Many organizations, firms, as well as individual entrepreneurs use cash receipt orders form 0402008 or PKO in their document flow. The 2020 cash receipt order form has its own purpose and filling features. The rules for filling out a receipt order are prescribed in the Regulations of the Central Bank of October 12, 2011 No. 373-P “On the procedure for conducting cash transactions...”

We recommend this service for entrepreneurs who want to focus their energy directly on business and not waste time on accounting. The benefits of working with this company have already been appreciated by thousands of entrepreneurs!

We will tell readers in this article what kind of document this is, who maintains it and how to fill it out correctly. And at the bottom of the page there are links where you can click on the cash receipt order and print it. There is also a sample filling there. Documents are posted in user-friendly Word and Excel formats.

Receipt cash order form 0402008: purpose of the document

In order to understand the purpose of a cash receipt order, it is necessary to define this document.

So, a cash receipt order (PKO) is a document for reporting. It is issued by the cash desk of any organization or company when accepting cash equivalents.

PKO has a unified form KO-1, approved on August 18, 1998. Form KO-1 of the cash receipt order is drawn up in one copy.

A cash receipt order is necessary for the legal registration of cash receipts (for example, from the founder, for compensation of damage, etc.).

In other words, the 2020 cash receipt order (Form No. KO-1) confirms the deposit of funds into the cash register that were received:

- as a result of the provision of services, sale of goods, performance of work;

- as a result of the return of the balance of money that was issued to employees but not spent;

- as a result of payment of a share in the authorized capital by a new participant (for an LLC);

- as payment for sold property, equipment;

- as a result of withdrawal of funds from the current account for specific needs.

What kind of document is this

A cash receipt order (PKO) is a document for reporting, which is drawn up when the cash desk of any organization receives the cash equivalent. The PKO is unified, approved on August 18, 1998.

There are enterprises that still adhere to manual reporting, while others are switching to computerization of the entire process. The arrival note is created in only one version.

This nuance cannot be avoided in all monetary transactions, because this is how you can confirm the receipt of cash using a primary document. You will need a PKO to legally formalize the money received from all persons: from the founder, when selling property, when compensating for damage caused by the company’s staff, from the customer of the work, the buyer of the goods in the form of proceeds.

The following video explains in detail why PKO is needed:

https://youtu.be/ciYne7nmq64

Who issues a cash receipt order?

The organization's accountant or another employee (including a cashier), determined by the manager in agreement with the chief accountant (if any) by issuing an order, is responsible for preparing the PQS. After looking at a sample of filling out a cash receipt order, you will see that the finished document of form KO-1 consists of two parts:

- Order.

- A tear-off receipt for a cash receipt order.

The accountant's signature must be on the cash receipt order. If the company does not have an accountant, then the document is signed by an authorized person.

The cashier checks the PKO. After checking the correctness of the order, a stamp is affixed to it. Most of the seal should be located on the tear-off receipt, and the smaller part should be on the order itself.

After stamping the document, an entry must be made in a notebook to record all transactions.

At the moment of transferring funds to the cashier, he tears off the receipt for the cash receipt order and hands it to the person (who deposited the funds). The main document (order) remains at the cash desk.

Registration of a parishioner and subsequent actions with him

Before entering the cash register, the PKO must be registered in a special registration register. Once it has been completed and recorded, an authorized officer must sign the receipt. This is done before the funds arrive at the cash desk.

As soon as the cashier has received the receipt, he must check whether it has the signature of the chief accountant and whether it is genuine. It also checks whether the document is filled out correctly.

If at least one of the requirements is not met, the recipient returns for revision. If the document is filled out correctly, the cashier accepts the cash, he signs the document and puts his initials on it. On the receipt he puts the date of receipt of cash and puts the company seal of the organization. Near the applications you need to put a stamp or the inscription “received”.

After receiving funds at the cash desk, the cashier tears the receipt from the order itself and hands it to the depositor.

How to fill out a cash receipt order?

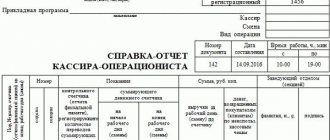

Although an example of filling out a cash receipt order is presented on this page, it would not be amiss to give the reader step-by-step instructions. So, let's move on to the step-by-step filling out of the cash receipt order form, form KO-1.

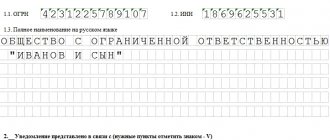

1. In the “Organization” paragraph, the name of the organization issuing the receipt is indicated. The name of the organization is entered in the same way as it is registered in the constituent documents.

2. In the line “Structural unit” the structural unit of the organization issuing the receipt is indicated. If the organization does not have a structural unit, a dash is added.

3. The serial number of the PKO is indicated in the “Document number” strip.

4. The date the order was issued is written in the “Date of Compilation” column. Date format: DD, MM, YYYY.

5. The accounting account number is indicated in the “Debit” line (this item does not have to be filled out).

6. The code of the division of the structure where the funds are deposited is indicated in the “Loan” paragraph. If the organization does not have structural divisions, a dash is added.

7. The code number of the branch of the organization for which the receipt is issued is indicated in the line “Code of structural unit”.

8. The analytical subject of the corresponding accounts is entered in the column “Analytical accounting code”.

9. The amount of incoming funds that arrived at the cash desk is entered in the line called “Amount”. The entry is made both in numbers and in words (with a capital letter).

10. The code number of purposes for using the received funds is entered in the “Purpose Code” item. If there is no corresponding code (it must be contained in the LLC documentation), a dash is added.

11. The following data is entered in the “Received from” field:

- name of the organization (firm, company, individual entrepreneur);

- surname and name of the representative of the organization (in the genitive case) transferring funds (if the money came from another organization);

- basis for the transaction: payment for sold products according to the invoice; payment for work performed or services provided under the act; compensation for material damage by court decision or order; making an advance payment under a purchase and sale agreement or under a service agreement; return of unused funds issued for reporting; compensation for identified shortages based on an audit or on the basis of an order; contribution to the authorized capital (for LLC).

12. The VAT amount can be indicated in numbers in the “Including” paragraph. If incoming funds are not subject to taxes, then “Without VAT tax” is indicated.

13. If there are attached documents, the details are recorded in the “Appendix” section. The tear-off part is filled in exactly the same way.

If any documents were attached to the cash receipt order, then a stamp should be placed. The order must be marked “Received”. The date is also included.

Filling out the PKO form: nuances

There are a number of nuances that characterize the procedure for filling out a cash receipt order form. Let's look at them.

The “Structural unit” column should be filled out only if cash is accepted from an employee of the organization. If they are transferred by another legal entity or individual, then a dash should be placed in the corresponding paragraph of the form.

The “Debit” and “Credit” items contain the accounts of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n) in accordance with the essence of the business operation.

The column “Purpose code” is filled in by organizations that use the appropriate coding system.

The column “Amount of rubles, kopecks” of the KO-1 form is filled in only with numbers, rubles and kopecks are separated by a comma (for example, “200.75”). In the “Amount in words” column, rubles are indicated in words (the first word is capitalized), and kopecks are indicated in numbers. You should also put a dash (if the document is filled out on a computer, then a continuous sequence of consecutive dashes) in the empty spaces of the corresponding column after indicating the amount in words.

If the company does not work with VAT, then in the “Including” column you should enter “Without VAT”. Otherwise, the corresponding VAT amount.

In the “Appendix” paragraph, you should record the primary documents that are the basis for entering figures into the PKO (for example, a cashier’s report).

In addition to the main part of the KO-1 form, you will also need to fill out a receipt, which is included in the structure of the PKO. The receipt will appear in the document on the same page as the main part of the form. As for affixing the seal, based on business customs, the seal is often affixed so that part of it is on the receipt, and the other part is on the PKO. Please note that in this case, claims from the tax authorities are possible. However, you can try to challenge them (see, for example, the decision of the Seventh Arbitration Court of Appeal dated 04/06/2010 No. 07AP-1517/10). In addition, today such disputes seem to us to be of little relevance, since in connection with the entry into force of the law of April 6, 2015 No. 82-FZ, the seal for organizations has ceased to be a mandatory requisite.

See also the material “ Printing is not a mandatory attribute of the primary document . ”

The order must be signed by the cashier or other authorized person. The cashier checks the signatures of authorized persons on the PCO with the samples (except for the situation when the receipt is issued in electronic form). If the document is filled out by an individual entrepreneur and does not hire a cashier, then the appropriate authority to sign the document is assigned to him. A receipt is issued to the person who deposited funds into the cash register.

NOTE! If you fill out the PKO electronically and sign with an electronic signature, then you can send a receipt to the depositor of funds at his request by email (clause 5.1 of instruction No. 3210-U).

From 08/19/2017, the cashier can issue a general cash receipt order at the end of the day for the entire amount of cash receipts, confirmed by fiscal documents - cash receipts and BSO online cash register (clause 4.1 of instruction No. 3210-U).

Checking the completion of data in the software

The PKO must be checked by the cashier of the organization or a person replacing him. He must ensure that everything is done according to the rules and whether the document contains any errors. When the cashier is convinced of the correctness of the receipt, he has the right to accept cash and put the date of the transaction and his signature on the form of the document.

There may be a situation where there may be errors in the order. In this case, the cashier returns the document for rework.

Under no circumstances are errors allowed in the cash receipt order form KO-1! You cannot make corrections to the software. In case of an error, the order is issued again!

A cashier who fails to issue a document may be subject to penalties. The fine currently amounts to 5,000 rubles (for an official who did not issue a document) and up to 50,000 rubles (for an offending organization).

Filling out PKO details (form KO-1)

Line “Organization” - indicates the name of the organization or individual entrepreneur;

The lines “Document number”, “Date” are indicated according to the registration log;

Lines “Debit” and “Credit” - indicate the corresponding transactions;

Line “Accepted from” - indicates the full name of the cash depositor (or the name of the depositor);

Line “Base” - indicates the content of the business transaction (for example, “payment under agreement No. 111 dated October 10, 2017”);

Line “Amount” - the amount received is indicated in words;

Line “Including” - indicates the presence or absence of VAT (“VAT amount” or “excluding VAT”);

Line “Attachment” - indicates the document attached to the PQS (“Advance report No. 11 dated 10.10.2017”).

No corrections can be made to the PKO, this also applies to RKO.

Download and print the 2020 cash receipt order form

Using the links below, the reader can obtain a cash receipt order for free. Also here you will find a sample of filling out a cash receipt order. For the convenience of visitors, documents are presented in Word and Excel formats

We would like to inform you that from June 1, 2014, a new procedure for conducting cash transactions has been established, according to which individual entrepreneurs may not draw up an Incoming and Outgoing Cash Order, and also not maintain a cash book (Instructions of the Central Bank of the Russian Federation No. 3210-U).

The article was edited in accordance with current legislation 01/04/2020

Prikhodnik - form (download for free)

You can fill out the PKO form either online (for example, at https://service-online.su), or by downloading, filling out and printing one of the electronic documents below. Any text editor is suitable for working with them, including the original Microsoft Office Word or Excel. The forms are presented in a convenient form, are easy to edit and are completely ready to fill out; You can print them on one A4 sheet.

See also: Procedure for drawing up specifications for a supply contract (+ sample)

PKO - form (download in Excel)

PKO - form (download in Word)

This might also be useful:

- Rules for filling out an expense cash order

- The procedure for maintaining a cash book for individual entrepreneurs

- Production of company letterhead

- New procedure for conducting cash transactions in 2020

- Registration of an individual entrepreneur cash register in 2020

- How can an individual entrepreneur keep accounting records?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!