Home / Labor Law / Payment and Benefits / Pension

Back

Published: 05/28/2020

Reading time: 11 min

0

15685

A number of regions of Russia are characterized by difficult climatic and other conditions associated with increased health hazards, as well as a high cost of living due to natural reasons. For this reason, various measures to support the population are applied at the local and regional level, aimed at equalizing income and maintaining material equality.

One of these tools is the use of regional coefficients, which are established at the level of the Government of the Russian Federation.

- Concept and determining factors

- What payments are subject to the regional coefficient?

- Regional coefficients in the Russian Federation in 2020

- How is the district coefficient used in calculations?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

The procedure for calculating and paying northern bonuses and coefficients

Order of the Ministry of Labor No. 2 of December 30, 1990 answers the question of how regional coefficients and northern allowances are calculated.

Northern surcharge

The northern surcharge is aimed at attracting workers to the north. This is the percentage by which the basic salary increases. It depends on length of service, industry, age and time of residence (work) in the north.

The entire territory of the north is divided into 4 zones, where premiums from 30 to 100% apply. The employee receives a 10% bonus 6 (12) months after concluding his first northern TD (employment contract). Breaks in work or departures to other regions are not taken into account in the length of service, but the sum of all periods of work at the CS is taken.

Organizations of all forms of ownership registered in this territory must pay a northern surcharge. Therefore, the question “is it possible not to pay the northern surcharge” does not arise. The Labor Inspectorate, as well as regional authorities, are strictly monitoring this issue.

Northern bonuses are paid simultaneously with salaries.

Regional coefficient

The regional coefficient increases:

- wages;

- length of service;

- compensation for harmful and dangerous working conditions;

- “13 salary”;

- payments under fixed-term contracts (including seasonal ones), part-time workers;

- sick leave;

- payment to part-time workers;

- Minimum wage;

- pensions.

The regional coefficient helps to equalize the standard of living of residents of the region in comparison with the Russian average.

The regional coefficient is not calculated for:

- vacation pay;

- business trips to the mainland;

- financial assistance;

- northern allowances;

- bonus incentives not specified in the TD.

The Northern pension increases by a factor only if you live in a specific region. After departure, payment stops.

Types of cash payments that require the calculation of a regional coefficient and a percentage increase

Every employer dealing with employees working in extremely harsh climatic conditions automatically has a question: for what types of payments should a regional coefficient and a percentage bonus be calculated? The use of the coefficient is necessary in the following cases:

- The employee’s basic salary corresponds to the position held, the amount of which is fixed in the employment contract.

- Various monetary compensations intended for individuals by the employer as a reward for certain merits.

- Cash provided for employees working overtime.

- Motivational cash payments.

- Additional payments.

This category includes all material incentives that act as a kind of compensation for employees working in hazardous or unhealthy working conditions, performing work that requires high qualifications, and also performing particularly complex duties.

Such benefits are provided in addition to the basic salary.

This group of payments includes all material compensation that an individual receives for non-planned performance of his work duties.

This may be compensation for all kinds of delays in working hours that are not provided for in the employment contract and, accordingly, last longer than the established standard working hours. This also applies to certain monetary incentives for additional trips to work on weekends and holidays .

Incentives of a motivating nature are funds provided and subsequently paid by the employer to just a few employees who perform their duties best.

Motivational payments are introduced with the aim of improving labor productivity and creating healthy competition in the team. These are bonuses, rewards, various raises and salary increases.

We draw attention to the fact that the coefficient and bonus, in addition to the above payments, in some cases must also be calculated for some payments established by the remuneration procedure that operates within a particular enterprise.

Information about northern allowances

To determine subsequent northern length of service, we must not forget about the certificate that must be obtained upon dismissal. This may be difficult later.

It usually states:

- requisites;

- employer's name;

- to whom it was issued;

- salary size;

- allowance.

Since there is no standard form for this document, other information is entered as necessary.

When leaving military service in the north, you also need to get a certificate about the length of service, it is issued in a form. The period of service in the north will subsequently be counted towards receiving the northern wage supplement.

Dismissal due to staff reduction and northern bonus

In the event of an unstable financial situation, the company may make reductions. Dismissal in the north has its own characteristics and guarantees.

After the employer has completed all the reduction procedures common to the country, the employee must receive a calculation taking into account northern allowances and regional coefficients in the amount of average monthly earnings. In addition, the employer will have to pay him an average monthly salary for the entire period of job search, but not more than 3 months.

If, after being laid off, the employee registered with the Employment Service within 1 month and it was unable to give him a job, then by decision of the same service the employee may retain his average earnings for a period of 4 to 6 months.

Another privilege of KS employees is the continuation of their work experience for 3 months of job search, and sometimes for 6 months.

Legislative regulation

Let's first understand what the regional coefficient is?

By such a concept as the regional coefficient, it is customary to understand a certain bonus to the basic salary, which is provided to employees performing their work duties in harsh climate conditions.

It should be noted that not all individuals working in such unfavorable conditions are guaranteed to receive additional payment, but only those whose employment agreement stipulates in a separate clause the conditions for providing them with a regional coefficient.

The main source that should be used if any questions arise regarding the regional coefficient is the Labor Code of the Russian Federation. In order to be aware of the rules dictated by law regarding the receipt of such additional payments, it is enough to pay attention to the following legislative acts:

- Article 315, which states that all individuals working in Russia, located in the northern part of the Arctic Circle, are entitled to an additional cash bonus to their monthly salary.

- Article 316, which places responsibility for establishing the size of the coefficient on the Government of the Russian Federation. This article also contains a list of some institutions and bodies that have preferential rights to calculate the highest coefficient.

- Article 317, informing employees of the Far North about the possibility of receiving a certain additional payment to their salary, which is calculated as a percentage equivalent of the basic rate and depends on the individual’s work experience in harsh climate conditions.

If, after reading the above documents, you still have any misunderstandings of any kind, we advise you to seek help from the clarification of the Russian Ministry of Labor number three, which entered into force on September 11, 1995 .

The explanation contains a whole list of settings for calculating cash bonuses and regional coefficients for individuals performing their work duties in the Far North. You can also additionally refer to Articles 146 and 148 of the Labor Code of the Russian Federation.

What is the methodology for calculating wages taking into account the northern bonus and the regional coefficient

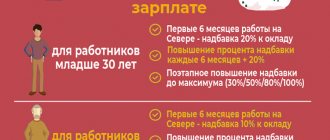

The calculation method is quite simple. For workers who have just arrived in the Far North, the northern bonus of 10% will begin to be paid from the initial stage six months (or a year) from the date of arrival (the period depends on the region). You can determine the time of stay by registration in your passport or insert.

Further increases occur once every six months by 10% up to the maximum percentage for the region.

For young people under 30 years of age, accrual is accelerated at 20% after the first half of the year and increases accordingly by 20%. There is only one condition: you must have lived in the north for 1 year beforehand.

If a citizen previously worked in the districts of the KS and equivalent to them, then he must bring a certificate of the northern allowance.

Interesting! Alaska residents receive $1,000 annually. This is their share of the income from mining in the state.

Let's look at how the northern surcharge and regional coefficient are calculated under various conditions:

- An enterprise located in one of the districts of the KS entered into a trade agreement with an employee over 30 years of age who had never lived in the KS . His salary is set at 40 thousand rubles.

The employee receives a salary for the first six months.

From the 7th month 40 thousand rubles. +40 thousand rubles*0.1=44 thousand rubles.

From the 13th month 40 thousand rubles + 40 thousand rubles * 0.2 = 48 thousand rubles. etc.

- Under the same conditions, but the organization is located in one of the areas equated to the KS .

For the first year, the employee receives only a salary.

From the 13th month 40 thousand rubles. +40 thousand rubles*0.1=44 thousand rubles.

From the 25th month 40 thousand rubles + 40 thousand rubles * 0.2 = 48 thousand rubles. etc. to the maximum value for the region.

In some areas equated to the KS, the premium is added every two years.

- An organization located in one of the districts of the KS hired an employee under 30 years of age . He has been living in the north for more than a year. Salary - 40 thousand rubles.

The employee receives a salary for six months.

From the 7th month 40 thousand rubles. +40 thousand rubles*0.2=48 thousand rubles.

From the 13th month 40 thousand rubles + 40 thousand rubles * 0.4 = 56 thousand rubles. etc. up to a 60% premium.

Subsequent increases will be once a year by 20% to a level of 80% or 100%.

- The same conditions, but for areas equated to KS.

Salary for the first six months.

From 7 months 40 thousand rubles. +40 thousand rubles*0.1=44 thousand rubles.

From 13 months 40 thousand rubles + 40 thousand rubles * 0.2 = 48 thousand rubles etc. up to a surcharge of 30% or 50%.

An employee who previously worked in the north receives a bonus from the first month of employment at a new enterprise in accordance with certificates received at previous places of work.

The regional coefficient is also calculated based on the employee’s salary, but various payments, bonuses, sick leave, etc. are also added.

- A citizen works in a region with a regional coefficient of 1.3 (30%). The salary, according to the TD, is 40 thousand rubles.

40 thousand rubles * 1.3 = 52 thousand rubles.

- If the TD indicates salary, allowances and bonuses, then all of them are taken for the calculation base.

40 thousand rubles. - salary; 10 thousand rubles. - allowance.

(40 thousand rubles + 10 thousand rubles) * 1.3 = 65 thousand rubles.

The final wage calculation with the northern bonus and the regional coefficient will look like this:

An organization located in one of the regions of the KS employs an employee who has lived in the region for 7 years (his northern bonus is 80%). Salary - 40 thousand rubles, regional coefficient - 1.3 (30%), bonus 10 thousand rubles, sick leave pay 13.5 thousand rubles.

40 thousand rubles + 40 thousand rubles * 0.8 + (40 thousand rubles + 10 thousand rubles + 13.5 thousand rubles) * 0.3 = 91.05 thousand rubles

Interesting! In Norway, the State Oil Fund was created to smooth out fluctuations in income from the sale of mineral resources and finance pensions (benefits). Oil is the property of the people and the income from it is also a common property.

Application of the regional coefficient

The stipulated bonus will be accrued at 100%, provided that the employee, who has not reached the age of thirty, started working after January 1, 2005 and has lived in a special climatic region of the country for more than five years. If the employee has lived in special areas for less than five years, but for more than twelve months in a row, the increase in the allowance is made using an accelerated regime.

Thus, for the territories of the Far North, after the first six months of work, an increase of twenty percent is established on the employee’s accrued salary, with a further increase of twenty percent every six months in total up to sixty percent.

Further, the bonus increases by twenty percent for each year of experience earned in the North, but it cannot exceed the maximum norm established by law. For areas equated to the regions of the Far North, an increase of ten percent for every six months is established.

Regional values: 100%, 80%, 50%, 30%

The calculation of the northern allowance in the regions of the Far North and equivalent areas occurs in accordance with the coefficient of one of 4 groups. Each of them has its own premium. Groups 1 and 2 with an increase of 100% and 80% belong to the regions of the Far North. Groups 3 and 4 (increase of 50% and 30%) - to areas equated to KS.

Let's see what the northern allowances are by region of their accrual and receipt:

- Group 1 (100%) includes Koryak Autonomous Okrug, the islands of the Arctic Ocean, Chukotka Autonomous Okrug, Antarctica

- Group 2 (80%) - Chukotka, Khabarovsk Territory, Yakutia (Sakha Republic), Vorkuta

- Group 3 (50%) - Republic of Karelia, Arkhangelsk region, Khanty-Mansiysk Autonomous Okrug

- Group 4 (30%) - Republic of Buryatia, Tyva, Komi Republic, Trans-Baikal Territory

It is worth noting that in each region there are areas where the coefficient may differ. This is not a complete list, but only an informational one. You can view the table of the size of the northern coefficient by region in the document Regional coefficients for wages in the regions of the Far North and equivalent areas.

There is also a list of territories in which the regional coefficient applies. These are not only areas of the KS, but also simply regions with difficult living conditions in some respects.

The legislative framework

According to Article 148 of the Labor Code, if a person works in non-standard climatic conditions, the employer must pay him an increased salary. Article 316 states that the Government of the Russian Federation establishes the minimum sizes of regional coefficients. But subjects have the right to make their own regulations to improve them.

The concept of the Republic of Kazakhstan is also mentioned in Article 10 of the Law of the Russian Federation No. 4520-1 of February 19, 1993. She clarifies that this indicator applies not only to wages, but also to scholarships, pensions and government benefits.

According to Article 317, workers in the Far North are also given a percentage bonus for length of service in these regions. Its size is determined in accordance with Appendix III to Order of the Ministry of Labor of the RSFSR No. 2 of November 22, 1990. It is calculated on earnings not adjusted for the Republic of Kazakhstan, and in some regions reaches 100%.

Legislative regulation of the issue of calculation and payment of regional and northern coefficients

The most important document in all matters of employment is the Labor Code.

In addition to the Labor Code, issues of northern allowances and coefficients are regulated by the law on northern allowances - Federal Law “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” No. 4520.

However, the state has not yet issued regulations provided for by these Federal Laws and the Labor Code of the Russian Federation. To this day, documents of the Russian Federation and the USSR regulating this issue are in force.

One of them is Order No. 2 of the Ministry of Labor dated December 30, 1990, covering the issues of providing social guarantees and compensation to CS employees and those equivalent to them.

It should be remembered that labor legislation does not apply to military personnel when performing military service. For them, the issue is regulated by Government Decree No. 1237 of December 30, 2011.

In this regard, employees of internal affairs bodies are treated like ordinary citizens.

Article TCRF 316. Regional coefficient of wages in the Far North

Commentary on Article 316

1. The regional coefficient is the numerical value of the increase in wages due to special climatic conditions, in this case in the regions of the Far North and equivalent areas (see Article 148 of the Labor Code).

2. In Art. 316 Labor Code and Art. 10 of the Law of the Russian Federation “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” contains three basic rules relating to the regional coefficient:

— its size and procedure for application are established by the Government of the Russian Federation;

- state authorities of the constituent entities of the Russian Federation and local self-government, at the expense of their budgets, can establish higher regional coefficients for employees of institutions financed from these budgets;

— state authorities of the constituent entities of the Russian Federation can establish a maximum amount for increasing the regional coefficient for its constituent municipalities.

3. Government decisions on the size of the regional coefficient and the procedure for its payment, which are referred to in Art. 316 of the Labor Code has not yet been adopted, therefore the previous regulatory legal acts continue to be applied, including those adopted in the USSR, which established the size of regional coefficients in the range from 1.15 to 2.0.

For practical purposes, the size of the coefficients for workers in non-production industries in the Far North and equivalent areas can be found in the current information letter approved by the Department of Pensions of the Ministry of Labor of Russia dated June 9, 2003 N 1199-16, Department of Income and Standards of Living The Ministry of Labor of Russia dated May 19, 2003 N 670-9 and the Pension Fund of the Russian Federation dated June 9, 2003 N 25-23\5995.

4. The application of the regional coefficient to wages begins from the first day of work in the regions of the Far North and equivalent areas and does not depend on the length of previous work experience.

5. The regional coefficient is calculated on the employee’s actual earnings received in the corresponding month, and not necessarily the full one.

This earnings include, in particular, payment at tariff rates and salaries; allowances and surcharges; increased pay for overtime work and work at night, on weekends and non-working holidays; payment for downtime; bonuses determined by the remuneration system; remuneration for length of service, paid monthly, quarterly or one-time (see clause 1 of the explanation of the Ministry of Labor dated September 11, 1995 No. 3).

An increase in wages using regional coefficients does not create new salaries and tariff rates, therefore, in cases where the law establishes that certain payments should be made only based on the tariff rate (salary), these coefficients are not applied.

The district coefficient is not accrued for various types of compensation (allowances for rotational work, field allowance, etc.), since they do not relate to wages (see Article 164 of the Labor Code), but are intended to reimburse the employee for costs incurred in connection with with his work activity.

The regional coefficient is not calculated for percentage increases in wages for work in the Far North and equivalent areas, one-time incentive payments, amounts of financial assistance, as well as for personal allowances.

The regional coefficient does not apply to average earnings, since the coefficient has already been taken into account when calculating it.

The legislation currently does not establish the maximum amount of earnings to which the regional coefficient should be applied, so the accrual should be made for the entire amount of actual earnings, regardless of its value.

6. Part 2 art. 316 of the Labor Code gives the right to government bodies of the constituent entities of the Russian Federation to establish, at the expense of their budgets, higher regional coefficients for institutions financed from these budgets, compared to those established at the federal level.

I believe that, taking into account the wording of other articles of Ch. 50 of the Labor Code (Articles 323, 325 and 326), concerning the rights of subjects of the Russian Federation to regulate guarantees and compensation, used in Part 2 of Art. 316 of the Labor Code of the Russian Federation the term “institutions” is a legal and technical error and the term “organizations” should be used.

The right granted by Part 2 of Art. 316 of the Labor Code, was used, in particular, by the Republic of Sakha (Yakutia), which adopted Law No. 476-III of May 18, 2005, in which (Article 2) regional coefficients for persons working in organizations financed from the state budget of this constituent entity of the Russian Federation, set at 1.7 in uluses (districts) located up to the Arctic Circle, and at 2.0 in uluses (districts) located beyond the Arctic Circle.

As a result, in a number of districts the coefficient turned out to be higher compared to federal standards, which established coefficient sizes from 1.4 to 2.0 in different districts.

In Art. 4 of the said Law of the Republic of Sakha (Yakutia) on the basis of the second sentence of Part 2 of Art. 316 of the Labor Code regulates that municipalities of this subject of the Federation cannot establish (even at the expense of their own budgets) higher amounts of regional coefficients compared to those established by Art. 2 of the commented Law for employees of organizations financed from the state budget of the Republic of Sakha (Yakutia).

7. In accordance with Part 3 of Art. 316 of the Labor Code, the amounts of expenses associated with payments of the regional coefficient are related to labor costs in full. Here we mean both the costs of the coefficient established at the federal level, and the costs in connection with the establishment of an increased size of the coefficient at the levels of the constituent entity of the Russian Federation and municipalities.

Comments to the Labor Code of the Russian Federation

Publishing House "Gorodets", 2007

Source: SPS Consultant

When to use

The regional coefficient for the regions of Russia 2020, the table of which is given below, is indexed for the following types of income of workers in regions with difficult working conditions:

- Minimum wage and payments calculated from the minimum wage;

- basic salary, wage rate, that is, all income from work received by the employee;

- compensation, incentives, bonus payments and allowances;

- increase for hazardous work or work in dangerous conditions;

- temporary disability benefits;

- wages of part-time workers and employees under GPC agreements;

- contributions to the Pension Fund;

- additional payments established in accordance with the provisions of the collective agreement.

When not applicable

The regional coefficient does not apply if earnings are calculated based on amounts in which this multiplier is already taken into account. These are the following payments:

- vacation pay, since they are calculated on the basis of the full salary, and that, in turn, is calculated taking into account regional allowances;

- financial assistance if it is paid one-time and not on an ongoing basis, and the accrual rules are not specified in the collective agreement;

- periodic bonuses;

- travel expenses if the trip is to a region for which a regional coefficient has not been established;

- when calculating the “northern” bonus, since a separate increasing indicator is provided for work in the Far North, increasing the same income group of employees involved in such conditions.

Who does it apply to?

All employees, regardless of the organizational and legal form or type of activity of the enterprise, working and living in areas experiencing difficulties with the following basic conditions can apply for a regional supplement:

- transport interchange;

- infrastructure;

- ecology;

- weather and climate;

- features of the organization's activities.

The rules apply to absolutely all employees - both full-time employees and employees working under civil contracts - working and living in the Far East, the Far North (and regions of similar status) and the south of the East Siberian territories.

Table of regional coefficients for Russia

Regional coefficient by regions of Russia 2020: the table is similar to that illustrating the list of constituent entities of the Russian Federation and coefficient indicators used in the current year, 2020. At the end of the article you can download this table as a file.

The territory of our country is huge, and it includes many areas, including areas with special climatic and geographical living conditions. Very often, in order to encourage people to enter into employment contracts in such regions, legislation provides for increased coefficients. The regional coefficient for the regions of Russia in 2020 is determined by Government Decree.

Regional coefficient Moscow 2020 table

- To calculate payment, you must use the average daily earnings indicator.

- It is calculated by dividing all accrued amounts by the number of days worked.

- In this case, an increasing multiplier is used for the location of the enterprise - Norilsk.

The islands (travel destination) allowance is not used.

- All wages, namely:

- minimum wage (minimum wage);

- basic payment;

- permanent bonuses and more.

- Additional payments depending on:

- length of service;

- discharge;

- skill;

- academic title and the like.

- Bonuses paid once a year (13th salary).

- Compensation for:

- harmfulness;

- night shifts;

- dangerous conditions.

- Reward for part-time work.

- Payment for contract work and seasonal events.

- Compensation for time of official illness.

- Pension accruals (depending on the place of registration).

Pensioners may lose their northern allowances when they change their place of residence, that is, they move to other regions of Russia. Important: regional coefficients cannot be included in the minimum wage itself. The Constitutional Court of the Russian Federation recalled this at the end of December 2020.

Regional coefficient and northern premium by regions of Russia in 2020

It is worth noting that there is also such a thing as a northern allowance. In this case, there is no list that is enshrined at the legislative level regarding the list of areas where it can be applied. Therefore, a person should independently find the required act in the area that establishes the right to receive a bonus.

- to wages, from the date of official entry into the position;

- to additional payments to wages, including sums for length of service;

- to the bonus part of the salary;

- to all allowances for existing qualifications;

- to compensation for work at night and to those paid for work in hazardous work;

- to all payments for temporary employment relationships and seasonal work;

- to all pension payments.

Afanasyevsky, Belokholunitsky, Bogorodsky, Verkhnekamsky, Darovsky, Zuevsky, Kirovo-Chepetsky, Kamensky, Luzsky, Murashinsky, Omutninsky, Nagorsky, Oparinsky, Podosinovsky, Slobodskoy, Uninsky, Felensky, Khalturinsky, Yuryansky districts, Kirov with the territory subordinate to the city Council of People's Deputies 1.15

Aleysky, Baevsky, Blagoveshchensky, Burlinsky, Volchikhinsky, Egorievsky, Zavyalovsky, Klyuchevsky, Kulundinsky, Mamontovsky, Mikhailovsky, German, Novichikhinsky, Pankrushikhinsky, Pospelikhinsky, Rodinsky, Romanovsky, Rubtsovsky, Slavgorodsky, Suetsky, Tabunsky, Uglovsky, Khabarovsky, Shipunovsky districts, cities regional subordination Aleysk, Slavgorod, Yarovoye 1.25

Regional coefficient by regions of Russia in 2020: what is it, what is affected by the table

The regulatory acts for establishing and calculating length of service for the purposes of applying the northern bonus is the Decree of the Government of the Russian Federation of October 7, 1996 No. 1012. Thus, for an employee it increases depending on the number of years worked in stages and can reach maximum values from 30 to 100% of earnings.

- Minimum wage and all payments depending on it;

- wages (salary, tariff rate, etc.);

- any additional payments to earnings, including compensation payments, bonuses, additional payments for length of service, etc.;

- payment of sick leave;

- additional payments made by the employer to employees employed in hazardous working conditions, in accordance with the Special Labor Conditions;

- payments under contracts with seasonal workers, part-time workers;

- compensation for part-time and flexible working hours;

- pension payments;

- other payments under an employment contract or collective agreement.

Minimum minimum wage from January 1, 2020 in Russia - the minimum amount in the regions and Moscow

In order to regulate the rules of employment of the population at the legislative level, such an indicator was introduced - the minimum wage.

With its help, the government sets a lower wage limit so that employers do not use citizens' labor for very little money.

The minimum wage is necessarily oriented towards the subsistence level, which is calculated on the basis of statistical data using the approved calculation methodology.

- There are great opportunities in the capital: economic growth, significant opportunities for the local budget, concentration of large businesses, high average salaries.

- There are significant needs in a metropolis: higher needs for survival, expensive transport, medicine, utilities and other services.

Regional coefficients

Legislative norms for using the coefficient are reflected in various legal regulations. In Art. 316 of the Labor Code of the Russian Federation establishes the scope of application of the coefficient, the possibility of changing its rate for government structures and setting a limit value. The territories for which a regional coefficient of a specific size is assigned are listed in Resolution of the Ministry of Labor dated September 11, 1995 No. 49

What is a regional coefficient and why is it needed?

The country has territories with different climates, for example, the entire northern part of Russia. Living on them, much less working, requires additional efforts for people.

This is often caused by the inaccessibility of the region, bad weather conditions, which increases people’s costs for purchasing food, transportation, etc.

Therefore, in order to stimulate the desire of the population to work in these zones, the Government of the country establishes an increased salary, which differs from the usual one by a certain level.

The regional coefficient of wages is the ratio of wages in a region with difficult living and working conditions to ordinary ones. Using these indicators, salaries are compared in all regions of the country.

The norms of labor law, in particular the Labor Code of the Russian Federation, do not define in any way how a region is considered the territory where increased coefficients apply. However, in 1967, a law was passed establishing a list of such regions.

This is what should currently be followed, subject to some changes and additions. They were last included in 2013, when two districts of the Khanty-Mansiysk region were included in the list.

At the federal level, basic coefficients are adopted, however, regional authorities have the opportunity to increase their values in accordance with available funds.

Northerners get more

Allowances for labor in the North have the same function and mechanism of action as the Republic of Kazakhstan. But these indicators are somewhat different. The Far North stands apart from a number of regions with a special financial status, distinguished by special climatic conditions. This is how legal norms that were adopted back in Soviet times and remained virtually unchanged are interpreted.

“Northern bonus” is an additional payment of a constant percentage to the salary part of the salary, carried out for work in certain regions of the Russian Federation, characterized by harsh climatic conditions (the Far North and similar areas). Its size is the same for all territories included in this list:

- 10% for the first six months of work;

- every 6 months there is a 10% increase up to the established limit of 80%, and in some areas - up to 100%;

- territories equated to the Far North allow you to increase the bonus by 10% only after a year of work and do this once a year with an increase of up to 50% (in some regions up to 30%);

- special standards are relevant for young specialists (up to 30 years of age) - they receive a double increase (20%) at an accelerated rate, starting from the first working day, if they have lived in the given region for 5 or more years before starting work.

Features of northern payments for different categories of workers

Payment according to the northern coefficient will be slightly different for employees performing work in different modes:

- Part-time workers , if their additional work is carried out in the northern region, have every right to an appropriate bonus (Article 285 of the Labor Code of the Russian Federation).

- Seasonal workers, shift workers, conscripts who temporarily arrive to work in such regions will also receive an allowance in accordance with Art. 302 Labor Code of the Russian Federation.

- Specialists who perform home work and work remotely will receive indexed pay if they permanently reside in the specified area, which is reflected in the employment contract.

- “Travelers,” or employees whose jobs involve a lot of movement, will receive additional funds based on where they travel rather than the location of their organization's headquarters.

What payments are affected by the regional coefficient?

All payments for which district coefficients must be applied are determined by law:

- The established minimum wage and benefits and other payments calculated on its basis.

- The main part of the salary is the tariff, salary, etc.

- All components of the salary established for the employee’s performance of his labor functions - bonuses, additional payments for professionalism, length of service, compensation, payments provided for by the legislation on commercial and state secrets, etc.

- Allowances for performing work under the influence of harmful and dangerous factors.

- To accruals to employees for seasonal work, during combination work, as well as for part-time work.

- To benefits calculated on the basis of a certificate of incapacity for work.

- Pension accruals.

- To other accruals established by labor agreements.

When using regional coefficients, there are no restrictions on the amount of income received. The coefficient must be applied to all income, from the beginning of the employment contract until its termination.

It must be remembered that the indexation of payments, including pensions, is carried out while those working and those who went to support live in these territories. As soon as they leave them, the coefficient ends. Therefore, for example, if retirees leave a given territory, the regional coefficient in relation to their payment ceases.

It is permissible to make a reference in a local wage act if such a provision reflects information about the application of the regional coefficient. In this situation, anyone working in the company must be familiar with this document upon signature.

Regional police coefficient Moscow 2020 table

The legal topic is very complex, but in this article we will try to answer the question “Regional police coefficient Moscow 2020 table.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Why was it necessary to introduce regional coefficients at all? Russia, as a state, has a very vast territory. Citizens of our country living in different regions sometimes find themselves in very different conditions.

In some areas, for climatic reasons, the cost of living is much higher, while working and living conditions are much more complex and involve additional stress on people’s health. It would be unfair to evaluate labor equally given such differences in the original “rules of the game.”

We need a certain state mechanism that would relatively equalize the rights of all workers of the Russian Federation. Its role in labor law is intended to be fulfilled by the district coefficient (RK).

What is the regional coefficient and where is it used?

IMPORTANT! The regional coefficient applies to all employees working on the basis of an employment contract, without exception, from the very first working day - subject to the essential condition of their permanent residence or employment in the specified territories.

Regional coefficients in the Russian Federation in 2020

- Salary from the date of entry into position (that is, actual earnings, including base and official salary, salary schedules).

- Additional payments to wages, including amounts for length of service (continuous service).

- Bonuses based on the results of the production year.

- Allowances for existing categories (tariff rates), excellence and academic degrees.

- Compensation for work at night, in dangerous or harmful conditions.

- Payments for temporary employment relationships and seasonal work.

- Minimum wage.

- Payments to employees working part-time or part-time.

- Pension (the right to use the regional coefficient when calculating a pension is retained only if you live in the territory for which such allowances are applied).

Sakhalin region.

Tyva Republic. Perm region. Tomsk region. The Republic of Buryatia. Transbaikal region. Amur region. Primorsky Krai. Altai Republic.

Regions and localities that are not classified as the Far North and equivalent areas but have special climatic conditions in which regional coefficients and percentage increases in employee salaries are applied:. Rostov region.

Regional coefficient Moscow 2020 table

The Republic of Dagestan. Republic of Kalmykia. Stavropol region. Astrakhan region. Saratov region. Vologda Region. The Republic of Khakassia. Novosibirsk region. Republic of Bashkortostan. Kostroma region. Kirov region. Orenburg region.

: Veteran of Labor of the Altai Territory list in 2020

All regional coefficients for regions of Russia in 2020: table

For mandatory additional payments to employees, a regional coefficient is applied to their earnings for work in special climatic conditions. Check the table for correct calculation. After all, understatement is not only a labor violation, but also a tax violation. It entails arrears of personal income tax and insurance premiums. These documents will help you correctly use the regional coefficient when calculating wages:.

What payments do not use the coefficient?

The coefficient does not apply to accruals that, due to the specifics of the calculation, are based on amounts that already contain it. In addition, it does not need to be applied to payments that are made in a lump sum or without any system.

Payments that do not use a coefficient include:

- Payments in connection with vacation - they are initially calculated on the basis of the employee’s full salary, already determined using a coefficient;

- Financial assistance paid in a lump sum. The coefficient is not used if the payment is not made on a regular basis and the principle of its calculation is not specified in the company’s local documents;

- Bonus payments that are assigned periodically on the occasion of an event;

- Travel allowance if an employee is sent to a region without the regional coefficient;

- The Northern Supplement is another type of payment for work in severe weather conditions. It and the regional coefficient are different types of accruals, and when determining one amount does not depend on the other.

In the case of quarterly bonuses

A quarterly bonus is one of the forms of monetary incentives. It is paid after every three months of work. Information on such payments must be reflected in the following types of documentation:

- Labor agreements.

- Regulations on bonuses.

- Miscellaneous other regulations.

When recording the fact of transferring bonuses for a quarter in local acts, money is part of the general system of remuneration for labor for the enterprise. Regional coefficients are introduced for any categories of employees.

https://youtu.be/FqKNvbtuKxw

Regional coefficient by regions of Russia in 2018 in the table

In many regions where a regional coefficient has been introduced, it can be set separately for certain regions or cities. As a rule, the size of the coefficient increases as you approach the north.

| Region name | Coefficient |

| The Republic of Dagestan | 1,15-1,2 |

| The Republic of Sakha (Yakutia) | 1,7-2,0 |

| Altai region | 1,15-1,25 |

| Krasnoyarsk region | 1,3-1,8 |

| Khabarovsk region | 1,3-1,7 |

| Arhangelsk region | 1,2 |

| Irkutsk region | 1,3-1,7 |

| Kamchatka region | 1,8-2,0 |

| Sakhalin region | 1,6-2,0 |

| Moscow | Not used |

| Saint Petersburg | Not used |

The value of the regional coefficient in 2020

The factor under study operates only in the subjects of the federation, where the climate is associated with severe seasonal fluctuations and exacerbations of bad weather.

It is used for the following sectors of the Russian Federation:

- Eastern Siberian southern regions.

- Far Eastern territories.

- The Far North and sectors with the same status.

Here are the coefficient indicators in some regions. The regional coefficient varies by region, as it depends on weather and climatic conditions.

| Regions of the Far North and territories equivalent to it | Regional coefficient indicator for 2020 |

| Islands located in the Arctic Ocean, including seas | 2 |

| The Republic of Buryatia | |

| Bauntovsky, Muysky, Severo-Baikalsky districts, Severobaikalsk and settlements subordinate to its administration | 1,3 |

| Barguzinsky, Kurumkansky, Okinsky districts | 1,2 |

| In the Republic of Sakha: in general - from 1.4 to 2 depending on the region | |

| regions of location of diamond mining enterprises; mines | 2 |

| Nizhnekolymsky district and Ust-Kuiga village | from 1.8 to 2 |

| Lensky district | 1,7 |

| Mirny | 1,7 |

| Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Verkhnevilyuysky, Verkhnekolymsky, Verkhoyansky, Vilyuysky, Zhigansky, Kobyaysky, Nyurbinsky <*>, Mirninsky, Momsky, Oymyakonsky, Oleneksky, Srednekolymsky, Suntarsky, Tomponsky, Ust-Yansky (except for the village of Ust-Kuiga) and Eveno-Bytantaysky districts | 1,6 |

| village Kangalassy | 1,5 |

| Rest of the republic | 1.4 |

| In the Sakhalin region: in general - from 1.4 to 2 depending on the region | |

| North Kuril, Kuril regions, Kuril Islands | 2 |

| Districts: Nogliki, Okha | 1,6-1,8 |

| In Kamchatka | |

| Commander Islands | 2 |

| Rest of territory | 1.6-2 depending on the area |

| Evenki Autonomous Okrug | |

| northern parts of the Evenki Autonomous Okrug (north of the Lower Tunguska River) | 1,6 |

| southern parts of the Evenki Autonomous Okrug (south of the Lower Tunguska River) | 1,3 |

| Chukotka Autonomous Okrug (entire) | 2 |

| Yamalo-Nenets Autonomous Okrug (entire) | 1,5 |

| In the Krasnoyarsk Territory: in general - from 1.3 to 1.8 depending on the region | |

| Norilsk | 1,8 |

| Turukhansky (north of the Lower Tunguska and Turukhan rivers) region, areas located north of the Arctic Circle (with the exception of the city of Norilsk and settlements subordinate to its administration), the city of Igarka and settlements subordinate to its administration | 1,6 |

| Boguchansky, Yenisei, Kezhemsky, Motyginsky, North Yenisei, Turukhansky (south of the Lower Tunguska and Turukhan rivers) districts, the cities of Yeniseisk and Lesosibirsk and settlements subordinate to its administration | 1,3 |

| In the Murmansk region: in general - from 1.4 to 1.8 depending on the region | |

| Murmansk - 140 and the territory subordinate to the city administration | 1,8 |

| village Fog | 1,7 |

| Other districts of the region | 1,4 |

| In the Komi Republic: in general - from 1.2 to 1.6 depending on the region | |

| Vorkuta | 1,6 |

| Inta | 1,5 |

| Izhemsky, Pechora, Troitsko-Pechora, Ust-Tsilemsky, Udora districts, the cities of Vuktyl and populated areas subordinate to its administration, Sosnogorsk and populated areas subordinate to its administration, Ukhta and populated areas subordinate to its administration, Usinsk and populated areas subordinate to its administration, Pechora and settlements subordinate to his administration | 1,3 |

| Rest of the republic | 1,2 |

| Tyumen region: in general - from 1.15 to 1.7 depending on the region | |

| Uvatsky district | 1,5 |

| Chita region | |

| Kalarsky, Tungiro-Olekminsky and Tungochensky districts | 1,3 |

| Tomsk region | |

| Alexandrovsky, Verkhneketsky, Kargasoksky, Kolpashevo, Parabelsky and Chainsky districts, cities of Kedrovy, Kolpashevo, Strezhevoy | 1,5 |

| Asinovsky, Bakcharsky, Zyryansky, Kozhevnikovsky, Krivosheinsky, Molchanovsky, Teguldetsky, Pervomaisky, Tomsk and Shegarsky districts, Tomsk, Alexandrovsky, Chainsky, Parbigsky, Pudinsky, Vasyugansky, Verkhne-Ketsky, Kargasoksky, Parabelsky districts and Kolpashevo | 1,3 |

| Throughout the rest of the region | 1,15-1,2 |

| In areas of construction and development of gas and oil fields | 1,5-1,7 |

| Khanty-Mansiysk Autonomous Okrug | |

| northern part of the Autonomous Okrug (north of 60 degrees north latitude) | 1,5 |

| southern part of the Autonomous Okrug (south of 60 degrees north latitude) | 1,3 |

| Amur region | |

| Zeya, Selemdzhinsky, Tynda (with the exception of the Murtygitsky village council) districts, the cities of Zeya and Tynda and settlements subordinate to their administrations | 1,3 |

| In Khabarovsk Territory | |

| Okhotsk region | 1,6 |

| Ayano-Maisky, Vaninsky, Verkhnebureinsky (north of 51 degrees north latitude), named after. P. Osipenko, Nikolaevsky, Sovetsko-Gavansky, Solnechny (Amgunskaya and Dukinsky rural administrations), Tuguro-Chumikansky, Ulchsky districts, the cities of Nikolaevsk-on-Amur, Sovetskaya Gavan and settlements subordinate to its administration | 1,4 |

| Amursky (the town of Elban and the settlements subordinate to its administration, Achanskaya, Voznesenskaya, Dzhuenskaya, Omminskaya, Padalinskaya rural administrations), Verkhnebureinsky (south of 51 degrees north latitude), Komsomolsky, Solnechny (with the exception of Amgunskaya and Dukinsky rural administrations) districts, cities Amursk, Komsomolsk-on-Amur | 1,2 |

| Irkutsk region | |

| Bodaibinsky, Bratsky, Kazachinsko-Lensky, Katangsky, Kirensky, Mamsko-Chuysky, Nizhneilimsky, Ust-Ilimsk, Ust-Kutsky districts, Bratsk and settlements subordinate to its administration, the cities of Bodaibo, Ust-Ilimsk, Ust-Kut | 1,3 |

| In the Republic of Karelia | |

| Belomorsky, Kalevalsky, Kemsky, Loukhsky districts, the city of Kem and settlements subordinate to its administration, Kostomuksha | 1,4 |

| Medvezhyegorsky, Muezersky, Pudozhsky and Segezhsky districts, the city of Segezha and settlements subordinate to its administration | 1,3 |

| Other areas, Petrozavodsk and Sortavala | 1,15 |

| Altai Republic | |

| Kosh-Agachsky, Ulagansky districts | 1,4 |

| Komi-Permyak Autonomous Okrug | |

| Gainsky, Kosinsky, Kochevsky districts | 1,2 |

| Arhangelsk region | |

| Leshukonsky, Mezensky, Pinezhsky and Solovetsky districts, the city of Severodvinsk and settlements subordinate to its administration | 1,4 |

| Rest of the region | 1,2 |

| Primorsky Krai | |

| Kavalerovsky district (village of Taezhny and Ternisty mines) | 1,4 |

| Kavalerovsky (with the exception of the villages of the Taezhny and Ternisty mines), Krasnoarmeysky (the villages of Vostok and Boguslavetskaya, Vostretsovskaya, Dalnekutskaya, Izmailikhinskaya, Melnichnaya, Roshchinskaya, Taezhnenskaya rural administrations), Olginsky, Terneysky districts, the city of Dalnegorsk and settlements that were subordinate his administration earlier | 1,2 |

| Tyva Republic | |

| Mongun - Taiginsky, Todzhinsky, Kyzylsky (territory of Shynaan rural administration) districts | 1,5 |

| Bai-Taiginsky, Barun-Khemchiksky, Dzun-Khemchiksky, Kaa-Khemsky, Kyzylsky (except for the territory of Shynaan rural administration), Ovursky, Piy-Khemsky, Sut-Kholsky, Tandinsky, Tes-Khemsky, Chaa-Kholsky, Chedi-Kholsky, Ulug-Kemsky, Erzinsky districts and Kyzyl city | 1,4 |

| Rest of the republic | 1,2 |

On the territory of one subject of the federation, the value of the increasing indicator may change.

How to use the coefficient in calculations

Employee A.G. Semenov performs the duties of a mechanic at Mechta LLC, which is located in Norilsk. For calculations, a regional coefficient of 1.8 is adopted.

For January, the employee was accrued the following amounts: salary 21,000 rubles, additional payment for length of service 3,000 rubles, holiday bonus 3,000 rubles.

Since the holiday bonus is not a monthly payment, the coefficient does not apply to it.

The salary amount will be: (21000+3000) x 1.8 + 3000 = 46200 rubles.

Is there a regional coefficient for the premium?

He also worked the night shift and on holidays and went on sick leave for 2 days.

His monthly earnings were:

- salary - 45,000.00;

- sick leave (2 days) - 3000.00;

- night - 2800.00;

- holidays - 4000.00;

- RK for the Krasnoyarsk Territory, including for the city of Norilsk - 1.80.

The regional coefficient is calculated on the actual salary, that is, on the salary and additional payments to it. In our case:

45 000,00 + 2800,00 + 4000,00 = 51 800,00.

We charge RK: 51,800.00 × 1.80 = 93,240.00 rubles.

Actual income of Petrov P.P. per month: 93,240.00 + 3000.00 = 96,240.00 – 13% (income tax) = 83,728.80 rubles.