The balance sheet and income statement are the main reports that external and internal users rely on. Based on the information on these forms, lenders think about the company’s solvency and whether it will be able to repay the loan. Investors will think a thousand times and become familiar with the accuracy and truthfulness of the reports before investing in a business. This article will talk about how to view the financial results report in 1C and what to pay attention to when preparing it.

General information

All commercial companies that do not maintain simplified accounting are required to annually submit to regulators the reporting forms described in the table below.

| No. | Form | Characteristic |

| 1 | Balance sheet | The main reporting form of a company, consisting of its assets and liabilities |

| 2 | Income statement | It is created on the basis of data from accounting transactions carried out in accounting registers. The information in the income tax return and the figures in the report may not coincide and this is not an error. This is due to the fact that tax information is reflected in the declaration, but not in the reporting form. |

| 3 | Applications | This includes a statement of changes in capital, a statement of cash flows and other annexes and explanatory notes, if required. |

How to view monthly revenue in 1c

> > As a result, postings are generated in 1C: Accounting.

The generation of transactions depends on the settings of accounting and tax accounting. It is possible to manually create a document on the sale of goods.

For this:

- The VAT rate, price, product and income account are entered automatically from the settings for the item.

- You need to select the “report” tab.

- Select the “retail store” report.

- Add the product that you sold.

- Indicate the quantity of goods sold.

- As a result, postings are generated that will show revenue from sales.

- We substitute the cash register account 50.01 – “organization cash desk” or you can select 50.02 – “operational cash desk”, 50.04 – “cash desk for the activities of the paying agent”.

We recommend reading: Is it possible to cash out mother’s capital and where?

The ability to reflect payment by bank loan or card has been implemented.

To do this you need:

- In the “type of payment” directory we set payment by payment card.

- Go to the “non-cash payments” tab.

- Enter the amount of payment by card.

A “cash receipt” document is created.

It shows in the program the receipt of money through the cash register to the current account. This document does not generate transactions.

Since the postings are carried out by the “retail sales report” report. But it ends up in the “cash book” report.

The sales report is generated automatically after the shift is closed.

Retail trade can be:

- Automated point of sale (ATP). Trading at retail prices, revenue is shown in the report: “retail sales report”.

- Manual point of sale (NTT). In a manual point of sale there is no online connection with the information database. Example: stall, away trade, etc.

The implementation algorithm is as follows:

- Inventory.

- Receipt of goods at the retail outlet.

- A cash receipt order records revenue.

- Creating a retail sales report.

How to view the financial results report in 1C

The reports menu will help you answer the user’s request on how to view the financial results report in 1C and go there to the regulated reports. The article proposes a detailed algorithm that describes the procedure for drawing up a report on financial results. So, you will have to go through these steps:

Step 1 – In the window that opens, you will need to use the create command and you will see a list of all the reports to choose from. The plus sign will open a list of options for reporting forms.

Step 2 - So, you have decided what you will now create and in our version this is the report of the given article, and then an additional form will appear for your review, where you will need to enter your company and the period to be reflected in the report. There may be several companies in the software, and in order for the machine to understand for whom the financial results are required, it is worth telling it the company’s TIN. Its form of ownership is also indicated precisely at this stage. The creation functionality allows you to open a field for entering informative information on a new regulated report.

Step 3 – Next you need to visit the financial results report tab.

The machine offers the user excellent functionality for auto-filling the reporting form. It is also available in other forms of reports.

Step 4 – You have a choice between two commands:

- Current report;

- All reports.

When using the latter, all reporting forms specified in this section will be filled in with credentials. The autofill function for the current report will fill only the currently open report.

Step 5 – If you are confident in the correctness of the manipulations, then you can save the reporting form. You have the right to take two further actions:

- Display it on the screen and print it.

- Perform electronic upload to external media.

How to generate a sales report in 1C 8.3 Accounting

Sales data is important business information. All trading programs have reports in which you can view summary data on the sale of goods and services for a certain period. How to generate a sales report in 1C 8.3 Enterprise, read this article.

Specialized trading programs provide many different reports to analyze revenue, profitability and other indicators. There are no such reports in accounting programs, with the exception of 1C 8.3 Enterprise. In this configuration, the developers have provided several reports in which you can view sales in 1C.

Read our article on how to generate sales reports in 1C 8.3 Enterprise. Download Go to the “Sales” section (1) and click on the “Sales by counterparties” link (2). A form will open to fill out.

In the form, indicate the organization (3), period (4) and click the “Generate” button (5).

The report will be filled with data. At the top there is a diagram that clearly shows monthly sales (6) by counterparties (7). At the bottom there is a table with data, in the rows there are counterparties (8), in the columns there are monthly data (9). The “Total” column (10) contains summary data for the entire period. The bottom row of the table summarizes the totals for all columns.

If you don't need a monthly breakdown, you can change the report type. To do this, click the “Show settings” button (11), a window for changing will open.

In the window that opens, go to the “Grouping” tab (12) and in the “Interval” field (13) select the value “Year”.

You can also specify other intervals here:

- Half year.

- Quarter;

- Day;

To display a report with new settings, click the “Generate” button (14).

The new report does not contain a breakdown by month; it has become more compact. In the next chapter we will tell you how to generate a sales report for product items in 1C. Guest, you have free access to a chat with an expert accountant. Order a call back to connect or call: (free within the Russian Federation).

How to make adjustments to the report

All numbers that find their place in the form can be corrected, modified or adjusted. This is only affected by changes in available fields or inaccuracies in inactive cells, which speaks to the possibility of errors and inaccuracies in the accounting work done. You will need to look for the error in the registers for conducting business operations. There are a number of color markers that you should pay attention to when correcting data:

- You cannot change white cells;

- The yellow ones were created by the developers in order to introduce manual numbers into them and decipher the information of other indicators. By adding and deleting positions, the information of this parameter is detailed and adjusted;

- The dark green color of the fields also tells the user that it is impossible to correct anything in them. These are the final figures, calculated on the basis of other columns, so the source of inaccuracies must be looked for in them;

- The light green color colors the positions entered on the basis of data from the accounting registers and the machine allows them to be adjusted manually.

Checking for errors

Before printing or uploading a report for users to read, you should make sure that you did everything correctly. For this purpose, the developers have come up with an option to check reports for errors. You just need to click on check and the machine will automatically match the control ratios of the completed form. If there are no detected errors, the machine will report this with an information message, but if there are any, it will point them out to you. A special error navigator will help you detect them for subsequent correction.

If you click on the error itself, the machine will tell you what exactly it is. The correctness of the completed form is indicated in the decoding field and activation will help you receive an explanation for each column and go directly from here to the balance sheet.

The machine contains a number of reference information on how to fill out one or another type of regulated report, displayed in special user instructions. The basic rule of thumb is:

The amount of profit on the 2500th line is equal to the profit on the 120th line minus the 180th position in the second application of the income tax return.

Income tax in 1C 8.3

Contents of the article This review is devoted to the procedure for calculating income tax and filling out the corresponding declaration in 1C 8.3, configuration “1C: Enterprise Accounting”. It is assumed that the reader is already familiar with the principles of PBU 18/02.

It is impossible to cover the entire Chapter 25 of the Tax Code of the Russian Federation in one article; we will focus on the main points and consider the algorithm of actions for calculating income tax using the 1C program. The income tax return in 1C reflects income and expenses accepted for calculating the tax base for income tax.

The procedure for filling it out is set out in detail in the Order of the Federal Tax Service MMV-7-3 / [email protected] dated October 19, 2016. The tax period for all companies is a calendar year, the deadline for submitting the annual declaration is March 28.

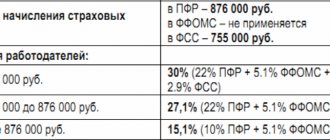

If the last day for submitting the declaration falls on a weekend, it is postponed to the next working day. There are some nuances regarding reporting periods and advance payments: Organizations with small turnover submit reports during the year based on the following results:

- 9 months until October 28th.

- Semester until July 28;

- 1 quarter until April 28;

At the same time, payments are made on accrued profits, which are considered advance payments, because

The full tax amount will be generated only at the end of the year.

Sometimes situations are possible when the amount of advance payments paid during the year exceeds the tax accrued at the end of the year, then the organization has an overpayment of tax. If an organization’s average quarterly revenue for the last 4 quarters is equal to or exceeds 15 million rubles, then they pay monthly advance payments of income tax until the 28th, formed by calculation (an example of the calculation will be later).

The deadline for submitting reports is similar to that given in the previous paragraph.

If at the end of the quarter the amount of advance payments is less than the amount of actually accrued tax, the delta will have to be paid additionally. The procedure for making an advance payment of income tax every month is not always beneficial for the organization.

Procedure for filling out a report on financial results

It is recommended that you carefully study the lines to understand what needs to be entered there. So, start your acquaintance with a list like this:

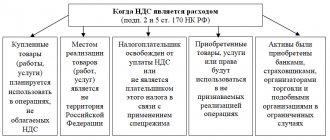

- Line 2110 shows the amount of revenue from the main activities of the company minus excise taxes and VAT and is equal to the amount of turnover on the credit of the 90th accounting account 90 minus debit turnover.

- The 2120th position shows the amount of costs incurred from conducting ordinary activities minus excise taxes and VAT. Information here is pulled from the debit turnover of the 90th accounting account in correspondence with the credit turnover of such accounting accounts as the 20th, 40th, 41st and 43rd. The amount in this cell is shown in parentheses, which means it is negative. Income from other activities is not included in revenue and is recorded as other income in the 91st accounting account. In turn, expenses from other types of business are also shown in such an account.

- Position 2100 is obtained automatically in the machine and represents the result of deducting cost from revenue. during the reporting period.

- The 2210th entry informs the user about the amount of all business expenses incurred from the main activity. The figure comes from the credit balance of the 90th accounting account in correspondence with the debit turnover of the 44th accounting account. Its meaning is also written in parentheses.

- The 2220th line is equal to the difference between the gross profit and the business costs incurred by the company. Profit less than zero is reflected only in parentheses.

- Line 2310 indicates the amount of funds received from business operations performed. A record is generated by using the debit figure of the 91st account in correspondence with the 76th accounting account 76.

- Column 2330 talks about interest on the use of credit funds. Amounts are also written in a negative value.

- In line 2340, the figures from the credit of the 91st accounting account are entered as the amount of other income minus the amount of VAT and excise taxes. Don’t forget to subtract lines 2310 and 2320 from it.

- Column 2350 states other expenses minus expenses under article 2330. Here the value has a negative value.

- Cell two thousand three hundred is calculated based on accounting information before the income tax is calculated. A negative value is written in parentheses.

- Position 2410 informs the user about the amount of income tax based on the information in the tax return. All companies that do not make a profit and, accordingly, do not remit taxes, leave all tax positions unfilled.

- Lines 2421, 2430 and 2450 contain information about PNO/PNA, ONO and ONA.

- The 2460th line summarizes all values that are not included in the lines listed above, but have a direct impact on the calculation of the company’s financial results.

- Line two thousand four hundred shows the amount of net profit or loss received by the company. As you already know, the resulting negative calculation value will need to be indicated in parentheses. The value of the position we are considering, by definition, must be equated to the amount of net profit or loss according to accounting accounts 84 based on the results of the past year or 99 based on the results of closed quarters.

- In the two thousand five hundredth line there is a value of line 2400, summed up taking into account the information in positions 2510 and 2520.

The main thing in the work of every accountant is to control the deadlines for submitting regulated reports to the relevant regulators. For this purpose, the machine has a special functionality that reminds you of upcoming deadlines, called an accountant’s calendar. It is an excellent assistant and will protect you from missing deadlines and accruing fines because of this.

Receipt and acceptance of fixed assets for accounting

Next, the company purchased equipment

It is interesting to view the document that ensures that equipment is accepted for registration.

You can reduce the amount of tax payments due to bonus depreciation

In the 1C program, the depreciation bonus is reflected in a special account KV

The effect of bonus depreciation on the amount of taxes paid will be explained below.