Kbk 39211620010066000140

The procedure for filling out details 101 is prescribed in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n and Appendix 5 to it. The latest version of this application was created by order of the Ministry of Finance of Russia dated 04/05/2017 No. 58n. Detail 101 needs to be filled out only when making certain transfers related to the payment of mandatory payments (taxes, fees, contributions).

Info

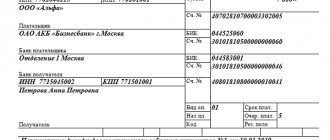

In field 101, located in the upper right corner of the payment next to the “Type of payment” field, a 2-digit digital code is entered, which allows you to characterize the payer in terms of organizational and legal form, type of activity and purpose of payment. For example, organizations, individual entrepreneurs and individuals, banks, tax and customs authorities, payment of taxes, fees, and insurance premiums are separately highlighted. Thus, this detail contains information about who pays and what pays.

Number name of the branch of the credit institution alpha bank

The bank was founded in 1993 as APR-Bank by a group of Russian information and advertising agencies - APR-Group. In December 1998, the main shareholder of the bank became OJSC Foreign Economic Association Aviaexport, a Russian exporter of civil aircraft.

In December 2000, the bank was transformed into an open joint-stock company.

Until April 2005, JSC V/O Aviaexport retained the status of the most important shareholder of the credit institution), and after its withdrawal from the shareholders, the capital was formally dispersed among a group of Russian legal entities and individuals, although V/O Aviaexport retained its relationship with the bank strategic partnership relationship. In September 2008, the ONEXIM group of the famous oligarch Mikhail Prokhorov announced the purchase of 100% of the bank’s shares, and by the end of November the transaction was completed. And in March 2009, APR Bank received a new name - OJSC JSCB International Financial Club .The bank was actually created as the heir to JSCB International Financial Company (IFC), which belonged to the Interros group (whose beneficiaries were Mikhail Prokhorov and Vladimir Potanin) and was merged in 2004. As a result of an additional issue in April 2010, it became one of the bank’s shareholders IFC also included other shareholders.

Number/name of the branch of the credit institution

Currently, the beneficiaries of the credit organization are: Alexander Abramov (19.71%), owner of the Renova group and co-owner of Rusal Viktor Vekselberg (19.71%), wife of the head of the Russian Technologies State Corporation Sergei Chemezov Ekaterina Ignatova (13.14%) , Mikhail Prokhorov (47.45%).

Previously, the shareholders also included Suleiman Kerimov, but in November 2012. Receive daily up-to-date information about profitable deposits, loans and all offers in your city.

You can change your subscription settings, adjust the frequency of notifications, or cancel it at any time.

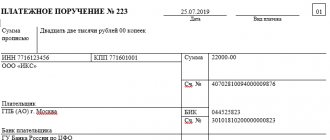

Penalties 182 1 0210 160 Fines 182 1 0210 160 Medical Contributions 182 1 0213 160 Penalties 182 1 02 02103 08 2013 160 Fines 182 1 0213 160 KBK for Social Insurance Fund (“for injuries”) Type of payment KBK B contributions 393 1 0200 160 Penalties 393 1 0200 160 Fines 393 1 0200 160 Example of a payment order for contributions to compulsory pension insurance Next, we provide an example of a payment order for the payment of pension insurance contributions in 2020 (OPS).

Payment for this type of contribution must be sent to the Federal Tax Service.

payment order for payment of mandatory pension contributions in 2018.

An example of a payment order for contributions to compulsory social insurance. Below is an example of a payment order for the payment of social contributions in 2020.

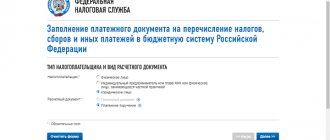

Filling out a payment order to the Pension Fund of the Russian Federation online on the Federal Tax Service website For some, filling out a payment document online will seem like the easiest option due to the fact that you won’t have to look for forms and spend a long time dealing with the new rules for filling it out.

P Form of payment order, numbers and names of its fields Federal Law “On the abolition of the mandatory seal...” dated April 6, 2015 No. 82-FZ On the fact that it is not necessary to have a seal for LLCs and JSCs, clause 23 of the Civil Code of the Russian Federation, FAS Resolution dated No. F03 -A51/08-2/3390 About the fact that it is not necessary to have a seal for an individual entrepreneur Order of the Ministry of Finance of the Russian Federation dated November 12, 2013

No. 107n Rules for filling out new payment orders in 2020 Typical errors Error No. 1: The organization’s accountant, when filling out a payment order to the Pension Fund of the Russian Federation, indicated the payer status code “14” on the basis that this was required by the tax inspectorate in the Letter dated January 26, 2020 No. BS- 4/11/[email protected]/NP-30-26/947/02-11-10/06-308-P.

Online magazine for accountants

In this case, the person who was obliged to provide any documentation on time, but for some reason did not do so, is fined. And the one who insures is the one who has the right to do so, or rather the state bodies for control and implementation of certain types of activities, which include the Pension Fund of Russia. It is the Pension Fund of Russia that imposes a fine for documentation not provided within the reporting period or for violating the rule on the reliability of the information presented in it.

If the question arises: “What is KBK 39211620010066000140 used for, what is the fine they pay for?” Then here is your ready answer. When they are fined All the necessary information about contributions, the calculation mode and other parameters of payment for pension insurance, the Pension Fund of the Russian Federation learns from the reporting form RSV-1. It is for failure to submit or late submission that fines are mainly imposed by the Pension Fund.

Penalty for late submission of a declaration to the tax authorities

There are no sanctions for offenses with a statute of limitations of 3 years or more.

In addition to applying fines, the Federal Tax Service may block the company's bank accounts. If we are talking, for example, about late submission of SZV-M or other personal reporting to the Pension Fund, such a violation provides for a fine of 500 rubles for each entity in respect of which it was necessary to submit information. If a company has not submitted a tax return 10 working days after the deadline established by law, the account is blocked.

There are no restrictions regarding the amount to be blocked by law. Taxpayers are not exempt from filing a return even if there is no need to pay tax: a zero return, which does not contain information about tax calculation, must also be filed.

Kbk 39211620010066000140: decryption in 2020

of the Russian Federation, and excise taxes on alcohol and (or) excisable alcohol-containing products 26 Individual, legal entity for repayment of claims against the debtor 27 Credit organizations (branches of credit organizations) that issued an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation 28 Participant in foreign economic activity - recipient of international mail If an individual entrepreneur makes deductions for himself, code 09 is indicated, if the document is issued for the purpose of making deductions for employees, code 14, because in this case, an individual entrepreneur acts as a person making payments to individuals. Status codes 27 and 28 came into force on October 2, 2017 based on the Order of the Ministry of Finance of the Russian Federation dated April 5, 2017.

Budget classification codes

The budget classification code (abbreviated KBK) is a special code consisting of 20 digits, which is used to group revenue and expenditure items of the state budget.

We recommend reading: Savings pays NSDI died

It is indicated in payment documents in which one of the parties is the state or its legal representatives (state bodies). Most often, the BCC must be indicated in the details of receipts for payment of fines, taxes, fees, duties and other payments to the state budget, as well as when filling out a tax return in Form 3-NDFL. However, not many citizens know where to get it, so we have collected all the necessary budget classification codes in one place and divided them by budget item.

for personal income tax may be needed both when paying and receiving (indicated in Section 1 of the tax return).

Name of income KBK Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation: - payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) 182 1 01 02030 01 1000 110 - penalties on the corresponding payment 182 1 01 02030 01 2100 110 — interest on the corresponding payment 182 1 01 02030 01 2200 110 — amounts of monetary penalties (fines) on the corresponding payment in accordance with the legislation of the Russian Federation 182 1 01 02030 01 3000 110 Personal income tax in fixed advance payments from income received by individuals who are foreign citizens engaged in employment activities on the basis of a patent in accordance with Article 2271 of the Tax Code of the Russian Federation:

KBC for payment of monetary penalties (fines)

14356 PENALTIES, FINALS KBK Monetary penalties (fines) for violation of the legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, clauses 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art.

129.4, 132, 133, 134, 135, 135.1 Tax Code of the Russian Federation 182 1 1600 140 Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 Tax Code of the Russian Federation 182 1 16 03020 02 6000 140 Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation 182 1 1600 140 Monetary penalties (fines) for violation of the legislation on the use of cash register systems when making cash payments and (or) settlements using payment cards 182 1 1600 140 Monetary penalties (fines) for violation of order handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions 182 1 1600 140 Monetary penalties (fines) for violating the currency legislation of the Russian Federation and acts of currency regulatory authorities, as well as the legislation of the Russian Federation and in the field of export control 182 1 1600 140 FILES Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations.

A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

Each type of offense punishable by a fine is regulated by government agencies at various levels, so the recipients of the fine will be different.

Kbk for paying fines has changed

That is, when paying taxes, fees, contributions, state duties, etc. We note that the affixing of the status of the preparer in the 2018 payments was influenced by amendments to the tax legislation, where most of the rules on insurance contributions to extra-budgetary funds were transferred from 01/01/2017. This has led to the fact that since the end of April 2017, Appendix No. 5 to Order of the Ministry of Finance No. 107n, which regulates filling out field 101, has been in effect in a new edition. All statuses of the document compiler in the 2020 payment order Code Who is the compiler of the payment and in what situation 1 Legal entity: · payer of taxes; · fees; · insurance premiums; · other payments that are supervised by tax authorities.

Your right

That is, if it changed during the calculation period, then such a calculation will be divided into several formulas using their own refinancing rates. Our penalty calculator will help you correctly calculate the amount of penalties. The differences between paying the amount of tax and penalties lie in filling out several fields of the payment order: Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the regulatory authority or “AP” » - when calculating penalties based on the inspection report.

Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement. Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

Originator status in payment order 2020

All individual entrepreneurs are faced with the fact that they have to make contributions to various funds for themselves and their employees, pay taxes, pay fines, etc. By the way, fines are paid to the budget in any case, so in order to fill out a payment order you will need to use a certain KBK, depending on which structure the fine must be paid to. For different structures and for different types of activities, there are separate BCCs for each type of fine.

One of these is KBK 39211620010066000140. What can they be fined for? Everyone is accustomed to the fact that a fine becomes one of the accompanying aspects of late payment of taxes, contributions and other financial troubles. But failure to provide reporting may also result in a fine being imposed on the individual entrepreneur.

What is kbk in a payment system in 2020

XX.XX.2014 XX.XX.2014 0401060 Receipt.

to the bank of payments. Debited from account plat. PAYMENT ORDER No. (From 1 to 6 characters) XX.XX.2014 (101) Date Type of payment Amount in words XXX rubles XX kopecks INN (60) KPP (102) Amount XXX-XX (8) (Name of payer) Account. No. ХХХХХХХХХХХХХХХХХХХ (20 characters) Payer (Name of payer bank) BIC ХХХХХХХХХ Account. No. ХХХХХХХХХХХХХХХХХХХХ (20 characters) Payer bank GRKTs GU Bank of Russia for the Kamchatka Territory Petropavlovsk-Kamchatsky BIC 043002001 Account. No. Recipient's bank INN 4101121182 KPP 410101001 Account https://youtu.be/2CUZWK1FLw0

No. 40101810100000010001 UFK for the Kamchatka Territory (Branch of the Pension Fund of the Russian Federation for the Kamchatka Territory Type of op. Payment term. Name of area. Scheduled payment. Code (22) Res. field Recipient (104) (105 ) (106) (107) (108) (109) (110) (24) Information identifying the purpose of the payment Purpose of payment Signatures Marks of the bank M.P.

We indicate the status of the originator in the payment order - 2017-2018

SV for compulsory insurance based on the cost of the insurance year, the insurance part (for the periods from 2010 to 2012);

- 39210202110060000160 – SV for compulsory insurance based on the cost of the insurance year, the accumulative part (for the periods from 2010 to 2012);

- 39210910010060000160 – SV on OPS in the form of FP debt for the period from 2002 to 2009, the insurance part;

- 39210910020060000160 – SV on OPS in the form of FP debt for the period from 2002 to 2009, the accumulative part;

- 39210202101080000160 – SV for compulsory medical insurance in the FFOMS;

- 39210202080060000160 – contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions;

- 39210202120060000160 – contributions from coal industry organizations;

- 39210202131060000160 – SV at an additional rate for insured persons employed in the relevant types of work, in accordance with paragraphs. 1 p.

Tax agent 3 Russian Post (on behalf of an individual, excluding customs duties) 4 Tax 5 FSSP and its territorial bodies 6 Legal entity - participant in foreign economic activity (exception - recipient of international mail) 7 Customs 8 Payer: · organization; · merchant; · private notary ;· lawyer;· head of peasant farm. Task: transferring money to the budget system. Exception: taxes, fees, insurance premiums and other payments supervised by tax authorities. 9 individual entrepreneurs: · payer of taxes; · fees; · insurance premiums; · other payments supervised by tax authorities. 10 Private notary: · payer of taxes; · fees; · insurance premiums; · other payments supervised by tax authorities. 11 Lawyer (adv. office): · payer of taxes; · fees; · insurance premiums; · other payments that are supervised by tax authorities. 12 Head of peasant farm: · payer of taxes; · fees; · insurance premiums; · other payments that are supervised by tax authorities.

Payment order kbk 39211620010066000140 originator status

Important

Moreover, such fines should not be more than 30% of the amount of contributions, and also should not be less than 1 thousand rubles. They, like all government prosecutions, must be paid. It must be said that the longer the RSV-1 is not filed at the destination, the greater the fine the entrepreneur expects from the Pension Fund.

Those who carry out entrepreneurial activities are interested in how to fill out a payment order in 2020? KBK 39211620010066000140 is indicated in field 104 of the payment order. Also, in field 22, you must indicate the UIN code, if there is one in the payment request. What to do with innovations 2020 brought some changes to legislation.

For example, those for which insurance premiums fall under the jurisdiction of the Tax Code. Will this affect RSV-1 and payment of fines on this form? Most likely no.

KBK - penalty for late submission of property tax report

Hello, 182 1 0600 110

BCC of the corresponding tax with the fourteenth digit 3

Failure to submit a declaration (Article 119 of the Tax Code of the Russian Federation) A gross violation of the rules for accounting for income and expenses and objects of taxation. resulting in an understatement of the tax base (clause 3 of Article 120 of the Tax Code of the Russian Federation) Non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation) Failure to transfer tax by a tax agent (Article 123 of the Tax Code of the Russian Federation)

182 1 1600 140

Violation of the deadline for tax registration (Article 116 of the Tax Code of the Russian Federation) Evasion of tax registration (Article 117 of the Tax Code of the Russian Federation) Violation of the deadline for reporting the opening and closing of accounts (Article 118 of the Tax Code of the Russian Federation) Gross violation of the rules for accounting for income and expenses and taxable items (Clause 1, 2 of Article 120 of the Tax Code of the Russian Federation) Failure to comply with the procedure for possession, use and (or) disposal of seized property (Article 125 of the Tax Code of the Russian Federation) Failure to provide information to the inspection (Article 126 of the Tax Code of the Russian Federation) Wrongful failure to report information (Article 129.1 of the Tax Code of the Russian Federation)

It turns out that you need 182 1 1600 140

Quote (Lenochka31): I also found it

BCC of the corresponding tax with the fourteenth digit 3

Failure to submit a declaration (Article 119 of the Tax Code of the Russian Federation) A gross violation of the rules for accounting for income and expenses and objects of taxation. resulting in an understatement of the tax base (clause 3 of Article 120 of the Tax Code of the Russian Federation) Non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation) Failure to transfer tax by a tax agent (Article 123 of the Tax Code of the Russian Federation)

182 1 1600 140

Violation of the deadline for tax registration (Article 116 of the Tax Code of the Russian Federation) Evasion of tax registration (Article 117 of the Tax Code of the Russian Federation) Violation of the deadline for reporting the opening and closing of accounts (Article 118 of the Tax Code of the Russian Federation) Gross violation of the rules for accounting for income and expenses and taxable items (Clause 1, 2 of Article 120 of the Tax Code of the Russian Federation) Failure to comply with the procedure for possession, use and (or) disposal of seized property (Article 125 of the Tax Code of the Russian Federation) Failure to provide information to the inspection (Article 126 of the Tax Code of the Russian Federation) Wrongful failure to report information (Article 129.1 of the Tax Code of the Russian Federation)

It turns out that you need 182 1 1600 140

If in doubt, then you must have a decision from the tax office to hold the organization accountable, indicating the KBK-fine for property tax for late submission of the declaration.

Quote (Lenochka31): I also found it

BCC of the corresponding tax with the fourteenth digit 3

Failure to submit a declaration (Article 119 of the Tax Code of the Russian Federation) A gross violation of the rules for accounting for income and expenses and objects of taxation. resulting in an understatement of the tax base (clause 3 of Article 120 of the Tax Code of the Russian Federation) Non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation) Failure to transfer tax by a tax agent (Article 123 of the Tax Code of the Russian Federation)

182 1 1600 140

Violation of the deadline for tax registration (Article 116 of the Tax Code of the Russian Federation) Evasion of tax registration (Article 117 of the Tax Code of the Russian Federation) Violation of the deadline for reporting the opening and closing of accounts (Article 118 of the Tax Code of the Russian Federation) Gross violation of the rules for accounting for income and expenses and taxable items (Clause 1, 2 of Article 120 of the Tax Code of the Russian Federation) Failure to comply with the procedure for possession, use and (or) disposal of seized property (Article 125 of the Tax Code of the Russian Federation) Failure to provide information to the inspection (Article 126 of the Tax Code of the Russian Federation) Wrongful failure to report information (Article 129.1 of the Tax Code of the Russian Federation)

It turns out that you need 182 1 1600 140

If in doubt, then you should have a decision from the tax office to hold the organization accountable

indicating the BCC penalty for property tax for late submission of the declaration.