10.03.2020

| no comments

The most important innovation of this year is the transfer under the control of the tax inspectorate of issues of calculation and payment of all established insurance premiums, with the exception of contributions for accidents and in connection with occupational diseases of employees (they remained under the jurisdiction of social insurance). As a result, the previously used calculation forms RSV-1 and 4-FSS (in the previous edition) were abolished and reformed.

Since 01/01/2017, a new document “Calculation of insurance premiums” has been in force in the country, approved by Order of the Federal Tax Service No. ММВ-7-11-551 dated 10/10/2016. According to the general rules adopted in relation to a single settlement, all Russian companies and businessmen performing the functions of policyholders must form it, namely:

- Companies and, if any, separate divisions;

- Individuals conducting commercial activities as individual entrepreneurs;

- Individuals who do not have the status of self-employed citizens;

- Heads of peasant farms.

Among accountants, many questions arise regarding the filling out of this document by policyholders who do not make payments to their staff during the reporting period, that is, drawing up a calculation of zero insurance premiums for 2020. In short, you need to fill it out.

What is the procedure for filling out the zero calculation of insurance premiums 2017?

Filling out a zero calculation for insurance premiums 2020

All doubts that arise as to whether it is necessary to form a zero calculation for insurance premiums for 2020, as well as the composition of the zero calculation for insurance premiums for 2020, are disclosed in the recent letter of the Federal Tax Service No. BS-4-11/6940 dated April 12, 2017. The rules for providing a single calculation imply its transfer to the Federal Tax Service, regardless of whether activity was actually carried out in the period under review or not. This is precisely the position taken by the Federal Tax Service and the Ministry of Finance. As a result, all insurers, that is, economic entities with hired employees, are required to submit a unified calculation of insurance premiums for 2020, zero or not.

So, you need to fill out the zero Calculation of insurance premiums for 2020. Which sheets need to be filled out are also disclosed in the specified letter from the tax inspectorate. The reporting form must be completed:

- Front page;

- Section No. 1, including subsections 1.1 and 1.2 of Appendix 1 to Section No. 1;

- Appendix No. 2 to section No. 1;

- Section No. 3.

When you fill out the zero calculation of insurance premiums in 2017, pay attention to the explanations provided in the above letter from the Federal Tax Service. According to this document, if there are no numerical values in the cells, “0” must be indicated, and in other cases, a dash must be placed in the cells.

It should be noted that Federal Tax Service employees do not differentiate between policyholders. These rules also apply to organizational forms of policyholders: calculation of insurance premiums for 2020 (zero) individual entrepreneurs and calculation of insurance premiums for 2020 (zero) LLC must be completed, despite the absence of payments. Let us remind you that for individual entrepreneurs without employees, the new calculation of insurance premiums replaced the former report to the Pension Fund of the Russian Federation in the form RSV-2. Therefore, even if there were no employees expected, it will have to be filled out as an individual entrepreneur.

What sections should be included in the zero contribution sheet?

In the absence of payments in favor of individuals under employment contracts, civil process agreements, copyright, etc. and, accordingly, in the absence of digital indicators for insurance premiums, policyholders will need to include the following sections in the calculation:

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- appendix 2 to section 1;

- section 3.

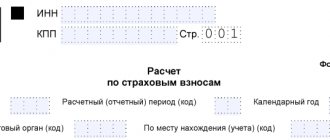

The title page contains the details of the policyholder (TIN, KPP, name/full name, OKVED code, telephone numbers), and the tax authority accepting the settlement (code). It also reflects whether the original form or the corrective one is submitted (if necessary, the adjustment number), the reporting period and the year to which it relates.

All data is certified by the signature of an authorized person indicating the date of preparation or submission of the report.

Section 1 with all the subsections and appendices we have indicated will contain zeros on all lines with summative and quantitative indicators and dashes on the remaining familiarities. It is best to register the BCC in the fields provided for this in order to avoid problems with the generation of electronic reporting.

We will tell you what information needs to be entered into section 3 of the zero calculation in the next section.

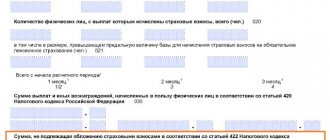

Section 3 contains information on each person insured in the compulsory health insurance system. In this case, it does not matter whether there were accruals in his favor during the reporting period or not (clause 22.1 of the Filling Out Procedure). Thus, the zero calculation for insurance premiums in Section 3 may include either employees who do not receive remuneration from their employer, for example due to being on unpaid leave, or a director - the only founder who also does not receive wages.

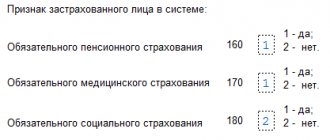

Subsection 3.1 contains information about whether the form is initial or corrective, the reporting period code, year, serial number and date of submission of information. Next comes the indication of all the data of the individual: TIN, SNILS, full name, date of birth, gender, code and details of the identity document, sign of the insured person in the OPS and Compulsory Medical Insurance systems.

Subsection 3.2 contains information about the amounts:

- remuneration in favor of individuals;

- accrued contributions to compulsory pension insurance.

According to clause 22.2 of the above Procedure, when submitting a zero calculation, subsection 3.2 is not filled out. However, you can also fill it out with zero values. The standard settings of most accounting programs are such that when you leave at your own expense, subsection 3.2 is automatically generated. The program will put down:

- in line 190 - months of the reporting period;

- in line 200 - code “НР”;

- Lines 210–240 print zeros.

Calculations with this design undergo format and logical control and are accepted by tax authorities.

Zero calculation of insurance premiums 2020 (filling example)

Let's consider what information should be included in the zero unified calculation of insurance premiums - 2020.

- Title page - information about the company or entrepreneur is reflected (TIN, KPP, OKVED codes, contact information, information about the person submitting the document to the inspection), information about the period of drawing up the calculation and the inspection that will verify it.

- Section No. 1 – this section should disclose the following information: The amount of accrued contributions to compulsory pension insurance for the quarter, broken down by month;

- Contributions to compulsory pension insurance at additional tariffs;

- The amount of compulsory medical insurance contributions for the quarter, broken down by month;

- The amount of accrued social security contributions;

- The amount of contributions accrued to the OSS;

- The amount of excess of transferred contributions and accrued.

- The number of employees;

- Sign of payment;

All numbers in the zero report take the value zero.

All Russian insurers must provide a zero report (calculation) on insurance premiums for 2020 to the tax authorities, despite the lack of payments to employees.

A sample zero calculation for insurance premiums 2020 can be downloaded below.

The 2020 insurance premium calculation form can be downloaded here.

How to fill out a zero RSV

We detail the information that needs to be included in the zero calculation of insurance premiums in 2020.

The title of the calculation reflects the following information:

- about the payer (payer status, his details - INN/KPP, OKVED code, contact phone number);

- about the tax authority to which the document is submitted;

- about the reporting period.

The title page is signed by a company representative (or authorized representative), which serves as confirmation of the information provided.

Section No. 1 records data on all types of insurance - compulsory and additional, for which the company pays premiums. Here the OKTMO code of the enterprise is indicated, and the corresponding BCCs are filled in by type of deduction. In section 1 and its subsections 1.1 and 1.2, instead of numbers, zeros are entered in the columns of accrual amounts for contributions and data for calculating the base.

Section No. 3 combines accounting information separately for each employee. The insured person's category code is assigned in accordance with the company's organizational form and tax regime. Their list is available in the above letter from the Federal Tax Service. Months are filled in in accordance with their generally accepted numbering, but only those in which the employee was employed by the insured.

The general rule for processing the calculation is continuous numbering of pages, filled-in INN/KPP fields on all pages, signature of the head (authorized representative) of the company and date. We offer our readers a sample of filling out a zero calculation for insurance premiums.

Who should take zero marks?

All policyholders must submit calculations of insurance premiums for the 2nd quarter of 2020 to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs.

We discussed in detail the issues of filling out the calculation for the 2nd quarter in the article “Calculation of insurance premiums for the first half of 2017: an example of filling out.” But is it necessary to report for the 2nd quarter of 2020 if the organization or individual entrepreneur did not conduct any activities in the reporting period (from January to June inclusive)? If no one’s salary was accrued during this period, is it necessary to submit an “empty” calculation to the Federal Tax Service? We have already tried to sort out these issues in the article “Zero calculation for insurance premiums: is it necessary to submit in 2020.” However, at that time there were no official clarifications on many issues.

But now there is more clarity. From letters of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07/17273 and the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940, we can conclude that the above circumstances do not relieve an organization or individual entrepreneur from the obligation to report to the Federal Tax Service for reporting period (half year). After all, the policyholder still remains the payer of premiums even if he does not conduct any activity. Here are quotes from these letters:

From the letter of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07/17273 “If the payer of insurance premiums does not have payments in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit a calculation to the tax authority within the prescribed period with zero indicators." From the letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940

“The Tax Code of the Russian Federation does not provide for exemption from the obligation of the payer of insurance premiums to submit Calculations in the event of the organization’s failure to carry out financial and economic activities.

Thus, if the payer of insurance contributions - organizations does not have payments and other remuneration in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit to the tax authority within the period established by the legislation of the Russian Federation on taxes and fees a calculation with zero indicators "

It turns out that the regulatory authorities clearly believe that a zero calculation for insurance premiums for the 2nd quarter of 2020 should be submitted to the tax office.

Who is required to take zero marks?

Payers of insurance premiums, which primarily recognize organizations and individual entrepreneurs making payments to individuals, must submit a unified calculation of insurance premiums. And if there were no payments during the reporting period, do I need to submit a calculation?

As stated in the Federal Tax Service Letter No. BS-4-11/6174 dated April 3, 2017, the Tax Code of the Russian Federation does not provide for an exemption from the obligation to submit a calculation in the event that an organization or individual entrepreneur fails to carry out financial and economic activities. The Tax Department explains that by submitting calculations with zero indicators, payers thereby declare to the tax authority that there are no payments and amounts of insurance premiums to be paid in a particular period.

Similar explanations were previously given by the Ministry of Labor of the Russian Federation, when a similar report was submitted to the Pension Fund (Letter of the Ministry of Labor dated July 13, 2016 No. 17-4/OOG-1055).

Failure to submit a zero calculation threatens an organization or individual entrepreneur with a fine of 1,000 rubles (Clause 1 of Article 119 of the Tax Code of the Russian Federation).

All policyholders must submit calculations of insurance premiums for the 3rd quarter of 2020 to the Federal Tax Service. In particular:

- organizations and their separate structures;

- private entrepreneurs.

Is it necessary to report for the 3rd quarter of 2020 if the organization or individual entrepreneur did not conduct any activities during the reporting period - from January to September inclusive? Is it necessary to submit a blank calculation to the Federal Tax Service if no one’s salary was accrued during this period? Finally, clear official clarifications on this matter have appeared, which have brought more clarity to these issues.

From letters of the Ministry of Finance dated March 24, 2020 No. 03-15-07/17273 and the Federal Tax Service of Russia dated April 12, 2020 No. BS-4-11/6940, we can conclude that the above circumstances do not relieve an organization or individual entrepreneur from the obligation to report to the Federal Tax Service for past 3rd quarter of 2017. After all, the policyholder is still the payer of the premiums. Even if he does not conduct any activity. Here are key quotes from these letters.

| “If the payer of insurance premiums does not have payments in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit a calculation with zero indicators to the tax authority within the prescribed period.” |

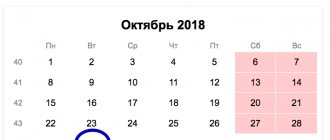

| It turns out that the regulatory authorities clearly believe that a zero calculation for insurance premiums for the 3rd quarter of 2020 should be submitted to the tax office. The law does not provide for special deadlines for submitting a zero calculation for insurance premiums for the 3rd quarter of 2020. That is, the zero calculation must be submitted within the same time frame as the report that contains the information. As a general rule, payments must be submitted to the Federal Tax Service no later than the 30th day of the month that follows the reporting period (Clause 7, Article 431 of the Tax Code of the Russian Federation). If the day of delivery falls on a weekend or holiday, you can submit the payment later - on the next working day (Article 6.1 of the Tax Code of the Russian Federation).

04.2017 No. BS-4-11/). This situation can be characterized as “no financial and economic activities were carried out, wages were not accrued or paid.” By submitting a zero RSV, the employer makes it clear to the tax authority that this is exactly the situation he has with regard to the calculation of insurance premiums. The delivery of a zero RSV also follows the usual rules. It must be sent to the tax authority on time (for the 1st quarter of 2020, due to the postponement of holidays, it expires on 05/03/2018). Late submission results in a fine, which in its minimum possible amount (RUB 1,000) will be charged even in the absence of digital indicators in the main sections of the report (clause 1 of Art. 119 of the Tax Code of the Russian Federation). Let's consider organizations and entrepreneurs that have no employees and have suspended their activities. Tax authorities provide clarification on this issue. They proceed from the fact that upon registration an organization receives the status of an employer, so they are required to provide a report even if they do not conduct activities and do not have employees. Despite the fact that the director does not enter into an employment contract, an employment relationship arises with him. In this case, in line 010 of 1.1 and 1.2 of subsection 2 of the application, the number of insured persons is indicated, that is, 1, the remaining lines should be zeros. If section 3 is not filled out, then the report will not be accepted, therefore, in lines 160-180 of subsection 3.1, indicate - 1. Example 2. The company sent a zero DAM for insurance premiums for the first quarter of 2020 on April 5. On April 6, she received a notification that there was an error in the employee’s TIN, so it was not accepted. If the accountant corrects this deficiency and submits the form by April 13, it will be considered accepted on April 5. If the payment is sent later, for example, April 14, this day will be the date of its receipt.

We recommend reading: When to get a passport at 14 years old

In the event that the average number of employees in whose favor payments are made for the previous reporting period was more than twenty-five people, and also if a newly formed legal entity has a staff number of more than twenty-five people, zero calculation for insurance premiums 2020 LLC or individual entrepreneur Can only be submitted electronically. All other requirements for the formation of the form are identical in comparison with other types of reporting - filled out in printed and capital characters, by hand or on computer software, without errors or typos. Numbering is carried out using the end-to-end method; the document is printed on one side, without stapling. The coding of values is given additionally in Order No. ММВ-7-11/ Thus, the calculation of insurance premiums for 2020 zero is submitted in the absence of payments to citizens. Why is there such a duty? There is no exemption from reporting. And this was done, first of all, in the interests of taxpayers. By providing empty data, the employer thereby declares the fact of non-accrual of remuneration to staff and other individuals, and therefore confirms zero CB for the period. As a result, as the tax authorities explain (Letter No. BS-4-11/6174 dated 04/03/17 ), the company has no obligation to pay funds to the budget, since the zero report of the Calculation of Insurance Premiums 2018 confirms the absence of a taxable base and accruals for SV.

The main issues relating to the procedure and timing of the submission of this document are regulated by Art. 431 Tax Code of the Russian Federation. Thus, its registration and submission to the Federal Tax Service must be carried out before the 30th day of the month following the reporting period, and the calculation must be drawn up even if the company suspended work and did not make any payments to staff. If in the reporting period there is no basis for calculating insurance premiums, then the obligation to submit a report to the tax office is not lifted - the taxpayer must submit a zero report. But there are exceptions. These exceptions, as well as how to correctly fill out the zero calculation, will be discussed in the article. Organizations always provide zero reporting on insurance premiums, since there is at least one person on staff under any circumstances - the sole executive body. The only exception can be the case when a management company acts as such a body. But in order to avoid disputes with tax authorities, it is better to file a zero report in such a situation. Thus, it is worth recognizing that payers of insurance premiums - persons making payments and other remuneration to individuals - must submit a single calculation for insurance premiums. At the same time, among the insured persons in the system of compulsory pension and health insurance, managers are directly named - the only founders of organizations. |

Why do tax authorities need zero calculation?

The letter of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07/17273 explains that by submitting calculations with zero indicators to the Federal Tax Service, a company or individual entrepreneur declares the absence of payments and rewards in a specific reporting period in favor of individuals who are subject to insurance premiums , and, accordingly, about the absence of amounts of insurance premiums payable for the same reporting period.

In addition, the submitted calculations with zero indicators allow tax inspectors to separate payers who do not make payments and other remunerations to individuals in a specific reporting period and do not carry out financial and economic activities from payers who violate the deadline for submitting calculations, and, therefore, do not hold them accountable.

In our opinion, the logic of the representatives of the Russian Ministry of Finance is very strange. After all, in essence, they call for accountability from those who may not even be payers of insurance premiums. The fact is that an organization or individual entrepreneur can be considered a “payer of insurance premiums” only if it makes payments and rewards in favor of individuals. This is stated in the regulatory legal acts:

Clause 1 of Article 419 of the Tax Code of the Russian Federation Payers of insurance premiums are persons who make payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs

Clause 1.1 of the Procedure for filling out the calculation for insurance premiums “The calculation for insurance premiums (hereinafter referred to as the calculation) is filled out by payers of insurance premiums or their representatives (hereinafter referred to as payers), namely by persons making payments and other remuneration to individuals.”

However, in this article we will not argue with the position of the Ministry of Finance and the Federal Tax Service. We will rely on the official position and assume that a zero calculation for insurance premiums for the 2nd quarter of 2020 must be submitted. Moreover, if an individual entrepreneur does not have employees and he pays insurance premiums only “for himself,” then he is not required to submit quarterly zero calculations for insurance premiums to the tax office. Accordingly, entrepreneurs without employees need not worry about passing zeros.

On the control ratio between the calculation of contributions and the calculation according to Form 6-NDFL

Reporting will not raise questions if the requirements of regulatory authorities regarding control ratios of indicators are met. Check the 3 directions of control ratios in the Calculation of Insurance Premiums.

- Mandatory equality between the amount of contributions from Section 1 and the amount of contributions under Section 3, which is filled out for each employee.

- The Calculation of Contributions must contain reliable information about the employee: full name, INN, SNILS.

- New reference ratio.

The Letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. BS-4-11 / [email protected] indicates the control ratio of the data for Calculation of insurance premiums with the data in Form 6-NDFL. Tax inspectors will compare line 030 in the Calculation of Insurance Premiums with line 020 minus line 025 from Form 6-NDFL. For the data specified in these lines, the control ratio must be fulfilled.

Compare with 6-NDFL:

| What to compare | How to do it right | Comments |

| All payments and rewards in favor of individuals under line 030 of section 1 | All payments in column 1 of line 030 of subsection 1.1 of section 1 of the calculation of contributions are less ( < ) or ( = ) Income line 020 - line 025 of the 6-NDFL calculation | If the ratio is violated, the Federal Tax Service will ask for clarification. The company must explain the difference Violation of the ratio is not always a mistake. Discrepancies may arise due to carryover payments, that is, accrued but unpaid contract income and vacation pay. If this is the reason, then in your answer emphasize that there are no errors in both calculations. |

| Note: The check is carried out only for companies that do not have separate divisions, since the ratio will not be carried out for them. | ||

If the company has only a director

Is it required to submit a zero calculation for insurance premiums in 2017 if the organization has only a general director, and the company does not conduct business and does not issue salaries? As we have already found out, according to the logic of officials, the Tax Code of the Russian Federation does not contain exceptions that would exempt an organization from the obligation to submit reports, even if it did not accrue any payments to anyone. Workers under an employment contract remain insured, despite the fact that they did not receive money. Following this, we can come to the conclusion that if only the director is on staff - the only founder, then the zero calculation for the 2nd quarter of 2020 must be submitted.

Is it necessary to submit a zero calculation for the general director - the only founder? Yes need. It is necessary to create a “zero” and enter information about the manager in section 3. After all, he can be regarded as an insured person. The logic, again, is strange, but this is the approach that suits the tax authorities.

When to take zero grades for the first half of the year

There are no special deadlines for submitting a zero calculation for insurance premiums for the first half of 2020. The zero calculation must be submitted within the same time frame as the report containing the information. As a general rule, payments must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). If the day of delivery falls on a weekend or holiday, you can submit the payment later - on the next working day (Article 6.1 of the Tax Code of the Russian Federation). The deadline for submitting a zero calculation for insurance premiums for the 2nd quarter of 2020 is July 30. This Sunday. Therefore, the deadline has been moved to the next working day – July 31. See “Deadlines for submitting calculations for insurance premiums in 2020.”

What kind of liability can there be?

Some organizations prefer to remain “in the shadows” and not appear before the tax authorities at all. In particular, they do not submit zero calculations for insurance premiums. We do not exclude that such companies will not submit a zero calculation for insurance premiums for the 2nd quarter of 2017. Let us explain what risks they take on.

Blocking accounts

In the article “Zero RSV in 2020: to surrender or not,” we said that for failure to submit zero calculations for insurance premiums, current bank accounts may be blocked. The Federal Tax Service insisted on this. However, the Ministry of Finance did not agree on this.

Closer to the submission of reports for the 2nd quarter, tax authorities and financiers apparently came to an agreement on this issue. By letter of the Federal Tax Service dated May 10, 2017 No. AS-4-15/8659, a letter from the Ministry of Finance was sent to lower-level inspectorates stating that it is impossible to suspend transactions on accounts for late payment.

It is unlawful to suspend transactions on a bank account for late payment of insurance premiums.

Fines

Since 2020, insurance premiums are regulated by the Tax Code of the Russian Federation. Therefore, for failure to submit a zero calculation for the 2nd quarter of 2020, the Federal Tax Service may fine the organization under paragraph 1 of Article 119 of the Tax Code of the Russian Federation. There are no charges in “nulevkas”, so the fine will be minimal - 1000 rubles. The calculation of the fine will not depend on the number of complete and partial months of failure to submit reports. However, in our opinion, it makes sense to send reports to controllers with zero indicators and protect the company from possible financial sanctions.

What is the liability for failure to submit a zero report on insurance premiums?

In general cases, failure to submit or delay in sending a contribution calculation may result in the imposition of various sanctions by the tax authorities. But what happens if you don’t submit a zero calculation on time? Will a person be able to do without a fine in this case, since there are no charges involved? Answer: no, he can’t. The fine will be mandatory, the tax authorities will simply impose it in the minimum amount - 1000 rubles, as provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Taking into account the above, an organization that does not pay any remuneration to individuals, like all others, must report to controllers on time. In addition, if you are more than 10 days late in submitting your report, the tax authorities will block the organization’s account—now they have the right to do so.

Which sections to include in the zero calculation

Let’s assume that the accountant decided not to take risks and submit a zero calculation for the 2nd quarter of 2020 to the INFS. But what sections should it include? Letter No. BS-4-11/6940 of the Federal Tax Service of Russia dated April 12, 2017 states that the “empty” calculation should include:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” and subsection 1.2 “Calculation of the amounts of insurance contributions for compulsory health insurance” of Appendix 1 to Section 1;

- Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1;

- Section 3 “Personalized information about insured persons.”

Example and sample of zero DAM for 9 months of 2020

Let's take a closer look at the mechanism for forming a zero DAM for 9 months of 2020:

Title page

It contains general data about the economic entity:

- Name,

- TIN and checkpoint,

- OKVED code,

- telephone number for contact and full name of the manager or his legal representative,

- the period and year for which the document is being drawn up (in our situation we will put “33” and “2018” respectively),

- number of the adjustment calculation (0 is indicated when submitting the document initially),

- code of the Federal Tax Service for which the report is intended.

Example of filling out a title page:

Summary data on the obligations of the payer of insurance premiums (section 1)

At the very top of the sheet, by analogy with the title page, you should put down the TIN and KPP of the business entity, then the OKTMO code (page 010 of the calculation). Then you need to enter the budget classification code (KBK). Moreover, in each part of Sect. 1, the BCC must be entered in accordance with the direction of insurance:

- 18210202010061010160 - for pension contributions (line 020);

- 18210202101081013160 - for medical contributions (page 040);

- 18210202090071010160 - for social contributions during disability and in connection with maternity (p. 100).

For each type of contribution, you should fill in the lines relating to the months of the reporting quarter (July, August, September), and also indicate the total amount of contributions for the quarter.

Example of filling out section. 1 (for contributions to pension and health insurance):

Example of filling out section. 1 (for social insurance contributions):

Calculation of the amounts of insurance contributions for compulsory pension insurance (subsection 1.1 appendix 1 to section 1)

This sheet displays detailed data on which tariff is used to calculate insurance premiums in accordance with the applicable taxation system: for example, 01 - OSNO, 02 - simplified tax system, 03 - UTII.

In addition, the following information is entered:

- number of employees subject to insurance (for the billing period with a monthly breakdown);

- the number of employees from whose wages insurance premiums are calculated, including when the maximum size of the base is exceeded;

- amounts of accrued payments and rewards;

- amounts not subject to insurance premiums;

- the basis for calculating contributions, including when the maximum amount is exceeded;

- the amount of calculated contributions.

An example of filling out a sheet for contributions to pension insurance:

Calculation of the amounts of insurance premiums for compulsory health insurance (subsection 1.2 appendix 1 to section 1)

This sheet contains information similar to what we filled out for pension insurance contributions:

- number of employees subject to insurance;

- the number of employees from whose wages contributions are accrued;

- amounts of calculated salaries and benefits;

- amounts that are not subject to insurance premiums;

- basis for determining contributions;

- the amount of calculated contributions.

An example of filling out a sheet for health insurance contributions:

Calculation of the amounts of insurance contributions for compulsory social insurance (Appendix 2 to Section 1)

This sheet records information about the payment attribute, which can be: 01 - direct payments or 02 - offset system. This point depends on who exactly pays benefits of a social nature (for illness or maternity).

If the company is located in a constituent entity of the Russian Federation, where a pilot project with direct payments through the Social Insurance Fund is used, code 01 must be entered. If benefits are initially issued through the employer and then reimbursed from the Social Insurance Fund, code 02 must be entered.

In addition, the section should display:

- number of employees subject to social insurance;

- amounts of calculated salaries and benefits;

- amounts not subject to insurance premiums;

- basis for determining contributions;

- the amount of calculated contributions;

- how much expenses were incurred to pay out insurance coverage;

- how much the FSS reimbursed expenses for paying insurance coverage;

- amount of contributions to be paid.

An example of filling out sheets for social insurance contributions:

Personalized information about insured persons (section 3)

This section contains specific information for each employee, so the number of sheets in section. 3 must match the number of employees. For each individual it is necessary to reflect:

- TIN and SNILS,

- FULL NAME,

- date of birth,

- citizenship,

- floor,

- passport details,

- sign of an insured person in the insurance system (by type): 1, if the employee is covered by insurance, 2 - if not.

An example of filling out a sheet about personalized information of employees:

Next, you need to fill out the continuation of section 3, related to the calculation of payments and rewards for each employee. For a zero calculation, all values here will be 0.

An example of filling out a sheet for employee payments and rewards:

Reporting deadlines

Calculation of contributions is submitted to the Federal Tax Service once a quarter. The reporting periods will be quarter, half year and 9 months. The billing period is one year. This means that the data in the calculation is shown as a cumulative total. But at the same time, in the calculation for any period there are always lines reflecting indicators for the last three months.

The 30th day of the month following the reporting quarter is the last day to send the calculation.

The report for the first quarter should be sent to the Federal Tax Service by 04/30/2020 inclusive.

The semi-annual calculation of the Federal Tax Service awaits reporting until July 30, 2020 inclusive.

Payments for 9 months must be submitted no later than 10/30/2020.

Submit a single calculation of insurance premiums on time and without errors! Use Kontur.Extern for 3 months for free!

What is RSV and who rents it?

After the transfer of authority to collect insurance contributions to the tax office, the contribution report, which was submitted to the pension fund, and part of the 4FSS form regarding contributions for sick leave and maternity insurance were combined. Of the two reports, one was obtained and it is now submitted to the tax office.

The report itself and the procedure for filling it out are described in detail in the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10.10.2016.

The calculation combines information on how much contributions to pensions, healthcare and social insurance are paid by the employer quarterly and for the year as a whole for its employed employees.

Such a report is generated and submitted by all employers, with the exception of individual entrepreneurs who work alone, without employees.

The calculation must be submitted by the 30th day of the month following the reporting quarter. This is enshrined in clause 7 of Article 431 of the Tax Code of the Russian Federation.

We will show in the table when you need to submit the calculation in 2020:

| Reporting period | Deadline |

| 2018 | Until January 30, 2020 |

| 1st quarter 2020 | Until April 30, 2020 |

| Half year 2020 | Until July 30, 2020 |

| 9 months of 2020 | Until October 30, 2020 |

| 2020 | The report must be submitted next year, 2020, by January 30 |

Expert opinion

Despite the fact that there are a huge number of explanations and documents regarding this calculation on the Internet and reference systems, many accountants ask various questions when preparing and submitting a report. This is due to the fact that the legislative framework still does not cover all situations that arise in the organization.

Senior consultant at the Economics Center,

E. Simonova

Filling procedure

The Federal Tax Service, in its order dated September 18, 2019 No. ММВ-7-11/ [email protected] , described how to fill out the calculation step by step. There is also an up-to-date report form. We will tell you about the main points of filling out an insurance calculation.

The insurance calculation actually combined two forms of premiums, so at first glance it seems voluminous. Do not forget that all calculation pages are not filled out very often, because many pages are quite specific.

The contribution calculation includes a title page and three sections. Some sections have applications.

Mandatory sections: title page, section 1, appendix 1 (subsections 1.1 and 1.2) and appendix 2 to section 1, section 3. It is in this composition that the calculation must be submitted if the company has insured persons to whom payments were made in the last 3 months and other rewards. If necessary, subsections and applications are added to the calculation depending on the specifics of the company’s activities. For example, subsection 1.3 should be completed by payers who calculate contributions based on an additional tariff. If temporarily staying foreigners received income, you will have to draw up Appendix 8 to Section 1.

If no payments were made, the calculation will be zero. An example of calculation of insurance premiums can be found below. In 2020, the calculation is filled out in the same way as in 2020, but taking into account the changes that have occurred in the new form. In the zero calculation, you should submit the title page, section 1, indicating the value “2” in the “Payer Type” field, section 3, putting dashes in the empty cells. Subsection 3.2 in this case is not completed.

Important! Cost indicators are entered into the calculation in rubles and kopecks.

Calculation of insurance premiums in 2020 sample filling for individual entrepreneurs

Calculation of insurance premiums is submitted to the tax authorities by all organizations, without exception, and individual entrepreneurs who have concluded at least one employment contract or civil servants' agreement with individuals.

It shows the amounts of contributions accrued for wages and other payments in favor of employees. The report should be made on the form put into effect by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. The same order also established the procedure for filling out the calculation.

The due date falls on the 30th day of the month following the reporting period. These include: first quarter, half year, 9 months, year.

You can send the report to the tax authorities on paper (in person, through an authorized representative, by mail) or electronically via TKS.

IMPORTANT! The choice of delivery method depends on the average number of employees of the policyholder. If it does not exceed 25 people, then you can choose any form of delivery. If the SSC is more than 25 people, then there is no choice - you need to submit the calculation electronically.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2019-2019, made using the free Business Pack program.

This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money.

Some additional functions in it are paid, but for payment orders it is free.

They promise to update the calculation of insurance premiums in 2020. But so far this has not happened. Therefore, for 2020, policyholders will report in the same form, already familiar to everyone (Appendix No. 1 to the Order of the Federal Tax Service of Russia dated October 10, 2019 N ММВ-7-11 / [email protected] ). And you will need to use the new form for calculating insurance premiums for the first time no earlier than for the first quarter of 2020.

As already mentioned, the calculation form used to report to the tax office for 2020 has not changed. As a result, the procedure for filling out the calculation of insurance premiums for 2020 has not changed. The calculation must include the title page, section 1, subsections 1.1 and 1.2 of Appendix 1 to section. 1, Appendix 2 to section. 1, as well as section 3.

Moreover, it is necessary to submit a calculation with the specified sections, even if the policyholder in 2020 did not make payments and rewards subject to insurance premiums in favor of individuals (clauses 2.2, 2.4 of the Procedure for filling out the calculation, approved by Order of the Federal Tax Service of Russia dated October 10, 2019 N MMV-7 -11/ [email protected] , hereinafter – the Procedure for filling out the calculation).

In such a situation, he needs to fill out a zero calculation of insurance premiums in 2020 (Letter of the Federal Tax Service of Russia dated April 12, 2019 N BS-4-11 / [email protected] ).

There are no official clarifications on this topic at the time of publication of this material. On thematic forums on the Internet, accountants express three points of view, and which of them is absolutely correct is still unclear.

There is only one thing that saves the situation: even if the incorrect payer status is indicated in field 101, this will not lead to loss of payment and subsequent arrears from the policyholder.

Federal Tax Service inspectors count payments, even if the payer status is incorrectly indicated.

- Status 01 – indicated when paying insurance premiums by a legal entity;

- Status 09 – indicated when paying insurance premiums by an individual entrepreneur;

- Status 10 – indicated when paying insurance premiums by a notary engaged in private practice;

- Status 11 – indicated when paying insurance premiums by the lawyer who established the law office;

- Status 12 – indicated when paying insurance premiums by the head of a peasant (farm) enterprise;

- Status 13 - indicated when paying insurance premiums for employees by an individual (who is not an individual entrepreneur).

- 200 rubles fine for late payment;

- 5% of the contribution amount when submitting annual reports;

- the amount of the fine according to the annual calculation should not be less than 1000 rubles, but should not exceed 30% of the amount calculated as the contribution for this period;

- in some cases, tax authorities may block the bank accounts of individual entrepreneurs or organizations.

The report is sent in electronic format if the number of employees exceeds 25 people. If the number is smaller, the entrepreneur can independently submit a report to the tax service, or this can be done by the person representing him on the basis of a power of attorney. You can also send the calculation by registered mail, describing its attachment.

At the moment, the form is in force according to the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10.10.16 (KND 1151111). Perhaps in the coming days, officials will approve updates to this form, but so far the new form has not been approved. Therefore, we are considering a sample of filling out the calculation of insurance premiums in 2020 using the old form.

In accordance with stat. 423 for reporting periods a quarter, half a year and 9 months are recognized, and for a tax year - a year. Is it necessary for an LLC or individual entrepreneur to submit a zero calculation for insurance premiums in 2020 for 2020, if no payments were made to individuals for a given period? We will answer the question based on the explanations of the tax departments.

In this material, we have summarized samples of payment orders for the payment of insurance premiums in 2020. Examples of payment slips relate to pension, social, medical and injury insurance contributions and are available for download.

The article explains the basic rules for filling out payment orders, provides the BCC for insurance premiums for 2020, and deciphers the fields of payment orders for the transfer of contributions for employees. The article may also be useful to individual entrepreneurs with employees.

If an individual entrepreneur pays insurance premiums only “for himself” in 2020, then in the article you can see the current BCCs for filling out payment orders.

- pension insurance (“pension contributions” or “OPS”);

- insurance for temporary disability and in connection with maternity (“social contributions” or “VNiM”);

- health insurance (“medical contributions” or “CHI”);

- insurance against industrial accidents and occupational diseases (injury contributions).

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

Let’s assume that an individual entrepreneur without employees decides to pay mandatory contributions “for himself” for the full year 2020. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia.

Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2020, but we will talk about this case at the very end of this article.

(Of course, individual entrepreneurs on the simplified tax system “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.)

Already on January 1, 2020, quite a few changes to tax and accounting legislation came into force, which we discussed in our review article. The changes also affected insurance premiums, namely, the form of the single calculation and the procedure for filling it out were changed. An example of filling out a calculation for insurance premiums for 2020 can be found in this article.

- Firms in which employees work in accordance with employment contracts and receive income;

- Companies in which employees work in accordance with the GPA;

- Branches of companies that have hired personnel working under labor agreements or GPC agreements;

- Private businessmen operating with hired staff;

- Farms that use hired labor in their activities.

Calculation of contributions is submitted to the Federal Tax Service once a quarter. The reporting periods will be quarter, half year and 9 months. The billing period is one year. This means that the data in the calculation is shown as a cumulative total. But at the same time, in the calculation for any period there are always lines reflecting indicators for the last three months.

Mandatory sections: title page, section 1, subsections 1.1 and 1.2, appendix 1 and appendix 2 to section 1, section 3. It is in this composition that the calculation must be submitted if the company has insured persons.

If necessary, sections are added to the calculation depending on the specifics of the company’s activities. For example, subsection 1.3 should be completed by payers who calculate contributions based on an additional tariff.

If temporarily staying foreigners received income, you will have to draw up Appendix 9 to Section 1.

If the amount of contributions turned out to be positive, i.e. for payment, then in line 090 the line attribute code “1” is indicated. However, if the amount of expenses incurred was greater than the accrued contributions, then the attribute code “2” is indicated in line 90. The amount in line 090 is always reflected only in a positive value, the minus sign is not placed.

In the case where the employee’s income, calculated on an accrual basis from the beginning of the calendar year, has exceeded this base, and the employer applies the basic (not reduced) rate of contributions for compulsory pension insurance, then from the amount of excess, contributions to compulsory pension insurance are charged at a rate of 10% (clause 1 Article 426 of the Tax Code of the Russian Federation).

Number of sheet (section, subsection) Name of sheet (section) Sheet 1 Title page Section 1 Summary of data on the obligations of the payer of insurance contributions Subsection 1.1 of Appendix No. 1 to Section 1 Calculation of contributions for compulsory pension insurance Subsection 1.

2 Appendix No. 1 to Section 1 Calculation of the amounts of contributions for compulsory health insurance Appendix No. 2 to Section 1 Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity Section 3 Personalized information about insured persons

Regardless of the activity being carried out, the following are required for completion by all payers of insurance premiums in accordance with the procedure for filling out the calculation: title page, section 1, subsections 1.1 and 1.2 to section 1, appendix 2 to section 1 and section 3 “Personalized information about insured persons” of the calculation .

- Front page.

This sheet contains the name of the organization, the date of compilation, and indicates for which quarter the zero DAM is issued. The filler must indicate the division of the tax service and its code, enter the codes and numbers of your organization: OKVED2, INN, KPP. The name of the compiler is entered and his signature is placed at the bottom of the page. - Section 1, Appendix 1.1. Includes information on the number of employees insured under the pension program. If absent, zeros are entered.

- Section 1, Appendix 1.2. Information about employee health insurance.

- Subsection 1, Appendix 2. Information on social insurance.

- Section 3, subsection of form 3.1.

Information about employees: passport details (name), SNILS, INN. Not only employees, but also people with whom there is a civil contract are considered insured. In lines 160-180 it is necessary to indicate whether the listed persons are insured or not.

What changed

The Federal Tax Service of Russia will now oversee insurance premiums. Only contributions for injuries remain under the jurisdiction of the Insurance Service. The calculation of contributions “for injuries” for this year was approved by order of the Social Insurance Fund No. 381 dated September 26, 2020. The first reporting campaign is for the 1st quarter of 2017.

According to the SZV-M form, accountants will continue to report to the Pension Fund of the Russian Federation. Since January, the due date has been moved from the 10th to the 15th of the month following the reporting month.

The Foundation is also going to approve a new report on the length of service of working citizens, which will need to be submitted once a year.

Procedure for submitting a new report

The new form for calculating insurance premiums has already been approved, the deadline for delivery in 2020 is known. The form must be submitted no later than the 30th day of the month following the reporting month (Clause 7, Article 431 of the Tax Code of the Russian Federation).

New report submission schedule for 2020

- 1st quarter - no later than May 2,

- 6 months - until July 31,

- 9 months - no later than October 30,

- Annual - until January 30, 2020 inclusive.

If the average number of personnel exceeds 25 employees, the report is provided via the Internet, with an electronic signature and via a secure channel. Other taxpayers can submit calculations on paper in person or send them by mail (clause 10 of Article 431 of the Tax Code of the Russian Federation).

The report must be submitted to the Federal Tax Service division at the actual address for organizations or residential address for entrepreneurs. Separate divisions submit reports at their location, while the branch does not need a current account or its own balance sheet.

Structure and content of the new calculation

The new calculation of insurance premiums is more similar to a tax return and is fundamentally different from the form of reporting to extra-budgetary funds in that all included indicators are related to the accruals of the reporting quarter.

There is no information about the listed payments, initial and final debt in the new form. And that's good ©

New form for calculating insurance premiums (PDF).

Section 1. Contains indicators of the amounts of insurance premiums payable to the budget. In addition to the basic contributions to pension insurance, amounts to the fund accrued at an additional rate and contributions to additional social security are indicated. The total amount and breakdown by 3 months are indicated. Each type of insurance premium has its own BCC.

Sample of filling out the calculation of insurance premiums. Top of the first section.

The budget classification code must be specified to correctly reflect the received information on the payer’s personal account. The debt in the Federal Tax Service system will be automatically repaid after payment of the fee by payment order.

The first section of the new report contains fields for indicating the amount of excess expenses over contributions accrued to the Social Insurance Fund of the Russian Federation. It is indicated in a single amount and monthly breakdown.

The first section has 10 Applications. They decipher general information about accrued insurance premiums.

Appendix 1 contains information on calculations for pension insurance, the number of insured employees and persons from whose wages mandatory contributions are calculated.

Appendix 1 to the first section

The base for calculating contributions is indicated with a breakdown: exceeding the limit and not.

Appendix 3 - information on expenses incurred for the purposes of compulsory social insurance. The form provides a breakdown of the amount by type of benefits: pregnancy and childbirth benefits, sick leave, child care benefits, etc.

Section 2. To be completed by farmers and heads of peasant farms. This category of payers indicates the amount of accruals to the Compulsory Medical Insurance Fund and the Russian Pension Fund for the reporting year with mandatory linking of payments to the corresponding BCC.

The appendix to the second section includes information about each member of the household: full name, SNILS, INN, membership period and income paid to him, broken down by month.

Section 3. Set of personalized information about all persons insured by the employer. Each employee who received income from an organization or individual entrepreneur for the past quarter is indicated on a separate sheet.

To reflect information about payments at the “regular” tariff, subsection 3.2.1 is used. If there were several tariffs, each is indicated on a new line.

Subsection 3.2.1 of the new calculation

The amounts of payments that are subject to additional tariffs are indicated in subsection 3.2.2.

The procedure for filling out calculations for insurance premiums was approved by Order No. ММВ-7-11 / [email protected] dated October 10, 2020.

If there is a mistake or misprint in the personal data of individuals, the report will not be accepted. The inspector will generate a notification; the employer will have 5 days to correct the inaccuracy if the report is submitted online, and 10 for the paper version. Only the third section needs to be corrected, indicating the corrected data. There is no need to re-enter those who were entered correctly.