Nuances of filling

To answer the question of how to fill out a personal income tax payment form, you should consider some nuances:

- In field 101, the applicant must indicate his status. Tax agents remitting tax for employees indicate status code 02, and entrepreneurs paying tax for themselves indicate status code 09.

- In field 104 you need to indicate who pays the tax and what his status is - a tax agent, a citizen or a private businessman for himself.

- If a company has branches and representative offices, personal income tax must be listed at the location of each of them.

- When indicating the order of payment, the number 5 is entered if the payment is current, but if the tax is paid at the request of the tax authority, the number 3 is entered.

- When paying current payments, there is no need to fill out line number 22.

- In field 107 indicate the month for which payment is made.

- Line 108 needs to be filled out only if the debt is being repaid at the request of the tax authority; in other situations, 0 is entered in this field.

A sample personal income tax payment order in 2020 is given below.

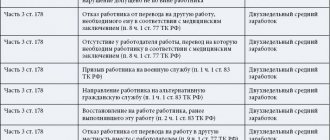

Is severance pay subject to personal income tax upon dismissal?

Accountants are often faced with the problem of filling out the personal income tax reporting form, since this form appeared in 2020, as well as with the rules for calculating the final payment, depending on the reason for the employee’s deduction.

It should be noted that the accrued amounts of the full settlement, as well as compensation for lost vacation days, are subject to personal income tax in full, regardless of the reason for the severance of the labor relationship between the employee and the company’s management.

Severance pay issued to a dismissed specialist is regulated by Article 217 of the Tax Code of the Russian Federation and is not subject to personal income tax. At the same time, the amount of severance pay retained for the duration of employment in a new place cannot exceed 3 times the monthly income of the dismissed person (6 times the amount for persons expelled in the Far North).

When issuing funds exceeding this amount, a tax is collected from the amount exceeding the exit remuneration on a general basis and transferred to the budget. The transfer of personal income tax to the budget is required no later than on the next working day, after the issuance of a full settlement with the expelled citizen (clause 6 of Article 226 of the Tax Code of the Russian Federation).

When a specialist is expelled, 2 income documents are issued on his final day of work:

- A certificate of average income for calculating sick leave at a future enterprise, maternity leave, and child care leave.

- Certificate 2-NDFL for a given year.

Procedure for paying personal income tax upon dismissal

Entrepreneurial activities of institutions and individual entrepreneurs require timely transfer of personal income tax. Legislative norms have developed a procedure for withholding tax and transferring personal income tax to the state budget, and legal entities should be familiar with this provision first of all, since they are considered tax agents. According to this provision, taxes are withheld from employees who work at the enterprise on the monthly salary paid.

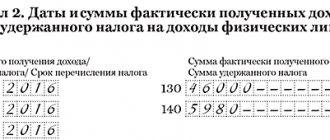

According to Art. 232 of the Tax Code of the Russian Federation, tax agents are required to send the following information about their employees to the Federal Tax Service:

- The amount of personal income tax that was accrued was withheld from the employees of the enterprise, and was also transferred to the budget for the reporting tax period.

- The amount of profit of an individual within the reporting period.

Note. According to the Tax Code of the Russian Federation, personal income tax must be transferred no later than April 1 of the current year following the reporting year. If the deadlines for transferring personal income tax are violated, the management of the enterprise is subject to administrative liability.

It should be noted that, depending on the circumstances, other deadlines for transferring personal income tax are allowed. For example, when an employee is dismissed in 2020, personal income tax is transferred no later than the date when the management of the enterprise received cash from the bank to issue a full payment to the dismissed person (salary for time worked and compensated payments for lost vacation days).

The final deadline for transferring personal income tax is the next day after the dismissed employee receives his salary.

To avoid punishment, legislative norms provide for those responsible for filing the declaration and complying with the specified deadlines.

These categories include:

- Persons who are not tax agents, and at the same time receive some income on the basis of a civil contract.

- Persons using rental real estate as their main income.

- Citizens engaged in entrepreneurial work without obtaining legal status. faces.

- Categories of persons who received winnings as income.

- Persons who have received a certain financial amount, securities and other remuneration as a gift.

- Citizens who are residents of the Russian Federation and receive profits abroad.

- Persons receiving profit from a share of the authorized capital.

- Institutions that receive income from business activities.

Note. Individuals working at an enterprise are not required to transfer personal income tax on their own, since a tax agent does this for them.

To independently transfer personal income tax, you need to draw up a tax return on a unified form 3-NDFL based on the results of the reporting period.

In the option of transferring taxes as a “freelancer”, a mark is made in the appropriate box of the form.

The personal income tax form is a document consisting of 19 pages. You can fill it out yourself or ask a qualified lawyer for help. Legal services in filling out the declaration will cost the taxpayer about 300 rubles.

When filling out the form, all pages must be numbered, otherwise a fine may be imposed on the submitter of the declaration.

The personal income tax is sent to the place of registration of the tax payer and, if necessary, additional materials are attached to it as directed by the Federal Tax Service employees.

The final day for the transfer of personal income tax is the 15th day after the end of the reporting period. In the option of paying income for which tax agents have not calculated tax amounts, the transfer is made 2 times for half the amount - no later than 30 days from the date of receipt of the notification from the Federal Tax Service. In this case, the second transfer must be made no later than one month from the date of the first transfer.

This is important to know: When is it better to quit before, after or during vacation?

Sample payment order for personal income tax payment upon dismissal

All institutions that pay salaries to their employees are required to transfer personal income tax to the budget. To avoid mistakes that lead to fines and other troubles, you need to carefully fill out payment orders.

There are no changes in payment processing in 2020. However, there are some differences in filling out instructions when transferring personal income tax from salary, from vacation pay, from payments when leaving an institution, as well as from paying penalties and penalties for personal income tax.

Below is a completed sample of such a payment order.

Deadlines for payment of labor income tax

Personal income tax must be paid strictly within certain deadlines. Consider them:

- Salary Employers must pay their employees wages twice a month - in the form of an advance payment, as well as a final payment. The tax must be paid once a month - simultaneously with the final payment.

- Sick leave benefits and vacation pay. The tax on them must be paid no later than the last day of the month of their payment.

- Calculation of severance. When an employee resigns, the employer must pay him in full on his last day of employment. The tax must be paid on the same day.

Transfer of personal income tax upon dismissal of an employee 2020

Termination of an employment agreement between an employee and the management of an institution can be carried out on the basis of Art. 77 Labor Code of the Russian Federation. This article will discuss issues of mutual settlements between the employer and the expelled person, and the features of withholding personal income tax (hereinafter referred to as tax).

This is important to know: Collective resignation letter

Number of generated payments

Firms and businessmen have the right to combine tax on various incomes (salary, bonus payments, vacation pay, etc.) in one payment slip, if all these charges were made in one month.

If the income on which personal income tax is paid belongs to different months, filling out a personal income tax payment form in 2020 is required for each period. If this rule is not followed, discrepancies will arise between actual contributions to the state budget and the calculation in Form 6-NDFL. The tax office may require an explanation of the current situation in writing.

What is a payment order?

A payment order is an order from the payer to the bank of his choice, established by the payment document, to transfer funds to the recipient's current account, which is opened in this or another bank.

Citizens who do not have an account with this bank, in accordance with clause 2 of Art. 863 of the Civil Code of the Russian Federation, the described operation is carried out in the same way.

Officially, this document can be prepared both in written and electronic form, but only in the form of an uploaded document to official sources, for example, in the client-bank system.

The payment order must be written or uploaded in 4 copies:

- 1 copy is required to carry out a banking transaction: debiting funds from the payer’s account.

- Copy 2 serves as confirmation of the crediting of funds to the specified account.

- Copy 3 serves as confirmation of the bank transaction.

- 4 copy is returned to the payer upon completion of the transfer in the form of a receipt confirming the acceptance of the operation and its execution.

The payment order is executed strictly within the agreed time frame, maybe even earlier.

After drawing up the document, the bank employee must check that all fields are filled out correctly, and also enter the date when the funds will arrive at the specified account.

The document described can be used to transfer finances:

- to pay loans and accrued interest on them;

- to state budgets and funds;

- for goods received, payment for work performed, for prepayment, etc.

If necessary, the bank has the right to attract other banks to make this payment, for example, if the recipient's account is registered with another bank.

If the payer’s account does not have enough funds or partial payment is provided, then the payment order goes into the category of unpaid on time.

Important: the bank is obliged to inform the payer about all operations performed in accordance with the agreement.

back to menu ↑

Payment order simplified tax system

Entrepreneurs who operate under a simplified taxation system must pay not only tax, but also an advance payment.

However, you should know that the advance payment is calculated every quarter, and the tax is calculated annually.

Two payments are paid only in whole rubles; if the amount is received with a balance, then it is rounded up.

To calculate the down payment, you need:

- know the income for the reporting period;

- know the amount of insurance premiums for individual entrepreneurs.

After this we use the following formula:

For example, an entrepreneur earned 300 thousand rubles for the period from February 1 to April 30, then he needs to pay an advance payment in the amount of 18,000 rubles, since according to the formula:

300,000 x 6% = 18,000 rub.

However, if by July 31 he can earn another 300,000 rubles. and pays all insurance premiums, which amount to 20 thousand rubles, then the advance payment will have the following meaning:

(300,000 + 300,000) x 6% - 20,000 - 18,000 = 8,000 rubles.

Now let's move on to calculating tax according to the simplified tax system, which is calculated using the following formula:

If, for example, in 2020 a certain entrepreneur’s earnings amounted to 2 million rubles, he also paid an insurance premium of 30 thousand rubles. and advance payments of 35 thousand rubles, then we can calculate the tax using the above formula:

2000,000 x 6% - 30,000 - 35,000 = 55,000 rubles.

All these payments are paid to the tax office, but you can reduce the time and generate a receipt in advance.

First, go to the tax service website:

Go to the “All services” section:

Next in the list, look for the section “Fill out a payment order” and follow it:

We skip the first step, where they ask you to enter the Federal Tax Service code and click the “Next” button:

Now you need to indicate your region, and then your registration address:

In the “Type of payment document” column, you must select “Payment document”:

Next, in the “Payment Type” column, you need to select the following:

The BCC is the same for everyone:

In the “Person Status” column, you must select an individual entrepreneur:

Based on the payment, we indicate the payments for the current year:

The tax period is indicated depending on the type of payment, so for an advance payment we indicate “KV”:

To pay tax, indicate “GD”:

The next field to fill out is your personal information:

Now you need to select a payment method. So, if you choose to pay in cash, you will see a window to download the generated receipt:

To pay using Internet banking, select “Cashless payment”, and then your credit institution:

Please note: payment must only be made from your personal card.

back to menu ↑

Payment order for payment of state duty

The state fee is a mandatory payment that is paid if you contact various authorities to carry out some legal transactions.

Let's look at a clear example of filling out a payment order for state fees.

Let’s imagine that ABV LLC submits an application to the Federal Tax Service for payment of an overpayment of property tax, which amounted to 80,000 rubles.

But the inspection does not return the amount within the specified period, then the enterprise submits an application to the Arbitration Court that the actions of the tax service are illegal, and also submits its demand for the return of the overpayment with interest in the amount of 1,000 rubles.

In this case, the company must pay 2 state duties:

- 3 thousand rubles so that the actions of the tax service are declared illegal in accordance with subparagraph. 3 p. 1 art. 333.21 Tax Code of the Russian Federation.

- RUB 3,240 (4% of 80,000 (overpayment) + 1,000 (interest)) – for a request for a refund in accordance with subclause. 1 clause 1 art. 333.21 Tax Code of the Russian Federation.

Thus, the total amount for paying the state duty will be 6,240 rubles.

When ABC LLC draws up a payment order, it will indicate the following data:

- Payer status – “01”;

- Recipient - Federal Tax Service No. 26 (taken solely as an example);

- KBK - 182 1 0800 110 (varies depending on the type of payment; for your specific situation, the contents of this field may differ);

- OKTMO – indicated depending on the location of the court;

- The basis of payment is “TP”;

- In lines 107, 108, 109 – put “0”.

A visual example of filling out a document:

back to menu ↑