Home / Labor Law / Payment and benefits / Wages

Back

Published: 01/12/2018

Reading time: 6 min

0

9736

When calculating many payments guaranteed to an employee by the Labor Code of the Russian Federation, the average amount of earnings for a certain period of time is taken as a basis - his average earnings.

For each type of payment there is its own calculation formula , in which you also need to know the value of the average daily earnings. This will be needed when determining the amount of payments for:

- Annual guaranteed leave, or compensation for it which is paid upon dismissal;

- Additional days off to care for disabled children;

- Time spent undergoing a medical examination;

- Business trips;

- Sick leave and maternity leave.

- What do you need for correct calculations?

- Calculation of average earnings using specific examples For compensation for vacation in case of dismissal of an employee

- For sick leave and maternity leave

- To calculate the amount of travel allowances

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

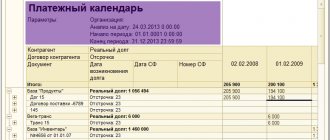

How to use the calculator

The average earnings calculator is easy to use.

For each month you will need to enter two values. 1. Indicate how many days the employee worked in a particular month.

2. Enter the employee’s salary for the same month in the next field of the calculator. You must indicate the amount in rubles.

You can set values in the calculator either by entering numbers from the keyboard or using the arrow buttons.

Please note that all months must be filled in. If the employee did not work in any of them, set the value to “0”.

When everything is ready, click on the calculator button “Calculate average daily earnings.”

The result will be displayed below.

Cases when wages increased

Average daily earnings are needed to calculate compensation for unused vacation; this indicator is multiplied by the number of unused vacation days, and the desired value is obtained.

The calculation of average daily earnings is carried out for a period called settlement. This is one year - 12 calendar months before the month in which the termination of the employment contract with the employee was recorded.

If less work is done, then the working time is taken in calendar months from the date of joining the company.

If an employee quits in the same month that he got a job, then the days worked in that month are taken into account.

All specified data on the time worked in the billing period and the income received during this time must be reflected in the fields of the online calculator.

To calculate your average daily income online, you need to fill out the following lines of the calculator:

- wages accrued for estimated time (only wages consisting of salary, tariff or rates, and bonus payments associated with wages are taken);

- date of dismissal - you should select the day of termination of the employment relationship on the calendar;

- days worked for each month of the pay period.

It is important to correctly fill in the data on earnings and working days in the calculator.

Income for calculation does not need to include all those amounts of money that were received in the billing period, but they were not provided for by the remuneration system. These types of payments include travel expenses, daily allowances, sick leave and maternity benefits, other social benefits, financial assistance, one-time bonuses for holidays, anniversaries and other similar vacation pay. All payments that were accrued based on the employee’s average daily earnings are not taken into account.

To fill out the online calculator, you need to add up all the accruals in favor of the employee for the pay period. Accrued amounts are taken before taxes.

With regard to time worked, it is important to establish whether all months of the billing period have been fully worked. If an employee went to the workplace every working day of the month, then he was fully worked.

If there were business trips, vacations, sick leave, absences from work, time off, downtime, then the days of such periods must be subtracted from the calendar number of days of the month.

In the fields of the online calculator you need to enter the number of calendar days that the employee was actually present at the workplace.

For example, if in October 2020 a person was on a business trip for 3 days, then for October you need to indicate 28 (31-3).

If the entire year has been fully worked out, then there is no need to change anything in the calculator; the calendar number of days is automatically inserted into the lines.

If the billing period is less than a year, then for those months of the last year that did not fall into the billing time, you need to enter zeros, since there are no days worked in them.

Next, in the calculator you should click the “calculate” button, after which the average daily earnings are calculated online.

The result of the calculations is shown below in the form of the number of fully worked months, days and average daily earnings.

To calculate compensation upon dismissal, it is enough to multiply the resulting figure by the number of unused days of annual basic and additional paid leave.

Employee Ivanov resigns on October 1, 2019.

Employment date: 02/10/2019.

The monthly salary is 30,000 rubles, in June there was a business trip for 5 days, the salary for June excluding travel allowances was 25,000 rubles.

In February 2020, the salary was 10,000 rubles.

The billing period is from 02/10/2019 to 09/30/2019.

Salary for working time = 10,000 30,000 30,000 30,000 25,000 30,000 30,000 30,000 = 215,000.

The first field of the online calculator is 215000.

The second field of the calculator is selected on the calendar 10/01/2019.

Filling out the third field of the calculator:

- October 2020 to January 2020 inclusive, zeros are entered in the calculator;

- February 2020 - 19 (Ivanova got a job from 02/10/2019);

- March - 31;

- April - 30;

- May - 31;

- June - 25 (30 - 5 days of business trip);

- August - 31;

- September - 30.

The list of situations when payments to an employee are calculated based on the calculation of the average amount of earnings is determined by the Labor Code of the Russian Federation. Among the most common and most often encountered situations in the activities of an ordinary organization that require the calculation of average earnings include:

- payment of vacation pay (Article 114 of the Labor Code of the Russian Federation);

- issuance of compensation for unused vacation - upon dismissal or for part of the vacation over 28 calendar days (Articles 126, 127 of the Labor Code of the Russian Federation);

- employee going on a business trip (Article 167 of the Labor Code of the Russian Federation);

- payment to employees for periods of training while away from work (Articles 173–176, 187 of the Labor Code of the Russian Federation);

- payment of severance pay (Article 178 of the Labor Code of the Russian Federation).

| Employees | Article of the Labor Code of the Russian Federation |

| Those engaged in collective negotiations or preparing a draft collective agreement (agreement) with exemption from their main job. At the same time, the average earnings for such workers can last up to 3 months. | 39 |

| Temporarily transferred to a job other than that provided for in the employment contract | 72.2 |

| Those forced to terminate an employment contract due to non-compliance with the rules for its conclusion (if the violations were not the fault of the employee) - in this case, severance pay is due in the amount of the average monthly salary | 84 |

| Failure to comply with labor standards and labor duties due to the fault of the employer | 155 |

| Forced to remain idle due to the fault of the employer - in such a situation at least 2/3 of the average salary is paid | 157 |

| Members of labor dispute commissions | 171 |

| The manager, his deputy or the chief accountant, dismissed upon change of ownership in the amount of 3 times the average monthly salary | 181 |

| Transferred to lower paid work due to health reasons | 182 |

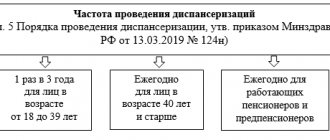

| Sent for mandatory medical examinations | 185 |

| Employees undergoing medical examination (from 01/01/2019) | 185.1 |

| Donors | 186 |

| Employees during suspension of the organization's activities | 220 |

| Pregnant women and women with children under 1.5 years of age transferred to another job | 254 |

| Women breastfeeding – when paying for breastfeeding breaks | 258 |

| Parents of disabled children when paying for additional days off and in some other cases | 262 |

The general and uniform procedure for calculating average earnings for all these cases is enshrined in Art. 139 Labor Code of the Russian Federation. The main rule: in any mode of work, the average salary is calculated based on the earnings actually accrued to the employee and the time actually worked by him for the 12 calendar months that have elapsed before the period in which the calculation of the average monthly salary is required. These 12 months are called the billing period.

The calculation procedure is spelled out in more detail in the regulation “On the specifics of the procedure for calculating the average salary,” which was approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. We will tell you in more detail about how to calculate the average monthly salary. The latest changes to this document were made in 2020, so you need to rely on it when calculating average earnings in 2019-2020.

For information on how to calculate the average number of employees, read the article “How to calculate the average number of employees?”

The calculation of average earnings takes into account all payments provided for by the organization’s remuneration system, including:

- wages - time-based, piece-rate, as a percentage of revenue, paid in cash or in kind;

- various incentive bonuses and additional payments, as well as all payments for working conditions - read more about them here;

- bonuses and other similar rewards;

- other payments applied by the employer (clause 2 of regulation No. 922).

At the same time, the calculation of average earnings does not include social payments, such as financial assistance, payment for food, travel, utilities, etc.

If the employee’s salary was not accrued during the billing period, the calculation of average earnings is based on the salary accrued for the previous 12 months. In the case where the employee does not have a salary (time worked) before the start of the billing period, but has one in the month of calculation, the average earnings are determined by the amounts accrued for this month. If there is no salary in the month of calculation, the average salary is calculated based on the assigned tariff rate or salary.

An increase in wages in an organization also affects the average monthly salary of an employee. It is important in what period the salary growth occurs:

- If the increase occurs during the billing period, all payments for the time preceding the increase are indexed. The indexation coefficient is calculated by dividing the new tariff rate, salary, etc. by the tariff rates, salaries that were in effect in each of the 12 billing months.

- If the salary increases after the billing period, but before the occurrence of the event for which the average earnings need to be calculated, the average earnings itself increases. The correction factor here is the ratio of the new wage to the previous one.

- If the increase is carried out already during the period of maintaining average earnings, only part of it increases from the date of the increase until the end of this period. The indexing coefficient is calculated in the same way as in the second case.

See also “Salary indexation in 2019-2020: how and by how much.”

In conclusion, we would like to draw the reader’s attention to the following. The concept of average earnings is used not only by labor legislation, but also by social security legislation. Thus, sick leave, maternity and child benefits are paid based on average earnings. However, this earnings are considered differently - in the manner established by the law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

Read more about calculating average earnings for social benefits in the following articles on our website:

- for sick leave - here;

- for child care benefits - here;

- for maternity payments - here.

To pay unemployment benefits, the average earnings for the employment center are calculated. The calculation is carried out in accordance with the resolution of the Ministry of Labor of the Russian Federation “On approval of the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities” dated August 12, 2003 No. 62.

Accounting for salary increases

Sometimes it is necessary to provide a certificate of average monthly earnings. It may be required by social protection services or at the employment center when registering an individual for payment of benefits due to temporary unemployment. Also, determining the exact amount is necessary when applying for loans in banking institutions and for courts.

These are the most common cases in which you need to know the average salary. The coefficient is usually calculated for three months or six months. Calculating average earnings is most often necessary not for personal needs, but for an urgent situation. Dismissed workers often cannot find a new suitable position, so they come to the employment center. A certificate of average salary is one of the documents required for calculating financial assistance.

The Tax Code of Russia establishes a clear procedure and sequence for determining the average salary. The following calculation principles exist:

- During the calculation, you need to take into account annual and monthly bonuses, advances and all incentives from management in the form of cash increases.

- Salary increases for each quarter are taken into account.

- Any accruals that are provided for by the company’s collective agreements are also taken into account.

The calculation period is 3 months before dismissal or voluntary resignation from a position. All payments until the termination of the employment relationship and from the last three months are counted and also used in the average daily earnings formula.

However, there are some exceptions to the income required for accounting. All social assistance payments are not taken into account. These include anniversary bonuses and one-time financial assistance. Compensation for leave for pregnancy and childcare is not included in the calculation of the average salary. In the event that work experienced downtime for corporate reasons, the employee is not responsible for this. The billing period does not include:

- the date when the employee was temporarily disabled due to pregnancy or caring for children under 3 years of age;

- period of compulsory leave (study, paid, free);

- days of temporary care for persons with disabilities;

- the time an employee is absent from the company is not his fault.

These factors should be included in the average salary calculator. It facilitates the calculation of the ratio of wages actually worked for the days actually worked for the established pay period.

Before bringing a certificate to the employment exchange to register the applicant as unemployed, it is necessary to use a clear calculation formula. To receive unemployment benefits, you need to know your average daily earnings. The amount of all payments for the billing period should be divided by the days actually worked. The estimated time is taken over a 3-month period.

After determining the average daily salary, you can calculate the total average salary for the month - this is done either independently or using a calculator, using a certain formula:

- Average salary = Total number of working days* Average daily earnings

This algorithm is constant and has not changed for many years. There is no need to constantly look for new calculation formulas, because they are always relevant. To facilitate the process, an average earnings calculator was created. It applies this algorithm and produces accurate results in a short time.

Average salary = Number of days worked / Number of calendar days* 29.3

Every employee needs annual leave, so everyone who works officially will be faced with calculating the average salary.

Bonuses are taken into account when calculating average earnings if they are established for work and their payment is provided for by local regulations (for example, regulations on bonuses) in accordance with the terms of the bonus. Bonuses that are not conditional on labor contribution (for anniversaries, vacations, etc.) are not taken into account when calculating average earnings.

To determine whether one or another bonus should be taken into account when calculating average earnings and how much bonuses of one type should be taken into account, you need to be guided by the following rules. 15 Regulations.

| Type of award | Number of premiums taken into account per 12-month billing period | Under what conditions are they taken into account? |

| Monthly | No more than 12 bonuses for one bonus indicator (condition) | If premiums are accrued in the billing period |

| Quarterly | No more than 4 bonuses for one bonus indicator (condition) | |

| Semi-annual | No more than 2 bonuses for one bonus indicator (condition) | |

| Annual | No more than 1 bonus for one bonus indicator (condition) | If the premium was accrued for the previous calendar year - regardless of whether the moment of accrual fell within the billing period or not |

To determine the amount of the bonus to be taken into account (in full or in proportion to the time worked in the billing period), you can use the following table. 15 Regulations.

| Situation | The billing period has been fully worked out | The billing period has not been fully worked out | |

| The working period is fully included in the billing period | The working period is not included in the calculation period in whole or in part | ||

| The bonus is accrued taking into account actual work performed during the working period | Fully taken into account | Fully taken into account | Taken into account in proportion to the time worked in the billing period |

| The bonus was accrued without taking into account actual work performed during the working period | — | Taken into account in proportion to the time worked in the billing period | |

When calculating average earnings, an increase in tariff rates and salaries is taken into account for all employees of the organization or all employees of a structural unit of the organization, if this increase occurred after the start of the billing period and before the end of the period subject to payment at the average earnings.

A structural unit is considered not only branches or representative offices of an organization, but also departments, workshops or sections. 16 Regulations; Clause 16 of the Resolution of the Plenum of the Supreme Court dated March 17, 2004 No. 2. Moreover, the increase is taken into account regardless of whether it was the same for all employees of the organization (structural unit) or differed by category of employees. If one employee’s salary was increased by 5%, and another by 20%, then such an increase must also be taken into account when calculating average earnings.

Payments that need to be adjusted when tariff rates and salaries increase. 16 Provisions:

- tariff rate, salary;

- bonuses, additional payments, allowances established to the tariff rate, salary in fixed amounts, that is, as a percentage (for example, 40% of the salary) or in an amount that is a multiple of the salary (for example, an additional payment to the salary in double size).

Payments that do not need to be adjusted when tariff rates or salaries increase. 16 Provisions:

- bonuses, additional payments, allowances set in a range of values (for example, from 10 to 40% of the salary or in a multiple of 1 to 5 salaries);

- bonuses, additional payments, allowances set in absolute amounts (for example, 2000 rubles).

If the increase in tariff rates and salaries was accompanied by changes in the remuneration system (for example, some allowances, additional payments, bonuses were canceled, while others were introduced), then the consolidated increase factor must be calculated. 5 clause 16 of the Regulations; Government Decree No. 916 dated November 11, 2009.

In order for the summary coefficient to reflect the final increase in wages, the following conditions must be met when calculating it:

- the increase in tariff rates and salaries was accompanied by a change in the list of only monthly payments provided for by the remuneration system and (or) an increase in the amount of previously established payments. When increasing the size and (or) changing the composition of payments established for a period of more than a month (for example, for a quarter), the consolidated increase factor does not need to be calculated;

- monthly payments are set in fixed amounts. Payments set within the range of values do not participate in the calculation of the summary coefficient.

The procedure for applying the increasing coefficient depends on the moment at which the salary increase occurred. Let's consider three possible situations.

SITUATION 1. The increase occurred in the billing period.

This situation arises if, for example, the employee had a vacation or business trip in September 2020, and the salary increase was from 01/01/2015.

Next, average earnings are calculated according to general rules (formulas 1-6).

SITUATION 2. The increase occurred after the billing period, but before the period during which the employee retains his average earnings.

For example, an employee’s vacation or business trip begins on September 14, 2020, and the salary increase began on September 1, 2015.

And then the average earnings are calculated according to the general rules (formulas 1-6).

SITUATION 3. The increase occurred during the period subject to payment according to average earnings.

For example, an employee’s vacation or business trip lasts from 08/24/2015 to 09/20/2015, and the salary increase was from 09/01/2015.

If the average salary was paid to the employee before the increase (for example, vacation pay), then after the increase it is necessary to calculate the average salary taking into account this increase and pay the difference to the employee.

To calculate the average salary, all types of payments provided for by the remuneration system must be taken into account, regardless of their sources (Part 2 of Article 139 of the Labor Code of the Russian Federation). The procedure for calculating wages is approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

https://youtu.be/j4S05knPbrc

Documents for subsidy

In accordance with the law of the Russian Federation, certain categories of citizens have the right to receive special subsidies when paying for housing and communal services. In order to receive them, you must provide the following documents for the subsidy.

This is directly an application for its receipt, passport data, a document confirming Russian citizenship, certificates of family ties with the family living with this person. You will need their passports and birth certificates in the case of minors. You must provide a certificate of family composition. Here you should fill out the income certificate form. You also need statements of your personal housing and communal services account and documentation confirming your rights to social support.

How to calculate the wages and salary if the specialist did not receive a salary?

Average earnings are calculated according to the rules established by Decree No. 922 of December 24, 2007. The Labor Code lists several cases when the average salary should be calculated:

- employee leave (regular, educational);

- temporary disability, maternity leave, child care;

- business trip;

- calculation of compensation upon dismissal;

- downtime due to the fault of the employer;

- other paid absences from the workplace (donor days, suspension of work due to non-payment of wages for more than 15 days, undergoing a mandatory medical examination, etc.).

Determination of the billing period for which the average monthly earnings are calculated. The law requires such calculations to be made for at least the last 12 calendar months. The days the employee is on business trips, vacations, downtime or on sick leave are excluded from the calculation period.

- The entire employee’s earnings for the last 12 calendar months are summed up, taking into account the above-determined amounts that are included in these calculations and excluding amounts that are not included in them.

- An employee’s earnings are divided by 12 if the employee did not have periods for which he was not paid. Or - the actual amount of working time of the employee for the billing period is determined and the calculation is carried out according to the days worked. Such periods include leave, including maternity leave, downtime, business trips, absenteeism or periods of temporary disability.

In certain situations, a different procedure for calculating the average monthly salary may be used, for example, when maintaining summarized records of working hours and with a flexible work schedule, it is also necessary to calculate the employee’s average hourly earnings.

If a specialist has not received labor income in the last two years, but payments to him were resumed in the month when the calculations are made, the average monthly salary must be calculated based on the amounts accrued during this time.

If the work has not become remunerated, the average salary for sick leave is calculated based on the amount specified in the contract between the employee and the employer, or the tariff schedule in force at the enterprise.

What the law says

The features and procedure for calculating average daily earnings are prescribed in Decree of the Government of the Russian Federation of December 24, 2007 N 922 (as amended on December 10, 2016) “On the features of the procedure for calculating average wages.” The Resolution prescribes all the main features of payments in various situations. It also prescribes the process of determining the calculation period, which is 12 calendar months preceding the period for which the employee is entitled to payment of average earnings.

When calculating, it is necessary to correctly determine the amount of average daily earnings, and also know which payments can be included and which are not necessary, depending on the reason for this payment.

Basic formulas and calculation examples

Calculation of average earnings for certain payments is always done based on average daily earnings.

SmZ = SdZ × N,

SMZ - average monthly salary;

SDZ - average daily earnings;

N is the number of days to be paid according to average earnings.

SWP = Sum. Salary per year / 12 months.

SMZ = 150,000 / 12 months. = 12500 rub.

Example 2. An employee of an enterprise wrote an application for annual leave from August 3 to August 15, 2020. Employee's salary for 2016-2017. has not changed and is 27,000 rubles. From April 11 to April 19, the employee was on sick leave, and the payment amounted to 23,000 rubles. It is required to calculate the average monthly earnings and the amount of vacation pay.

29.3 / 30 (number of days in April) * 21 (number of days actually worked) = 21 days

FFP = (27,000 * 11 months 23,000) / (29.3 * 11 months 21 days) = 932 rubles.

Vacation pay = 932 rub. * 13 days vacation = 12,116 rub.

If an employee gets sick while on vacation...

If an employee has provided a certificate of incapacity for work (sick leave) for illness or injury, which was issued during vacation, it is necessary to calculate and pay temporary disability benefits. In this case, the vacation is extended by the number of days of sick leave or these days are transferred to another time.

When extending your vacation, it is not necessary to recalculate your average earnings; you can simply transfer the vacation days to the timesheet, the amount remains the same.

When transferring vacation, it is necessary to reverse the amount paid for vacation days falling during the sick leave period. If vacation is granted at another time, you will need to recalculate your average daily earnings based on a different calculation period.

Note. A certificate of incapacity for caring for a sick family member during vacation is not paid and does not give the right to extend or postpone the vacation.

How to calculate average daily earnings upon dismissal?

The main feature of calculating average earnings per day is that different rules for its calculation have been established:

- for payment of vacation pay and compensation for unused vacations;

SD = salary for the billing period / days actually worked in the billing period.

The billing period is 12 months (Article 139 of the Labor Code of the Russian Federation). If the employee worked for less than 12 months, then the calculation period is equal to the actual period of work.

SDZ = salary for the billing period / 12 / 29.3.

SDZ = salary / (29.3 × full calendar months worked, calendar days in incomplete calendar months).

29.3 / number of calendar days in a month × calendar days worked.

Example

Let’s say the employee was sick from October 17 to October 31, 2020. Then the number of days in partially worked October: 29.3 / 31 (calendar days of October) × 12 (calendar days worked for the period from October 1 to October 16) = 11 days.

494,600 / (29.3 × 11 11) = 1,483.95 rubles.

SDZ = salary / per number of working days according to the calendar of a 6-day working week.

Quite legal tricks

In some cases, an employee may be able to “save” vacation days or earn slightly more vacation pay by taking days off at the beginning and end of the vacation period.

For example, an employee goes on vacation for three weeks from July 4 to July 24. In fact, he rests from July 2 to July 24 (July 2, 3, 23 and 24 are days off).

An employee can write an application from 2 to 24 (including weekends), or from 4 to 22. The rest time will be the same, but in the first case, vacation pay will be accrued for 23 days and there will be another 5 days of vacation (28 - 23) that can be used Later. In the second case, vacation pay will be accrued for 19 days, but there will still be 9 days of vacation left.

Both options do not contradict the law. Please note that at least one part of the vacation per year must be at least 14 days (in accordance with Article 125 of the Labor Code of the Russian Federation).

What exactly should be taken into account when calculating average earnings?

How average earnings are calculated is specified in the Regulations on the Calculation of Average Earnings. Average daily income is calculated based on wages for the previous 12 months. Its calculation includes all days and payments for the time when the employee was at work, and does not include for the time he was absent from work:

- disease;

- vacation;

- business trip;

- other absence, paid or unpaid.

One-time payments that are not related to the employee’s performance of work duties should not be included in the calculation: holiday incentives, financial assistance.

| Type of award | The procedure for inclusion in the calculation |

| For a period less than the estimated period (monthly, quarterly) | Completely one for each bonus indicator (for example, revenue volume, number of sales) |

| For a period longer than the estimated period (for example, for fulfilling a long-term customer order) | In the amount of a monthly portion for each indicator for each month of the billing period |

| At the end of the year | Included in full, regardless of the date of actual accrual and payment |

If there was an increase in salaries throughout the company or in the department in which the employee works, then the payments included in the calculation after the increase must be adjusted by the coefficient:

- Wages - includes the entire amount of accrued wages to an employee, including for work at a rate or salary, for work on a piece rate basis, paid as a percentage of the cost of products sold, as a commission. In addition, the calculation must also include wages, the payment of which is made in kind (non-cash);

- Allowances, additional payments - all additional payments and allowances that are paid to an employee in addition to the salary or tariff rate are also subject to consideration when calculating average earnings. These include payments for length of service, experience, combination or leadership position;

- Bonuses paid in accordance with the established wage system.

- And other benefits paid in connection with working conditions. These include payment for work under particularly difficult conditions, for night work, etc.

Cases for the need to calculate average daily earnings

There are many circumstances when you need to calculate the average monthly or daily earnings:

- if for a number of reasons a full-time employee is not able to perform his or her job in full;

- his employment is carried out in a special regime.

How to calculate the average daily earnings for each specific case?

The main concepts related to average daily earnings are supported by the Government Decree of 2007; you can find out the corresponding list directly in this document. Payment of this indicator is used for all types of payments:

- for the period of the next vacation;

- during additional or educational leave;

- remuneration throughout the entire travel period;

- compensatory vacation payments related to dismissal;

- in case of downtime that occurred due to the fault of the company.

Important! The previous 12 months are taken into account.

Vacation

Regulatory acts provide for the use of average income indicators to determine vacation payments required by law. How is average earnings calculated in this case? First, the time period that will be studied is determined. The data must be calculated taking into account all previously made payments, which must include all funds paid related to wages in this organization.

Note! A correctly performed calculation of average earnings included in vacation payments should consist of additional payments for work on holidays and weekends, irregular days, and regional coefficient bonuses.

Temporary disability benefits

Due to the fact that initially payments for temporary disability or illness are made by the employer, it is necessary to carry out calculations based on average daily earnings.

Before calculating the average daily earnings, it is important to remember that the funds paid to the employee will be fully compensated by the Social Insurance Fund. Providing incomplete information can lead not only to data inconsistencies, but also to unplanned financial costs.

A striking example is the average daily earnings, which is used when calculating maternity benefits, which must be calculated over two years. The received amount of remuneration is divided by the total number of days of this period. The following periods are subject to exclusion:

- temporary disability, which includes the entire maternity period;

- if the employee was fully or partially relieved of his position with mandatory retention of full salary. During this time, no insurance premiums should be charged.

Registration of sick leave benefits

Important! Maternity benefits in Russia have legal restrictions on maximum and minimum amounts of payments. Failure to meet these indicators will mean that the company has violated the law.

Business trips

According to the Labor Code, it is mandatory to calculate the average earnings for the entire duration of a business trip. It should be calculated from daily averages. The organization is obliged to make payments for each business trip day. Compensation also includes payment for the entire period of stay on the road. Weekends should not be counted unless otherwise provided by the employment agreement.

Travel allowances

Compensation payments

Most of the legally accepted compensation payments should also be calculated based on average earnings. Compensation is subject to days when, for example, a mandatory medical examination of employees is carried out. The Labor Code also requires compensation for the time when employees donate blood.

Note! In any case, the fact of absence must be confirmed by a certificate from the relevant institution.

You need to calculate the amount of payments according to the average daily coefficient.

Payment for downtime

Downtime in a company's operations cannot affect employees' wages. The calculation of due payments must be determined based on the average daily earnings and include all downtime in the total indicator. A break caused by the company is paid in full. In the absence of his fault, the amount of payments is 2/3 of the total amount. Payment for downtime must be made every month.

Suspended work

If wages are delayed, the employee has every right not to go to work, but the company must pay the average daily wage for the entire time when there was no work.

Payment for a special nature of work

Payment for employees who work at night or on holidays is also calculated according to average earnings, unless other options are provided by law.

Transfer of an employee to another position

Sometimes, due to certain circumstances, it is necessary to temporarily transfer a staff member to another vacancy. During this time, a salary must be fixed that is at least the daily average of the previous position.

Termination of labor relations

Not in all situations, upon dismissal, the company must pay the employee severance pay. The presence of contractual obligations to pay two weeks' salary upon termination of employment implies a calculation taking into account the daily average. The absence of such obligations predetermines payments based on average monthly data.

Note! In other situations, the need to carry out calculations may arise when preparing financial or audit reports. The cost analysis should also include these indicators.

Periods excluded from the calculation period

We have already said that the billing period is 12 calendar months preceding the period in which average earnings are calculated. However, individual periods, as well as the amounts accrued for them, are excluded in the calculation. These are the periods when:

- the employee retained his average earnings (only breaks for feeding the child are not excluded);

- the employee was paid sick leave or maternity benefits;

- the employee did not work due to downtime for which the employer was to blame, or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but did not work because of it;

- the employee was given days off to care for a disabled child;

- in other cases, the employee was released from work with full or partial retention of wages or without it (clause 5 of Regulation No. 922).

The basic rule that accountants follow is: “To determine the average daily earnings, it is necessary to exclude from it payments that are not related to the employee’s direct performance of his or her job duties.” Then, when calculating the SDZ, you will need to subtract from the employee’s total income:

- financial assistance for any reason (birth of a child, anniversary, development of professional experience, death of a close relative, etc.);

- cost of gifts (for professional and national holidays, for children);

- compensation for travel, food, accommodation;

- funds issued for recreation and recovery;

- money to pay for utilities, kindergarten.

Vacation pay in calendar days

This is the 12 calendar months preceding the period for which average earnings are paid.

3 tbsp. 139 Labor Code of the Russian Federation; clause 4 of the Regulations, approved. Government Decree No. 922 dated December 24, 2007 (hereinafter referred to as the Regulations). A local regulation or collective agreement can establish a billing period of a different duration both for all employees of the organization and for employees of a separate structural unit. 6 tbsp. 139 Labor Code of the Russian Federation. The clause of an organization’s local regulatory act (for example, regulations on remuneration) regarding the establishment of its billing period can be formulated as follows.

Calculation of average earnings for all employees of the Company in cases provided for by the Labor Code of the Russian Federation is based on accrued wages and time worked for 3 calendar months preceding the period during which the employee retains the average salary.

However, the amount of average earnings calculated on the basis of one’s calculation period cannot be less than its amount calculated on the basis of a 12-month period. 139 Labor Code of the Russian Federation. Therefore you will always have to do the calculation twice:

- based on your billing period;

- based on a 12-month billing period.

And from the results obtained you will need to choose the largest one.

When calculating average earnings, the following must be excluded from the calculation period:

- the period of preservation of the employee's average earnings in accordance with the law (for example, the period of a business trip, annual paid leave) sub. “a” clause 5 of the Regulations, except:

- breaks for feeding the child, sub. “a” clause 5 of the Regulations;

— days of inter-shift rest in connection with work beyond the normal working hours for a shift. 5 Regulations; subp. “g” clause 4 of the Regulations, approved. Government Decree No. 213 dated April 11, 2003 (lost force). Payments for these periods must also be taken into account when calculating average earnings. 5 Regulations;

- period of temporary incapacity for work, maternity leave, parental leave, subclause “b”, “e” clause 5 of the Regulations;

- period of downtime due to the fault of the employer or for reasons beyond the control of the employer and employee sub. “c” clause 5 of the Regulations;

- the period during which the employee did not participate in the strike, but in connection with it was not able to perform his work. "g" clause 5 of the Regulations;

- additional paid days off for caring for disabled children. “d” clause 5 of the Regulations;

- other periods when the employee was released from work, regardless of whether the salary was maintained (in particular, leave without pay) sub. "e" clause 5 of the Regulations.

If payments were made to the employee during these periods, they are not taken into account when calculating average earnings. 5 Regulations.

First of all, you need to check when the employee had payments: before the pay period, after it, or there were none at all. And apply the calculation procedure that is established specifically for this situation.

This situation is possible if the employee was on maternity leave, on a long business trip, or on leave without pay during the entire billing period. To calculate the average earnings, such an employee needs to take the previous period, equal to the calculation period, in which he had a salary and days worked.

That is, you need to count 12 months, but not from the beginning of the “empty” billing period, but from the beginning of the period of long-term absence of the employee from work. 6 Regulations. For example, a woman who has been working in an organization since January 1, 2010, has been on maternity leave since May 24, 2012. The child was born on August 2, 2012.

From October 11, 2012, at the end of maternity leave, she took out parental leave until the child reached the age of 3 years. At the end of her maternity leave, she wrote an application requesting annual paid leave from August 3, 2020. The billing period is 12 calendar months.

And then you calculate the average earnings according to the general rules (formulas 1-4).

This situation arises if an employee is hired in the same month in which he needs to be paid for the period of average earnings (in the month of going on vacation, going on a business trip, etc.).

We calculate the average earnings for vacation pay or compensation for unused vacation in calendar days in two stages. 7, 10 Regulations.

This situation arises, for example, if the beginning of the period paid according to average earnings coincides with the first day of work (for example, either the employee began vacation, or the employee was sent on a business trip on the first day of work).

It is clear that when calculating average earnings, it is not necessary to take into account all “salary” payments accrued in favor of the employee from the moment of his employment. The calculation includes amounts accrued during the billing period. In general, it is equal to 12 calendar months preceding the period for which the employee retains his average earnings (clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

In this case, a number of periods are excluded from the calculation.

SDZ – average daily earnings;

PM – the number of full calendar months;

ND – the number of calendar days in incomplete calendar months.

KM1..-..KMn – number of calendar days of the nth month;

KR1…-…KRn – the number of calendar days falling within the time worked in the nth month.

Calculation of benefits upon liquidation of an organization

When calculating the average monthly salary, different bonuses are taken into account differently, depending on the period for which they were accrued (clause 15 of Regulation No. 922).

When paying monthly bonuses, the calculation includes no more than 1 bonus per month for each bonus indicator, for example, 1 bonus for the number of attracted clients and 1 bonus for sales volume. As a result, no more than 12 bonuses of each type can be taken into account during the billing period.

If bonuses are accrued for a period of more than a month, but less than the calculation period, for example, for a quarter or half a year, they are taken into account in the amount actually accrued for each indicator. And if the duration of the period for which they are accrued exceeds the duration of the billing period - in the amount of the monthly part for each month of the billing period.

Annual bonuses and one-time remuneration for length of service (work experience) are taken into account in full, regardless of the time of their accrual.

In a billing period that is not fully worked, bonuses are taken into account in proportion to the time worked. Bonuses accrued for actual time worked are taken into account in full.

Payments to employees upon company liquidation include:

- salary until the day of dismissal;

- compensation for unused vacation;

- severance pay;

- benefits during employment if the employee has not found a job within two months; in exceptional cases, by decision of the employment service, income is retained for another month.

The average daily income for compensation for vacation not taken is determined similarly to the calculation for vacation pay.

Let's look at how to calculate the average daily earnings for severance pay and payments retained during employment. It is determined by dividing the base by the number of days worked in the billing period. Severance pay is determined by multiplying the average daily income received by the number of working days in the first month after dismissal. The amount of payment saved during the job search is calculated in the same way.

Calculation for certificate of incapacity for work

Determining the average daily income for sickness benefit has a number of features. Firstly, it is determined based on payments for the two calendar years that preceded the year in which the employee took sick leave. Secondly, the number of days in the billing period is always taken to be 730 (Federal Law of December 29, 2006 No. 255).

The income on the basis of which the benefit will be calculated includes all payments from which insurance contributions to the Social Insurance Fund were calculated in case of temporary disability.

The base for the payroll period is determined not only by the income that was paid to the employee at the current place of work, but also by income from previous employers. The employee must confirm his salary at his previous place of work with a certificate in a form approved by the Ministry of Labor.

| Year | Limit value, rub. |

| 2017 | 718 000 |

| 2018 | 755 000 |

Therefore, in 2020, the maximum daily benefit cannot exceed (755,000,718,000) / 730 = 2,017.81 rubles.

Also, the daily benefit payment cannot be lower than calculated from the minimum wage. The minimum average daily earnings from the minimum wage in 2020 is 11,280 × 24 / 730 = 370.85 rubles.

Calculation formula

You can calculate your average daily earnings using the established formula. This calculation does not apply to accrual of vacation pay. The average daily salary is determined by the formula.

Does the employee work an hourly job? Then you need to find out the employee’s average hourly rate using the formula.

The data obtained must be multiplied by the working days or hours that are included in the billing period.

When calculating, only working days are taken into account. Holidays and weekends are not taken into account in calculations.

Results

The rules for calculating average earnings (average monthly wages), described by us above, apply exclusively to the cases listed at the beginning of the article, including when calculating average earnings when an employee is laid off to pay him severance pay, and social benefits and unemployment benefits do not apply .

You can find out more about social payments in our “Benefits” section.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

What data is taken for calculation

To correctly calculate your average daily earnings, you should consider:

- all salary accruals, fees, bonuses issued and other income that accrues to the company, including non-monetary ones;

- additional payments;

- coefficients that increase earnings;

- payments to public service employees.

It is important to know: the accrual period must exactly coincide with the time for which you want to calculate the average earnings.

Not taken into account:

- paid sick leave;

- vacation pay;

- funds for transportation and food;

- travel allowances

- various social benefits.