Regional coefficient, northern bonus and minimum wage

In this case, the calculation of the average salary is carried out in accordance with Article 139 of the Labor Code of the Russian Federation, which states that all accruals for the year are taken into account, except for financial assistance, which implies the summation of salary, allowances, and the accrued coefficient.

That is, in fact, when calculating the average wage, the coefficient is already taken into account initially, and for the entire past year, that is why the regional coefficient is not applied when calculating days of incapacity. Also in Art. 22 of the Labor Code of the Russian Federation states that the company’s management is obliged to provide wages equal to the labor costs of employees, and for the duration of a full shift and within the scope of duties approved by the same job description and mutual cooperation agreement. And since the scale according to which the physical costs of workers are determined has not been developed, and due to the fact that many employers deliberately underestimate the level of wages, a minimum wage has been approved at the legislative level, which, in essence, acts as a guarantor of minimum material security in regarding ordinary workers.

How is additional payment made to the minimum wage level?

In order to find out whether an additional payment needs to be made, you must first determine the employee’s average daily earnings. Everything is identical with the calculation of vacation pay. After this, the resulting figure is compared with the average daily minimum wage. If the first indicator is less, then an additional payment is required.

In order to correctly calculate the average daily earnings, you should focus on Resolution No. 922. In accordance with it, all wages received during the year are taken. It is divided by 12 (the number of months). The resulting value must be divided by 29.3 (the average number of days per year). This formula is recommended by labor legislation. It takes into account that during the year the employee had 14 holiday days off. That is why the figure is taken at 29.3. The same figure is taken to calculate the average daily salary for a particular month.

If the calculations show a result that is below the minimum wage, then an additional payment must be made. In order to justify additional costs, you can issue an accounting certificate.

Leave for work in the Far North and equivalent areas

According to Art. 321 of the Labor Code of the Russian Federation, citizens working in the Far North and equivalent areas are granted additional leave. It is provided in addition to the annual basic paid leave.

The duration of additional leave is: 24 calendar days for persons working in the Far North, and 16 calendar days for equivalent areas. This procedure applies not only to full-time employees, but also to part-time workers. This also applies to employees working on a rotational basis (Article 302 of the Labor Code of the Russian Federation).

Northern coefficient, regional bonuses and increasing the minimum wage

If an employee’s salary is set at 7,500 rubles (no bonuses are accrued, there are no additional coefficients), after tax is withheld, he will receive 6,525 rubles (7,500 - 13%). In this case, the employer will not violate the law unless a regional agreement provides for a higher minimum wage.

Therefore, for example, if an employee is registered with a company registered and located in the Far North region, but at the same time periodically travels to field work in other regions, when calculating the salary of such an employee, the regional coefficient of the region where he actually worked at that time must be applied. or another period.

What is the minimum wage in the Far North?

In connection with the increase in the minimum wage in 2020, how should the wages of employees of the Far North state institution (kindergarten) be calculated? The accounting department says that the salary was not increased to the level of the minimum wage, but they are making additional payments to the level.

We recommend reading: Application form to the tax office for pensioners

What they say in accounting is true, because... The minimum wage is the minimum wage; accordingly, the salary should not be lower than the minimum (that is, salary + allowances, bonuses), and how it is calculated in your case, you need to study internal documents. What size of the minimum wage in the Far North region can be seen in the table at the link https://buhguru.com/spravka-in.

How to arrange a salary increase to the new minimum wage: two ways

- increase salary;

- establish a surcharge.

It is worth saying that this method is used by many employers every time after a change in the minimum wage. However, it has obvious disadvantages. Every time the minimum wage changes, it is necessary to issue not only an order to increase wages, but also change employment contracts, staffing schedules and other documents that mention the size of salaries.

To do this, it will be necessary to issue an order to increase wages to the minimum wage starting in 2020. A template for such an order might look like this:

- ORDER ON CHANGES IN THE STAFF SCHEDULE IN CONNECTION WITH INCREASING THE MINIMUM WAGE DOWNLOAD A SAMPLE ORDER ON CHANGES IN THE STAFF SCHEDULE IN CONNECTION WITH INCREASING THE MINIMUM WAGE

It is much more convenient for employers to permanently fix a special additional payment in an internal local act, for example, in a separate order or regulation on wages. After all, it is not the salary that is compared with the minimum wage, but the total salary. That is, salary plus bonuses and other payments.

With this option, there will no longer be a need to change employment contracts and other local acts every time the minimum wage changes. It is enough to establish a compensatory additional payment up to the minimum wage, for example, in the regulations on remuneration. Then you won’t have to issue orders for each case when an additional payment is prescribed.

This is important to know: Application for non-vacation leave: sample 2020

Here is an example of wording that can be included, for example, in the Remuneration Regulations:

6. Indexation of wages to the minimum wage

6.1. The salary of employees of Stella LLC is indexed in connection with the increase in the officially established minimum wage (minimum wage).

6.2. With each change in the minimum wage, Stella LLC increases the salaries of employees to the minimum wage established by law.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

6.3. Salary, taking into account indexation, is paid to employees of Stella LLC starting from the date when the new minimum wage came into force.

Is it necessary to compare vacation pay and minimum wage?

/ 31 days x 28 days – 166.94 rubles/day. x 28 days = 26.97 rub. Average earnings and regional minimum wage A number of constituent entities of the Russian Federation have established their own regional minimum wage, which cannot be less than the federal one. 133.1 Labor Code of the Russian Federation. Does this mean that in this case you don’t have to bother with additional payments to the federal minimum wage? If you paid your employees a salary not lower than the regional minimum wage, which before January 1, 2013 was not lower than the new federal minimum wage, then you will not have to pay your employees anything extra.

Payment for an employee's vacation is made based on the actual accrued wages and the time actually worked by him for the 12 calendar months preceding the month the vacation began (Part 3 of Article 139 of the Labor Code of the Russian Federation). Article 133 of the Labor Code of the Russian Federation enshrines guarantees for establishing a minimum wage. So, in part 3 of Art. 133 of the Labor Code of the Russian Federation stipulates that the monthly salary of an employee who has fully worked the standard working hours cannot be less than the minimum wage. The procedure for calculating average earnings (including for determining the amount of vacation pay) is regulated by the Regulations on the specifics of the procedure for calculating average wages, approved. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as the Regulations).

Features of calculating vacation pay

To calculate the amount of vacation payments, you first need to calculate the average amount of income received for one day of work. This is done by adding up all income received and further dividing it by the number of days in the billing period.

In the process of determining average daily earnings, the following types of income are taken into account:

- labor benefits;

- bonuses;

- commission payments;

- other income received directly from the employing organization;

- temporary disability benefits, etc.

When using the formula

With a fully worked out standard billing period - a calendar year, the benefit amount is calculated using a fairly simple formula:

Length of vacation in days * Average daily income of the employee

The average value of income received for one day is determined by the following formula:

Amount of income received during the billing period / (29.3 * 12)

If the billing period includes an incompletely worked month, the formula changes slightly:

Amount of income for the billing period / (29.3 * Number of fully worked months * Number of days worked in the last month)

As a result, the final formula for calculating the amount of the benefit due is as follows:

Amount of income for the billing period / (29.3 * Months worked + (29.3 / Number of calendar days in a month not fully worked * Number of holidays and weekends in it)

Is it possible via the Internet (online)

It is not at all necessary to manually calculate the amount of vacation remuneration due.

This can be done automatically without any problems using a special Internet calculator. The program is able to calculate the amount of benefits based on the data entered by the user.

The algorithm for its use is as follows:

- indicate the periods of vacation taken out and its type;

- enter the dates of the billing period;

- indicate the presence or absence of features, namely the excluded periods and the fact of an increase in wages during its validity;

Photo: calculating vacation pay online (step 1)

- Next, you will need to fill out information about the amount of income received for each month in the billing period;

Photo: calculating vacation pay online (step 2)

- As a result, the calculator will calculate the amount of the benefit.

Examples of calculating the billing period

It is worth considering every possible option for calculating the amount of vacation payments depending on the citizen’s working conditions.

Photo: minimum wage size

Taking into account the minimum wage or SK

If the calculated benefit amount is less than the established minimum wage, then the employer is obliged to additionally pay an increase to the required value.

Example:

| Minimum wage for 2020 | 11 thousand 163 rubles |

| Salary for the year | 120 thousand rubles |

| Term | 15 days |

Accordingly, the amount of vacation pay will be:

(120,000 / (29.3 * 12) * 15 = 5 thousand 119 rubles

Minimum minimum wage:

11,163 / 29.3 * 15 = 5 thousand 714 rubles

So, since the calculated value is less than the minimum mark calculated according to the minimum wage, the employer will have to pay extra up to it.

The situation is similar with northern coefficients - if a vacation is taken out by a citizen working in the regions of the Far North or in regions equal in status to them, then the employer additionally indexes payments according to the established values of the insurance system.

Completely worked out

An example of calculation for fully worked periods is presented below:

| Billing period | One calendar year |

| The amount of income received during this time | Five hundred thousand rubles |

| Vacation booking | 20 days |

Accordingly, the benefit amount will be:

20 * (500,000 / (29.3 * 12) = 28 thousand 441 rubles

Including bonuses

Accounting for bonuses when calculating the amount of the described payments occurs as follows:

one bonus paid on one basis per month is added to the amount of total income for the billing period

For example:

| Annual income | 500 thousand rubles |

| Overtime bonus paid 12 times per year | 120 thousand rubles |

| Holiday bonus paid 6 times in six months | 30 thousand rubles |

| Term | 20 days |

Accordingly, the benefit amount will be:

(500,000 + 120,000 + 30,000) / (29.3 * 12) * 20 = 36 thousand 973 rubles

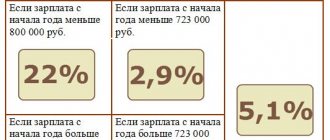

Minimum wages in the Far North

Thus, when establishing a remuneration system in organizations located in areas with special climatic conditions, unfavorable factors associated with work in these conditions, in accordance with Articles 315, 316 and 317 of the Labor Code of the Russian Federation, must be compensated by special coefficients and an allowance for wages.

At the same time, when establishing a remuneration system, each employer must equally comply with the provisions of part three of Article 133 of the Labor Code of the Russian Federation, which guarantees to an employee who has fully worked the standard working hours for the month and fulfilled the labor standards (labor duties), a salary not lower than the minimum wage, as well as the provisions of Articles 2, 132, 135, 146, 148, 315, 316 and 317 of the Labor Code of the Russian Federation, including the rule on increased wages for work performed in the Far North and equivalent areas compared to payment for identical work performed in normal climatic conditions (Definitions of the Constitutional Court of the Russian Federation dated December 17, 2009 N 1557-О-О and dated February 25, 2010 N 162-О-О).

How to pay extra for minimum wage in the far north

Calculate the advance payment and salary taking into account all current indicators. Remuneration for labor in the regions of the Far North and equivalent areas is carried out using regional coefficients and percentage increases in wages. In this case, the coefficient and bonus must be calculated in excess of the salary brought up to the minimum wage (also see “”). However, in some cases, the monthly salary may be lower than the minimum wage.

Basic salary (basic official salary), basic salary rate - minimum salary (official salary), salary rate of an employee of a state or municipal institution carrying out professional activities in the profession of a worker or position of an employee included in the corresponding professional qualification group, excluding compensation, incentives and social payments.

Registration of additional payment

How exactly to make the additional payment is decided by the head of the company. He has 2 options:

- The surcharge is added to a bonus, financial assistance or other payment , the amount of which varies. There is no need to prepare any additional documents.

- The payment is made by a separate order of the director.

The order can be drawn up in free form, but it must include the following information:

- Company name;

- title of the document and date of its preparation;

- Full name, passport details of the employee, information about the profession, position;

- the amount of additional payment up to the minimum wage and the date of its payment;

- reasons for which additional payment is made (usually this is Article 133 of the Labor Code of the Russian Federation);

- Full name and position of the responsible employee;

- Signature stamp.

Vacation in the Far North - what is the duration

In this case, the location of the employer for whom the person works does not matter. His office may even be located in the south of the Russian Federation, but additional leave will need to be paid for an employee working in the North. In turn, if an employee works in the south, and the employer is located, for example, in Chukotka, he does not have to fulfill the obligation to provide leave.

We recommend reading: How Divorce Happens

A special situation is in the field of education. For teachers of schools and universities, the bulk of vacation is provided in the summer. In practice, this means that teachers, as a rule, use both types of leave, main and northern, at the same time.

Is the regional coefficient included in the minimum wage?

Wage supplements are awarded for the duration of work in the Far North (experience). This is how the regional coefficient is taken into account when determining the minimum wage. It is incorrect to state that the regional coefficient is included in the minimum wage. If an accountant includes a regional coefficient in the minimum wage, he is acting incorrectly, violating the rights of an employee working in unfavorable conditions. It is necessary to calculate the regional coefficient for the minimum wage, but not include it in the indicator itself. Otherwise, it turns out that workers in the Far North are no different in wages from other citizens working in normal climatic conditions. There is also no need to increase the regional coefficient for the minimum wage, since the accountant must act within the law.

Is there a regional coefficient for the minimum wage? Article 129 of the Labor Code of the Russian Federation establishes that the salary of an enterprise employee for work depends on the level of complexity of his work, quantity, and quality. The salary includes compensation payments: allowances and additional payments. Is the regional coefficient calculated for the minimum wage? To understand this, it is necessary to understand the concept of “regional coefficient”. This is an indicator that is used to determine the amount of wages based on work in difficult climatic conditions. Article 148 of the Labor Code of the Russian Federation states that work is paid in a special manner for citizens who work in regions with an unfavorable climate. This order means increased earnings. If an employer, for example, is located in the Far North and has divisions and branches there, he must pay wages taking into account the regional coefficient. His obligation is enshrined in Article 316 of the Labor Code of the Russian Federation.

How vacation pay is calculated in the north when the minimum wage increases

Calculation of vacation pay for a worker is carried out on the basis of his actually accrued salary and the time he worked for the 12 calendar months preceding the month in which the vacation began (paragraph 3 of Article 139 of the Labor Code of the Russian Federation).

Then, if the federal minimum wage is less than the regional one, then in fact the employee will receive less wages. The minimum wage determines the total amount of money received. That is, his basic labor remuneration may be less if he regularly receives various bonuses and allowances

Additional payment of vacation pay up to the minimum wage

» Employees working under an employment contract have the right to take rest once a year for 28 days.

It appears after reaching the work experience mark of 6 months. The law obliges employers to pay vacation pay at the minimum wage. That is, an employee who goes on full leave is guaranteed to receive funds in the amount of the minimum wage. The amount of monetary remuneration when going on vacation is calculated based on.

If there was an increase in earnings during the billing period, the payment should be changed to take this into account. Vacation pay is subject to indexation when salary increases:

- interest charges on the salary (with the exception of additional payments regulated by the lease agreement).

- tariff rates;

- basic labor remuneration;

We recommend reading: The difference from fraud and misappropriation and embezzlement

Vacation pay is indexed through a special indicator - an increasing coefficient. In the process of accrual

How to calculate vacation pay when the minimum wage increases in 2020

- Calculate the average daily earnings for calculating vacation pay, as required by PP 922 for all employees.

- Determine the amount of average monthly earnings.

- Compare the resulting value with the current minimum wage.

- If your average monthly earnings are below the minimum wage, make an additional payment.

In January 2020, when the employee is on vacation, he must receive at least 11,280 rubles for a full month. If he received the minimum wage throughout 2020, of course the vacation pay will be lower. In this case, the accountant must check the fact that vacation pay does not meet the established minimum and make an additional payment up to the minimum wage for vacation pay in 2020.

How to calculate the amount of surcharge?

There is a special formula for this. It is necessary to take the minimum wage for the vacation period and divide it by the number of days in a month during which the employee will rest. The value is multiplied by the duration of the vacation. The amount of vacation pay is deducted from it.

Additional payment can be made to external part-time workers. It is carried out on a general basis. The concept of “external part-time work” means working in two companies at once. One job may be permanent. The second usually takes significantly less time.

This is important to know: Application for a day on account of vacation: sample 2020

It doesn't really matter. It is important here under what conditions the employee works. If he is employed at 0.5 rate, then he can count on at least 50% of the established minimum wage on vacation. The amount of vacation pay does not reach this level? Then the employer from the second place must make an additional payment so as not to violate the law.

Here you should take into account the number of days actually worked. For example, a subject worked 11 days a month (with a maximum of 22). Then the amount of the surcharge will be significantly less.