According to the norms of current legislation, companies and individual entrepreneurs that hire specialists in labor and civil law contracts perform the functions of fiscal agents: they calculate, withhold and transfer to the state budget income tax on payments to employees. Carrying out the above operations involves the formation of appropriate entries in the accounting program of a commercial structure. Let us say right away that a special personal income tax account is not provided for by the current chart of accounts. To reflect it separately, a subaccount is opened to account 68.

Reflection of personal income tax in accounting: examples

To understand the principles of income tax reflection, let's look at practical situations.

- Dt 84 – Kt 75 in the amount of 50 thousand rubles. – accrual of dividends;

- Dt 75 – Kt 68.01 in the amount of 4.5 thousand rubles. (13% of 50 thousand) – income tax withholding;

- Dt 75 – Kt 51 – in the amount of 55.5 thousand (50 – 4.5) – transfer of dividends to Ivanov on a bank card;

- Kt 68.01 – Dt 51 – payment of tax to the state treasury.

Let's calculate the amount of personal income tax on income at a rate of 13%:

The accountant will make an entry for payroll Dt 44 - Kt 70 in the amount of 40 thousand rubles. Then it will withhold personal income tax (Dt 70 - Kt 68.01) in the amount of 5200. To reflect the transfer of tax to the budget, the entry Kt 51 - Dt 68.01 will be used.

If you find an error, please select a piece of text and press Ctrl+Enter.

Taxation of earnings of individuals

As a rule, the main source of income for an individual is payments in accordance with the current employment contract. These, in addition to wages, also include incentive payments, bonuses and other compensation.

As already noted, by making such payments, the employer acquires the status of a tax agent and must fulfill all the obligations assigned to him by tax legislation. Thus, minus all the provided deductions, the amount of income is multiplied by the corresponding rate, the value of which is 13% for residents and 30% for non-residents, except for the cases specified in Art. 227.1 Tax Code of the Russian Federation.

These transactions should be reflected in accounting in the following form:

- accrual of earnings - Dt 44 (20.26) Kt 70 (indicating the employee’s full name);

- tax calculation - Dt 70 (indicating the employee’s full name) Kt 68/NDFL;

- payment of earnings - Dt 70 (indicating the employee’s full name) Kt 51;

- transfer of tax to the budget - Dt 68/NDFL Kt 51.

Personal income tax: postings

Personal income tax accounting is carried out on account 68.01 in the context of analytics: tax, penalties, fines for violation of tax legislation on personal income tax (NDFL).

According to the Tax Code of the Russian Federation, the calculation and withholding of income tax must be carried out by the person who pays the income to the individual, the so-called source of payment.

From the point of view of tax legislation, the source of payment of income to individuals is the tax agent. His responsibility is to transfer personal income tax to the budget from the amount of remuneration paid no later than the day following the transfer of funds to the employee, with the exception of two cases:

- sick leave payment;

- vacation pay payments.

For these cases, the deadline for paying income tax is the last day of the month in which vacation pay or sick leave benefits were paid.

Property tax

Property tax is established by the legislation of the constituent entities of the Russian Federation. It is paid either at the end of the calendar year or quarterly in the form of advance payments (if any) to the local budget.

It is better to consider the tax as part of other expenses. Reflected by wiring:

- Debit 91.2 Credit 68 “Property”

.

The organization must transfer an advance payment for property tax for the second quarter in the amount of 27,545 rubles.

Postings for the transfer of property taxes.

In Russia, wages are considered taxable income. The responsibility for withholding tax and transferring it to the budget rests with the employer.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

How is personal income tax withheld from wages processed in 2020? The employer is required to withhold income tax from employees' salaries.

But not all income of an employee is taxable. In what cases is personal income tax withheld in 2020 and how to correctly display the operation in accounting?

Personal income tax rates

Personal income tax is calculated at a rate of 13%, except for the following cases:

- Income taxed at a rate of 35%:

- winning prizes (in a lottery, promotion, etc.);

- interest on bank deposits;

- interest on bonds of Russian companies;

- savings on loan interest;

- credit consumer and agricultural cooperatives from providing loans.

- Income taxed at a rate of 30%:

- non-residents of the Russian Federation, with the exception of dividends from Russian organizations, earnings of highly qualified specialists, as well as remuneration received by non-residents from certain types of labor activity established by paragraph 3 of Article 224 of the Tax Code of the Russian Federation;

- for securities, with the exception of those listed in clause 5 of Art. 224 Tax Code of the Russian Federation.

- Income taxed at 15%:

- dividends from Russian companies received by non-residents.

- Income taxed at 9%:

- interest on mortgage-backed bonds issued before 01/01/2007;

- founders of trust management of mortgage coverage, under mortgage participation certificates issued before 01/01/2007.

When personal income tax is accrued, a posting occurs on the credit of account 68.01 in correspondence with the accounting accounts for which income is accrued.

Paying taxes - how to reflect them in accounting entries

In such a situation, the organization itself must determine on which accounting accounts the personal income tax amounts will be taken into account, and consolidate the chosen procedure in the accounting policy order. In accounting, operations related to personal income tax calculations are carried out in accordance with the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia on October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions on its application" (hereinafter referred to as the Chart of Accounts). To summarize information about settlements with budgets for taxes and fees paid by an organization, account 68 “Calculations for taxes and fees” is intended.

Insurance LawPermalink

Personal income tax: main correspondence accounts

Depending on the type of remuneration received by the employee, the entries for calculating personal income tax have the following correspondence:

- Dt 70 Kt 68.01 - personal income tax withheld:

- from salary;

- from sick leave;

- from vacation pay;

- from bonuses;

- from business trips in excess of the norm;

- with material benefits from savings on interest.

- Dt 73 Kt 68.01 - income tax accrued:

- with financial assistance over 4000 rubles,

- from gifts over 4000 rubles.

- Dt 75 Kt 68.01 - personal income tax is charged on dividends to the founders.

- Dt 76 Kt 68.01 - income tax on payments under a GPC agreement to persons who are not members of the state.

When personal income tax is withheld, no additional posting occurs, because income tax is withheld at the time of payment of income to an individual. Since income is paid minus accrued tax, this is an operation to withhold income tax by the tax agent. Until income minus income tax is paid, personal income tax is not considered withheld.

Basic moments

When calculating wages, any employer must accrue, withhold and pay to the budget the mandatory tax on the income of an individual, that is, his employee.

According to Russian legislation, payments to hired personnel are made at least twice a month. Personal income tax is withheld only once a month based on monthly calculations.

Namely, personal income tax is not charged on compensation payments, state benefits,.

Personal income tax must be withheld from such payments as:

- wage;

- amounts under writs of execution;

- and (other than those excluded);

- (for business trips within the Russian Federation from 700 rubles, for foreign trips - from 2,500 rubles);

- financial assistance in the amount of more than 4,000 rubles for an employee and in the amount of over 50,000 rubles for the birth of a child;

- dividends;

- payments for material benefits;

- income in kind;

- credit interest.

Where does the payment go?

The employer is obliged to transfer the personal income tax withheld from wages to the budget. For this purpose, special reporting is provided for the agent, in which he must display the amount of taxable income and the amount of calculated taxes ().

Personal income taxes are deducted to replenish the state treasury. Subsequently, the funds are used to finance government programs, including the social security of taxpayers.

The social level in the state largely depends on the completeness of tax payment. The bulk of income taxes goes to the budgets of the constituent entities of the Russian Federation, but a certain share is allocated to local budgets.

The tax agent transfers taxes withheld from employee salaries to the tax authorities at the place of registration. A separate division makes payments at its location.

In this case, income tax is paid in a single payment. Further distribution among budgets is handled by the Federal Treasury.

It should be noted that citizens often confuse the withholding of personal income tax from salaries with pension contributions. It is important to understand that this tax is in no way related to contributions to the Pension Fund.

Legal basis

Accounting for transactions related to personal income tax settlements is carried out in accordance with the Instructions for the Application of the Chart of Accounts adopted.

Information about ongoing calculations of taxes and fees paid by the organization is summarized on account 68.

Analytical accounting is organized on this account, which is maintained by type of tax. When recording personal income tax amounts, a “personal income tax” subaccount is opened in account 68. Payments to staff are displayed on account 70.

Display of accounting entries

The posting made when deducting personal income tax is an integral part of any calculation of employee income. The only exceptions are non-taxable transactions.

Any calculations are an asset/liability, that is, depending on the direction of calculations, accounts can become active or passive.

The peculiarity of the transaction in question is that, depending on what payment is made, the debit account in it changes, the credit account always remains unchanged.

Account 68, used to record settlements, is a complex account to which several subaccounts can be opened. In this case, this is the “NDFL” subaccount.

Tax accrual for payment to the budget is displayed on the credit of account 68, tax payment is carried out on the debit of this account.

Dt60 (76) Kt68. Personal income tax

If personal income tax is withheld from the wages of workers in the main production, the posting will be as follows (the employee works according to):

Dt70 Kt68.NDFL

Primary document

- document's name;

- Date of preparation;

- name of the compiler (organization);

- contents of the business operation;

- the measurement value of a business operation with the display of the units of measurement used;

- the name of the staff positions of the persons who performed and are responsible for the operation and registration;

- signatures of the indicated persons with details for accurate identification.

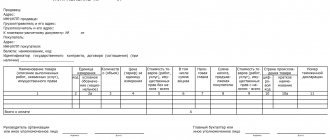

The primary documentation used when calculating wages includes the following forms:

- - a time sheet used to track working time and payroll calculations. Based on this document, salaries are calculated to employees. It is necessary for maintaining accounting of payroll calculations. In addition, the report card acts as an economic justification for labor costs when maintaining tax records. In fact, the document certifies the performance of labor activities by personnel.

- statements for settlements and payments

When using T-49, other statements are not used. When salaries are transferred directly to bank cards, only form T-51 is used.- T-53a - a journal used for registering payrolls. The form is used for registering and accounting for all payrolls for employees.

- personal account forms

Forms are used to display monthly information about salaries, all accruals, deductions, and payments to employees throughout the year.

When paying dividends

Persons who are participants (founders) of an organization and have a share in the authorized capital of the company have the right to receive part of the profit from activities or dividends.

These earnings remain after all taxes have been withheld from the company's total. Each owner receives dividends in proportion to the size of his share.

Dividends from individuals are considered taxable income. When paying, personal income tax must be withheld from them. The tax rate on dividends for residents of the Russian Federation is 13%, for non-residents – 15%.

The accrual of personal income tax is reflected in the postings

Today, the basis for personal income tax is certain types of income. These are basic and additional wages, amounts of sales or leasing, rental payments for movable, immovable property and other material assets that are the property of an individual, work performed and services provided, dividends from participation in capital, income from deposits and other receipts. The main points of personal income tax accounting should be considered separately.

Personal income tax is quite rightly called one of the most specific deductions. Its features are that the basis for calculating tax is the entire income of an individual, and payers as tax agents are legal entities.

The accounting department accountant enters the following entries into the business transactions journal for the calculation of personal income tax for payment to the budget, depending on the specifics of the formation of income amounts:

Get 267 video lessons on 1C for free:

| № | Content | Dt | CT | Primary document |

| 1 | Personal income tax under GPC agreements | 76 | 68 | GPC agreement |

| 2 | Personal income tax on interest on short-term loans from individuals | 66 | 68 | Loan agreement |

| 3 | Personal income tax from salary | 70 | 68 | Tax accounting register |

| 4 | Personal income tax when renting premises from a company employee | 76 | 68 | Lease contract |

| 5 | Personal income tax on financial assistance to an employee | 73 | 68 | Employee statement |

| 6 | Personal income tax on dividends | 75 | 68 | Protocol |

| 7 | Personal income tax on interest on long-term loans from individuals | 67 | 68 | Loan agreement |

Employer-initiated deductions

Occurs in case of damage or loss of property (Debit Credit 73.2), debt on accountable amounts (Debit Credit 71). The employer can also deduct part of the funds from the employee’s salary to repay a previously issued loan (Debit Credit 73.1).

Sometimes an employer may mistakenly pay a larger salary. Then part of the overpayment is withheld from the employee.

Another situation: an employee took full paid leave, but quit before the end of the period for which it was taken. Amounts of vacation pay for those days to which the employee is not entitled are withheld (Debit Credit 73).

The employee has funds withheld from his salary (RUB 000) to repay a loan in the amount of RUB 5,500.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Employee salary accrued | 000 | Payroll statement | ||

| 68 personal income tax | Personal income tax withheld | 3640 | Payroll statement | |

| 73.1 | Loan amount withheld | 5500 | Loan agreement Accounting certificate |

We correctly reflect personal income tax withholding from wages

The main task of an accountant in the accounting department of an enterprise is the correct calculation of earned income, vacation pay, sick leave, night pay, compensation payments, various allowances, financial assistance and the accurate withholding of tax from this income. Regulatory acts provide that taxable total income includes dividends, winnings, prizes, gifts, compensation for travel expenses exceeding the daily expense limit established by the state.

Personal income tax is calculated within the framework of clause 3 of Art. 225 of the Tax Code of the Russian Federation, which defines all types of charges subject to taxation. Tax rates are clarified in the Tax Code, Art. 224.

The calculation is made using a standard formula, where the total tax is multiplied by the tax base by the tax rate:

- Personal income tax = (salary - SV) * tax rate

where ZP is the amount of income received, rub.; SV - standard deductions, rub.

An enterprise, in the role of a tax agent, calculates the amount of tax and, no later than the day following the day of payment of income, transfers it to the budget. The tax calculation will be as follows:

The business journal will contain the main entries:

Deductions initiated by the employee

The employee may request that a certain amount be withheld from his salary each month. These could be amounts to repay a loan from an employer, for charity, voluntary insurance or trade union dues (Debit

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting. Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

Types of possible deductions from an employee’s salary:

Income not subject to withholding

These types are established by Art. 101 of Law No. 229-FZ. The main types of such income:

- Compensation for damage caused to health or in connection with the death of the breadwinner;

- Compensation for injury to an employee and family members if they die;

- Compensation from the budget as a result of disasters (man-made or radiation);

- Alimony;

- Amounts of business travel, moving to a new place of residence;

- Financial assistance in connection with the birth of a child, marriage, etc.;

Deduction order

Deductions from an employee's salary are made in the following sequence:

- personal income tax;

- Writs of execution for alimony for minor children, for compensation for harm to health, death of the breadwinner, crime or moral harm;

- Other writs of execution in the order of receipt (other mandatory deductions);

- Retentions at the initiative of the manager.

Limiting the amount of deductions

The amount of mandatory deductions cannot exceed 50% of the wages due to the employee. In some cases, the amount of deductions may be increased. For example, deductions based on writs of execution. These deductions are subject to a 70% limit:

- On alimony for minor children;

- Compensation for damage caused to health, death of the breadwinner;

- Compensation for criminal damage.

Also, when calculating deductions, you should take into account:

- If the amount of mandatory deductions exceeds the limit (70%), then the amount of deductions is distributed in proportion to the mandatory deductions. No other deductions are made;

- The amount of limitation on deductions initiated by the employer is 20%;

- At the request of the employee, the amount of deductions is not limited.

Example of calculating salary deduction

In the name of employee Vasilkov A.A. 2 writs of execution were received: alimony for the maintenance of 3 minor children - 50% of earnings and compensation for damage to health in the amount of 5,000.00 rubles. The salary amount was 15,000.00 rubles. The personal income tax deduction for 3 children amounted to RUB 5,800.00.

We will calculate deductions based on writs of execution:

- Personal income tax tax base = 15,000.00 – 5,800.00 = 9,200.00 rubles;

- Personal income tax = RUB 1,196.00;

- Amount of earnings for calculating deductions = 15,000.00 – 1,196.00 = 13,804.00 rubles;

- Limit amount = RUB 9,662.80.

Get 267 video lessons on 1C for free:

Deductions in the amount of =11,902.00 rubles, of which:

- For alimony = 6,902.00 rubles. (58% of the total withholding amount);

- Compensation for damage = 5,000, rub. (42% of the total withholding amount).

As a result, deductions are made according to writs of execution in the amount of:

- For alimony – 9,662.80 *0.58 = 5,604.42 rubles;

- Compensation for damage – 9,662.80 *0.42 = 4,058.38 rubles.

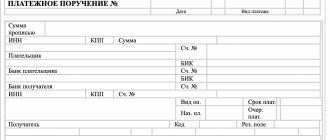

We prepare transactions for the transfer of personal income tax

Nowadays, the state clearly sets deadlines and methods for introducing accrued amounts into the budget. It is mandatory to transfer the entire amount of accrued tax to the budget settlement account on the day of payment of wages or no later than the next day after the payment of wages or other income to an individual. The wiring looks like this:

- Dt 68 Kt 51. The documentary basis is the payment order and bank statements.

- Dt 68 Kt 50. Cash order, cash book, bank receipt.

In this case, the tax payment process can be combined. The transfer is made in non-cash form from a current account, or in some situations, money can be deposited into a budget account in cash through the bank's cash desk.

Sample tax payment order:

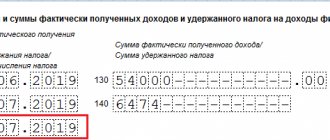

In 2020, a new form of personal income tax report 6 was introduced, which provides a summary of data on a legal entity. The company reports on this form in terms of the total amount of money paid to employees, the total tax deduction, the rate and personal income tax paid from the income of the company's employees.

To record calculations for personal income tax, account 68 “Calculations for taxes and fees” is used. This is a complex account that has a number of sub-accounts. To account for personal income tax, a “NDFL” subaccount is opened in accounting account 68.

Credit 68 of the account reflects the accrual of tax for payment to the budget, and the debit indicates its payment.

Depending on the type of income received by the employee, credit 68 of account corresponds with the debit of the corresponding accounts for accounting for settlements with personnel.

Calculation of personal income tax from wages:

A 13% rate applies to wages. For each child, Petrov is entitled to a standard deduction in the amount of 1400. Read about tax deductions and rates here.

Tax = (20000 – 1400 – 1400) * 13% / 100% = 2236

Postings for accounting for personal income tax from salary:

D44 K70 – wages accrued for November (20000)

D70 K68.NDFL – personal income tax withheld from wages (2236)

D70 K50 – wages paid (20000 – 2236 = 17764)

D68.NDFL K51 – personal income tax transferred to the budget (2236)

Calculation of personal income tax on dividends:

The founder Petrov received income in the form of dividends in the amount of 30,000.

Dividend income is taxed at a rate of 9%, no deductions are applied to this rate.

Postings for accounting for personal income tax on dividends:

D84 K75 – dividends accrued (30,000)

D75 K68.NDFL – dividend tax withheld (2700)

D75 K50 – dividends paid (27300)

D68.NDFL K51 – NDFL transferred to the budget (2700)

Calculation of personal income tax on income received from a short-term loan:

Tax = 5000 * 13% / 100% = 650.

D50 K66 – short-term loan received from Petrov (100,000)

D91 K66 – interest accrued on the loan (5000)

D66 K68.NDFL - tax withheld from interest received by Petrov on the loan (650)

D68.NDFL K51 – transfer of tax to the budget.

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

Features of tax calculation

The main types of income for which personal income tax must be withheld are all kinds of accruals under an employment and civil service agreement. This list includes not only direct wages, but also bonuses, allowances, and some compensation received. Special formulas are used to calculate payments.

However, personal income tax postings are made in the following situations:

- when calculating salaries;

- when deducting tax;

- when issuing wages;

- after transferring the personal income tax amount to the budget.

If an organization has employees who are periodically sent on business trips, they are entitled to appropriate travel allowances, which are also taxed (subject to the legal limit).

So, after deduction of personal income tax, the posting is completed in accordance with the appropriate procedure.

In the situation with travel expenses, several types of postings are provided:

- when issuing an advance to an employee for travel expenses;

- when calculating expenses;

- if personal income tax is assessed on amounts for business trips that exceed the norm;

- After the personal income tax is transferred to the budget, the posting is also done.

If you purchase any services from an individual, you may also need to make tax payments. In this case, the organization must deduct the appropriate amount and provide the seller with funds, taking into account the payment of personal income tax. In such a situation, wiring is also done:

- when the product or service was purchased from an individual;

- posting when withholding personal income tax;

- when transferring personal income tax to the budget;

- when transferring the amount for services or goods to the seller.

When personal income tax has been assessed on the amount, the posting of its deduction and transfer to the treasury is mandatory. After all, entities that transfer income to individuals, as a general rule, simultaneously become tax agents. Accordingly, their responsibilities include withholding and remitting tax payments.

Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

You will find the current form and the procedure for filling it out in the article “Unified form No. T-54a (personal account (SVT)).”

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

Trading operations with individuals

When carrying out financial and economic relations with individuals, an organization must remember that it also acts as a tax agent and must calculate and withhold the amount of personal income tax and only then transfer the remaining amount of income to this individual.

These transactions are reflected in accounting as follows:

- purchase of goods - Dt 08 (10, 20, 26, 44) Kt 76 (indicating the full name of the individual);

- tax calculation - Dt 76 (60) Kt 68/NDFL;

- tax transfer - Dt 68/NDFL Kt 51;

- payment of remuneration to an individual - Dt 76 (60) Kt 51.

It should be noted that analytical records must be kept for each individual with whom trading transactions are carried out. In addition, trade transactions must be checked for possible tax exemption (Article 217 of the Tax Code of the Russian Federation).