What does registration at the labor exchange give to a job seeker?

For those unemployed who are interested in whether the time spent at the labor exchange is included in their length of service, the Federal Law on Employment is relevant.

It says that the time spent registered at the employment center will not be counted towards the insurance period. At the same time, it is indicated that if a person receives unemployment benefits, then his work experience is not interrupted. Registration gives the right to receive financial assistance from the state in the form of benefits. The amount of payments depends on the average salary at the previous place of work, but the law sets the maximum and minimum benefit thresholds. Labor Exchange inspectors offer the applicant vacancies that correspond to his qualifications.

The concept of work experience can be called generalized, since it is divided into several types:

general;- insurance;

- special;

- continuous.

Each of the above types of length of service has its own calculation procedure established at the legislative level. When applying for pension payments, the insurance period is taken into account, which means the total duration of work or other activity. During this entire period of time, insurance contributions to the pension fund must be made in favor of the citizen.

Important! According to Article 11, Part 1, Clause 4

No. 173-FZ of 2001

the period of time when a citizen was registered with the employment center and received benefits, as well as monetary rewards for performing public works for which he was directed by the employment service, is taken into account when calculating his insurance period.

The length of service includes periods when a citizen receives unemployment benefits.

Registration as an unemployed person with the employment service gives the citizen the right to receive unemployment benefits. The size of this benefit depends on the size of the citizen’s official salary and, in the current year, cannot be less than 1,500 and more than 8,000 rubles per month.

In addition, employees of the employment service will help the citizen find a job, offering various vacancies that correspond to the qualifications of this citizen.

If a citizen’s current qualifications are not enough for employment, this citizen may be sent to improve their qualifications or to learn a new profession. In this case, the training will be carried out at the expense of the employment service, and the citizen will receive a stipend during the training period.

To receive the title of labor veteran, a citizen, among other things, must have been working for quite a long time. The time when a citizen was registered with the employment service as unemployed is not included in the length of service required to obtain this title.

Period and features of receiving cash payments

The time during which a person recognized as unemployed will receive cash payments is determined in Art. 31 of the Law of the Russian Federation “On Employment of the Population of the Russian Federation” dated April 19, 1991 No. 1032-1.

The benefit begins to accrue on the same day the citizen is declared unemployed. The law divides the unemployed into several categories, each with its own payment period:

- For people recognized as unemployed, including those who, within 12 months before registering with the employment service, were dismissed from military service due to conscription due to the expiration of its term, and who were in an employment/service relationship for at least 6.5 months before the dismissal . The period of cash payments cannot be more than 6 months in a cumulative period of 12 months.

- For citizens who have not worked before; want to resume work after a long break; who were fired due to the fact that they violated the internal charter of the organization; who were fired for various reasons within 12 months before being declared unemployed, but who worked at their previous job for less than 6.5 months. Also, for those citizens who were declared unemployed, after which they were sent for training from the Employment Center and expelled for improper behavior (for example, absenteeism), the benefit payment period cannot be more than 3 months in total within 12 months.

- Citizens to whom cash payments were stopped due to the fact that they were deregistered by the employment service due to the fact that during the month they did not appear at the Employment Center unreasonably and without good reason; those who tried to obtain benefits through deception and/or false information; those who refused to cooperate with the employment service using a written statement and who were unemployed after being deregistered. The next time they apply and are recognized as unemployed, they will not be able to receive benefits until 12 months have passed from the date of first registration of the person as unemployed.

As a feature of receiving benefits, one can highlight the procedure for receiving cash payments in the event of job loss due to the fact that the employer’s organization has reduced the number of employees.

In case of staff reduction, the employer is obliged to pay the dismissed employee a benefit in the amount of the average monthly salary during the period of employment of the person in a new job, but not more than for 2 months.

At the request of the Employment Center, this period can be increased to 3 months. To do this, a laid-off citizen should contact the employment service within 2 weeks after dismissal.

If a citizen is not employed within 2 months, the Employment Center has the right to demand that the employer pay for another month of searching, as stated in Art. 178 of the Labor Code of the Russian Federation. Also, paragraph 3 of Art. 31 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1 states that unemployment benefits will be accrued to such a citizen from the first day after the end of the period of payment of funds from the employer.

To ensure that benefit payment is not interrupted ahead of schedule, you must visit the Employment Center on time. Usually this is 1-2 times a month.

Read about the reasons for receiving unemployment benefits and extending the terms of its payment here.

Receipt of unemployment benefits may differ for pregnant women, orphans, pensioners, persons dismissed at their own request and by agreement of the parties, as well as after maternity leave.

Early retirement at the labor exchange due to reduction

An unemployed citizen registered with the employment center can apply for an increase in his work experience for this period of time only if he was employed or engaged in other activities before and (or) after that (Article 11 No. 173 -FZ). Receiving unemployment benefits does not affect the amount of pension payments.

If a citizen was registered with the employment center and received a cash benefit, then this fact will in no way affect the amount of the pension in the future, since contributions to the pension fund are not deducted from such payments.

Thus, the period of time when an unemployed person is registered with the employment center and receives financial assistance is included in the length of service, but is not reflected in the amount of the future pension. In addition, periods of receiving unemployment benefits are not included in the total length of service, which is used when calculating cash payments related to temporary disability, pregnancy and childbirth.

Not only people who were fired from their previous job, but also those who are looking for work for the first time can contact the employment center to look for work (we wrote about the nuances of applying for unemployment benefits after dismissal here). The main condition for receiving cash benefits is the recognition of a citizen as unemployed. Information about who is eligible to receive unemployment benefits is written here.

According to the legislation of the Russian Federation, any unemployed citizen can apply for help to the employment service. You must provide the following package of documents:

- application for recognition as unemployed;

- passport;

- a document confirming your education or other professional skills.

Important! If a person has not previously had a job, then a work book does not need to be provided.

After submitting all the necessary documents, employees of the employment center, no later than 11 days, make a decision to recognize the citizen as unemployed, which gives him the right to receive the appropriate benefits.

If a citizen, after reviewing his documents, does not appear at the service on the appointed day, he will not be registered as unemployed. A complete list of documents that all citizens may need to register and receive benefits can be found in a separate article.

The amount of financial assistance for unemployment depends on several factors:

- whether the citizen was employed before contacting the employment center;

- what was the salary at your last place of work;

- if he was fired, then for what reason;

- for how long has the person been unemployed?

If a person does not have work experience, then after he is declared unemployed, he can count on receiving benefits only in the minimum amount - 850 rubles. The maximum period of time during which unemployment benefits are paid is 24 months out of 36. Our material describes how to calculate unemployment benefits, and in this article we wrote about the timing and procedure for paying such benefits.

If during the first year after payments are calculated, a person is still unemployed, then he is entitled to financial assistance in the amount of the minimum benefit for the next 12 months.

Today, work experience is a generalized concept. For its different types, there are different rules regarding the inclusion/non-inclusion of the time when a person was registered. With regard to pensions, the insurance type is relevant. Article 11 of Article 173 of the Federal Law establishes that when receiving unemployment benefits, this period is counted as years of labor.

In the same article, this thesis is paraphrased as follows: the duration of being registered with the employment center is counted as length of service if the person worked before and after this time. The same procedure for recording time is followed when an unemployed person directly took part in paid public works.

There is a theoretical possibility of retiring earlier. To do this, you must at least register with the employment center. As you know, in Russia the current age is 55 and 60 years for female and male representatives, respectively.

Through the labor exchange you can leave two years earlier, i.e. at 53 and 58 years old. However, representatives of this state organization, which deals with the rights of unemployed citizens, cannot send a person to retire on their own initiative. To do this, you will definitely need the consent of a person of pre-retirement age.

Very often, people of pre-retirement age are fired when staffing is reduced. This basis is acceptable for early retirement. This procedure is also possible if the dismissal occurred due to liquidation. In addition to the type of dismissal, it is important to have appropriate length of service and reach 58 years of age (53 years for women).

Plus, the employment center should not have job offers for a citizen. If employment options are available, then you won’t be able to retire early.

But to the question of whether it is possible to join the labor exchange if you have a long-service pension, the answer is negative. A person receiving an old-age pension cannot be recognized by the state as unemployed.

Similar

If you have questions, consult a lawyer

You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

To get an accurate answer to the question of whether the time of registration on the stock exchange is included in the length of service, you need to carefully study the relevant legal and regulatory acts:

- No. 173-FZ - it lists which time periods can be included in the length of service and which cannot.

- No. 400-FZ - it establishes which time periods are included in a person’s length of service.

This includes not only the period of official labor activity, but also the time when an individual could not work for various reasons. We are talking about standard leave, disability caused by illness, and so on.

For a person who is officially registered on the stock exchange and receives a special allowance, cash contributions to pension insurance are not made. Accordingly, the time spent in unemployed status according to the law cannot be included in the calculation of the standard insurance period.

Despite the fact that the time of registration in the center does not officially affect the length of service and does not affect the calculation of standard pension accruals, this period is included in the usual working hours.

Attention: This method is used in the absence or shortage of official documents, it is auxiliary, with its help only the period of a citizen’s total length of service is proven. The rules for confirming length of service in a documentary manner are divided, in turn, into 2 stages:

- Before registering as an insured person on the basis of the Federal Law on personalized accounting, which came into force in 1996.

- After pension insurance.

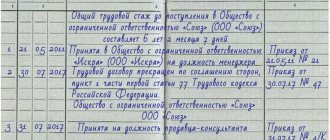

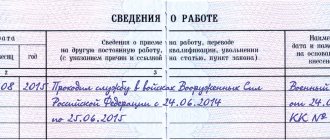

Based on the Federal Law “On Labor Pensions,” the procedure for calculating the length of service earned by citizens during different periods of their working life is regulated. All established facts are confirmed in the form of various documents, which are stored in the prescribed manner at the place of work. What can be evidence? When applying for a pension, a citizen’s length of service is calculated on the basis of the employee’s main document – the work book.

detention of unjustly repressed and then rehabilitated citizens, care for the disabled by decision of social protection authorities, care for elderly relatives over 80 years of age, and others. Each case must be confirmed by official documents. You can find out more detailed information about these changes in legislation and confirmation of work experience when caring for an elderly or disabled relative from this video.

At pre-retirement age, it is quite difficult to find a job even if you are registered with the employment center. Such citizens are interested in in what cases the labor exchange sends pensions earlier. The law provides for such an early opportunity for the unemployed, but only under certain conditions. The main thing is that the person’s dismissal occurs due to layoff or liquidation.

In such cases, both for women and men, the retirement ages are reduced - 53 and 58 years, and the requirements for work experience are as follows - 20 and 25 years. At the same time, the labor exchange should not have relevant proposals, and citizens themselves are required to provide written consent for pension registration.

After dismissal due to reduction, a person at pre-retirement age must register with the employment center within the established time frame. The exchange requirements include the following official documents:

- passport - to identify a person who wants to register;

- certificate of average earnings - to calculate the amount of benefits;

- work book - to calculate the total length of service and to confirm the fact of dismissal with a corresponding entry.

Further, much depends on the specific service. Its employees can offer work, but if one is not found, and the citizen meets the legal conditions, then an official offer of early retirement will be issued. Such a statement is issued by the authority in response to a statement from the person himself about his consent to become a pensioner early.

Before reaching the actual retirement age, a person will be deprived of the right to get a job. If he gets a job, the payments will stop. During these two years, the funds will be continuously paid not by the pension fund, but by the labor exchange at the expense of its budget.

There are no major restrictions on who can be included in the employment center database. Therefore, when leaving a job, a person of pre-retirement age needs to register as early as possible.

Is the labor exchange included in the length of service required to receive a pension?

For both women and men in such cases, the retirement ages are reduced to 53 and 58 years, and the requirements for work experience are as follows: 20 and 25 years. At the same time, the labor exchange should not have relevant proposals, and citizens themselves are required to provide written consent for pension registration.

After the day of dismissal, any person is given exactly two weeks for this procedure. In practice, employees of this service register even those people who have several months left before reaching retirement age. At the same time, these individuals are regularly offered jobs, because the management of the employment service has no desire to make pension payments from their own budget.

What types of experience are there?

Based on the norms of the current legislation of the Russian Federation, it is customary to distinguish the following types of length of service: general length of service, insurance length of service and special work experience.

The total length of service represents the time periods when a citizen worked as an employee or was engaged in other socially useful activities.

An exhaustive list of time periods included in the total length of service is contained in the norms of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation.”

Study and work experience.

The insurance period represents the time periods during which a citizen carried out labor or other activities, during which insurance contributions were transferred to the account of this citizen in the Pension Fund of the Russian Federation.

Special work experience represents time periods during which a citizen worked or served in special conditions, localities or professions for which a labor or state pension is assigned early.

Important! Until recently, continuous work experience was used to calculate benefits in connection with temporary disability, as well as for pregnancy and childbirth. However, at present, these benefits are calculated based on the total length of service, and the concept of “continuous work experience” has actually been abolished.

Now that the types of work experience have become clear, it is necessary to figure out whether the period a citizen is registered with the employment service as an unemployed person is included in the insurance period.

When calculating the insurance period, this period of service is correlated with continuous work experience. Note that if the insurance period is less than the continuous work experience, then the calculation of benefits will be carried out based on the continuous work experience.

What does continuous work experience affect?

Initially, such a concept as continuous work experience was introduced in order to increase the attractiveness of permanent work among citizens. This gave them the opportunity to receive many privileges, bonuses and allowances. For example, the opportunity to get a trip to a sanatorium or retire with a large increase in payments.

Now this scheme continues to operate, however, no longer at the state level, but at the local level. If previously all the benefits that workers with large NTS received were paid for by the state, now the number of such bonuses has decreased significantly. At the same time, many large companies and corporations at the local level are trying to reward employees who work for them for a long time. Bonuses are also provided for citizens working in the healthcare system.

However, in this case, it is not the continuity of the experience itself that plays a big role, but its duration. At the same time, the total length of service includes not only direct work time, but also military service, as well as training in higher educational institutions and industrial practice.

Regarding the amount of the pension, today it is enough to make the necessary monthly contributions to the Pension Fund. The size of payments in the future will depend on their number and size. At the same time, transfers for employees working under an employment contract are made by the company’s accountant in the manner and amount established by law. If a citizen operates as an individual entrepreneur, then he independently determines the amount of contributions and upon retirement, it will be enough for him to present the relevant statements.

In this regard, the question of the need for such a concept as continuous work experience in modern realities has been raised more than once. Indeed, from a practical point of view, it does not have a significant impact. During the discussions, the question was raised about the possibility of using NTS for early retirement or obtaining a preferential loan. However, at this time a final decision has not been made. Although some credit institutions note that they are more likely to issue loans to those citizens who have a long continuous work history, as this increases the chances of repayment of the issued funds.

In fact, at the moment the NTS does not provide significant preferences. For civil servants, long continuous experience is a plus on their resume, and at some enterprises it makes it possible to obtain more convenient annual leave periods for the employee. However, all this is only a minor bonus for workers, which cannot replace the real bonuses that workers with long-term NTS received previously.

Main types of accumulated experience

The standards of modern legislation of the Russian Federation have established the following categories of experience:

- Insurance;

- General labor;

- Labor special.

The total length of service is the periods of work of a person when he carried out the required labor activity as an officially employed employee. The time when he was engaged in activities useful to society is taken into account.

The accumulated insurance experience is life time when a person was engaged in labor or other type of employment. We are talking about employment, during which the statutory contributions to the Pension Fund were calculated for him in the Pension Fund.

Special accumulated experience is a period when a person was officially employed or served in military service in unfavorable geographical regions, in difficult conditions. This also includes professional activities for which a pension is legally assigned much earlier than the usual period.

Previously, when calculating benefits for temporary disability and during maternity leave, continuous work experience was used. Currently, such benefits are calculated solely on the basis of total length of service. At the same time, the concept of continuous accumulated experience, which is familiar to many, is practically not used.

So, is the period of registration of an unemployed person on the stock exchange taken into account as an element of work experience? If we consider the accumulated insurance experience, it directly correlates with the continuous hours worked.

Here you need to remember that if the official insurance period is less than the standard labor period, the accrual of the required benefits will be made on the basis of continuous accumulated years.

In what cases is work experience not interrupted after dismissal?

The law provides for cases in which length of service does not cease to be maintained. The list of such circumstances is as follows:

- When changing jobs within one month;

- When canceling a contract by women who are pregnant or have children under 14 years of age or a disabled child under 16 years of age. The period of service will not be interrupted until the child reaches the specified age;

- For working citizens of the northern regions, breaks from work should not exceed two months;

- When military personnel serve under a fixed-term contract. If the period between dismissal and new employment does not exceed a year;

- Maternity leave, including parental leave;

- Termination of the organization's functioning;

- The period after retirement;

- Upon dismissal in regions with a high percentage of unemployment;

- When returning to office after the removal of an unjustified sentence;

- Carrying out paid public works.

There are situations when, for some reason, you have to leave your place of work. Then the question of breaks in work experience after dismissal becomes most relevant. To obtain as much information as possible on the relevant topic, you should refer to the provisions of labor legislation.

Obtaining labor veteran status through the exchange

In some cases, a citizen who contacts the employment center may qualify for an extension of benefit payments, as well as early retirement.

This applies to the following cases:

If a man whose age is less than 60 years old, or a woman who has not reached 55 years old, and their insurance experience is 25 and 20 years or more, respectively, applies to the employment service, and they also have the necessary experience in the relevant types of work, which gives them the opportunity to enter early retirement.

Subject to the extension, unemployment benefits cannot last more than 24 calendar months within a 36 calendar month period.It is necessary to pay attention to the fact that the insurance period includes not only work activity, but also other activities during which contributions were made to the pension fund.

- If a citizen is unemployed, but has lost his job due to the liquidation of an organization, or due to a reduction in staff, and it is not possible to find a new job, then the employment center can assign the citizen (with his personal consent) a pension, which he will receive until the moment his right to receive an old-age labor pension arises.

Perhaps this is no earlier than 2 years before the onset of this age.

Thus, according to Art. 32 of the Law of the Russian Federation No. 1032-1, an unemployed citizen registered with an employment center has the right to extend unemployment benefits under the following conditions:

- age 53 and 58 years for women and men;

- having a total experience of at least 20 and 25 years.

Such citizens receive benefits for more than 12 months. The period will depend on how long their length of service exceeds the norm required for an old-age pension (age pension).

Important! For each year of overtime work, 2 calendar weeks are added.

To make a decision on increasing the duration of unemployment benefits, the procedure will be as follows:

A citizen applies to the employment center, where he is already registered, to the employee responsible for registering citizens as unemployed, with a request to extend the payment of benefits beyond 12 months on the basis of Art. 32 of the Law of the Russian Federation No. 1032-1.- The unemployed person draws up an application asking for assistance in obtaining information about the existing insurance experience from the pension fund. This information serves as confirmation of the grounds for further calculation of benefits.

- After receiving an extract from the pension fund, an employee of the employment center, based on data about the unemployed and his length of service, calculates the amount of payments and the timing of their extension.

- The decision on further payment of benefits is formalized in the form of an order certified by the director of the employment center.

- After the decision has been made, the unemployed citizen reads the order and confirms his agreement with the amount of the established payments and the deadline with a personal signature.

- All documents drawn up and signed by both parties are attached to the personal file of the unemployed citizen.

Important! An unemployed citizen has the right to appeal a refusal to increase the duration of payment of unemployment benefits for existing reasons to the executive authority of a constituent entity of the Russian Federation or the Federal Service for Labor and Employment.

When contacting the employment center to register and further search for work, as well as receive cash unemployment benefits, it should be taken into account that in most cases this period of time will be included in the length of service, but even the time when the employment center pays benefits does not in any way affect the pension payments in the future.

If you find an error, please highlight a piece of text and press Ctrl Enter.

Unemployed women who have reached 53 years of age and men who have reached 58 years of age have the right to apply for an early pension, provided that the total work experience of these citizens is 20 and 25 years, respectively. In addition, these citizens must express a desire to early retire in writing.

Why do you need continuous work experience?

What length of service should a “Veteran of Labor” have? Read here.

Please note! When first contacting the employment center, a citizen will need to provide the following documentation:

- citizen's identity document,

- certificate of average earnings - necessary for calculating unemployment benefits,

- documentation of education - necessary to determine the qualifications of a citizen,

- work book - necessary to confirm the fact of dismissal of a citizen due to staff reduction, as well as to calculate the total length of service.

After assigning a citizen the status of unemployed and assigning benefits, employment service employees will offer this citizen various vacancies corresponding to the level of education and qualifications of this citizen.

Is the army included in the total length of service?

If for a long time this citizen cannot find a job, then this citizen has the right to submit an application with a request to be sent to early retirement. This application is considered by the employment service, and if a positive decision is made, the citizen is given a referral for early retirement.

With this referral, the citizen goes to the territorial division of the Pension Fund of the Russian Federation and goes through the procedure for registering a pension. After the pension is assigned, the citizen will need to come to the employment service and deregister as unemployed.

Remember! A citizen who has received an early pension does not have the right to officially carry out labor activities before reaching retirement age.

Citizens who have 2 years left before their official retirement can apply for retirement holidays and due payments ahead of schedule. Another important condition is the presence of a total accumulated experience of 20 years for women and 25 years for men.

If a person understands that he meets the listed conditions, he must submit a special written application.

- Obtaining official unemployed status;

- A search for a suitable vacancy is carried out;

- If there is no suitable position, an application for a regular pension is submitted, a maximum of two years before the due date.

What does registering with the Employment Center give to an unemployed person?

Registration with the Employment Center allows people to receive some advantages compared to searching for a job on their own. These benefits include:

- Monthly payment of unemployment benefits. Cash payments that will be made to the unemployed as benefits are calculated in accordance with Art. 30, and 34 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1.

- Helping applicants find a job. The main activity of the Employment Centers is helping people who are temporarily unemployed to find a new job. The employment service selects vacancies that match the experience and qualifications of the applicant and schedules interviews. A citizen may also be offered public works as temporary employment.

- Special job search assistance for job seekers with disabilities. In Art. 24.1 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1 states that disabled people have the full right to contact the employment service for the purpose of selecting a job, while employees are obliged to organize an individual approach for a citizen with a disability, and also select work places equipped with equipment for disabled people. Read about the conditions and procedure for applying for unemployment benefits for disabled people of groups 1, 2 and 3 here.

- Free retraining or advanced training. According to Art.

12 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1, citizens registered with the Employment Center can receive a referral for free training in a new profession, advanced training in their current specialty, or simply undergo retraining. Free training is organized in those specialties that are in great demand in the labor market. If a citizen meets one of the conditions specified in Art. 12 of the same Law - he has the right to receive free vocational training. - The right to early retirement for people of pre-retirement age. Art. 32 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1 states that persons of pre-retirement age (from 58 years of age for women and from 63 years of age for men), subject to the conditions specified in the article, have the right to early retirement pension old age.

- Help when moving to another area. According to Art. 22.1 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1 Employment centers can assist a registered citizen and his family in relocating if a suitable vacancy has been found for the unemployed. Such material support can be provided both with temporary moving to a non-permanent place of work, as well as in the case of moving to a permanent place of residence.

- Help in starting your own business. There are several programs through which a citizen can receive assistance from the Employment Center to develop their business. The amount of the subsidy is determined depending on the region of residence and can amount to more than one hundred thousand rubles. The main conditions for receiving the payment are having a good business plan and registering with the Employment Center for more than 30 days.

Is it possible to join the labor exchange a year before retirement?

Any citizen who has lost his job has the right to contact the employment service and register as unemployed. And citizens whose age is close to retirement are no exception.

A citizen fired due to staff reduction must contact the employment service within two weeks. After completing the necessary procedures, the citizen is assigned the status of unemployed.

Employment service employees regularly offer vacancies to all citizens, including citizens of pre-retirement age who are registered as unemployed. And only if a citizen of pre-retirement age has been unable to find a job for a long time, does this citizen have the right to apply for early retirement.

How to confirm work experience without a work book?

How unemployment benefits affect your pension

In addition, in certain cases, periods when an unemployed citizen was registered with the employment service are included in his work experience.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Show content

The concept of work experience can be called generalized, since it is divided into several types:

- general;

- insurance;

- special;

- continuous.

Each of the above types of length of service has its own calculation procedure established at the legislative level. When applying for pension payments, the insurance period is taken into account, which means the total duration of work or other activity. During this entire period of time, insurance contributions to the pension fund must be made in favor of the citizen.

Important! According to Article 11 Part 1 Clause 4 No. 173-FZ of 2001, the period of time when a citizen was registered with the employment center and received benefits, as well as monetary rewards for performing public works for which he was directed by the employment service, is taken into account when calculating his insurance period.

The length of service includes periods when a citizen receives unemployment benefits.

An unemployed citizen registered with the employment center can apply for an increase in his work experience for this period of time only if he was employed or engaged in other activities before and (or) after that (Article 11 No. 173 -FZ). Receiving unemployment benefits does not affect the amount of pension payments.

If a citizen was registered with the employment center and received a cash benefit, then this fact will in no way affect the amount of the pension in the future, since contributions to the pension fund are not deducted from such payments.

Thus, the period of time when an unemployed person is registered with the employment center and receives financial assistance is included in the length of service, but is not reflected in the amount of the future pension. In addition, periods of receiving unemployment benefits are not included in the total length of service, which is used when calculating cash payments related to temporary disability, pregnancy and childbirth.

Not only people who were fired from their previous job, but also those who are looking for work for the first time can contact the employment center to look for work (we wrote about the nuances of applying for unemployment benefits after dismissal here). The main condition for receiving cash benefits is the recognition of a citizen as unemployed. Information about who is eligible to receive unemployment benefits is written here.

According to the legislation of the Russian Federation, any unemployed citizen can apply for help to the employment service. You must provide the following package of documents:

- application for recognition as unemployed;

- passport;

- a document confirming your education or other professional skills.

Important! If a person has not previously had a job, then a work book does not need to be provided.

After submitting all the necessary documents, employees of the employment center, no later than 11 days, make a decision to recognize the citizen as unemployed, which gives him the right to receive the appropriate benefits.

If a citizen, after reviewing his documents, does not appear at the service on the appointed day, he will not be registered as unemployed. A complete list of documents that all citizens may need to register and receive benefits can be found in a separate article.

The amount of financial assistance for unemployment depends on several factors:

- whether the citizen was employed before contacting the employment center;

- what was the salary at your last place of work;

- if he was fired, then for what reason;

- for how long has the person been unemployed?

If a person does not have work experience, then after he is declared unemployed, he can count on receiving benefits only in the minimum amount - 850 rubles.

The maximum period of time during which unemployment benefits are paid is 24 months out of 36.

Our material describes how to calculate unemployment benefits, and in this article we wrote about the timing and procedure for paying such benefits.

If during the first year after payments are calculated, a person is still unemployed, then he is entitled to financial assistance in the amount of the minimum benefit for the next 12 months.

In some cases, a citizen who contacts the employment center may qualify for an extension of benefit payments, as well as early retirement.

This applies to the following cases:

- If a man whose age is less than 60 years old, or a woman who has not reached 55 years old, and their insurance experience is 25 and 20 years or more, respectively, applies to the employment service, and they also have the necessary experience in the relevant types of work, which gives them the opportunity to enter early retirement.

Subject to the extension, unemployment benefits cannot last more than 24 calendar months within a 36 calendar month period.It is necessary to pay attention to the fact that the insurance period includes not only work activity, but also other activities during which contributions were made to the pension fund.

- If a citizen is unemployed, but has lost his job due to the liquidation of an organization, or due to a reduction in staff, and it is not possible to find a new job, then the employment center can assign the citizen (with his personal consent) a pension, which he will receive until the moment his right to receive an old-age labor pension arises.

Perhaps this is no earlier than 2 years before the onset of this age.

Thus, according to Art. 32 of the Law of the Russian Federation No. 1032-1, an unemployed citizen registered with an employment center has the right to extend unemployment benefits under the following conditions:

- age 53 and 58 years for women and men;

- having a total experience of at least 20 and 25 years.

Such citizens receive benefits for more than 12 months. The period will depend on how long their length of service exceeds the norm required for an old-age pension (age pension).

Important! For each year of overtime work, 2 calendar weeks are added.

More on the topic Valorization of pensions: increase for Soviet experience in 2020

To make a decision on increasing the duration of unemployment benefits, the procedure will be as follows:

- A citizen applies to the employment center, where he is already registered, to the employee responsible for registering citizens as unemployed, with a request to extend the payment of benefits beyond 12 months on the basis of Art. 32 of the Law of the Russian Federation No. 1032-1.

- The unemployed person draws up an application asking for assistance in obtaining information about the existing insurance experience from the pension fund. This information serves as confirmation of the grounds for further calculation of benefits.

- After receiving an extract from the pension fund, an employee of the employment center, based on data about the unemployed and his length of service, calculates the amount of payments and the timing of their extension.

- The decision on further payment of benefits is formalized in the form of an order certified by the director of the employment center.

- After the decision has been made, the unemployed citizen reads the order and confirms his agreement with the amount of the established payments and the deadline with a personal signature.

- All documents drawn up and signed by both parties are attached to the personal file of the unemployed citizen.

Important! An unemployed citizen has the right to appeal a refusal to increase the duration of payment of unemployment benefits for existing reasons to the executive authority of a constituent entity of the Russian Federation or the Federal Service for Labor and Employment.

When contacting the employment center to register and further search for work, as well as receive cash unemployment benefits, it should be taken into account that in most cases this period of time will be included in the length of service, but even the time when the employment center pays benefits does not in any way affect the pension payments in the future.

Lawyers say that many people ask whether time registered at the labor exchange is included in the length of service. Therefore, good news for all of them will be the information that being in the employment center database is included in the length of service.

At the same time, this will not affect the amount of pension payments.

Any citizen who has lost his job has the right to contact the employment service and register as unemployed. And citizens whose age is close to retirement are no exception.

A citizen fired due to staff reduction must contact the employment service within two weeks. After completing the necessary procedures, the citizen is assigned the status of unemployed.

Employment service employees regularly offer vacancies to all citizens, including citizens of pre-retirement age who are registered as unemployed. And only if a citizen of pre-retirement age has been unable to find a job for a long time, does this citizen have the right to apply for early retirement.

How to confirm work experience without a work book?

Citizens who have 2 years left before their official retirement can apply for retirement holidays and due payments ahead of schedule. Another important condition is the presence of a total accumulated experience of 20 years for women and 25 years for men.

If a person understands that he meets the listed conditions, he must submit a special written application.

- Regular civil passport;

- An official certificate of average salary, which is required to calculate the amount of the required benefit;

- Documents about the education received. They are required to determine a person's skill level;

- Labor record, where there is a note that the citizen was fired due to staff reduction.

As soon as a citizen is assigned the official status of unemployed and is assigned the appropriate benefit, the search for a suitable position begins.

If there is no place of employment suitable for education and qualifications, a person may receive an early pension. But only if you have worked for 20-25 years and if there are two years left before retirement.

- Obtaining official unemployed status;

- A search for a suitable vacancy is carried out;

- If there is no suitable position, an application for a regular pension is submitted, a maximum of two years before the due date.

How to confirm your work experience?

The corresponding entry is made in the work book after graduation or after receiving a diploma. The insurance period is the sum of periods of labor or other activity when insurance premiums were accrued and paid to the citizen’s account in the Pension Fund of the Russian Federation, and other periods counted. Special work experience is the sum of periods of work or service in special conditions, localities or professions, taken into account when assigning an early state or labor pension.

Please note: previously, when determining the amount of payments for sick leave, as well as for pregnancy and childbirth, continuous work experience was taken into account. Today, these payments are calculated based on the total length of service, and the concept of “continuous length of service” has been de facto abolished. A break in work experience is only bad because it shortens its total duration.

Warn the future pensioner: if he intends to receive a pension immediately from the day on which this pension is due to him (that is, from the date of birth), then he must submit the appropriate application to the Pension Fund at his place of residence in advance. 4 Explain to your employee that he will have to deal with the registration of his pension independently.

A detailed list of necessary documents for this procedure will be given to him by the Pension Fund. As an employer, you will only perform that part of the work required by law. 5 What are these obligations? 1. Within 3 working days, issue all documents (copies) related to work at this enterprise. This is: a salary certificate, a copy of the work book, certified by the seal of the organization.2.

Experience and time of registration on the exchange

To get an accurate answer to the question of whether the time of registration on the stock exchange is included in the length of service, you need to carefully study the relevant legal and regulatory acts:

- No. 173-FZ - it lists which time periods can be included in the length of service and which cannot.

- No. 400-FZ - it establishes which time periods are included in a person’s length of service.

This includes not only the period of official labor activity, but also the time when an individual could not work for various reasons. We are talking about standard leave, disability caused by illness, and so on.

For a person who is officially registered on the stock exchange and receives a special allowance, cash contributions to pension insurance are not made. Accordingly, the time spent in unemployed status according to the law cannot be included in the calculation of the standard insurance period.

Despite the fact that the time of registration in the center does not officially affect the length of service and does not affect the calculation of standard pension accruals, this period is included in the usual working hours.

How can the amount of payments affect the size of the pension?

An unemployed citizen registered with the employment center can apply for an increase in his work experience for this period of time only if he was employed or engaged in other activities before and (or) after that (Article 11 No. 173 -FZ). Receiving unemployment benefits does not affect the amount of pension payments.

If a citizen was registered with the employment center and received a cash benefit, then this fact will in no way affect the amount of the pension in the future, since contributions to the pension fund are not deducted from such payments.

Thus, the period of time when an unemployed person is registered with the employment center and receives financial assistance is included in the length of service, but is not reflected in the amount of the future pension. In addition, periods of receiving unemployment benefits are not included in the total length of service, which is used when calculating cash payments related to temporary disability, pregnancy and childbirth.