Why is a collection order necessary?

The role of a collection order is simple: to pay for any services or work without the direct participation of the payer and his prior consent. However, such a procedure is only possible if an appropriate agreement has been concluded between the counterparties (i.e., including a clause on collection payment).

In other words, thanks to this document, the bank of the recipient of the goods or service transfers funds to the bank of the contractor or manufacturer, bypassing the parties to the transaction themselves. Neither the customer nor the contractor may provide the bank with any payment orders or other documents; the only thing that happens is that the payer’s bank notifies its client about the transfer of funds, and the recipient’s bank about their crediting to the account.

FILES

Collection order and how to fill it out

- After the conclusion of the contract, the exporter provides the service or ships the goods according to the circumstances.

- Transfer of transport papers from the carrier to the exporter.

- The exporter prepares all documentation and submits it with a collection order to the remitting bank.

- The bank checks the papers and sends them to the collecting bank in the importer's country.

- The collecting structure provides all documentation to the payer for verification in order to receive payments.

- Receiving payments from the payer and issuing papers to him.

- Transfer of proceeds to the remitting bank.

- Crediting of funds to the exporter's accounts by this bank.

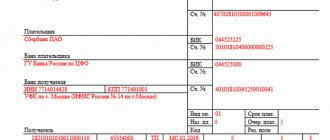

Payment order date (Payment order date). Date of the payment order in the format DD.MM.YYYY. To be completed if partial payment was made according to the collection order. Partial payment amount. The amount of the partial payment is indicated in numbers according to the rules established for the “Amount” field, if a partial payment was made according to the collection order.

https://youtu.be/yd8xYA7l0VI

In what cases is this document required?

It cannot be said that the collection order is widespread. However, in some cases it occurs quite often, for example, in the practice of the tax inspectorate, when a collection order is sent to the tax debtor’s bank and debts are automatically written off from his accounts (such collection orders are subject to unconditional execution and cannot be contested). Or in the activities of public utilities, when an agreement is concluded between public utilities and the recipient of the service with the possibility of direct (i.e., not requiring the permission and participation of the direct payer) payments - in this case, the payment from the bank of the recipient of the service to the bank of the utility organization is also transferred by using a collection order.

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

Fields in the payment order in 2020: 106, 110, 101

5) indicate the transferred amount in field (6) in words One hundred fifteen thousand rubles 50 kopecks ; and in field (7) with the numbers 115,000-50 ; rubles are separated from kopecks by a dash; if the amount is without kopecks, then an equal sign is placed after it, for example, 115,000= ;

Payment order fields in 2020: sample filling

Let's give a clear example of a payment slip and fill out a sample for taxes for January 2020 . Let's fill in the fields that an organization must fill in for the bank to accept a payment document to transfer money to the budget:

After checking the correctness of completion, all copies of accepted payment documents are affixed with the stamp of the issuing bank, the date of receipt and the signature of the responsible executor. Unaccepted documents are deleted from the register of settlement documents submitted for collection and returned to the recipient of funds (collector), the number and amount of settlement documents in the register are corrected.

When collecting funds on the basis of enforcement documents, the collection order must contain a reference to the date of issue of the enforcement document, its number, the number of the case on which the decision subject to enforcement was made, as well as the name of the body that made such a decision.

Who is interested in the collection form of payment?

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

- Payment of obligations to suppliers and contractors, advance payments are acceptable. Indicate the exact details of the accounts and agreement in the assignment. Do not fill in fields 104–110 and 101 and 22. Be sure to indicate VAT in the cost of goods, works, services, and if it is missing, write “Without VAT”.

- Payments for loans and borrowings in banking and financial institutions. Enter the details of the agreement (loan agreement) in field 24. Do not fill in fields 104–110, 101, 22.

- Transfers of wages, advances, vacation pay and benefits to employees of a budgetary institution. Pay attention to filling out the queue (cell 21); for salary, enter “3” (Article 855 of the Civil Code of the Russian Federation). The transfer deadlines specified in the collective agreement must be observed. Leave fields 22, 101, 104–110 blank.

- Advances for travel expenses for employees. Indicate the number of the basis document (estimate) in the purpose of payment. Do not fill in the fields to clarify tax payments.

- Transfer of insurance premiums, taxes, fees. Check that fields 104–110 of the form are filled out correctly. The BCC can be clarified with the Federal Tax Service or the Social Insurance Fund (for payments for injuries).

- “TP” - payments of the current year;

- “ZD” - voluntary repayment of debts for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority;

- “BF” - current payment of an individual - bank client (account holder);

- “TR” - repayment of debt at the request of the tax authority;

- “RS” - repayment of overdue debt;

- “OT” - repayment of deferred debt;

- “RT” - repayment of restructured debt;

- “PB” - repayment by the debtor of debt during the procedures applied in a bankruptcy case;

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “IN” - repayment of investment tax credit;

- “TL” - repayment by the debtor’s founder of the debt during the procedures applied in a bankruptcy case;

- “ZT” is the repayment of current debt during the procedures used in a bankruptcy case.

Settlements by payment orders

Here, indicate for what and on what basis (documentation) the payment is made. The accountant can indicate the deadlines for fulfilling obligations under the contract or the deadlines for paying tax obligations, if necessary. Or establish a legislative reference establishing the basic requirements for carrying out calculations

This is interesting: Is parental leave included in the length of service for the Zemstvo Doctor program?

Payment requests, payment of which can be made by order of the payer (with acceptance) or without his order (without acceptance); collection orders, payment of which is made without the order of the payer (in an indisputable manner).

What needs to be done for the “scheme” to work

If enterprises are interested in making payments between them without their direct participation, they need

- conclude an agreement between themselves in which it is required to include a clause on settlements through a collection order;

- submit this agreement to the servicing credit institution.

After the agreement is concluded and the transaction is completed, the supplier’s (seller’s) bank forwards the collection order to the consumer’s (buyer’s) bank. Then the bank notifies the buyer about receipt of the document for payment and, if confirmed, the transfer occurs, then the recipient's bank similarly informs its client about the crediting of funds to the account.

Who is interested in the collection form of payment?

First of all, collection is beneficial to the buyer. This is due to the fact that he always retains the right to transfer the payment or refuse it (this determines the low reliability of these transactions). However, the seller can hedge his bets by pre-stocking certain documents, in the absence of which the buyer will not be able to take possession of the goods legally.

This is important to remember, given that this banking operation is carried out in conjunction with the acceptance of such a payment, which implies the immediate shipment of products under the current contract, regardless of whether funds have been received from the buyer or not. The buyer pays the price of the goods upon receipt of a complete package of payment documents, which must first be checked by the seller to ensure compliance with its cost, quality and quantity with the conditions specified in the contract.

The payment procedure by collection orders has one significant drawback: documents go through banks for quite a long time, so payment may not occur as quickly as we would like. Along with this, there is an advantage: in banks this service is quite cheap.

The concept and essence of collection payments

Collection is a method of settlement between parties in which not the supplier, but the bank receives the due amount or acceptance of payment from the buyer's bank.

The basis for this is monetary, settlement or commodity documents. The creditor's request to the bank to collect the amount of debt from the debtor is carried out through a collection order. At the same time, banks in such transactions act only as an intermediary and are not responsible for non-payment of documents by the buyer.

There is a distinction between pure and documentary collection. In the latter case, documents are required that confirm the fact of delivery (waybills, invoices, etc.)

In international trade, collection is an order from the bank to the exporter to receive payment from the importer upon delivery of supporting documents, and to transfer the money to the exporter without obligation on the part of the banks. Unlike letters of credit, collection is used to establish a trusting relationship between the seller and the buyer.

To reduce the risk of buyer insolvency and inability to pay collection documents, suppliers often insist on providing them with a bank guarantee.

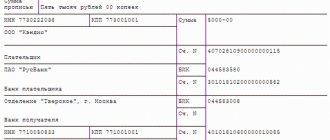

Rules for registration and preparation of a collection order

The collection order must be drawn up in a certain form. It contains

- information about the parties to the agreement (names of enterprises),

- information about the banks between which direct transfer of funds occurs,

- numbers of current accounts of organizations,

- transfer amount,

- number and date of document preparation.

If there is an undisputed collection of funds from the payer’s account (for example, when writing off tax debts and other reasons), then the collection order must also indicate a reference to the rule of law.

The document is drawn up in four copies :

- the first one remains with the employees of the credit institution and on the basis of it the funds are written off from the payer’s account;

- the second copy is transferred to the receiving bank. In cases where the accounts of both organizations are in the same bank, the second copy of the collection order receives the status of a memorial order when funds are credited to the payee's account;

- the third copy is intended for the account holder himself;

- the fourth copy is certified by a bank employee and the seal of the credit institution and handed over to the client.

Payment scheme through collection

The mutual settlement scheme is quite simple if acceptance from the payer is not required. Acceptance is the written consent of the counterparty that the amount of funds reflected in the payment documents will be debited from his account. The payer may agree to complete debt write-off. In this case, acceptance is considered complete. If the payer approves the debiting of only part of the amount, then the acceptance is called partial.

The payer's consent, that is, acceptance, can be positive or negative. If the acceptance is positive, then written consent is required from the debtor. But in the case of a negative, it is considered that consent to write-off is given if the payer does not refuse it in time.

Types of acceptance and conditions for refusal of payment are usually prescribed when concluding a contract. Thus, both parties to the transaction are aware in which case the counterparty may refuse to pay or pay the amount partially. Typically, depending on the type of acceptance, after issuing a payment request, the bank must debit the payer’s account within three or five days.

If all of the above seemed complicated to you, then the document flow diagram will help you figure it out. For settlements using collection with accepted payment requirements, participants in mutual settlements go through the following stages:

- The counterparties enter into an agreement, which spells out the terms of cooperation in detail, and also specifies the form of mutual settlements.

- The seller ships the goods and transfers all necessary documents to the payer.

- The seller prepares a payment request for payment on behalf.

- The seller sends a payment request to the bank to obtain acceptance from the buyer.

- The recipient of the goods gives consent to the bank to debit funds from his account.

- The bank collects the amount of debt from the payer's account in payment of the accepted payment order.

- The bank transfers the amount of debt collected from the buyer to the seller.

- The seller receives a statement from the current account confirming the payment has been credited and closes the transaction.

The bank begins to process a collection order when it receives a request to do so from the seller of the goods. After this, the bank sends a payment request to the debtor along with an invoice for payment. This form of mutual settlements involves first shipping the goods, regardless of the debiting of funds from the debtor’s account.

Obviously, the bank guarantees the security of the transaction. The buyer agrees to write off the debt after receiving the goods and checking the quality and quantity of the accepted goods.

If we consider the collection calculations step by step, then everything becomes clear; there is nothing complicated about them. Obviously, both the seller and the buyer transfer and receive money through an intermediary as safely as possible. All processes are supported by the necessary documentation, namely an agreement, collection order and acceptance, which are in the hands of the bank.

Sample of filling out a collection order

- First, write the document number and indicate the date it was completed.

- Next, indicate the type of payment and amount (necessarily in words and numbers).

- Then information about the payer is entered into the form: in the required cells put

- TIN and checkpoint numbers,

- full name of the company,

- information about the payer's bank (indicating its BIC).

- Next, in a similar manner, information about the payee and the credit institution in which he is serviced is entered into the collection order form.

- On the right side of the document, the current accounts of all organizations specified in the document are entered, and below:

- type of payment,

- purpose of payment

- and its order (if necessary).

- Then an agreement is entered into the document, according to which it became possible to use this document in settlements between enterprises (number and date of its preparation).

- Finally, the document must be signed by a responsible bank employee.