Skip to content Kontur.Partner

PRACTICAL ACCOUNTING, TAXES, PERSONNEL

8-800-551-36-30

Free call within Russia

10/09/2019 Lara Bodrova Question and answer

Salary at the junction of periods

Salaries for the last month of the quarter are paid in the first days of the next. For example, for March - in April, for June - in July. How to reflect this in 6-NDFL?

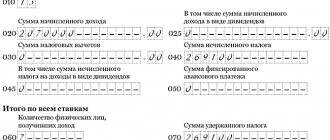

There is a letter from the Ministry of Finance dated March 18, 2016 No. BS-4-11/ [email protected] , which addresses this issue. Salary for March paid in April should be reflected in section 1 of the calculation for the 1st quarter. By analogy, salaries for June paid in July are reflected in section 1 of the half-year calculation . The entry is like this:

- on line 020 - the amount of accrued salary;

- on line 040 - the amount of calculated personal income tax.

to record the tax amount on line 070. The salary is paid in the next period, accordingly, and the tax must be withheld even then. If you reflect it in line 070 for the period for which the salary was accrued, there will be an error and a fine of 500 rubles under Article 126.1 of the Tax Code of the Russian Federation.

Note! A common mistake is to reflect tax on line 080 in such a situation. Since the personal income tax withholding date has not yet arrived, it cannot be reflected in this line.

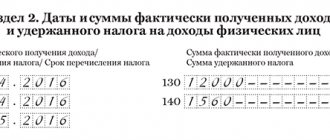

There is also no need to include this operation in section 2 This will be done in the next period . For example, if the June salary is issued on July 5, then section 2 of form 6-NDFL for the 9th month will look like this:

- on line 100 - 06/30/2019 (date of receipt of income in the form of salary - the last day of the month);

- on line 110 - 07/05/2019 (date of payment and withholding of tax);

- on line 120 - 07/08/2019 (personal income tax is transferred to the budget the next day, but 07/06 is Saturday);

- on line 130 - the amount of salary for June;

- on line 140 - the amount of personal income tax withheld from it.

How to reflect the transfer of earnings ahead of schedule in 6-NDFL

Declaration 6 consists of a title and 2 sections. In the first section, all types of remuneration applied for the entire period, deductions and withheld personal income tax should be reflected on a cumulative basis from the beginning of the calendar year. Form 6 of the second section is filled out according to the reporting quarter, indicating the dates of transfer.

Recalculation of personal income tax into 6-personal income tax: all complex cases

Filling out section 1:

- The salary with accruals issued earlier should be included in the total amount on line 020;

- all deductions used to calculate income are entered in line 030;

- The calculated income tax, and also from earnings, which is issued ahead of schedule, is indicated in line 040.

In order to correctly reflect taxes on line 070, it is necessary to do an analysis of deductions. For example, if personal income tax on earnings for June was withheld from an advance payment for July, these amounts should be excluded from the half-year report.

If tax is withheld and paid prematurely, these amounts should be included on line 070.

Filling out section 2 of section 6 of personal income tax when paying early wages.

Withheld tax, but forgot to pay: how to fill out 6 personal income taxes in such cases

Wages received earlier than the established dates should be reflected in a separate block of the section. This can be done as follows:

- 100 – the last date of the month when wages were paid;

- 110 is the day when income tax must be withheld. In case of transfer ahead of schedule, you need to indicate the date of the nearest payment for wages (for example, the nearest advance payment calculated based on average earnings);

- 120 – the next working day after the date indicated on page 110, in accordance with the requirements of Tax Code Art. 226 paragraph 6);

- 130 – wages;

- 140 – withheld income tax.

Example 1 of filling out report 6

The organization issued wages for April on the 28th before the weekend. 16.05 employees received an advance minus taxes for April.

- Accruals of income for April amounted to 250.00 thousand rubles;

- when calculating wages, deductions in the amount of 14.00 thousand rubles were applied;

- income tax – 30.68 thousand rubles.

We will reflect the early salary in the calculation of 6 personal income taxes for the six months.

1st section:

- The amounts reflected on line 020 must include accrued wages for April;

- on page 030 - include deductions applied in this period;

- Wage tax for April is included in lines 040 and 070.

2nd section.

Earnings received in advance are reflected in a separate block:

- 100 – April 30;

- 110 – May 16;

- 120 – May 17;

- 130 – 250,00;

- 140 – 30,68.

The sample clearly demonstrates filling out 6 personal income tax calculations when paying salaries in installments.

It is important! In the case of withholding personal income tax upon early payment of wages and transferring it to the treasury the next day, in the declaration the date of withholding will be earlier than the day of transfer.

Example 2 of reflection in the calculation of wages paid ahead of schedule

For June, salaries were issued ahead of schedule on June 29, with the simultaneous transfer of personal income tax to the treasury.

Correct reflection of bonuses paid to employees in the calculation of 6 personal income taxes

Fill out section 2:

- pp. 100 – 30.06;

- pp. 110 – 29.06;

- pp. 110 – 30.06.

Tax for June must be included in 040 and 070 of the first section.

If income tax is paid to the treasury in the next quarter, the calculation is completed as usual.

Example 3 of reflection in the annual report

For the year, the organization made calculations for wages for 5 employees:

- Payroll for 1 month – 210.00 thousand rubles;

- Payroll for the calendar year – 2520.00 thousand rubles;

- applied deductions 30.80 thousand rubles;

- Deadlines for advance payment and settlement: 20th and 5th.

In November, management decided to pay the salary for November ahead of the 25.11 deadline, in a calculation where only the previously paid advance was offset.

For November, personal income tax was not transferred; it was withheld from the advance payment for December.

Filling out the annual declaration of the first section:

- 010 – 13%;

- 020 – 2520,00;

- 030 – 30,80;

- 040 –323.60 (additional income tax accrual on employee earnings);

- 060 – 5;

- 070 – 296.30 (tax withheld from the total amount of earnings paid for the calendar year).

Unpaid wages for December will be transferred to employees in January. Then income will be withheld from wages for December. Therefore, there is no need to include it on page 070.

Filling out the second section 6 of personal income tax with early salary.

For this example, it is important to remember that the report includes the carryover salary for September, paid in October. Wages for December must be included in the declaration for the 1st quarter of the future period. If it was included in the annual declaration, it must be reversed.

October:

- 100 – 30.09;

- 110 – 05.10;

- 120 – 06.10;

- 130 – 210,00;

- 140 – 26.94 (tax withheld when paying wages).

Filling out the block in November if the salary is paid in installments:

- 100 – 31.10;

- 110 – 05.11;

- 120 – 07.11;

- 130 – 210,00;

- 140 – 26,94.

December for the option if there is no accrual of income for a given month:

- 100 – 30.11;

- 110 – 20.12;

- 120 – 21.12;

- 130 – 210,00;

- 140 – 26,94.

Below is a sample of filling in with early salary for this example.

Personal income tax from “advance”

Salaries in the organization are paid as follows: on the 30th day - advance payment, on the 15th day - the rest of the salary. Will personal income tax be withheld from the advance in this case?

The date of actual receipt of wages is considered to be the last day of the month for which it was accrued. On the day of payment of the salary for the first half of the month (“advance”), income has not yet arisen. Therefore, in general, personal income tax is not withheld from advances.

In the example given, it turns out that the dates of payment of the advance and the actual receipt of income will coincide in those months in which there are 30 days . If there are such matches, the organization will have to calculate the amount of personal income tax for the past month. On the same day, personal income tax must be withheld (ruling of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804), and on the next working day it must be transferred to the budget.

Therefore, in this case, 6-NDFL will be filled out depending on the number of days in the month . For example, September has 30 days in a month , so section 2 would look like this:

- on line 100 - 09/30/2019 (income received on the last day of the month);

- on line 110 - 09/30/2019 (personal income tax was withheld on the same day);

- on line 120 - 10/01/2019 (deadline for transferring tax to the budget).

there are 31 days in October , so the entry will be like this:

- on line 100 - 10/31/2019;

- on line 110 - November 15, 2019 (day of salary payment and personal income tax withholding);

- on line 120 - November 18, 2019 (next business day).

Is there any liability for paying personal income tax before salary?

If personal income tax is transferred before the salary payment deadline, inspectors may consider personal income tax unpaid, and the funds transferred by the employer to the budget as an erroneous payment. Moreover, the employer may be refused to offset this erroneous payment against his personal income tax debt.

In such a situation, the employer will have to re-transmit income tax to the budget, pay penalties and fines for late payment.

There have been precedents in judicial practice when employers managed to prove that they were right and that the income tax transferred in advance was paid by them not from their own money, but from the funds of their employees. If the employer is ready to sue the Federal Tax Service, then he can transfer personal income tax in advance. But in order to avoid controversial situations, it is worth transferring the tax only after it has been deducted from the employees’ salaries.

Thus, the obligation to transfer income tax to the budget arises for the employer as a tax agent only after the actual deduction of personal income tax from funds that are payable by the taxpayer. Therefore, according to the position of the Federal Tax Service, an employer who paid personal income tax before the payment of wages must pay the tax again, despite the fact that an overpayment actually occurs. For early payment of income taxes, the employer may be held liable in the form of fines and penalties.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call :

Or on the website. It's fast and free!

Payments upon dismissal

The employee quits, and on the last working day he receives wages and compensation for unused vacation. How to reflect this in 6-NDFL?

Let's say an employee quits on October 7, 2020. He was paid:

- Salary. In this case, the date of receipt of income is considered to be the last day of work.

- Vacation compensation. The date of receipt of income is the day of payment.

Both dates fell on October 7th. On the same day you need to withhold personal income tax. The transfer must be made within the usual time frame, that is, no later than the next day. We get section 2 as follows:

- on line 100 - 10/07/2019 (the day of actual receipt of income in the form of wages and compensation, that is, the last day of work);

- on line 110 - 10/07/2019 (date of tax withholding);

- on line 120 - 10/08/2019 (date of transfer of personal income tax to the budget).

Expert opinion of the Ministry of Labor of the Russian Federation on the timing of salary calculations and incentive payments

The essence of the issue is related to the amendment introduced to Part 6 of Art. 136 of the Labor Code of the Russian Federation by Federal Law of the Russian Federation No. 272 of July 3, 2016. We are talking about wages. From this moment on, the date of payment of earnings is determined by the organization independently and is fixed in a labor or collective agreement or internal regulations. You can fix the set payment dates in any of the listed documents at your own discretion.

The main requirement is compliance with the established interval between the end of the reporting period and the payment of the second part of the salary. It cannot exceed 15 days. In other words, it is prohibited to pay wages later than the 15th of the next month.

Thus, Federal Law No. 272 did not change the payment procedure. New edition of Art. 136 of the Labor Code of the Russian Federation obliges employers to pay wages monthly for the first half of the month from the 16th to the 30th (31st) day, and for the second half - from the 1st to the 15th of the next month. That is, it is necessary to determine the dating of the advance payment and the second part of the salary, taking into account the mentioned intervals.

As for incentive payments, the situation is different. These usually include bonuses, various types of additional payments, and allowances. These amounts are also part of the salary, but they can be assigned and given to the employee at a longer interval. For example, some types of bonuses are paid based on monthly or annual results. And this is not considered a violation of Art. 136 Labor Code of the Russian Federation.

The text of this letter was signed by the Director of the Department of Remuneration, Labor Relations and Social Partnership M.S. Maslova.

Example 1. Postponement of the date of payment due to weekends

In accordance with the Regulations on Remuneration, Priboy LLC pays an advance to employees every month on the 25th, and the second part of earnings on the 10th. Accordingly, for February 2020, money should be issued on February 25 (advance payment) and March 10 (final payment).

Both dates fall on weekends: 02/25/2018 is a Sunday, and 03/10/2018 is a Saturday. It follows that the employer has the right to initiate payment of money on the eve of the weekend. Taking into account the transfer, both parts of the salary for February 2020 will be issued to employees ahead of schedule, on the following days:

- February advance—02/23/2018.

- The final payment (balance) for February is 03/09/2018.

The actions of the employer in the situation under consideration are lawful and supported by the norms of Part 8 of Art. 136 Labor Code of the Russian Federation. Salaries were issued no later than March 15, 2020.

Example 2. Transfer of personal income tax upon early payment of earnings

Factor LLC, in accordance with the remuneration standards enshrined in the internal regulations, issues full pay to employees on the 1st of each month. It follows from this that the balance of the salary for April 2020 will be paid on 05/01/2018.

May 1 is a holiday, so the payment of salaries is postponed a day earlier (04/30/2018). The money will be given to employees on this day, personal income tax will be withheld, but it will not be transferred. Justification - the balance of earnings was issued ahead of schedule. All transactions for the transfer of this tax will be carried out next month (after the holiday, 05/02/2018).

Annual bonus and recalculation of vacation pay

In May, the organization paid a bonus for the previous year. Those employees who were on vacation from January to May of the current year had their vacation pay recalculated taking into account the bonus. These amounts were paid on May 15, personal income tax was transferred on May 16. How to fill out 6-NDFL?

For vacation pay, the date of receipt of income is the day of payment . Personal income tax must be transferred to the budget no later than the last day of the same month. Vacation pay was paid in May, therefore, this operation falls into 6-personal income tax for the six months . In section 2 you need to indicate:

- on line 100 - 05/15/2019 (day of payment of vacation pay);

- on line 110 - 05/15/2019 (personal income tax withholding day);

- on line 120 - 05/31/2019 (the deadline for transferring tax on vacation pay is the last day of the month in which they are paid).

6-NDFL.

In Form 6-NDFL for 2020, the company must reflect the December salary only in section. 1. In form 6-NDFL for the first quarter of 2020, section. 1 and 2 the company must fill in like this.

In form 6-NDFL for the first quarter of 2020, the indicators of section. 1 and 2 the company must fill in like this.

When the salary is zero

It turned out that the employee is not entitled to anything for July - he is in debt (previously deductions were made by court decision, and then he was on vacation). How to fill out 6-NDFL?

The date of receipt of income and calculation of tax will be the last day of July. However, the employer will not be able to withhold personal income tax , since there is no amount to be paid. But he will have to do this with the next payment of income in cash . This will most likely be an advance payment for August. Let's say it is paid on the 20th. Personal income tax is transferred the next day. In section 2 you need to indicate:

- on line 100 - 07/31/2019;

- on line 110 - 08/20/2019;

- on line 120 - 08/21/2019;

- on line 130 - the amount of accrued salary for July (before all deductions);

- on line 140 - the amount of tax withheld from wages for July.

Salary payment deadline for December 2018

When to pay the last salary of 2020 depends on what payment days are set by the employer.

The New Year holidays will last 10 days - from December 30, 2018 to January 8, 2019 inclusive. A company whose payday falls during this period must issue December wages on the last working day before the holidays (Part 8 of Article 136 of the Labor Code). In 2020 it is December 29th.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

If so, then in December employees should receive wages for November, advance payment and wages for December.

We do not recommend paying wages earlier than December 29. Otherwise, you will violate your own deadlines for issuing wages. Wages should be paid on certain dates (Part 6 of Article 136 of the Labor Code).

Salary ahead of schedule

Due to the departure of the director, we plan to pay salaries a week earlier. That is, on the 20th, employees will receive an advance, and on the 28th, the balance of the salary for the month. How to withhold tax and fill out 6-NDFL.

Let’s say this is the situation with salaries for October. There are 2 options.

Option 1. Tax is withheld from payment on October 28, that is, ahead of schedule . There is no ban on this. But the day of actual receipt of income will be October 31, that is, the last day of the month (clause 2 of Article 223 of the Tax Code of the Russian Federation). Entry in section 2:

- on line 100 - 10/31/2019;

- on line 110 - 10/28/2019;

- on line 120 - 10/29/2019.

Option 2 . Tax may not be withheld from October payments. The agent has this right because payments are made before the date of receipt of income - October 31. In this case, personal income tax will need to be withheld from the next payment - the advance payment for November, which is paid on the 20th. Personal income tax will need to be transferred to the budget no later than November 21. In Section 2 this operation will be reflected as follows:

- on line 100 - 10/31/2019;

- on line 110 - November 20, 2019;

- on line 120 - November 21, 2019.

Is it possible to pay personal income tax before salary payment?

All employers are well aware that a delay in transferring personal income tax threatens them with penalties. So, on the basis of Art. 75 and 123 of the Tax Code, untimely payment of tax to the budget threatens the employer with penalties and a fine in the amount of 20% of the amount subject to withholding. But transferring personal income tax in advance is also extremely undesirable.

Income tax, which was transferred by the employer in advance (that is, until it is withheld from the income received by individuals), according to tax authorities, is not personal income tax.

Such clarifications were made by representatives of the Federal Tax Service in an explanatory letter dated 2014 No. BS-4-11/14507. On the Federal Tax Service website, also in support of this position, a decision dated 2016 No. SA-4-9/ [email protected] . The situation was this: the organization transferred personal income tax to the budget before the income was actually paid to employees. When considering this situation, the inspectors considered the tax unpaid, since the tax was not transferred after the actual payment of wages. Based on the results of the audit, the controlling authority assessed additional personal income tax in the amount of 4.5 million rubles. and penalties - 1.9 million rubles.

The employer filed a complaint against the actions of the controllers and indicated that early payment of personal income tax is not prohibited by current legislation. To confirm that he was right, he emphasized that the tax was transferred according to the correct BCC and indicating the correct OKATO.

But the Federal Tax Service did not agree with the arguments and reminded that personal income tax is withheld from the taxpayer’s income upon actual payment (according to paragraph 4 of Article 226 of the Tax Code). Whereas according to paragraph 9 of Art. 226 payment of tax from the funds of tax agents is unacceptable.

In such a situation, the tax agent could return the payment from the budget, since it cannot be offset against the tax.

Reflection of debts

Salaries for June were paid late - on August 20. What are the features when filling out 6-NDFL?

Typically, the day you receive income in the form of salary is the last day of the month. But if it is paid late, this rule does not apply. Therefore, the June salary received in August must also be reflected in August (letter of the Federal Tax Service dated 10/07/2013 No. BS-4-11 / [email protected] ). Section 2 for this operation in 6-NDFL for 9 months looks like this:

- on line 100 - 08/20/2019;

- on line 110 - 08/20/2019 (personal income tax withheld before payment);

- on line 120 - 08/21/2019 (the day following payment is the deadline for tax transfer);

- on line 130 - the amount of wage arrears paid in August (without reduction for deductions);

- on line 140 - the total amount of tax withheld (including applied deductions for June).

How to reflect vacation pay arrears? Employees who went on vacation in April received them only in May.

The date of receipt of income in the form of vacation pay is the date of their actual payment. Vacation pay arrears were repaid in May, say, on the 20th. Then you need to withhold personal income tax. It should be transferred to the budget no later than the last day of the month in which vacation pay was received . That is, no later than May 31. So section 2 would look like this:

- on line 100 - 05/20/2019 (date of actual payment of vacation pay arrears);

- on line 110 - 05/20/2019 (date of tax withholding);

- on line 120 - 05/31/2016 (the deadline for transferring personal income tax from vacation pay is the last day of the month).

Risks of each interpretation

With the “advance” interpretation, it is recommended to withhold the f/l tax from payments made either on the last day of the month or the next after it (i.e., de facto, when transferring an advance for the first half of the next month). But in practice, no one waits for the next payments, and the tax is withheld and transferred from “early” amounts (including for reasons of insurance in case of dismissal of the employee in the future).

With the second interpretation, as indicated above, there are risks of paying tax from one’s own funds.

Some experts also suggest a third option: enter the date of actual salary payment in position 100 (for our example, this is 03/25/2019), while leaving all other positions unchanged:

| Report position | Date/amount |

| 100 | 25.03.2019 |

| 110 | 25.03.2019 |

| 120 | 26.03.2019 |

| 130 | 100 000 |

| 140 | 13 000 |

However, avoiding violation of the tax withholding period, in the situation proposed by the experts, we violate the provisions of Art. 223 of the Tax Code of the Russian Federation for position 100.

In our opinion, the “advance” interpretation is more correct: that is, when information about advance payments and tax withholding in the reporting period is not entered into the calculation, but is transferred to the next calculation.

This conclusion is confirmed by the timing of the release of the “advance” clarification of the Federal Tax Service, which is later than the opposing letter, and also by the fact that the fiscal authorities also do not have an unambiguous position regarding the early transfer of tax.

- On the one hand, there are clarifications that when transferring an “advance” tax on a personal income tax to the budget, such payment is not recognized as a tax, and the duty of the tax agent in this case is not fulfilled (letter of the Ministry of Finance dated September 16, 2014 No. 03-04- 06/46268, Federal Tax Service dated 02/06/2017 No. GD-4-8/ [email protected] , dated 09/29/2014 No. BS [email protected] ).

- On the other hand, the point of view according to which payment of tax before the actual payment of wages does not indicate the presence of tax arrears. Fine for n/a under Art. 123 of the Tax Code of the Russian Federation in this case also does not arise (letter of the Federal Tax Service dated September 29, 2014 No. BS-4-11 / [email protected] ).

IMPORTANT! The latter position is not clear in judicial practice either. In support of the position - Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13; AS MO dated July 28, 2016 in case No. A40-128634/14, etc. The opposite position is the resolution of the AS SZO dated June 19, 2015 in case No. A56-41307/2014.

Gift for a former employee

The employee retired, and after that he was given a valuable gift. Personal income tax cannot be withheld. How to make a calculation correctly?

In this case we are talking about income in kind. The date of actual receipt of such income is considered to be the day the gift is transferred . Let's say it's October 7th. As of this date, personal income tax must be calculated, and it should be withheld from any income in favor of this individual. But since no more payments are expected to be made to him, personal income tax will never be withheld.

In the annual 6-NDFL in section 1 we make the following entries:

- on line 020 - the price of the gift;

- on line 030 - non-taxable amount of 4,000 rubles;

- on line 040 - personal income tax amount;

- on line 080 - the amount from line 040, since the tax was not withheld until the end of the reporting year.

In section 2 , in lines 110 and 120, respectively, you need to reflect the date of tax withholding and the deadline for its transfer. But since it was not withheld, then in these lines you should indicate “00.00.0000” (letter from the Federal Tax Service dated 08/09/2016 GD-3-11 / [email protected] ). Section 2 will look like this:

- on line 100 - 10/07/2019;

- on line 110 - 00.00.0000;

- on line 120 - 00.00.0000;

- on line 130 - the price of the gift;

- on line 140 - 0 rubles.

Before March 1 of the next year, you must submit a 2-NDFL certificate with feature 2 to the Federal Tax Service.

The Ministry of Finance has prohibited withholding personal income tax from December salaries, what should an employer do?

The Ministry of Labor has prepared updates for the professional standard “Accountant”. The Ministry of Labor has published a draft regulatory legal act “On the approval of the professional standard “Accountant”. The document introduces changes to the professional standard for accounting professionals, adds two additional qualification levels for accountants and... »»» tags: accounting, 10/25/17

The Bank of the Russian Federation will be able to inspect the financial statements of companies applying for a large loan. The Federal Tax Service and the Bank of the Russian Federation have entered into an agreement allowing credit institutions, through the tax service, to confirm the accuracy of the financial statements of possible borrowers. The Bank of the Russian Federation will be able to inspect the accounting and tax reporting of companies that wish to receive a loan for...

The Federal Tax Service of the Russian Federation provides the opportunity to submit tax and accounting reports through its own official website. The Federal Tax Service of the Russian Federation is conducting a pilot project to operate software that allows the submission of tax and accounting reports in electronic form through the official website of the Federal Tax Service. »»» tags: accounting reporting, tax reporting, 09.27.17 The newest form of invoice is being introduced. From October 1, 2020, companies must use the newest form of invoice. Let us recall that the line government contract identifier was previously introduced, which entailed entering configurations into the form from July 1, 2020. As for the newest form...

Renting premises from an individual

The company rents premises from a citizen who is not a registered individual entrepreneur. Rent is calculated monthly, and payment is made once a quarter, on the 15th day of the month following its end. For example, for the 1st quarter the payment is transferred on April 15. How to correctly reflect this in the calculation?

Income in the form of rent for personal income tax purposes is considered received on the day the funds are issued or transferred . Therefore, the transaction must be indicated in section 1 of the period in which the actual payment date falls . That is, the rent for the 1st quarter will be reflected in section 1 of the half-year calculation, since it was transferred in April. Accordingly, the payment for the 2nd quarter will fall into section 1 for 9 months and so on. In the same period, this operation is reflected in section 2.

For example, regarding payment for the 1st quarter, in 6-NDFL for the half year you need to indicate :

- on line 100 - 04/15/2019 (on this day the rent was actually transferred);

- on line 110 - 04/15/2019 (personal income tax was withheld on the same day);

- on line 120 - 04/16/2019 (the next day is the deadline for transferring the tax to the budget);

- on line 130 - rent in total for January, February and March;

- on line 140 - the amount of tax on the rent indicated in line 130.

Filling out 6-NDFL if the salary was paid earlier

Form 6-NDFL is presented in two sections. The first shows information about wages paid to staff cumulatively from the beginning of the reporting year. This block reflects the amount of personal income tax withheld for the entire period and indicates the total values of tax deductions that were actually applied to employees’ earnings.

The second section contains the data of the last reporting period of time. It must contain references to the dates of accruals, deductions and transfers. Early salary in 6-NDFL is equivalent to an advance payment. Income from this income is indicated in the month when it became possible to actually withhold tax.

Example

If the salary is paid ahead of schedule, the following information will be reflected in Form 6-NDFL for 9 months in Section 2:

- in the line with code 100, the date of the last day of the billing month is indicated - 07/31/2018 (this indicator does not depend on the day of actual transfer of income, it is tied to the month for which accruals are made);

- line 110 records the date on which the tax was withheld - in the example it is 08/13/2018;

- in line 120 enter the day 08/14/2018 (next to the date of personal income tax withholding);

Answers to common questions

Question No. 1: Salaries are paid on the 25th and 10th. An employee going on vacation on the 9th asks to be paid wages for the days worked before going on vacation. Do I need to pay wages for these days before the start of the vacation?

Answer: The Labor Code of the Russian Federation does not oblige the organization to pay the employee wages for the days worked before the start of the vacation. If the employer pays wages for the days worked before the vacation, before the due date for payment of wages, the employer may be brought to administrative liability under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation for violating the terms of salary payments.

Rate the quality of the article. We want to be better for you:

Early salary in 6-NDFL is reflected without fail. This form must show all accruals in favor of hired personnel. The date of occurrence of actual income can only affect the assignment of payments to a specific reporting interval. The issuance of earnings to employees before the end of the payroll period may occur due to erroneous actions of the accounting department or as a result of deliberate settlement with the staff in advance.