General characteristics of federal taxes and fees

The system of taxes and fees is established in Chapter 2 of the Tax Code of the Russian Federation. It involves dividing mandatory payments into federal, regional and local. At the same time, the criterion according to which their composition is determined is not the recipient of payment (receipt to the budget of a certain level) or the administration procedure, but the authorities that establish the rules of calculation and collection, as well as the territory in which the corresponding act will operate.

The definition of such mandatory payments is given in Art. 12 of the Tax Code of the Russian Federation. Federal taxes and fees are payments established by the Russian Federation, represented by authorized bodies, according to a certain procedure, and mandatory for payment, as a rule, throughout the country.

The general characteristics of these payments suggest the following characteristics:

- The law refers the establishment of these taxes and fees to the federal level. Regional and local authorities do not have the right to make decisions regulating the administration, accounting and control of such payments, as well as any other rules relating to federal taxes. Examples include VAT and duties;

- The legislation requires the establishment of these mandatory payments by a certain authority. Only the State Duma can do this. No governing body (agency, service, control, etc.) can perform the functions of establishing taxes and fees;

- The law regulates the process of adopting acts providing for each new mandatory payment. The calculation is made on maintaining the unity of the tax system;

- Payments are required throughout the Russian Federation. These do not include special tax regimes.

What are federal taxes?

Federal taxes paid on the territory of the state are special fees levied on individuals and legal entities, as well as citizens who have received the status of individual entrepreneurs. They are established exclusively by the Tax Code of the Russian Federation. And since the provisions of a regulatory act can be changed only by adopting a new federal law, the right to edit provisions on federal taxes has:

- The State Duma.

- Council of the Federation.

- The president.

Payments go to the budget and are then implemented directly by the authorities in accordance with the current state of affairs.

The difference between federal and regional and local payments

The main difference is that all mandatory elements of taxes are determined at the federal level. These include the calculation procedure (calculation), the procedure and terms of payment, rate, base, tax period and object of taxation.

An example is the rules on establishing VAT. At the regional and local level, we are talking only about the ability to determine individual parameters. These include rates, payment procedures and terms. Also, regional and local authorities can resolve issues of determining the base and apply benefits if such powers are provided for by the Tax Code of the Russian Federation.

The differences also include the effect of regional and municipal acts in space. It is limited by the corresponding administrative boundaries, within which local and regional acts are mandatory.

There is an opinion that the system of mandatory payments involves administration, accounting and control at the local level. It does not correspond to the real situation. Administration and control of payment of all types of taxes is carried out by the Federal Tax Service. Local authorities cannot create a specialized agency or service to perform these functions.

Regional and local taxes in 2020

Such taxes and fees exist in every subject of the Russian Federation, just as local taxes exist in a separate municipality. The list of types of mandatory payments is established not at the federal, but at the regional and local levels. They may change depending on the decisions of the relevant authorities operating at the level of constituent entities or municipalities. However, the Tax Code of the Russian Federation plays a decisive role in the formation and establishment of the procedure for payment of these taxes. Regional taxes include:

- on the organization's property;

- for gambling business;

- transport.

Read also: Procedure for checking a counterparty on the tax service website

The list of local tax payments in 2020 includes:

- land;

- on the property of individuals.

The same list includes a trade tax, the procedure for calculation and payment of which is established by Art. 411, 412 Tax Code of the Russian Federation. The amount of such payments is determined at the level of constituent entities of the Russian Federation and local. For example, the payment rate for the property of a legal entity is regulated by regional authorities, guided by the provisions of the Tax Code of the Russian Federation. The specified rate depends directly on the place of registration of the organization whose property is included in the taxable list.

Most regions of Russia establish payment obligations based on the cadastral value of the property. However, the location to which payments for such property are transferred depends on its location. If the property in question is located at the registration address of the parent organization, then no questions arise. However, if these addresses do not coincide at the level of constituent entities of the Russian Federation, then transfers will be made to the budget of the subject in which the property is actually located.

One of the distinctive features is the absence of the right of local and regional authorities to inflate the rates specified in the Tax Code of the Russian Federation. They may be lower than the established ones, but not higher. This rule protects the rights of payers from arbitrariness and artificial inflation of various types of contributions to the state.

Functions and significance of federal taxes and fees

The federal tax system performs 2 main functions.

The fiscal task is associated with the need to fill the budget, the income of which is formed by tax revenues from citizens and organizations. According to the provisions of the Russian constitution, a significant part of the powers is transferred to the center. For this reason, governing a country requires a developed and predictable system for paying fees and taxes. This is also related to the fact that each tax office is part of a single structure. This service carries out administration, accounting and control over the fulfillment of duties in the field of mandatory payments.

Another function is economic stimulation. In order for the budget to receive revenue, it is necessary to provide conditions for business activity. Therefore, the tax system is subject to constant adaptation to the changing requirements of the economy.

The classification of a significant number of individual mandatory payments as federal is intended to ensure standard rules throughout the Russian Federation.

This serves as one of the integral elements of a single economic space.

These functions may seem to be in conflict. However, the tax regime should help to find the right balance of interests of public and private entities. An example is VAT. Accurate calculations make it possible to develop the economy and support the social sphere, benefits for certain categories of citizens and organizations. Benefits can also serve as a tool to stimulate investment.

Types of federal taxes and fees

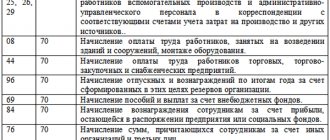

According to Art. 13 of the Tax Code of the Russian Federation, federal taxes and fees include the following mandatory payments:

- VAT;

- all types of excise taxes;

- personal income tax;

- corporate income tax;

- MET;

- water tax;

- state duty;

- fees associated with the use of fauna and aquatic biological resources.

These payments can be divided into taxes and fees and grouped according to several criteria.

In the case of taxes, the obligation to pay them is not related to receiving specific services in return. For this reason, the tax service (inspectorate) carries out their administration, control and accounting. Income from them, especially VAT and personal income tax, largely forms the budget.

The nature of the fees differs significantly. They are associated with the provision of a specific service in return. For example, the procedure for registering organizations requires payment of a corresponding fee. The result of this procedure is the receipt of the service of entering information about a legal entity into the Unified State Register of Legal Entities.

If the necessary fees are not included in the budget, then registration of organizations is not carried out. As for administration and control, no accounting is carried out, since the fact of payment is verified by the body providing the service (service, agency, department, inspection and others).

Federal fees include all types of state duties, as well as fees associated with the use of wildlife and aquatic biological resources.

The remaining mandatory payments provided for in Art. 13 of the Tax Code of the Russian Federation, relate to federal taxes.

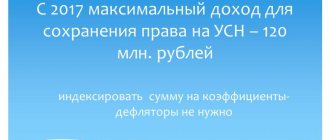

Taxes and special regimes

In addition to the previously discussed groups of taxes, the Tax Code of the Russian Federation identifies so-called special regimes, the use of which exempts from payment of income tax, personal income tax (for individual entrepreneurs), VAT, property tax of organizations and individuals, but introduces the obligation to pay a single tax.

The following modes are distinguished:

Read about the specifics of calculating and paying this tax in the “STS” section.

The materials in the “UTII” section will help you switch to UTII and organize activities in this mode.

- regime for agricultural producers;

For materials on calculation, payment and reporting in this mode, see the “Unified Agricultural Tax” section.

- production sharing agreement;

- patent system.

The nuances of the patent taxation system can be found in the “PSN” section.

Tax legislation occupies an important place in the mechanism of economic development of any legal state.

The procedure for establishing taxes and fees

In order for taxpayers to have an obligation to pay, a number of procedures must be followed. They include the right to make a decision, its form and content.

According to the requirements of Part 2. Art. 12 of the Tax Code, acts establishing new taxes and fees must be adopted by a representative body of government. This is the State Duma, which adopts legislation.

This system of adopting tax acts is traditional. It is believed that deputies elected by taxpayers have the right to make such a political decision. If decisions could be made by governing bodies whose composition was formed administratively (agency, service, inspection and other types of executive structures), then chaos would arise in the industry.

The system related to the consideration of tax bills has also been streamlined. The list of its subjects is limited by Art. 104 of the Russian Constitution. Among the governing bodies granted this right are the Government of the Russian Federation and the President.

At the same time, any tax bill can be introduced only if there is a government conclusion. This applies to any subjects, including Duma deputies. At the same time, the opinion of this body is not taken into account. In order for the right to review a project to appear, cost estimates or characterization of the impact on budget revenues are important.

If a draft law is developed by a separate body that carries out management (agency, inspection, service), then it must be agreed upon by all higher executive bodies. The current practice requires the conclusion of the Ministry of Finance as the structure that implements the basics of tax policy. The outcome of the initiative is its consideration by the Government. If it is approved, then the project is submitted to parliament.

Features of establishing payment obligations

The law requires that new taxes be introduced in the form of additions or changes to the Tax Code of the Russian Federation. Adoption of a legislative act in another form is not permitted.

The timing of implementation of changes is also important. As a general rule, amendments cannot come into force earlier than 1 month from the date of publication. In addition, they cannot come into force before the next tax period.

Another important rule is complete tax certainty. The adopted rules require the following list: object of taxation base, rate, tax period, calculation procedure (calculation) and payment procedure. If at least one of these elements is missing, the tax is considered unestablished and the taxpayer has the right not to make payment to the budget.

However, benefits are not a mandatory element of this payment. Their establishment depends on the specific situation. Often benefits are provided to pensioners and disabled people, allowing them to receive additional income.

Establishing a fee (duty) involves determining the payer and some of the elements of the tax. In particular, there is no tax period.