Advance payments for land tax

Since January 1, 2006, throughout the entire territory of the Russian Federation, the Law of the Russian Federation of October 11, 1991 N 1738-1 “On payment for land” has lost force and Ch.

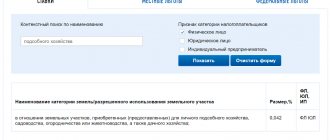

31 “Land tax” of the Tax Code of the Russian Federation. The innovations also affected individual entrepreneurs. The fact is that they were equated to organizations in terms of paying land tax on those plots that they use in business activities. In accordance with Ch. 31 of the Tax Code of the Russian Federation, individual entrepreneurs (in relation to plots used in business activities) must independently calculate and pay advance payments based on the results of reporting periods and the amount of tax based on the results of the year, submit calculations for advance payments and tax returns.

At the same time, organizations and individuals are not recognized as taxpayers in relation to those land plots that are held by them under the right of gratuitous fixed-term use or transferred to them under a lease agreement. Land tax is a local tax, that is, it is established by local authorities, but they cannot go beyond the Tax Code of the Russian Federation.

Let's sum it up

Unlike individuals and individual entrepreneurs, who pay taxes based on notifications from the tax inspectorate, legal entities must independently calculate the tax and pay it on time. When calculating the amount of tax in 2018-2019, the applied rate is taken into account, which depends on the category of land, as well as on the location of the site itself (or rather, on the legislative norms in a particular subject of the country). It is important not only to pay the necessary taxes, but also to do it on time, since if the deadlines are missed, the organization risks incurring additional costs.

This is interesting: How to open a hostel on your own: business advantages

If a legal entity is at the stage of creation and the tax burden has not yet affected the company, you should take a responsible approach to choosing the name of the organization. There are certain company names that bring good luck in business, especially if the name best reflects the key essence of the activity.

Tax calculation procedure

The tax base for calculating land tax is the cadastral value of land as of January 1 of the year, which is the tax period (clause 1 of Article 391 of the Tax Code of the Russian Federation). The cadastral value of land plots is determined based on the results of the state cadastral valuation of land, which is based on the classification of land by intended purpose, type of functional use and is carried out to determine the cadastral value of land plots for various purposes. The assessment results are approved by the executive authorities of the constituent entities of the Russian Federation on the proposal of the territorial bodies of Rosnedvizhimost.

Tax rates for land tax are differentiated depending on the purpose of land plots. For agricultural lands and those occupied by housing, the maximum tax rate is set at a preferential rate of 0.3%. For all other categories of land, the maximum rate is 1.5%. However, the actual tax rate (within the specified limits) is set by local authorities. They also decide whether advance tax payments will be made in their territory. Advance payments must be paid for the first quarter, half a year and 9 months.

The tax period for land tax according to paragraph 1 of Art. 393 of the Tax Code of the Russian Federation is the calendar year. The tax amount for the tax period is calculated as the product of the tax base and the tax rate. The amount of the advance payment at the end of the reporting period is determined as 1/4 of the tax amount for the tax period. If the taxpayer must make advance payments for land tax, then the amount of tax payable to the budget at the end of the tax period is determined as the difference between the calculated amount of tax and the amounts of previously paid advance payments.

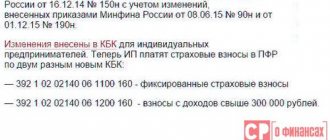

Tax returns for land tax are submitted to those tax inspectorates with which the taxpayer is registered at the location of the land plots owned by him. Individual entrepreneurs are required to submit tax returns no later than February 1 of the year following the expired tax period, and calculations for advance payments - no later than the last day of the month following the expired reporting period (clause 3 of Article 398 of the Tax Code of the Russian Federation). The calculation form is given in Appendix No. 1 to Order of the Ministry of Finance of Russia No. 66n <1>. The tax return form is approved by Order of the Ministry of Finance of Russia N 124n <2>.

<1> Order of the Ministry of Finance of Russia dated May 19, 2005 N 66n “On approval of the tax calculation form for advance payments of land tax and Recommendations for its completion.” <2> Order of the Ministry of Finance of Russia dated September 23, 2005 N 124n “On approval of the tax return form for land tax and the procedure for filling it out.”

The deadlines for paying taxes and advance payments are approved by regulations of local authorities. However, the deadline for paying the tax, as established by paragraph 1 of Art. 397 of the Tax Code of the Russian Federation cannot be determined earlier than February 1 of the year following the expired tax period.

Example. The entrepreneur purchased a plot of land in 2005 to grow vegetables. As of January 1, 2006, the cadastral value of the site (conditionally) amounted to 1,360,000 rubles.

Local authorities have established a procedure for paying advance payments of land tax for the first quarter, half a year and 9 months, and the tax rate for agricultural land plots is set at 0.3%.

Payment of the advance payment must be made no later than the date of submission of the calculation for advance payments, that is, no later than the last day of the month following the expired reporting period. The tax payment deadline is set no later than February 15 of the year following the expired tax period.

In this case, the individual entrepreneur must pay advance payments for land tax and the amount of tax:

- May 2, 2006 (April 30 - day off) - 1020 rubles. (RUB 1,360,000

Penalty for late payment or evasion of duty

Non-payment of tax can be intentional or accidental due to a number of factors that do not allow the payment to be made on time. In case of violation of the deadline for payment of land tax by legal entities, the following is provided:

- Administrative liability in the form of penalties and fines occurs in the event of intentional or unintentional, partial non-payment.

- Criminal liability - comes into force when a legal entity deliberately hides from representatives of the inspectorate, and also hides property and cash savings that can be used to pay off debts.

In case of unintentional non-payment or partial payment of the required amount, the legal entity is subject to a fine of 20% of the total debt.

Legal entities are required to pay land tax! To pay the fee, you must submit a tax return to the inspectorate at the location of the land. The amount must be paid no later than the 10th, otherwise a fine and other types of punishment may be imposed, including criminal liability!

Possible problems with tax calculation

At the moment, there are no contradictions between individual entrepreneurs and tax authorities regarding land tax. On the one hand, entrepreneurs have a new responsibility, the fulfillment of which requires additional effort and resources, and on the other hand, there are problems that concern all land tax payers under the new rules, and not just entrepreneurs.

Previously, in accordance with the provisions of Law of the Russian Federation N 1738-1, individual entrepreneurs, like citizens, paid land tax on the basis of notifications received from the tax office. Often these notifications did not arrive on time due to the fault of the tax authorities, and entrepreneurs received an unplanned additional deferment. Now according to ch. 31 of the Tax Code of the Russian Federation, they are obliged to calculate land tax independently, therefore entrepreneurs bear responsibility for the timely calculation and payment of tax.

Please note: if an individual entrepreneur has several land plots that are located on the territory of one municipality, then he must submit only one tax return. The peculiarity of filling out a tax return is that for each object of taxation (including a share in the right to a land plot) you must fill out a separate sheet, section. 2 tax returns for land tax. This procedure is established by Order of the Ministry of Finance of Russia N 124n.

It should also be noted that if an entrepreneur is late in paying advance payments for land tax, he will no longer be able to avoid the accrual of penalties, since, unlike advance payments for personal income tax and unified social tax, advance payments for land tax are calculated from the actual tax base, and from the same itself, from which the amount of tax will be calculated.

There are situations when entrepreneurs register land plots in the name of relatives. In this case, the land is not owned by the entrepreneur and is not leased by him. Is there any benefit here? On the one hand, the amount of land tax does not change, since tax rates are equal for both organizations and individuals. On the other hand, the entrepreneur does not need to submit calculations and a tax return, and the tax amount will be presented to a relative who is not an entrepreneur on the basis of a tax notice. (The form of this document is approved by Order of the Federal Tax Service of Russia N SAE-3-21 / [email protected] <3>.) At the same time, the representative bodies of municipalities have the right to establish for individual taxpayers only two advance payments for land tax (clause 4 of Art. 396 of the Tax Code of the Russian Federation).

<3> Order of the Federal Tax Service of Russia dated October 31, 2005 N SAE-3-21/ [email protected] “On approval of tax notification forms.”

And one more question that sometimes arises among entrepreneurs: do they need to pay land tax for the land on which the store is located? Let's turn to civil law. In accordance with paragraph 1 of Art. 552 of the Civil Code of the Russian Federation, under a contract for the sale of a building, structure or other real estate, the buyer, simultaneously with the transfer of ownership of such real estate, is transferred the rights to that part of the land plot that is occupied by this real estate and is necessary for its use. In addition, according to paragraph 1 of Art. 35 of the Land Code of the Russian Federation, when the ownership of a building, structure, structure located on someone else’s land plot is transferred to another person, he acquires the right to use the corresponding part of the land plot occupied by the building, structure, structure and necessary for their use, on the same conditions and in the same amount as their previous owner.

Thus, you have to pay tax. And this is not even affected by the fact that the entrepreneur may not have a document on the right to use the land. The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 7644/03 dated October 14, 2003, established that the absence of a document on the right to use land, the receipt of which depends solely on the will of the user himself, cannot serve as a basis for exempting him from paying land tax.

P.V.Yakovenko

Journal expert

"IP: accounting and taxation"

How to calculate and pay land taxes in 2019-2020

Among all the payments and taxes made by citizens of the Russian Federation in favor of the state, land tax requires special attention. Questions that relate to this legal topic require detailed explanation, because it is not always clear who should pay for what and how much.

What is land tax - basic concepts and terms

Land tax is cash payments made by individuals and legal entities to the state treasury for the right to own land. All provisions are clearly described in Chapter 31 of the Tax Code of the Russian Federation and apply to all regions of the Russian Federation, but local authorities have the right to change and adjust them within the framework of the law.

The Land Code of the Russian Federation notes that the use of land plots in Russia is paid. According to this, for you, as a citizen of the Russian Federation, tax is a mandatory condition for owning land if:

- you are the owner of a piece of land (documented ownership);

- you have the right to use the land (a specific plot) indefinitely;

- a certain area of land is your lifetime possession.

Other forms of land ownership, such as lease or temporary ownership of a plot, are not subject to taxation. In these cases, taxes are paid by the direct owners of land plots.

All aspects relating to the establishment, calculation, benefits and terms of payment of land tax are approved by local authorities, which is why it is also called “local tax”. Payments are also made to local budgets.

Objects of land tax are specific plots of land that are under the authority of territories with local self-government, as well as cities of federal significance - Moscow, St. Petersburg, Sevastopol.

It is also important to understand that the calculation and payment of taxes on land plots is carried out separately from other taxes and penalties established by the laws of the Russian Federation.

Changes in the calculation of land tax in 2020

Any government changes rarely please citizens, especially if they concern increases in prices, taxes, utility bills, etc. Even before 2020, the amount of land tax was calculated depending on the book value of the land plot. It was relatively low, and as a result, the final amount was also not burdensome for the owners.

In connection with the changes that have come into force, land tax in 2020 is calculated taking into account the cadastral value of a plot of land, which provides for its possible increase for certain citizens by a substantial amount.

But in order to avoid a sharp rise in the increase in land taxes for the population, it was decided to gradually increase the fiscal base - every year for 5 years by 20%. That is, when calculating payments for 2020, the value of the land property is taken into account in the amount of 80% of the real one.

The cadastral value of an object (also called the tax base) is determined by settlement organizations, taking into account a number of parameters, the main of which are the location of the land area, its purpose, the type of permitted activity and other nuances. It is entered into the real estate register and directly affects the amount of taxes.

The market value of a piece of land is the price set by the owner-seller taking into account the real estate market, and with which the buyer agrees. To install it profitably, owners often resort to the help of independent experts.

You can find out the cadastral value of the property here – https://kadastr.ktotam.pro/ by filling out the form with the address or entering the cadastral number of the land plot:

The cadastral value is most often higher than the market value by approximately 25% , but it can be even more. Moreover, calculations made by different experts may differ. All this leads to the fact that owners of land plots go to court to challenge the assessment of cadastral value, because the amount of land taxes turns out to be inflated.

If the claim was satisfied, then the taxes were recalculated and the taxpayer paid a lesser amount than the amount previously accrued for the current period. This was the case until 2020 inclusive, but in 2020 changes are envisaged in this paragraph, see below

Source: https://zemelnyj-nalog.com/

Procedure for calculating land tax and advance payments

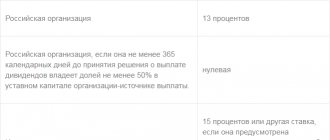

Taxpayer organizations calculate the amount of land tax and advance payments for it independently. The tax amount is calculated at the end of the tax period as the product of the cadastral value and the tax interest rate (clauses 1, 2 of Article 396 of the Tax Code of the Russian Federation). Taxpayers for whom the reporting period is defined as a quarter calculate the amount of advance tax payments at the end of the I, II, III quarters of the current tax period as 1/4 of the product of the corresponding tax interest rate and the cadastral value of the land plot as of January 1 of the tax year period (clause 6 of article 396 of the Tax Code of the Russian Federation). At the end of the tax period, the tax amount is determined as the difference between the amount accrued for the year and the amounts of advance payments during this year (clause 5 of Article 396 of the Tax Code of the Russian Federation).

Note that the representative body of the municipality and government bodies of the city. Moscow and St. Petersburg may provide for certain categories of taxpayers the right not to calculate or pay advance tax payments during the tax period (clause 9 of Article 396 of the Tax Code of the Russian Federation).

Example 1. An institution is the owner of a land plot with the right of permanent (perpetual) use. The regulatory legal act of a local government body establishes that this institution is a payer of land tax and is obliged to calculate and pay advance payments for it. The tax rate is set at 1%. The cadastral value of the land plot as of January 1, 2009 is 3 million rubles. It is necessary to calculate the amount of tax for 2009 and the amount of advance payments due during 2009.

The institution must pay advance payments in the amount of 7,500 rubles for the first quarter, half a year and nine months. (RUB 3,000,000 x 1% x 1/4). At the end of the calendar year, the tax amount will be 7,500 rubles. ((RUB 3,000,000 x 1%) - (RUB 7,500

How taxes are calculated for beneficiaries

Preferential privileges are issued for certain land plots in accordance with the legislation of the Russian Federation. All lands must fully comply with the conditions prescribed in the Tax Code of Russia:

- The land plots contain road routes of international and national importance.

- Lands that are under the care of legal entities and have the status of economically important zones. It is worth noting that for five years from the date of entry into force of property rights, land tax is not levied.

Local authorities reserve the right to make additions and amendments to land tax benefits for legal entities, reducing the rate and forming the amount.

Land tax: deadlines for payment of advance payments for land tax

x 3 sq.)).

If an institution does not own a land plot from the beginning of the calendar year, the coefficient of use of the land plot is used to calculate the tax. The coefficient is calculated as the ratio of the number of full months during which the land plot was owned by the institution to the number of calendar months in the reporting period. If the right of ownership arose or terminated before the 15th day of the month inclusive, then the month of the rights’ emergence is taken as the whole month, and if after the 15th day, then the month of termination of the right is taken as the whole month (clause 7 of Article 396 of the Tax Code of the Russian Federation).

Example 2. An institution received a land plot for indefinite use from April 14, 2009. The land tax rate is set at 1.5%. The cadastral value of the site as of January 1, 2009 was 2 million rubles. It is necessary to calculate the amount of the advance payment for the third quarter of 2009.

The land ownership coefficient is 0.7 ((6 / 9) months). The amount of the advance payment for the third quarter of 2009 will be 5,250 rubles. (RUB 2,000,000 x 1.5% x 1/4 x 0.7).

Land tax

Advances for individual entrepreneurs and individuals

For individual entrepreneurs and individuals, payment of land tax is provided after receiving the appropriate receipt (notification) from the Federal Tax Service. There are no advance payments for them.

For an individual entrepreneur, the obligation to pay land tax exists regardless of what type of taxation he uses. Individuals and individual entrepreneurs must pay tax for 2020 in 2017 by December 1. In the event of a revaluation of the cadastral value of a plot, the taxpayer may apply to the Federal Tax Service with an application to revise the amount of land tax.

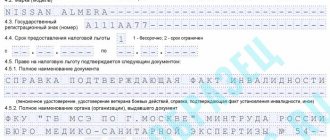

Individuals of certain categories (Article 391 of the Tax Code of the Russian Federation) have a benefit in the amount of 10,000 rubles, which reduces the tax base.

The amount of tax payable can be calculated on the Federal Tax Service website. For details, see the material “Physicists can calculate land tax on the Federal Tax Service website.”

NOTE! Since 2020, individuals are required to report to the Federal Tax Service about the objects of taxation that have appeared in their possession (real estate, car, land).

The message form can be downloaded here.

New bans on tax exemptions

New paragraph 2 of Art. 395 of the Tax Code of the Russian Federation, which was introduced by Law No. 353-FZ of November 27, 2017, regulates the situation when, when dividing or merging land plots, tax exemption is not applicable to the resulting objects. This applies only to the following categories of payers:

- residents of a special economic zone (there will be no tax exemption for the first 5 years);

- shipbuilding enterprises are residents of the industrial and production SEZ (there will be no tax exemption for the first 10 years);

- participants of the free economic zone (there will be no tax exemption for the first 3 years).