When concluding an employment relationship, all requirements of the Labor Code of the Russian Federation must be observed; in case of violation of the established rules, a fine may be imposed on the employer for an unregistered employee.

In the case where the employee has actually started work, the employer is given three days to prepare documents. The contract is bilateral, so one copy remains with the employee, the other with the employer, despite this, employees sometimes wait for months for their document, especially if the company’s head office is located in another region.

Reasons for introducing liability for violation of employee registration

Any work must be formalized, be it the establishment of labor relations with a hired worker of an individual entrepreneur, with an employee of an LLC, a state-owned enterprise, or a company. What are the dangers of neglecting these responsibilities?

Unregistered workers, receiving wages “in envelopes,” doom themselves to the following possible consequences of such a relationship with the employer:

- they are not protected from the arbitrariness of the manager in the event of illegal dismissal, delay or cancellation of vacation, untimely payments, etc.;

- are deprived of state support in the insurance sector;

- they lose in length of service and contributions to the Pension Fund, and therefore in their future pension.

The damage to the state is the arrears of a significant amount of taxes and fund contributions.

Such serious negative consequences have led to a serious attitude towards this type of offense on the part of regulatory authorities. The employer's responsibility for unregistered employees has been tightened.

Liability of legal entities

If the employer who hired the employee unofficially is a legal entity, the company may be subject to a fairly large fine - from 30 to 50 thousand rubles, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Sanctions can also be applied to the head of the enterprise, to the head of the personnel department, as well as to any person responsible for proper employment.

If the illegal actions of an organization repeatedly cause financial damage to the state budget, the amount of fines increases accordingly to 200 thousand rubles, and the responsible persons may be disqualified.

Also, the administrative responsibility of the employer arises if documents related to the employment of company employees are filled out incorrectly. The same applies to evasion of proper registration of labor relations.

The responsibilities of those responsible for maintaining documentation include timely completion of documents in accordance with established standards; the slightest mistake can lead to the application of penalties in ruble equivalent:

- officials - from 10 to 20 thousand;

- IP and physical persons – from 5 to 10 thousand;

- legal persons – from 50 to 100 thousand.

A separate category is labor relations with foreign citizens. In relation to such workers, personnel officers should be especially careful, because financial penalties in this case are much higher than in the case of improper employment of Russians.

https://youtu.be/ZFXrdN9GFU4

So that there are no problems

To avoid many troubles, which we will talk about below, you need to formalize your employment relationship on time and correctly. In order for an employee to be officially hired, the employer must:

- conclude an employment contract with him;

- be registered with the Pension Fund of Russia and the Social Insurance Fund and submit relevant reports there on time;

- document the personnel procedure: application from the person being hired, enrollment order, registration of a personal card, entry in the employment record, signature in familiarization with the job description, etc.

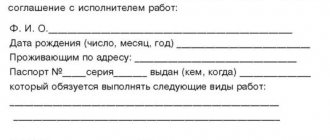

The main evidence of the formalization of the “employee-employer” relationship is an employment contract with the signatures of both parties. When applying for a job, it must be drawn up and signed in 3 identical copies: for the employee, for the employer and for submission to the Employment Service. The contract must indicate:

- full name of the person being hired;

- employer details;

- the position for which the employee is applying (must correspond to the qualification list);

- handwritten signatures of the employer and employee.

An incorrectly drawn up employment contract is already a reason for a fine, and its absence can lead to more serious liability.

IMPORTANT INFORMATION! The law allows no more than three days to register an employee; further delays are considered a violation punishable by a fine.

Fines for the employer if the employee is not officially registered

One of the goals of business is to reduce costs as much as possible. In a number of cases, companies and organizations violate the law. The most common example is the informal employment of employees. Businesses resort to such measures for the following reasons:

- the absence of concluded employment contracts makes it possible not to pay taxes for employees;

- if employees are not on staff, then the employer does not pay contributions to the pension fund, Social Insurance Fund and Compulsory Medical Insurance Fund;

- the administration has no formal obligations to the staff (for example, workers can be laid off without severance pay due).

There are a number of serious risks associated with using this scheme. If the employer is caught in violations, liability for failure to register an employee can bring much greater losses, compared to possible savings on taxes and other payments.

Two types of responsibility

Individuals and legal entities, using the labor of hired employees, are differently responsible for their registration before the state.

It often happens that individual entrepreneurs ignore employment contracts, which does not relieve them of responsibility if this fact is established, especially against the backdrop of tightened control. Legal entities more often commit violations and delays in registration. Both of them face very serious, albeit different, penalties for such violations.

Let's consider the forms of liability depending on the type of employer.

What threatens the “thrifty” individual entrepreneur

If a private entrepreneur does not do all the work himself, but hires other people, he must comply with the requirements of the Labor Code of the Russian Federation. It is quite understandable to want to save on taxes and deductions; you don’t want to waste time and effort on official registration. However, if illegal employees are identified, the individual entrepreneur may receive such troubles and financial losses that no savings on payments can compare with them.

If an employee has worked for hire for 3 or more days, and no contract has been concluded with him, this will delay the start date of tax collection and the counting of the length of service, which means damage will occur. The later the employee is registered, the higher the damage. Depending on the time of delay and the number of such employees, liability may be administrative or criminal.

The administrative responsibility of an individual entrepreneur includes:

- imposition of a fine in the amount of 1-5 thousand rubles. for each employee;

- forced suspension of the organization’s work for up to 90 days.

Significant violation of registration deadlines and the absence of employment contracts for a large number of workers indicate that the amount of taxes and deductions not received by the state is very significant. Such a violation requires more serious liability, especially if the perpetrator is unable to pay damages. When the violation is not under an administrative, but under a criminal article, the amount of fines and types of sanctions are different.

Individual entrepreneurs face criminal liability :

- a fine in the amount of 100-300 thousand rubles;

- imprisonment (real, not suspended) for up to 2 years;

- After serving time in prison, the entrepreneur will never again be able to engage in business in the area where he committed this offense.

FOR YOUR INFORMATION! Any type of liability obliges the violator to first compensate the treasury for losses caused in the form of unpaid taxes and fees, and then be punished by a fine.

Is it possible to work without an employment contract?

Labor law rules determine that the basis of labor relations is the execution of an employment contract between the parties. The provisions of legislative acts do not define the concept of informal employment.

But based on their content, it can be established that the type of relationship between the employer and the employee is when an employment contract is not signed between them, entries are not made in the work book, and wages are issued unofficially.

Therefore, an employee hired in this way is not considered an employee of the company, is not included in its payroll, contributions are not paid to him, and as a result, this period is not counted as part of the length of service that gives the right to receive a pension.

Current regulations stipulate that working with an employee without drawing up an employment contract is not allowed. This is a serious offense both on the part of the employer and on the part of the employee himself.

Important! If this fact is revealed, liability measures are applied to these entities. Therefore, working without an employment contract is prohibited by law. See how to officially hire an employee.

How will a legal entity be responsible for errors in employee registration?

At enterprises of this form of ownership, the persons responsible for hiring and registering employees are the director and personnel department employees.

If the violation is minor and consists only of a relatively small delay or inaccuracies in registration, and also if we are talking about 1-2 employees, the fine will be issued not to the responsible persons personally, but to the enterprise. The amounts are significant - from 100 thousand rubles. for each incorrectly or lately registered employee.

If such offenses are detected repeatedly, and their scale is significant, we are talking about particularly large amounts of damage. In addition to a fine for the enterprise, the perpetrators will be punished personally: HR department employees are dismissed under the appropriate article (without severance pay), and the director can spend a long time on public works or “in places not so remote.” The punishment is determined depending on the degree of damage.

Responsibility of individual entrepreneurs for informal employment

For an unregistered employee - administrative responsibility

If the fact of unofficial hiring of employees is revealed, the entrepreneur faces administrative liability. The fine for an unregistered employee can range from 1 to 5 thousand rubles for an entrepreneur, but the activities of the enterprise can be suspended for 90 days, which leads to large losses and often becomes the reason for its closure.

The costs of officially employing an employee will be significantly lower than the losses from penalties. However, if an employee has been working unofficially for more than one year, and all this time taxes have not been paid to the state, then it is possible to initiate a criminal case under Article 199-1 of the Criminal Code of the Russian Federation.

Causing damage to the state on a large scale is punishable by either a fine for an entrepreneur in the amount of up to 300,000 rubles, or imprisonment for a period of 2 years. In case of criminal prosecution and proof of guilt, the entrepreneur will be deprived of the right to engage in such activities for a long period.

Usually, when unofficial employment is identified, the task of government agencies is not to close the enterprise, but to ensure payment of all taxes due to the budget, as well as compensation for non-payment in the form of fines. This will cause serious financial damage to an individual enterprise, so it is better not to risk it and immediately fill out all the necessary documents and notify the tax office.

How “illegal” employees can be caught

To establish and suppress violations in labor legislation, there are regulatory authorities. There are quite a few of them, but the most common “headache” directly related to employee rights is tax and labor inspections. The legislative system of inspections is based on Federal Law No. 294, and the tax office inspects enterprises in accordance with Chapter 14 of the Tax Code of the Russian Federation. Both of them can catch “illegals”.

Tax passions

The fact of a violation can be revealed as a result of a desk (upon submission of reports) or an on-site (in-depth and thorough) inspection. Tax officials have the right to study in detail the current year of activity and the 3 previous ones, while they are allowed by law to interview witnesses, inspect premises, seize documents, etc.

IMPORTANT! The employer must review the inspection permit and the inspectors' credentials.

Based on the results of the inspection, a special certificate indicates its subject and timing. Based on the certificate, a report is drawn up with the identified violations and instructions for their elimination, for which the employer has 2 weeks.

Pros and cons of working without a contract for an employee

This side of the labor relationship has both its pros and cons.

The positive aspects include:

- The employee receives a higher salary, i.e., in fact, the tax is not withheld from him in favor of the budget.

- Minimum possible liability. There is no official contract, so he cannot be officially held accountable for damage to property, waste, shortages, etc. If the employer tries to do this unofficially, then you can always file a complaint with the regulatory authorities.

- No deductions are made from wages based on writs of execution, since there is no official registration.

- The opportunity to work in cases where this is officially impossible - for teenagers, pensioners, and the disabled.

At the same time, there are significant disadvantages:

- The employer may not provide a guaranteed period of annual leave or pay for it in full.

- Sick leave is not paid officially (only by agreement with the employer).

- There is no special assessment of workplaces, and special clothing to protect against harmful factors is not issued.

- Pension and work experience do not count, there are no contributions to pensions.

- An employee can be “fired” at any time, and the employer may not even pay the money he earned.

You might be interested in:

An employment contract with an employee: what it should contain, the procedure for concluding, a standard form

Protecting the right to work

The labor inspectorate can visit any organization during a scheduled inspection. An unscheduled “invasion” of inspectors can be provoked by a complaint from an offended employee or a disgruntled competitor. A joint inspection raid with other control bodies is also possible.

The labor inspectorate draws up a protocol with the following information:

- Full name of the inspector;

- identified violations;

- recommendations for elimination.

The protocol is the basis for imposing a fine or for going to court to determine the extent of criminal liability.

In the arsenal of regulatory authorities there are various ways to force the culprit to bear responsibility - from blocking bank accounts to suspending the activities of an enterprise by a court verdict.

Permission to work by an unauthorized person

It happens that a citizen is hired, allowed to perform the duties of an employment contract, and then it turns out that the employer is unaware of the presence of a new employee. In such a situation, the manager has the right to leave the registered employee in the actual position if no violations are identified in the employment contract.

When a decision is made to fire an employee due to lack of knowledge about hiring, the company is obliged to pay the employee wages for the entire period of employment, regardless of the employer’s knowledge. In this case, an official who illegally hired an employee for a position is subject to a fine of 10 to 20 thousand rubles. If such an act is committed by a citizen who is not related to the company, he will be fined from 5 to 10 thousand rubles.

Since civil contracts can regulate labor relations, they are often concluded by persons who do not want to pay taxes. If employees are offered to formalize a relationship within the framework of a contract for the provision of services, they should be extremely careful when applying for such a job, so as not to subsequently be left without social security.