Safe VAT deduction in your region: where to look

All necessary information is published on the websites of regional tax services. We strongly recommend that you check the percentage of deductions in your organization's tax bill against the average for your region (read on to learn why this is important).

As of 02/01/2020, the Federal Tax Service updated regional statistics on deductions. Current data on the safe percentage of VAT deductions is shown in the table below:

| Region | Safe share of deductions as of 02/01/2020 | Safe share of deductions as of 11/01/2019 | Safe share of deductions as of 08/01/2019 | Safe share of deductions as of 05/01/2019 | Safe share of deductions as of 02/01/2019 | Safe share of deductions as of 11/01/2018 | Safe share of deductions as of 08/01/2018 |

| Republic of Adygea | 86,6 | 85,9 | 86,3 | 86,8 | 85,7 | 85,7 | 85,7 |

| Altai Republic | 101,8 | 90,8 | 91,8 | 93,3 | 90,1 | 90,1 | 90,7 |

| Republic of Bashkortostan | 94,2 | 91,1 | 89,4 | 90,4 | 88,2 | 88,1 | 87,6 |

| The Republic of Buryatia | 93,1 | 90,6 | 91,6 | 89,6 | 88,9 | 88,9 | 88,2 |

| The Republic of Dagestan | 80,4 | 83,6 | 84,6 | 84,6 | 85,9 | 85,6 | 86,1 |

| The Republic of Ingushetia | 93,0 | 93,3 | 94,3 | 93,8 | 95,9 | 96,2 | 93,3 |

| Kabardino-Balkarian Republic | 93,2 | 91,6 | 91,9 | 90,4 | 93,3 | 93,4 | 93,4 |

| Republic of Kalmykia | 71,0 | 80,9 | 83,2 | 87,9 | 81,9 | 82,0 | 80,1 |

| Karachay-Cherkess Republic | 91,6 | 92,2 | 92,3 | 92,8 | 91,8 | 91,8 | 93,0 |

| Republic of Karelia | 78,4 | 74,9 | 76,7 | 80,6 | 83,5 | 83,5 | 84,0 |

| Komi Republic | 80,1 | 76,4 | 76,5 | 76,1 | 78,6 | 78,6 | 79,3 |

| Mari El Republic | 88,3 | 87,3 | 87,1 | 89,1 | 90,2 | 90,1 | 89,0 |

| The Republic of Mordovia | 90,0 | 92,5 | 93,1 | 93,3 | 90,1 | 90,1 | 90,0 |

| The Republic of Sakha (Yakutia) | 88,7 | 91,0 | 90,1 | 86,9 | 86,1 | 86,1 | 86,6 |

| Republic of North Ossetia–Alania | 85,4 | 89,1 | 89,5 | 89,5 | 86,9 | 86,6 | 86,4 |

| Republic of Tatarstan | 91,3 | 87,9 | 87,5 | 87,4 | 87,9 | 87,1 | 87,9 |

| Tyva Republic | 78,0 | 78,4 | 77,2 | 82,5 | 76,6 | 76,9 | 75,5 |

| Udmurt republic | 78,2 | 80,0 | 79,4 | 79,8 | 81,1 | 80,1 | 80,1 |

| The Republic of Khakassia | 89,6 | 89,7 | 90,1 | 90,1 | 89,7 | 89,8 | 89,9 |

| Chechen Republic | 97,4 | 97,7 | 100,5 | 66,9 | 100,7 | 100,8 | 101,1 |

| Chuvash Republic | 82,0 | 83,7 | 84,3 | 85,6 | 83,6 | 83,7 | 83,3 |

| Altai region | 90,4 | 89,9 | 89,7 | 89,9 | 90,5 | 90,4 | 90,0 |

| Transbaikal region | 88,3 | 89,6 | 87,4 | 87,5 | 89,4 | 89,6 | 90,1 |

| Kamchatka Krai | 88,4 | 90,2 | 89,8 | 82,4 | 90,1 | 90,0 | 89,2 |

| Krasnodar region | 93,2 | 90,6 | 90,6 | 91,1 | 90,0 | 89,9 | 89,6 |

| Krasnoyarsk region | 72,5 | 78,1 | 79,6 | 80,9 | 76,5 | 76,4 | 75,1 |

| Perm region | 87,2 | 82,1 | 80,9 | 80,9 | 79,2 | 79,3 | 78,9 |

| Primorsky Krai | 96,5 | 94,6 | 93,5 | 93,2 | 95,6 | 95,7 | 95,1 |

| Stavropol region | 89,4 | 88,8 | 88,9 | 88,8 | 88,8 | 88,8 | 88,5 |

| Khabarovsk region | 91,9 | 92,9 | 92,3 | 91,7 | 89,6 | 89,6 | 89,1 |

| Jewish Autonomous Region | 89,8 | 87,2 | 90,9 | 105,8 | 96,1 | 96,2 | 92,4 |

| Nenets Autonomous Okrug | 157,7 | 148,5 | 141,5 | 157,2 | 121,1 | 121,1 | 119,8 |

| Khanty-Mansiysk Autonomous Okrug – Yugra | 64,0 | 58,7 | 57,0 | 56,6 | 58,5 | 58,4 | 60,1 |

| Chukotka Autonomous Okrug | 116,1 | 120,7 | 115,5 | 111,3 | 105,7 | 105,6 | 103,3 |

| Yamalo-Nenets Autonomous Okrug | 69,4 | 64,4 | 62,9 | 62,0 | 69,7 | 69,4 | 64,9 |

| Tver region | 88,4 | 90,2 | 89,7 | 90,8 | 88,6 | 88,6 | 88,7 |

| Tomsk region | 76,5 | 77,2 | 76,8 | 76,8 | 75,6 | 75,6 | 74,1 |

| Tula region | 97,1 | 97,0 | 97,5 | 96,7 | 92,7 | 92,7 | 91,5 |

| Tyumen region | 87,1 | 84,2 | 84,6 | 84,5 | 83,5 | 84,1 | 83,4 |

| Ulyanovsk region | 89,2 | 91,0 | 90,8 | 90,8 | 91,9 | 91,8 | 91,6 |

| Chelyabinsk region | 91,1 | 91,0 | 90,7 | 90,8 | 88,4 | 88,4 | 86,8 |

| Yaroslavl region | 86,1 | 89,3 | 89,9 | 87,7 | 87,2 | 87,2 | 86,5 |

| Moscow | 89,0 | 88,7 | 88,0 | 88,0 | 88,4 | 88,4 | 88,2 |

| Saint Petersburg | 89,0 | 87,9 | 87,7 | 87,6 | 90,1 | 90,1 | 89,9 |

| Amur region | 136,0 | 130,1 | 127,3 | 131,1 | 116,4 | 116,1 | 113,9 |

| Arhangelsk region | 108,3 | 77,0 | 83,0 | 78,7 | 82,1 | 82,1 | 82,6 |

| Astrakhan region | 71,8 | 65,9 | 64,5 | 60,4 | 62,7 | 62,8 | 61,1 |

| Belgorod region | 93,3 | 91,6 | 91,8 | 92,0 | 89,3 | 89,2 | 88,5 |

| Bryansk region | 93,7 | 90,0 | 88,6 | 86,3 | 87,8 | 87,9 | 86,7 |

| Vladimir region | 85,1 | 85,3 | 85,8 | 85,7 | 85,2 | 85,5 | 84,9 |

| Volgograd region | 96,3 | 90,7 | 88,3 | 89,2 | 86,4 | 86,4 | 85,7 |

| Vologda Region | 101,3 | 98,9 | 99,3 | 99,9 | 88,1 | 88,1 | 83,2 |

| Voronezh region | 92,7 | 93,0 | 92,8 | 93,6 | 92,9 | 92,5 | 92,5 |

| Ivanovo region | 91,9 | 92,5 | 92,5 | 92,9 | 92,6 | 92,5 | 92,5 |

| Irkutsk region | 77,7 | 77,1 | 77,2 | 77,9 | 77,5 | 77,4 | 77,8 |

| Kaliningrad region | 63,6 | 60,3 | 60,3 | 61,3 | 62,9 | 62,9 | 64,1 |

| Kaluga region | 86,9 | 90,0 | 89,9 | 89,8 | 88,2 | 87,3 | 87,3 |

| Kemerovo region | 97,7 | 90,8 | 89,4 | 88,7 | 83,7 | 83,6 | 82,8 |

| Kirov region | 98,0 | 87,2 | 87,6 | 88,9 | 86,7 | 86,7 | 86,7 |

| Kostroma region | 86,0 | 86,5 | 86,2 | 88,0 | 85,4 | 84,7 | 84,7 |

| Kurgan region | 85,0 | 85,8 | 86,1 | 86,2 | 87,0 | 87,1 | 87,0 |

| Kursk region | 93,4 | 90,0 | 90,8 | 92,1 | 91,3 | 92,9 | 92,9 |

| Leningrad region | 88,8 | 86,2 | 87,0 | 88,9 | 81,7 | 81,6 | 81,3 |

| Lipetsk region | 103,2 | 104,7 | 105,6 | 106,9 | 92,8 | 87,7 | 87,7 |

| Magadan Region | 97,0 | 98,0 | 98,8 | 95,4 | 98,6 | 98,8 | 99,9 |

| Moscow region | 88,4 | 89,2 | 89,2 | 89,1 | 90,4 | 90,3 | 90,4 |

| Murmansk region | 232,4 | 122,1 | 103,2 | 84,5 | 81,2 | 81,3 | 78,9 |

| Nizhny Novgorod Region | 92,1 | 89,0 | 88,3 | 88,6 | 88,4 | 88,3 | 88,0 |

| Novgorod region | 98,6 | 95,8 | 95,1 | 97,6 | 89,9 | 89,9 | 86,9 |

| Novosibirsk region | 88,8 | 89,7 | 89,7 | 90,0 | 89,5 | 89,5 | 89,2 |

| Omsk region | 89,4 | 88,4 | 88,7 | 89,2 | 84,0 | 84,0 | 82,9 |

| Orenburg region | 73,7 | 71,5 | 69,9 | 70,8 | 70,1 | 70,1 | 69,7 |

| Oryol Region | 91,3 | 93,1 | 92,6 | 93,5 | 94,5 | 94,6 | 94,0 |

| Penza region | 90,8 | 91,1 | 91,1 | 90,7 | 90,9 | 90,8 | 90,3 |

| Pskov region | 90,7 | 89,2 | 88,1 | 90,7 | 87,2 | 87,3 | 88,2 |

| Rostov region | 91,0 | 92,7 | 92,9 | 93,7 | 91,9 | 90,2 | 91,7 |

| Ryazan Oblast | 82,2 | 82,1 | 83,9 | 85,6 | 84,9 | 84,9 | 85,0 |

| Samara Region | 84,5 | 83,4 | 83,2 | 83,9 | 84,4 | 84,3 | 83,8 |

| Saratov region | 87,6 | 84,1 | 83,6 | 84,0 | 84,9 | 84,9 | 85,1 |

| Sakhalin region | 72,0 | 98,9 | 97,2 | 94,7 | 103,1 | 98,6 | 97,6 |

| Sverdlovsk region | 91,1 | 91,7 | 91,5 | 91,3 | 88,2 | 88,1 | 87,1 |

| Smolensk region | 91,7 | 95,4 | 94,6 | 94,1 | 94,2 | 94,2 | 93,2 |

| Tambov Region | 96,6 | 96,3 | 97,2 | 99,1 | 95,4 | 95,3 | 95,7 |

| Republic of Crimea | 86,8 | 85,9 | 86,4 | 87,2 | 87,7 | 87,8 | 88,0 |

| City of Sevastopol | 81,1 | 81,4 | 81,3 | 81,1 | 82,0 | 82,1 | 82,1 |

| Baikonur city | 72,1 | 93,4 | 71,5 | 74,5 | 57,9 | 58,4 | 58,4 |

How to calculate your share of deductions? You can find out about this in ConsultantPlus. The experts not only gave the formula and comments on it, but also gave an example of the calculation:

Get trial access to K+ for free and go to the Ready-made solution.

New VAT tax agents

The new edition of clause 6 and new clauses 6.1 and 6.2 equated owners of watercraft and aircraft who did not register their transport in the registers within the prescribed period to tax agents for VAT.

This is important to know: Who is entitled to a tax deduction when buying an apartment?

Thus, starting from 2020, an organization that purchased a watercraft or civil aircraft and did not register it in the state register within 90 calendar days acquires the status of a tax agent. She will pay VAT on the cost of selling the vessel (the cost of work/services for its construction).

Please note that the Federal Air Transport Agency sends current information about registered vessels to the tax authorities every month no later than the 10th day of the next month.

This change was made by clause 2 of Art. 2 of the Law of September 29, 2019 No. 324-FZ.

What should you keep in mind regarding the percentage of deductions?

Exceeding the above safe percentage of deductions is not a violation. However, it is fraught with increased interest of tax authorities in the data included in the declaration. At a minimum, the inspection may ask you for clarification.

ConsultantPlus experts gave the procedure for this case:

You can view the full recommendations and explanations by getting trial access to K+ in the Ready Solution.

Read more about transferring deductions to a later date here.

What to do if the deduction amount is higher than the recommended standards?

If there is a lot of input VAT and it exceeds the recommended values, 2 options are possible:

- Leave your actual data and wait for a call to the commission;

- Transfer part of the deductions to later periods.

In the first case, an explanatory letter may be attached to the declaration indicating the reasons for exceeding the permissible percentage of the deduction share.

If the organization has chosen method 2, then deductions can be transferred to later tax periods, but no more than 3 years from the date of capitalization of inventory items. Taxpayers have this right since January 1, 2015, and it is regulated by paragraph 1.1 of Art. 172 of the Tax Code of the Russian Federation. The tax is claimed for deduction in the tax period when the company decided to actually declare it. In this case, the incoming invoice is recorded in the purchase book for this particular quarter.

However, there are exceptions to this rule. The tax must be deducted at one time if:

- subsequent sale of assets is taxed at a rate of 0% (Letter of the Federal Tax Service of Russia dated April 13, 2016 N SD-4-3/ [email protected] );

- fixed assets, equipment for installation or intangible assets are purchased (Letter of the Ministry of Finance of Russia dated 04/09/2015 N 03-07-11/20293);

- advances have been paid to suppliers or invoices have been received from tax agents (Letter of the Ministry of Finance of the Russian Federation dated 04/09/2015 N 03-07-11/20290). ⊕ Accounting for VAT on advances received in 2020

Let's look at an example.

Results

Tax authorities systematically process statistical information on VAT deductions. The results of such processing make it possible, in particular, to determine the average share of deductions for each region. Exceeding the value of this share is fraught with increased interest of the INFS in the process of forming the tax base for VAT.

Sources:

- Tax Code of the Russian Federation

- Official website of the Federal Tax Service of Russia

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

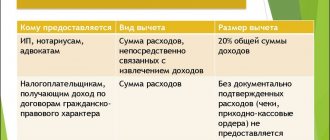

What is a tax deduction

An entire chapter in the Tax Code is devoted to value added tax - Chapter 21. The tax is calculated based on the requirements of Article 166 of the Tax Code of the Russian Federation.

Tax deductions represent those amounts that reduce the amount of tax for transfer to the budget . Thus, the VAT that “comes” to the company with purchases can be deducted and reduce the amount of tax. The full list of deductions is prescribed in Article 171 of the Tax Code of the Russian Federation. The main ones are the following:

- The amount of VAT when purchasing goods (works, services) in our country for use in activities subject to VAT

- VAT on travel and entertainment expenses

- VAT on construction and installation work for yourself

- VAT on advances

- Other types of deductions

Deductions are accepted only if there are supporting documents, the main one of which is an invoice. Documents must be prepared in accordance with established rules, otherwise deductions will not be accepted and you will have to pay additional tax.

Why is a high share of VAT deductions dangerous?

To ensure that deductible write-offs do not exceed a safe level, any taxpayer has the right to shift part of them to another period (Article 172 of the Tax Code). However, if deductions cannot be reduced to a safe level, it will be necessary, if necessary (request from tax authorities), to write an explanatory note to the tax service, which will provide detailed explanations about the reasons for the high values of your deductions. It is advisable to prepare for submitting such a note in advance. What reasons should you give? This could be, for example: a company has recently opened, a small sales volume, and so on.

The explanatory note should also be accompanied by copies of invoices with the highest values for input value added tax, as well as copies of documents confirming the need to increase VAT deductions (this could be: new lease agreements, supplies, and so on).

explanations in ".docx" format : doly-vichet-nds.docx

This is important to know: Is it possible to get a property tax deduction for a second time when buying an apartment?

If the explanatory note is not provided or submitted on time, the legal entity, in accordance with Article 129.1 (clause 1) of the Tax Code of the Russian Federation, will have to pay a fine in the amount of 5 thousand rubles (clause 1 of Article 129.1 of the Tax Code of the Russian Federation). For subsequent violations in accordance with the same article (clause 2) throughout the calendar year, the fine amount increases to 20 thousand rubles.

If the arguments presented in the explanatory note are not convincing to the tax inspectorate, then the head of the company and the chief accountant may be called to discuss this issue, or an on-site inspection commission will be held at the enterprise itself.

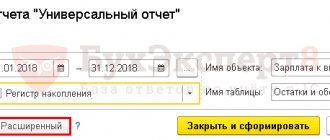

How to calculate the safe share of VAT deduction in 2020

Calculate the share of deductions using the tax authorities’ method. They divide all deductions by region by the entire accrued VAT. The result is converted into percentages. You need to do the same, only within your company. Divide all deductions for the first quarter by the entire accrued tax and multiply by 100 percent. This is your percentage of deductions. To find out if your deductions are within a safe limit, check the rate for your region in the table at the end of the article. Find out what threatens VAT deductions

Example. How to determine the share of VAT deductions