Cash collection is often referred to as the procedure of transportation, the physical movement of cash from one place to another.

A typical example is the transfer of cash proceeds from retail outlets to the servicing financial institution. As a rule, in such situations we are talking about transporting fairly large amounts of cash.

This is a serious and responsible operation, therefore it is always carried out according to certain rules, strictly regulated by the regulatory documents of the Central Bank of the Russian Federation.

Cash collection involves performing specific actions.

This applies to the procedure itself, its documentation and accounting.

What is it and what is it for?

Cash collection is a complex concept that means a set of interrelated measures for the physical movement of cash between individual business entities (organizations), their structural (separate) divisions and servicing banks.

Transportation of cash is carried out by authorized collectors - specialists with the necessary professional training.

The actions of all participants in this procedure - cashiers, collectors, bank employees - are subject to the established procedure regulated by Directive of the Central Bank of the Russian Federation No. 3210.

As a rule, collectors are contacted for the following reason - ensuring the safety of cash during its transportation.

Cash collection is a guarantee of its safety and protection from external attacks.

In fact, the transportation of cash by armed cash collectors is the priority and safest way to physically move it from the cash desk of the enterprise to the servicing bank.

The cash collection procedure allows you to successfully solve the following tasks:

- Physical movement (transportation) of cash proceeds of a commercial enterprise from a retail outlet to a servicing bank.

- Delivery of the required amount of cash from a financial institution to the cash desk of a business entity for the next payment of salaries to its employees.

- Transportation of cash between separate structural divisions (branches) of a particular bank.

- Regular replenishment of ATMs with the required amount of paper bills with the generation of a report on the current state of cash counters.

- Periodic withdrawal of cash proceeds from payment terminals that accept cash.

- Safe transportation of material assets and documentation.

The cash collection service, which implies the subsequent crediting of transferred funds to a bank account, is provided legally in the following ways:

- Directly through bank tellers.

- With the help of a collection service authorized to transport cash. These may be collection departments at servicing financial institutions, as well as private security structures that have the legal right to accompany the transportation of cash.

- Through the RosInkas service, a collection agency that has a special permit from the Central Bank of the Russian Federation.

- Through the federal postal system.

- Directly through automatic safes.

Is it mandatory for an LLC?

Current legislation - regulatory documentation of the Central Bank of the Russian Federation - provides for a requirement to limit the cash balance of business entities.

We are talking about setting a limit on the total amount of cash remaining in the organization's cash desk at the end of each operating day.

This condition applies to all business entities carrying out incoming and outgoing transactions with cash, except for individual entrepreneurs and organizations related to small enterprises.

It should be noted that business entities that fall under the exceptions have the right to limit the cash balance, but not the obligation.

If an individual entrepreneur/small enterprise nevertheless decides to exercise this right, compliance with the established standard (limit) will be mandatory. Read about the limit for small businesses here.

Exceeding the limit cash - exceeding the established limit - is subject to withdrawal from the cash desk of a business entity and mandatory transfer to the servicing bank with its subsequent crediting to the organization's current account.

Cash collection is considered the safest method of physically moving cash from a business's cash desk to a servicing financial institution.

If we are talking about significant amounts, it is recommended to use the services of professional cash collectors who guarantee the safety of the money being moved.

Business entities are allowed to accumulate and retain excess cash in excess of the limit only on paydays and holidays/weekends.

Violation of these rules results in the imposition of penalties on the perpetrators. The fine for officials ranges from 4,000 to 5,000 rubles, for organizations (enterprises) – from 40,000 to 50,000 rubles.

Methods of depositing funds into the bank

You can deposit cash to the bank account of the company in one of the following ways:

- Independently to the bank's cash desk (the organization deposits the cash itself). In this case, the company is required to provide transportation for employees responsible for cash delivery, as well as take additional security measures.

- Via federal postal service. Money is deposited into special safes (terminals), which act as cash registers, and the account in which it should be credited is indicated.

- With the help of a special organization that is part of the Bank of Russia system (for example, a collection service). Such a service is usually a structural unit of the bank in which the company has an account or a separate organization licensed to provide collection services.

Important! The legislation limits the list of persons who can deposit company cash with the bank. However, it would be more appropriate for the organization to appoint a cashier as such a person, who is the employee who is financially responsible for the safety of money.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Rules and procedures for cash in an enterprise

There are generally binding legal norms that clearly regulate the procedure for cash collection in an organization.

These rules, as mentioned earlier, must be strictly observed by all participants in this process - the cashier of the enterprise transferring cash, and the collector delivering the transferred money to the bank.

In addition, collection rules may be regulated by a signed agreement on the provision of collection services, which, for example, provides for the frequency of transfer of funds and other specific conditions.

The cash collection procedure itself involves the sequential performance of the following actions by its participants:

- The transferred cash is prepared by the cashier of the business entity for dispatch. At this stage, a thorough counting and packaging of funds are carried out, which are then placed in bags. A set of necessary documents is prepared in several copies. The completed papers are also placed in collection bags with money. This stage ends with the sealing of bags to be handed over to collectors.

- Cash packed in bags is handed over to the collector. This action is performed by the cashier of the transferring organization in a special room. The auditor, financial controller, chief accountant, and head of the organization have the right to control this procedure. The cashier checks the identity and papers of the collector, enters information into the appearance card, provides a sample of the seal, and gives the bag with money and documentation to the collector. The collector verifies his identity, presents the necessary papers to the cashier and returns empty bags, accepts bags with money, checks the serviceability of seals, verifies document data, signs and dates the receipt, and puts a stamp.

- Transportation (physical movement, transportation) of transferred funds directly to the servicing bank. This procedure is carried out by an authorized collector along a route developed and approved in advance.

- Delivery and acceptance of bags with cash at a financial institution. The collector transfers the bags of money to the servicing bank, which duly accepts these funds. The acceptance procedure is carried out according to established rules. If it is completed successfully, the collector’s full financial responsibility for the transferred money ceases.

- The transferred cash is accepted and received by a bank employee who checks the bags, the integrity of the seals, and the correctness of the information in the accompanying papers.

Documenting

In order to correctly transfer cash to the collector for transportation to the bank, the cashier draws up the following documentation:

- The accompanying statement in three copies (one - in the bag, the second - to the cashier, the third - to the collector);

- a register of completed transactions (placed in a bag), the amount of which must correspond to the amount of the statement;

- money bag invoice;

- receipt for money bag.

The collector verifies his identity, presents a power of attorney, and gives the cashier an appearance card to fill out.

The cashier enters the necessary information into the appearance card and returns it to the collector. Subsequently, this card is checked by a bank employee and compared with the cash order.

Accounting and postings

In the accounting of a business entity that transfers cash to the bank through collection, certain correspondence accounts are used, accompanied by the preparation of the necessary documents:

| Operation | Debit | Credit | Document |

| The cashier handed over the cash to the collector | 57 | 50 | RKO, receipt |

| The collected amount is credited to the bank account | 51 | 57 | Bank account statement |

| The corresponding commission has been paid to the bank | 91 | 51 | Bank account statement |

Actions of collectors

The collection management draws up a schedule and the time of arrival of collectors at the serviced companies and coordinates this time with the management of the companies. During the collection procedure in a company, the collector on duty fills out card 0402304, which is then transferred to the credit institution.

Before leaving, collectors receive a stamp, keys and cards 0402303, powers of attorney for the transportation and collection of cash, and bags. When a company employee transfers a bag with money to a collector, the second must present the first with the relevant documents, card 0402303 and an empty bag.

Collection of funds: the procedure for its implementation

.

Collection of funds is the collection of financial resources, settlement and payment documents, as well as bills of exchange of clients of any banking institution from the cash desk by collectors, ensuring safety until delivery to a particular bank and subsequent crediting to the client's current account.

- Deliver proceeds from trading enterprises to banking institutions.

- Deliver money from a banking institution to the company's cash desk to ensure the issuance of salaries for employees from there.

- Ensuring the transportation of funds to retail locations when applying for a bank loan for a purchase.

- Deliver cash proceeds from all retail outlets of commercial entities to their offices for deposit in the bank in the future.

Cash collection: organization, registration, accounting

Attention! Archived publication This page contains a long-standing archived publication of the accounting weekly Debit-Credit, which is now quite possibly out of date and may not comply with current accounting and tax standards.

To work with current magazine materials, go to or select the section of the DK portal you need in the top navigation line. The need for cash collection from legal entities is due not only to the owners’ concern for its safety, but also to the requirements of current legislation.

According to clause 2.8 of Regulation No. 637, enterprises can keep cash proceeds (cash) in their cash registers outside of working hours within limits not exceeding the established cash register limit. The rest of the cash must be handed over to banks to be credited to bank accounts.

Such requirements are not imposed on individuals, but those who work with large cash proceeds can also use the services of cash collectors if they wish.

How is the transportation of money organized?

The procedure for collecting funds is as follows:

- The cash desk employee checks the collector's passport details, power of attorney, application card, and accepts the bag.

- The collector shows a sample of the seal, fills the bag, and attaches documents and receipts.

- The cashier fills out the documents, indicating all the actions taken within the framework of collection.

- The money is put in a bag. The collector, in the presence of the cashier, needs to inspect it and the seal to make sure there is no damage and that there is no access to the contents.

- The cashier fills out the accompanying documents and signs.

- Valuables are transported to the bank. If the banking day is over, the package can be sent to the collection office for temporary storage - this issue is resolved at the stage of concluding the contract.

- The bank carries out a count of money, an inventory of valuables, and verification of their authenticity and integrity. After this, the amount is credited to the company’s account.

Cash collection: accounting clearance

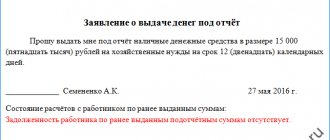

Based on the receipt remaining in the organization (with the signature and stamp of the collector), a cash expense order (RKO) is drawn up, in which:

- In the RKO line “Issue”, indicate your full name. cashier of the organization or other employee who transfers cash to collectors. It is erroneous to indicate the collector's data in the cash register - such a consumable is considered incorrectly issued.

- In the “Appendix” line, you should indicate the date and number of the receipt (letter of the Central Bank of the Russian Federation dated October 16, 2015 No. 29-1-1-OE/4065).

The next step is to make an entry in the Cash Book based on the RKO.

Dt account 57 “Transfers in transit” - Ch account 50 “Cash desk”

cash was transferred to the collector for crediting to a bank account. Posting is done based on the receipt and consumables.

After accepting and crediting the money to the current account, based on the bank statement, we make the following entry:

Dt account 51 “Current account” - Kt account 57 “Transfers in transit”

— the money arrived in the organization’s bank account.

The bank will typically charge a fee when accepting cash from customers and this will be reflected on the account statement. Let's do the wiring:

Dt account 91.2 “Other expenses” – Kt account 51 “Current account”

— the bank deducts a commission for accepting and counting cash.

Collection services are reflected in accounting as part of other expenses:

Dt account 91.2 “Other expenses” – Kt account 60 “Settlements with suppliers and contractors”

- collection services;

Dt account 19 “VAT” – Kt account 60 “Settlements with suppliers and contractors” -

VAT on collection services.

Please note: in the tax accounting of simplified organizations with the object “income minus expenses”, collection services relate to payment for bank services, which means that the tax base can be reduced for them (clause 9, clause 1, article 346.16 of the Tax Code of the Russian Federation). Organizations using OSNO, when calculating income tax, define these services as non-operating expenses (clause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

The procedure for collection, processing, formation and packaging of cash.

Creating your own cash collection structure requires large expenses and is not always impractical; the advantage of the services of third-party organizations is their liability for untimely collection of funds. How is cash collected in an insurance company kept track of?

An organization that includes separate divisions that do not have a current account independently determines the limit on the cash balance in these divisions. For each of them, the organization maintains its own section of the cash book.

The deposit of funds to the appropriate bank accounts can be made: - directly to bank cash desks;

Using the services of bank collection services;

With the help of a specialized collection service with a license

Bank of Russia;

Through the organization of the federal postal service; - in automatic safes.

A separate division (branch, representative office) of an organization that has a bank account is collected in the same manner as a legal entity. At the same time, at the cash desk, it is necessary to document the receipt of revenue (receipt orders) and its delivery to the bank (withdrawal order). Entries are made in sections of the cash book of a separate division.

The rules for the storage, transportation and collection of cash in credit institutions on the territory of the Russian Federation are established by the Bank of Russia Regulation No. 318-P dated April 24, 2008 “On the procedure for conducting cash transactions and the rules for the storage, transportation and collection of banknotes and coins in credit institutions on the territory of the Russian Federation "(hereinafter referred to as Regulation No. 318-P). In accordance with Federal Law No. 86-FZ dated July 10, 2002 “On the Central Bank of the Russian Federation (Bank of Russia)”, transportation of cash, collection, as well as cash operations for accepting and processing cash can only be carried out by organizations included in the Bank of Russia system .

To transport cash, a credit institution may engage organizations that provide services for the transportation of valuable goods. And if a license is required for collection, then such requirements are not imposed for the transportation of funds. However, it can only be carried out by specialized organizations that provide services for the transportation of valuable goods.

Relations with collection employees carrying out cash transportation and collection are determined by an agreement on full liability. If operations for the transportation and collection of cash are carried out jointly by several collection workers and it is not possible to differentiate their responsibility for causing damage, an agreement on collective (team) liability is concluded.

In the case of collection services, an agreement is concluded for collection, recalculation and crediting (transfer) of cash to the bank accounts of the organization. If collection is carried out by bank employees, a bilateral agreement is signed, if a non-bank credit organization is involved, a tripartite agreement is signed. A responsible person is appointed from each of the three parties.

As a rule, under a collection agreement, an organization is required to ensure free and illuminated access roads, entrances, exits and corridors, an isolated and invisible cash register room locked from the inside, unhindered movement of armed cash collectors in the building along the route entrance - cash desk - exit, escort by a security officer or other official of the organization.

Rules for collection

For each organization that collects cash, the bank issues monthly numbered appearance cards 0402303. The forms of this and other documents are approved by Bank of Russia Regulation No. 318-P. The appearance card indicates the numbers of the assigned bags, name, address, phone number of the organization, weekends, end time of work, arrival time of collectors, etc.

Taking into account the volume of collected cash, the number of empty bags issued to the organization is determined. Each bag is assigned an individual number. The head of collection, in agreement with the organization, sets the time and frequency of arrivals of collectors.

The cash collector, in the presence of the cashier, checks the integrity of the bag and seal, the compliance of the seal with the existing sample, and the correctness of filling out the invoice and receipt. After the cashier fills out the appearance card, the collector checks the correspondence of the amount of cash indicated in the appearance card, the invoice and the receipt. It also checks the number of the bag with cash with the number indicated on the appearance card, invoice and receipt. An incorrect entry on the appearance card is crossed out, and a new entry certified by the cashier is entered in the margins. The collector has no right to make entries in the appearance card.

When accepting a bag with cash, the collector signs a receipt for the bag, puts a stamp on the date of acceptance of the bag with cash and returns the receipt to the cashier. If the collector reveals a violation of the integrity of the bag or seal or an incorrect preparation of the delivery note for the bag, then the bag will not be accepted.

Packing defects and errors in drawing up the accompanying sheet for the bag are eliminated in the presence of collectors, if this does not interfere with their work schedule. Otherwise, bags with cash are accepted at the organization upon repeated arrival of collectors at a time convenient for them. The corresponding entry is entered in the “Repeated arrivals” section of the attendance card.

If the bag is not handed over to the collector, the cashier of the organization is obliged to make the entry “Refusal” in the appearance card in the line for this date, give the reasons for the refusal and certify with his signature.

The collectors are not responsible for any shortage or surplus of funds, as well as for counterfeit and insolvent banknotes discovered during the counting of money, if the collection bag is in good working order. This is confirmed by judicial practice. However, if the collector accepts a defective bag or its loss occurs, he, according to current legislation, bears financial liability to his client in the amount of lost funds (Resolution of the Federal Antimonopoly Service ZSO dated 05.05.2009 No. F04-2204/2009 (4483-A70-8 )).

©2015-2019 website All rights belong to their authors. This site does not claim authorship, but provides free use. Page creation date: 2016-04-12

Specialized services, bank security units and certain departments at enterprises have the right to carry out collection of retail outlets. An agreement is concluded with each of these services for the provision of services for the collection and transportation of money and material assets.

Cash collectors not only collect cash and transport it to various authorities. They also have the right to transport cultural property, jewelry, secret documents and jewelry. Each of these employees collects money or valuables, as required by the collection instructions. The punishment for violating the regulations is very strict, ranging from dismissal or a large fine to criminal liability. It all depends on the consequences of the violation.

When concluding an agreement with a special service or bank armed security, the collection procedure is regulated by the current regulations and internal regulations of these institutions and services. Authorized divisions have the right to service customer retail outlets and transport cash from them in accordance with the regulatory standards established by the actual contract.

Sometimes large enterprises are allowed to independently organize the collection of funds at their branches and from partners selling their products. For this purpose, an in-house service is created to collect and transport cash. Activities at other retail outlets not related to this organization are prohibited.