Home / Risks

Back

Published: March 23, 2020

Reading time: 7 min

0

1

- 1 What taxes are paid on vacation compensation?

- 2 Basis for payment of severance pay and other compensation

- 3 Payment of personal income tax

- 4 What taxes are charged on compensation for unused vacation upon dismissal?

- 5 Reply

- 6 Taxation of compensation for unused vacation with income tax

- 7 Personal income tax

What taxes are paid on vacation compensation?

Of course, each organization sets its own number of vacations for employees, which is reflected in the contract, but it should not be lower than the minimum established by law. Is compensation upon dismissal subject to personal income tax? Yes. In addition to insurance premiums, you also need to withhold a tax deduction. The personal income tax rate is 13%. Types of severance payments that are not taxed As a rule, an employee who is about to resign receives standard payments: salary (actual) and compensation. Some citizens are entitled to additional leave if they have an irregular schedule and often work overtime. The law stipulates that payment is required for processing. Its size and calculation procedure are specified in the agreement. Are there payments that should not be subject to any tax? When the amount is somewhere within three average earnings of a citizen, the income is not subject to taxation.

Error when returning vacation pay upon dismissal

If an employee has taken a year’s vacation and decides to resign before the end of the year, the employer has the right to withhold overpaid vacation pay. Personal income tax has already been calculated from this amount, which needs to be recalculated, because... this amount does not relate to income, and the company has overpaid personal income tax. Therefore, personal income tax must be returned based on the application. The overpayment of personal income tax must be transferred to the employee. Another option is when the employee personally returns the personal income tax by filing a 3-NDFL.

https://youtu.be/2-Ha6nmi2JY

When personal income tax is not charged

When paying relatives of a deceased employee

The fact that an enterprise should not withhold these fees is stated in Letter No. 03-04-06/4-28 of the Ministry of Finance of the Russian Federation - according to it, the organization does not bear the responsibilities of a tax agent called upon to withhold taxes if the employee to whom the accrual is made is dead .

Consequently, his relatives must receive all the money in full without deducting fees - which is understandable, because these fees are calculated for medical care, pensions and other services for the citizen, which, naturally, are no longer required by the deceased.

https://youtube.com/watch?v=FLLCiDch1WA

Is vacation compensation upon dismissal subject to insurance contributions?

The fact that the right to initiate the replacement of vacation with compensation belongs to the employee does not mean that vacation in all cases, at the request of the employee, is replaced by a cash payment. The right of the final decision - to replace or not - belongs to the employer, who can justify his refusal by production necessity or other reasons.

Info

It is prohibited to replace vacation with money:

- pregnant women;

- employees whose age is under 18 years;

- workers engaged in hazardous work.

The amount of compensation is calculated in the same way as the average salary. The calculation is carried out for the last 12 months. Since compensation for unused vacation is the employee’s income, it is subject to personal income tax of 13%.

The procedure for calculating the number of compensated days upon dismissal

When dismissing, it is important to take into account that in some years the employee may not have used several days of entitlement leave. In the event of an incomplete year of work, each month worked for this employer must be calculated based on the proportion of vacation days:

Number of vacation days / 12 months

With a 28-day vacation, for each month worked, 2.33 days of vacation are due, which can be rounded in favor of the employee.

Based on this, you need to calculate:

- total length of service in the organization

- the total number of days of entitlement leave for all years of work

- number of holidays used

- difference between allocated and used vacation

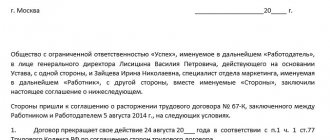

What taxes are charged on compensation for unused vacation upon dismissal?

Download the agreement form Having found out what payments are due to the dismissed person and what the calculation period is, you need to decide on the taxation of compensation for unused vacation. After all, untimely and incomplete withholding of all taxes and contributions due may result in the imposition of serious fines on the employer. Let's figure out whether compensation for unused vacation is subject to personal income tax and whether insurance premiums are withheld from this income of the employee (insured). Taxation when calculating compensation for unused vacation When paying compensation for unused vacation upon dismissal, the employer must withhold personal income tax.

This type of compensation payments is an exception from the number of tax-free incomes of individuals (paragraph 7, paragraph 3, article 217 of the Tax Code of Russia). Moment of personal income tax withholding As indicated in sub. 1 clause 1 art.

Celebrities What to do after intimacy: 9 rules You've finished having sex. Maybe it was good, maybe it was bad, but that's not the point. The process is over. So what should you do... Sexuality 25 Mistakes People Unknowingly Make in Bed You don't need champagne or silk sheets to enjoy your sex life. Try to avoid these common mistakes, and your... When an employee is dismissed, he is due compensation payments, including compensation for vacation that was not used by the employee. Such compensation is subject to mandatory taxation.

The Tax Code and special laws establish what taxes are imposed on compensation for leave upon dismissal. Accordingly, if an employee quits his job this year and did not use his vacation, then he needs to make a calculation, taking into account compensation for unused vacation.

The Labor Code of the Russian Federation establishes that the employer is obliged to provide a working employee with leave, which must be paid, for at least 28 days every year. Compensation for unused vacation is not equal to the non-taxable income of citizens, which is established by Article 217 of the Tax Code of the Russian Federation.

Deductions are calculated from the amount:

- Pension Fund;

- FSS;

- FFOMS, including contributions “for injuries”.

For further details please refer to Art. 9 of Law No. 212-FZ of July 24, 2009, Art. 20.2 of Law No. 125-FZ of July 24, 1998. You also need to take into account the following regulations:

- Clause 3, Article 8 of the Tax Code of the Russian Federation;

- Article 422 of the Tax Code of the Russian Federation;

- Article 20.2 of Law 125-FZ.

What types of severance payments are not subject to taxes? In addition to basic income, there is a category of compensation payments that are not subject to insurance premiums.

So, at the time of dismissal, the employee is entitled to severance payments. And if the amount is within 3 average earnings of the applicant, then no tax is paid.

For employees of enterprises in the Far North and equivalent regions, the amount of non-taxable benefits was increased to 6 average monthly earnings. This possibility is mentioned in Art.

It turns out, on average, 2 days of vacation for every month of work. The number of vacation days is established in the organization for each position separately, but should not be less than the minimum established by law.

To the contents What taxes are charged on compensation upon dismissal for unused vacation? The tax base of deductions includes the personal income tax, which is 13% of the amount of all income of citizens, as well as the following mandatory payments - contributions:

- to the Pension Fund of the Russian Federation;

- to the Social Insurance Fund;

- contribution to the Compulsory Health Insurance Fund;

- contribution to territorial compulsory health insurance funds.

That is, deductions and deductions should be made when calculating compensation for unused vacation for all specified items for contributions and taxes.

According to the Tax Code of Russia, the moment of receipt of taxable income is the date of issuance of funds through the cash desk of the enterprise or their transfer to the employee’s bank account. The employing company, which withholds tax from the employee's income, acts as a tax agent.

According to paragraph 4 of Art. 226 of the Tax Code, personal income tax is withheld at the time of actual payment. Thus, if such payments are made on the very last day of work before the employee goes on leave with dismissal after its completion, tax is withheld on the day of calculation.

At the same time, the employee receives his income, already “cleared” of tax. What insurance premiums are deducted from vacation compensation? As stated in sub.

“d” clause 2, part 1, art.

What taxes are collected and how are they withheld?

The amount of compensation that a resigning employee receives for the unrealized right to rest is subject to a mandatory payment such as personal income tax. In turn, the enterprise must transfer insurance premiums to extra-budgetary funds. They are also calculated based on the amount of compensation. Let's consider what the amounts of the listed payments are.

Income

The rate for this tax is 13% for residents of Russia and 30% for non-residents. The mechanism for calculating the tax payment is quite simple and is expressed in the fact that the accrued income is multiplied by the rate.

Insurance contribution to the Pension Fund

The purpose of the employer paying a contribution to the pension fund is to provide pensions for citizens. The mechanism for withholding such a contribution has features of regressive taxation.

- 10% on amounts above the specified limit.

To the Social Insurance Fund

Such a payment is used to form a monetary base for the payment of benefits for the period of incapacity of workers and benefits related to maternity. The contribution is calculated only for those incomes that are less than 815 thousand rubles.

At the same time, paragraph 2 of Article 426 of the Tax Code of the Russian Federation approved the following rates:

- 2.9% of the income of citizens of the Russian Federation;

- 1.8% of the income of foreign nationals and stateless persons.

Contribution to the FFOMS

For the purpose of compulsory health insurance, the employer is obliged to pay 5.1%, calculated on the basis of payments accrued to the employee.

To the territorial Compulsory Medical Insurance Fund

Federal and territorial funds constitute a single system that ensures the functioning of compulsory medical insurance. Therefore, taxpayers do not need to make separate contributions to territorial funds.

How to document compensation payments for unused vacation days

When calculating days to determine the amount of compensation, the accountant must take into account all types of vacations not taken by the employee. As a rule, payment for them is made:

- without an application, special instructions from management, on the basis of an order confirming the fact of dismissal of an employee, and the Labor Code of the Russian Federation;

- when making a payment using form T61. A special form is filled out by personnel officers and accounting department indicating a detailed calculation of the amount to be paid and the accrual of personal income tax;

- minus income taxes withheld from the worker's income.

The final settlement with the employee upon his dismissal is carried out on the last day of work. When calculating accounting, it is necessary to correctly determine the amount of tax and Social Insurance contributions based on the tax base.

- Moscow and region:

+7-499-938-54-25 - St. Petersburg and region:

+7-812-467-37-54 - Federal:

+7-800-350-84-02

Calculation of the number of days for which compensation is due

In any situation upon dismissal, be it:

- vacation followed by dismissal

- receiving payment for vacation not taken

the employee needs to calculate the number of unused vacation days for the period from the beginning of his work in this organization.

Sometimes it happens that an employee takes vacation for the whole year, but quits before the expiration of the vacation period. Therefore, it is necessary to check the vacation record for the entire period from the date of employment.

Important! The employer has the right to refuse to provide leave with subsequent dismissal due to the fact that it is necessary to hire a new employee for this position. In the meantime, while the resigning employee is on vacation, this position cannot be filled.

Answer

In accordance with Article 1 of the Labor Code of the Republic of Kazakhstan (hereinafter referred to as the Labor Code), vacation is the release of an employee from work for a certain period to ensure the employee’s annual rest or social purposes while preserving his place of work (position) and, in cases established by the Labor Code, the average salary fees.

According to Article 1 of the Labor Code, compensation payments

- cash payments related to special work hours and working conditions, loss of work, compensation to employees for costs associated with the performance of their labor or other duties provided for by the laws of the Republic of Kazakhstan, as well as payments related to professional training, retraining and advanced training of employees or other persons, not in an employment relationship.

Healthy

Article 95 of the Labor Code establishes that the part of the paid annual leave unused in connection with the recall, by agreement of the parties to the employment contract, is provided during the current working year or in the next working year at any time or is added to the paid annual leave for the next working year.

According to Article 95 of the Labor Code, when an employee is recalled from paid annual leave, instead of providing the unused part of the leave at another time, by agreement between the employee and the employer, the employee is paid compensation for the days of the unused part of the paid annual leave.

In accordance with paragraph 2 of Article 115 of the Labor Code, deductions from an employee’s salary to pay off his debt to the organization in which he works can be made on the basis of an act of the employer with written notification to the employee in cases of transfer or recall of the employee from annual paid leave, with the exception of Article 95 of the Labor Code.

Healthy

In accordance with paragraph 1 of Article 341 of the Code of the Republic of Kazakhstan “On taxes and other obligatory payments to the budget” (Tax Code), as amended by Article 33 of the Law of the Republic of Kazakhstan “On the entry into force of the Code of the Republic of Kazakhstan “On taxes and other obligatory payments” to the budget" (Tax Code)" (hereinafter - the Law on Introduction), payments are excluded from the income of an individual subject to taxation in accordance with the laws of the Republic of Kazakhstan "" and "" (hereinafter - the laws on social protection of citizens).

Healthy

The provisions of this subparagraph apply when an individual submits:

- statements indicating the amount of income adjustment within the limits established by the laws of the Republic of Kazakhstan “On the social protection of citizens affected by an environmental disaster in the Aral Sea region” and “On the social protection of citizens affected by nuclear tests at the Semipalatinsk nuclear test site”;

- copies of supporting documents.

Based on the above, taking into account the position of the Ministry of Labor and Social Protection of the Population of the Republic of Kazakhstan dated July 4, 2018 No. 03-1-24/14000, since the laws on social protection of citizens do not provide for payments in the form of compensation for days of the unused part of paid additional annual leave, accordingly, These payments are subject to

individual income tax and social tax .

Answers to common questions

Question No. 1 : Is it mandatory to pay compensation upon dismissal or can leave be provided?

Answer : Payment of compensation or leave is the employer’s decision, because payment must be made in any case, and if leave is granted, the employer will not be able to hire a new employee for this position, because one staff unit will employ 2 people until the end of the dismissed person’s leave . This is especially important if the employee has accumulated several unused vacations over several years; in this situation, the employer is unlikely to agree to a vacation of more than 28 days.

Question No. 2 : Is payment for vacation not taken to an external part-time worker made and is it necessary to pay taxes and contributions for such an employee?

Answer : All employees, without exception, including part-time workers, need to calculate the payment for vacation not taken, due to the fact that the Labor Code of the Russian Federation guarantees payments for part-time workers in the same way as main employees. Personal income tax and contributions are paid on the same terms as for main employees.

Taxation of compensation for unused vacation with income tax

The current legislation of the Russian Federation makes it possible to include clauses in the collective agreement regarding the duration of the annual leave of some employees. However, it may exceed the minimum (28 days). For example, people in management positions quite often receive additional days of rest because their working hours are not standardized. In accordance with Article 119 of the Labor Code of the Russian Federation, additional leave can last at least 3 days.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call:

- Moscow: +7 (499) 350-8059.

- St. Petersburg: +7 (812) 309-9401.

In accordance with Article 270 of the Tax Code of the Russian Federation, the costs of paying for additional vacation days provided for by the collective agreement are not taken into account when determining the income tax base. This is only relevant if the total number of vacation days exceeds 28. Accordingly, compensation for these vacation days is also not taken into account for tax purposes. This is confirmed by the following documents:

- letter of the Ministry of Finance No. 03-03-04/1/284;

- letter of the Department of Tax Administration of the Russian Federation No. 28-11/55896.

Such a decision is based on the principles prescribed in Article 124 of the Labor Code of the Russian Federation. It sets out the rules according to which an employee cannot fail to take paid leave for two years in a row.

The above interpretation, however, is quite controversial and may raise doubts due to the fact that in Article 126, which provides for the possibility of replacing leave with monetary compensation, there is no mention of time limits.

Article 127 of the Labor Code of the Russian Federation specifies the rule according to which, in the event of dismissal, an employee must receive compensation for unused vacation days for the entire period.

Thus, the Labor Code of the Russian Federation limits the number of years during which you can not go on vacation, however, it does not in any way limit the number of years from which you can receive compensation for unused vacation pay. And the Tax Code, in turn, refers to labor legislation, explaining the features of including labor costs in the tax base.

Insurance premiums for compensation

Also, to pay the employee, the organization makes payments to extra-budgetary funds if such payments exceed three times the average monthly salary (Article 420 of the Tax Code of the Russian Federation), because even if the employee does not work at this enterprise, he has the right to apply to his former employer for sick leave within a month, seek medical help and is a future pensioner.

The amount of contributions when the amount exceeds three times the average monthly wage is determined as a percentage of the amount of wages, but not at the expense of payments to the employee, but at the expense of the organization’s expenses and is:

| Type of contribution | Size, % | Limit value of the base for calculation |

| OPS | 22,0 | OPS - 1,021,000 rubles, above this amount - 10% |

| OSS | 2,9 | OSS - 815,000 rubles, above this amount - 0% |

| Compulsory medical insurance | 5,1 | There is no maximum base amount - it is charged from the entire payment amount |

| Contributions for injuries | 0,2-8,5 |

Contribution rates may vary, depending on the tax regime used (USN, UTII, Unified Agricultural Tax, PSN, OSNO)

Contributions must also be transferred by payment order with the correct indication of the KBK:

| Payment type | KBK from 2020 |

| Contributions for compulsory pension insurance | 182 1 0210 160 |

| OSS contributions | 182 1 0210 160 |

| Compulsory medical insurance contributions | 182 1 0213 160 |

| Contributions for injuries | 393 1 0200 160 |

Taxation of compensation for unused vacation

However, now you can pay all your bills via the Internet; all you need is a bank card or an e-wallet.

Income tax is paid by entrepreneurs and people with passive income. VAT is a mandatory tax for entrepreneurs; they need to tax the price of products and services. Tax rates may change, the Tax Code is updated every year

A certificate of the amount and deadline for payment, as well as the code of the required tax, can be found in the code or asked from a tax specialist. Important: taxes must be paid on time; unscrupulous taxpayers face penalties. You only need to pay in rubles

Pay either directly to the tax office or through a bank by filling out a form.

https://youtube.com/watch?v=QFeLPN6T0ug

It is important to provide the details correctly, otherwise the amount will go to the wrong place. Nuances of the procedure When can I receive my severance pay upon dismissal? Immediately as soon as the corresponding order is issued

Things to remember

When dismissing from a position, the standards given in the Labor Code of the Russian Federation, as well as in the directives of Government Decision No. 922, must be taken into account. In case of violations by the employer, the Criminal Code (CC) comes into force. According to the Criminal Code, an employee has the right to file a claim to receive compensation. A claim is also being filed to collect penalties for the period of delay. If the claim is satisfied, the employer is liable under the Criminal Code (Article 145.1).

Potentially possible amounts of compensation upon dismissal for unused vacation are calculated taking into account the following factors:

- average daily salary of an employee. This takes into account the total income received during the previous year of work at an individual entrepreneur or any other enterprise. After this, the total income is divided by the amount of time worked during the year. It should be understood that this amount is calculated without holidays, time off, etc.;

- vacation is calculated taking into account the entire volume of the vacation period that was not claimed in the reporting year.

In the latter case, a special formula is used: SD = OD / 12 / 29.3. Where:

- SD is the total income that a person received in the twelve months preceding the calculation;

- 12 are months;

- 29.3 is the average number of days index. A similar index was ratified by Resolution No. 922.

In addition to the formula described above, another equation can be used: SD = 29.3 x Km + Kd. It is deciphered as follows:

- SD is the total income received by the employee for the twelve months before the layoff;

- 29.3 is the average number of days;

- Km is the number of months that the employee has fully worked;

- Kd are the days that the dismissed person worked partially.

Any enterprise or individual entrepreneur has the legal right to offer an alternative solution upon dismissal. This decision does not imply vacation, but the accrual of appropriate compensation, which is accrued for unused vacation.

Personal income tax

This tax must also be withheld. As in other cases, it is 13% of the amount of income, since this payment will also qualify as income.

Amounts and calculation of taxes

Let's take the matter to a more practical level and give the exact amounts of deductions that will need to be paid, and also carry out calculations of exactly how much money will be paid to the employee, and how much will go to the state budget or funds. First, let's establish the amounts of taxes and contributions.

Let's start with the personal income tax; its size will depend on whether the payer is a resident of the Russian Federation. For residents, the tax level is set at 13%, for non-residents – 30%. Note that the right to standard tax deductions in accordance with Article 218 of the Tax Code in relation to compensation is not granted, since they are made only once a month, and in this case they will be deducted from wages.

Now let's look at other payments - their difference from personal income tax is that if it is formally paid by the employee himself, then the remaining fees are borne by the employer. As a result, the employee usually sees that personal income tax was deducted from the payment, and therefore almost everyone knows about the notorious 13%, but the amount of the remaining fees is not indicated. What is he like?

Contributions to the Pension Fund are the most substantial - 22%, this is the amount that is always charged from wages, and it will also need to be paid from compensation for unused vacation. Subsequently, on the basis of this money, pension payments to the citizen will be formed.

Contributions to the Federal Health Insurance Fund are less - 5.1%, but unlike pensions, which are returned to the citizen in the form of money, albeit only when he retires, in this case the return is assumed in the form of medical services, which not everyone uses at all – after all, many citizens now prefer to be treated in private clinics.

Contributions to the Social Insurance Fund are 2.9% - it is from this money that payments are made in case of illness and receipt of a certificate of temporary disability, that is, the employee provides them for himself. In addition to this payment, another contribution is established for insurance against accidents at work, but its size will greatly depend on the working conditions.

Now let's do the calculation based on these numbers. The payment for unused vacation before taxes for an employee is 37,000 rubles (you can read about how this payment is calculated in separate articles). Our task is to establish how much the employee himself will receive, as well as how much the company will pay for it to state funds .

First you need to calculate personal income tax: 37,000 x 0.13 = 3,810 rubles

Now we subtract the resulting figure from the original: 37,000 - 3,810 = 32,190 rubles - thus, we have received the amount that should be issued to the citizen, since all other payments will no longer reduce it.

How much will go to the Pension Fund? 37,000 x 0.22 = 8,140 rubles.

To the Social Insurance Fund: 37,000 x 0.029 = 1,073 rubles.

To the Medical Insurance Fund: 37,000 x 0.051 = 1,887 rubles.

To this should also be added a payment for insurance against industrial accidents, but since it is not fixed, we will not take it into account in this calculation.

As a result, it turns out that the company must pay an additional 8,140 + 1,073 + 1,887 = 11,100 rubles. The total amount spent by the employer was 48,100 rubles, of which the employee received 32,190.

Regulatory regulation

Labor Code of the Russian Federation Art. 126 determines vacation time and art. 127 – compensation for vacation

Decree of the Government of the Russian Federation dated December 24, 2007 N 922 regulates the calculation of vacation pay

The Tax Code of the Russian Federation, Part 2 regulates personal income tax payments

Ch. 34 of the Tax Code of the Russian Federation is devoted to insurance premiums

Federal Law of December 29, 2006 N 255-FZ defines social insurance

Federal Law No. 167-FZ dated December 15, 2001 is devoted to the payment of pension contributions

Federal Law of July 24, 1998 N 125-FZ - accident insurance

Rules “On regular and additional holidays” (dated April 30, 1930 N 169) within the framework that does not contradict the Labor Code of the Russian Federation

Also, at the local level, the organization may provide compensation for vacation pay, which is based on the Labor Code of the Russian Federation, without infringing on the rights of employees.

Personal income tax payment

Personal income tax is a tax on personal income. This concept is regulated by Chapter 23 of the Tax Code of the Russian Federation, part two.

Withholding income tax on compensation due to an employee of an enterprise is regulated by Article 217 of the Tax Code of the Russian Federation. Thus, according to paragraph 5 of clause 3 of this article, compensation for unused vacation is an exception to the list of non-taxable payments. Thus, withholding personal income tax from monetary compensation for vacation is mandatory.

Article 224 of the Tax Code of Russia sets the tax rate at 13% (in other cases specified in this article, this value can vary from 9% to 35%).

It is worth noting that in such a situation the employee is directly the taxpayer, and the employer acts as a tax agent. Based on this, the monetary value of 13% will be withheld directly from the amount due to the employee, and the remaining 87% of the compensation will be issued to the employee. The employer does not bear the tax burden and additional expenses.

In this case, the deadline for transferring the withheld income tax to the Federal Tax Service, in accordance with paragraph 6 of this article, is the next day after the day of payment of income to the employee (taxpayer).

Payment of tax in case of death of an employee

As for the payment of personal income tax on monetary compensation in the event of the death of an employee, this answer is also regulated by letter of the Department of Tax and Customs Policy of the Ministry of Finance of Russia No. 03-15-06/24374 dated 04/24/2017.

Based on the information provided, we can conclude that personal income tax is not paid on compensation for vacation in the event of the death of an employee. This is due to the fact that subparagraph 3 of paragraph 3 of Article 44 of the Tax Code of Russia states that the taxpayer’s obligation to pay tax terminates at the time of his death, while paragraph 18 of Article 217 of the Tax Code removes the obligation to tax income received by individuals in the manner inheritance.

Thus, to summarize, we can say that the amount of monetary compensation for an unused vacation period is subject to taxation in all cases, with the exception of receipt of money by inheritance by relatives of a deceased employee.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

Payment deadlines

Both income tax and insurance premiums are paid monthly. Despite the fact that personal income tax is actually paid by an individual, the obligation to transfer the payment to the budget lies with the employer.

In this case, the enterprise makes a payment of funds in favor of the individual minus the personal income tax payment. And the payment should be sent to the budget no later than the next day.

For insurance premiums, the payment deadline is slightly different. Based on paragraph 3 of Article 431 of the Tax Code of the Russian Federation, the organization transfers contributions by the 15th day of the month following the month of payment.

What taxes are charged on compensation upon dismissal 2020

Therefore, contributions to the Pension Fund, Social Insurance Fund and Federal Compensation Fund must be calculated from the amount of compensation according to the general rules - the same as from other taxable payments in favor of the employee (Part.

1 tbsp. 7 of the Law of July 24, 2009 No. 212-FZ). The deadline for contributions to be transferred to the budgets of extra-budgetary funds is the 15th day of the month following the month in which contributions were accrued (Part 5, Article 15 of Law No. 212-FZ of July 24, 2009)

Please note: failure to pay required contributions and tax deductions on time may result in the imposition of penalties for the organization.

Yes, this is relevant this year.

The situation is explained by the fact that this compensation is an exception to the above list. When tax is withheld The transfer of funds to the current account of a dismissed employee is considered the moment he receives income that is subject to taxation. This is stated in paragraph 1, paragraph 1 of Art.

How are they accrued upon dismissal?

When an employee leaves the organization, regardless of the reasons, compensation is accrued for all unused days of annual leave.

This payment is made on the last working day and is also subject to insurance premiums.

The taxation procedure and accrued interest do not depend on the reason for which the compensation amount was accrued: as payment for additional days or upon dismissal.

Contributions must also be calculated and personal income tax withheld upon termination of the contract.

If an employee has died, and the payments accrued to him are paid to relatives, then the compensation is not subject to insurance premiums.

Accrual and payment terms

If the compensation amount is accrued in connection with the replacement of additional leave with money, then the deadline for transferring contributions is no later than the 15th day of the month following the month of payment of income.

This is important to know: Dismissal without compensation for unused vacation: consequences

If payment for unused vacation is made upon dismissal, then the payment period is similar.

Insurance deductions must also be transferred before the 15th day inclusive of the next month.

Calculation of insurance premiums for compensation of unused vacation

Compensation for unused vacation is not exempt from the calculation of insurance contributions to the Pension Fund and the Social Insurance Fund (currently all these contributions are collected by the Tax Inspectorate). These payments must be made from the employer’s funds and cannot reduce the amount of compensation.

Contributions from compensation are deducted for pension, social and health insurance, as well as for “injury”. Contribution rates depend on the applicable tax regime, the availability of benefits from the employer and the type of activity. In general, 22% is allocated to pension insurance, 5.1% to medical insurance, 2.9% to social insurance, and from 0.2 to 8.5% to injuries.

When determining the amount of insurance premiums, the employer must take into account the limits established for the current year. If the employee’s income exceeds 1,021,000 rubles, then the pension insurance rate is reduced to 10%. The limit for social insurance, beyond which contributions are not paid, is 815 thousand rubles.

Insurance premiums are transferred within the standard time frame: before the 15th day of the month following the billing month.

As for personal income tax, vacation compensation, unlike severance pay, is subject to contributions in full. Personal income tax is charged at a standard rate of 13%. In this case, the employer performs the functions of a tax agent: he withholds and transfers the withheld tax to the budget. Personal income tax is translated in accordance with clause 3 of Art. 217 Tax Code of the Russian Federation.

For example, if the amount of vacation compensation was 25 thousand rubles, then the employee will receive 21,750 rubles. minus personal income tax (25000-25000*13%).

Is it taxable?

Compensation for unused vacation days is accrued either upon dismissal or in the event of replacement of additional days with money. How to calculate compensation?

The accrued amount in favor of the employee is subject to taxation, since this type of payment is not included in the list of non-taxable income from Article 20.2 of Law 125-FZ as amended. dated 07/29/2017.

Compensation is subject to personal income tax at a rate of 13% and insurance premiums at a general rate of 30%.

In this case, income tax is withheld from the accrued amount, and insurance contributions are calculated in excess of compensation and are transferred at the expense of the employer.

Deductions include payments for compulsory pension, social and medical insurance:

- 22% is allocated to compulsory public health insurance;

- 2.9% - for VNIM (temporary disability and maternity);

- 5.1% - for compulsory medical insurance.

These types of insurance contributions are paid to the Federal Tax Service.

In addition, you must also calculate the percentage for injuries from the accrued compensation; its rate may vary, but the minimum is 0.2%.

Online calculator for calculating compensation - calculate.