Last modified: March 2020

There are situations when a citizen is hired under an employment contract without a work book. In some cases this is done legally. In others, the employer deliberately evades the obligation to formalize the relationship properly. In this way, it reduces the costs of social and tax contributions.

Often employees agree to unfavorable conditions. As a result, they lose the protection of the law and are deprived of their benefits and payments. The employer, in turn, risks getting into trouble in the event of an unexpected inspection by regulatory authorities.

Legal grounds for working without a work book

As a general rule, a citizen must provide a work record book along with an application for employment. It contains information about the employee’s activities.

The law allows not to keep a document in exceptional cases:

- the citizen gets a part-time job with a second employer;

- the employer is an individual without registration as an individual entrepreneur.

In case of part-time work, the work book is stored in the personnel department at the main place of employment. A record of the second job is entered at the request of the employee. If the employer is a citizen, he does not have the right to draw up this document.

Example 1. E.V. Frolov is employed in. In his free time from his main job, he works in. The citizen signed an agreement with the second employer without presenting a work book. The document is maintained by the personnel department.

Important! It is allowed to hire a citizen who is employed for the first time without a work book. The employer draws up the document immediately after the conclusion of the agreement. Temporary work under a contract without a work book is also allowed if it is lost and an application for reinstatement has been received.

What types of work activities are considered to be the length of service required to receive a pension?

Reading time: 5 minutes(s) Throughout his life, a person works continuously: he studies at university, serves in the army, goes to work. All this is not a waste of time, since for each individual citizen all his work is recorded and tracked by the state. Why is seniority so important? It is based on this information that the state pays pensions and unemployment benefits if a person finds himself in such a situation. In order to understand this situation in more detail, let's study this concept more carefully.

What is work experience?

Work experience is the length of work activity of each person. The regulatory framework is set out in the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ and in the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ.

Concept and legislative framework

The concept of seniority was discussed earlier. Speaking about length of service, it is necessary to refer to such concepts as “labor pension” and “insurance period”. According to Federal Law No. 173, a labor pension is a monthly payment in cash equivalent as compensation for wages and other payments that are currently impossible due to a citizen’s incapacity for work or his retirement.

The insurance period, according to the same law, represents the duration of a person’s entire work activity during which insurance contributions were paid to the Pension Fund.

It is necessary to take into account the right to receive a labor pension.

Insurance and labor pensions are synonymous.

Its functions and application in practice

The functions of seniority include:

- Providing security;

- Regulator of the amount of this security

Receiving a labor pension is only possible if you have worked for a full 15 years. In order to better understand, consider an example of calculating work experience:

For example, Sidorov I.I. got a job on March 5, 2005. Then, he quit of his own free will, as he found a better-paid job and had already agreed to take it on March 7, 2010. In addition, citizen Sidorov performed military service for one year. Let's say today is March 18, 2020. What is the citizen’s work experience at this moment? It is equal to the sum: 5 years and 2 days + 1 year (military service) + 8 years and 11 days (years can also be converted to months). Total, Sidorov I.I.’s work experience equals 14 years and 13 days.

Existing types

There are 3 types of internships:

- Total work experience (total duration of work, regardless of whether the person was fired or not, + other socially useful activities;

when moving to a new place of work, the time that the person worked at the new job is added to the existing length of work); - Special length of service (the total duration of work and other activities useful to society in a certain position, in special working conditions or in a certain area);

- Continuous work experience (duration of work at one enterprise).

What kind of work is included in the work experience?

What we consider to be work experience is not always what it is. Let's talk about general work experience and what it actually includes.

- Firstly, any work is included in the length of service if the employer paid taxes to the Pension Fund of Russia (PFR). Thus, if this condition is met, then both permanent and temporary work count towards seniority.

- Secondly, seniority is not just work. And then what? We list the types of activities that are also considered work experience:

- Military service. This concept includes not only contract service, but also conscript service;

Temporary disability. In cases where the disability is caused by valid reasons, and the citizen receives benefits from the state, this period of time also includes the total length of service;

- Maternity leave.

According to Russian legislation, a woman who gives birth to a child continues to receive work experience, even if she is temporarily not engaged in work. This period ends when the child reaches one and a half years of age. The same situation applies to the second child. However, it should be remembered that such “work experience” has its limitations, equal to three years. In other words, after the birth of the third child (if the woman had previously been on maternity leave for 1.5 years 2 times), maternity leave is not considered work experience; - Public works and work in places of deprivation of liberty (MLS). If a prisoner, while serving his sentence, is engaged in public works, then his total work experience also increases;

- Caring for an elderly or disabled person. There are cases when a person cannot get a job due to the fact that he is caring for a disabled person of the first group. In such cases, the time spent caring for a person is considered work experience. A similar situation is with a person who cares for elderly people if their age is 80 years or above.

Speaking about special work experience, it should be mentioned that not all professions are included there. This applies only to medical workers, military personnel, teachers and others whose work involves heavy physical activity and stress.

Doctors can count on receiving special work experience and receiving a pension ahead of schedule (early term) if they have worked in villages for 25 years, and in the city - 30 years.

Special work experience is also awarded to people who carried out their work activities in difficult working conditions. Such employees include:

- Textile workers, but only if their work is considered difficult;

- Women whose work involved driving vehicles such as tractors or construction machines;

- Men who worked with heavy equipment, in mines and mines;

- Citizens who worked in hazardous conditions, for example, in an environmentally unfavorable area, heavy production, institutions associated with the production of chemicals and places with a high level of radiation.

All of the listed categories of citizens have the right to receive a pension early: women at 50 years old, men at 55 years old.

In addition to all of the above, it is worth mentioning that individual entrepreneurs (individual entrepreneurs) can also accrue work (insurance) length of service. To do this they will need the following documents:

- Document confirming the state registration of individual entrepreneurs;

- Extracts confirming payments of insurance premiums to the Pension Fund;

- A document confirming the termination of the individual entrepreneur's work.

Activities that do not constitute work experience

What kind of activity does not have the right to be called work experience? The first misconception people have is that work experience accumulates while studying. It is not true.

The only exception to this rule is studying at military universities or schools.

Why is studying at a university not considered work experience? Universities do not pay taxes to the Pension Fund, but these payments are the basis for calculating seniority. The same applies to internships from the university in various institutions and organizations.

Confirmation of work experience

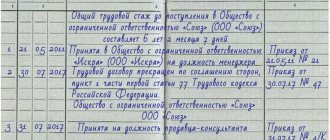

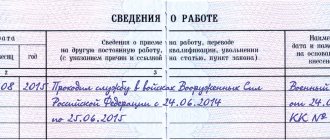

The main document confirming your work experience and its availability in general is the work book.

In cases where such a document is missing or the entries made in it are incorrect or insufficiently complete, the length of service can be confirmed by a certificate, an extract from the order, a written employment contract, a bank statement on receipt of wages and other documents that indicate the period of work . To confirm military service, military IDs, Red Army books, and extracts from military commissariats are taken into account. If you were unable to work for some period of time, then you must confirm this with an extract that is issued at your place of work.

When caring for a disabled person of the first group, a passport of this person and an extract from the hospital are required, which confirms the disability and the period from which it began. Below are photographs of the above documents.

Thus, based on the above information, several conclusions can be drawn:

- To receive a labor pension, your work experience must be 15 full years;

- Not all types of activities are grounds for accruing seniority, but any rule has its exceptions and nuances;

- There are 3 types of work experience, each of which has its own distinctive features;

- The length of service includes not only the total duration of work, but also the time when the person was temporarily disabled;

- The main document confirming the presence of work experience is a work book;

- Some categories of citizens have the right to receive a labor pension early (military, astronauts, doctors);

- An individual entrepreneur can also accumulate work experience if he provides the necessary documents and pays taxes to the Russian Pension Fund on time.

Did this article help you? We would be grateful for your rating:

0 0

How to register a citizen for work without a work book?

Let us consider in detail the features of registering relationships without a work book.

Admission procedure

If an employee takes a part-time job, you will need to fill out a job application. The document is drawn up in free form.

In practice, the following data is entered into it:

- about the employer;

- about the employee;

- request to be hired as a part-time employee;

- date;

- signature.

The application is accompanied by a standard list of documentation, with the exception of the work book.

If a citizen intends to work for an individual without the formation of an individual entrepreneur, there is no need to write an application. It is enough to conclude an agreement.

You should know! A citizen has the right to hire an employee under an employment agreement if the activity is not of a commercial nature. For example, nanny, maid, cook, personal assistant. The parties agree on the terms of cooperation individually.

Signing an employment contract

The contract for part-time work is drawn up taking into account the norms of Chapter 44 of the Labor Code of the Russian Federation.

The agreement must include the following sections:

- subject: position, workplace, period of validity, start date of duties, information about part-time work;

- rights and obligations of participants;

- conditions for payment of wages;

- working hours;

- provisions on rest and leave;

- other conditions;

- details and signatures.

Thus, the document must contain the same rights and guarantees as for main employees.

An agreement between individuals is concluded according to the rules of Article 303 of the Labor Code of the Russian Federation. It includes all mandatory conditions that are essential for both parties.

The employer is obliged:

- draw up an agreement in writing;

- pay obligatory payments;

- issue SNILS to the employee;

- register the agreement with the local government authority.

The document can be signed for either an indefinite or a definite period. Information about the employer is entered on the basis of a passport, tax registration certificate.

The employee provides:

- passport;

- TIN;

- SNILS;

- document confirming education, if required.

For some types of work you need to provide a medical certificate.

Example 2. E.B Ignatieva gets a job with A.L Pavlenko as a child’s nanny. The employer asked to bring a diploma of pedagogical education, a medical certificate with tests for HIV, hepatitis, a report from a narcologist and a psychiatrist, as well as a certificate of no criminal record. After providing the required documents, an agreement was signed between the individuals.

Advantages and disadvantages of hiring without registration

Many citizens prefer informal employment. There are a number of advantages to this, but there are certain disadvantages as this option cannot be considered safe.

For a pensioner

A pensioner who is not registered as a labor pensioner will receive the same pension that was assigned to him; its amount will not be cut off. Such activities often involve a flexible schedule, thanks to which employees have the opportunity to choose a convenient time to complete their duties. Although there will be no notes in the work book, the work contract is used as evidence of the period of time worked.

But there are many more disadvantages to this employment option:

- An employee cannot count on receiving sick leave, vacation, maternity benefits, or compensation in the event of a work injury.

- Experience is not accrued, so it will be difficult to prove that you have experience at your next job.

- There are no bonuses.

- The employer may not fulfill its obligations to contribute to the pension fund and pay for health insurance.

- The pensioner must pay taxes himself from the amount received.

- It is possible to terminate an employment contract at any time, even if it has not yet expired.

- An employer can fire illegally and still not pay wages, and the employee will not be able to complain anywhere.

- The worker can be fined at any time.

We invite you to familiarize yourself with the Commission Agreement - sample, rules of execution, subject and essential conditions

Therefore, before hiring, you should weigh all the pros and cons of this option in order to avoid difficulties in the future.

For the employer

It is convenient for company owners to hire informally, as this:

- Allows you to avoid paying taxes.

- Set a salary less than the amount established by law.

- Do not pay vacation and sick pay to employees.

- Involve subordinates in any work.

- Fire people without explanation or provision of wages.

- Fail to follow safety regulations and create a safe working environment for employees.

But not everything is as good as it seems at first glance. For this the employer:

- Bears tax, criminal and administrative liability.

- Can be punished for lack of transfers to the Social Insurance Fund and the pension fund.

In addition to large fines for hiring without registration, other more serious penalties are possible.

How to confirm your insurance experience?

In practice, the question arises whether the length of service is valid in the case of work under an employment contract drawn up without a work book.

Currently, instead of the concept of length of service, insurance experience is used. According to the Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015, in the absence of a work book, the length of service is confirmed by an employment agreement.

The document will be required if the citizen’s period of activity was not reflected in the pension insurance system. The employer is responsible for paying pension contributions, so information about employment is reflected in the Pension Fund database.

The contract employment contract is included in the length of service

Work carried out under a contract before January 1, 1992 is not included in either the insurance period or the general labor period. Labor activities carried out after this date began to be included in the pension period, but only if specific conditions were met:

- in the general labor contract in the presence of a contract agreement and a certificate of completion of work;

- in the insurance company, if insurance premiums were transferred to the Pension Fund under this agreement.

This point is indicated in Art. Chapter 11 III of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ. It states that the insurance period includes only those periods of work that were carried out in Russia and for which pension insurance contributions were calculated and transferred.

The difference between an employment contract and a civil law agreement

Often, an employment agreement drawn up without a work book is confused with a civil law contract.

It is signed within the framework of the Civil Code of the Russian Federation, and not the Labor Code of the Russian Federation. Let's look at the main differences between the two agreements:

| Employment contract | Civil contract |

| Compiled in accordance with the Labor Code of the Russian Federation | Compiled in accordance with the Civil Code of the Russian Federation |

| The participants are the employee and the employer | The participants are the customer and the contractor |

| Internship in progress | Experience is not calculated |

| Can be concluded for an indefinite period | Concluded for a specific period |

| Salaries must be paid twice a month | Payment terms are agreed upon by the parties |

| An employee performs job duties for a long time without any final result. | The Contractor provides services or performs work within the agreed scope with the final results |

| The employer provides the citizen with working conditions | The citizen arranges his own workplace |

| The employee enjoys guarantees and compensation in accordance with the Labor Code of the Russian Federation | Social guarantees are not provided to the performer |

Important point! If a civil contract has been concluded with an employee, but in fact it is an employment contract, the court has the right to reclassify it.

Example 3. The LLC company concluded with Yu.V. Shiryaev civil contract for waste collection services. The FSS conducted a scheduled inspection. During which he established that, in fact, an employment contract had been concluded with the citizen. The company was fined for failure to pay contributions to the fund. The LLC appealed the FSS decision in court. During the judicial review of the dispute, it was established that, under the terms of the agreement, the employee must perform work in a specific specialty. Labor is long-term. Remuneration is paid at certain intervals. The court concluded that the agreement was concluded within the framework of the Labor Code of the Russian Federation.

Is the length of service covered by a fixed-term employment contract?

Constitution of the Russian Federation to the extent that in the system of current legal regulation the mechanism established by them for social protection of disabled family members of a judge (retired judge) who died due to reasons not related to his official activities, which were his dependents, does not guarantee these persons pension provision in the event of the loss of a breadwinner in an amount comparable to the lost family income in the form of a judge’s salary (the monthly lifelong salary of a retired judge), on conditions determined taking into account his constitutional and legal status and at least no worse than those provided for family members of persons who carried out labor or other socially useful activities and, in connection with this, were subject to compulsory pension insurance, according to the Resolution of the Constitutional Court of the Russian Federation of July 10, 2007.

Pros and cons of working without a work book

Employment under a civil contract without an entry in the work book has its pros and cons.

Benefits for the employee:

- free schedule;

- the ability to work with several customers;

- higher income compared to registration under the Labor Code of the Russian Federation;

- The customer controls only the final result.

However, the disadvantages of such cooperation are the lack of contributions to insurance funds, guaranteed vacation, sick leave payments, and insurance coverage.

It is beneficial for an employer to register a citizen under a civil law agreement, since there is no need to prepare a workplace, monitor compliance with safety regulations, ensure proper working and rest conditions, or pay vacation pay.

We must remember! If a citizen gets a part-time job or with an individual on the basis of an employment agreement, he is not deprived of the right to paid leave and sick leave. The employer also transfers insurance payments for him, so the length of service is not lost.

Is the length of service covered under a contract for paid services?

Independent payments are made only by “self-employed”: individual entrepreneurs, lawyers, notaries working under the patent system, etc. You won’t be able to make payments yourself, you can only control them.

I'm wondering if work under a contract is included in the total length of service?

Olga Semyonovna! There are labor relations and civil law. Only the first ones are included in the work experience. Although many civil law contracts today are sham transactions, and labor relations are hidden under them.

I work in an LLC under a contract, they collect taxes. Is this time included in the length of service?

Hello! It’s not clear what kind of agreement this is? And what kind of experience are we talking about? Most likely about work experience. Please provide more information to resolve your issue.

Is length of service counted when working under a civil contract? All contributions, including to the pension fund, are made.

According to paragraph 7 of the Rules, the insurance period is determined when assigning benefits on the day of the occurrence of the corresponding insured event (temporary disability, maternity leave). In this connection, the first day of the occurrence of an insured event is not taken into account when calculating the insurance period.

Employer's liability

If a company illegally signed an agreement with an employee without a work book, it bears administrative responsibility.

Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for the following punishment:

| Intruder | Fine |

| employee | 1,000-5,000 rub. (or warning) |

| entrepreneur | 1,000-5,000 rub. |

| firm | 30,000-50,000 rub. |

Responsibility for evading the execution of an employment agreement or signing a civil law agreement is as follows:

| Intruder | Fine |

| employee | 10,000-20,000 rub. |

| entrepreneur | 5,000-10,000 rub. |

| firm | 50,000-100,000 rub. |

The employer is obliged to keep a work book and conclude an agreement with the person under the Labor Code of the Russian Federation. In case of violations, the employee has the right to file a complaint with the labor inspectorate or court. These facts are also established during scheduled and unscheduled inspections by regulatory authorities.

In what cases is it possible

An entry in the document is not required when the working relationship is between an individual and an employee. For example, governesses, nannies, and gardeners work according to this principle.

The main thing is that employers use labor for themselves, and not for sale. The employer does not have the status of a legal entity and cannot make entries in the work book, so the parties enter into an agreement.

In this case, the employer undertakes:

- he is obliged to submit a copy of the agreement to local executive bodies;

- taxes are paid to the Pension Fund, and amounts are also transferred to health and social insurance funds;

- if a citizen who does not provide a work book does not have a certificate, registration falls on the employer.

Payment, additional benefits and sick leave are negotiated before signing the agreement. When they come to mutual understanding, the provisions are recorded in the document, and citizens sign.

Features for a pensioner

Article 3 of the Labor Code establishes the ability of citizens to equally exercise the right to work. It is prohibited to limit or provide benefits to a citizen based on age, so pensioners are registered and work on an equal basis with everyone else.

The only exception is the refusal to employ a person over 65 years of age for certain positions (heads of educational institutions, civil servants, etc.).

You can conclude an employment contract with a pensioner for an open-ended period, a document on the provision of services, or a fixed-term contract. Retired citizens have the right to work part-time; a work book is not required.

Evidence of work experience

All evidence is divided into documentary and testimonial. Preference is given to documentary evidence and only if it is impossible to obtain it, witness testimony is taken into account.

The list of written evidence of work experience is in the Regulations on the procedure for confirming work experience for the assignment of pensions in the RSFSR (approved by order of the Ministry of Social Security on October 4, 1991 No. 190). The most important of them is the work book. If it is lost or lacks all records of work, the following will be accepted as evidence:

- Extracts from orders on hiring and dismissal;

- Certificate;

- Financial documents on payroll;

- Employment contracts with a mark of execution;

- Membership card and trade union member card;

- Labor and registration lists;

- Pay books;

- Other written documents confirming the fact and duration of work.

In the absence of written documents, the testimony of at least 2 witnesses who worked together with the citizen at an enterprise or organization can serve as evidence of work experience (clause 2.1 of the above-mentioned Regulations).

Military service

Military service on a professional basis is carried out in accordance with a special document - a contract. In this case, upon entering the service or after its completion, the book is not issued. It will be possible to make a record of military service in the organization in which the citizen will continue to work after service. It is necessary to provide the military ID to the responsible secretary or clerk - the employee will study the information from the military ID, make the necessary entries and confirm their accuracy.

Video on the topic:

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

If an individual carries out operations under a contract, he is interested in information about whether work under a contract is included in the length of service for a pension. This point depends on several factors that need to be considered in more detail.

Reflection of contract agreements in pension reporting (SZV-STAZH)

Labor activity with the conclusion of a contract must be reflected in the pension accounting register SZV-STAZH, provided that insurance contributions for compulsory pension insurance were accrued for it. In this case, in the appropriate columns it is necessary to enter the start and end dates of the work period, as well as special codes for work contracts - “AGREEMENT”, “NEOPLDOG”, “NEOPLAVT”.

In the event that an individual is simultaneously included in the staff (working under an employment contract) and performs operations under a contract, these periods must be reflected in two lines in the SZV-STAZH. There is no need to use any coding for the main activity, and the same codes are used for the contract.

The nuances of dismissal

If an employee understands that he is not satisfied with the workplace, he has the right to terminate the contract or agreement without making an entry in the work book. If the document does not establish notification rules, you can leave on any day.

If the contract specifies its validity period, early termination occurs by agreement of the parties. In this case, the person is obliged to notify the employer several days in advance and write a statement.

Agreements, contracts and additional agreements offer many opportunities for self-realization; in some cases, citizens receive more than working with a work book for a permanent employer.

However, the absence of a record during registration makes a person less protected. The employer is not responsible to the employee and can terminate the relationship at any time.

Responsibility for violations

If the parties do not draw up any agreement and do not make entries in the work book, they are breaking the law, as established in Government Decree No. 225 of 2001.

Some employers try to include clauses of the employment contract into the civil contract. For example, for performing certain services or concluding a document of an author's order. These violations can be identified by the tax service after a complaint received from a citizen.

A person can, through the court, obtain recognition of a civil law contract as an employment contract if the first contains the relevant provisions. Many employers simply change the name of the document in order not to bear the liability defined by the Russian Labor Code.