5,00

5

| Reviews: | 0 | Views: | 8908 |

| Votes: | 1 | Updated: | n/a |

File type Text document

Document type: Act

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

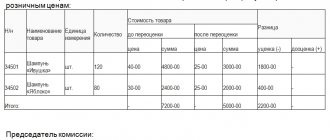

Appendix No. 2 to the Instructions on the procedure for processing commission transactions and maintaining accounting records in the commission trade of non-food products, approved by Order of Roskomtorg dated December 7, 1994 No. 99 ACT OF MARKETING “___” ______ 20___, the commission agent represented by ________________________ (last name, first name, patronymic) and the principal ________________________________________ made a markdown (last name, first name, patronymic) of the following goods. ——————————————————————— Date¦ Name ¦No. contract¦ Price according to ¦Percentage¦Price after ¦ goods ¦ ¦ contract ¦ markdown¦ markdown —-+—————+————+—————-+——-+———— —-+ —————+————+—————-+——-+———— —-+—————+————+—————-+——- +———— ——————————————————————— Commission agent ______________________ (signature) Committent _________________________ (signature) COMMENTS: ———— The markdown of things is formalized by an act drawn up commission agent in one copy (Appendix No. 2), and is recorded in the list. At the same time, the new price and markdown date are indicated on the product label attached to the item. The markdown act is transferred by the financially responsible person with the product report to the accounting department.

Download the document “Report of Markdown of Goods”

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Report of Markdown of Goods”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Corrections

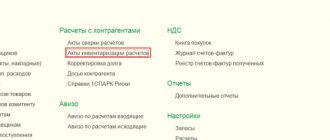

Revaluation is often carried out using the 1C program. There is a similar table there. Some fields are filled in automatically. If you have to fill out the document manually, then the remaining empty lines can be crossed out. If errors occur, their correction must be formalized accordingly. Cross out the erroneous value with one line, and then write the correct one on top or on the side. In this case, all members of the commission and the head, as well as (if any) the financially responsible person present when drawing up the act, must sign next to the correction.

Documents found on the topic “deed of markdown of goods sample”

- Act of markdown of goods Accounting statements, accounting → Act of markdown of goods

... account in commission trade in non-food products , approved by order of Roskomtorg dated 12/07/94 no. 99 act of markdown "" 20, the commission agent represented by (last name, first name, patronymic) and the committent made a markdown (last name, first name, patronymic) ... - Act about markdown flap (Unified form N TORG-25)

Documents of the enterprise's office work → Certificate of markdown of the flap (Unified form N TORG-25)You can get the document “ Act on markdown

- Act about markdown (Unified form N KOMIS-3) (2)

Enterprise records management documents → Statement of markdown (Unified Form N KOMIS-3) (2)The document “ Act of markdown (unified form n commission-3)” in excel format can be obtained from the link “download file”

- Act about markdown marketable-material assets (Unified form N MX-15)

Documents of the enterprise's office work → Act on the depreciation of inventory items (Unified Form N MX-15)You can get the document “ Act on depreciation inventory

- Sample. Act for damage, fight, scrap goods (material). Form No. 12

Accounting statements, accounting → Sample. Act of damage, damage, scrap of goods (material). Form No. 12...its markdown (write-off) due to the material. (damage, battle, etc.) as a result of the inspection it turned out: - no. quantity actir markdown sum pre- +- +- markdowns discount.name of goods , sorted.grossnetto price sum newamount or materials, art...

- Sample. Act control check of correct loading of products (goods)

Contract for the carriage of goods and passengers → Sample. Certificate of control verification of the correct loading of products (goods)act of control verification of the correct loading of products ( goods ) name and details of the enterprise: “” 20, no...

- Sample. Act for transmission goods, containers and equipment when changing bartenders

Accounting statements, accounting → Sample. Act on the transfer of goods, containers and equipment when changing barmenOkud code 0903115 (enterprise, organization) act no. for the transfer of goods , containers and equipment when changing bartenders on 20. handing over: receiving: (position, function...

- Sample. Act about the established discrepancy in quantity and quality upon admission goods (material). Form No. 115

Agreement for the supply of goods and products → Sample. An act on the established discrepancy in quantity and quality upon receipt of goods (material). Form No. 115organization standard form no. 115 enterprise - act no. about the established discrepancy of goods in quantity and quality upon receipt - material "" 20g. place of origin...

- Sample. Act about detection of shortage of products (goods) when opening a carriage (container, van)

Contract for the carriage of goods and passengers → Sample. Report on detection of shortage of products (goods) upon opening of a carriage (container, van)(name of the recipient) (address of the recipient) act on the discovery of a shortage of products ( goods ) when opening a carriage (container, van) "" 200, place of drawing up...

- Sample. Act about the established discrepancy in quantity when accepting imported goods. Specialized form No. 2-on

Agreement for the supply of goods and products → Sample. An act on the established discrepancy in quantity when accepting imported goods. Specialized form No. 2-onspecialized form no.2-on +-+ code according to okud 0903002 +-+ “I approve” “” 20 act no. dated "" 20 about the established discrepancy in quantity when accepting imported goods place of drawing up the act : ...

- Sample. Act inventory goods shipped. Form No. inv-4 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

Accounting statements, accounting → Sample. Inventory report of goods shipped. Form No. inv-4 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)... financial obligations approved by order of the Ministry of Finance of the Russian Federation dated June 13, 1995 no. 49 act of inventory of goods shipped no. +-+ codes +- form no. inv-4 according to okud 0309004 +- organization according to okd...

- Sample. Act inventory of materials and goodson the way (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

Accounting statements, accounting → Sample. Inventory report of materials and goods in transit (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)... financial obligations approved by order of the Ministry of Finance of the Russian Federation dated June 13, 1995 no. 49 act of inventory of materials and goods in transit no. +-+ codes +- form no. inv-6 on okud 0309006 +- about...

- Sample. Act on detection of non-conformity of quality and completeness of products (goods) requirements of standards or other documents certifying quality when opening a carriage (container, van)

Contract for the carriage of goods and passengers → Sample. Act on the discovery of non-compliance of the quality and completeness of the product (goods) with the requirements of standards or other documents certifying the quality when opening a carriage (container, van)(name of the recipient) (address of the recipient) act on the discovery of non-compliance of the quality and completeness of the product ( goods ) with the requirements of the standard or other documents approved...

- Act about the return of defective goods

Enterprise records → Certificate of return of defective goodsAct No. dated "" 20 about the return of defective goods 1. name of the organization 2. full name of the authorized person...

- Sample. Act about removing an item from sale

Commission agreement for purchase and sale → Sample. Act on the removal of an item from sale...accounting for commission trade in non-food products , approved by order of Roskomtorg dated December 7, 1994 no. 99 act on the withdrawal of an item from sale "" 20 we, the undersigned, the head of the enterprise, (full name) are financially responsible ...

Accounting and postings

The method of reflecting markdowns in accounting depends on the specifics of the enterprise - a wholesale company or a retail enterprise. The legislation offers two ways to account for inventory: at purchase prices or at sales prices.

In the event that the markdown will be made in an amount exceeding the markup, the enterprise creates a special reserve for the markdown of each unit or group of similar goods, which is reflected in accounting as follows: from the debit of account 91 (subaccount “Other expenses”) the amount is written off to the credit of account 14 reserve formed to reduce the cost of goods.

From the amount of the reserve, if necessary, losses for reducing the cost of products more than their cost are covered from the debit of account 14 to the credit of account 91 “Other expenses”.

In the balance sheet, the cost of goods is reflected minus the formed reserve (clause 25 of PBU 5/01 “Accounting for inventories”). The amount of the initially formed reserve may vary depending on market conditions. If the market value of the product has decreased even more, then the reserve is increased. Otherwise, the reserve is reduced or completely restored.

Enterprises that maintain a simplified method of accounting are exempt from the formation of a reserve (paragraph 2, paragraph 25 of PBU 5/01). Such enterprises include small businesses, non-profit enterprises and organizations participating in the Skolkovo project. All other organizations must form a reserve for inventory depreciation without fail (clause 20 of the Guidelines for accounting of inventories).

At purchase prices

It is applicable for both wholesale and retail.

Example:

In the case where goods and materials were discounted within the amount of the trade margin, then the decrease in its value does not need to be reflected in accounting:

- Dt 41 – Kt 60 – 215,000 rub. – 100 units of linen sets were capitalized at a purchase price of RUB 2,150.

- Dt 50 – Kt 90 (sub-account “Revenue”) – 119,000 rubles. – 35 sets of underwear were sold and the accountant reflects the revenue for 35 sets at a retail price of 3,400 rubles.

- Dt 90 (sub-account “Cost of sales”) – Kt 41 – RUB 75,250. – the cost of 35 sold sets is written off.

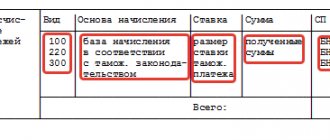

- Dt 90 (sub-account “VAT”) - Kt 68 (sub-account “Calculations for VAT”) - value added tax is charged on sold sets of linen.

After markdown, the calculation of the sales amount should be carried out at new prices:

- Dt 50 – Kt 90 (sub-account “Revenue”) – 27,000 rubles. – 10 discounted sets were sold and the accountant reflects the proceeds from sales at the new price of 2,700 rubles.

- Dt 90 (sub-account “Cost of sales”) – Kt 41 – 21,500 rubles. – the cost of 10 sets was written off at purchase prices.

- Dt 90 (sub-account “VAT”) - Kt 68 (sub-account “Calculations for VAT”) - VAT is charged on sets of linen sold.

At sales prices

This accounting method is used in retail.

Example:

If at a retail outlet accounting is carried out at sales prices, then the postings from the previous example will look like this:

- Dt 41 – Kt 60 – 215,000 rub. – 100 sets of linen were capitalized at a purchase price of RUB 2,150.

- Dt 41 – Kt 42 – 125,000 rub. – the trade margin on the purchased batch of bed linen is reflected in a separate posting.

- Dt 50 – Kt 90 (sub-account “Revenue”) – 119,000 rubles. – 35 sets were sold and the accountant reflects the proceeds from sales at a retail price of 3,400 rubles.

- Dt 90 (sub-account “Cost of sales”) – Kt 41 – RUB 75,250. (35 pcs. x 2,150 rub.) – the cost of sold sets is written off.

- Dt 90 (sub-account “Cost of sales”) – Kt 42 – 43,750 rub. – the trade margin on sold sets is reversed ((RUB 3,400 – RUB 2,150) x 35 pcs.).

- Dt 90 (sub-account “VAT”) – Kt 68 (sub-account “Calculations for VAT”) – VAT on sold sets of linen is written off.

After the remaining sets have been marked down, the accountant records the following entries:

- Dt 41 – Kt 42 – 45,500 rub. – “reversal” operation to reduce the difference in the trade margin of the remaining 65 discounted sets ((3,400 rubles – 2,700 rubles) x 65 pcs.).

- Dt 50 – Kt 90 (sub-account “Revenue”) – 27,000 rubles. – revenue from the sale of 10 sets of linen at a new price of 2,700 rubles is reflected.

- Dt 90 (sub-account “Cost of sales”) – Kt 41 – 21,500 rubles. – write-off of the sales value of 10 sold sets.

- Dt 90 (sub-account “Cost of sales”) – Kt 42 – 5,500 rub. – the trade margin on sets sold after markdown was reversed ((RUB 2,700 – RUB 2,150) x 10 pcs.).

- Dt 90 (sub-account “VAT”) – Kt 68 (sub-account “Calculations for VAT”) – VAT is written off on sets of linen sold.

Related documents

- Act-receipt for the performance of warranty and paid work on the repair of telephone sets. Form No. tf-2-22 (letter of the Ministry of Finance of the Russian Federation dated February 22, 1994 No. 16-36)

- Act-request for replacement (additional supply) of materials. Form No. m-10

- Analytical data on accounting for the costs of procuring and purchasing materials for journal order No. 6

- Analytical data on accounting for deviations in the cost of materials for journal order No. 6

- Certificate of assessment of the value of buildings and structures approved. Ministry of Agriculture of the Russian Federation on January 22, 1992 (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm)

- Certificate of assessment of the cost of machinery, equipment and transport (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Certificate of assessment of the cost of unfinished capital construction (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act on the assessment of the value of working capital (appendix to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act of transfer (sale) of collective farm (state farm) property to the rural (settlement) council of people's deputies (appendix to the regulations on the commission for land privatization and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- An acceptance certificate

- Balance sheet of an insurance organization (quarterly). Form No. 1-insurer (Order of Rosstrakhnadzor dated April 16, 1996 No. 02-02/12)

- Balance sheet of the enterprise (Form No. 1 for capital) (approved by Letter of the Ministry of Finance of the Russian Federation dated October 13, 1993 No. 114 for annual reporting for 1993)

- Balance sheet of an insurance organization - form No. 1 - insurer. (approved by the Russian Federal Service for Supervision of Insurance Activities in agreement with the Ministry of Finance of the Russian Federation for quarterly reporting in 1993)

- Balance sheet of economic and financial activities of the enterprise

- Balance sheet of economic and financial activities of the enterprise form 1.

- Statement of uncollected overdue receivables and violations of settlement discipline on synthetic accounts

- Statement of receipt of funds to the account of a branch of a foreign legal entity. Form No. 1-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Statement of expenditure of funds from the account of a branch of a foreign legal entity. Form No. 3-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Inventory results sheet

- A list of supplier invoices accepted for payment by a branch of a foreign legal entity. Form No. 6-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended dated December 29, 1995 No. vz-6-06-672))

Change of price tags

In large organizations, there is a well-thought-out algorithm for changing prices for individual items. Its main principle is the replacement of old prices with new ones on a priority basis.

Upward prices change earlier than downward prices. Moreover, it is prohibited to cross out the old value and write a new one on them. It is better to print new information on adhesive paper and, with one movement of the hand, replace irrelevant information on the sales floor (or in another place where buyers receive information about the cost of goods).