Payment procedure to founders

The frequency of dividend payments is chosen by the owners of the enterprise. Payments can be made quarterly, semi-annually or annually. Specific dates are determined at a meeting of all shareholders.

When no deadlines are specified, income must be paid no later than 60 days from the date of the relevant decision.

There is no special document for transferring dividends to the recipient. You can use standard payment forms that are used to transfer funds to a current account.

If there is no minutes of the shareholders' meeting, the accounting department does not have the right to reflect business transactions or pay dividends.

After drawing up the document, it is necessary that all responsible employees sign autographs:

- the head of the company paying the specified funds;

- employees to whose account dividends are transferred;

- direct executor, accountant.

The primary document for formalizing the payment of profits is the decision of the company’s founders.

And if there is only one founder, then instead of a protocol it is necessary to formalize the decision of the participant or shareholder on the payment of dividends.

Distribution of profits is not the responsibility of society.

Profits may remain intact. The absence of a decision does not give any participant the right to receive the share due to them, even if they apply to a judicial authority.

If the decision has been made, but the amounts have not been paid, then you can even receive the organization’s property for the amount due.

How to fill out a payment order for transfer?

The payment document for the payment of dividends is drawn up according to the general rules. The payment amount can be transferred to both an individual and a legal entity.

Moreover, if a member of the company is an individual, then dividends are transferred by payment order to his bank card. If a member of the company is a legal entity, then dividends are transferred by payment order to the current account of the participant - a legal entity.

The payment order form is established by the Central Bank of the Russian Federation; it displays the following information:

- about the payer and recipient of funds (name of the enterprise, full name of the individual);

- about codes and banks of the sender and recipient;

- about the date of registration of the payment and the actual transfer of funds;

- on the amount of dividend transfer.

In the “payment purpose” field of the payment slip, it is stated that dividends are paid for a certain period of time, based on the decision of the meeting or the order of the sole founder (document details).

Field 101 records information about the applicant’s status: 01 - legal entity, the order of payment is indicated by the number 5.

The payment order is signed by the head of the organization and the chief accountant and stamped.

At the same time, a payment order for personal income tax on dividends is issued. For individuals who stayed in Russia for at least 183 days during a calendar year (tax residents), the tax rate is 13%, for other categories - 15%.

Detailed payment form filling can be found here.

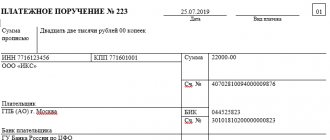

An example of filling out a payment slip for the payment of dividends to the founders of a company - sample.

This is what the sample looks like:

Important points

Paying dividends is not an easy task for an accounting employee. At a meeting of shareholders it is not always possible to find a single decision on setting the amount of dividends.

These funds can be used to expand the scale of production, participate in new business projects, and tenders.

We should also not forget that unstable payment of dividends or a sharp increase in them can lead to a decrease in the company's share price.

Before crediting funds, you must carefully read the current legislation.

Making a profit is the legitimate desire of an investor who has bought a share of a particular company and risks his own funds within the limits of the share.

A participant cannot count on a positive result from an investment if the company is declared bankrupt or does not generate any income while it is simply paying for itself (paying mandatory payments).

From vacation pay

In December 2020, the company received and distributed profit in the amount of RUB 200,000. Now you need to calculate personal income tax on dividends. Since both company participants are residents of the Russian Federation, a 13% rate is applied to their income.

KBC on personal income tax from dividends 2020

Thus, paying personal income tax in 2020 with a payment order that is generated according to a specific model requires close attention to avoid making a mistake. Here is a payment order form that in 2020 legal entities can use to transfer personal income tax.

Personal income tax on dividends in 2020 for those individuals who were in the Russian Federation at the time of payment for at least 183 days during the year - that is, for Russian tax residents - is 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation). As for non-residents, the dividend tax for this category in Russia is 15%.

Now the LLC, as a tax agent, must calculate and withhold personal income tax amounts from income. Both investors are residents of the Russian Federation, and for residents the interest tax rate is 13%. This means that with Vasilenko the personal income tax will be equal to 78,000, and with Tereshchina it will be 000. It is these amounts that the tax agent undertakes to withhold from the income of an individual.

Some subtleties

(or) develop your own methodology for calculating net profit. However, such techniques usually do not provide reliable information about the financial position of the company in comparison with accounting data. Therefore, the tax authorities may regard the amounts paid on their basis not as dividends, but as gratuitously transferred money or wages (if the participant is also an employee of the organization).

This fact is especially convenient for large organizations, because non-cash money transfers significantly save working time. One of the points that is often overlooked is field 4 “date of completion”. Filling out this field is easy. In order to correctly enter the date, you need to know the exact deadlines for paying the tax for which the order is being drawn up.

Please also note that LLC participants who are individuals do not need to pay insurance premiums on accrued dividends. Due to the fact that contributions are levied on payments under employment and civil contracts, the subject of which is the performance of work and, as a result, dividends do not apply to these payments.

How to process dividend payments: documents

According to the law, a dividend is any income of a shareholder (participant) on shares (shares) owned by him, which is received from an organization during the distribution of its net profit in proportion to the shareholder’s (participant’s) share in the authorized (joint) capital of this company (clause 1 of Article 43 of the Tax Code RF).

Thus, dividends are payments in favor of, for example, the founder of a legal entity. Also, the recipient of dividends can be an organization (for example, an LLC) if it acts as a shareholder (participant) of another organization. There were no changes in this regard in 2020 or 2020.

In this case, the decision on the payment of dividends must be made by the general meeting of shareholders (participants) (clause 3 of Article 42 of the Law of December 26, 1995 No. 208-FZ, clause 1 of Article 28 of the Law of February 8, 1998 No. 14-FZ ). It must be documented in the minutes of this meeting.

There is no special document required to formalize the payment of dividends. Therefore, you can use standard forms that are filled out when paying money from the cash register or when transferring funds from a current account. At the same time, keep in mind that dividends must be paid to shareholders in cash.

Purpose of payment when transferring dividends

In order to correctly draw up a payment document for the transfer of personal income tax on dividends received, you must follow the recommendations approved by Order of the Ministry of Finance No. 107-n. All details in the payment order must be indicated correctly: only in this case the funds will be credited, and the tax authorities will not have any claims against the sender.

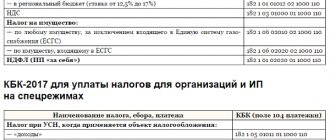

What do we pay to KBK for personal income tax on dividends* Personal income tax on dividends 182 1 0100 110 Personal income tax penalties on dividends 182 1 01 02020 01 2100 110 Personal income tax interest on dividends 182 1 0100 110 Personal income tax fines on dividends 182 1 0100 110 *We hasten to note that Exactly the same BCC must be indicated to the company in the payment order in all cases when it comes to transferring personal income tax. Before we move on to filling out a payment order to pay personal income tax on dividends, let’s look at the tax rate.

Example of payment orders in 2020

Payment orders for the payment of dividends in 2020 must be executed according to the general rules. At the same time, we believe it would be advisable to provide two samples of payments:

- For dividends in favor of an individual.

- For dividends in favor of the organization.

Sample 1: dividends to individuals

Let’s assume that the LLC decided in 2020 to pay dividends to its participant in the amount of 123,000 rubles from its net profit. A sample payment order in this case takes the following form:

Sample 2: organizational dividends

Let’s assume that the participants of a legal entity or shareholders decided to pay dividends in 2020 to another company (LLC), which partially owns a business here, in the amount of 290,000 rubles. Here is an example of a payment slip for dividends addressed to such a company:

Income of participants: to whom and how much

Dividends are recognized as part of the net profit of the company, which, by decision of its participants, is distributed among them in proportion to their shares in the authorized capital or in proportion to the par value of the shares they own.

The following payments are not considered dividends:

- participants or shareholders upon liquidation of the company within the limits of their contributions.

- to a participant or shareholder - a non-profit legal entity, if the payment is not related to the statutory activities of the non-profit organization.

- participants or shareholders from the company's profit after taxation in proportion to their shares of participation.

The three above payments to participants or shareholders are not subject to the tax rates and deadlines established for dividend payments.

How the issue of profit distribution in JSC and LLC is resolved, read in Table 1.

Table 1. Profit distribution decision

| Legal entity form | Who decides | Frequency of dividend payments | Deadlines for decisions |

| JSC | General Meeting of Shareholders |

| No later than 3 months after the end of each period |

| OOO | General meeting of participants |

| – |

Payment. When paying tax on dividends, indicate KBK 182 1 0100 110 in the payment order. It is entered in field 104. The code must consist of 20 characters.

Sample payment order when transferring personal income tax on dividends in 2020

2-NDFL. Indicate the amount of dividends with personal income tax in section 3 of the certificate. Use income code – 1010 (Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2020 No. ММВ-7-11/387). If your organization received dividends from other companies and you took them into account when calculating tax, indicate the amount of the deduction in section 3 of the certificate. Deduction code – 601.

6-NDFL. Include the amount of income paid, taking into account personal income tax, in the indicator on line 020, indicate the amount of dividends separately in line 025. Include accrued personal income tax in line 040, and separately reflect the tax on dividends in line 045. In line 070, show the withheld tax on payments.

When to pay dividends

The period for paying dividends depends on the organizational and legal form of the legal entity - LLC or JSC.

Thus, an LLC is obliged to pay dividends to its participants - organizations or individuals - within the period provided for by one of two documents:

- LLC charter;

- decision on the payment of dividends.

However, if neither the charter nor the resolution establishes a deadline for the payment of dividends, then they must be transferred within 60 calendar days from the date of the decision on payment on the basis of clause 3 of Art. 28 of the Law of 02/08/1998 No. 14-FZ.

In turn, joint-stock companies are required to pay dividends to their shareholders - organizations or individuals - within 25 working days from the date on which the persons entitled to receive them are determined. This date is indicated in the decision on the payment of dividends.

Free legal consultation

What are dividends? This is a percentage of net profit on which all taxes have already been paid, distributed among the founders of the company, its participants or shareholders. Thus, for the Federal Tax Service, dividends are the same income from which income tax is taken. This means that personal income tax on dividends is subject to the same provisions as income tax on wages or other payments.

This is important to know: Payment of dividends in installments throughout the year

When transferring part of the profit to a participant, a payment order is issued in accordance with the general procedure. The recipient of the funds transfer and his bank details are indicated. It is necessary to correctly specify the purpose of the payment when paying dividends to the founder so that the transfer can be clearly qualified by the bank and regulatory authorities.

The rules for paying dividends to LLC founders in 2020 are still based on the restrictions contained in Art.

The deadline for paying dividends to an LLC after a decision is made cannot exceed 60 calendar days. But at the same time, the Protocol or Charter may provide for other deadlines not exceeding this date.

Payment to the budget

You need to pay personal income tax to the budget the next day after payment of income (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation). For example, if dividends were paid to a participant (shareholder) on March 26, 2019, then the tax must be paid on March 27, 2019.

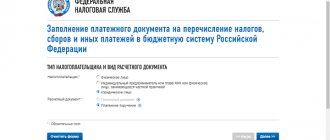

You need to fill out a personal income tax payment for dividends in 2020 according to the model from the Central Bank Regulation No. 383-P dated June 19, 2012 and the Rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n. The most important thing is to correctly indicate the recipient's bank on the payment slip. If you make a mistake, the tax will not be credited (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). When filling out the payment slip, you should indicate the month when the income arose, and field 110 “Type of payment” does not need to be filled in (Order of the Ministry of Finance dated October 30, 2014 No. 126n).

Especially for our readers, our specialists have prepared a sample personal income tax payment form for dividends from KBK in 2020. You can download it for free using a direct link on the website.

If you find an error, please select a piece of text and press Ctrl+Enter.

What to do if you made a mistake with the KBK for personal income tax on dividends in 2019

When a company passes through many payments with different budget classification codes, it is very easy to make a mistake in writing the BCC for personal income tax on dividends. Fortunately, the error can be corrected without significant damage to the organization if the right steps are taken.

First of all, you need to submit an application to the territorial branch of the Federal Tax Service. This possibility was indicated by the Ministry of Finance in its letter dated January 19, 2017 No. 03-02-07/1/2145. The application is written in free form, but it must be noted:

- Number and date of the payment order with an erroneous BCC;

- The amount of payment, its type;

- Directly incorrect code;

- The required KBK.

Minutes of the meeting of founders on the payment of dividends - sample

Income is divided among shareholders according to an order that clearly states the distribution mechanism.

The order is drawn up on the basis of the protocol of the founders (shareholders). The meeting is held every year and a decision is made whether it is advisable to accrue dividends. At least 50% of shareholders must be present at the meeting, only in this case its decisions will be valid. The minutes drawn up at this meeting necessarily contain the following provisions:

- the agenda is indicated;

- everyone present at the meeting is listed;

- the location of this meeting is indicated;

- The date and number of the protocol must be indicated;

- At the end of the document, the chairman and secretary of the meeting put their signatures.

Minutes of the founders' meeting on the payment of dividends:

After all formalities have been completed and a decision has been made to distribute profits among the founders at the end of the year (or quarter), the head of the company draws up a corresponding order for the accounting department. A sample meeting minutes is provided below.

Is it possible to transfer dividends to the founder on a card?

Greetings, dear reader!

Today I will tell you how to transfer dividends to the founder on a card. I will indicate possible payment terms and standards for processing a payment document. Let's start with the basis - the source of accruals to the founder, that is, the net profit of the legal entity.

This is the amount remaining after paying the necessary payments for the company. According to the order of the head of the organization, the accounting department sends settlement orders to transfer money to the settlement accounts and debit cards of the founders.

Is it possible to transfer dividends to a salary card?

When the deadline for accrual to the company's shareholders arrives, the accounting department issues special instructions and sends them for execution to the bank where the recipients' accounts are located.

For individual founders, money is always credited to a debit bank card. A salary account is no different from a regular debit account, so the company can transfer the due funds to an individual’s card. If the founder is a legal entity, then the funds are transferred by bank transfer to a current account.

When to pay profit

According to the legislation of the Russian Federation, LLCs have the right to distribute income once a year, once every six months and quarterly. The company's management is given a maximum period for transferring dividends - 2 months from the moment when the decision was made at the meeting of owners on the amount of accrual.

Payouts depend on the type of shares. Thus, preferred securities bring their owners no more than a quarter of the amount of the authorized capital.

In order to fairly distribute and transfer funds, a meeting of the owners is necessary to discuss losses, revenue and other operational issues. Based on them, the volume of dividends is determined.

Businesses can transfer proceeds to:

- every month;

- after completion of a major project, transaction, etc.;

- once a quarter;

- at the end of the reporting period.

The frequency of payments is determined by the owners of the LLC in accordance with the legislation of the Russian Federation. The meeting of shareholders sets the exact dates of payments.

Registration of an order for transfer

The payment document with which dividends are transferred to an individual’s personal debit card is drawn up in accordance with the requirements of the Central Bank of the Russian Federation.

In order for the bank servicing the LLC to credit funds to the founder, the payment order (PP) must include the following information:

- date of registration (PP);

- the amount to be transferred;

- sender information (name and details);

- details of the servicing bank;

- information about the recipient (full name, account and card number, TIN);

- the order of the assigned payment in a special column (the value 5 is indicated).

The purpose of the planned payment is filled in in the correct field, and the status of the transfer (profit accrual) is indicated in the column. A mandatory condition is the signature of the head of the company and the chief accountant.

Purpose of payment for individuals

The main details of the payroll are the intended purpose of the transfer. With its help, the bank will transfer a pre-agreed amount to the founder’s card. In the destination column, you need to enter information that the payment is income from dividends calculated for a certain period of time. The period is determined by the owners or the sole owner of the enterprise.

Where to find a sample

Specialized portals for accountants, for example https://www.glavbukh.ru, are always ready to lend a helping hand. This particular one asks you to register, but it is not complicated, but not only a sample payment order for paying dividends to an individual on a bank card will become available https://www.glavbukh.ru/art/80321-platejnoe-poruchenie-2019-obrazets, but also many other forms.

Important points

In the Russian Federation, every type of profit is taxed, including dividends. The deduction occurs at the settlement stage in the company’s accounting department before transfer to the card. Russian residents pay 9% of their income, which is quite a high figure. Non-resident founders pay 15% of the profits received.

The current situation is not very beneficial for shareholders, but this is the only opportunity to transfer profits from dividends in our country.

Conclusion

The duty of each LLC is to transfer the funds due to them to the founders on time and in full. The only legal way to receive funds from participation is a transfer to a bank account or shareholder card. To do this, it is enough to follow the rules of calculation and accrual.

That’s all for today, subscribe, share your opinion and experience, talk about our article on social networks.

See you!

Source: https://greedisgood.one/dividendy-uchreditelyu-na-kartochku

Who signs the order?

The protocol indicates how much payment is due to each founder, based on the share participation of each. If there is only one founder, then neither a meeting nor minutes are needed, and the founder makes all decisions himself, documenting them with an appropriate resolution.

But in the usual manner, after signing the protocol, the head of the firm or company draws up an order to pay the appropriate profit in accordance with the participation of each shareholder as the founder of a particular private enterprise.

List of documents for payment

It is necessary to have the following documents:

- minutes of the general meeting of founders (shareholders) or the founder’s decision on payment;

- an order signed by all responsible persons , i.e. the head of the company, accountant;

- balance of funds;

- a report on profits and losses for the year

- and another statement of capital flows and all cash flows during the year;

- appendix to the balance sheet and explanatory note.

All these documents must be collected in one package, which will become the basis for the transfer of funds earned by the shareholder or founder.

Sample payment order for transfer

It is clear that dividends are the profit that a shareholder or founder expects to receive at the end of the year. And this is a completely legitimate desire, since he invested certain funds by purchasing shares and now wants to make a profit.

He will not receive it if at the end of the year the enterprise is declared bankrupt or simply does not generate any income, but simply pays for itself, with the obligatory payment of all necessary taxes and salaries, as well as other obligations.

If the profit is received, the decision on payments is made, then it needs to be made. And in this case, there is no special document that should be provided in this case. Therefore you can use the following:

- form for payment of money from the cash register or when transferring to an account;

- accounts to shareholders, payments to whom are made in non-cash form.

Here is a sample payment slip for the payment of dividends to individuals: download

For an organization, such a payment document looks somewhat different, although, in essence, it is not very different.

Sample payment order for payment of dividends to a legal entity: download

Correct execution of a payment order for the transfer of profit received is a guarantee of its timely receipt, and therefore evidence that the company founded by shareholders is thriving.

Personal income tax payment from dividends 2020: sample filling

The following example shows a personal income tax payment from employee salaries. The fields marked with numbers are the details of the document about which questions arise. Their decoding can be found in the table below.

Sample of filling out the PP for payment of personal income tax on employees' wages

We suggest you consider a sample of filling out a personal income tax payment slip for 2018, understand the rules for drawing up this document, as well as its purpose. In addition, individuals who need to transfer funds will be able to learn all the intricacies of this procedure.

Payment order

If an individual has opened an account in a bank, deposited a certain amount of money into it and wants to transfer it to another account, then he needs to draw up an appropriate settlement document containing this instruction, which is called a payment order. Most often, employers encounter documentation of this kind when transferring personal income tax from the salaries of their employees to the state budget.

Many taxpayers believe that completing documentation containing reporting data on the personal income tax they have transferred and making the appropriate payment is sufficient.

However, in addition to this, it is necessary to enter data into the payment order form approved by the Federal Tax Service. This will guarantee that the funds allocated for personal income tax will be transferred exactly to the destination address.

In such a situation, the taxpayer will need to check all the details and find out all the information relating to the payment made, which will require additional time and effort.

Since not only the account owner, but also bank employees contribute to the procedure for transferring funds, some lines in the payment slip must be left blank. Blank spaces are intended for marking by individuals who are bank employees.

First of all, this is the direction of the payment, the signature of an authorized employee for its execution and the wet seal of the bank. In addition, two dates are placed at the top of the form. The first of them is the date of receipt of money in the bank of an individual acting as a payer, and the second is the date of its debiting from the account.

In 2020, the form of such a document as a payment order remained practically unchanged compared to the form in force in 2020.

Most of the information required from the taxpayer is numbers (dates, amounts, account numbers, etc.). However, in some places in the document you also need to indicate text (for example, the amount of the money transfer). In order to correctly enter words into a document, write them in printed font.

The payment form contains several abbreviations that most individuals encounter for the first time, and there are also lines that require entering codes that encrypt certain information. In this regard, the parameters that require special attention during the process of processing payment orders are given and explained below:

- Taxpayer status. In a separate square, inside of which there is the designation 101 in brackets, you need to note the status. If an individual is an employee of the tax service and has the right to withhold personal income tax from taxpayers’ profits, then he must indicate code 02, if an individual entrepreneur - 09. However, in most cases, code 13 is used, which is intended for individuals who do not have a special status.

- TIN - identification number is issued not only to individuals, but also to legal entities, including banking organizations. In this regard, in the payment form it is necessary to indicate the TIN of two banks - the sender and the recipient. As a rule, these are numerical ciphers consisting of ten characters and conditionally divided into five blocks of two numbers, each of which carries its own meaning (for example, the first two characters are the subject’s code).

- Checkpoint - since banking organizations are registered simultaneously with several tax authorities, in addition to the TIN, they are also assigned a so-called reason for registration code. This digital code carries information about which tax authorities are responsible for controlling the income of a particular legal entity.

- BIC is a mandatory attribute of any bank, which is needed to record participants carrying out settlement transactions. And this abbreviation stands for bank identification code. Such ciphers consist of nine digits and are used only on the territory of the Russian Federation.

If the head of a company needs to pay personal income tax, the amount of which is 235,000 rubles, from the monthly salary of all his employees, transferred to their bank cards on May 27, 2018, then the following information is entered into the payment slip:

- Document number and date of completion. Next to the name of the form (“PAYMENT ORDER”) you need to put its serial number. Or, in other words, indicate a number reflecting the number of issued payments in a given bank account. After this, the date the form was filled out is written. In this case, this is the next day after employees receive their salaries - May 28, 2020.

- Amount of payment. In order to correctly record the amount that the manager wants to transfer to the state budget, it is necessary to write its amount as follows: “two hundred thirty-five thousand rubles 00 kopecks.”

- Payer details. To indicate which legal entity is the personal income tax payer, you will need to write its identification code, checkpoint, account number, re-enter the amount that will be transferred as a result (only in numerical format), indicate the name of the company, bank and BIC.

- Recipient's bank details. In order to correctly enter data regarding the organization to whose account personal income tax payments will be received after some time, you should also display the TIN and BIC assigned to it. In addition, the account number and name of the bank in which it is opened for the recipient must be written. In addition, you need to indicate the tax service that will receive the money (inspectorate number and city of location).

- Additional information. In a column such as the order of payment, in 2020 the number five is entered, and in the column called “code” a zero is entered if the manager pays material resources on his own initiative, and not in response to a written request for repayment of personal income tax debt from tax officials services.

- Recipient information. Point four described how to correctly enter the details of the recipient’s bank. However, this information is not enough for the payment - information is also required about the tax service itself, which will receive this transfer. You will need to write the budget classification code and the combination of numbers established by the classifier for settlements or municipalities (OKTMO), as well as put additional marks regarding the payment, if any.

The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. Whether all fields on the form are filled out correctly determines whether the banking institution will accept it. Having carefully studied the example of filling out a payment order in 2020, you can fill out payment orders quickly and without errors.

According to established rules, such documents are filled out by private entrepreneurs and companies performing transactions that are subject to taxes. Another category of taxpayers are individuals or legal entities engaged in the supply of goods across the customs border.

Persons and organizations that:

- They are engaged in performing various types of work, selling goods and providing services that are subject to VAT. For example, they sell building materials, renovate premises, and provide consultations.

- Transfers goods without the need to rally them, performs assigned tasks and provides services. In this case, the tax base is the actual market price for the type of services provided and work performed.

- They distribute goods throughout the country that are intended to fulfill their own needs. Such an action is subject to taxes if the company did not take into account the cost of carrying out these operations when calculating income taxes.

- They are engaged in construction work or installation of structures.

All persons carrying out such transactions must pay tax to the state treasury if the amount of money received for the previous trimester is more than 2 million.

rubles (the amount does not include the amount of tax). For entrepreneurs who sell goods subject to excise tax, this rule does not apply - they must pay tax regardless of their revenue.

The procedure for filling out payment orders in 2020

You can obtain tax exemption by filling out a special form that is submitted to the regulatory authority.

Documents confirming the financial transactions carried out by the company or entrepreneur must be attached to the form: companies need to attach extracts from the balance sheet, persons engaged in entrepreneurial activities - books of inputs and expenses, sales, and other internal business transactions.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf. Click the “Next” button and check everything again... After making sure that the data is entered correctly, click on the “Pay” button. If you want to pay in cash, using a receipt, then select “Cash payment” and click on the “Generate payment document” button "That's it, the receipt is ready

- Since we entered KBK 18210202140061110160, we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs.

- In order to issue a receipt for payment of the mandatory contribution for health insurance, we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

- medical insurance for an individual entrepreneur for himself - 182 1 0213 160.