A situation often arises that, for various reasons, you did not have time to make changes to the Accounting Policies before the beginning of the year. Or they deliberately didn’t. I wanted to think about it better, remember all the changes - and modify it later. But it is important to take into account that with continuous numbering of orders for conducting financial and economic activities, the order approving changes to the accounting policy for 2020 must be dated exactly 2020.

Each company has its own accounting policy

There are many innovations in legislation, but not all of them should be included in the accounting policy. It makes sense to describe in the accounting policy only those provisions that relate specifically to your company and take into account the specifics of accounting and the characteristics of a particular business.

The accounting policy sets out accounting methods that you must establish yourself or choose for yourself the best option from acceptable alternatives. Duplicating the direct provisions of the Tax Code - mandatory and not providing for a choice from possible options - is pointless. You should not burden the document with them. Let it be small, but meaningful and useful.

There is no point in “inflating” the rules and developing accounting policies for the future just in case. Take into account only the real subtleties of accounting work. When new accounting objects appear, the accounting policy can be supplemented.

Who approves the accounting policy of the enterprise

The management program is approved by the head of the organization - this condition is established by law:

- clause 4 PBU 1/2008 - for unitary enterprises for accounting purposes;

- Art. 313 of the Tax Code of the Russian Federation - for tax management.

The role of the chief accountant is no less important - his responsibilities (among others) include the process of forming the management system.

However, a situation where the chief accountant will need to sign the order approving the management program is possible if two circumstances coincide:

- The UP must be approved and put into effect in the company legally;

- the manager is absent, having given the right to sign administrative documentation to the chief accountant.

In addition to the chief accountant, any authorized person has the right to sign an order to approve the management plan, if such a duty has been assigned to him by the head in a separate order or power of attorney.

Changes to accounting policies in 2020

There is no direct obligation to review accounting policies annually. This is the right of the organization. But due to the fact that many legislative changes have been adopted that come into force on January 1, 2020, the accounting policy for 2020 should be reviewed and updated.

Innovations since 2020

A new restriction has been introduced when switching from a linear to a non-linear method of depreciation of fixed assets - no more than once every 5 years. Until January 1, 2020, the five-year moratorium was valid only for the transition from non-linear to linear. From 2020 - any change in the depreciation method - no more often than after 5 years.

From January 1, 2020, the following changes were made to the depreciation procedure:

- Depreciation on fixed assets transferred for free use cannot be recognized as expenses that reduce the tax base for income tax.

- The useful life of the object will not be extended for a period of conservation of more than 3 months. For a conservation period of more than 3 months, fixed assets are excluded from depreciable property.

These are direct provisions of the Tax Code - mandatory rules. They need to be taken into account in the work, but there is no need to include them in the accounting policy.

The horizon for applying the investment income tax deduction has been expanded:

- deductions are allowed for fixed assets of 8-10 depreciation groups (except for buildings, structures, transmission devices). Currently it only applies to 3-7 groups;

- The list of expenses that can be covered by deductions has been expanded: up to 100% of the amount of expenses for the creation of transport and utility infrastructure facilities and no more than 80% of the amount of expenses for the creation of social infrastructure objects. Provided that the creation of these objects is provided for in an agreement on the comprehensive development of the territory for the construction of standard housing.

The 50% limitation on the carry forward of losses from previous years has been extended until December 31, 2021.

If for 2020 you decide to change the procedure for making advance payments for income tax - based on actual profits, monthly or quarterly advance payments for income tax - this should be reflected in your accounting policies. If the procedure does not change from January 1, 2020, no changes need to be made.

Sample filling

We figured out when to make changes to accounting policies. Let's see how to draw up an order for its approval. It's easy to do in 4 steps.

Complete the administrative part. If changes are caused by new legislation, an explanatory part can be drawn up above the administrative part. The explanatory part indicates what changes in legislation have occurred and on what date they come into force.

In the administrative part, indicate:

- For what year is the accounting policy approved?

- Who is responsible for the execution of the order:

Let's draw up an order step by step.

In the header of the document, indicate the name and details of the budget organization.

Enter the name of the act, indicate its number, place of preparation and date.

Draw up the contents of the act itself depending on the purpose.

If the order approves the creation of a new accounting policy, reflect this information, as well as provide the full name and position of the specific employee of the enterprise who will control execution.

If changes are made, in addition to new items, indicate the reason, the date on which these changes will take effect, as well as the name and position of the employee who will monitor the execution of the order. In one of the articles we provided a current example of an order to supplement the accounting policy.

The act must be signed by the head of the budget organization. Then you need to familiarize yourself with the order of the employee who is responsible for execution.

Rules for accounting and payment of taxes for separate divisions

If a company has created several separate divisions located in one region, then the accounting policy establishes the procedure for paying taxes to the regional budget from two possible options:

- Each department independently.

- Centrally - through the parent company or through a responsible division.

The accounting policy lists the separate divisions to which the right of representation is delegated, indicating the taxes in respect of which the specified division will perform duties - submit tax returns and pay taxes.

If from January 1, 2020, such a procedure was prescribed in the accounting policy and you do not plan to change it, there is no need to make changes. But with regard to the centralized payment of personal income tax and insurance premiums, there are innovations that need to be included in the accounting policy for 2020.

Innovations since 2020:

- From January 1, 2020, it is officially allowed to submit 2-NDFL and 6-NDFL reports and transfer personal income tax in a single payment for all separate divisions located within the same municipality (within one OKTMO).

- From January 1, 2020, the company has the right to grant the authority to transfer insurance premiums only to those separate divisions that have a bank account.

Don’t forget to notify the tax authority about the centralized procedure for paying taxes, submitting reports and choosing a responsible department. Please note that regarding the centralization of personal income tax, only the selected inspectorate should be notified - the rest of the Federal Tax Service will receive information automatically. Each Federal Tax Service is notified regarding insurance premiums, in which the “separate” ones are registered. Messages are sent either about the vesting or deprivation of powers of the corresponding separate unit.

How to create an order

Since 2013, the use of unified standard forms of primary personnel and accounting documents has been abolished. Now any orders can be written in any form or, if the organization has its own document template, based on its sample.

In this case, in any case, it is necessary that the order in its structure corresponds to certain parameters of office work, and in its content includes a number of mandatory information. These include:

- Title of the document;

- date of its compilation and number;

- the name of the company where it is produced.

Then comes the main part:

- the essence of the order is described, that is, the fact of approval of the accounting policy is recorded, indicating the exact date from which it is put into effect;

- a link is given to the appendices to the order - documents that, in fact, determine the main provisions of the accounting policy;

- the obligation of department heads to familiarize their subordinates with it is prescribed.

Finally, the order should designate the employees responsible for its implementation. If the administration of the organization believes that the order needs to be supplemented with some other information, it should also be included in the form in separate paragraphs.

If you switch to a different tax regime from the beginning of the year, you need to draw up a new accounting policy

When changing the object of taxation according to the "simplified" tax system - from "Income" to "Income minus expenses" and vice versa - the change must be made to the accounting policy for 2020.

In the event of a transition from UTII to “simplified” taxation, the accounting policy must specify the accepted methods and accounting procedures for the new taxation procedure - the simplified taxation system.

Innovation from 2020:

From January 1, 2020, sellers of three groups of goods subject to mandatory labeling will lose the right to use UTII and PSN: medicines, shoes, clothing and other products made from natural fur.

In return for UTII, small companies and individual entrepreneurs will consider the option of switching to the simplified tax system.

To switch to the simplified tax system, the current accounting policy will have to be revised. And it’s important: no later than December 31, 2020, do not forget to notify the tax authority by sending an application to switch to the simplified tax system using form No. 26-1. Otherwise, in 2020 you will have to pay taxes according to the general taxation system.

If part of the business is transferred to UTII or the opportunity to receive targeted financing opens up, the accounting policy needs to detail the procedure for maintaining separate accounting.

There are still many tax innovations that will come into effect on January 1, 2020. Eg:

- the obligation to restore VAT during reorganization if the successor applies a special regime or begins to use the received property, goods, work, services in non-VAT taxable activities;

- the obligation to use electronic forms of salary reporting 6-NDFL, 2-NDFL, calculation of insurance premiums for companies with a staff of 10 people or more;

- new deadlines and formats for submitting tax reports;

- deadlines for payment of advance payments for transport and land taxes established at the federal level, and others.

All these innovations are unambiguous norms for execution that do not allow for choice of actions or alternative judgments. Therefore, it is necessary to take them into account in the work, but it is not necessary to include them in the accounting policy.

Please note other provisions of existing accounting policies. It is possible that some of the elements have lost their relevance, while others do not take into account the changes that have occurred in the structure of the company or the peculiarities of doing business. Some accounting methods require simplification, while others require replacement to achieve optimal results.

This may concern:

- working chart of accounts;

- inventory procedure;

- methods for valuing assets and liabilities;

- list of direct expenses;

- methods of maintaining separate accounting, if such an obligation is provided;

- benefits for which you have the right to apply and other solutions for organizing accounting.

If you create reserves in accounting and tax accounting, do not forget to take inventory of them as of December 31, 2020. From January 1, 2020, you can refuse to form reserves for tax purposes by reflecting the decision made in your accounting policies.

Why is UE needed?

Accounting regulations provide for certain rules for reflecting income and expenses, and the Tax Code of the Russian Federation provides its own rules. The methods chosen by the organization influence:

- on the cost of products, works and services;

- on its financial performance;

- on the amount of taxes.

All this should be provided for in the UE for accounting and tax purposes. The requirement for its preparation is regulated by:

- for accounting purposes: clause 2 of PBU 1/2008 and part 1 of Art. 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”;

- for tax purposes: Article 11 of the Tax Code of the Russian Federation.

And more useful for an accountant

How not to be responsible for someone else's mistake

On July 26, 2020, an addition was made to the accounting law that all employees of the organization are required to comply with the requirements of the chief accountant (or the person responsible for accounting) regarding the execution and submission of primary accounting documents.

The accountant must submit a request to eliminate the identified violation or the need to submit certain information to the accounting department in writing to the employee.

In the accounting policy for 2020, the accountant should use this opportunity: fix this condition, approve the form (form) of the chief accountant’s written request to the employee, prescribe the procedure for issuing such requirements, deadlines for their implementation, responsibility and other conditions.

All documents and information go to the accounting department!

In 2020, to be honest, I was surprised by the negative judicial practice, which confirmed the legality of holding an accountant liable for failure to record primary documents on new objects and operations that he did not even know about. True, the decision of the Krasnoyarsk Regional Court No. 7Р-116/2019 dated March 14, 2019 concerns a budgetary organization, but every accountant should take precautions.

To do this, it is worthwhile to prescribe in the accounting policy - in addition to the company's existing document flow regulations - the procedure for the company's employees to notify the chief accountant of all transactions with new accounting objects: forms of accounting documents, deadlines for their submission and responsibility.

About the closed list of accounting registers

In the accounting policy, it is advisable to approve a closed list of accounting registers for accounting. Which can be - at your discretion - concise and short. And consist, for example, of the general ledger, sales ledger, purchase ledger and balance sheets for accounting accounts (list them).

This can be a great help in not having to submit a ton of documents for the unlimited demands of the tax authorities.

Taking into account the provisions of the accounting policy, tax authorities can request only those accounting and tax registers that are maintained in the prescribed manner. This is what the state tax policy regulator, the Ministry of Finance, thinks so (letter dated May 11, 2010 No. 03-02-07/1-228).

You should not indicate in your accounting policy a link only to the accounting program: 1C or other software packages. You understand that a great variety of accounting forms and transcripts can be generated and downloaded from the database according to any requests of the inspectors. Save your time.

Innovations in PBU

Please note the updated versions of PBU 13/2000, PBU 16/02 and PBU 18/02 and the FSBU standard 25/2018 “Lease Accounting”.

FAS 25/2018 comes into force in 2022, but if the company decides to apply it ahead of schedule from 2020, this should be stated in the accounting policy for accounting.

About the annual report

Pay attention to the new accounting forms. And according to the order of the Ministry of Finance dated April 19, 2020 No. 61n.

Lines about the audit of the annual reports have been added to the balance sheet - if the audit of the annual report is mandatory for the company, a check mark is placed and information about the auditor is indicated.

In the balance sheet and financial results report, you cannot indicate data in millions of rubles, but only in thousands of rubles.

Updated financial reporting forms are applied starting with reporting for 2020. But the company has the right to decide to use them earlier, consolidating changes in accounting policies.

Starting from 2020, annual reports do not need to be submitted to Rosstat. If this condition was specified in the accounting policy, it should be excluded in the new edition.

The role of the order

An order approving an enterprise's accounting policy, being a kind of link between the legislation of the Russian Federation on accounting and tax accounting and the company's regulations, is needed for internal use.

The order obliges all divisions of the company, regardless of their location, to comply with the rules of accounting policies, and also appoints persons responsible for monitoring this.

The order is usually written by the secretary of the organization, and he also gives it to the director for signature.

About changes in accounting policies in the middle of the year

The accounting policies developed when the company was founded are applied consistently from year to year. During the year, changes and additions can be made to the accounting policy for tax purposes only in two cases:

- if new operations have appeared or you have mastered a new type of activity;

- if amendments to the legislation are made during the year.

There are no other opportunities to change previously established accounting methods in the middle of the year by tax law.

Rules revised at will can be applied only from the new year. And approve them before it starts - before December 31.

For accounting purposes, the reasons for changes in accounting policies during the year are similar. There are three of them:

- when the legislation of the Russian Federation on accounting, federal or industry accounting standards changes;

- when developing or choosing a new method of accounting, the use of which leads to improved quality of information;

- when there is a significant change in the operating conditions of an economic entity (for example, reorganization, change in types of activities, etc.).

What should an order approving accounting policies include?

Formation of an order for approval of accounting policies (AP) is a process that is subject to internal requirements for the development and approval of general administrative documentation.

The accounting legislation and the Tax Code of the Russian Federation do not say anything about the content of the order approving the UE, therefore:

- the structure of the order is standard (generally accepted in a given company) for this type of document (title of the order, explanatory and administrative parts, signature of the manager);

- order form - it is drawn up in any form with the obligatory indication of the number of this document, its topic and date;

- content of the order - its text may reflect important aspects for the company (for example, from what date the CP is introduced, indication of the full name and position of the responsible employee who is entrusted with monitoring the execution of the CP).

Read about the types of general orders in the following materials:

- “Orders for core activities – what are these orders?”;

- “Orders for personnel - what are these orders (types)?”.

Answers to common questions

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Question: Do I need to draw up an accounting policy every year?

Answer: No, it is necessary to change or draw up a new accounting policy only if there have been changes in the legislation.

Question: When do accounting policies need to be drawn up again?

Answer: Re-draft the accounting policy, for example, if the organization changes its accounting method. But sometimes it is easier to make changes to the current accounting policies by issuing an appropriate order.

Sample order on prolongation of accounting policy

/ / 04/16/2018 351 Views Even with the general principle of taxation, an individual entrepreneur can take into account documented expenses of Article 221 of the Tax Code of the Russian Federation. Is it necessary to send an order to the tax office approving the tax accounting policy?

No, this obligation is not provided. But when leaving, the tax inspectorate may require it to familiarize itself with Article 93 of the Tax Code of the Russian Federation. Is it necessary to annually approve the accounting policy by order? This is not necessary - it is enough to approve it once.

Over time, you can supplement it or make changes.

For this purpose, a corresponding order is issued.

If a non-profit organization Non-profit organizations must also formulate an accounting charter. Since such organizations are also recognized as taxpayers, and therefore must maintain tax reporting. The legal status of non-profit entities is regulated by Federal Law No. 7-FZ “On Non-Profit Organizations”.

What sections should the accounting policy contain?

We will provide an approximate composition of accounting policies so that you can check your template and (or) adapt our sample to your needs. When developing a document, take into account the specifics of your activity (production, trade, services, etc.).

So, the standard sections:

- working chart of accounts;

- forms of primary documents;

- accounting registers;

- forms of documents for internal reporting (if the organization plans to prepare it);

- inventory procedure;

- methods for assessing assets and liabilities;

- document flow procedures, accounting information processing technology;

- the procedure for monitoring business operations;

- other elements and principles influencing the organization of accounting.

Order to extend the accounting policy

The beginning of any reporting year is associated with the responsibility of the accountant to draw up accounting policies. The principle of the enterprise's accounting policy is enshrined in PBU 1/08 “Accounting Policy of the Enterprise”.

Based on the regulatory act, a certain sequence of actions is built through which it is possible to formulate and adjust the primary accounting policy, applying it for the next year.

Contents However, there is not always confidence that everything is provided for in the new sample and that there will be no problems with the tax office in the future. Legislation changes frequently, so it is necessary to regularly adjust the organization's policies to new rules. What does every accountant need to know when creating an accounting charter for the next reporting period?

The work of any organization is not possible without the formation of a competent accounting charter. It has two types - accounting and tax:

Regulation No. 1. “On accounting policies for accounting purposes for 2014”

On the accounting policy for accounting purposes for 2014 for the organization Berezka LLC

Organization of accounting

1. Establish the organization, form and methods of accounting on the basis of current regulatory documents:

- Federal Law of the Russian Federation of December 6, 2011 N 402-FZ “On Accounting”;

- Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n (as amended and supplemented on December 30, 1999, March 24, 2000, September 18, 2006, March 26 2007, October 25, December 24, 2010)

- Accounting Regulations 1/2008 “Accounting Policies of Organizations” (as amended on March 1, 2009, October 25, November 8, 2010, April 27, December 18, 2012), approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008. N 106n;

- Chart of accounts for accounting financial and economic activities of organizations and Instructions for its application, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000. N 94n (as amended on September 18, 2006).

- Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 N 66n. “On the forms of financial statements of organizations” as amended.

2. Establish that accounting is carried out by the manager.

3. Install computer technology for accounting information, organizing accounting in 2014 using 1C:Enterprise software.

4. When reflecting the financial and economic operations of an organization, use the standard chart of accounts approved by the Order of the Ministry of Finance of the Russian Federation dated October 31, 2000. No. 94n.

5. The list of persons who have the right to sign in primary accounting documents is established by order of the organization.

Methodology for maintaining accounting records in an organization

Section 1 Accounting for fixed assets

Organize accounting of the presence and movement of fixed assets of the organization in the context of their types in accordance with the All-Russian Classifier of Fixed Assets, approved by the Resolution of the State Committee of the Russian Federation for Standardization, Metrology and Certification dated December 26, 1994. No. 359.

1.1. Set a limit on the value of fixed assets in respect of which the conditions provided for in paragraph 4 of PBU 6/01 are met in the amount of 40,000 rubles. Fixed assets with a cost of no more than RUB 40,000.00. accounted for as part of inventories in a separate subaccount to account 10 “Materials”.

Fixed assets with a cost not exceeding the established limit per unit, as well as purchased books, brochures, etc. publications are written off as production costs as they are released into production or operation.

1.2. The cost of fixed assets is repaid by monthly depreciation on them. During the useful life of an object of fixed assets, the accrual of depreciation charges shall not be suspended, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months, as well as during the period of restoration of the object, the duration of which exceeds 12 months.

1.3. Depreciation of fixed assets is calculated regardless of the results of the organization's economic activities in the reporting period in a linear manner in accordance with the groups established by the Decree of the Government of the Russian Federation dated 01.01.2002. N 1, monthly. The selected method of calculating depreciation for a group of homogeneous fixed assets shall be applied throughout the entire useful life of the objects included in this group.

1.4. In the event of an improvement in the initially adopted standard indicators of an object of fixed assets as a result of reconstruction or modernization, the organization shall revise the useful life of this object.

1.5. If, based on the results of completion, retrofitting, reconstruction and modernization of a fixed asset, a decision is made to increase its initial cost, then such costs increase the initial cost of the fixed asset.

1.6. Do not revaluate fixed assets.

1.7. Costs for repairs of fixed assets should be accounted for at actual costs incurred.

Section 2 Accounting for inventories

Organize proper accounting and assessment of inventories. When organizing accounting, be guided by PBU 5/01 “Accounting for inventories.

2.1. Purchased materials are accounted for at actual cost.

2.2. Establish a method for writing off materials at average cost.

2.3. Inventories purchased for sale and marketing, as well as for own consumption, are accounted for at actual cost without using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets” directly on account 10 “Materials”.

Section 3 Cash discipline

3.1. Register the movement of funds through the cash desk using unified forms of primary documentation for recording cash transactions, approved by the resolution of the State Statistics Committee of Russia dated August 18, 1998. No. 88 (as amended on May 3, 2000):

KO-1 “Cash receipt order”

KO-2 “Cash expenditure order”

KO-4 “Cash Book”

3.2. Ensure control over cash settlements with legal entities of no more than 100,000 rubles. under one contract.

In this case, a business transaction means one agreement concluded between legal entities. This provision applies to one contract, regardless of the period of its validity, including contracts during the implementation of which additional agreements are signed on the implementation and payment of their individual stages.

3.3. Create a list of employees to whom cash is issued for business needs and approve it by order.

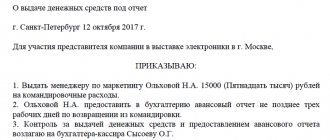

3.4. Accountable funds are issued based on a written application from an employee of the organization. The period for which funds are issued for business needs is determined by the manager depending on the situation and is endorsed on the employee’s application for the release of money on account. When returning from a business trip, employees report within 3 days from the date of return from the business trip, presenting a report on the amounts spent to the accounting department to make a final payment for them.

Daily allowance is determined in the amount of 700 rubles. within the country and 2500 rub. for foreign business trips. For business trips to Moscow and St. Petersburg, the daily allowance is determined in the amount of 2000 rubles.

Section 4 The procedure for accounting for expenses and the formation of the cost of products (works, services).

4.1. In order to manage costs and formulate product costs, organize synthetic and analytical accounting of expenses for ordinary activities. When organizing, be guided by PBU 10/99 “Expenses of the organization.”

4.2 All expenses not related to the implementation of ordinary activities are included in other expenses in account 91.02.

4.3. General business expenses should be generated on account 26 and debited to account 20 quarterly.

Section 5 Accounting for expenses on loans and borrowings

5.1 The principal amount of the obligation for the loan (credit) received is reflected in the accounting records of the borrowing organization as accounts payable in accordance with the terms of the loan agreement (credit agreement) in the amount specified in the agreement.

Section 6 Reserves

6.1. Do not create a reserve for doubtful debts.

6.2 Do not create reserves for reducing the value of material assets.

6.3. Do not create reserves for repairs of fixed assets.

Section 7 Accounting for certain types of income and expenses

7.1. Costs incurred by the organization in the reporting period, but related to subsequent reporting periods, are reflected in the balance sheet in the period in which they were incurred. Among them are:

— licensing costs;

— expenses for subscription to periodicals;

— general business expenses in the absence of revenue;

— costs of using software licenses;

Section 8 Accounting for accounts receivable

8.1. Overdue receivables, the obligation for which is not secured by a pledge, surety, bank guarantee and retention of the debtor's property, as well as in other ways provided for by law or contract, shall be recognized as doubtful.

Overdue receivables with an expired statute of limitations (three years) should be transferred from the category of doubtful to uncollectible and written off as losses. Write-off is carried out at the expense of business results.

8.2. There is no transfer of long-term debt to short-term debt.

Section 9. Accounting is kept electronically and, if necessary, printed.