What is a payment order

A payment order is a financial document drawn up in the form prescribed by law. It represents an order from a bank client to transfer a certain amount of money to another legal entity or individual. The persons indicated in the document may have accounts in other financial institutions.

The payment order must be drawn up according to the unified form 0401060. Despite the fact that most unified forms are currently not mandatory for use, the payment order is an exception, since it relates to primary accounting documents.

One of the required details of the document is the date of its preparation. It is she who determines how long the payment order is valid for providing it for the transfer of money.

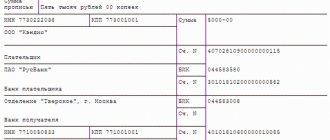

In addition, the form used must contain the following data:

- Data of the parties - payer and recipient of funds;

- The amount to be transferred and its purpose;

- Bank details of both parties. These data are indicated twice even if the payer and recipient have the same financial institution.

The payment order can be filled out either in a specialized program or manually.

https://youtu.be/XSXHfhHdGFA

Article 864 of the Civil Code of the Russian Federation. Acceptance of a payment order for execution by the bank

1. The content (details) of the payment order and its form must comply with the requirements provided for by law and banking rules.

2. When accepting a payment order for execution, the bank is obliged to verify the payer’s right to dispose of funds, check the compliance of the payment order with the established requirements, the sufficiency of funds to execute the payment order, and also carry out other procedures for accepting orders for execution provided for by law, banking rules and agreement .

If there are no grounds for executing a payment order, the bank refuses to accept such a payment order for execution with notification of this to the payer no later than the day following the day of receipt of the payment order, unless a shorter period is established by banking rules and the agreement.

3. The sufficiency of funds in the payer’s bank account to execute a payment order is determined in the manner established by law, banking rules and agreement, taking into account the requirements of Article 855 of this Code.

Unless otherwise provided by law, banking rules and agreement, if there are insufficient funds in the payer's bank account to execute the payment order, the bank does not accept the payment order for execution and notifies the payer about this no later than the day following the day of receipt by the bank payment order.

4. Acceptance of a payment order for execution is confirmed by the bank in the manner prescribed by law, banking rules and agreement.

5. The payment order may be revoked by the payer before the moment of irrevocability of the funds transfer, determined in accordance with the law.

See all related documents >>>

1. Submission of a payment order to the bank is an action performed by the client in pursuance of the bank account agreement (unilateral transaction). The bank has the right not to fulfill this order only if it contradicts the law.

A bank transfer is an abstract transaction, independent of the agreement between the payer and the recipient of funds under which settlements are made.

The presentation of a payment order to a bank by a person who does not have an account (together with the amount of money that needs to be transferred) should be considered as an offer. The acceptance of such an order for execution should be considered as acceptance, i.e. the bank's consent to conclude an agreement with the client on making a bank transfer.

The form and content of the payment order must comply with legal requirements.

In practice, the payment order form (0401002) continues to be used, which is Appendix No. 23 to the previously in force Instruction of the State Bank of the USSR dated May 31, 1979 No. 2 “On non-cash payments in the national economy.” In accordance with clause 2.2 of the Regulations on Payments and clause 3.2 of State Bank Instruction No. 28, settlement documents must be signed by the manager (first signature) and the chief accountant (second signature) - persons authorized to manage the account, and sealed. In some cases, it is allowed to submit payment documents with one first signature and/or without a seal.

Clause 2.1 of the Regulations on Non-Cash Payments establishes requirements for the content of payment documents, including payment orders, according to which they must include the following information: a) name of the payment document; b) number of the payment document, day, month, year of its issue; c) number of the payer’s bank and its name; d) name of the payer, his bank account number; e) name of the recipient of funds, his bank account number.

In addition, letter of the Central Bank of the Russian Federation dated March 1, 1996 N 245 stipulates that payment documents must include the priority and payment deadline, as well as the taxpayer identification number.

2. If the content of the payment order submitted to the bank does not meet the requirements specified in clause 1 of Art. 864 of the Civil Code, the bank has the right (but is not obliged) to take measures to clarify the content of the payer’s order by sending him a corresponding request. Such a request must be made promptly. If a response is not received within the period established by law, banking rules or agreement (and in its absence, within a reasonable time), the bank has the right to return the payment order without execution. There are no regulatory deadlines for responding to a bank’s request, and they can be established in the bank account agreement.

The rule specified in paragraph 2 does not apply to cases of incorrect execution of a payment order (for example, the first signature is missing), in which the bank has the right to return the order without execution.

3. The procedure for settlements by payment orders is regulated by law, as well as banking rules issued in accordance with it and business customs applied in banking practice.

Thus, according to the general rule established by the Regulations on non-cash payments on the territory of the Russian Federation, the payer’s order is executed by the bank only if there is money in the account. If there is no money in the payer’s account, the payment order: a) is placed in the file cabinet to off-balance sheet account N 9929 “Settlement documents not paid on time” (card file N 2 - clause 1.8 of the letter of the Central Bank of the Russian Federation dated June 30, 1994 N 98 “On the implementation Decree of the President of the Russian Federation of May 23, 1994 N 1005 “On additional measures to normalize payments and strengthen payment discipline in the national economy”); b) or paid through an overdraft (see Article 849 and commentary thereto), if the possibility of providing such a loan is provided for in the agreement.

How long is a payment order valid?

The payment order is valid for 10 days. This period is determined according to the following rules:

- The validity period is calculated in calendar days, that is, it includes weekends and holidays;

- The countdown starts from the day following the date indicated in the payment order.

This procedure is determined by the Regulations on the rules for transferring funds, which was approved by the Bank of Russia No. 383-P dated June 19, 2012.

This means that the organization does not need to send the payment order to the bank immediately after it is drawn up. She has the opportunity to do this within the above 10 days. But at the same time, you need to take into account that if the 10th day falls on a weekend or holiday, it will not be transferred to the next working day and, accordingly, the document must be sent earlier.

The company can also send the order to the bank immediately on the day it is drawn up. Even though it is not included in the validity period.

If the payment order is overdue, the bank will refuse to accept it.

If an expired document is identified, there are two options for solving the problem:

- Correct the order date. But this method is only possible if the next payment orders have a date of preparation that has not yet passed 10 days, or are missing altogether. Otherwise, there will be a discrepancy in the numbering of documents, which may raise questions during verification.

- Leave the financial document unexecuted and make a duplicate of it with a different date. Put a mark on the document that the validity period has expired, this will serve as an excuse for verification.

The entire order should be withdrawn only when the number assigned to it can be entered into another document.

In case of advance payment the scheme will be different

The bank simply will not accept it, and you will need to either change the date of the order or draw up a new document.

The first option is ideal if there were no others after the late payment. Then the chronology will not go astray. If a document whose submission deadline to the bank has passed has already been executed by the bank, we recommend leaving this document unexecuted and drawing up a new one. If necessary, the presence of an unrecorded document can easily be explained by the expiration of its validity period.

Buyer Supplier

1 3 8 6

Buyer's bank Supplier's bank

2 4 5

- The buyer, on the basis of an advance payment agreement, issues PP and submits them to his bank

- The bank debits the amount specified in the PP from the buyer’s account

- The buyer is sent a statement indicating that money has been debited from the account.

- The bank transfers this amount to the supplier’s bank along with the PP

- The supplier's bank records this amount on the supplier's account

- The supplier's bank sends the supplier an account statement indicating that money has been credited to his account

- The buyer sends the paid PP to the supplier

- The supplier ships the goods to the buyer

There are consolidated PPs. They are intended for transferring funds in several orders.

The consolidated PP is divided into parts by horizontal lines, the total amount is written off based on 1 copy of the consolidated PP, and the second copy is cut into pieces of paper and sent to each recipient of funds along with bank statements.

Payment order execution deadline

The document execution period is the period during which the bank needs to execute the accepted order, that is, transfer money to the recipient.

This period is determined by Article 863 of the Civil Code of the Russian Federation. According to her instructions, the money must be transferred no later than during the next business day. This is a maximum period that cannot be exceeded. But at the same time, an agreement can be drawn up between the bank and the client to reduce this period.

The payment order is valid for 10 days, which are counted from the date indicated on it. The calculation of this period is expressed in calendar days and is counted from the day following the date of preparation. This period is called the validity period of the payment order. They also distinguish the concept of the document execution period; this is the period during which the bank transfers money from the payer’s account in favor of the recipient. The maximum period for transferring money is the next business day after receipt of the document.

Results

The statutory validity period for a payment order exists and is equal to 10 calendar days. If you miss it, the bank will not accept the payment, and you will need to either change the date on the expired document or create a new one.

When a company or entrepreneur sends an order to transfer funds to its bank, it thereby authorizes the credit institution to carry out the transaction to transfer funds according to the details specified in the payment document. This operation is performed over a certain period of time. The validity period of the payment order is established by law and is 10 calendar days.

Validity

Now let’s look at how long a payment document for transferring money has a valid status. In accordance with clause 5.5 of the Money Transfer Rules, which were approved by the Central Bank on June 19, 2012, the validity period of a payment order is 10 calendar days (do not confuse a working day with a calendar day!).

EXAMPLE

Let's say the payment order was generated on May 15, 2017. To determine the time of its validity, it is necessary to count 10 calendar days starting from May 16, 2020. The date you are looking for will be May 25, 2020.

Thus, the order can be presented to the credit institution for execution no later than May 25, 2020 inclusive. If you present the document later, the bank will refuse to execute it because the validity period has expired.

Knowing that the payment order is valid for 10 days, it is not difficult for the payer to calculate the date of presentation of this document to the credit institution. Therefore, taking into account the allowable period, he can plan his time wisely and visit the bank when it is convenient for him, and not immediately after drawing up a payment order.

Therefore, before going to the bank, you should make sure that the payment order is valid today.

If you find an error, please select a piece of text and press Ctrl+Enter

.

Good afternoon. If I filled out a payment order but did not have enough money in my account to transfer the entire amount to the recipient's account, will the payment order be valid? Or will they write off some part from the account according to a payment order? Then how long does it take to top up your account for the payment order to be fully executed and remain valid?

By law, the validity period of a payment order is limited to 10 days. In principle, it is possible to transfer funds gradually, but in practice this is quite troublesome. It is better to wait until you have the required amount to send it to the recipient. This will help you avoid unnecessary paperwork.

Operations carried out by payment orders

The following operations can be carried out using payment orders:

- transfer of funds to contractors for services provided, goods, work performed (including payment of utilities);

- transfers to various types of funds, both budgetary and extra-budgetary;

- transfer of funds for the purpose of partial or full payment of a loan or loan, replenishment of a deposit;

- other payments provided for by law.

Any of these transactions must be reflected in the “Purpose of payment” column. If the payment is made in accordance with the invoice or agreement, then the output data of these documents (number, date) is also recorded in the relevant sections of the payment order.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Filling out a payment order

Filling out a payment order is regulated by regulations, namely Regulation No. 383-P and Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N.

| Filling stage | Explanation |

| Payment order number, date | Indicate the serial number of the document, date in the format DD.MM.YYYY |

| Type of payment | “Urgent” - in this case, the transfer of funds will be carried out by means of urgent transfer. If the payment type remains blank, then such an order is classified as non-urgent using the appropriate means of transfer. |

| Status | It is necessary to indicate only when making a transfer in favor of the budget. Status codes are located in the previously mentioned Order No. 107-N. |

| Sum | Indicate the amount in words with a capital letter, while writing the words “rubles” and “kopecks” in full, but write the number of kopecks in numbers. Digital designation of the amount: · between rubles and kopecks a “-” is placed; · if the amount is round (without kopecks), then the “=” sign is placed at the end. For example : seventeen thousand one hundred fifty rubles 17 kopecks (17150-17) |

| Payer | · Taxpayer Identification Number · Organization name or full name · Bank details: payer account, name, BIC, correspondent account |

| Recipient | See Payer, but the Recipient's details are entered |

| Type of operation | The payment is always coded 01 |

| Payment order | As a rule, stage 5 (tax deductions, insurance premiums, transfer of payments to counterparties) |

| Code | In the case of current payments, 0 is entered in the column. If the payment is made in accordance with the UIP, then its code specified in the document on the basis of which the payment order is generated is entered. |

| Purpose of payment | The number of the contract, invoice, etc. is indicated. If the payment is tax, then the cells located above the “Purpose of payment” cell are filled in in the following order: KBK; OKTMO; two-digit payment basis code; tax period (quarter, half-year, year, or simply indicate the date of tax payment): MS.03.2017, KV.01.2017, GD.00.2017, 03.20.2017; No. of the document on the basis of which the payment is made (in the case of tax payments, set to 0); the date of drawing up the document on the basis of which the payment is made (in the case of a tax payment, the date of signing the declaration is indicated); leave payment type blank. |

For example:

ABV LLC makes personal income tax deductions for March 2020 in the amount of 16,145 rubles.

When creating a payment order, you should pay attention to:

- Status – 02 (tax agent)

- KBK 18210102010011000110

- Two-digit payment basis code – TP (current period)

- Tax period MS.03.2017

Questions and answers

- We plan to file a claim in court. When is it necessary to pay the state duty?

Answer: According to paragraph 1, paragraph 1, Article 333.18 of the Tax Code of the Russian Federation, payment of the state duty is made before filing a statement of claim.

- How can I confirm payment of the state fee if I transferred funds to a notary?

Answer: In accordance with paragraph 3 of Art. 333.18 Tax Code The fact of payment of the state duty by the payer in cash is confirmed either by a receipt of the established form issued to the payer by the bank, or by a receipt issued to the payer by an official or the cash desk of the body to which the payment was made.