How to use the TORG-18 goods register

In order for the storekeeper to be able to record the movement and balances of inventory items (inventory and materials), as well as containers in the warehouse entrusted to him, the TORG-18 form is provided, the form of which was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. Information about receipt/expense and balance of goods. The unified form contains all the necessary details and columns that are needed to maintain inventory records.

Information for entry into TORG-18 is taken from primary documentation (invoices) or from cumulative statements for accounting for the day of containers and inventory items. The journal is filled out by item, quantity, price, and grade.

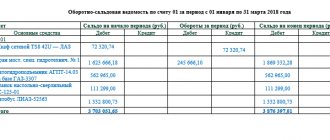

For information on how to fill out a document similar in structure, the turnover sheet, read the article “How to fill out the turnover sheet (form, sample)?” .

If the company uses the option of automated information processing when maintaining accounting, then this form is also recommended for use. It can be maintained and stored both on typewritten media and in paper form.

Accounting books for individual entrepreneurs: new forms

Resolution of the Ministry of Taxes and Taxes dated January 30, 2019 No. 5 approved the Instructions on the procedure for keeping records of income and expenses (hereinafter referred to as Instruction No. 5) and the forms of accounting documents for individual entrepreneurs. The specified documents apply from 04/05/2019.

Instruction No. 5 determines the procedure for keeping records of income and expenses for individual entrepreneurs <*>:

— paying income tax from individuals <*>;

— paying a single tax <*>;

- applying the simplified tax system and keeping records in the Book - in relation to income subject to income tax, and if they decide to keep records of income and expenses on a general basis <*>.

In addition, individual entrepreneurs on the simplified tax system with accounting in the Book must be guided by Instruction No. 5 when drawing up primary accounting documents and drawing up written decisions on the principles and methods of accounting <*>.

Instruction No. 5 establishes a list of new forms of accounting documents (Appendices 2 - 11), which must be maintained by individual entrepreneurs depending on the tax they pay. As before, accounting documents can be maintained both on paper and in electronic form <*>.

Let us consider the main changes that have occurred in the forms of books and the procedure for maintaining records.

Previously, individual entrepreneurs paying a single tax kept records of revenue for tax purposes in Section I of the book of accounting for gross proceeds from the sale of goods (work, services), accounting for goods imported into the territory of the Republic of Belarus from member states of the EAEU. From 04/05/2019, individual entrepreneurs are required to account for revenue in a separate ledger for accounting for revenue from the sale of goods (work, services) <*>. Compared to the previous edition, the names of the columns in the new book have not changed.

In the book of total accounting of goods, the names of some columns have been changed. This is due to the fact that now the book should take into account goods intended for retail and (or) wholesale trade <*>. Previously, this book was intended only for accounting for goods in retail trade <*>.

The forms of accounting books have not changed, compared to previously existing books:

— fixed assets <*>;

— intangible assets <*>;

— individual items as part of working capital <*>;

— raw materials <*>;

— goods (finished products) <*>.

At the same time, the individual entrepreneur is given the right not to use the above books. In return, they need to develop their own forms, providing them with the necessary indicators for maintaining records and calculating the tax base <*>.

Note that currently individual entrepreneurs are given the opportunity to maintain one general accounting document. In this case, in its individual sections, in accordance with the specifics of the activity, accounting of fixed assets, intangible assets, individual items as part of working capital, raw materials and supplies, goods (finished products), VAT, total accounting of goods <*> is carried out. Previously, this possibility was not provided.

Changes have been made to the names of individual columns in the book of income and expenses. This is due to the fact that in 2020, individual entrepreneurs - “income earners” - were given the right to choose the principle of accounting for income from sales (by payment or by shipment) <*>.

Please note that now, when paying income to individuals in cash, individual entrepreneurs have the right to draw up a payslip in any form. At the same time, it must contain the mandatory details for primary accounting documents <*>.

Rules for filling out the journal

Information is entered into the journal for each transaction performed (expenditure or receipt), reflecting the movement of inventory items in the warehouse. At the same time, for each transaction reflected in TORG-18, the balance of goods in the warehouse is calculated.

PLEASE NOTE! Information in the register is entered in the units of measurement that were indicated on the title page of the journal.

In this accounting register, on the first and subsequent pages, the tabular section contains the following data:

- date of the completed transaction for the expense/receipt of inventory items;

- number of the primary document on the basis of which the operation was performed;

- the quantity of goods received/shipped, which is entered in the “Incoming” or “Output” columns;

- the remaining quantity of goods after completion of the operation (the total weight of inventory items received from the supplier can be displayed here, along with containers and packaging intended to keep inventory items intact);

- Any comment can be indicated in column 7; Typically, information is provided here that may affect the total weight of inventory items.

For information about what documents are drawn up when accepting goods, read the material “Unified Form TORG-1 - Certificate of Acceptance of Goods”.

How to fill

The material assets accounting journal (filling sample) is no different in structure from ordinary accounting registers. It consists of a title page and pages arranged in the form of a table.

The title page is filled out once - when creating a document. The following information is provided here:

- name of the institution and name of the structural unit;

- the period for which entries are made (month, quarter, year, depending on the number of transactions);

- information about the position and full name is indicated. employee responsible for maintaining the register.

It is acceptable to provide additional information. For example, type of activity according to OKVED, TIN, OKPO, KPP and other registration data.

The tabular part of the document is filled with data on the movement of inventory items:

- The number is entered in order.

- Then enter the date of the transaction.

- The data of the primary document on the basis of which the entry is made is indicated. For example, when receiving goods and materials, indicate the number and date of the invoice. Upon disposal - the number and date of the act for write-off, transfer.

- Specify the recipient. If this is an employee of the institution, then write down the position and full name, if it is a third-party company, then indicate the name of the company.

- Register the name of the inventory, unit of measurement and cost for the product, then indicate the quantity and amount based on the quantity issued (received).

You can download the completed wealth register for free.

Materials accounting card (form M-17)

A book of warehouse accounting of materials in warehouses in storerooms instead of warehouse accounting cards, it is allowed to keep records in warehouse accounting books. In the warehouse accounting books, a personal account is opened for each item number. Personal accounts are numbered in the same order as cards. For each personal account, a page sheet or the required number of sheets is allocated. In each personal account, the details specified in the warehouse accounting cards are provided and filled in.

Accounting for material assets in the warehouse is carried out in accordance with the requirements specified in Section. Reception, storage, issuance and accounting of materials in the warehouse is carried out by an official who is responsible for their safety, as well as for the correct and timely execution of operations for their movement.

Used for printing newspapers or similar products. It has low density and, accordingly, low wear resistance. The advantage of this paper is its low price. Widely used in printing books, magazines, etc.

Materials inventory book (form M-17)

Warehouse operations are always carefully completed by employees, because they are financially responsible for each unit of goods. But small companies still use a journal or inventory book in paper form or Excel. For the warehouse accounting journal, the sample is not approved by any standards. But that doesn't mean it came out of nowhere. The use of a book instead is permitted.

Classic view of the materials inventory book. This year, the state simplified most of the unified warehouse forms, allowing enterprises to use their own modifications.

But most companies are also satisfied with old samples of warehouse accounting books, which can always be downloaded on the Internet. The Form M journal contains detailed information about products and documents on the basis of which records of operations are made.

Unlike a card, which records one product item, the number of items recorded in a book is limited only by its thickness. The journal takes into account only incoming and outgoing transactions; internal movements are not displayed in it. Acts of write-off of defective, spoiled products and expired goods can also be recorded. It is almost impossible to maintain inventory records at large facilities in paper form.

The materials inventory journal remains popular with accountants because of its versatility. It reflects the movement of goods, and the documents recorded in it are indelible evidence of the operations that took place in the warehouse. In the food inventory book, you need a column with expiration dates.

Book M allows a lot, but its capabilities cannot be compared with the functionality of warehouse accounting programs. Such software allows you to fully automate trade and warehouses, saving on personnel and speeding up business operations. At most enterprises, the material inventory book, Form M, is maintained according to a standard model. After all, it’s easier to buy it than to do it yourself.

Therefore, the markings in the journal correspond to those in the approved warehouse accounting card M. Internal markings of the M17 book for warehouse accounting. The name of the enterprise and, if any, structural unit are indicated on the cover of the book. The facing pages are completely identical and include two tables. The header indicates the financially responsible person, the name of the product and its personal code number. The first top table has the following columns:.

The first table indicates only one type of product, which is taken into account on the page. Depending on the planned turnover, several sheets in a row can be reserved for each product code.

The last sheet of journal M with a list of accounting checks. At the end of Form M of the warehouse accounting book there is a sheet of regular checks by the accounting department for the correctness of the entries made. This page contains a table with three columns:. Thus, one journal combines the movement of all accountable goods and the results of checks on the actions of storekeepers.

By picking up just one document you can analyze almost all warehouse operations. When organizing a warehouse, you can download the materials inventory book for free on the Internet.

Its pages can be edited to suit the needs of the enterprise and the required number of sheets can be printed. You can also buy a ready-made journal at a stationery store that specializes in accounting documents. An example of filling out an expense transaction in the warehouse accounting book M. Goods in the accounting book are maintained according to personal accounts indicated in the corner of each page.

To make it easier to find the right place to record a warehouse operation, all sheets are numbered. At the end of the journal there is a list of personal accounts with the name of the product and a list of pages on which they are recorded. This attachment is free-form printable and can be separated from the book itself.

Although it is better to stitch the list of personal accounts with M itself. Business transactions are reflected in the warehouse journal both on the basis of documents from the enterprise itself and from third-party organizations. Other people's invoices are not always harmonized with accepted accounting.

They may contain different units of measurement, changed nomenclature names, and other special attributes. Therefore, when filling out form M17 of the warehouse accounting book, non-standard situations may arise that you need to know about and be able to resolve them correctly.

An example of an invoice on the basis of which data is entered into form M. You can maintain warehouse documentation in Excel format, but the main disadvantage of this method for form M is the ability to freely edit the file and the lack of control of the storekeeper. Therefore, if you want to automate trade and accounting, it is better to use WMZ warehouse management systems or specialized warehouse accounting programs. They allow you to track the history of each entry while monitoring employees.

The form of the warehouse accounting book itself is not specially maintained in the programs; it is only a reporting form, generated as needed. The information in the warehouse book M is subject to careful recording, and the storekeeper is financially responsible for it. Therefore, when maintaining a journal, it is important to use procedures that will not allow data to be undetected or unfounded entries made. Types of commodity accounting of warehouse operations.

The use of form M17 by an enterprise is not mandatory. Following her example, you can create your own warehouse operations journal without unnecessary columns.

However, it is recommended to leave the general principles of maintaining such a document the same. In order to reduce warehouse costs, it is better to use electronic accounting forms. After all, the use of special programs makes the work easier not only for storekeepers, but also for the management of the enterprise.

Digital technologies make it possible to control a warehouse remotely and quickly make decisions based on available data. We have a ready-made solution and equipment for online cash registers. The User's consent to the Agreement, expressed by him within the framework of relations with one of the listed persons, applies to all other listed persons.

Using the Services means the User agrees with this Agreement and the terms and conditions specified therein; in case of disagreement with these terms, the User must refrain from using the Services. Moscow, st. Academician Ilyushina, d. The purpose of this Agreement is to protect confidential information that the Parties will exchange during negotiations, concluding contracts and fulfilling obligations, as well as any other interaction including, but not limited to, consulting, requesting and providing information, and performing other assignments.

The Parties agree to keep confidential all confidential information received by one Party from the other Party during the interaction of the Parties, and not to disclose, divulge, make public or otherwise provide such information to any third party without the prior written permission of the other Party, except in cases specified in the current legislation, when the provision of such information is the responsibility of the Parties.

Each Party will take all necessary measures to protect confidential information using at least the same measures that the Party uses to protect its own confidential information. Access to confidential information is provided only to those employees of each Party who reasonably need it to perform their official duties under this Agreement.

The obligation to keep confidential information secret is valid within the validity period of this Agreement, the license agreement for computer programs from. In this case, the Party must immediately notify the other Party of the received request;.

Insales does not verify the accuracy of the information provided by the User and does not have the ability to assess his legal capacity.

Insales has the right to make changes to this Agreement. When changes are made to the current edition, the date of the last update is indicated. The new version of the Agreement comes into force from the moment it is posted, unless otherwise provided by the new version of the Agreement. By accepting this Agreement, the User acknowledges and agrees that Insales may send the User personalized messages and information, including, but not limited to, to improve the quality of the Services, to develop new products, to create and send personal offers to the User, to inform the User about changes in Tariff plans and updates, to send the User marketing materials on the subject of the Services, to protect the Services and Users and for other purposes.

The user has the right to refuse to receive the above information by notifying in writing to the email address Insales - contact ekam. By accepting this Agreement, the User understands and agrees that Insales Services may use cookies, counters, and other technologies to ensure the functionality of the Services in general or their individual functions in particular, and the User has no claims against Insales in connection with this.

The user understands that the equipment and software used by him to visit sites on the Internet may have the function of prohibiting operations with cookies for any sites or for certain sites, as well as deleting previously received cookies.

Insales has the right to establish that the provision of a certain Service is possible only on the condition that the acceptance and receipt of cookies is permitted by the User. The user is independently responsible for the security of the means he has chosen to access his account, and also independently ensures their confidentiality.

The User is solely responsible for all actions and their consequences within or using the Services under the User’s account, including cases of voluntary transfer by the User of data to access the User’s account to third parties under any conditions, including under contracts or agreements.

For security purposes, the User is obliged to independently safely shut down work under his account at the end of each session of working with the Services. Insales is not responsible for possible loss or damage to data, as well as other consequences of any nature that may occur due to the User’s violation of the provisions of this part of the Agreement. The Party that has violated the obligations stipulated by the Agreement regarding the protection of confidential information transferred under the Agreement is obliged, at the request of the injured Party, to compensate for the actual damage caused by such violation of the terms of the Agreement in accordance with the current legislation of the Russian Federation.

Compensation for damage does not terminate the obligations of the violating Party to properly fulfill its obligations under the Agreement. All notices, requests, demands and other correspondence under this Agreement, including those including confidential information, must be in writing and delivered personally or via courier, or sent by email to the addresses specified in the license agreement for computer programs from If one or more provisions of the terms of this Agreement are or become invalid, this cannot serve as a reason for termination of the other provisions of the terms.

This Agreement and the relationship between the User and Insales arising in connection with the application of the Agreement are subject to the law of the Russian Federation.

The User has the right to send all suggestions or questions regarding this Agreement to the Insales User Support Service www. Novoryazanskaya, 18, bldg. All products Tariffs For retail trade and services For online stores and online services.

For the browser to work correctly, you must enable javascript! Scope of application of form M of the warehouse accounting book For the warehouse accounting register, the sample is not approved by any standards. Classic view of the materials inventory book In the year, the state simplified most of the unified warehouse forms, allowing enterprises to use their own modifications.

The following assets can be maintained in form M17: auxiliary materials; raw materials; spare parts; basic materials; container; semi-finished products; components; Construction Materials; fuel; Other materials.

It is almost impossible to maintain warehouse records in paper form at large facilities. The documents that serve as the basis for entries in the journal are: receipt and expense orders; invoices; invoices; other documents that provide for the transfer of ownership. In the food inventory book, a column with expiration dates is needed. The material inventory book, form M, allows storekeepers to do the following: generate periodic reporting on the movement of individual item items in the warehouse; analyze the turnover of each product, which allows you to plan warehouse space for future deliveries; control the shelf life of placed products; monitor the packaging of the enterprise in the context of each assortment unit; maintain address records of product balances; track the sources and timing of shortages and surpluses at the warehouse facility.

Marking the materials inventory book At most enterprises, the materials inventory book, Form M, is maintained according to a standard model.

Main features of the program:

- The program can be translated into any language convenient for you.

In addition, you can work with several languages at once. Any language - You can sell any product, conveniently classifying everything at your discretion

Any product

- For clarity, you can save an image of each product by capturing it from a web camera. It will also be displayed when making a sale.

Product photo

- The program can work with any number of departments and warehouses. All branches will work in a single database via the Internet

Warehouses and shops

- You can easily enter initial balances using the import function from modern electronic formats

Import

- The program can notify the right employees about important processes or matters: for example, that a certain product is running out of stock

Alerts

- Our program can work with many types of retail and warehouse equipment

Equipment - Integration with TSD will help optimize the operation of large warehouses, provide your employees with mobility, and make it easier to carry out an inventory of all

TSD - At any time, you can conduct an inventory of any warehouse by instantly downloading the planned quantity from your program and comparing it with the actual quantity using a barcode scanner or TSD

Inventory - When selling, various documents may be generated.

The receipt can be printed with or without fiscalization on a regular receipt printer Documents - You will have a unified database of contractors and suppliers with all the necessary contact information

Counterparty database

- You will be able to send bulk SMS messages or set up the sending of individual messages

SMS mailing - Email distribution will allow you to send any electronic document to your counterparty

Email

- The program will even be able to make a call on behalf of your organization and communicate any important information to the counterparty by

voice Voice mailing - All payments made will be under your full control

Payment statistics

- The report will show which of the suppliers you have not yet fully paid off with

Debts

- You can find out all sales statistics for each legal entity separately

Legal faces

- The program will help you find the most profitable branch of your chain of stores

Chain of stores

- All financial movements will be under your complete control. You can easily track what you spend the most money on for any period

Cost control

- The program will show any movements of goods and balances for each warehouse and branch for the specified period

Inventory control

- You will find out which products are in high demand

Popular product

- Thanks to the statistics of requests for products that are not in the assortment, you will be able to make an informed decision on expanding your product range

Did not have

- The program will tell you what goods need to be purchased and allow you to automatically generate a request

Minimum

- Using the analysis of stale goods, you can optimize warehouse resources

Stale goods

- The goods supply forecast will help you always have the right amount of the most popular items

Forecast

- The supplier report will show the best prices and data on recent purchases

Supplier Analysis

- Integration with the latest technologies will allow you to shock your clients and deservedly gain the reputation of the most modern company

Exclusivity

- The ultra-modern function of communication with a PBX will allow you to see the caller’s data, shock the client by immediately addressing him by name, and not waste a second searching for information

Telephony - The necessary data can be uploaded to your website to monitor the status of the order, display the balance of goods in a warehouse or branch and prices - there are many possibilities!

Website integration - Use a telegram robot so that your customers can independently submit requests or receive information on their orders from your

Telegram bot - A special program will save a scheduled copy of all your data in the program without the need to stop working in the system, automatically archive and notify you when it is ready

Backup - The scheduling system allows you to set up a backup schedule, receive important reports strictly at a certain time, and set any other actions of the

Scheduler - Our organization, taking care of its customers, has developed an official mobile application that will speed up and simplify doing business.

Employee app - The mobile application is convenient to use for customers who regularly interact with the company regarding its services and/or products in which customers are constantly interested.

Application for clients - The Modern Manager's Bible is an addition to the program for directors who consider themselves professionals or want to become one.

BSR - Reliable control will be ensured by integration with cameras: the program will indicate data on the sale, payment received and other important information in the captions of

the video stream. Video surveillance - You can quickly enter the initial data necessary for the program to work. This is done using convenient manual data entry or import.

Fast start

- We have added many beautiful templates to make working in our program even more enjoyable

Beautiful design

- The program interface is so easy that even a child can quickly figure it out.

Easy program

Order now

Language of the basic version of the program: RUSSIAN

You can also order an international version of the program, into which you can enter information in ANY LANGUAGE of the world. You can even easily translate the interface yourself, since all the names will be placed in a separate text file.

The materials inventory book is a document that is used to record inventory items on the territory. Every entrepreneur is interested in maintaining constant order in the storage room. Of course, this will ensure the highest quality work and optimize all process functions in the warehouse enterprise. The Universal Accounting System will help sort and archive cargo and products by their names, grade, size, shape and quantity. You can download a demo version of the warehouse materials accounting book on the information platform of our page. You can also contact us by email. We will accept your suggestions and take into account all your wishes to improve the software! The form of the materials inventory book includes systematic control over the receipt and consumption of materials during industrial operations. This can be commercial and industrial interaction with suppliers, business partners and clients: receipt and release of goods, calculation of residual materials, identification of defects and surpluses. This book is one of many electronic products created by the best specialists of the USU company. This form, thanks to the warehouse management of activities in the warehouse, guarantees the improvement of the work of employees - storekeepers and warehouse managers. They will no longer have to waste valuable time on bureaucracy. You just need to download this book. The program for the materials inventory book will carry out and reflect all the incoming and outgoing processes of such products as basic and additional materials, items of labor, semi-finished products and blanks, building materials and other forms. The book in the USU system can be used not only by accountants, but also by all employees of the warehouse site. They can easily download this application, master it and use the material inventory book form in a short time. This is facilitated by a lightweight and easy-to-use interface, which can also be designed to suit your taste. This will make working much more enjoyable for you and your employees.

The program exercises systematic control over the organization and regulation of the work process during the receipt and expenditure of incoming and outgoing cargo that is located in the warehouse. She also maintains a review of material records with a journal maintained in the storeroom or storage areas. You can be absolutely sure that the warehouse organization will not make mistakes or omissions in the process of filling out product counting forms and identifying residual stocks.

Upon completion of work upon acceptance of commodity units, a document is generated that indicates the inventory has been carried out. You can identify the residual value that is reduced to the actual ratio by adding the amount of unaccounted materials. This document form is stored in the storage archive. Calculations are also made in cooperation with importers and the required forms of documents are prepared, which will be necessary in the event of disclosure of an insufficient number of units of production. This way you can file a complaint regarding deviations from quality standards and delivery conditions using the accompanying documentation.

If previously it was not possible to control the actions of the storekeeper on the territory of the storage facility, and he could, on occasion, download and edit information and files, now, with the help of the USU program, you can avoid such situations. The ledger form application provides the ability to monitor the history of an account.

Receipt and expense book for accounting of work book forms and inserts in it

Home / Work book

| Table of contents: 1. General requirements for the receipt and expenditure book 2. Instructions for filling + sample 3. How to make corrections to the log 4. Responsibility for the absence of a book | Document: Download the receipt and expenditure book Download a sample book |

Current legislation obliges the employer to keep records of blank forms of work books (inserts). For this purpose, by Decree of the Ministry of Labor of the Russian Federation dated October 10, 2003 No. 69, the form of the receipt and expenditure book was approved for recording the forms of the work book and the insert in it (Appendix No. 2 to this legal regulation) .

The accounting book (journal) is usually kept in the accounting department by a person authorized by order of the manager (IP). It records all operations related to the receipt and use of forms, with the obligatory indication of the series and number of each individual form.

General requirements for the receipt and expenditure book

1) Continuous numbering. You can number the book either page by page or simply by sheet. Since both methods ensure the impossibility of removing individual elements from the document.

2) Firmware. The journal must be stitched and sealed with a wax seal or sealed. The standard fastening of the free ends of the threads using a pasted sheet of paper containing a certification note, in this case, may cause claims from the inspection authorities.

3) Certification record.

A certification note is made on the back cover of the book, which must contain:

- document's name;

- number of sheets (pages), written in numbers and in words;

- log start date;

- signature of the responsible person with a description of the position and full name.

Please note: the head of the organization (IP) must sign the back of the book. The person responsible for maintaining the journal does not have the authority to affix a certification signature.

The shelf life of the receipt and expenditure book is 5 years (subparagraph “d” of Article 695 of the List, approved by order of the Ministry of Culture of Russia dated August 25, 2010 No. 558).

In this regard, it is advisable to start a new journal every year. This procedure will allow timely disposal of documents with expired shelf life.

Instructions for filling

The unified form is a table of 12 columns, which are filled out as follows:

| Column ordinal number | Content |

| 1 | The serial number of the record is indicated |

| 2, 3, 4 | The date of entry is indicated in the format: DD.MM.YYYY |

| 5 | Fill in the name of the organization that supplies the forms or the position and full name of the personnel employee responsible for maintaining work books and inserts, upon whose application the forms are issued |

| 6 | Indicate the name and details of the document on the basis of which the forms were capitalized/written off (bill of lading, application from an employee of the HR department, act of destruction of the form) |

| 7, 8, 9 | Filled out when forms are received by the organization. In this case, you need to write down the total number of copies in the appropriate column (7 - work books, 8 - inserts) and list the details (series and number) of each individual form, and in column 9 indicate the total cost of the batch (including VAT) |

| 10, 11, 12 | Filled out when writing off forms. The corresponding column (10 – work books, 11 – inserts) indicates the number of forms used and their details, and column 12 – their cost, subject to reimbursement by the company’s employees (including VAT) |

The employee responsible for maintaining the income and expense book must prepare a monthly report on the number of blank forms available, the number of forms written off and the amounts received from employees as compensation for the employer's expenses.

Note: if the personnel officer spoils the form during the filling process, the unusable document must be disposed of. In this case, a free form destruction act is drawn up, into which you need to paste the identifier of the damaged form (a cut-out field with the series and number).

Sample of filling out the receipt and expenditure book

How to make corrections to the log

Corrections to the income and expense book are entered in the same way as accounting registers are adjusted:

- o is entered in the blank line immediately below the erroneous entry or after the last entry;

- a new entry is made in the line below containing reliable information;

- Under the correct entry, the full name, position and signature of the person who made the changes, as well as the date of the transaction, are indicated.

Responsibility for the absence of a receipt and expenditure book

For non-compliance with the Labor Code of the Russian Federation and other normative acts of labor law, the employer faces administrative liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- warning or imposition of a fine on the responsible official (individual entrepreneur) in the amount of 1,000 to 5,000 rubles;

- warning or imposition of a fine on the organization in the amount of 30,000 to 50,000 rubles.

Read in more detail: Receipt and expense book of work books

Did you like the article? Share on social media networks:

- Related Posts

- Extract from the work book

- Series of work books by year of issue

- Work book: instructions for filling out 2020

- Application for issuance of a work book

- Book of movement of labor books

- Entry of transfer in the work book: sample

- An example of a dismissal entry in a work book

- Receipt for receipt of work book

Leave a comment Cancel reply

Materials inventory book. Form M-17

In what cases is the warehouse accounting book used? Accounting book according to the canceled form M document structure. Where can I download a sample inventory book? Materials arriving at the warehouse must be registered by the materially responsible person of the MOL in a book or card for recording the relevant materials. In this case, the use of books or cards for recording materials is equivalent to clause. A feature of warehouse accounting books is the need to number their sheets and lace them together. The document must be sealed and certified by the chief accountant or other competent person.