Example of filling out and due date for the DAM for the 1st quarter of 2020

- Information about payments under the pension insurance program:

- in field 020 - payment KBK;

- in field 030 - the total payment amount for the billing period;

- in fields 031–033 - payment amounts for each of the 3 months of the billing period.

- Information about payments under the health insurance program:

- in field 040 - KBK;

- in field 050 - the total amount for the billing period;

- in fields 051–053 - amounts for each of the 3 months of the billing period.

- Information on social insurance payments (except for those related to injury insurance):

- in field 100 - KBK;

- in field 110 - total amount;

- in field 111–113 - amounts for each of the 3 months of the billing period.

- Subsection 1.1, which reflects:

- in field 010 - the number of employees (contractors) for the billing period and each of the 3 months;

- in field 020 - the number of employees who received payments subject to pension contributions;

- in field 030 - the amount of payments subject to contributions;

- in field 040 - the amount of payments to the employees (contractors) taken into account above, for which contributions were not accrued;

- in field 050 - the amounts for which pension contributions were calculated;

- in field 051 - amounts for which pension contributions were accrued in a reduced amount due to exceeding the limits for accruing contributions in the usual amount;

- in field 060 - the amount of contributions accrued in each of the 3 months of the billing period;

- in field 061 - the amount of contributions accrued from payments within the limit.

- Subsection 2.2.

https://youtu.be/ZH8-s1qh95s

RSV and sick leave at the junction of periods

Is sick leave reflected in the RSV?

Sick leave is not subject to insurance premiums. But it is still necessary to show it in the RSV:

- as part of payments that are exempt from contributions - line 040 of Subsection 1.1 of Appendix 1 to Section. 1:

IMPORTANT! Line 040 reflects the full amount of the benefit, including part of the sick leave paid at the expense of the employer (for the first three days of illness).

Read more about filling out line 040 RSV in this article.

- as part of the costs of paying insurance coverage - line 070 of Appendix No. 2 to Section. 1 (except for pilot regions):

Read more about filling out line 070 RSV.

A breakdown of expenses due to social insurance is given in Appendix No. 3 to section. 1:

If sick leave is transferable

Quite often, sick leave is accrued in one reporting (billing) period, and paid out in the next. So, you need to include such a benefit in the DAM in the period of its accrual, not payment.

For example, if the benefit was accrued in December 2020 and issued in January 2020, it must be shown in the RSV for 2020.

Officials point to this (letters from the Ministry of Finance of the Ministry of Finance dated November 20, 2019 No. 03-15-06/89513, Federal Tax Service for Moscow dated October 10, 2019 No. 27-15 / [email protected]

Also, in the accrual period, carryover vacation pay is reflected in the DAM (when vacation is paid in one period, and the employee rests in the next).

Look for other nuances of filling out the RSV in the materials in our special section.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Unified form RSV-1 PFR in 2020: form and sample filling

- 1 – assessment of contributions occurred on the basis of desk audit reports, and prosecution occurred in this quarter;

- 2 – assessment of contributions occurred on the basis of on-site inspection reports, and prosecution occurred in this quarter;

- 3 – the employer independently identified errors and calculated the amount of contributions.

- Section 5. This section is completed only by those insurers who pay certain amounts to students working in student groups. Such payments do not require additional contributions to the Pension Fund, but certain conditions must be met: In this case, all clarifications must be accompanied by documents for personalized accounting. All documents subject to clarifications should be submitted taking into account the rules that were in force during the period in which the errors were made in the report.

- First section. This section contains information about insurance payments paid and payments that still need to be paid. Here we should highlight contributions to the Pension Fund that were accrued and paid for 2010-2013. This information is indicated in columns 4 and 5 - information on insurance and savings, respectively. And contributions to the fund from the beginning of 2014 are shown in column 3 (there is no division into the insurance and savings part). Other contributions are reflected in columns 6, 7 and 8 (for example, those for which additional tariffs apply). As for the information for 2010-2013, the first section has lines, each of which has its own purpose. So, line 100 reflects the debt until 2014. Column 3 contains data on debt or overpayment of contributions to the Pension Fund as of 2020. In the 120th line - payments that were accrued later, in 140 - fully paid contributions and in the 150th line - unpaid contributions for 2010-2013.

- Second section. Data on accrued payments and insurance deposits is displayed here. The section has three subsections that display data about additional tariffs and calculations for them. All employers enter information into subsection 2.1, but 2.2 and 2.3 are filled out only if the employee for whom the contribution was paid works in hazardous or heavy work, respectively. If insurance premiums in the period for which the report is provided were calculated at several tariffs, this section must be completed according to the number of tariffs that were applied. Information in paragraphs 2.2 and 2.3 is provided only by companies whose benefits are 6 or 4%, respectively. In general, the following factors influence the size of such benefits:

In RSV how to fill out the amount for sick leave from the employer

Typically, sick leave is paid for by the employer and the Russian Social Insurance Fund (FSS). The first 3 days of sick leave are paid by the employer from the organization’s own cash reserves (clause 1 of Part.

2 tbsp. 3 of the Law of December 29, 2006 No. 255 - Important Federal Law).

Deductions are expenses for labor functions.

The following days, until the end of the sick leave, payments are made by the Social Insurance Fund. The amount of payment for compulsory social insurance can be reduced due to expenses incurred for the payment of the following subsidies: for disability (after the third day of illness);

RSV for the 1st quarter of 2020: how to reflect reimbursement of hospital benefits from the Social Insurance Fund in the calculation

Namely:

- code “1” - if the amount of expenses incurred for the month did not exceed the amount of calculated contributions;

- code “2” - if expenses exceed the amount of calculated insurance premiums.

If the cost of paying benefits exceeds the amount of calculated contributions as a whole for the last three months of the reporting period, column 4 of line 090 also displays attribute “2”.

In line 090, the amount is always reflected as a positive value. If the calculation contains negative values, the inspectors will demand that the necessary changes be made and the updated calculation of the Federal Tax Service be submitted to the inspectorate (see.

""). Data from line 090 of Appendix No. 2 to section 1 of the DAM are reflected in section 1 of the calculation:

- on lines 120 - 123 - the amount of excess of expenses over contributions (with the sign “2”).

- on lines 110 - 113 - amounts payable to the budget (with the sign “1”);

When filling out the section

Sample of filling out RSV with sick leave

Such payments do not require additional contributions to the Pension Fund, but certain conditions must be met: In this case, all clarifications must be accompanied by documents for personalized accounting. All documents subject to clarifications should be submitted taking into account the rules that were in force during the period in which the errors were made in the report.

And contributions to the fund from the beginning of 2014 are shown in column 3 (there is no division into the insurance and savings part). Other contributions are reflected in columns 6, 7 and 8 (for example, those for which additional tariffs apply).

What

How to fill out the RSV subject to payment of sick leave

In accordance with the procedure for filling out the calculation of insurance premiums (hereinafter referred to as the Procedure), Appendix No. 2 to Section 1 of the Calculation is intended to calculate the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity. According to paragraph 11.

15 of the Procedure establishes that in line 090 of Appendix No. 2 to Section 1 of the calculation, the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, subject to payment to the budget, or the amount of excess of the costs incurred by the payer for payment are reflected in the corresponding columns insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity over the calculated insurance premiums for this type of insurance, indicating the corresponding attribute from the beginning of the billing period, for the last

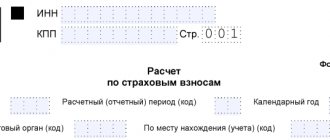

Calculation of insurance premiums (filling example)

No. ММВ-7-11/551 and began to operate with reporting for 2020. This legislative document also establishes the procedure for filling out the DAM. All organizations and entrepreneurs that use hired labor in their activities are required to submit the DAM.

The report must be submitted for each quarter, even if no activity was carried out and no salaries were accrued.

What is included in the DAM Calculation of insurance premiums includes a fairly large number of sheets, which, however, are required to be filled out by not all companies. The DAM contains several sheets that must be filled out by all employers, while other sheets are used only as needed.

Basic sheets to fill out:

- Section 1 (with appendices) to reflect the amount of insurance premiums;

- Title page;

- Section 3 to reflect the personal data of the organization’s employees.

Recalculation of sick leave after payment: how to reflect additional payment in RSV

This procedure is established by clause 2.1 of the Federal Law of December 29, 2006 No. 255-FZ.

Calculate salaries and benefits in the web service. The date of payments and other remunerations is the day payments and other remunerations are calculated in favor of the employee (clause

1 tbsp. Tax Code of the Russian Federation). The calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity is reflected in Appendix No. 2 to Section 1 of the DAM form on lines 010 - 070.

Line 070 indicates the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first, second and third month of the last three months of the billing (reporting) period, respectively (P.

11.13 Procedure for filling out the DAM, approved.

Calculation of insurance premiums for the 2nd quarter: sample

in April, 6000 rub.

in May and 4000 rubles. in June. These amounts include sick leave paid at the expense of the employer - 3,000 rubles each.

in every month. One employee was paid 16,350.33 rubles in June. No benefits were paid in the first quarter. Income for the six months paid to employees is 700,000 rubles, including: in April – 120,000 rubles, in May – 119,000 rubles, in June – 115,000 rubles. Number of employees – 5 people. The FSS credit system of payments is used, the tariff is 2.9%.

In Appendix 2 of the calculation, we indicate payment attribute “2” - the employer pays benefits to employees, and then a credit is made against the payment of insurance premiums. In our example of filling out the calculation of insurance premiums with sick leave, we will distribute the amounts of income (line 020), non-taxable amounts (line 030) and calculate the base for calculating social insurance contributions (p.

050). In this case, the amount of all benefits is not subject to contributions, incl.

and sick leave at the expense of the employer.

Free legal assistance

The exception is temporary disability benefits.

Attention, the employer is obliged to pay for the first three days of illness of an individual at his own expense (Part.

2 tbsp. 3 of Law No. 255-FZ). The costs of paying benefits in this part do not reduce the amount of contributions payable, therefore, when filling out Appendix No. 2 to Section 1 of the new calculation of insurance premiums, they do not need to be taken into account.

Specialists of the Federal Tax Service of Russia, in clarification dated December 28, 2016 No. PA-4-11/, clarified that on line 070 of this application it is necessary to indicate only those expenses that were incurred to pay contributions. N PA-4-11/ explains: According to line 070 of Appendix No. 2

“Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”

to section 1 of the calculation, the corresponding columns reflect the amounts of the payer's expenses incurred for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity.

How to correctly fill out the RSV reporting form with sick leave if the employer received compensation from the Social Insurance Fund?

The form and reporting procedure for RSV-1 were approved by Order of the Federal Tax Service of 2016 No. Opinion of a lawyer Dmitry Ivanov Legal Support Center This article talks about standard ways to resolve the issue, but each case is unique.

If you want to find out how to solve your particular problem, call:

- Moscow: .

- Saint Petersburg: .

Or on the website.

In this case, the receipt of such compensation must be reflected in the RSV-1 reporting form.

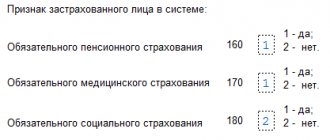

Calculation of insurance premiums (DAM) for the 1st quarter of 2020: example of filling out

Confirmation of the accuracy and completeness of information in the calculation of insurance premiums for the 1st quarter of 2020 - this information is necessary for tax authorities. In the special fields of the title page, write down the name of the policyholder, indicate the date of the calculation and sign. If the calculation is submitted by a representative, then an additional copy of documentary evidence of authority should be attached to the reporting. Most likely, no questions will arise with the design of the remaining cells of the title page. But if in doubt, refer to the completed sample:

The sheet “Information about an individual who is not an individual entrepreneur” comes after the title page. It must be generated by individuals who submit calculations for insurance premiums for the 1st quarter of 2020 for hired workers and who did not indicate their TIN in the calculation. Then on this sheet the employer must show his personal data (in particular, full name, date and place of birth and passport details). This sheet looks like this:

26 Jun 2020 glavurist 867 Share this post

Conditions for filling out reports

RSV-1 reporting is required to be submitted to the Tax Inspectorate by all legal entities and individuals who use hired labor in their work and are payers of insurance premiums. The form and reporting procedure for RSV-1 were approved by Order of the Federal Tax Service of 2020 No. ММВ-7-11/ [email protected]

Lawyer's opinion Dmitry Ivanov Legal support center Ask a lawyer a question

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call:

Or on the website. It's fast and free!

Part of the benefits for temporary disability on sick leave is paid by the employer from his own funds, the other part is compensated by the Social Insurance Fund.

If the amount of accrued benefits turns out to be less than the amount of benefits paid, then the employer has the right to receive compensation to his current account. In this case, the receipt of such compensation must be reflected in the RSV-1 reporting form.

Thus, the conditions for filling out RSV-1 reporting are as follows: the employer has the status of a legal entity or individual entrepreneur, he employs employees under an employment contract, or he engages persons for certain operations under a civil contract, he is a payer of insurance premiums.

Sick leave at the expense of the employer does not fall into the RSV

Therefore, contributions to extra-budgetary funds should be calculated from it in the general manner, as from the amount paid to the employee within the framework of the employment relationship (,). As you know, the amount of benefits that the employer paid to its employees can be offset against the payment of VNIM contributions ().

10 mistakes to avoid in the DAM for the first half of 2020

The figures indicated in the calculation of contributions and in the documents submitted to the Social Insurance Fund for reimbursement of benefits must be the same. For more information about these documents, as well as about the current procedure for offset and return of excess expenses for the payment of benefits over the accrued amount of contributions to VNiM, read the answer to the question

On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form. The Company pays sick leave to employees and receives reimbursement from the Federal Social Insurance Fund of Russia for the payment of insurance coverage. How in such a situation the calculation of insurance premiums is filled out, the Federal Tax Service of Russia explained in a letter from Clause 2 of Art. If, at the end of the accounting reporting period, the amount of such expenses turns out to be greater than the amount of accrued contributions, the difference is either counted by the tax authority against upcoming payments, or reimbursed by the territorial body of the Federal Social Insurance Fund of Russia. Appendix 2 to Section 1 of the calculation of insurance premiums. The calculation form and the procedure for filling it out are approved by order of the Federal Tax Service of Russia dated Appendix 2 shows: by line - the amount of accrued insurance premiums p. Each of these periods contains five columns for indicating values from the beginning of the billing period, for the last three months of the billing reporting period, and also for the first, second and third months of the last three months of the billing reporting period. In the commented letter, the Federal Tax Service of Russia indicated that the amounts of compensation from the Federal Tax Service of Russia are shown in the columns of the line corresponding to the month in which they were actually received by the company.

Zero DAM: example of filling out download What has changed in the calculation of insurance premiums for 9 months of the year Changes in the procedure for filling out the DAM for 9 months of the year are associated with the abolition of benefits on insurance premiums for some categories of policyholders. Now companies in special regimes with preferential types of activities apply not reduced, but regular tariffs. In the letter from the Federal Tax Service from the Letter from the Federal Tax Service from the Calculation form for insurance premiums for 9 months of the year can be filled out on paper or electronically. In the paper version, the report is filled out in blue or black ink. You must write in clear, legible handwriting, with capital letters. Erasures and the use of corrector are not allowed.

How to fill out the RSV form correctly

The RSV-1 calculation contains information that is the basis for the calculation and payment of insurance premiums from the 1st quarter of 2017. One of the sections of the report is devoted to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.

It consists of a title page and three sections indicating contributions for pension, medical and social insurance of employees, as well as personalized information.

In the RSV-1 form, it is necessary to fill out only those sections in which the employer has something to transfer. For example, if an employer does not have contributions with additional tariffs, then he does not fill it out and submit it to the inspectorate.

After the employer submits a report on contributions to the Federal Tax Service, the inspectorate transmits it to the territorial division of the Social Insurance Fund (Appendix 2-4 to Section 1 with information on accrued contributions and benefits). Therefore, the employer should take into account that the figures calculated for contributions and those transferred to the Social Insurance Fund to receive compensation must be the same.

1c recalculation of sick leave RSV negative amount

or salary minus accrued unearned vacation pay in the amount of 18,000 rubles. (20,000 rubles – 2000 rubles)?

Determination of the base for contributions during the period of recalculation of vacation pay Svetlana Petrovna PAVLENKO State Advisor of the Russian Federation, 2nd class - Considering that the base for calculating insurance premiums is determined on an accrual basis, in October it will be determined as the amount of accrued wages minus the amount of deductions for unworked vacation days. That is, the base will be 18,000 rubles. If, after adjusting the base for calculating insurance premiums in the current reporting period, its value is greater than or equal to 0, an updated calculation of insurance premiums does not need to be submitted.

All adjustments are reflected in the current period by reducing the base for calculating insurance premiums. But there is a situation in which the recalculation of contributions simply cannot be reflected in the calculation of contributions in the current period.

Personnel accounting and payroll calculation in 1C 8.3 ZUP 3.1

What needs to be done in the ZUP program 3.1 (3.0) so that in July, when calculating salaries, additional contributions for June are accrued?

First, you need to open the document that approved this staffing unit (Approval of staffing dated 01.06.

2016) and on the “Additional” tab, check the box - Contributions are collected for those employed in jobs with early retirement.

Secondly, to determine the percentage of the tariff, indicate the working conditions - in our example this is Work with harmful working conditions, subparagraph 1 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation”.

However, we see that our contributions were calculated only for JULY, and additional accruals for JUNE did not occur.

How to fill out the RSV when recalculating disability benefits

When using materials in full or in part, an active link to spmag.ru is required, subject to compliance.

Insurance premiums 2020: calculations and recalculations in 1C

Recalculation according to the basic tariff leads to an increase in the amount of insurance premiums payable.

5. When calculating insurance premiums, the program did not indicate that the position was listed in the list of hazardous professions subject to additional tariffs. After the error was discovered and corrected, the recalculation resulted in an underpayment of insurance premiums at additional rates.

Let's look at the features of recalculating insurance premiums in “1C: Salaries and Personnel Management 8” edition 3 using examples. Employee V.S. Ivy works in a warehouse as a storekeeper with a salary of 10,000 rubles.

Rice. 1. Card of a separate unit “Warehouse”

Recalculation of sick leave after payment: how to reflect additional payment in RSV

July 16, 2020 July 16, 2020 In the first quarter of 2020, the employer calculated and paid sick leave benefits to the employee, and in April (that is, in the next reporting period) recalculated sick leave and credited the employee with the missing amount of benefits. How to reflect this surcharge in the calculation of insurance premiums (DAM)?

The answer to this question is contained in a letter from the Federal Tax Service of Russia. As you know, to calculate benefits you need to know the employee’s earnings for the two previous years.

If the employee worked for several employers during this period, then he must bring to the employer, who will accrue benefits to him, certificates of earnings for the specified period from previous places of work.

If the employee does not have such certificates, the benefit is calculated based on the information and documents available to the employer.

Subsequently, after the employee brings proof of earnings, the benefit is recalculated. This procedure is established by clause 2.1 of the Federal Law of December 29, 2006 No. 255-FZ.

The date of payment and other remuneration is the day of accrual of payments and other remuneration in favor of the employee (clause

11.13 Procedure for filling out the DAM, approved. by order of the Federal Tax Service of Russia). Based on the norms mentioned above, the authors of the letter draw the following conclusion. If in April 2020, based on a certificate of earnings, the employer recalculated the amount of benefits for the previous period, then the payment date will fall in April.

Therefore, the amounts of additional benefits paid in the form of expenses for the payment of insurance coverage should be reflected for April in the calculation of insurance premiums for the first half of 2020.

Please note: when submitting calculations of premiums, those policyholders who use web services to prepare and check reports (for example, the system for sending reports “”) will feel most comfortable.

There, the latest test programs are installed automatically, without user intervention.

If the data entered by the policyholder does not correspond to the current control ratios, the system will certainly warn him about this and tell him how to correct the errors.

How to correctly fill out the RSV reporting form with sick leave if the employer received compensation from the Social Insurance Fund?

Therefore, the employer should take into account that the figures calculated for contributions and those that were transferred to the Social Insurance Fund to receive must be the same.

According to the procedure for filling out the reporting form RSV-1, the amounts of insurance premiums for insurance in connection with maternity are prescribed in Appendix 2 to Section 1.

Line 060 displays accrued contributions from the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown. Line 070 records benefits that have been accrued since the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown.

According to clause 11.14 of the Procedure, line 080 indicates the amount of compensation from the Social Insurance Fund in the column that corresponds to the month of receipt of the actual compensation.

For example, if expenses are compensated by the fund in April, then this is displayed in the column for the first month of the 2nd quarter.

Line 090 of Appendix No. 2 indicates the amount calculated using the following formula: accrued contributions minus expenses for temporary disability payments plus the amount of compensation received from the Social Insurance Fund for the reporting period.

There was a recalculation of sick leave and in line 070 RSV there was a negative amount

Based on the norms mentioned above, the authors of the letter draw the following conclusion. If in April 2020, based on a certificate of earnings, the employer recalculated the amount of benefits for the previous period, then the payment date will fall in April.

Therefore, the amounts of additional benefits paid in the form of expenses for the payment of insurance coverage should be reflected for April in the calculation of insurance premiums for the first half of 2020.

Please note: when submitting calculations of premiums, those policyholders who use web services to prepare and check reports (for example, the Kontur.Extern reporting system) will feel most comfortable.

There, the latest test programs are installed automatically, without user intervention.

In 2020, all employers faced major changes to their current reporting procedures.

If up to this point

Recalculation of sick leave in the RSV 1c report

Appendix No. 3 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred in accordance with the legislation of the Russian Federation to Section 1” of Section 1 of the calculation reflects the expenses incurred by the employer for the purposes of compulsory social insurance in case of temporary disability. disability and in connection with maternity. According to clause 11.13 of the Procedure, line 070 of Appendix No. 2 reflects the amounts of the employer's expenses incurred for sick leave from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first, second and third month of the last three months of the billing period. (reporting) period respectively.

Law of December 29, 2006 No. 255-FZ

“On compulsory social insurance in case of temporary disability and in connection with maternity”

(hereinafter referred to as Law No. 255-FZ).

Salary corrections and recalculations

Source: https://konsalt74.ru/1s-pereraschet-bolnichnogo-rsv-otricatelnaja-summa-67731/

How to reflect sick leave in RSV-1

According to the procedure for filling out the reporting form RSV-1, the amounts of insurance premiums for insurance in connection with temporary disability and maternity are prescribed in Appendix 2 to Section 1.

Line 060 displays accrued contributions from the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown. Line 070 records benefits that have been accrued since the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown.

According to clause 11.14 of the Procedure, line 080 indicates the amount of compensation from the Social Insurance Fund in the column that corresponds to the month of receipt of the actual compensation. For example, if expenses are compensated by the fund in April, then this is displayed in the column for the first month of the 2nd quarter.

Line 090 of Appendix No. 2 indicates the amount calculated using the following formula: accrued contributions minus expenses for the payment of temporary disability benefits plus the amount of compensation received from the Social Insurance Fund for the reporting period.

According to the above calculations, either a negative or a positive value can be obtained. The employer should take into account that if the difference is negative, then he does not need to put a minus in front of the number.

The sign of the resulting difference is indicated using the numbers 1 or 2. If the value is set to “1”, this indicates that the contributions are more than the costs of insurance compensation for workers, “2” - the employer’s costs are more than the accrued contributions. Accordingly, if the value according to the formula for line 090 is negative, then the number “2” is entered.

If the amount is positive, this means that the employer must make an additional payment to the budget; if it is negative, then he will be reimbursed from the budget.

If the employer remains in debt, then he fills out one of the lines: 110, 111, 112, 113. When he has an overpayment, then fill out lines 120, 121, 122, 128. At the same time, these lines are not filled in: that is, the employer can or must budget, or overpay into it.

If there is a discrepancy between the data from the DAM report and the financial statements, accountants often have questions about whether the form has been filled out correctly. Typically, a discrepancy arises between the actual state of affairs and the figure indicated in column “090”.

For example, if the Fund has already reimbursed the employer for expenses, and when filling out the reporting form it turned out that the company owes the Social Insurance Fund a larger amount than in reality (after all, reimbursed expenses are added to accrued contributions), then there is no error in this. The employer will have to pay only accrued contributions to the budget, and not the amount from the final line 110 or 90 of the DAM report.

If the costs of temporary disability benefits were taken into account by the employer last year, and the employer received compensation in the current year, then the report is also filled out in the standard manner.

In the above formula, it does not matter for what period the employer received compensation; it is taken into account in the month of actual receipt. This position is confirmed by the explanatory letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 2020. A similar conclusion can be drawn based on the analysis of Art. 34 of the Tax Code, which provides for the offset of expenses for temporary disability and maternity benefits against upcoming payments.

Most accounting programs today are configured to automatically check all ratios and prevent you from filling out lines incorrectly. But if the employer fills out the reports independently, then the control ratio is given in the Federal Tax Service Letter of 2020 No. GD-4-11 / [email protected]

Sample document: an example of filling out the RSV with sick leave can be viewed.

Also, the employer can always find out whether taxes have been paid correctly by ordering a reconciliation of calculations from the Federal Tax Service. If the accounting data matches the reconciliation results, then there is nothing to worry about.

Sample of filling out the DAM with compensation from the Social Insurance Fund

Let's give an example of filling out the RSV when reimbursing the Social Insurance Fund.

Initial conditional data for our example:

Contributions accrued for the half-year:

| Total (RUB) | April | May | June |

| 150 000 | 50 000 | 50 000 | 50 000 |

Benefits paid for the 2nd quarter:

| Total (RUB) | April | May | June |

| 350 000 | 100 000 | 100 000 | 150 000 |

The excess of benefits over contributions was: 350,000 - 150,000 = 200,000 rubles.

The lines of Appendix 2 to Section 1 in the DAM for the 2nd quarter that interest us, when filled out for this example, look like this:

Let’s assume that we reimbursed the payment of benefits to the organization in August 2020.

Let's consider where the DAM reflects compensation from the Social Insurance Fund when filling out Appendix 2 of Section 1 for 9 months, if contributions were accrued for the 3rd quarter:

| Total (RUB) | July | August | September |

| 150 000 | 50 000 | 50 000 | 50 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of contributions for the 1st, 2nd and 3rd quarter): 150,000 + 150,000 = 300,000 rubles.

Benefits paid for the 3rd quarter:

| Total (RUB) | July | August | September |

| 120 000 | 45 000 | 40 000 | 35 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of benefits paid for the 1st, 2nd and 3rd quarter): 350,000 + 120,000 = 470,000 rubles.

In the 3rd quarter there was compensation from the Social Insurance Fund:

| Total (RUB) | July | August | September |

| 100 000 | 0 | 100 000 | 0 |

Then the lines of Appendix 2 of Section 1 of the RSV for 9 months of 2020 that interest us will look like this:

Please note that at the end of 9 months, the amount to be reimbursed from the budget was obtained.

When filled out, it is indicated with the sign “2” in column 1. This means that for 9 months the amount of benefits paid to employees exceeded insurance accruals.

And at the end of the third quarter, the amount due was paid to the budget. It is indicated with the sign “1” in column 3. That is, for the 2nd quarter, the amount of insurance accruals exceeded the amount of benefits.

For clarity, we will show in the pictures how the values indicated in lines 090 were calculated.

In just 9 months, benefits exceeded contributions by 170,000 rubles. (300,000 - 470,000 = -170,000). If we add the funds transferred to the FSS in August 2020 in the amount of 100,000 rubles, it turns out that the FSS still owes the organization 70,000 rubles. We indicate this value in line 090 with the sign “2”.

For the third quarter, insurance accruals, taking into account the compensation received from the Social Insurance Fund, exceed the costs of benefits. To be paid to the budget - 130,000 rubles. We enter this value when filling in with the sign “1”.

In July 2020, the Social Insurance Fund has not yet reimbursed the organization’s expenses, so in the calculation of 100,000 rubles. they don't take it. We indicate contributions payable in the amount of 5,000 rubles.

In August 2020, we add the reimbursed 100,000 rubles. to the difference between lines 060 and 070, since it was in this month that they were listed.

In September we indicate only the difference between lines 060 and 070.

We hope that now filling out the RSV when receiving compensation from the Social Insurance Fund 2020 will be a simple task for you.

Let us remind you that the DAM based on the results of 9 months of 2020 must be submitted no later than October 30.

You can read more about filling out the RSV in this material.

Methods and deadlines for submitting RSV with sick leave

The settlement period for the DAM is a calendar year. The report for 2018 is due no later than January 30, 2020. At the same time, the reporting periods for employers who make payments to individuals are quarterly, half-yearly and 9 months.

For the specified reporting periods, reports are submitted no later than April 30, July 31 and October 30.

For delay in submitting the report, the employer faces a fine of 5% of the amount of contributions not paid within the established time frame on the basis of Art. 119 of the Tax Code of the Russian Federation. The maximum fine that can be imposed on a company is 30% of the unpaid amount, the minimum is 1 thousand rubles. Therefore, if the company paid everything, but was late in submitting the calculations, then the fine for it will be 1 thousand rubles.

Officials who are responsible for submitting reports may be subject to punishment according to the norms of the Code of Administrative Offenses of the Russian Federation. In Art. 15.5 of the Administrative Code provides for a warning or an administrative fine of 300-500 rubles.

DAM reporting can be submitted in electronic and paper form. Calculation of insurance premiums in electronic form is submitted by organizations in which the number of employees exceeds 25 people. This also applies to newly formed companies. If a company does not comply with the current procedure for submitting reports electronically, then it faces a fine of 200 rubles. (under Article 119.1 of the Tax Code).

If a company or individual entrepreneur employs less than 25 people, then they have the right to make their own decisions regarding the optimal form of reporting: paper or electronic.

The report in paper form may be submitted to:

- In person at the inspection office at your place of residence or place of registration.

- Through an authorized representative of a legal entity or individual entrepreneur with a power of attorney.

- Send it by registered mail with a list of attachments.

Thus, from 2020, all employers report insurance contributions to the Social Insurance Fund using the RSV-1 form. When receiving compensation for sick leave, a situation often arises that the amount of accrued contributions for payment is greater than what the employer must transfer. But this is not considered an error and should not frighten accountants, since employees of the Federal Tax Service and Social Insurance Fund receive information about accrued contributions not from the DAM, but from the budget payment cards.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free! Author's rating 77 Author of the article Mikhail Tareev Lawyer. Civil law Articles 149 written

Organizations and entrepreneurs using hired labor must submit insurance premium calculations (DAM) to the tax office once a quarter. We will tell you about the rules for filling out the calculation in our article.

FSS pilot project and direct benefit payments: how to set up in 1C

In the regions that are included in the pilot project of the FSS of the Russian Federation, payments of sick leave, children's and other benefits are carried out directly by the territorial branches of the FSS. The number of participants has expanded - since July 1, 2020, 39 constituent entities of the Russian Federation are already taking part in the pilot project for paying benefits directly from the Fund. 1C experts tell you how to use the capabilities of the 1C: Salaries and Personnel Management 8 version 3 program to interact with the Social Insurance Fund, including if the company uses electronic sick leave.

Direct payment of benefits from the Social Insurance Fund: regulatory regulation

A new system for paying benefits to employees - directly from the Social Insurance Fund of the Russian Federation - was launched in 2011. The features of direct payments of benefits for compulsory social insurance in case of temporary disability and in connection with maternity in the constituent entities of the Russian Federation participating in the implementation of the FSS pilot project were approved by Decree of the Government of the Russian Federation of April 21, 2011 No. 294. The goal of the “Direct Payments” project is to improve the situation of insured citizens and policyholders when carrying out activities related to the assignment and receipt of benefits within the framework of compulsory social insurance. Transfer of benefits to employees directly by the Fund provides guarantees to employees. Benefits within the framework of the direct payment mechanism are calculated and paid to insured persons directly by the territorial bodies of the Fund within strictly established periods of time by law, regardless of the financial situation of the employer. As for the work of accountants, on the one hand, in the regions participating in the Social Insurance Fund project, accountants do not face the risk of falsifying certificates of incapacity for work, do not calculate the part of the benefit that the Social Insurance Fund pays directly to the employee, and do not find funds for timely payments. The employer must only provide the data necessary for the calculation. On the other hand, preparing and sending documents to the Social Insurance Fund does not significantly reduce the workload of accountants in pilot regions. And it is still necessary to calculate benefits, because part of the benefit is paid by the employer. Now the direct procedure for paying benefits from the Social Insurance Fund is already successfully working in 39 constituent entities of the Russian Federation. The capabilities of the 1C: Salary and Personnel Management 8 program, edition 3, for interaction with the Social Insurance Fund allow you to generate and send to the Fund all required documents in a timely manner and without errors, including if an electronic certificate of incapacity for work (ELN) is used.

Interaction with the Social Insurance Fund in “1C: ZUP 8” (ed. 3)

To use the capabilities of interaction with the Social Insurance Fund in the program “1C: Salaries and Personnel Management 8” edition 3 (1C: ZUP in the Organization Details settings (Settings menu) on the Accounting Policies and other settings tab on the Accounting Policies link, you must set the I confirm that the organization is registered flag in a region with direct payment of benefits through the Social Insurance Fund and indicate the date from which the payment of benefits was transferred to the Social Insurance Fund (Fig. 1). Fig. 1. Setting up accounting policies If organizations from the pilot project region do not transfer the payment of benefits to the Social Insurance Fund, then simultaneously with the I Confirm flag that the organization is registered in a region with direct payment of benefits through the Social Insurance Fund, you should select the switch Benefits are paid by the policyholder. Regions’ entry into the Social Insurance Fund project for direct payments traditionally occurs on July 1, but an organization can “move” to a region with a pilot project at any time. Starting from version 3.1.5 in “1C:ZUP 8” edition 3, you can specify any date for joining the pilot project or select it from the provided general list.

in the Organization Details settings (Settings menu) on the Accounting Policies and other settings tab on the Accounting Policies link, you must set the I confirm that the organization is registered flag in a region with direct payment of benefits through the Social Insurance Fund and indicate the date from which the payment of benefits was transferred to the Social Insurance Fund (Fig. 1). Fig. 1. Setting up accounting policies If organizations from the pilot project region do not transfer the payment of benefits to the Social Insurance Fund, then simultaneously with the I Confirm flag that the organization is registered in a region with direct payment of benefits through the Social Insurance Fund, you should select the switch Benefits are paid by the policyholder. Regions’ entry into the Social Insurance Fund project for direct payments traditionally occurs on July 1, but an organization can “move” to a region with a pilot project at any time. Starting from version 3.1.5 in “1C:ZUP 8” edition 3, you can specify any date for joining the pilot project or select it from the provided general list.

Workplace to simplify document flow with the Social Insurance Fund for direct payments

The 1C:ZUP 8 program implements all the necessary documents and reports for participants in the FSS pilot project for the payment of benefits directly by the Fund, including:

- employee statements,

- registers of information and the possibility of presenting them electronically in current formats,

- possibility of forming and printing on paper.

A specialized workplace to simplify the organization’s document flow within the framework of the Social Insurance Fund pilot project is provided in the menu Reporting, certificates - Benefits at the expense of the Social Insurance Fund (Fig. 2).Fig.

Fig. 2. Workplace for interacting with the Social Insurance Fund for direct payments. Clicking the Create sick leave button in the program opens a new document, which, in addition to the standard bookmarks, contains the Social Insurance Fund Pilot Project tab (Fig. 3). Fig. 3. Document “Sick leave” for an organization participating in the pilot project. If the organization participates in the “Electronic Sick Leave” project, then this sick leave data will be filled in from the FSS server automatically by clicking the Receive data from the FSS button. What is the system of interaction with the FSS for the exchange of ELN and how the functionality works in 1C programs, read on the website. [td] 1C:ITS Read more about the exchange of electronic certificates of incapacity for work with the Social Insurance Fund, including receiving data from the Social Insurance Fund, entering the “Sick Leave” document into “1C: Salary and Personnel Management 8” (rev. 3), creating and sending For the ELN register in the FSS, read the reference book “Personnel records and calculations in 1C programs” in the “Personnel and remuneration” section.

On the FSS Pilot Project tab, following the Filling in Data link, you must enter additional information required in the ENL register. Data that is already in the program is entered automatically.

The employee’s application for payment of benefits must be submitted to the Social Insurance Fund office. It can be prepared right there using the link Enter an employee’s application for payment of benefits.

Application registers are created using the Create registers button. The generated registers can be sent electronically to the FSS directly from the program using the 1C-Reporting service.

How to work with benefits at the expense of the Social Insurance Fund as part of a pilot project in “1C:ZUP 8” ed.3

From the editor. On July 26, 1C: Lecture Hall hosted a lecture “Payment of disability and other benefits at the expense of the Social Insurance Fund in “1C: Salary and Personnel Management 8” (ed. 3)” with the participation of I.V.

Uspenskaya (Department of Insurance in Case of Temporary Disability and in Connection with Maternity of the Federal Social Insurance Fund of the Russian Federation) and 1C experts. I.V.

Uspenskaya spoke about the rules for calculating and paying disability benefits, about the conditions under which payments can be assigned, and about the features of calculating benefits in connection with changes in the minimum wage from 05/01/2018.

1C experts demonstrated how to pay for disability and other benefits at the expense of the Social Insurance Fund, calculate length of service in the program “1C: Salary and Personnel Management 8” (rev. 3), and also spoke about electronic sick leave and direct payments from the Social Insurance Fund in “1C: Salary and Management staff 8" (ed. 3).

The video recording of the lecture can be found on the 1C:ITS website on the 1C:Lectures page.

Source: https://buh.ru/articles/documents/73902/

When will you have to pay?

So, is sick leave subject to insurance premiums? No. But if it is customary for an enterprise to pay certain amounts in addition to state benefits in order to bring the payment up to the average earnings, then they already have to pay interest to the Pension Fund and other funds. According to the law, such additional payments are not compensation, but are considered as additional income for the employee. Therefore, in this case, it is necessary to apply the rules for calculating payments to social funds that are common to all other types of income.

There is another situation when the employer will have to pay social insurance from sick leave - the Social Insurance Fund did not accept for deduction the amount of benefits calculated and paid to the employee. Officials emphasize that if the company has not received compensation from the social insurance fund, then the payment cannot be considered a benefit exempt from contributions. And in other cases, when receiving income, it is necessary to “share” with the state.

Reasons for refusing reimbursement

Fund employees may refuse to compensate the employer’s expenses if:

- the benefit was calculated incorrectly (the length of service, the average salary were not accurately determined);

- initially, the documents were drawn up by medical workers with violations (although there are already court decisions that recognize such actions of the FSS as illegal, see, for example, Resolution of the Supreme Court of the Russian Federation of September 29, 2015 No. F01-3911/2015 in case No. A38-6283/2014);

- all the data necessary for the calculation are not provided;

- documents were not properly completed if the worker was injured due to an industrial accident.

All employees for whom Social Security contributions are paid, if they fall ill, have the right to receive sick leave benefits. It is calculated on the basis of a sick leave certificate, which is issued by a doctor when the employee himself is ill or if care is needed for a sick child, as well as another family member. Pregnant women are also given sick leave before going on maternity leave.

Are sick leaves subject to insurance premiums? Our article will answer this question.

What code should be entered according to the classifier?

For each period of service during which the employee does not work, but does not leave the organization and the calculation of length of service is not interrupted, there is a code that must be recorded in column 11 of section 3 of the SZV-STAZH report.

The code for the period of leave under the BiR differs from the code for the period of temporary disability. If an employee is on sick leave, then this time is assigned the code “VRNETRUD”; for a woman’s length of service on leave under the BiR - “DECREE”.

Expert opinion

Voitova Anna Anatolyevna

Experience in advising on legal issues of individuals - more than 5 years

I would like to make some digression or addition on the topic. Articles often talk about maternity leave for women. However, there are often cases when only the father can care for the child: the mother died during childbirth or left the family due to postpartum depression. The law does not prohibit the father from going on maternity leave. All information in SZV-STAZH is entered in the same way: the data that is indicated in relation to a female employee is the same as when applying for parental leave for a man.