Accounting

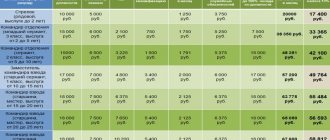

Which bonuses are not subject to taxes? Employers are required to charge income tax on an employee’s bonus and

What is a discount to the tariff Insurance premiums “for injuries” are transferred by organizations and individual entrepreneurs,

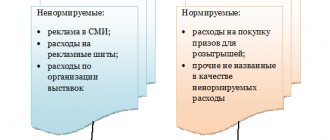

Concept and types of advertising expenses The main task of advertising is to attract and maintain the attention of potential

There are often cases when a company's fixed assets require modification, completion or technical repurposing. It happens,

Aries horoscope from May 25 to May 31, 2020 For those born under

Military personnel who have entered into a contract with paramilitary government agencies and serve in the ranks of the Russian Armed Forces,

Regional coefficient, northern bonus and minimum wage. In this case, the calculation of the average salary is carried out in accordance with

Every entrepreneur, director, and chief accountant is familiar with the feeling of slight anxiety when receiving demands from tax authorities.

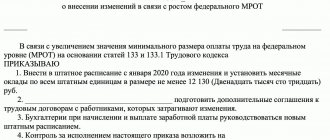

When it is necessary to recalculate wages In accordance with Article 22 of the Labor Code of the Russian Federation, the employer is obliged to pay

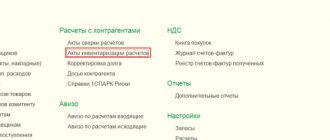

Inventory of accounts in 1C 8.3, if they talk about it within the framework of accounting, implies a control