Zero calculation of 6-NDFL is a situation when the company does not operate and does not make payments to employees. Is it necessary to submit 6-NDFL to the Federal Tax Service if there is zero reporting?

The calculation of personal income tax was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] It is submitted quarterly by all tax agents who pay income to individuals and are required to withhold income tax from these payments.

In practice, situations arise when a company does not operate and does not pay income to employees. This is possible if the organization has just been registered or, on the contrary, is in the process of liquidation. Other reasons are also possible. Accountants know that even non-operating companies are required to submit certain reports, for example, a single simplified declaration. By analogy, they have a question about whether they need to submit 6-NDFL if there are no payroll accruals. Let's consider possible situations.

Zero 6-NDFL: is it necessary to submit it?

The calculations are submitted by tax agents who paid income to individuals. Thus, in order to determine whether 6-NDFL is zero, you need to analyze whether your company made such payments. This can be not only wages, but also:

- dividends;

- material aid;

- rent under lease agreements with individuals;

- other taxable payments.

If there were no such payments, then there is no need to submit reports.

A similar conclusion about whether to submit 6-NDFL zero or not is contained in the explanations of the Ministry of Finance in Letter dated 01.08.16 No. BS-4-11 / [email protected]

Where to submit 6-NDFL calculations for organizations and individual entrepreneurs

6-NDFL calculations are submitted to the tax office at the place of registration of the tax agent (clause 2 of Article 230 of the Tax Code of the Russian Federation). The organization is “rented” at its location, the entrepreneur - at the place of residence (Clause 1, Article 83, Article 11 of the Tax Code of the Russian Federation).

However, depending on the status of the organization or individual entrepreneur (or source of income), the procedure for submitting 6-NDFL may be different. Details are presented in the table:

| Who receives income and where? | Where to submit 6-NDFL |

| Head office employees | To the inspectorate at the location of the head office |

| Employees of separate departments | Inspectorate for the location of units. Form 6-NDFL is drawn up for each separate division, even if they are registered with the same inspectorate. If the “separate division” was liquidated (closed), provide at the place of its registration the calculation for the last tax period: for the period of time from the beginning of the year until the day the liquidation (closure) of the separate division was completed |

| Employees simultaneously receive income at the head office and in separate divisions: | |

| – based on income for time worked at the head office | To the inspectorate at the location of the organization’s head office (indicate its checkpoint and OKTMO) |

| – based on income for time worked in separate units | To the inspectorate at the location of each separate unit (indicate the checkpoint and OKTMO of the corresponding unit) |

| Employees of “separate units” receive income in units that are located in the same municipality, but in the territories of different tax inspectorates | To the inspectorate where the units are registered. A separate calculation is filled out for each department |

| Employees of the largest taxpayers, including separate divisions | In the Federal Tax Service in the same order as “regular” organizations |

| Employees of the entrepreneur on UTII or PSN | To the inspectorate at the place where the entrepreneur operates UTII or PSN. If the activity in the special mode is terminated, the calculation is submitted for the period from the beginning of the year until the day the business ceases |

| Employees of an entrepreneur who combines UTII and simplified tax system | For employees engaged in activities on UTII - to the inspectorate at the place of such activity. For employees engaged in activities on the simplified tax system - to the inspectorate at the place of residence of the entrepreneur |

What are the possible risks if you decide not to submit zero 6-NDFL?

So, we found out that the calculation must be submitted only if the company made payments to individuals, subject to income tax. If there are no such payments, then the zero 6-NDFL for the 3rd quarter of 2020 should not be submitted to the tax office.

But the tax authorities do not have information about whether the organization made payments to employees or not. The fact that there were no such payments and the company lawfully did not submit a report must be notified to the Federal Tax Service. This can be done in simple written form by bringing the letter in person, sending it by mail or electronically.

If you do not do this, the tax authorities will decide that the zero 6-personal income tax for 9 months of 2020 was not submitted unlawfully. In this case, the inspectorate will block the company's bank accounts. We will tell you further whether such organizations rent out zeros.

Reporting during temporary suspension of payments to staff

Doubts about 6-NDFL may also arise among organizations that have personnel who are temporarily not receiving remuneration. For example, if employee benefits were temporarily suspended due to financial difficulties. Since the restoration of payments is still planned in the future, it is more advisable to submit to the tax authority not a notice of termination of obligation, but a zero 6-NDFL report. And although those who are not tax agents are not required to submit it, inspectors do not have the right to refuse to accept zeros.

The procedure for filling out 6-NDFL was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] The rule for filling out the form in the absence of indicators is prescribed in clause 1.8, according to which 0 is entered in the total lines, and in other lines of sections 1 and 2 dashes are added. The title page is filled out in the usual manner.

Before submitting a zero report during a temporary suspension of activity, it is important to ensure that no payments were actually made. Typically, organizations forget to take into account payments for one-time services to contract workers or remuneration to employees in kind (not cash).

Is it possible to send a blank report?

Please note that the calculation is filled in with a cumulative total from the beginning of the year. This means that it is necessary to check whether payments have been made previously. That is, if an organization paid taxable income in the 1st quarter of 2020, then submit the calculation for the 1st quarter, and for six months, and for 9 months, and for the year. Such clarifications are given by the Federal Tax Service in Letter dated March 23, 2016 No. BS-4-11/ [email protected]

Also, instead of a letter to the Federal Tax Service about the absence of an obligation to submit a calculation, the company has the right to submit a blank report. In this case, the Federal Tax Service is obliged to accept it (Letter of the Federal Tax Service dated 05/04/16 No. BS-4-11 / [email protected] ).

Submission of a report in the absence of employees

All tax agents are required to submit the 6-NDFL report. That is, those who pay any amounts to individuals and pay tax on these amounts to the Federal Tax Service.

With employees

Individual entrepreneurs and employees definitely submit a report. The report includes wages and taxes paid on them. Individual entrepreneurs are subject to reporting on any taxation system, be it the simplified tax system (USN), UTII (imputation), PSN (patent), OSNO or ENVH. The certificate contains information about each employee.

For example, if an individual entrepreneur pays an employee a salary of 10,000 rubles per month, then in 6-NDFL he writes 11,300, adding the amount of tax.

In addition to employees, an individual entrepreneur (or his accountant) takes into account in 6-NDFL payments of dividends and other types of income on which personal income tax was paid.

Do individual entrepreneurs need to submit 6 personal income taxes if there are no employees or contract employees?

Paying tax

Without employees

Do I need to submit 6 personal income tax for individual entrepreneurs without employees? If an individual entrepreneur works for himself and has no employees, then he does not have to submit 6-NDFL, except for a number of factors. The fact is that an individual entrepreneur may not have permanent employees, but periodically have hired ones. Or, engage the services of individuals under a contract.

It follows from this that an individual entrepreneur without employees submits 6-NDFL only if payments were made to any other individuals.

Form 6 Personal Income Tax, if there are no employees (taxpayers), and therefore no wages were accrued to individuals, there is no reason to submit a calculation. Therefore, in the absence of financial activities and income payments, there is no need to submit a reporting document.

A report without employees is not required:

- if there is staff, but no payments; there is no subject of taxation, the reporting will also be “empty”.

- there is no activity, that is, a source of profit, the calculation and withholding of taxes is impossible.

The form of the report, the procedure for filling out 6 personal income taxes and its submission are determined by the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] At the beginning of 2018, changes were made to it by order of the Federal Tax Service of Russia dated January 17, 2018 N ММВ-7-11/ [email protected] , which came into effect on March 26, 2020.

A report that shows the calculation of personal income tax amounts is submitted quarterly in electronic format, if during the reporting quarter the organization made payments in favor of 25 people or more. If the organization reports for less than 25 people, then the form can be submitted on paper. The tax amount is filled in in rubles, and the income amount is filled in rubles and kopecks.

There is a fine for failure to comply with the deadlines for submitting the report. Each month of delay will cost 1000 rubles according to the norms of clause 1.2 of Article 126 of the Tax Code of the Russian Federation. The official responsible for failure to submit personal income tax reports on time will be fined from 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If the information in the 6-NDFL report is found to be unreliable, the organization will be fined 500 rubles (Clause 1 of Article 126.1 of the Tax Code of the Russian Federation). Therefore, the chief accountant of each organization should know thoroughly how to fill out 6 personal income taxes.

Unlawful submission of the 6-NDFL report on paper carries a fine of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

In 2020, the legal successors of reorganized companies were required to submit 6-NDFL, if the company itself did not do so before the end of the reorganization. In particular, the successor organization should:

- indicate the TIN and KPP at the top of the title page;

- use code “215” (for the largest taxpayers - “216”) in the details “at the location (accounting) (code)”;

- in the “tax agent” detail, indicate the name of the reorganized entity or its separate division;

- in the new detail “Form of reorganization (liquidation) (code)” indicate one of the values: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

- indicate “TIN/KPP of the reorganized company.”

In addition, there have been other changes to the procedure for completing the form.

The largest taxpayers provide checkpoints using a certificate of registration with the tax office at the location of the legal entity, and not at the place of registration as the largest taxpayer.

Tax agent organizations that are not major taxpayers must indicate the value “214” instead of “212” in the details “at location (accounting) (code)”.

The title page indicates the full details of the document confirming the authority of the representative.

The electronic format of 6-NDFL is also adjusted taking into account the listed amendments.

Although the report has been in effect for the fourth year, filling out 6-NDFL still raises questions among employers and accountants. In addition, a number of changes have been made to it that must be taken into account when filling out. In addition, young accountants are entering the profession and need instructions for dummies on how to correctly fill out 6 personal income taxes: we will analyze the steps step by step.

The document consists of the following sections:

- Title page.

- Section 1 (information is formed on an accrual basis).

- Section 2 (information is reflected only for the specified quarter, without taking into account previous periods).

Below are instructions for filling out form 6-NDFL for 9 months of 2020.

Cover page of form 6-NDFL

Step 1. TIN and checkpoint

In the appropriate fields, indicate the TIN and KPP data of the organization submitting the report. If the report is submitted by a branch, then the branch checkpoint is indicated.

If 6-NDFL is submitted for the first time during the reporting period, then zeros are reflected in the “adjustment number” field.

An adjustment involves changes to the information provided to the Federal Tax Service. Clarification of the calculation for the corresponding reporting period is indicated by the adjustment number. For example: 001, 002, 003 and so on.

The period for providing 6-NDFL is the quarter for which the employer reports:

- 1st quarter - code 21;

- half-year - code 31;

- 9 months - code 33;

- year - code 34.

Codes for organizations providing information at the stage of reorganization (liquidation) are indicated in appendix. 1 Order.

The tax period is the calendar year for which the information is provided. The corresponding 4 digits are entered in the field.

The line indicates the code of the tax office to which the reports are submitted. This is a four-digit code in which:

- the first 2 digits are the region number;

- the second two digits are the inspection code itself (using the example of Federal Tax Service Inspectorate No. 9 of the Central District of St. Petersburg).

It is important to remember that reporting is sent to the inspectorate at the location of the organization or its separate division. Individual entrepreneurs submit this report to the tax office at their place of residence or place of business.

The code “By location (accounting)” helps determine which organization submits reports. The full list of codes is defined in the appendix. 2 to the Order.

The most common for organizations:

- by place of registration - 214;

- at the place of registration of a separate subdivision - 220;

- the largest taxpayers indicate 212.

Individual entrepreneurs also indicate special codes:

- at place of residence - code 120;

- at the place of activity - code 320.

The short (if any) or full name of the company is printed in the “tax agent” field.

As required by the order of filling out report 6 of personal income tax, approved by the Order of the Federal Tax Service of the Russian Federation, indicate the code of the municipality in whose territory the organization or branch is located and registered. Sometimes citizens are paid money (salaries and bonuses) by both the parent organization and its division. In this case, two forms with different OKTMO codes are filled out and submitted at once.

Section 1

1. For each bet separately:

- tax rate percentage;

- amount of accrued income (the form may not include income that is completely exempt from personal income tax, or income that is less than the limit, depending on the type of income. For example, financial assistance in connection with the death of a close relative, financial assistance for the birth (adoption, establishment of guardianship rights) of a child up to 50 thousand rubles per child, etc.);

- amounts of tax deductions;

- personal income tax amounts (including from income in the form of dividends).

2. Generalized information on all bets (displayed once in the section for the first bet):

- number of individuals who received income;

- amounts of tax withheld;

- amounts of tax not withheld;

- personal income tax amounts returned by the tax agent.

Personal income tax rates in 2020 on the income of employees and persons performing work (providing services) under civil contracts: 13%, 15%, 30% and 35%. Rates have not changed in 2020.

How to take into account personal income tax will be shown by an example of filling out 6 personal income taxes for the 3rd quarter of 2020: instructions are given by sections and lines.

More about personal income tax

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

There is no need to submit a “zero” calculation of 6-NDFL if you did not accrue or pay income on which you need to pay tax (Letters of the Federal Tax Service of Russia dated November 16, 2018 N BS-4-21/ [ email protected] , dated August 1, 2016 N BS-4-11/ [email protected] ).

Please note that the calculation is filled in with a cumulative total from the beginning of the year. This means that it is necessary to check whether payments have been made previously. That is, if an organization paid taxable income in the 1st quarter of 2020, then submit the calculation for the 1st quarter, and for six months, and for 9 months, and for the year. Such clarifications are given by the Federal Tax Service in Letter dated March 23, 2016 No. BS-4-11/ [email protected]

Also, instead of a letter to the Federal Tax Service about the absence of an obligation to submit a calculation, the company has the right to submit a blank report. In this case, the Federal Tax Service is obliged to accept it (Letter of the Federal Tax Service dated 05/04/16 No. BS-4-11 / [email protected] ).

Sample filling

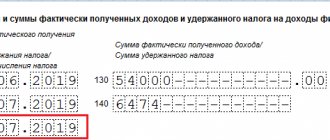

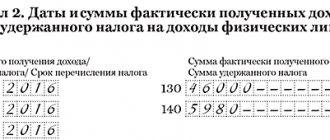

Using a conditional example, consider the order of filling:

LLC "Company" was registered on December 12, 2018. Since that moment, the organization has one director on staff, who is on leave at his own expense. In May 2020, the director returned from vacation, worked the entire month, and was accrued and paid a salary of 20,000 rubles. (the amount of personal income tax is 2600 rubles). On June 1, the director again went on vacation at his own expense, where he remained until the end of the year.

For the first quarter, the organization decided to submit the calculation with zeros.

Nulevka for the 1st quarter of 2020

Since the director’s salary was paid in the second quarter, the usual calculation was submitted, and the organization is required to submit a report for 9 months. The first section indicates cumulative indicators from the beginning of the year. That is, it will reflect the May payment.