteria: reasonableness, efficiency, compliance with legal requirements, autonomy, reliability, harmlessness.

Efficiency is the complete use of all tax minimization opportunities in the scheme. Compliance with legal requirements - taking into account all possible legal consequences of using the scheme, thoughtful mechanisms for responding to changes in current legislation or actions of tax authorities.

Autonomy - the scheme is considered from the point of view of complexity in management, controllability in application and complexity in implementation.

Reliability is the stability of a scheme to changes in external and internal factors, including the actions of business partners.

Harmlessness involves avoiding possible negative consequences from using the scheme within the Prestige-Remont LLC enterprise.

You can also propose minimizing tax payments.

Tax optimization involves: minimizing tax payments (in the long and short term for any issue) and avoiding penalties from fiscal authorities, which is achieved by correct calculation and timely payment of taxes.

Tax minimization is a misleading term. In reality, of course, the goal should not be to minimize (reduce) taxes, but to increase the enterprise’s profit after tax.

The goal of tax minimization is not to reduce any tax as such, but to increase all financial resources of the enterprise. Optimizing the tax policy of Prestige-Remont LLC allows you to avoid overpaying taxes at any given time, albeit not by much, but, as you know, today’s money is much more expensive than tomorrow’s. In conditions of high tax rates, incorrect or insufficient consideration of the tax factor can lead to very unfavorable consequences or even cause bankruptcy of the Prestige-Remont LLC enterprise. The situation when an enterprise pays taxes “head-on”, i.e. following the letter of the law formally, without reference to the specifics of one’s own business, is becoming increasingly rare and indicates that no one worked on taxes at the enterprise.

Reducing tax payments only at first glance leads to an increase in the profit of the enterprise. This dependence is not always so direct and immediate. It is quite possible that a reduction in some taxes will lead to an increase in others, as well as to financial sanctions from regulatory authorities. Therefore, the most effective way to increase profitability is not to mechanically reduce taxes, but to build an effective enterprise management system; As practice shows, this approach provides a significant and sustainable reduction in tax losses over the long term.

The state provides many opportunities to reduce tax payments. This is due to the tax benefits provided for in the legislation, and the presence of different tax rates, and the existence of gaps or ambiguities in the legislation, not only due to the low legal qualifications of legislators, but also due to the impossibility of taking into account all the circumstances that arise when calculating and paying a particular tax.

It is always necessary to remember the significant difference between three similar methods of optimizing the tax press: tax planning, tax evasion and tax avoidance. At first glance, the difference is not significant, but the implementation paths have a significant difference.

Tax evasion (tax evasion) is an illegal way to reduce one’s tax obligations for tax payments, based on the deliberate, criminally punishable (Article 198 of the Criminal Code of the Russian Federation for individuals, Article 199 for management and responsible legal entities) use of methods of concealing income and property from the tax authorities, creating fictitious expenses, as well as deliberate (intentional) distortion of accounting and tax reporting. There is no legal way to “evade taxes.” Any purposeful actions of the subject that violate the current legislation, as a result of which the budget in one way or another does not receive the amounts of taxes due to it by law, are harmful and illegal and lead to tax or criminal liability.

It is illegal to intentionally fail to report income on your tax return. This is tax evasion.

Tax planning is a legal way to reduce tax liabilities, based on using the opportunities provided by tax legislation by adjusting your business activities and accounting methods. This is the use of all legal measures to minimize taxes.

Tax avoidance - minimizing tax obligations by legal use of conflicts and shortcomings in regulatory legislation; at the same time, the taxpayer fully discloses his accounting and reporting information to the tax authorities. This method makes it possible in the future to quite successfully challenge tax authorities’ claims to the chosen tax policy in arbitration court, based on the principle “what is not prohibited by law is permitted.” Both of the latter methods, from a legal point of view, do not imply a violation of the legitimate interests of the budget. True, tax avoidance carries additional risks associated with enormous difficulties in litigation with tax authorities.

Depending on the time period, tax optimization can be divided into current and future.

Although the legislation of the Russian Federation provides for the right of the taxpayer to implement measures to protect property rights, as well as the right to take actions aimed at reducing tax liabilities, nevertheless, this right cannot be used unlimitedly.

There are several common tax evasion methods that are illegal in nature. The most common method is the non-receipt of revenue and inventory, for example, the sale of unaccounted goods for cash. Another way is to operate a company without registration (presupposes the previous one).

A key feature of tax evasion schemes based on unrecorded cash flows is the systematic use of fictitious transactions.

In some cases, officially earned non-cash money in a bank account is cashed out or exchanged for unaccounted for cash. We are talking about concluding a fictitious contract for the performance of work or provision of services. Thus, the enterprise avoids taxes on wages and distribution of profits and receives unaccounted cash, which is usually used to pay “black” wages to employees, to generate personal income for managers and owners of the relevant taxpayer enterprises, as well as for bribes to officials, “kickbacks” to representatives large clients for profitable orders, etc.

Another case is de-cash, or the exchange of unofficially earned cash for non-cash money legally credited to the account of the relevant company, which is identical to the concept of money laundering. In this case, two contracts are concluded - one for the purchase of goods by a special company from a wholesaler, the other for the supply of the same goods to a retailer.

Both contracts are fictitious, because the product is actually transferred directly from the wholesaler to the retailer.

Another way to optimize tax payments is tax planning.

Tax planning refers to the purposeful activities of the taxpayer, aimed at maximizing the use of all the nuances of existing tax legislation in order to reduce tax payments to the budget.

The goals of tax planning are correlated with the strategic (commercial) priorities and interests of the enterprise, with the costs of its implementation and with the severity of the tax burden. The correct approach to competent tax planning is to use benefits in combination with other techniques, often more organizational than financial or accounting.

Tax planning is one of the main components of the financial planning process. There is a preliminary calculation of options for the amounts of direct and indirect taxes, turnover taxes based on the results of general activities and in relation to a specific transaction or project, depending on the various legal forms of its implementation. Tax planning is available to anyone, but it should be carried out not after any business transaction or the end of the tax period, but before that.

External planning can be carried out using several methods: replacing the tax entity, replacing the type of activity, replacing the tax jurisdiction.

The method of replacing a tax entity is based on the use, for tax optimization purposes, of an organizational and legal form of doing business that is subject to a more favorable tax regime. For example, the inclusion of “disabled” companies in the business scheme - those that have benefits as a society for the disabled or that have a share of disabled people in the workforce of more than a certain level - allows you to save on direct taxes.

The method of changing the type of activity of a tax subject involves a transition to the implementation of such types of activities that are taxed to a lesser extent compared to those that were carried out. An example of the use of this method would be the transformation of a trade organization into a sales agent or commission agent working on someone else’s instructions with someone else’s goods for a certain fee or the use of a trade credit agreement - for reasons of easier accounting and less taxation.

The method of replacing tax jurisdiction is to register an organization in a territory that provides preferential taxation under certain conditions. The choice of place of registration (territory and jurisdiction) is important given the heterogeneity of the territory. When each region of the country is vested with the authority to formulate local legislation and subjects have some freedom in this field, each territory uses this freedom in its own way. Hence the differences in the amount of tax deductions. Development of a company development strategy implies the possible organization of affiliation structures in external zones with minimal tax burden (offshore).

Tax legislation provides the taxpayer with many opportunities to reduce the amount of tax payments through internal planning, in connection with which general and special methods can be distinguished. Common methods include: selection of accounting policies, development of contractual schemes, use of working capital, benefits and other tax exemptions. Among the special ones: the method of replacing relations, the method of dividing deviations, the method of deferring tax payment and the method of direct reduction of the object of taxation.

The choice of an organization's accounting policy, developed and adopted once a financial year, is the most important part of internal tax planning. This document confirms the validity and legality of a particular interpretation of regulatory legal acts and actions in relation to accounting.

One of the trivial and frequently used methods of tax optimization is to reduce taxable profit through the use of accelerated depreciation and (or) revaluation of fixed assets. Thus, if the possibilities for accelerated depreciation in Russia are small, then revaluation of fixed assets is a fairly effective way to save on income tax and property tax.

Benefits are one of the most important details of internal and external tax planning. Theoretically, benefits are one of the ways for the state to stimulate those areas of activity and areas of the economy that are necessary for the state to the extent of their social significance or due to the impossibility of state financing. In practice, most benefits quite strictly limit the segment of their use. Benefits and their application largely depend on local laws. As a rule, local laws provide a significant part of the benefits.

Some benefits, seemingly not directly related to the area of activity, become so-called indirect benefits; companies are included in the list of beneficiaries for formal reasons.

Tax legislation provides for various benefits: exemption from taxes for individuals or categories of payers; lowering tax rates; targeted tax benefits, including tax credits (deferred collection of taxes), other tax benefits.

Special tax optimization methods can be recommended to the Prestige-Remont LLC enterprise.

Special tax optimization methods have a narrower scope of application than general ones, but can also be applied to all enterprises.

The method of replacing relationships is based on the multivariate ways of solving economic problems within the framework of existing legislation. The subject has the right to prefer any of the acceptable options both from the point of view of the economic efficiency of the operation and from the point of view of tax optimization.

The variance separation method is based on the replacement method. In this case, not the entire business transaction is replaced, but only part of it, or the business transaction is replaced by several transactions. The method is used, as a rule, when a complete replacement does not achieve the expected result.

The method of deferring tax payment is based on the ability to postpone the moment of occurrence of an object of taxation to the next calendar period. In accordance with current legislation, the deadline for paying most taxes is closely related to the moment the object of taxation arises and the calendar period. Using elements of the replacement method and the division method, you can change the deadline for paying the tax or part of it for a subsequent period, which will significantly save working capital.

The method of direct reduction of the object of taxation is aimed at reducing the size of the object subject to taxation, or replacing this object with another one, subject to a lower tax or not taxed at all. The object can be both business transactions and taxable property, and the reduction should not have a negative impact on the business activity of the entrepreneur.

Classification of taxes in order to minimize them.

The classification is based on the position of the tax relative to the cost price.

1. Taxes included in the cost price. Reducing such taxes leads to a decrease in production costs and an increase in income taxes. As a result, there is an effect from minimizing such taxes, but it is partially offset by an increase in income tax.

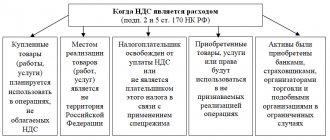

2. Taxes outside the cost price (VAT). Minimizing VAT payments consists not only in minimizing revenue (on which VAT is paid), but also in maximizing VAT, which is offset (VAT paid by the entire chain of suppliers) and compensated to the company.

3. Taxes above cost (income tax). For these taxes, one should strive to reduce the rate (by changing the entity from a legal entity to an individual or jurisdiction) and formally reduce the tax base. In this case, it is possible to increase taxes “inside” the cost.

4. Taxes paid from net profit. For these taxes, they strive to reduce the rate and tax base.

Tax avoidance.

The application of the method “what is not prohibited by law is permitted” until recently in Russia was limited by the “principle of taxation”. It assumes that all objects of taxation should be subject to taxes, with the exception of those that are directly listed as such in the law. The principle implies that the taxpayer himself will have to prove that he did not pay the tax on completely legal grounds. It’s up to the authorities to believe him or not.

However, from the moment the Tax Code of the Russian Federation came into force, the “principle of presumption of correctness” applies to the taxpayer. All irremovable doubts, contradictions and ambiguities of legislative acts on taxes are interpreted in favor of the taxpayer. But the principle does not fully apply (for example, according to Article 40 of the Tax Code of the Russian Federation, the tax inspectorate can determine the price of transactions for tax purposes itself and recalculate all taxes from this price). And the taxpayer in this case must prove that he is right.

This is why tax avoidance, although it seems so tempting, due to the numerous gaps and contradictions contained in the legislation and due to the principle of the presumption of correctness, in practice the taxpayer must in this case establish very good relations with the tax office. Otherwise, proving that you are right may turn out to be too expensive.

Prestige-Remont LLC adheres to a schedule for drawing up declarations in the organization and submitting them to the tax authorities. The taxman is responsible for late tax returns and fines are applied for failure to comply with the schedule.

Conclusion

The history of taxes is as old as the existence of the state. And as long as they exist, taxpayers have made many efforts to reduce their payments. Entrepreneurs, managers and ordinary taxpayers view taxes as losses for business. The state, for its part, seeks to influence its citizens with suggestions that taxes are the payment for a civilized society (this is the inscription on the facade of the US Internal Revenue Service) and that they allow society to fight the so-called market failures and finance capital investments in those areas where private business does not rush due to the long payback period of the project, and they pay for the creation of public goods. In any case, it turns out that it is extremely difficult to create a fair tax system in which everyone makes their fair contribution, it is impossible to even assess the contribution of everyone, and society faces the problem of shifting the tax burden.

A confrontation arises between the interest of taxpayers in avoiding what they consider to be unnecessary tax payments and the interest of the state in replenishing the state budget and stopping tax evasion. The existence of special government bodies and punitive measures provided for in legislation does not allow the average taxpayer to change the amount of taxes paid with impunity and at their own request, so taxpayers have to undertake special activities called tax optimization. One of the most serious problems of the Russian economy in the transition period of its development is the state’s lack of financial resources, caused to a large extent by low tax revenues to budgets of all levels. Without implementing a set of measures to increase tax collection, it is impossible to carry out a structural restructuring of the Russian economy, increase investment activity, and solve pressing social problems in society.

It is quite obvious that increasing the fiscal focus of tax reform in relation to those enterprises that regularly pay or at least try to pay taxes is futile; moreover, practice has shown that for this category of payers it is necessary to reduce the tax burden.

In these conditions, the main attention of both the legislative and executive authorities and fiscal authorities should be directed precisely at those who, by hook or by crook, hide their income. First of all, we are talking about enterprises, firms and entrepreneurs working in the field of trade, public catering, consumer services, repair, construction and other types of activities.

In this thesis, the main aspects of accounting for settlements of an enterprise with the budget for taxes are studied, the existing tax system of the Russian Federation is considered, the concept of tax reporting and tax accounting is given, the main objectives of which are the formation of complete and reliable information on the procedure for generating data on the amount of income and expenses of the organization, determining the size of the tax base of the reporting tax period, as well as providing this information to internal and external users to monitor the correctness of calculation, completeness and timeliness of income tax payments to the budget.

Practical material is based on data from Prestige-Remont LLC. Documents of this enterprise are presented in the appendices. Accounting at Prestige-Remont LLC should be organized in such a way as to ensure a continuous reflection of the facts of economic activity in chronological order.

To do this, the company needs to develop instructions for document flow and the sequence of operations for the formation of tax accounting indicators. The thesis study examines in most detail the procedure for calculating value added tax and property tax, and presents the corresponding calculations confirming the data of tax returns.

In a separate chapter of the work, an analysis of the tax payments of the enterprise was carried out, the structure of tax payments, dynamics, changes in the amount of taxes paid were studied, and the level of the tax burden of the enterprise was calculated.

The thesis was written using current legislative and regulatory documents, as well as special literature containing information on the topic of the work.

Tax optimization methods for individuals

Individuals can use 3 legal methods for optimizing income tax (difficulties may arise in proving the validity of their use):

- Through tax deductions (treatment, study, purchase of real estate, etc.).

- By registering an employee as an individual entrepreneur, this will help save on taxes if a simplified taxation system is chosen.

- By registering part of your salary as financial assistance (there is a monthly limit).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Conclusion

The law provides businessmen with many opportunities to optimize their income tax.

Those who use special tax regimes or are engaged in “socially significant” activities may not pay this tax at all.

For certain types of income (for example, from dividends or securities) and for residents of special economic zones, reduced rates are provided.

All other taxpayers can “balance” their costs by creating reserves or using accelerated depreciation.

Methods for optimizing income tax for legal entities

There are also legal methods for optimizing income tax for legal entities:

- Creation of reserves (uniform distribution of income tax throughout the year - allows you to avoid peak deductions during holidays, identification of debts, repairs of operating systems).

- Optimization of some tax accounting items (selection of a method for accounting and recording revenues and expenses that is most beneficial in terms of paying taxes).

- Transfer of the tax base to subsidiaries (profit is transferred to a company with a preferential income tax regime with the obligatory withdrawal of it from there without any tax burden).

- The use of temporary differences when calculating tax and its subsequent transfer to a new period.

- Transition to a preferential tax regime (so that there is no income tax, or that there is a legal way not to pay it).

- Division (contracts for the provision of a large range of services can be divided into several agreements, taking into account the non-taxation of income tax on some work).

- Optimization of depreciation charges (approval of an increasing coefficient for fixed assets operating around the clock, purchase of expensive equipment in parts, depreciation bonus).

- VAT refund as a credit against income tax.

- Application of debt documents (bills, sureties, etc.).

- Adjustment of contracts (part of the expenses can be attributed to the current period at a time).

- Optimization of cost accounting, division into direct/indirect.

- Optimization of production costs (cost control).

- Planning of expected profit.

Optimization of income tax through the creation of a reserve for doubtful debts

Most businesses have outstanding accounts receivable. Companies can insure themselves against tax losses that will occur due to debtors' failure to fulfill their debt obligations by creating a reserve for doubtful debts. This means that the company will reduce its obligations to the budget to transfer amounts of tax on profits that have not yet been received.

Doubtful debt from the point of view of tax legislation is a debt that is not paid within the period specified in the agreement and is not secured by collateral, a bank guarantee or surety.

Legal reserve formation scheme:

- Include the possibility of creating a reserve in the accounting policy documents (recommended).

- Conduct an inventory of accounts receivable as of the last day of the reporting or tax period.

- Calculate the reserve:

- if the debt arose more than 90 days ago, the amount includes the debt identified during the inventory;

- if the debt appeared between 45 and 90 days ago, the amount includes 50% of the debt identified during the inventory;

- if the debt arose less than 45 days ago, the amount of the debt does not increase.

There are a number of requirements for implementing this optimization method:

- An enterprise must determine income and expenses using the accrual method.

- The amount of the reserve should not exceed 10% of the amount of revenue for the entire reporting (tax) period.

- The formation of the reserve amount must be supported by a calculation-certificate from the accounting department, as well as a tax register (the amount of deductions goes to non-operating expenses on the last day of the reporting period).

- The method is used only in cases where it is necessary to cover losses from bad debts (impossible to collect).

Accounting entries:

| Operation | DEBIT | CREDIT |

| Creation of a reserve for doubtful debts | 91 “Other income and expenses” | 63 “Provisions for doubtful debts” |

| Write-off of unclaimed debts previously recognized as doubtful | 63 “Provisions for doubtful debts” | 91 |

Receivables written off at a loss are accounted for in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” for 5 years in case the debtor has the funds to repay the debt.

Optimization of income tax by applying a non-linear depreciation method

It is necessary to consolidate this method in accounting policy documents. Depreciable property is property in the possession of the taxpayer, used for the purpose of making a profit, the cost of which is gradually repaid by calculating depreciation (useful life - more than 1 year, original cost - more than 10 thousand rubles).

The non-linear accrual method is a method in which the amount of accrued depreciation for 1 month is equal to the product of the residual value of the object and the depreciation rate. The depreciation rate is calculated using the formula:

NA = (2 : n) * 100% , where

- NA – depreciation rate,

- n – useful life (months).

From the month in which the cost of the object becomes equal to 20% of the original price, depreciation is calculated differently:

- the residual value becomes the basis for subsequent calculations,

- the amount of depreciation per month becomes equal to the base cost divided by the number of months until the end of the useful life of the object.

Optimization of income tax when selling intangible assets

To optimize profits using this method, you need to adhere to the following scheme. Identify the intellectual property objects (IPR) available at the enterprise. To do this, you need to issue an order for a commission meeting, preferably with the involvement of a patent specialist and patent attorneys, to conduct an inventory. The result of the commission’s work should be the drawing up of an inventory and assessment report of IP with a list of names, useful lives and costs. Based on it, the period over which intangible assets will be amortized will be determined. The following OIS can be found:

- inventions and utility models,

- innovative ideas, secrets of the production process,

- scientific discoveries, literary and artistic works,

- topology of integrated circuits,

- databases and computer programs,

- industrial designs,

- trademarks, names of places of origin of goods.

Draw up and register the IP. It is necessary to obtain a patent or certificate, depending on the type of IP found. Trade secrets are not subject to registration and are protected by trade secrets, so as documentation you will have to draw up papers on working with such objects. For this:

- a list of objects (information) included in official or commercial secrets is determined;

- rules for working with data are determined;

- limit the circle of employees who are allowed to work with confidential information, listing everyone by name. Conclude a confidentiality agreement with each of them. For the creation of technology, the employee is entitled to a remuneration, the amount of which must be established by order or specified in the contract with the employee.

Register intellectual property objects. The order is issued on the basis of an inventory act and sets the date from which the use and depreciation of intangible assets begins. The initial cost of an intangible asset is an amount equal to the amount of payment (or accounts payable) by the company for the purchase or creation of an asset. Expenses are collected on account 08 and 97. For each intangible asset, a card is created in form No. Intangible-1.

Revaluate intangible assets at market value. This procedure is carried out maximum once a year by an independent appraiser of intangible assets. The revaluation task is documented in the form of an order. The initial information for the income method of revaluation is taken from the company’s business plan (the higher the expected profitability, the higher the cost of intangible assets).

The amount of the revaluation is credited to additional capital; when conducting tax accounting, the results of the revaluation are not taken into account, but are reflected in the intangible assets cards. Calculate depreciation. The cost of intangible assets with a specified useful life is subject to repayment by calculating depreciation over a given period.

The depreciation method is reflected in the accounting policy:

- linear,

- write-off of cost in proportion to the volume of products or work,

- using the reducing balance method.

Accounting entries:

- accumulation of depreciation amounts on the account. 05 or

- reduction in the initial cost of the account. 04.

Optimization of income tax through R&D

You can optimize your income tax 1.5 times more effectively than through any other expenses through the costs of research and development (from a closed list):

- technologies for storing, providing and processing information,

- information security technologies,

- new Internet technologies (including search tools, analysis, and filtering of information).

The list of R&D costs is prescribed in the Tax Code (expenses are recognized regardless of the results of research and development):

- depreciation means for fixed assets and intangible assets (except for buildings and structures) used to carry out R&D,

- labor costs for employees performing R&D,

- material costs for R&D,

- other costs related to R&D, in the amount of no more than 75% of the amount of labor costs,

- cost of work under R&D contracts,

- contributions to funds to support innovative, scientific, technical, scientific activities.

Expenses are included in the list of other expenses in the reporting or tax period during which the work was completed.

For example, a company using OSNO ordered R&D from another company using OSNO or USN; the cost of the research was 1 million rubles. When reflecting R&D costs, you can take them into account for income tax with an increasing factor of 1.5 (to do this, you will have to submit to the Federal Tax Service a report on the R&D performed with an income tax return). The second side will take into account income without a coefficient.

Blog about taxes by Vladimir Turov

Legal ways to optimize income tax, as well as examples of illegal methods of minimizing income tax, which you definitely should not use.

The second most important question after the question: “How to avoid VAT” is the question of entrepreneurs – “How to reduce income tax.” In order to understand how to competently optimize this tax, you need to understand its nature and origin.

Who pays income tax

An entire chapter of the Tax Code of the Russian Federation is devoted to corporate income tax. Payers of income tax, as a general rule, are all Russian organizations that apply the Basic Taxation System (OSNO) and some foreign organizations that receive income in the territory of the Russian Federation.

The obligation to pay tax arises only when there is an object of taxation. If there is no object, there is no reason to pay tax. The object of taxation for corporate income tax is the profit received by the taxpayer. What is profit? As a general rule, profit is the difference between the income and expenses of an organization (Article 247 of the Tax Code of the Russian Federation).

What methods of optimizing income tax should never be used?

What do most entrepreneurs do in order to reduce income tax, and even avoid VAT? They enter into fictitious transactions or “buy” a product/service, thereby artificially inflating their costs. And then they widen their eyes when they see the amounts of additional charges based on the results of tax audits.

Indeed, the idea of increasing your expenses is correct. But the way it is implemented is wrong and illegal. As you know, cooperation with “cash out” offices and one-day companies is fraught with liability not only for committing a tax offense, but also with criminal liability.

How to reduce income tax using legal methods

Now I propose to consider legal opportunities for optimizing income tax.

Conclusion of contracts for paid services

One of the main opportunities for minimizing income tax is the conclusion of contracts for the provision of paid services. But not formal provision, but services that are really needed by this company.

For example, to maintain qualified accounting and tax records, you can hire an outsourcing company that provides such services. In addition, this organization has a strong influence on increasing the security of the parent company and its sole executive body. It is safer for a company to use outsourcing, since during a tax audit, inspectors will not be able to seize documents in batches, taking into account those that you did not want them to see at all.

If outsourcing is used in cases of violations of the financial and economic activities of the company, which lead to criminal liability, then the sole executive body will avoid applying to it the formulation “committed by a group of persons” - usually this formulation is applied to a group consisting of the general director and chief accountant.

You can also enter into warehousing and service agreements with specialized companies, rather than independently maintaining premises and staff (warehousekeepers, loaders) who are not involved in the company’s main activities. Involving such companies for service not only makes it possible to optimize income tax, but also save on insurance premiums by applying benefits in accordance with clause 8 of Art. 58 of Federal Law 212-FZ On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, and the Federal Compulsory Medical Insurance Fund.

Again, by reducing insurance premiums, the need to pay “envelope” wages is correspondingly reduced.

Employee training

It is also possible to legally reduce the tax base by training your employees with whom an official employment contract has been concluded. You can always find an opportunity to send your employees to special training courses and seminars. Such expenses can be classified as other expenses associated with production and sales (Article 253 of the Tax Code of the Russian Federation).

Application of the manager of an individual entrepreneur as a sole executive body

Using an individual entrepreneur as a sole executive body is a great way to reduce income tax. This form of management in the company is provided for by Federal Law 14-FZ “On Limited Liability Companies” and Federal Law 208-FZ “On Joint-Stock Companies”. Plus, it's a great way to have some spare cash. The tax base for the services of an individual entrepreneur is reduced on the basis of Article 264, clause 1, clauses 14, 15, 18, 41 of the Tax Code.

Introduction of corporate style in the company

The opportunity to optimize income tax is provided by the introduction of a corporate style in a company. But there are pitfalls here. Clothing should be given to staff free of charge or sold at low prices and then become the property of the staff. If this condition is met, such expenses can be written off as employee wages.

Registration of trademarks for the business owner

Also, if your company uses any proprietary developments or trademarks, it is possible to register them in the name of one of the business owners to reduce the tax base and minimize income tax by concluding a commercial concession agreement. Based on this agreement, your company will pay the copyright holder a fee for the right to use the object of his intellectual property. Such expenses can be classified as other expenses.

Voluntary property insurance

Another opportunity to reduce the tax base is voluntary property insurance. Art. 263 of the Tax Code of the Russian Federation provides a detailed explanation of which types of insurance can reduce the income tax base.

We have provided a list of legal ways to minimize corporate income tax. It is important for businessmen to remember, no matter which of the above methods they resort to, it is necessary to observe the reality of transactions (i.e. pay for real, not mythical goods and services) and adhere to the rules of document flow. Otherwise, any optimization may turn out not to be in favor of the taxpayer and its results will appear not in the form of savings, but in the form of additional charges based on the results of a tax audit.

Optimization of income tax when merging an unprofitable company

Since 2007, the Tax Code has not contained restrictions on the amount of losses carried forward to future periods. Thanks to this, “unprofitable reorganizations” allow you to reduce income taxes. This procedure also brings an advantage in relation to VAT - the successor company acquires the right to deduct VAT paid by the affiliated company on advances.

To ensure that the Federal Tax Service does not have any complaints, the reorganization must be justified by specific business objectives, otherwise the transaction will be regarded as fictitious. This will be facilitated by:

- Suspicious counterparty being added (for example, the company does not have personnel, fixed assets, warehouse space, etc.).

- Compliance of the acquired company with the criteria for tax unreliability available in the Federal Tax Service database (YUL-KPO database):

- registration of an enterprise at a “mass address”,

- participation in the registration of several similar institutions,

- frequent change of general director, etc.

- Doubtful losses. The Federal Tax Service will check why the company being acquired has become unprofitable, and whether there is an artificially generated loss.

- Multiple reorganizations. The most suspicious thing is to join dubious companies during periods of particularly large profits.

It is possible to identify business goals that justify the acquisition of an unprofitable company:

- industry consolidation,

- purchase of assets,

- creation of a holding company,

- harmonization of the product line,

- integration of production processes, etc.

Before joining, you need to notify the FAS, Federal Tax Service. The tax service has a reason to conduct an on-site audit. The period for carrying forward losses cannot exceed 10 years following the tax period in which the unprofitable company was merged.

Optimization of income tax using raw materials supplied by customers

It is possible to optimize tax payments by concluding an agreement for the processing of customer-supplied raw materials (type of contract), this will reduce the total tax burden.

Tax legislation recognizes transactions with customer-supplied raw materials as services, not works. The cost of services for the processing of customer-supplied raw materials is subject to VAT (18%), regardless of the rate at which the raw materials and the processed product itself are taxed. This means that if raw materials were not subject to VAT at all or were taxed at a 10% rate, services are still subject to VAT at an 18% rate, and this is an additional tax deduction.

You can also organize production from customer-supplied raw materials yourself by opening a new enterprise and concluding a processing agreement with it. It will be necessary to reconsider the organizational structure of the business - to break the production process into technologically complete stages, making the customer and processors (LLC and individual entrepreneur) the main links.

The most labor-intensive stages of production should be transferred to subsidiaries under a preferential tax regime, this will ensure an increase in the profit of the entire enterprise due to the refusal to pay the unified social tax. Companies using the simplified tax system do not pay not only the unified social tax, but also income tax and VAT. The tax base can be reduced by the amount of insurance premiums (no more than half the amount), the effective rate will decrease by 3%.

Tax optimization - basic principles

- Legality. This principle is that all tax reduction measures must be carried out in strict accordance with the norms of current legislation. Compliance with this principle distinguishes tax optimization from evasion.

- Complexity. Optimization of taxation of an organization should be carried out not according to one or several taxes, but taking into account the total tax burden of the company. Other risks (for example, legal) should also be taken into account.

- Efficiency. Tax legislation is one of the most rapidly changing areas of law. Therefore, all tax optimization methods used must be constantly updated.

- Validity. Any tax reduction measures, even those carried out in accordance with the law, always attract close attention from the tax authorities. Therefore, the taxpayer must prepare in advance justifications for all his actions, keeping in mind possible disputes with tax authorities.

Comparison of income tax optimization methods

For convenience, the comparison is shown in the table:

| Method for optimizing income tax | Where is it better to use | Advantages of the method | Disadvantages of the method |

| Method of creating a provision for doubtful debts | At enterprises that have outstanding receivables at the time of payment of income tax. | The amount of doubtful debts that is not fully used can be transferred to the reserve of the new reporting period. | Debts must be overdue for more than 45 days. |

| The need to use the accrual method when determining the income and expenses of an enterprise. | |||

| The amount of the reserve should not exceed 10% of revenue for the period. | |||

| Can only be used in cases of uncollectible debts. | |||

| The need for an inventory. | |||

| Method of creating a repair fund and various methods of calculating depreciation | In companies that often require repairs of fixed assets, replacement of parts and components. | The ability to transfer reserve funds to the next tax period without including the remaining amount in income. | The maximum reserve amount cannot exceed the average of actual repair costs incurred over the last 3 years. |

| The need to fill out a separate tax register. | |||

| Nonlinear depreciation method | For companies for which it is important to reduce taxable profit at the beginning of equipment operation. | Rapid write-off of the cost of depreciable property, especially at the beginning of operation. | The need to indicate the method in the accounting policy, and the method of accrual cannot change during the time the object is used. |

| Optimization method through R&D costs | In companies where there are gaps in the production process that require the development of the latest technologies. | You can take into account R&D costs even if the developments are not justified. | The Federal Tax Service will have to prove with documentation the fact that the funds were spent on R&D with the aim of making a profit for the company in the future. |

| Method of joining a loss-making company | In companies that would like to reduce taxable profits during periods of receiving them on a large scale. | Possibility of deducting VAT of the affiliated company. | The need to notify creditors and early payment of debts before the merger of an unprofitable company. |

| The need to preserve primary documentation proving losses from the merger of the company for 10 years. | |||

| Optimization method through concluding a raw material supply agreement | In companies that require processing of raw materials at the production stage. It is especially beneficial for companies that do not have their own production base for processing raw materials. | No tax risks when creating a new production from scratch or acquiring a new production. | The need to prove the purpose of concluding contracts to generate income (with a business plan, cost estimate, production plan). |

An example of optimizing income tax by creating a reserve for doubtful debts

The founding policy of LLC “Company” involves recognizing income and expenses on an accrual basis. The company's revenue from the sale of products for 9 months of 2006 amounted to 12 million rubles, costs (excluding VAT) - 9 million rubles. Over the past 9 months, LLC “Company” has accumulated outstanding receivables:

- 1.4 million rubles (excluding VAT) under agreement dated May 30, 2006 No. 45. The products were shipped on June 15, 2006, payment documents were given to the buyer on May 17, 2006. According to the terms of the agreement, payment was to be made no later than 7 days from the date of sending payment documents.

- 0.6 million rubles (excluding VAT) under agreement dated August 15, 2006 No. 71. The goods were shipped on August 20, 2004, and payment documents were issued immediately. They had to be paid on the next business day, August 21, 2006.

On the last day of the reporting period, the Company carried out an inventory of accounts receivable, and a reserve of 1.4 million rubles was created - the full amount of debt under agreement No. 45 (overdue by more than 90 days).

The amount under contract No. 71 cannot be taken into account. The reserve cannot exceed 10% of sales revenue for 9 months 1.2 million rubles (12 million * 10%). That is, on the last day of the reporting period (September 30, 2006), the company can include 1.2 million in non-operating expenses.

Now you can calculate income tax for 9 months.

- Income tax = (income - expenses (including non-operating)) * 0.20 = (12 million - (9 million + 1.2 million)) * 0.20 = 360 thousand rubles.

- If the reserve had not been created: Income tax = (12 million - 9 million) * 0.20 = 600 thousand rubles.

- Optimization of income tax made it possible to reduce tax by 600,000 – 360,000 = 240,000 rubles.

Cost management

If a company cannot take advantage of any of the benefits listed above, then cost optimization mechanisms within the standard rate remain for it.

Strictly speaking, all the methods discussed below do not reduce income tax payments “in general”, i.e. in the long term. In any case, the company may ultimately recognize only those costs that were actually incurred.

But the above optimization methods either allow you to avoid “distortions” in expenses or make it possible to recognize expenses faster, which means you can pay less tax now, which is beneficial given the reduced cost of money.

- Formation of reserves.

The Tax Code of the Russian Federation provides businessmen with the opportunity to create various types of reserves:

- for doubtful debts (Article 266 of the Tax Code of the Russian Federation);

- on payment of vacation pay (Article 324.1 of the Tax Code of the Russian Federation);

- for warranty repairs (Article 267 of the Tax Code of the Russian Federation);

- for the repair of fixed assets (Article 260 of the Tax Code of the Russian Federation).

Each of the reserves is formed according to a specific algorithm, taking into account the actual costs of vacations, repairs, the state of settlements with counterparties, etc.

Income tax expense is recognized when provisions are established. Then, when holiday pay needs to be paid or renovations need to be financed, these payments are made from the accumulated amounts. If the reserve is sufficient, then additional income tax costs no longer arise.

At the end of the year, unused reserves are included in the company's income. If the reserve is “selected” in full, then the excess of the corresponding costs reduces the income tax base in the usual manner.

- Accelerated depreciation

A businessman has the right, under certain conditions, to apply an increasing factor (up to 3) to the “regular” depreciation rate. The conditions under which accelerated depreciation is applied are listed in Art. 259.3 Tax Code of the Russian Federation.

It can be used, for example, for fixed assets operating under high load: in aggressive environments or around the clock.

Also, the maximum increasing factor (up to 3) can be applied to objects purchased on lease. Therefore, when choosing a method of financing expensive fixed assets (“regular” loan or leasing), you need to take into account, among other things, possible savings on income tax.

- Depreciation bonus

When purchasing fixed assets, a businessman can write off part of their cost as expenses at a time (Clause 9, Article 258 of the Tax Code of the Russian Federation).

The maximum write-off amount - up to 30% of the cost of the object - can be applied to fixed assets belonging to depreciation groups III - VII. For all other groups, the depreciation bonus cannot exceed 10%.

It is important to note here that such a one-time write-off reduces the original cost of the item. Those. in the future, depreciation will be accrued in smaller amounts than with the “regular” scheme for registering fixed assets.

All of the above cost optimization methods must be reflected in the accounting policies. It is important to remember that their use in most cases leads to deviations between accounting and tax accounting. This complicates document flow and increases the likelihood of errors. Therefore, the effect of such measures should compensate for possible risks.

Legislative acts on the topic

It is recommended to study the following documents:

| Document | Description |

| Decree of the Government of the Russian Federation dated 08/09/1994 No. 967 “On the use of the mechanism of accelerated depreciation and revaluation of fixed assets” | On accelerated depreciation and revaluation of fixed assets |

| clause 4.2 PBU No. 6/97 | Depreciation methods |

| Regulations on accounting and financial reporting in the Russian Federation | The procedure for creating a reserve for doubtful debts, etc. |

| Art. 260 Tax Code of the Russian Federation | On the possibility of creating a reserve for upcoming expenses for repairs of fixed assets |

| Art. 324 Tax Code of the Russian Federation | The procedure for creating a reserve for future OS repair work |

| PBU 14/07 “Accounting for intangible assets” | About accounting of intangible assets |

| Art. 1370 Civil Code of the Russian Federation, Art. 14 of the Federal Law “On Copyright” | On the ownership of IPOs by the organization in which they were created |

| Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a | Approval of the card form for intangible assets |

| Art. 374 Tax Code of the Russian Federation | On non-payment of property tax in relation to intangible assets |

| Decree of the Government of the Russian Federation of December 24, 2008 No. 988 | List of R&D that can reduce income tax |

| Resolution of the Federal Antimonopoly Service of the Moscow District dated July 14, 2014 No. F05-6936/2014 in case No. A40-86741/13 | On the impossibility of applying a multiplying factor of 1.5 to account for R&D expenses if reports have not been submitted to the tax service |

Optimization of enterprise taxation

The problems of tax optimization for Russian enterprises are considered. The stages of tax planning are analyzed. The principles of tax optimization are presented. It is concluded that state tax policy is one of the most important tools that ensures an increase in the efficiency of taxation of an organization at the macroeconomic level.

Key words:

problems, tax optimization, tax planning, state tax policy.

Currently, the problem of optimizing taxation for Russian enterprises is one of the most pressing. Many enterprises, in order to reduce costs, strive for a legal reduction in tax payments to the budget, which is called “tax optimization.”

In general, tax optimization is an activity carried out by the taxpayer to reduce tax payments to the budget without violating the legislation on taxes and fees. [2]

The most important role in optimizing taxation is given to tax planning, which includes the development of the organization’s tax policy and methods of tax regulation and tax control used by the taxpayer. When forming a particular method of tax optimization, all significant aspects of both optimization and the activity of the enterprise as a whole must be analyzed. When choosing a tax planning method, the requirements of branches of legislation are taken into account.

Tax planning is a set of specific actions by the taxpayer to reduce tax payments to the budget, aimed at increasing the financial resources of the organization. The set of actions for tax planning includes regulating the size and structure of the tax base, influencing the efficiency of management decision-making and ensuring timely settlements with the budget, in accordance with the deadlines provided for by the tax legislation of the Russian Federation.

Tax planning should be carried out at the enterprise even before the tax period. It should begin at the stage of preparation for concluding any contract and searching for counterparties, since already in this case it is possible to plan future tax payments to the budget and, if possible, take actions to minimize them. Optimization of taxation at an enterprise is based on the following principles:

1. The principle of legal compliance, which is one of the key principles that organizations should use when using a system to improve tax efficiency. This principle assumes that optimization methods in an enterprise must be legal and legitimate.

2. The principle of rationality of costs means that the benefits from savings on tax payments should exceed the costs of the enterprise in implementing optimization of the taxation system.

3. The principle of diversification is that the enterprise, in the event of an adverse impact of external factors on one of the optimization methods used, must be adapted to the rapid change in the tax optimization system.

4. The principle of confidentiality means that the management of an enterprise should strive to ensure that access to information is as limited as possible.

5. The principle of autonomy implies that tax optimization efforts should have minimal dependence on external participants.

The most productive way for an enterprise is to develop a general tax optimization model depending on the organization’s field of activity and, in accordance with this model, carry out specific actions aimed at minimizing the taxation of the enterprise. [3]

Tax optimization is not only a local process, it is a process implemented at the state level and is an element of its tax policy and is implemented through legislative activity. Therefore, tax optimization, as a way of adjusting the tax burden of organizations, is a tax mechanism that allows, on legitimate grounds, to determine the acceptable amount of tax payments in order to increase the financial results of an organization by saving tax expenses.

State tax policy is one of the most important tools that ensures an increase in the efficiency of taxation of an organization at the macroeconomic level. The country's tax policy is the main factor in determining the strategy for optimizing the taxation of business entities. The choice of tax optimization methods, the rationale for its mechanism and legal support depend on how effective state tax policy is. While at the microeconomic level, the main tools for developing a mechanism for optimizing the taxation of an organization are considered to be tax administration, corporate tax planning, and tax risk management.

In addition to the elements of tax planning, there are a number of techniques in which the result in the form of a reduction in tax payments is achieved through the actions of a qualified organization for the calculation and payment of taxes, which eliminates cases of unjustified overpayment of taxes. To reduce tax payments, the legislation provides the taxpayer with a wide range of opportunities to minimize the amount of taxes. In this regard, general and special ways to reduce tax payments are identified.

General methods include the following tax optimization techniques:

1. The choice of an organization's accounting policy is a significant part of internal tax planning. Accounting policies for tax purposes ensure the selection of the most accessible explanation of regulations and actions in relation to accounting. One of the most well-known methods of tax optimization is to reduce taxable profit and reduce the tax base for property tax through the use of the accelerated depreciation method, as well as the revaluation of fixed assets. In the Russian Federation, the method of revaluing fixed assets is the most optimal, while the possibility of using the accelerated depreciation method is impractical and the possibilities for their use are minimal.

2. The contract scheme makes it possible to optimize the tax regime when concluding a specific contract and fulfilling obligations under it. The essence of this method is the use by the taxpayer of specific wording in contracts, rather than the accepted traditional ones, as well as the use of several contracts providing for one transaction. All this makes it possible to organize the optimal tax regime for the execution of a certain transaction, taking into account the schedule of receipts and costs of cash and commodity resources.

3. Tax benefits are one of the main details of tax planning. Typically, most benefits are provided by local legislation, which provides various benefits.

It is impossible not to mention special methods of tax optimization. After all, almost all entrepreneurs know about the general methods, and most enterprises can use them. Special methods include the following:

1. A method for replacing relationships, based on a variety of ways to solve economic problems within the framework of current Russian legislation. An entity can use any of the acceptable options for using legal norms that are most suitable for specific business conditions.

2. The separation method, based in part on the relation replacement method. In this case, a business transaction is not completely replaced, or one business transaction is replaced by several similar ones. The method is used in cases where complete replacement does not achieve the expected result.

3. The method of deferring tax payment is based on the ability to postpone the moment of occurrence of a tax liability to the next calendar period. In accordance with the tax legislation of the Russian Federation, the deadline for paying most taxes is closely related to the moment the object of taxation arises and the calendar period.

4. The method of direct reduction of the taxable object is aimed at reducing the size of the object or replacing this object with another that is subject to a lower tax or not taxed at all. The object can be both business transactions and property, and the reduction should not have a negative impact on the activities of the enterprise.

For the Russian Federation, the most acceptable method of tax optimization is the choice of an organization's accounting policy, which allows minimizing the tax base by using the method of revaluation of fixed assets. One of the current methods of optimizing taxation for Russian enterprises is the method of deferring tax payment, since with its help it is possible to transfer the resulting tax liability to the next calendar period, which allows improving the management of the company’s current assets.

So, every enterprise seeking to increase profits must conduct tax planning, develop and introduce tax optimization methods. If the leaders of an organization do not have knowledge of the regulatory framework of tax legislation, this may lead to the fact that the enterprise, in a highly competitive environment, will not be able to take a leading position in the market and will give way to a more competitive enterprise. But it should be remembered that tax minimization should be applied within reasonable limits. For this purpose, legal benefits and tax exemptions permitted by law are applied. Such actions do not entail the collection of penalties, tax sanctions or additional taxes. It is important to take an integrated approach, where optimization costs should be significantly lower than the profit from it.

In the practice of using tax optimization, it is necessary to follow certain principles that are not only financial, economic, legal, but also moral in nature. For example, when planning tax optimization, it is impossible to rely only on gaps in legislation. It is necessary to take into account all political aspects, as well as the role that the enterprise plays in replenishing the budget, therefore, when optimizing taxation, one should adhere to the principle of a comprehensive calculation of savings and losses. [1]

Currently, in the changing Russian economy, stopping attempts at “creative tax evasion” is absolutely legitimate and has been elevated to the rank of state tax policy. The state regularly fights against business entities that seek to deviate from paying taxes. This is manifested in administrative and judicial protection of budget interests.

By applying the basic principles of tax optimization and painstakingly researching the regulatory framework, an enterprise can achieve the best results from legal tax savings.

Literature:

1. Balabanov, I. T. Fundamentals of financial management / I. T. Balabanov. M.: Finance and Statistics, 2003. - 236 p. — ISBN 5–91452–0059–5

2. Negashev E.V. Analysis of enterprise finances in market conditions / E.V. Negashev. M.:, 2009. - 186 p. — ISBN 5–8586–49–3

3. Popova R. G., Samonova I. N., Dobroserdova I. I. Enterprise finance / Popova R. G. [etc.]. - M.: INFRA-M, 3rd ed. - St. Petersburg: 2010. - 208 p.

Typical errors in calculations

Mistake #1. The company creates a reserve for doubtful accounts receivable that exceeds 10% of sales revenue for the reporting period.

The reserve for doubtful debts should not be higher than 10% of the amount of revenue for the reporting period in which the reserve is created.

Mistake #2. The company charged depreciation on fixed assets in one way, and after some time decided to charge depreciation using a different method.

You cannot change the method of calculating depreciation until the useful life of the depreciation object has expired.

Answers to common questions

Question No. 1. Is it possible to take into account R&D costs in order to reduce the taxable base for income tax if the costs are actually incurred, but there are no results?

The main thing is that R&D expenses were aimed at making a profit. Then costs confirmed by reports, expert opinions, business plans, even for unusable R&D, can be taken into account for profit tax purposes.

Question No. 2. Will the optimization of taxes by concluding an agreement on the processing of customer-supplied raw materials be suspicious of the tax authorities if subsidiaries are separated from the enterprise and are taxed under a preferential regime?

Yes. If it is seen that the general taxes of the entire enterprise have decreased noticeably after the separation of subsidiaries, to which the most complex stages of production are transferred in order to evade taxes that are not provided for payment by preferential taxation systems. It is safer to create a new enterprise from scratch or buy a new production facility.

Principles of tax planning

When optimizing taxation, an organization should follow a number of principles:

- adequacy of expenses - savings during tax planning should not exceed a certain threshold of expenses that the enterprise will incur when optimizing the system,

- legitimacy - in addition to compliance with current legislation, when optimizing, you cannot use gaps in regulations or ambiguous interpretations, since in the future they can be filled in, corrected, and not in favor of the interests of the enterprise,

- confidentiality - access to the organization’s tax system should be as limited as possible,

- independence - minimal dependence on counterparties in order to reduce risks,

- neutrality - the system is implemented without increasing the amounts of payments from suppliers and buyers,

- controllability - it is necessary to develop and implement tools for monitoring the use of the enterprise tax optimization program.

offers you professional tax planning using the optimal set of tools.

Optimization is possible in a small organization or in a group of companies or holding. 12 years of practice, theoretical training, as well as consultations with the Ministry of Finance of the Russian Federation and the Ministry of Taxes and Duties of the Russian Federation allow us to operate with information that is relevant today.

By contacting us, you will be able to choose the right taxation system, which will allow you not only to reduce payments, but also to more effectively operate with the opportunities provided by the tax legislation of the Russian Federation, such as, for example, a safe deferment of payments without penalties.

Call and find out more about how to reduce risks and get new funds for business development.