Payment of dividends from the LLC cash register

Good afternoon.

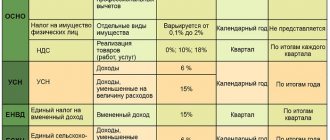

What’s stopping you from doing as before, that is, withdrawing money from your account and paying dividends? The procedure for paying dividends is established by the general meeting of shareholders (participants) (clause 3 of Article 42 of the Law of December 26, 1995 No. 208-FZ, clause 1 of Article 28 of the Law of February 8, 1998 No. 14-FZ). LLC members may elect to pay dividends in cash. It is their right, the main thing is to formalize their decision in the minutes of the meeting. In the third basket we will add all other payments, including dividends. They cannot be paid from cash proceeds, but it is not necessary to withdraw money from the current account. In addition to cash proceeds and receipt of cash from the bank, other receipts to the cash desk are also possible.

Where to invest money in 2020 so as not to lose

A good investment option is buying a small apartment, which is easiest to rent out. The price of such objects is only growing; they can be sold the fastest if you need to get cash. The benefit from two or three small apartments is greater than from one with a large area.

The risk that an object of art will depreciate is small. But at the same time there are a number of disadvantages. Firstly, even at famous auctions you can find fakes. Moreover, no one is immune from this if the purchase is made privately. Secondly, such an investment does not bring any intermediate income, and you can wait a very long time for its price to rise.

26 Jun 2020 stopurist 3665

Share this post

- Related Posts

- Is it possible to transfer private housing construction land to private limited plots?

- Preferential travel ticket for labor veterans in 2020

- Documents for registration of ownership of an apartment

- What benefits does a disabled person of group 2 have in Belarus 2019

Payment of dividends through the cash register

According to clause 2 of Bank of Russia Directive No. 1843-U dated June 20, 2007 “On the maximum amount of cash payments and spending cash received at the cash desk of a legal entity or the cash desk of an individual entrepreneur” (hereinafter referred to as Directive No. 1843-U), legal entities and individual entrepreneurs can spend cash received in their cash registers (for goods sold by them, work performed by them and services provided by them, as well as insurance premiums) for the following purposes:

Thus, the list of payments to which cash proceeds can be allocated is limited and the payment of dividends to shareholders (participants) is not included. Tax authorities, when checking compliance with cash discipline, can hold the organization liable under Part 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation for failure to comply with the procedure for storing available funds, resulting in the expenditure of funds for purposes not permitted by Directive No. 1843-U.

What, to whom and how can you now issue cash

: No, you don't need to do that. An individual entrepreneur is a participant in cash payments only when he pays for something in cash precisely as an entrepreneur, and not as an individual regarding clause 2 of the Instructions. Therefore, the obligation to withdraw money from the account to pay rent (issuance and repayment of a loan, etc.) in cash exists only when the individual entrepreneur is paying within the framework of an agreement concluded by him as an entrepreneur and for entrepreneurial purposes.

There is no such restriction for LLCs; they can pay dividends in cash, but only from money received at the cash desk not as revenue. Until June 1, dividends to employees could still be subsumed under “other payments to employees,” which were included in the closed list of payments for which cash proceeds are allowed to be spent under clause 2 of Directive No. 1843-U. Now these “other payments” have disappeared from the list and clause 2 of the Directive. Dividends obviously do not apply either to payments included in the wage fund or to payments of a social nature. Other receipts to the LLC cash desk are suitable for their payment, for example, loans provided by lenders or loans returned by borrowers, money not spent by accountants, amounts withdrawn from a bank account.

We recommend reading: Cancel maternity capital

Payment of dividends from the cash register

But even if LLC participants decide to pay cash dividends from proceeds, they need to consider the following. A number of restrictions have been established regarding the expenditure of cash proceeds from the organization's cash desk. The list of purposes for which funds from the cash register can be spent is given in paragraph 2 of the instruction of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U. The payment of dividends is not mentioned in it.

Only proceeds from the sale of your own goods (performance of work, provision of services) can be spent for these purposes. Cash accepted from citizens as payments in favor of other persons (for example, during intermediary agreements, payment for the services of mobile operators, commission trading) must be handed over in full to the bank.

We recommend reading: Medical certificate to replace your license at the traffic police

Cash payments 2020

The second paragraph of the Directive states that the manager responsible for the cash register must determine the cash limit for it upon completion of work by the end of the day.

This standard is calculated using the methodology contained in the Directive. If an individual entrepreneur or organization violates the Bank of Russia’s methodology for determining the limit or commits a violation in relation to cash payments between legal entities in 2020, then sanctions will follow. They will generally deprive the enterprise of the right to store money in its cash register.

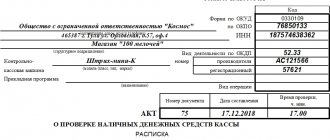

To maintain a cash register, a company must maintain documentation that was adopted by the State Statistics Committee of Russia in Resolution No. 88. Working with other forms is not allowed.

Clause 4.1 of the Directive states the need to register cash transactions with a receipt and debit order. They must be filled out by the chief accountant, simply an accountant or cashier of the organization.

How to withdraw dividends from an LLC: founder’s income

- The accountant calculates the company's net assets;

- A meeting of founders is convened (if there is only one, then he can resolve this issue independently);

- Minutes of the meeting are drawn up, which indicate the shares for the distribution of funds and the final date for their transfer;

- The agreed funds are paid (in compliance with the deadlines specified in the minutes of the meeting).

Sometimes confusion arises and the company begins counting from the moment the order to pay dividends is issued. This calculation is incorrect; the order may be issued much later. In order to avoid controversial issues, you can indicate the date of transfer of dividends in the minutes of the meeting of founders.

Payment of dividends from the cash register: relevant for LLCs and farms

In accordance with clause 3.4 of Resolution No. 637, cash is issued from the enterprise's cash desk using cash receipts (standard form No. KO-2, Appendix 3 to Regulation No. 637) or expense statements. Documents for cash disbursement must be signed by the manager and the chief accountant or an employee of the enterprise authorized by the manager. The issuance of cash to persons who are not on the staffing table of the enterprise is carried out according to cash receipts, which are issued separately for each person, or according to a separate expense sheet drawn up for each participant - recipient of dividends. For the payment of dividends to several participants - employees of the enterprise, one expense sheet can be drawn up. Recipients of cash provide passports or documents replacing them and sign in the appropriate column of the document. The authorized person (cashier), after paying on the statement of funds against the names of employees to whom dividends have not been paid, makes an o, and at the end of the statement indicates the actual amount paid and the unpaid amount of dividends. Settlements may be attached to cash receipts. The expenditure order should indicate the passport details of the recipient, information about the period for which dividends are paid, as well as details of the order for the payment of dividends. Cash disbursement must be confirmed by the recipient's signature.

Enterprises have the right to keep cash received from the bank in the cash register for payment of dividends in excess of the established cash register limit for three working days, including the day the cash is received from the bank. If you received cash to pay dividends, but within the prescribed period (3 days) did not use it for the intended purposes (or to pay for other economic needs of the enterprise), then hurry to the bank! After all, as stated in the same paragraph 2.10 of Regulation No. 637, in this case, unused excess cash should be returned to the bank no later than the next business day of the bank.

Where to invest money in 2020 so as not to lose

A reliable method to save money is to invest in precious metals, in particular gold. Metals are purchased in the form of ingots, which are stored in banking institutions. The cost of the metal forms a special account. The price of the metal may fluctuate, but overall there is a reliable return on investment from this type of investment. If transactions with metal are made in an impersonal form, then VAT is not charged. Otherwise the tax is 18%.

More to read: What documents are needed to create an individual entrepreneur 2020

Most members of society are completely ignorant of politics. They do not care at all about the economic processes taking place in the country, and even more so they do not want to delve into the intricacies of public administration. They are interested in only one question: how to optimally manage their money during a crisis.

This video is unavailable

There is a turnover from the sale of products that really improve people’s lives in various aspects, and this is health, finance, doing business, trainings and courses on relationships, self-development, increasing spirituality and much more - in general, you will like it.

We recommend reading: Can bailiffs seize property that does not belong to the debtor?

Entrance to the site costs 15 dollars, every month we pay 12 dollars for our activity and for this we get a clone. This is why the movement in the matrices does not stop; the clones are always pushing you to get money.

Payment of dividends in cash from the cash register to

Since the payment of dividends from cash proceeds is expressed in a one-time, one-time action of an official, such an offense cannot be considered ongoing, which means that a resolution in a case of an administrative offense cannot be made after two months from the date of the commission of the administrative offense.

The amount of the fine for violating the rules for storing free funds under Part 1 of Art. 15.1 of the Code of the Russian Federation on Administrative Offenses ranges from 40,000 to 50,000 rubles. In order to avoid problems, you need to receive money from your current account for these purposes.

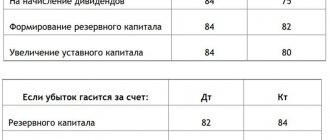

Accounting for dividends: postings, examples, accrual

The basis for recording dividends to be paid is the decision of the founder of the enterprise, formalized in writing. Since there is no unified form for such a document, the decision is drawn up in any form. Since the founder has resident status, 9% of personal income tax must be withheld from his income.

If at the end of the year the activity of an economic entity resulted in a loss, then all dividends paid to individuals - shareholders or founders of the organization should be considered as ordinary payments from the enterprise's profit after taxation. This means an increase in the tax burden. Of these amounts, it is necessary to withhold personal income tax in the amount of 13% of the amount of income and 30% in the form of insurance premiums.

Payment of personal income tax on dividends in 2020

In accordance with the current legislation of the Russian Federation, individuals must pay income tax on dividends received. From this article, the reader will learn about the personal income tax rate on dividends, on which BCCs and within what time frame to pay income tax in 2020.

All his debts will need to be taken into account and the organization must put forward counterclaims to the founder. If the founder's debt is greater than/equal to the amount of dividends, then the company has the right to refuse to pay him. That is, the organization in this situation receives an installment plan to pay income tax.

Dividend payment terms

The founders of LLCs and other organizations are interested in what regulatory documents regulate the procedure for paying dividends, what article of the law allows you to calculate the amount of payments, how to document everything, and whether such a payment is subject to taxation or whether it is a class of payments that do not provide for mandatory payments to the budget.

- Law No. 208 of 1995 and No. 14 of 1998 say that the decision on the payment of dividends is made by the general meeting. For this purpose, an appropriate protocol must be prepared and signed;

- Law No. 14 of 1998 determines that profits can be distributed every 3, 6 or 12 months;

- The Russian Tax Code establishes the obligation of LLCs to independently calculate the amount of taxes for transferring them to the budget;

- the deadline for paying taxes is regulated by letters from the Ministry of Finance;

- The law allows dividends to be paid with property if there are no funds in the company’s accounts - this method is not profitable, since it involves paying additional taxes, such as personal income tax and VAT.

What are dividends and their source?

Dividends are usually called a part of the net profit received by the company, which, by decision of the participants of the legal entity, is directed to payment to them in proportion to the share of their contribution to the authorized capital or by another method of distribution established in the company’s charter.

Net profit is the profit that remains at the disposal of the company after making all obligatory payments to the budget.

Payment of dividends to the founders of an LLC is possible under certain conditions from net profit, which are defined in the relevant legislation.

Therefore, the source of dividends to the founders is profit. It is calculated on the basis of accounting information. To decide on the payment of dividends to an LLC, the owners must first approve the financial statements, which reflect the presence of net profit.

The legislation provides for the possibility of paying interim dividends. Their source is the retained earnings of the current year. However, such an opportunity exists if the enterprise received it during the selected period of time (quarter, half-year).

Attention! Since the current algorithm for calculating profit determines the need to determine it on an accrual basis for the year, its final size can only be determined based on the results of the past year. Then, if the founders decide to pay dividends, it will be necessary to take into account the amounts they received interim during the year.

The following payments made by owners are not considered dividends:

- Payments to a liquidated organization in an amount not exceeding the owner’s contribution to the authorized capital.

- Payments to the founders in the form of the organization buying out their shares in the company into ownership.

- Payments to a non-profit organization for its activities provided for by its charter, if it is one of the owners of the company.

Is it possible to pay dividends in cash from the cash register?

Is it possible to pay dividends in cash from the cash register? Joint stock companies do not have the right to issue dividends from the cash register. They are required to transfer them to the recipients' bank accounts (if there is a corresponding application) or send them by postal transfer (clause 8 of Article 42 of Law No. 208-FZ). The document came into force on June 1, 2014. There is no such rule in relation to limited liability companies. Therefore, they need to follow the general rules for cash transactions. They are established in the Instruction “On making cash payments”, approved by the Bank of Russia dated October 7, 2013 No. 3073-U. According to paragraphs 2 and 4 of the Instructions, companies cannot use received cash proceeds to pay dividends. Cash proceeds do not include: - withdrawn from the settlement accounts cash; - unused imprest amounts returned by employees and loans received; - shortages reimbursed by employees, etc. Therefore, these cash funds can be used to pay dividends, it is written that funds withdrawn from the current account are not cash. So you can or Is there no way to issue dividends to the LLC in cash, withdrawn to the cash register from the current account?

We recommend reading: Allowed Square Meters for an Apartment for a Young Family

But when paying from the cash register, one condition should be taken into account. The income of participants is not included in the list of transactions that the company has the right to pay from cash proceeds received for goods sold (clause 2 of Bank of Russia Directive No. 1843-U dated June 20, 2007). Similar rules are enshrined in the new Directive No. 3073-U dated 10/07/13, which will soon come into force. Therefore, to pay dividends from the cash register, you first need to receive the required amount by check from the current account and only then give it to the founder.

How to properly reset the debt on accountable amounts of an employee

Another variation of this method of resetting reporting is to pay compensation to the director for the use of the car. In this case, you will not need to withhold personal income tax at all, nor will you need to pay contributions. The basis is paragraph 3 of Article 217 of the Tax Code of the Russian Federation, subparagraph “and” of paragraph 2 of part 1 of Law No. 212-FZ. But when calculating income tax, it will be possible to take into account only payments within the norms. If the engine capacity is less than 2000 cc. cm (inclusive), then the compensation rate will be 1200 rubles. per month. If the engine capacity is over 2000 cc. cm - 1500 rub. per month. For motorcycles, the monthly compensation rate is set at 600 rubles.

We recommend reading: Passing a medical examination when applying for a job

Material aid . Financial assistance not exceeding 4,000 rubles per employee. per year, exempt from personal income tax (clause 28 of article 217 of the NKRF). Contributions are also imposed on the amount of financial assistance exceeding 4,000 rubles. per year per person. Officials have been insisting on this for a long time (letter from the Ministry of Health and Social Development of Russia dated May 17, 2010 No. 1212–19).

Can a JSC pay dividends through a cash desk?

By virtue of paragraph 1 of Art. 8.7 of Federal Law No. 39-FZ of April 22, 1996 “On the Securities Market” (hereinafter referred to as Law No. 39-F3), owners of shares and other persons exercising, in accordance with federal laws, rights under securities whose rights to shares are recorded by the depositary, receive dividends in cash on shares through the depository of which they are depositors.

The decision to pay (declare) dividends is made by the general meeting of shareholders. The said decision must determine the amount of dividends on shares of each category (type), the form of their payment, the procedure for paying dividends in non-monetary form, the date on which the persons entitled to receive dividends are determined. In this case, the decision regarding the establishment of the date on which persons entitled to receive dividends are determined is made only at the proposal of the board of directors (supervisory board) of the company (clause 3 of Article 42 of Law No. 208-FZ).

How much are individual deposits insured in 2020?

Currently, there are about 500 banks operating in Russia - participants in the deposit insurance system for individuals. To check whether your savings are insured by the state, you must first clarify where you took the money: to a bank, microfinance organization, cooperative or somewhere else.

The creation of a system of compulsory insurance of bank deposits of individuals (CDI) is a special state program. It is implemented in accordance with the Federal Law “On Insurance of Individuals’ Deposits in Banks of the Russian Federation” No. 177-FZ of December 23, 2003.

Dividends from the cash: be aware of "cash" restrictions

Let us remind you that the limitation on the maximum amount of cash payments is provided for in clause 2.3 of Regulation No. 637

.

In turn, the size of such a maximum amount is established by the resolution of the NBU Board dated 06/06/2013 No. 210 (cf. 025069200)

.

From this resolution

it follows that the maximum amount of dividends that an enterprise can pay within one day is:

It is very important that Regulation No. 637

does not impose requirements on enterprises regarding the intended use of cash received from their bank account.

This means that, having withdrawn money, for example, for household needs, you may well spend it differently - pay dividends. The same applies to cash proceeds - it can be used to pay dividends without first being credited to the company’s bank account (see, for example, NBU letter No. 50-0004/95394 dated November 21, 2016

). The main condition is that cash received from a bank or in the form of revenue must be promptly and in full capitalized at the enterprise’s cash desk (we discussed in more detail the rules for recording cash at the enterprise’s cash desk in the special issue “Taxes and Accounting,” 2020, No. 40).

Is there a maximum period for issuing money for reporting?

The law does not prohibit giving money to accountants not only for a few days or months, but also for several years. At the same time, it is worth understanding that excessively long periods of time for funds to remain with the accountable must be justified by production necessity, and the funds themselves must be spent on targeted expenses. Otherwise, there may be a risk that regulatory authorities will reclassify accountable amounts as income or an interest-free loan, which entails the need to withhold personal income tax from income (or material benefits).

We recommend reading: Article Dismissals on Your Own 2020

IMPORTANT! All organizational issues relating to the procedure for issuing and returning accountable funds should be fixed only in orders, but not in accounting policies. Otherwise, changing this procedure if necessary will be problematic (Clause 6, Article 8 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).