Distribution of VAT for separate accounting

Value added tax amounts presented by suppliers of goods, works, and services must either be deducted (in taxable transactions) or included in the cost of goods and services for calculating income tax (in tax-exempt transactions). This is indicated in paragraph 4 of Art. 170 Tax Code of the Russian Federation.

Moreover, if a company does not maintain separate accounting for VAT, but carries out taxable and tax-exempt activities, then it cannot apply the right to deduct input VAT, nor increase the cost of products by the tax amount (paragraph 6, paragraph 4, article 170 of the Tax Code RF). The same is stated in the letter of the Ministry of Finance dated November 11, 2009 No. 03-07-11/296. The courts also agree with this, as evidenced by the established judicial practice of refusing taxpayers’ claims if they do not keep separate records of VAT (Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 21, 2009 No. F04-2146/2009(4710-A27-19) , F04-2146/2009 (4321-A27-19) in case No. A27-10576/2008).

However, if goods, works, services are used only in relation to taxable transactions, then even in the absence of separate VAT accounting, the taxpayer has the right to exercise the right to deduct for them (letter of the Federal Tax Service dated 02.02.2007 No. ШТ-6-03 / [email protected] ).

Input VAT distribution

Input VAT must be distributed in the tax period in which the property was received (work, services accepted) intended for use in taxable and non-taxable transactions (letter of the Federal Tax Service of Russia dated October 24, 2007 No. ШТ-6-03/820).

When distributing input tax, calculate:

- the share of VAT-free transactions in the total volume of the organization’s operations;

- the amount of VAT not deductible;

- the amount of VAT to be deducted.

Determine the share of VAT-free transactions:

- for the distribution of input VAT on fixed assets and intangible assets accepted for accounting in the first or second month of the quarter, based on the results of the first or second month of the quarter;

- for the distribution of input VAT on other types of property based on the results of the quarter in which this property was taken into account.

Calculate the share of transactions not subject to VAT using the formula:

| Share of transactions not subject to VAT | = | The cost of goods shipped per quarter (month) (work performed, services rendered, property rights transferred), the sale (performance, provision, transfer) of which is exempt from VAT (or subject to UTII): Total cost of goods (work, services, property rights), shipped (fulfilled, rendered, transferred) for the quarter (month) |

This procedure is provided for in paragraph 4.1 of Article 170 of the Tax Code of the Russian Federation.

When calculating the share of transactions not subject to VAT:

- take into account the cost of goods shipped (work performed, services rendered, property rights transferred). The specifics of determining the tax base for individual transactions do not affect the calculation of the proportion. For example, when transferring certain property rights, the tax base for VAT is the difference between their cost and acquisition costs (clause 3 of Article 155 of the Tax Code of the Russian Federation). However, when calculating the share of transactions not subject to VAT, it is necessary to include the entire amount of income from the sale of these property rights. Such clarifications are contained in the letter of the Federal Tax Service of Russia dated March 21, 2011 No. KE-4-3/4414;

- do not take into account other income not related to the sale of goods (performance of work, provision of services, transfer of property rights). For example, dividends received and interest on bank deposits. This was stated in the letter of the Ministry of Finance of Russia dated November 11, 2009 No. 03-07-11/295.

The distribution of input tax when separately accounting for VAT-taxable and non-VAT-taxable transactions can be reflected in a calculation certificate drawn up in any form.

An example of the distribution of input VAT when using acquired property (work, services) in transactions subject to and not subject to VAT

Alpha LLC sells medical products, some of which are exempt from VAT in accordance with paragraph 2 of Article 149 of the Tax Code of the Russian Federation. The procedure established in the accounting policy for the distribution of input VAT between transactions subject to and not subject to this tax provides for the following rules.

1. Expenses for the purchase of goods (work, services) are accounted for separately in the following groups: – related to transactions subject to VAT; – related to transactions not subject to VAT; – relating to both types of transactions (input VAT on these expenses is subject to distribution).

2. Input VAT on non-current assets acquired for use in both types of operations is taken for deduction (included in their initial cost) in proportion to the volume of sales, subject to and exempt from VAT: – in the 1st and 2nd months of the quarter – based on the results each of these months; – in the 3rd month of the quarter – for the quarter as a whole.

3. Input VAT on the remaining property (work, services) acquired for use in both types of operations is taken for deduction (included in the price) in proportion to the volume of sales, subject to and exempt from VAT, based on the results of the quarter in which the assets were registered .

The distribution of expenses and input VAT amounts is reflected in a certificate approved quarterly by the chief accountant. The certificate contains the following information:

- calculation of the shares of taxable and non-taxable transactions in the total sales volume - calculated monthly based on the cost of sales excluding VAT;

- calculation of the distribution of input VAT on non-current assets - compiled based on the results of each month;

- calculation of the distribution of input VAT on other assets - compiled based on the results of the quarter;

- calculation of the amount of input VAT accepted for deduction and included in the cost of acquired assets for the quarter.

The indicators required for the distribution of input VAT in the first quarter are presented in the tables.

Distribution of expenses by type of operation (RUB)

| Type of expenses (assets) / Period | January | February | March | Total for the quarter | |

| Expenses related to transactions subject to VAT | OS | 300 000 | 0 | 800 000 | 1 100 000 |

| NMA | 0 | 0 | 0 | 0 | |

| Other assets | 870 000 | 2 000 000 | 270 000 | 3 140 000 | |

| Total for the period | 1 170 000 | 2 000 000 | 1 070 000 | 4 240 000 | |

| Expenses related to transactions not subject to VAT | OS | 0 | 200 000 | 0 | 200 000 |

| NMA | 0 | 0 | 0 | 0 | |

| Other assets | 500 000 | 800 000 | 2 000 000 | 3 300 000 | |

| Total for the period | 500 000 | 1 000 000 | 2 000 000 | 3 500 000 | |

| Costs related to both types of operations | OS | 700 000 | 0 | 400 000 | 1 100 000 |

| NMA | 1 000 000 | 0 | 0 | 1 000 000 | |

| Other assets | 100 000 | 750 000 | 1 300 000 | 2 150 000 | |

| Total for the period | 1 800 000 | 750 000 | 1 700 000 | 4 250 000 | |

| TOTAL | 3 470 000 | 3 750 000 | 4 770 000 | 11 990 000 | |

Shares of transactions subject to and exempt from VAT in total sales volume (rub.)

| Type/Period | January | February | March | Total for the quarter |

| Cost of shipped goods (work performed, services rendered), subject to VAT | 1 500 000 | 2 000 000 | 7 000 000 | 10 500 000 |

| Cost of shipped goods (work performed, services provided), not subject to VAT | 2 000 000 | 1 000 000 | 3 000 000 | 6 000 000 |

| Total cost of goods (work, services) shipped per quarter (month) | 3 500 000 | 3 000 000 | 10 000 000 | 16 500 000 |

| Share of transactions subject to VAT in total sales volume | 42,8571% (1 500 000 : 3 500 000 × 100) | 66,6667% (2 000 000 : 3 000 000 × 100) | 70,0000% (7 000 000 : 10 000 000 × 100) | 63,6364% (10 500 000 : 16 500 000 × 100) |

| Share of transactions not subject to VAT in total sales volume | 57,1429% (100% – 42,8571%) | 33,3333% (100% – 66,6667%) | 30,0000% (100% – 70,0000%) | 36,3636% (100% – 63,6364%) |

Distribution of input VAT on non-current assets acquired for use in both types of operations (RUB)

| VAT Amounts / Period | January | February | March | Total for the quarter |

| Amount of input VAT to be deducted from the cost of fixed assets | 54 000 (700 000 × 42,8571% × 18%) | 0 | 45 818 (400 000 × 63,6364% × 18%) | 99 818 (54 000 + 45 818) |

| The amount of input VAT is taken into account in the initial cost of fixed assets | 72 000 (700 000 × 18% – 54 000) | 0 rub. | 26 182 (400 000 × 18% – 45 818) | 98 182 (72 000 + 26 182) |

| Amount of input VAT to be deducted from the value of intangible assets | 77 143 (1 000 000 × 42,8571% × 18%) | 0 rub. | 0 rub. | 77 143 |

| The amount of input VAT is taken into account in the initial cost of intangible assets | 102 857 (1 000 000 × 18% – 77 143) | 0 rub. | 0 rub. | 102 857 |

| Total VAT deductible | 131 143 (54 000 + 77 143) | 0 rub. | 45 818 | 176 961 (131 143 + 45 818) |

| VAT on the initial cost of fixed assets/intangible assets | 174 857 (72 000 + 102 857) | 0 rub. | 26 182 | 201 039 (174 857 + 26 182) |

Input VAT on other assets acquired for use in both types of transactions is distributed as follows.

VAT deductible: RUB 2,150,000. ×63.6364% × 18% = RUB 246,273

VAT on the value of assets: RUB 2,150,000. × 36.3636% × 18% = 140,727 rubles.

The total amount of input VAT for all types of assets acquired in the first quarter is distributed as follows.

VAT deductible: RUB 176,961. + 246,273 rub. + 4,240,000 rub. × 18% = RUB 1,186,434.

VAT on the value of assets: RUB 201,039. + 140,727 rub. + 3,500,000 rub. × 18% = 971,766 rub.

At the end of the quarter, the Alpha accountant recorded all the data received in the calculation certificate.

Situation: based on what value of goods (work, services, property rights) - including VAT or without - should the proportion for the distribution of input tax be calculated?

Include in the calculation the cost of goods (work, services, property rights) without VAT.

To calculate the proportion for the distribution of input tax, you need to determine the share of transactions not subject to VAT in the total volume of the organization's transactions. In this case, the proportion must be calculated based on comparable indicators. The cost of shipped goods (work performed, services rendered, transferred property rights) used in non-taxable transactions does not include VAT. Consequently, when assessing the total cost of goods (works, services, property rights), tax also does not need to be taken into account. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated August 18, 2009 No. 03-07-11/208, dated June 26, 2009 No. 03-07-14/61, dated June 17, 2009 No. 03-07-11/ 162, Federal Tax Service of Russia dated March 21, 2011 No. KE-4-3/4414.

Arbitration practice confirms the legitimacy of this approach (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 No. 7185/08, determinations of the Supreme Arbitration Court of the Russian Federation dated January 21, 2009 No. VAS-7652/08, dated August 28, 2008 No. 7185/08, dated June 25, 2008 No. 7435/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated June 3, 2010 No. A46-16246/2009, dated March 4, 2008 No. F04-1298/2008(1320-A03 -29), East Siberian District dated November 25, 2008 No. A58-1304/07-F02-5788/08, dated August 13, 2008 No. A10-4072/07-04AP-1043/08-F02-3784/ 08, dated April 22, 2008 No. A78-4854/07-F02-1414/08, dated March 14, 2006 No. A33-28616/05-F02-962/06-S1, North Caucasus District dated June 23, 2008 No. F08-3566/2008, Ural District dated December 29, 2008 No. F09-9883/08-S2, Volga-Vyatka District dated December 23, 2005 No. A79-4355/2005). The courts also justify their position by the fact that when determining the proportion (share), comparable indicators must be taken into account. The tax base for calculating VAT is defined as the cost of goods (work, services, property rights), calculated on the basis of market prices taking into account excise taxes (for excisable goods), but excluding VAT (Article 154 of the Tax Code of the Russian Federation). And the amount of VAT is additionally applied to the price of goods sold (work, services, property rights) (Article 168 of the Tax Code of the Russian Federation). Since VAT is charged on top of the price of goods (works, services, property rights), the amounts of revenue excluding tax are comparable. The inclusion of VAT in the cost of goods (work, services, property rights) when determining the proportion (share) leads to a distortion of tax liabilities.

Situation: how to take into account the cost of services for providing an interest-bearing loan when calculating the proportion for the distribution of input VAT?

The answer to this question depends on the type of loan (interest-bearing or interest-free).

Loan transactions in cash are exempt from VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). And if an organization, in addition to providing loans, also carries out activities subject to VAT, it is obliged to distribute input tax (clause 4, 4.1 of Article 170 of the Tax Code of the Russian Federation). Organizations may not distribute input VAT if the share of expenses on transactions exempt from taxation does not exceed 5 percent of the total amount of expenses for the tax period (paragraph 7, paragraph 4, article 170 of the Tax Code of the Russian Federation). As a rule, the share of costs associated with providing cash loans is less than this value. Therefore, in the absence of other non-taxable transactions, the entire amount of input VAT can be deducted from the budget.

If the share of expenses on transactions exempt from taxation exceeds 5 percent, separate accounting must be maintained. When calculating the proportion for the distribution of input VAT, the cost of services for providing loans is equal to the interest at which they were issued. The amount of the loan itself is not included in the price, since the operation of issuing it is not a sale (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation).

Therefore, if an organization carries out operations subject to VAT and provides a cash loan, then calculate the proportion for the distribution of input tax based on the interest provided for when providing the loan. When providing an interest-free loan, when calculating the proportion, include the market cost of services that the borrower would have to pay if using borrowed funds on paid terms.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated April 2, 2009 No. 03-07-07/27, dated September 11, 2008 No. 03-07-11/302.

Increase in expenses in the amount of VAT

If the purchased goods (work, fixed assets, services, intangible assets or property rights) will be used only in tax-exempt activities (the list of such operations is specified in paragraphs 1–3 of Article 149 of the Tax Code of the Russian Federation), then the taxpayer has the right to increase their value by the amount of VAT for subsequent calculation of income tax. This is indicated in paragraph. 2 clause 4 art. 170 Tax Code of the Russian Federation.

The same applies to goods that are sold in a place not recognized as the territory of the Russian Federation.

Separation of transactions when accounting for VAT

The main purpose of separate accounting for this tax is to separate transactions subject to VAT from the bulk of the “input” tax. This amount will be deducted. The remaining block must be added to the cost of purchased goods and services or added to the expense group. It is effective to divide in accounting between taxable and “zero” transactions, in addition to the amount of VAT and goods, also expenses with revenue. A common practice in this case is to open sub-accounts for the nineteenth, forty-first, ninetieth and other accounts.

Separate accounting of VAT is required if a company wants to use the right to deduct amounts of “input” VAT and/or increase the cost of goods or services sold by the amount of VAT.

It is optimal to achieve a clear separation of accounting for various options for the organization’s activities in order to minimize the number of calculation methods.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Principles of maintaining separate VAT accounting

1. In one type of activity.

When purchasing goods and services that are entirely used in taxable activities, the taxpayer does not have any difficulties in displaying them in tax accounting. Thus, the buyer will be able to fully accept the VAT presented by the supplier for deduction on the basis of clause 1 of Art. 172 and paragraph 4 of Art. 170 Tax Code of the Russian Federation.

If the purchased goods are fully used in tax-exempt activities, then the entire amount of VAT will be attributed to the increase in their value.

2. In several types of activities.

In cases where the purchased goods, fixed assets (FPE), services, intangible assets (ITA), work or property rights will be used in both taxable and VAT-exempt activities, the distribution of VAT for separate accounting will be special. Then part of the tax presented by the supplier can be used as a deduction, and the other part can be used to increase the cost of the purchase.

In order to determine which amount of tax will be used as a deduction and which will go to increase the cost, it is necessary to calculate the proportion (paragraph 4, clause 4, article 170 of the Tax Code of the Russian Federation).

The taxpayer should make an entry about the received invoice in the purchase book only in that part that will be deducted (clause 2, subparagraph “y”, clause 6, clause 23(2) of the Rules for maintaining the purchase book, approved by decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Changing the VAT accounting method

If, upon receipt of materials, one accounting method was indicated (for example, “Distribute”), and upon write-off, the accountant realized that it was necessary to “Accept for deduction,” then in the document “Request-invoice” you can indicate the desired method. It will be used for these materials.

ATTENTION ! You can change the VAT accounting method only before the VAT is distributed. This means that if you make a document “VAT Allocation” at the end of the quarter, the VAT of all materials received in this quarter will be distributed. And those that you wrote off, and those that are still in stock. This means that in the next quarter you will no longer be able to change the way VAT is written off for these materials.

Features of calculating proportions for separate VAT accounting

1. Tax period.

The proportion is determined based on data from the tax period, which is a quarter (letters from the Ministry of Finance dated November 12, 2008 No. 03-07-07/121 and the Federal Tax Service dated May 27, 2009 No. 3-1-11 / [email protected] ). The VAT received from the supplier should be distributed in the tax period when the goods were accepted for registration (letter of the Ministry of Finance dated October 18, 2007 No. 03-07-15/159).

The exception is fixed assets and intangible assets that were registered in the first or second month of the quarter. The taxpayer has the right to distribute VAT in accordance with the proportion on these assets based on the results of the month when they were reflected in accounting in connection with their acceptance (subclause 1, clause 4.1, article 170 of the Tax Code of the Russian Federation).

In addition, special rules when calculating proportions apply to:

- operations with financial instruments of futures transactions (subclause 2, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- clearing operations (subclause 3, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- operations to provide a loan in securities or money, REPO operations (subclause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation) or the sale of securities (subclause 5, clause 4.1, article 170 of the Tax Code of the Russian Federation).

2. Formula.

In order to understand how separate VAT accounting is carried out, you should familiarize yourself with the following formulas:

PNDS = SNDS / Commun.

where PVT – proportional VAT to be deducted;

SNDS – the total value of revenue for goods shipped as part of taxable transactions;

Total – the total amount of goods shipped during the reporting period.

VAT = Sneobl / Commun.

VAT – the amount of VAT allocated to increase the cost of goods;

Sneobl - the cost of goods shipped as part of tax-exempt transactions;

Total – the total amount of goods shipped during the reporting period.

See also the material “It is explained how to calculate the proportion for separate accounting if there has been a sale of securities .

The above formulas are derived on the basis of the norms contained in clause 4.1 of Art. 170 Tax Code of the Russian Federation. In this case, when calculating the proportion, one should not take into account those receipts that cannot be recognized as revenue from the sale of goods. This:

- interest on deposits (letter of the Ministry of Finance dated March 17, 2010 No. 03-07-11/64);

- dividends on shares (letters of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64, dated November 11, 2009 No. 03-07-11/295);

- discounts on bills (letter of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64);

- amounts received in the form of penalties associated with changes in loan terms (letter of the Ministry of Finance dated July 19, 2012 No. 03-07-08/188);

- financing received by the division from the parent company (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 30, 2012 No. 2037/12);

- transactions of issuers of depositary receipts of Russia for the placement of these receipts, as well as for the purchase and sale of securities related to receipts (paragraph 8, clause 4, article 170 of the Tax Code of the Russian Federation).

When calculating the total amount of goods shipped for the reporting period, sales should be taken into account both in Russia and abroad (determination of the Supreme Arbitration Court of the Russian Federation dated June 30, 2008 No. 6529/08).

It is impossible to use other formulas to calculate proportions - for example, based on the area of premises used for taxable and tax-exempt activities (Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2009 No. A33-7683/08-F02-959/09) .

3. Amount excluding VAT.

To calculate the proportion, it is necessary to take the cost of shipped goods excluding VAT (letter of the Ministry of Finance dated August 18, 2009 No. 03-07-11/208, Federal Tax Service of Russia dated March 21, 2011 No. KE-4-3/4414). It is necessary to take into account that the established judicial practice fully supports the conclusions of the financial department and controllers (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 No. 7185/08).

Officials, the Presidium of the Supreme Arbitration Court of the Russian Federation and lower arbitration courts justify their decisions by the fact that separate accounting for VAT should be in comparable values. Moreover, when calculating both VAT-taxable and non-taxable transactions.

At the same time, some judges do not see in Art. 170 of the Tax Code directly indicates that when calculating the proportion, the amount of VAT must be excluded, and decisions are made in favor of taxpayers who do not agree with the position voiced above (resolution of the Federal Antimonopoly Service of the West Siberian District dated May 7, 2007 No. F04-2637/2007(33744 -A45-42) in case No. A45-6961/2006-46/292, FAS Moscow District dated 06/28/2007, 06/29/2007 No. KA-A40/5984-07 in case No. A40-73242/06-129-462) .

How to calculate the proportion for the distribution of “input” VAT

“Input” VAT on general business expenses, which relate to both taxable and non-taxable transactions, is deductible in the part related to taxable transactions (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Calculate the share of VAT deductible using the formula (clause 4.1 of Article 170 of the Tax Code of the Russian Federation):

In this share you will calculate VAT deductible for each invoice on which you distribute VAT. Register supplier invoices in the purchase book for the amount of VAT that you have the right to deduct (clause “y”, clause 6 of the Rules for maintaining a purchase book).

For the rest of the “input” VAT, include it in the cost of purchased goods (work, services, property rights).

The share of VAT, which is included in the cost of goods (work, services, property rights), is equal to (clause 4.1 of Article 170 of the Tax Code of the Russian Federation):

Example of calculating the proportion for VAT distribution

During the quarter, the organization shipped the following goods:

VAT exempt – in the amount of RUB 250,000;

subject to VAT – in the amount of RUB 750,000. (excluding tax).

The total cost of goods shipped during the quarter amounted to RUB 1,000,000. (RUB 250,000 + RUB 750,000).

During the quarter, a batch of raw materials was purchased, which was used in both taxable and non-taxable transactions. “Input” VAT on purchased raw materials (in the amount of 80,000 rubles) needs to be distributed.

The share of VAT deductible will be 3/4 (RUB 750,000 / RUB 1,000,000). The amount of tax to be deducted is 60,000 rubles. (RUB 80,000 x 3/4).

The share of VAT included in the cost of raw materials is 1/4 (RUB 250,000 / RUB 1,000,000). The amount of tax included in the price is 20,000 rubles. (RUB 80,000 x 1/4).

the proportion for the distribution of VAT on fixed assets and intangible assets registered in the first or second month of the quarter without waiting for the end of the quarter. Determine it based on the cost of goods (work, services, property rights) shipped in the month when you registered the fixed assets (intangible assets) (clause 1, clause 4.1, article 170 of the Tax Code of the Russian Federation).

What amounts are included in the calculation of the proportion?

When calculating the proportion, include the cost of all shipped (transferred) goods, works, services, property rights, both taxable and not subject to VAT (clause 4.1 of Article 170 of the Tax Code of the Russian Federation).

Include the cost of taxable goods, works, services, property rights in the calculation of the proportion without the tax accrued on them (Letter of the Federal Tax Service of Russia dated 03/21/2011 N KE-4-3/4414, Determination of the Constitutional Court of the Russian Federation dated 05/27/2010 N 730-О-О ).

Do not include in the calculation proportions of receipts that are not revenue. This could be, in particular, dividends, interest on bank deposits, interest on securities, etc. This follows from paragraphs 4, 4.1 of Art. 170 of the Tax Code of the Russian Federation (see also Letters of the Ministry of Finance of Russia dated January 16, 2017 N 03-07-11/1282, dated August 18, 2014 N 03-07-05/41205).

For some transactions, such as the provision of loans, transactions with securities and derivative financial instruments, there are features of determining income for calculating the proportion.

Are exchange rate differences taken into account when calculating the proportion for separate accounting of “input” VAT?

There is no need to include exchange rate differences in the calculation of the proportion. They are not revenue, but are taken into account in non-operating income or income tax expenses (clauses 4, 4.1 of Article 170, clauses 2, 11 of Article 250, clauses 5, 6 of clause 1 of Article 265 Tax Code of the Russian Federation).

Methodology for separate VAT accounting

In ch. 21 of the Tax Code of the Russian Federation does not prescribe the methodology for separate VAT accounting, so taxpayers determine it independently. In practice, enterprises consolidate methodological recommendations for separate accounting of VAT in their accounting policies (Resolution of the Federal Antimonopoly Service of the Volga Region dated April 19, 2011 No. A55-19268/2010 and letter of the Federal Tax Service of Moscow dated March 11, 2010 No. 16-15/25433).

If an enterprise actually uses separate accounting for VAT, but this is not reflected in the rules for its maintenance in the accounting policy, then it is possible to challenge the likely denial of the tax authorities’ right to deduction in court. In this case, it is only necessary to provide evidence that such a division is carried out when accounting for VAT (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated August 17, 2011 No. A53-19990/2010).

However, there is also negative judicial practice for taxpayers who could not prove that separate accounting is maintained (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 20, 2011 No. F03-2961/2011). Therefore, you should not ignore the reflection of the rules of separate accounting in the accounting policy.

For information on what to do if there was no shipment in a certain period, see the material “Separate accounting of VAT in non-income periods is carried out according to the taxpayer’s rules .

Separate accounting method

There are no specific methods, much less techniques, that a company must use. The way out of this situation is standard - the company must:

- determine the principles of separate accounting for taxable and non-taxable VAT;

- independently develop the appropriate procedure and consolidate it in the accounting policy.

Such requirements have been voiced by the courts. In practice, separate tax accounting of input VAT is carried out as follows:

- On sub-accounts specially opened for sales accounts;

- Using analytical accounting data (tables, certificates, etc.);

- Based on information from the invoice journal and the Sales Book.

The chosen procedure must be fixed in the accounting policy. For those companies that are just planning to switch to separate accounting, we offer the following formulations:

If the company’s activities affect areas where there are VAT rates of 10 or 0%, then the part of the accounting policy on separate accounting can be supplemented with the following paragraph:

It makes sense to devote a separate section (subsection) of the accounting policy to separate accounting of transactions subject to and non-taxable with VAT. In particular, you can specify the following:

After listing the subaccounts, it is necessary to describe the essence of separate accounting of input VAT. For example, like this:

If, due to the specifics of the accounting program, the use of analytics on subaccounts is not enough, the company can approve separate analytical registers in the annex to the accounting policy. The development and use of registers eliminates the question of “cameramen” about documents confirming separate accounting.

The Five Percent Rule

If for a quarter expenses on non-VAT-taxable transactions do not exceed 5% of the total amount of expenses, then all input VAT can be deducted without distributing it. As a rule, an experienced accountant will determine by eye that the figure will be less than 5%. However, in order to deduct all input VAT calculated under this rule, a register or, at a minimum, an accounting certificate is required.

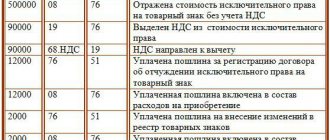

How to maintain separate VAT accounting: postings

It is necessary to open second-order subaccounts to account for VAT received from suppliers. Thus, subaccount 19-1 will collect VAT on goods (services, fixed assets, intangible assets) that are used in both types of activities. 19-2 proposes to accumulate VAT on goods that will be used in taxable activities. Subaccount 19-3 will take into account VAT, which will subsequently increase the cost of goods used in tax-exempt activities.

Example of postings when capitalizing a fixed asset:

May

Dt 08 Kt 60 (equipment accepted from the supplier) - 60,000 rubles.

Dt 19-1 Kt 60 (input VAT included) - 10,800 rubles.

Dt 60 Kt 51 (money transferred to the supplier) - 70,800 rubles.

Dt 01 Kt 08 (equipment accepted for registration) - 60,000 rubles.

June

Dt 44 Kt 02 (depreciation is calculated using the straight-line method, the useful life of the equipment is 4 years) - 1,250 rubles.

March

Dt 19-2 Kt 19-1 (VAT, which will be used as a deduction) - 7,000 rubles.

Dt 19-3 Kt 19-1 (the amount of VAT that will go to increase the cost of equipment) - 3,000 rubles.

Dt 68 Kt 19-2 (VAT accepted for deduction) - 7,000 rubles.

Dt 01 Kt 19-3 (increase in the book value of equipment) - 3,000 rubles.

Dt 44 Kt 02 (additional depreciation for June) - 62.5 rubles.

Dt 44 Kt 02 (depreciation for July) - 1,131.25 rubles.

Changes in separate VAT accounting adopted from January 1, 2014

| Rules in force until 12/31/13 | Rules effective from 01/01/14 | |

| How are the proportions calculated for input VAT on securities (when taking into account expenses for general business activities) | The “sale value” of securities is taken into account | The amount of “tax profit” (net income) from the sale of securities is taken into account |

| How are transactions on depositary receipts accounted for in the event of their repayment? | Taken into account | Not taken into account when receiving a “tax” loss |

When is it possible not to maintain separate VAT accounting?

Sometimes situations may arise when a taxpayer carries out taxable and tax-exempt transactions, but he does not have the obligation to maintain separate VAT records.

1. The 5% rule.

Before 2020, taxpayers may not have kept separate tax records in those tax periods when the total costs of operations exempt from VAT (not subject to VAT) were less than or equal to 5% of the total value of all costs of the production process. During these periods, all amounts of VAT claimed by suppliers were subject to deduction in full. Since 2020, maintaining separate records has become mandatory in such periods. At the same time, the opportunity to deduct the entire tax in them remained.

It is important to remember that when calculating indicators, it is the costs of conducting non-taxable transactions that are used, and not the revenue from such activities (letter of the Ministry of Finance dated September 8, 2011 No. 03-07-11/241). At the same time, when calculating the 5% barrier, expenses for all VAT-free transactions are taken into account, and not for just one (letter of the Federal Tax Service dated August 3, 2012 No. ED-4-3 / [email protected] ).

2. Other cases.

The courts also recognize the right of taxpayers not to keep separate records:

- if the goods were immediately purchased for purposes not subject to VAT, but subsequently their purpose was changed (determination of the Supreme Arbitration Court of the Russian Federation dated June 26, 2008 No. 8277/08);

- if promissory notes of third parties are presented for redemption, taking into account the fact that the main activity subject to VAT is also carried out.

In this case, the Federal Antimonopoly Service of the Moscow District sided with the taxpayer, indicating that he should not keep separate records, since neither general administrative nor production expenses can be included in the costs of purchasing bills of exchange. In addition, in paragraph 4 of Art. 170 of the Tax Code of the Russian Federation does not mention transactions related to the circulation of securities - only commodity transactions (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 23, 2009 No. KA-A40/9481-09).

When is it necessary to maintain separate VAT?

The presence of activities both subject to and non-taxable to VAT is a signal that the company is obliged to begin maintaining separate tax accounting for input VAT.

Separate accounting is necessary due to the fact that for non-taxable transactions, firms cannot deduct “input” VAT (instead, the tax amount is taken into account as expenses when calculating income tax), but for taxable transactions they can. Please note: in the absence of separate accounting, the amount of “input” VAT cannot be attributed either to deductions for VAT-taxable transactions, or taken into account as expenses when calculating income tax on non-taxable transactions (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Also, non-VAT-taxable transactions for the purpose of maintaining separate accounting include not only those listed in Article 149 of the Tax Code (“Tax-exempt transactions”), but also the following transactions:

- falling under UTII;

- sale of goods, works and services, if the place of their sale is recognized as a foreign state;

- operations carried out by firms and entrepreneurs who have taken advantage of the exemption from VAT payer obligations on the basis of Article 145 of the Tax Code of the Russian Federation (exemption is provided if the amount of revenue excluding VAT for the three previous months did not exceed 2 million rubles);

- operations that are not recognized as sales, in accordance with paragraph 2 of Article 146 of the Tax Code of the Russian Federation.

For almost a year and a half, there has not been a single exception when a company could write in its accounting policy a refusal to separately account for taxable and non-taxable transactions. There were no concessions with the onset of 2020 - the corresponding changes to the Tax Code of the Russian Federation were introduced by Federal Law No. 335-FZ of November 27, 2017.

Results

The obligation to maintain separate accounting requirements for VAT suppliers arises if the taxpayer carries out both taxable and non-taxable activities. The conditions and principles for maintaining such records are specified in paragraphs. 4 and 4.1 art. 170 of the Tax Code of the Russian Federation, but taxpayers determine its methodology independently.

If an enterprise purchases materials, goods or services that will subsequently be used for both activities, then the proportion according to which the input VAT will be divided should be calculated. In this case, part of the tax will be used as a deduction when accounting for transactions subject to VAT, and the other share will go to increase the value of assets that were used in transactions not subject to VAT.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Letter of the Federal Tax Service of the Russian Federation dated October 24, 2007 N ШТ-6-03/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.