Estimate

| Reviews: | 0 | Views: | 983 |

| Votes: | 0 | Updated: | n/a |

File type Text document

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

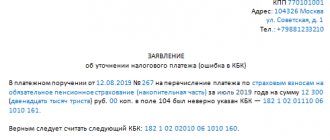

Receipt to the bank of payments. ____________ ________________ PAYMENT REQUIREMENT N : : : : _________ 20___ : : : 0401001 : :___________: :_______________: Payer DEBIT Amount ____________ ______________________________ : : : : : : Code : : : : :___________:________________________________: : : : : : : Payer's bank in the city : Code : Account. N : : __________________________________ :__________:___________: : Recipient : : LOAN : : ____________:_________________: _____________ : : : : : : Account. N : : : Code : : : : :___________:________________________________ :___________:_________________: : : : : Recipient's bank in the city: Code :Account. N : : ___________________________________:___________:__________ :_________________: : : _____________ :fine for ___days : : : :from ____ % R. : : Code : Shipper and station. : : :___________:_____________________________________________:_________________: : : _____________ : : : : : : : Code: Consignee and destination. : amount with penalties : :___________:_____________________________________________:_________________: : : : : Agreement : :Vmd arr. : : _________ : :_________:_______: : : : : Order N : :Type of transaction: : : :_________:_______: ______________________________: : : : Shipment date 20____: Shipping method q/inc.N : Queue. fees: : ______________________________:___________________________:_________:_______: : : : Name of goods, work performed, services provided, :Purpose of fees: : NN and amounts of sales documents or specifications of goods. :_________:_______: : : : :Payment deadline: : :_________:_______: : Conducted by the bank: “___”__________ 20___. : : bank signatures : _______________________________________: : M.P. Documents provided for in the contract: sent (delivered) to the payer: “___”__________20____. : Client signatures

Download the document “Payment request”

Classification

The supplier may issue a payment request with or without acceptance. The latter option is used in cases provided for by law or established in the main agreement between the parties. When included in the agreement, the bank providing services to the payer must have the right to write off funds from the account without his consent. The payment request can be urgent or early. The first ones are used when making:

- Advance payment (before delivery of services, work, products).

- Payments after delivery.

- Partial payments in large transactions.

The transfer can be carried out in two ways. If the required amount is not available in the payer’s account, partial repayment of the debt is allowed. This is noted on the payment document. In other cases, full payment is made accordingly.

Calculation scheme

- The buyer submits a payment request to the bank in 4 or 5 copies. He receives one of them back as a receipt from a financial institution.

- Based on the first copy of the document, the required amount is debited from the account.

- The bank servicing the buyer sends a payment request in 2 copies and the funds themselves to the lender's financial institution.

- The amount is credited to the account of the supplier (recipient).

- Banks issue relevant statements to clients.

What is this in simple words?

The payment request form has the form 0401061 of a paper or electronic document, which is intended for processing settlements with other entities.

The document form is strictly unified and must be used. Usually 2 copies are drawn up: one is transferred to the bank, the other to the account holder.

The essence of the form is an offer to transfer funds to pay off obligations. This is one of the functions of bank cash management services.

Payment requirements vary depending on the characteristics and features:

- with acceptance, if consent is expected from the debtor to pay the debt, the document is marked “with acceptance”;

- without acceptance, the operation is carried out automatically without informing the account owner.

To fulfill the requirement without acceptance, it is necessary to have appropriate conditions in the signed agreement between the credit institution and the client.

After complying with all formalities, suppliers of goods have the right to put an inscription without acceptance, the funds will be automatically debited.

Filling out a payment request without acceptance in practice requires a lot of time and is extremely rare.

Automatic transfer of funds is possible in the following cases:

- compliance with the norms of a special legislative act (there is a special field for details);

- carrying out utility payments (electricity, gas, water supply), registering meter readings and current tariffs;

- claims against the account holder;

- penalties under signed contracts (supply agreement).

Often the requirement is used as an enforcement mechanism of the court.

This type of document is used by bailiffs, the winning party in a lawsuit.

Once you receive a court decision, you can fill out a payment request immediately at the bank.

How is it different from an assignment - similarities and differences

Accounting professionals sometimes confuse these two concepts, but they differ in both form and function.

Unlike an order, funds under a payment request (without acceptance) are debited from the debtor’s account without his consent; the owner is only notified of the transaction.

Based on the payment order, the business entity independently manages cash flows by sending the appropriate instructions to the credit institution.

If the need for consent from the debtor is indicated, the request indicates the deadline for its receipt. If consent is not received on time, the document is returned without execution.

https://youtu.be/tszR6Gyd3bQ

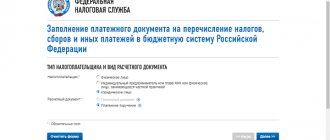

Decor

When entering information into the payment request, the recipient in the “period for acceptance” column enters the number of days determined by the parties. If there is no agreement on this period, it is taken as five days. On all copies accepted by the servicing bank, the authorized employee in the “Expiration” column enters the date upon which the period for accepting the supplier’s offer expires. Calculation is carried out on working days. In this case, the date on which the payment request was received by the bank is not taken into account. The last copy of the settlement document is used as a notification to the debtor about the receipt of paper. It is transferred to the payer for acceptance no later than the next day from the date of its acceptance by the banking organization. The document is sent to the debtor in the manner established in the bank account agreement.

Legal basis

Let's look at a few fundamental documents.

- The unified form of payment was approved by the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P “On the rules for transferring funds.”

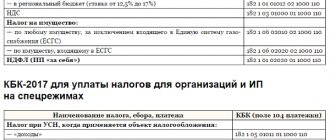

- At the same time, there is Order of the Ministry of Finance dated October 12, 2013 No. 107n, which establishes the rules for filling out orders for the payment of funds to the budget system.

- The latest order was issued by the Ministry of Finance of Russia dated 04/05/2017 No. 58n, amending Order No. 107n.

Payment

The payment request is placed by the servicing bank in the file cabinet of settlement documentation awaiting repayment. It is kept there until a response is received from the debtor (refusal or acceptance) or until the end of the established period (5 days). During the prescribed period, the payer provides the banking organization with a document confirming the acceptance of the request or a partial/complete refusal of it. The grounds for the latter action are provided for in the main agreement. These include the discrepancy between the payment method used and the terms of the transaction agreement. The debtor in his response refers to the clause, date, number of the contract and indicates the reasons for his refusal.

What does the payment request form look like?

Sample payment request

2017 has the same details as the payment/collection order.

It is important to indicate all the details of both the payer and the recipient of funds, as well as the document number and its date. The document is valid for presentation to the bank for 10 days. The payment request

must be signed by authorized persons.

Our article will help you not to make a mistake in choosing a serial number for a payment order

.

A complete list of mandatory requirements is given in Appendix No. 1 of the Central Bank Regulation No. 383-P dated June 19, 2012.

Our article will help you sort out the details of payment documents

.

Payment request form

No. 0401061 implies that the recipient of funds fills out all the required details.

If an error is detected in the payment request

, the bank will return this order without execution.

Payment request form

can be downloaded on our website:

The same will happen if the payer does not approve this write-off of funds in favor of the submitter of the payment request

. We will discuss the conditions for executing this order below.

Statement

Upon acceptance, two copies are drawn up. The first is certified by the signatures of employees who have the appropriate authority, as well as by the debtor’s seal. In case of complete/partial refusal, the application is drawn up in 3 copies. The first two are certified by the signatures of persons with the appropriate authority, as well as the payer’s seal. The responsible employee servicing the account checks the completeness and correctness of the information in the application, the presence of grounds for refusal, references to the date, number, clause of the main agreement, where they are provided for. In addition, the correspondence between the number and the number specified in the requirement is established. After checking, the employee puts a stamp, his signature and date on all copies. The last copy is handed back to the buyer and acts as a receipt for receipt of the application.

Posting amounts

The accepted demand, no later than the day following the date of receipt of the application, is debited from the off-balance sheet account for recording the amounts of settlement documentation awaiting payment, using a memorial order. A copy of the application and the first copy of the supplier’s paper are placed in the card index of the day as grounds for withdrawing the amount from the account. In case of complete refusal to accept, the claim is written off in the same way. Then, no later than the business day following the date of acceptance of the application, the amount is returned to the issuing bank. Documents are placed in a file cabinet as grounds for debiting funds from an off-balance sheet account and returning the payment paper without payment. In case of partial refusal, the amount is written off no later than the next day in full by memorial order. Then the payment requested by the debtor is made. The amount of the payment document is circled and another one to be withdrawn is placed next to it. This entry is certified by the signature of an authorized bank employee. One copy, along with the first copy of the request, is placed in the documentation as grounds for debiting funds from the account. Another application form no later than the next working day. days after its acceptance, it is sent to the issuing bank, where the funds are transferred.

Documents found on the topic “payment request 2018”

- Payment request (form 0401061) Accounting statements, accounting → Payment request (form 0401061)

download the document “ Payment request (form 0401061)” using this link - Payment requirement

Accounting and financial documents → Payment requestreceived in the bank of payments. payment request n : : : : 20g. : : : 0401001 : :: :: payer debit amount : : : : : : code : : : : ::: : : : : :…

- Payment requirement-order

Accounting and financial documents → Payment request-orderreceived in the bank of payments. payment request - order n : : : : 20g. :: : 0401040 : :: payer debit amount : : : : : : code : : : : ::: : : …

- Sample dated November 30, 1995 Statement of claim for payment of the cost of the stage of work performed and a fine for unjustified refusal to accept payment requirements

Statements of claim, complaints, petitions, claims → Sample dated November 30, 1995. Statement of claim for payment of the cost of a stage of work performed and a fine for unjustified refusal to accept a payment request... a deposit for the amount of rubles. based on contract no. from "" 20, the plaintiff completed the work of the stage. from payment of payment request no. from "" 20 the defendant completely (partially) refused for the reason. stated claim no. from "" 20...

- Sample filling payment instructions filled out by the credit institution upon submission payment orders from clients to the settlement network of the Bank of Russia (letter of the Central Bank of the Russian Federation dated 09/05/96 No. 323)

Accounting and financial documents → Sample of filling out a payment order filled out by a credit institution when submitting payment orders from clients to the settlement network of the Bank of Russia (letter of the Central Bank of the Russian Federation dated 05.09.96 No. 323)Appendix 3 to the letter of the Central Bank of the Russian Federation dated 09/05/96 no. 323 sample of filling out a payment order filled out by a credit institution when submitting payment orders from clients to the bank’s settlement network...

- Payment order (form 0401066)

Accounting statements, accounting → Payment order (form 0401066)download the document “ Payment order (form 0401066)” using this link

- Payment order (form 0401060)

Accounting statements, accounting → Payment order (form 0401060)download the document “ payment order (form 0401060)” using this link

- Payment order (sample)

Accounting and financial documents → Payment order (sample)sample entry to the bank of payments. +-+ -+ +-+ +-+ payment order n +-+ payer debit amount +-+ -+- account n code - payer’s bank in the city -+-+ credit recipient +- account….

- Settlementpayment statement. Form N T-49

Documents of the enterprise's office work → Payroll. Form N T-49document “settlement and payroll . form n t-49″ in excel format you can get from the link “download file”

- Sample. Payment statement. Form No. 253

Accounting statements, accounting → Sample. Payment statement. Form No. 253standard form no. 253 organization page shop - to calculation. statement no. department payroll no. for issuance for 20 years - port. report card - last name, first name, patronymic amount receipt receipt no. ny no. il...

- A completed sample payment order for an individual entrepreneur to himself

Accounting and financial documents → Completed sample payment order for an individual entrepreneur to himselfDownload in Word format “Completed sample payment order for an individual entrepreneur to himself”

- Payment order to pay the registration fee. Form No. PD-5

Accounting and financial documents → Payment order for payment of the registration fee. Form No. PD-5payment order for payment of registration fee notice form no. PD-5 payee ... privatization established ...

- Payment statement. Form N T-53

Enterprise records management documents → Payroll. Form N T-53... payroll document number date of preparation ...

- Payment order to pay imputed tax

Accounting and financial documents → Payment order for payment of imputed tax... written off from the account. plat. payment order No. 000133 02/26/2013 by mail ...

- Sample. Payment order to transfer funds abroad (Russian or English)

Accounting and financial documents → Sample. Payment order for transfer of funds abroad (Russian or English)payment order for the transfer of funds abroad (Russian/English) - bank for foreign trade of the Russian Federation - on behalf of-by or...