To generate documents for individual entrepreneur registration, you can use the free online service directly on our website. With its help, you can prepare a package of documents that meets all the requirements for completion and legislation of the Russian Federation.

What to choose - career growth or your own business? Employment is a more reliable option, but many people want to try their hand at business. At first, it would be great to combine entrepreneurial activity and work. Is this legal? In other words, is it possible to open an individual entrepreneur if you are officially employed? Let's look at what the law says about this.

What is IP

An individual entrepreneur (IP) is not a form of company, not a position, but a special status of a citizen. Once you receive it, you can legally do business. So being an entrepreneur and at the same time working under an employment contract is absolutely legal for most citizens.

Why for the majority and not for all? The fact is that there are still restrictions associated with professional activities. It is established for those whose work involves serving the state. First of all, these are military personnel, but not only them. Is it possible, for example, for a civil servant to open an individual entrepreneur? No, this is prohibited by the law on the state civil service. A civil servant cannot engage in entrepreneurial activity either personally or through proxies. He also does not have the right to participate in the management of a commercial organization.

A similar ban on doing business is established for military personnel of any positions and ranks - it is established by the relevant law on their status. There are legislative restrictions for deputies, as well as heads of municipalities.

Doubts often arise whether it is possible for a citizen to open an individual entrepreneur and run a business if he is officially employed in a budget organization. It depends on whether he is a civil servant. If not, then maybe. The mere fact of working in the public sector does not impose restrictions.

Free consultation on individual entrepreneur registration

Is it possible to register as an individual entrepreneur if there is an official job?

Often, citizens who have an official job may be looking for additional part-time work, and therefore think about whether it is possible to register an individual entrepreneur in this case. It is necessary to focus on the fact that an individual entrepreneur has a dual status:

- individual (citizen);

- business entity.

In accordance with this, it can be assumed that, on the one hand, he has the right, as an individual, to work for hire under the terms of an employment contract, and on the other hand, to conduct business as an individual entrepreneur. This assumption is absolutely correct.

A citizen has the opportunity to work in both statuses - both as an employee and as an individual entrepreneur. However, it is necessary to take into account that there are some restrictions, for example, civil servants cannot register individual entrepreneurs.

The two types of work activities are not related to each other, and therefore an individual can cooperate with his employer in both of them. For example, as a full-time employee, he can work as a manager, and as an individual entrepreneur, provide services under a GPC agreement when developing business card designs.

Should I notify the employer?

The law does not oblige the entrepreneur to inform the employer about his new status, and there is no need for this. Work for hire and within the framework of your own individual entrepreneur have no documented overlap. In other words, an entrepreneur does not need to make an entry in his own work book, since he cannot work in “his own” individual entrepreneur. After all, according to the law, a citizen cannot enter into an agreement with himself.

But upon learning that the employee has become an entrepreneur, the employer may offer him to re-register the relationship, that is, instead of an employment contract, enter into a civil law one. This is much more profitable for the employer - fewer mandatory payments.

There will be a benefit for the individual entrepreneur himself - he will be able to save a little on tax. After all, personal income tax is withheld at a rate of 13% from the wages paid by the employer. If an individual entrepreneur switches to a preferential tax regime, for example, to the simplified tax system with the object “Income,” then he will pay 6% tax on the same amount.

Let's give an example. Employee Ivanov I.I. received a salary of 56,500 rubles, including personal income tax of 13%. That is, they gave him 50,000 rubles in his hands. If he becomes an individual entrepreneur using the simplified tax system of 6% and, instead of an employment contract, enters into a civil contract with his company, then with the same cost of services, his income after tax will be 53,110 rubles (56,500 - 56,500 * 6/100).

Why is combination needed?

Citizens studying the question of whether it is possible for an individual entrepreneur to work officially at another job do not always fully understand why this is actually necessary.

Having the status of a business entity during official employment has its advantages:

- Thanks to the registration of an individual entrepreneur, a citizen has the opportunity to carry out professional activities, simultaneously engage in business and receive wages.

- products can be promoted through specialized websites, subject to the availability of certificates issued by government agencies to citizens with individual entrepreneur status;

- Thanks to large-scale marketing activities, a business entity will be able to quickly bring its business to the regional market, confidently outperforming its main competitors;

- heads of commercial structures do not object to combining the work of a citizen and a business entity;

- Some employers plan to minimize tax costs by hiring an individual entrepreneur.

Doing business as an individual entrepreneur

Federal legislation allows Russian citizens to combine running their own business with performing professional duties. In this case, there should not be any negative impact on the final result of work from the staff member.

If an individual entrepreneur seeks to earn additional income, he needs to find out whether an individual entrepreneur can work in another organization. Having this status can lead to a variety of problems at the third-party facility. First, he should study the regulations governing this issue. After receiving the necessary information, an individual can begin planning to build a career with an employer. When registering as a member of the state, a citizen is not obliged to notify his superiors about the status of a business entity.

Risks for an entrepreneur

But the benefits calculated above are obvious only at first glance. The fact is that when cooperating with an entrepreneur, his former employer will stop paying insurance premiums for him. The individual entrepreneur will pay them himself, but in a much smaller amount. This will lead to the fact that his insurance period and pension coefficient will accumulate more slowly, and the pension will be small.

There are also other guarantees that work under an employment contract provides. For example, annual paid leave, temporary disability benefits (sick leave), maternity and other payments. Some employers compensate for the use of a personal car, transportation costs, mobile phone costs, and sports activities. But all this will end with the termination of labor relations.

In addition, inspection authorities may suspect a substitution of the type of contract. This may be regarded as the employer’s desire to save on mandatory payments. If the relationship between a company and an individual entrepreneur has signs of employment, the contract can be reclassified as an employment contract, with additional taxes and contributions being assessed.

For example, if in an agreement with an individual entrepreneur it is written that he must comply with the internal rules adopted by the company, then this will be a clear sign of an employment relationship. The same applies to the establishment in an agreement with an entrepreneur of payments that relate to labor - compensation, bonuses, wage calculation based on salary, and so on.

The difference between work for hire and cooperation with a company in the status of an individual entrepreneur also lies in who must provide working conditions. If a person is employed, then this is the responsibility of the employer. If he is hired to perform certain work as an entrepreneur, then he must ensure working conditions himself. This means, for example, that he must use his own tools, equipment, etc. At the same time, he has the right not to comply with the daily routine established in the company, as well as not to obey any other internal documents.

Is it possible to get hired by a company as an individual entrepreneur?

It happens that a citizen has opened his own business, but has not yet received the desired result, or he has received a lucrative job offer. Can he get a job again in a company with individual entrepreneur status? Of course, there are no obstacles to this. It is only important to remember that an individual entrepreneur pays contributions for pension and health insurance for himself the entire time he is registered in this status. This does not depend on whether he is active or not. If an entrepreneur decides to completely end the business and work for hire, he needs to deregister.

Can management find out about the individual entrepreneur?

Many employees are afraid that their company's management will find out about their business activities. Could this happen? Yes, it is very easy to find out that a person is registered as an entrepreneur. After all, this information is not confidential. On the contrary, data on each individual entrepreneur is openly contained in the Unified State Register of Individual Entrepreneurs (USRIP). Any interested person can obtain information from it directly on the tax service website.

So the employer can find out about the business. Will this have negative consequences? Let’s just say that the law allows you to be an individual entrepreneur and work under an employment contract, so the employer’s claims will be unfounded. The fact of running a business also cannot be a basis for dismissal. If this happens, there is a reason to contact the Labor Inspectorate.

Hiring an individual entrepreneur for work under an employment contract

There may be cases when an already registered individual entrepreneur gets a job under an employment contract. The work of an individual entrepreneur for an individual entrepreneur is not prohibited by law. There is also no need to close the IP. Just keep in mind that the status of an entrepreneur does not provide any privileges during a job interview.

For the employer, it does not matter whether he enters into an agreement with an ordinary citizen or with an individual entrepreneur. If an individual entrepreneur hires an individual entrepreneur, then according to the standard procedure he will make payments to the employee and state funds, and pay contributions for him.

According to the clauses of the legislation of the Russian Federation regulating the responsibilities of individual entrepreneurs, an individual with this status must pay insurance premiums for himself.

From the above it follows that for an entrepreneur working under an employment contract, both his employer and he himself are obliged to make contributions to the Pension Fund and the Social Insurance Fund. All this will ultimately affect, for example, the size of the pension (in a positive direction).

An individual entrepreneur is required to pay insurance premiums for himself even if he does not receive any profit from the business.

True, there is an exception in the form of grace periods when an individual is not able to conduct business activities.

These include:

- service in the RF Armed Forces;

- care for a child up to 1.5 years old/a person over 80 years old/a disabled person.

Also, individual entrepreneurs who are spouses of diplomatic mission employees or contract military personnel who are unable to find employment for 5 years may not pay insurance premiums for themselves.

In 2020, the minimum insurance premium for an individual entrepreneur is 32,385. If his income exceeds 300,000, then another 1% above this limit is added to the minimum level. For example, with an income of 600,000, an entrepreneur will have to pay a total of 35,385 (+3,000).

If an individual entrepreneur has a staff of employees, then he is obliged to contribute a total of 30% of payments under employment contracts to insurance funds for them. There are completely legal ways to reduce these contributions.

How to open an individual entrepreneur for a working person

Now let's look at how to open an individual entrepreneur if you are officially employed. The registration procedure for those who work does not differ from the standard one. Here's what to do:

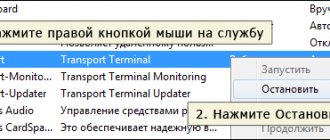

- Select the authority to which documents will be submitted. The inspection can be found on the Federal Tax Service website at your address. In addition, documents can be submitted to some MFCs.

- Decide how documents will be submitted - in person, through a representative, by mail or online. The latter option is possible with an electronic signature.

- Select statistics codes for your activities from the All-Russian OKVED classifier. Codes with a length of at least 4 digits are suitable. One of them should become the main one, the others will be additional.

- Pay a state fee in the amount of 800 rubles to the details of the registering Federal Tax Service. If documents are submitted electronically, no fee is paid.

- Fill out an application in form P21001 (Federal Tax Order No. ММВ-7-6/ [email protected] ). On the last page you must indicate your e-mail address - the registration result will be sent to it. But you don’t need to sign!

- Visit a notary if the future individual entrepreneur does not go to the MFC or the tax office himself. The notary certifies his signature on the application, as well as a copy of his passport. If a representative carries the registration documents, you will additionally need to issue a power of attorney.

- Take the documents to the tax authority or send them in another chosen way.

- After 3 working days, receive an extract from the Unified State Register of Individual Entrepreneurs by e-mail. When contacting the MFC, the period may be longer. This will mean that the individual entrepreneur is registered.

- If you receive a refusal due to problems with documents, redo the application without errors and apply for registration again. If you do it within 3 months, you don’t need to pay the state fee a second time.

Taxes and contributions of individual entrepreneurs working for hire

So, we answered the question whether it is possible to work officially as an employee and open an individual entrepreneur at the same time. Now let’s figure out what will happen to taxes in such a situation.

In relation to the employee, the company is a tax agent and insurer. This means that she withholds personal income tax from the amounts due to him at a rate of 13%. In addition, the employer pays contributions to the budget for the employee’s pension, medical and social insurance, and from his own funds. What to do with all these payments if a citizen has received the status of an individual entrepreneur?

The answer is simple - all these payments will remain. That is, nothing will change in terms of the amount that a citizen earns as an employee. But the individual entrepreneur makes all transfers from business income himself in accordance with the taxation system he has chosen.

And another popular question: is it possible to open an individual entrepreneur and not pay insurance premiums if you are officially employed? After all, the employer continues to do this. No, you won't be able to save money. From the amounts that an individual entrepreneur receives from his business, he is obliged to pay contributions to pension and health insurance himself.

One big disadvantage of working as an individual entrepreneur for hire

The main disadvantage is one, but it is significant. During your employment, you are not exempt from paying fixed contributions as an individual entrepreneur. For example, in 2020 you will have to give 40,874 rubles to the state in the form of personal contributions.

It turns out that you cannot simply “abandon” your IP. It is advisable to continue working in parallel with hired employment in order to “recapture” at least 40 thousand rubles. insurance premiums that will have to be paid to the state.

It is cheaper to close an individual entrepreneur than to keep it “in reserve”.

And, if you can’t combine two jobs, it’s better to close the individual entrepreneur, it costs only 160 rubles. If necessary, you can always open an individual entrepreneur again for 800 rubles. If all transactions are completed electronically through the gosuslugi.ru portal, then you will not spend any money at all. While you pay insurance premiums for an “inactive individual entrepreneur” every month, at least 3,400 rubles.

Let's sum it up

We found out that a person who works for hire can simultaneously engage in business. Whether he should quit, time will tell. Practice shows that individual entrepreneurial activity is rarely profitable at the start.

An officially employed person, having opened an individual entrepreneur, retains the right to all the guarantees that the employer must provide him. They pay taxes and contributions together: the employer - from wages, the entrepreneur - from business income.

The registration process for an employee does not have any special features. There is no need to notify the employer that the employee has become an entrepreneur. If desired, a citizen can quit and then get hired for another job - the status of an individual entrepreneur is not a hindrance to this. It is only important to remember that if no activity is carried out, the obligation to pay contributions is not suspended.

Impact on relationship with manager

When concluding an employment agreement with the head of a commercial organization, an individual is not required to notify about the status of a business entity. Due to the fact that the entry about the individual entrepreneur will not be entered into the employee’s work book, the employer does not need this information.

Benefits for pensioners for individual entrepreneurs - is it possible to open them, pros and cons

But the working relationship between a manager and a full-time employee who is an individual entrepreneur can be negatively affected by the presence of the corresponding status.

Important! Every boss is primarily concerned with the issue of the employee fulfilling his professional duties in full.

If entrepreneurship does not interfere with your main job, then having the status of an individual entrepreneur will not have a negative impact on relations with management.

The relationship between the individual entrepreneur and the company management

If an individual is a highly qualified specialist in his profession, he may eventually think about starting his own business. This desire can lead to dismissal from the main place of work, causing concern on the part of management about staff turnover, especially if this is an employee of a bank or similar place. Before notifying the owner of the company, it is better for him to find out from lawyers or tax authorities whether a working person can open an individual entrepreneur.

Important! In order to avoid the emergence of conflict situations in the future, both with the employer and with regulatory authorities, a citizen-entrepreneur must switch to civil law relations.

When drawing up an appropriate agreement, the following factors must be taken into account:

- Parties to the transaction can only be the head of a commercial company and a business entity - an individual. If the parties have drawn up and signed a civil agreement, then they will not have to indicate the position occupied by the individual entrepreneur.

- Salary to an individual with the status of an individual entrepreneur is paid for the amount of work performed. Its value will not be affected by the following factors: salary, cost of one hour of work, etc.

- In such agreements there is no need to indicate the presence of special working conditions, the absence or presence of a social package.

- An individual does not have the right to transfer commercial information obtained at the main place of work to third parties.

- A business entity that is officially employed is not required to follow internal regulations. He does not need to follow any rules invented by the employer.